Premiums paid towards these insurance plans buys you protection . What’s more – you can also get tax benefits on the maturity amount/returns from insurance plans. For employees Jan-Feb is season of submitting income tax proof. Many people buy insurance policy, in a hurry, to save tax and submit the proof to employer. Buying an insurance policy is a long time commitment, similar to marriage. So It is advisable to understand all aspects of claiming tax benefit in buying insurance policy. Let us examine these aspects in detail as per current income tax laws.

What is tax benefit available for insurance policy?

Any amount paid to an insurer to buy or to keep a life insurance policy in force can be claimed as a deduction from gross total income by the policy holder. So premium paid for a life insurance policy can be deducted from gross total income before arriving at taxable income subject to certain conditions.

- Life insurance plans are eligible for tax deduction under Sec. 80C. Deduction benefit up to Rs 1.5 lakh under Section 80C. Section 80C relates to deduction allowed under investments in instruments like PPF ,insurance and pension policies.

- Pension plans are eligible for a tax deduction under Sec. 80CCC. Deduction benefit up to Rs 1.5 lakh under Section 80CCC.

- Health insurance plans/riders are eligible for tax deduction under Sec. 80D. You can get a tax deduction of maximum Rs 25,000 on the health insurance premium for self and family. If you are a senior citizen, you can claim tax deduction on the premium of up to Rs 30,000.

Combined Limit of deduction under Sec 80C & 80CCC & 80CCD is Rs 1,50,000.

The proceeds or withdrawals of our life insurance policies are exempt under Sec 10(10D), subject to norms prescribed in that section.

Who can get the tax benefit on premium paid for a life insurance policy?

Only an Individual or a Hindu Undivided family (HUF) can avail tax benefits on premium paid for a life insurance policy.

On whose name should the life insurance policy be to claim the tax benefit?

- An individual can only claim tax benefit under Section 80C of the Income tax Act, 1961, on life insurance policy(s) bought in the name of self, spouse or children. You can buy a life insurance policy for any number of your children irrespective of whether they are minor, major, married, unmarried or adopted. A policy taken in the name of any other person won’t be eligible for any tax benefits. So life insurance premium paid by you for your parents (father / mother / both) Brother, Sisters or your in-laws is not eligible for deduction under section 80C.

- In case of a Hindu Undivided Family or HUF, the policy can be taken in the name of any of its members to avail the tax benefits.

Does an insurance policy has to be taken from LIC alone to get tax benefit section 80C ?

No. One can claim tax benefits on a insurance policy bought from any insurer ,private or public sector, approved by the IRDAI.

Does one have to buy a specific kind of life insurance policy to claim 80C benefit?

No. Life insurance is meant to offer financial protection to dependents in the unfortunate event of one’s death. Its purpose is to enable one’s dependents to maintain their current life style and pursue their life goals. In India most of Life/General Insurance is optional except Third party liability policy which is compulsory for every motorized vehicle in India The different types of life insurance policies are given below. Our article Life Insurance covers these policy in details with examples. Any life insurance policy such as endowment or money back policy is an assurance on the life of the policy holder and hence the premium paid on such policy would be eligible for tax benefit under section 80C. Please verify it before buying the policy.

- Term Life Insurance

- Whole Life Policy

- Endowment Plans

- Unit Linked Insurance Plans

- Money Back Policy

Can one claim Tax benefit on premium paid for a insurance policy only in the year one buys it?

No. You can claim tax benefit under appropriate section of Income Tax for every year that you pay premium. Say Rajan bought a term insurance plan in Mar 2015 for premium of Rs 12,000. So he can claim tax benefit for every year he pays premium. To claim the tax benefit he need not buy a new policy every year.

Is there some rule on what the premium amount or percentage should be to claim 80C benefits?

Deduction will be allowed only for premiums up to a maximum of 10% of the sum assured for policy issued on or after April 1, 2012. If the policy is issued before March 31, 2012, deduction will be allowed only for premiums up to a maximum of 20% of the sum assured. Please note Sum Assured does not include any bonus amount which is to be received.

- Ex1: Mr Mehta pays a premium of Rs. 7,200 on his life insurance policy which is taken in Jan 2011.

- Deduction will be restricted to 20% of capital sum assured which is Rs. 25,000 i.e Rs. 5,000. Hence, out of Rs. 7200, he will be eligible to claim deduction of Rs. 5,000.

- Ex2: But if Mr Mehta pays premium of Rs 7,200 on his Life Insurance policy which is taken in Mar 2013.

- Deduction will be restricted to 10% of sum assured i.e Rs 2,500.

- Ex3: Mr Mehta pays premium of Rs. 40,000 on life insurance policies taken in the name of his three children -a minor son, a major married daughter and a major married son, who is a engineer. The policies are term plans and premium on all the policies worked out to be 8% of capital sum assured.

- Premium in respect of policy taken in the name of his children works out to be 8% of capital sum assured. Hence, entire amount of premium of Rs. 40,000 will be eligible for deduction. Please note that deduction is allowed for all children irrespective of the fact whether they are dependent/independent, major/minor, or married/unmarried.

In case the insured suffers from severe disability or disease as specified by the Income Tax Act and rules and his/her policy was issued on or after 1.4.2013, then for them the limit will be 15%. For this purpose, disability has to be one of those specified in section 80U e.g. autism, mental retardation and disease has to be one of those specified in section 80DDB read with Rule 11DD of income tax rules, e.g. blindness.

Is there a limit on how many insurance policies can one claim tax benefit?

No. If you are paying premium for more than one insurance policy, then you can claim tax benefit for all premiums paid till limit for 80C benefit,currently 1.5 lakh, is exhausted.

Is there any specified method of premium payment to claim the 80C benefit?

No, the premium can be paid via any method such as by cash, cheque, account transfer etc in order to claim the 80C benefit.

To claim the tax benefit on insurance policy you need to pay the premium.

Section 80C(2) also clarifies that in order to claim the deduction from gross total income for a particular year, the premium must be paid or deposited in that particular financial year itself. For example, for FY 2015-16, the premium must be paid between 1.4.2015 and 31.3.2016 (both dates inclusive) in order to claim the deduction for that year. For example, assume your policy premium due date was 26.3.2016 but you paid the premium late, say after 3.4.2016 but within the grace period allowed by the insurer. The insurer may accept the premium even on say 10.04.2016 as generally 15 days grace period for payment is allowed but the premium so paid cannot be claimed as deduction in FY 2015-16. However, this amount can be claimed as deduction in FY 2016-17 i.e. the FY in which the premium is actually paid.

If I take an insurance policy and can’t /don’t pay premium amount next year or after an year or so is that okay?

No. There is a Minimum lock-in period for policy to retain tax benefit under section 80C. So you need to pay the premium atleast for some number of years. The minimum time period for which the policy must be held by the policy holder in order to retain tax benefits on premium paid are:

- For single premium life insurance policy – 2 years from date of commencement of policy.

- For ULIPs – at least 5 years, for which premium has been paid, from start of policy.

- For any other life insurance policy – at least 2 years, for which premium has been paid, from start of policy.

If one stops paying premium after the lock in period then is that OK?

After paying premium for some years , you might want not to pay the premium any longer. Then you have two options:

- Discontinue the policy and take whatever money is due to you. The amount the insurance company then pays is known as surrender value. The policy ceases to exist after this payment has been made. But you need to find out how much is the surrender value? What are the penalty charges?

- No deduction will be allowed to him for the premium paid for the year in which the policy is surrendered/terminated and the deductions claimed in earlier years for premium paid, if any, will be considered as his income in the financial year in which his policy is surrendered or terminated and taxed accordingly.

- If you discontinue to pay the premiums, but do not withdraw the money from your policy, the policy is referred to as paid up. The sum assured is reduced proportionately, depending on when you exit from the policy. You then get the amount at the end of the term.

Our articles Insurance : Surrender or Make policy paid up or Continue , Discontinue Life Insurance Policy: Surrender,Paid Up,Loan discusses it in detail.

So buying insurance is a long time commitment. It’s like a chakarvyuh and you don’t want to end up stuck like Abhimanyu in Mahabharat. Our article Checklist for buying Life Insurance Policy explains what one should consider before one commits one to buying an insurance policy.

How do we claim the tax benefit if one buys the insurance policy?

To claim the deduction you need to pay the premium .

- If you are an employee you need to submit the receipt to your finance/pay roll department, who will use it calculation of your tax liability. In Form 16 it will be mentioned.

- If you don’t submit the receipt to your finance department / you don’t work for some one then you can still claim the premium paid while filing the Income Tax Return.

In Income Tax return you need to show the deductions claimed under various section.

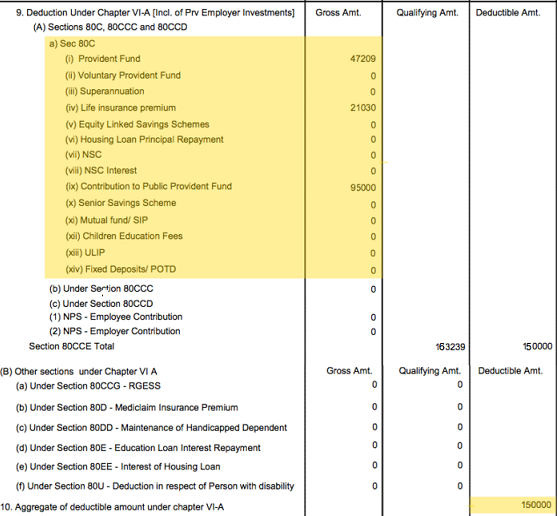

Form 16 with 80C deductions. Our article Understanding Form 16: Chapter VI-A Deductions covers it in detail.

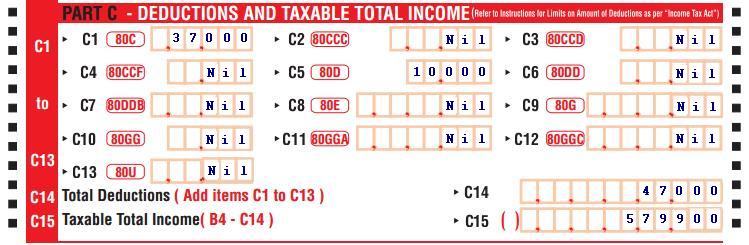

ITR with 80C and other deductions are shown in image below. Our article Filling ITR 1-Form explains it in detail.

ITR1 with deductions 80C and others

What is the maximum tax benefit that one can claim under section 80C?

Deductions are restricted to investments upto Rs 150,000 under Section 80C (including life insurance premiums). Our article Choosing Tax Saving options : 80C and Others discusses in detail.

The maximum amount that can be claimed as deduction under section 80C is Rs 1,50,000 as per current income tax laws. Section 80C lists several investment options, Section 80C relates to deduction allowed under investments in instruments like EPF,PPF ,insurance and pension policies. Even if you have invested more than Rs 1.5 lakh in total in these investment options including the premium paid for your policy, only Rs 1.5 lakh can be claimed as deduction from taxable income.

Further, remember in case you have made investments which are eligible for similar tax benefit under section 80CCC and 80CCD then these investments will be clubbed with investments under Section 80C for the purpose of calculating the Rs 1.5 lakh limit on the tax benefit.

Rahul has made the following payments during the financial year 2015-16 to avail of the advantage of deduction under section 80C:

- His EPF deduction of Rs 30,000

- Investment in PPF Rs. 40,000.

- Investment in NSC Rs. 10,000. Interest accrued during the year on NSC amounted to Rs. 1,000.

- Payment of tuition fees of his minor daughter Rs. 5,000.

- Principal on Repayment of housing loan Rs. 12,000.

- Investment in post office time deposit Rs. 10,000.

- Premium of Rs. 20,000 on life insurance policy taken in the name of his wife. Policy was taken in April 2014 and sum assured was Rs. 2,00,000.

So sum total of investments for 80C that Rahul has made is 1,38,000( 30,000+40,000+10,000+11000+5000+12,000+10,000+20,000 ). He can claim all the above mentioned investments under 80C.

If however the eligible amount of deduction exceeded 1.5 lakh say it came to Rs. 1,61,000. However, as total deduction under section 80C cannot exceed Rs. 1,50,000, hence, deduction will be limited to Rs. 1,50,000.

How much tax does one save by investing in tax saving investments?

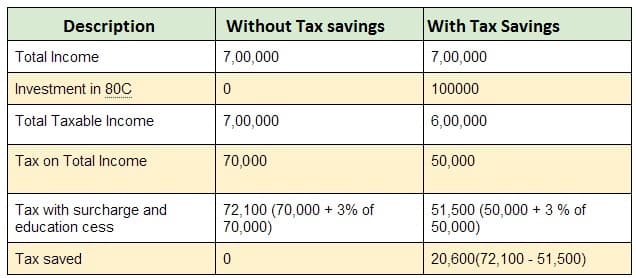

Your tax slab defines how much income tax can be saved by you. Following image shows that by investing 1 lakh in tax saving instruments a person with 7 lakh income can save 20,600 Rs.

Tax is paid at 10%, 20% and 30% on pre-defined income tax slabs that your income falls in. There is a cess of 3% also that is charged , so actually the tax rate comes to 10.30%, 20.60% and 30.90%. All tax payers will basically fall in these three brackets.

| Tax bracket | Tax saved |

| 10.30% | 15,450 |

| 20.60% | 30,900 |

| 30.90% | 46,350 |

Table of Contents

Tax Benefits for Insurance Policies

In this section we summarise the tax benefits under various sections for insurance policies.

Tax Benefits under Section 80C for Life Insurance Policies

- Who can avail deductions: Individuals and Hindu Undivided Family

- Eligible Savings: Premiums paid or deposited to keep the insurance policy in-force on life of self , spouse and children

- Deduction limit: Deduction will be allowed only for premiums upto a maximum of 10% of the sum assured for policy issued on or after April 1, 2012.

In case of policy issued before March 31, 2012, deduction will be allowed only for premiums upto a maximum of 20% of the sum assured - Limit on amount of deduction:

- Disallowance: The deductions claimed earlier will be taxable as income if the policy is terminated either by notice or by failure to pay any premium in case of

- Single premium policy: within 2 years after the commencement date

- Regular premium policy: before premiums have been paid for 2 years.

Tax Benefits under Section 80CCC for Pension Plans

- Permitted Deduction: Section 80CCC allows deduction of premiums paid under a pension scheme up to a maximum of Rs 150,000.

- Receipts under the policy: Income will be taxed if, in the financial year, one

- Receives an amount on surrender (whole/part) of annuity plan,

- Receives an amount as Pension

Tax Benefits under Section 80D for Medical or Health Insurance Plans

- Who can avail deductions: Individuals and Hindu Undivided Family

- Eligible premiums: Premiums paid to effect or to keep in force insurance on the health of self, spouse, dependent children and parents.

- Deduction and upper limit: For financial year 2015-16 one can pay premium for self, spouse and dependent children is Rs. 25,000(earlier was Rs 15,000) and additional deduction upto Rs. 20,000(earlier Rs 15,000) for the parents.

A higher amount of upto Rs 30,000(earlier Rs 20,000) is permitted if the person, for whose health insurance the premium was paid, was aged 60 years or more.

Additionally any payment made on account of preventive health check-up of the assessee or his family by any mode including cash to the extent it does not exceed in the aggregate five thousand rupees is also eligible for deduction under section 80D

Tax Benefits under Section 10(10D) on maturity of Insurance Policy

As per Section 10(10D) of Income tax Act, 1961, any sum received under a life insurance policy, including the sum allocated by way of bonus on such policy is exempt from tax. However, this rule does not apply to following amounts:

- sum received under Section 80DD(3), or

- any sum received under a Keyman Insurance Policy, or

- any sum received under an insurance policy issued on or after the 1st day of April, 2003 but on or before the 31st day of March, 2012 in respect of which the premium payable for any of the years during the term of the policy exceeds twenty per cent of the actual capital sum assured or (Other than in case of Death)

- any sum received under an insurance policy issued on or after the 1st day of April, 2012 in respect of which the premium payable for any of the years during the term of the policy exceeds ten per cent of the actual capital sum assured (Other than in case of Death)

Insurance should be bought primarily for the purpose of insurance and not solely for availing the tax benefits. Buying insurance policy is a long term commitment and one should make sure that one is buying insurance policy for right reasons for its easy to buy but difficult to come out. Many people end up buying the insurance policies for saving tax and it does not match their risk profile, their goals and their financial plan.

Have you bought insurance policies just to save tax? Do you think saving tax is important? What do you think one should look at before buying insurance policy for saving taxes.