Banks have been reducing interest rates on Fixed Deposits. This article talks about Fixed Deposit Interest Rates, gives Fixed Deposit Interest Rates of Top Banks. It also discusses how Interest Rates of Fixed Deposits are changing and why they are expected to go down? What do FD rates depend on?

Table of Contents

Top Banks FD Interest Rates June 2020

The interest rate of the fixed deposit changes from time to time and it varies from bank to bank. The interest rate depends on the amount of investment and tenure. So Compare the list of bank FD Interest Rates before investing in them. Senior Citizens get around 0.5% more.

Few Small Finance Banks offer very attractive rates on fixed deposits. But remember one needs to look for safety while investing in Fixed Deposits.

FD Interest Rates are at the lowest level since 2004

| Bank Name | Tenure | FD Interest Rates (p.a for < ₹2 crore) |

|---|---|---|

| SBI | 7 days – 10 years | 3.50% – 5.70% |

| HDFC Bank | 7 days – 10 years | 3.50% – 6.25% |

| Axis Bank | 7 days – 10 years | 3.50% – 6.50% |

| Bank of Baroda | 7 days – 10 years | 4.25% – 6.15% |

| ICICI Bank | 7 days – 10 years | 3.50% – 6.00% |

| Punjab National Bank | 7 days – 10 years | 4.25% – 5.80% |

| IDBI Bank | 15 days – 20 years | 3.10% – 5.90% |

| Canara Bank | 7 days – 10 years | 4.25% – 5.85% |

| RBL Bank | 7 days – 10 years | 5.00% – 7.25% |

| Yes Bank | 7 days – 10 years | 5.00% – 7.25% |

Post Office FD Rates

The USP of the Post office term deposit schemes is that it is backed by the government and rates are revised every quarter. But in the case of banks, there is no such rule. Bank FD rates get impacted after the Reserve Bank of India (RBI) changes its repo rate.

Post Office FD Interest Rate Table

| Tenure | FD Interest Rates (p.a) |

|---|---|

| 1 year | 5.50% |

| 2 years | 5.50% |

| 3 years | 5.50% |

| 5 years | 6.70% |

The interest rate of State Bank of India

| Tenors | Revised Rates For Public w.e.f. 27.05.2020 | Revised Rates for Senior Citizens w.e.f. 27.05.2020 |

|---|---|---|

| 7 days to 45 days | 2.90 | 3.40 |

| 46 days to 179 days | 3.90 | 4.40 |

| 180 days to 210 days | 4.40 | 4.90 |

| 211 days to less than 1 year | 4.40 | 4.90 |

| 1 year to less than 2 year | 5.10 | 5.60 |

| 2 years to less than 3 years | 5.10 | 5.60 |

| 3 years to less than 5 years | 5.30 | 5.80 |

| 5 years and up to 10 years | 5.40 | 6.20 |

Change in Interest Rates of Fixed Deposits

For someone who does not want any kind of uncertainty with regard to his or her investments, Fixed Deposits is the right choice. But Banks have been reducing rates on Fixed Deposits. Major banks, both private and public sector, recently revised their interest rates on fixed deposits (FDs)This is among the lowest FD rates in the industry now. Why are Interest Rates on FD declining? How will FD rates pan out in Future.

- Increased liquidity on the back of rise in cash deposits by customers, due to the government’s demonetisation move. According to the Reserve Bank of India (RBI), banks have received deposits in excess of Rs 5.11 trillion since the announcement. All banks have money more than their requirement.

- A large chunk of these deposits have been in savings accounts and banks will have to give a minimum of 4% interest on these deposits.

- The influx of cash in such large volumes also means that there are more funds to be lent to customers. This is an indication of a cut in the lending rate. A cut in lending rates is preceded by a cut in the deposit rates. The relationship between deposit rates and the marginal cost of funds based lending rate (MCLR) is such that a decline in deposit rates results in decline of the MCLR. And MCLR determines the lending rate for the consumers. Banks have to announce an MCLR every month.

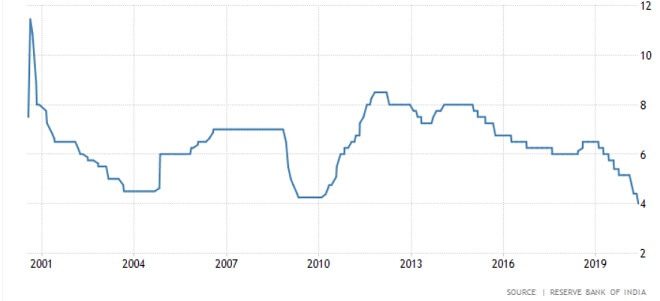

- Repo rate cuts in the past monetary policies have led to a fall in deposit rates. Everything from interest rates on loans to returns on deposits is influenced by the Repo Rate set by the RBI. The image below shows how Repo rates have changed over time from Trading Economics

One of the key points with a bank FD is that the changes in the FD rates will impact only prospective investors. Those who are already invested in FDs will get rates that were applicable when the investment was made. This means that if one invests in, a three-year FD at 7.5% per annum, then the interest rate remains at this level for the entire duration of the deposit even if rates change in the interim period.

Since interest rates are expected to go down, the smart strategy for investors today is to ensure that they lock themselves into a fixed deposit for a longer time period so that they continue to earn higher rates of interest even if rates were to go down. Alternatively, you can also consider investing in a debt fund.

RBI Repo Rate

Repo Rate, or repurchase rate, is the key monetary policy rate of interest at which the central bank(the Reserve Bank of India in case of India) lends short term money to banks, essentially to control credit availability, inflation, and the economic growth. Repo Rate in India is the primary tool in the RBI’s Monetary and Credit Policy.

Repo Rate is the most significant rate for the common man. Everything from interest rates on loans to returns on deposits is influenced by this crucial rate set by the RBI, which is why interest rates on home loans, car loans and other kinds of borrowings go up and down based on the direction of Repo Rate change. Similarly, banks adjust savings account, fixed deposit returns based on this benchmark.

Other policy rates, such as Reverse Repo Rate and Marginal Standing Facility Rate(MCLR), are often directly linked with the Repo Rate of RBI.

Video explaining What is Repo Rate?

This video explains what is repo rate?

RBI latest interest rate changes

| Change date | percentage |

| may 22 2020 | 4.000 % |

| march 27 2020 | 4.400 % |

| october 04 2019 | 5.150 % |

| august 07 2019 | 5.400 % |

| june 06 2019 | 5.750 % |

| april 04 2019 | 6.000 % |

| february 07 2019 | 6.250 % |

| august 01 2018 | 6.500 % |

| june 06 2018 | 6.250 % |

| august 02 2017 | 6.000 % |

Interest on FD is Taxable

The interest rate on FDs is entirely taxable. Our article Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund discusses about FD interest rate, TDS and ITR

- Interest that is earned on fixed deposits is taxable in the hands of the depositor as per the income slab so a person who earns income between 2 lakh to 5 lakh pays only 10% tax on it while the person who earns above 10 lakh pays 30% tax (And education cess and surcharge at the rate of 3%). If TDS is deducted and you are in 20% tax slab then you need to pay a remaining tax of 10%.

- If the aggregate interest income from fixed deposits that you are likely to earn for all your deposits held in a branch is greater than Rs 10,000 in a financial year, you become liable for TDS.

- If PAN is not submitted TDS is deducted at the rate of 20%.

If you fall in the highest tax bracket of 30.9%, then 6.5% annual return from an FD would get reduced to a return of 4.49% post-tax. Now, let’s factor in inflation, say 5.28%, the average Consumer Price Index-based (CPI) inflation from September 2015 to September 2016. In this case, a post-tax return of 4.49% for individuals in the highest tax bracket will translate to a negative return figure of -0.79%.

Similarly, if you are in the 10.3% tax bracket, then your post-tax return will be seen at 5.83%. With the average inflation figure, the returns here would be 0.55%.

Low Fixed Deposit Rates

This is the right time to explore the scenario of falling interest rates and take a prudent look at the alternative investment avenues to bank fixed deposits. Over the last one-and-a-half years, RBI has been following an accommodative monetary path, adding liquidity and reducing policy rates. An economic environment with low demand led to a drop in interest rates, while the government’s historic decision of demonetisation has channelled cash into the banking system.

- The fixed deposit schemes offered by most banks can be availed for tenures ranging from as short as seven days to as long as 10 years. Few of the banks, such as the State Bank of Patiala, IDBI Bank, the Ratnakar Bank, etc. offer FDs that stretch to 20 years as well. The interest on FDs is compounded on a quarterly basis.

- Most of the banks offer from 0.25% to 0.50% extra to senior citizens.

- Banks offer a higher interest for deposits of Rs. 1 crore and above. These deposits are called Bulk Deposits.

- Most banks compound interest quarterly.

- Banks offer Loan/Overdraft against the amount available in Fixed Deposit. The interest is generally 0.5% to 1% more than that offered to FD.

- TDS (Tax deduction at source) at the rate of 10% is deducted if the interest income is more than Rs 10,000 in financial year per bank

- There might be penalty for pre-mature withdrawal of Fixed Deposits

Note: You can go to individual banks’ websites to check these interest rates for different tenures. Evidently, surplus bank liquidity and low-interest rates are here to stay.

Related Articles:

Best Tax Saving Fixed Deposit under section 80C

- Articles for Learning Investing , Basics,Investing in PPF,Stocks,Mutual Funds,Post Office,FD

- Fixed Deposits and Tax

- Premature withdrawal or Breaking of Fixed Deposit

- Senior Citizen,Fixed Deposits and Tax

- Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund

Do you invest in FD? What do you think how FD interest rate will behave over the next few years?

Apps like ETMONEY have launched Fixed deposit with returns upwards of 7%. https://etmoney.onelink.me/unJQ/e333a260

Check FD Interest Rates of Top Banks and NBFCs

https://etmoney.onelink.me/unJQ/e333a260

I read this article but I confused why the FD rates are changing with the time. is FD depends on the market conditions or anything else?

NEED TO UPDATE FD RATES FROM JUNE 2020 ONWARDS

THERE IS LOTS OF CHANGES IN FD RATES

Thanks for pointing out.

Have updated it