“In case of superannuation funds and recognised provident funds, including EPF, the same norm of 40 per cent of corpus to be tax free will apply in respect of corpus created out of contributions made on or from April 1, 2016,” finance minister Arun Jaitley said in his Budget speech on 29 Feb 2016. This article explores the changes in EPF withdrawal due to Budget 2016. What does this mean for EPF subscribers?

Finance Minister Arun Jaitley on Tuesday, Mar 8 2016, announced he was withdrawing a controversial Budget proposal to tax 60% of EPF balances at the time of withdrawal. He also withdrew another proposal to tax contribution made by an employer beyond Rs 1.5 lakh a year. However, the proposal to not tax 40 per cent of money withdrawn from national pension system stays.

EPF is again EEE now EPF is taxable now

At present, EPF, social security schemes run by retirement fund body EPFO, is tax free EEE scheme. That means deposits, accrual of interest and withdrawals are tax free under the scheme. Our article Taxation of investments : EEE, ETE, TEE.. talks about EEE etc in detail.

Budget 2016 has proposed making 60% of employee contribution EPF corpus taxable for contributions after 1.4.2016. Till now withdrawal of EPF corpus after 5 years of continuous service was fully tax exempt. The new provisions indicates that if the EPF is not used for buying an annuity then 60% of that portion of the corpus which is built from the employee contributions made from 1.4.2016 would be taxable.

Clarifying government’s stand on EPF in Lok Sabha, Jaitley said, “The main argument is that employees should have choice of where to invest. Our intention was to encourage more and more employees join the national pension scheme”. “In view of representations received, the government would like to do a comprehensive review of this proposal and therefore I withdraw the proposal,” Jaitley added.

So what changes in Provident Funds should one be aware of due to Budget 2016?

- PPF contributions will continue to be tax exempt.

These are only prospective changes and that existing savings will not be impacted in any way.All contributions + interest accrued will be taxed to EPF after April 1, 2016 will be taxed. All the contributions till Mar 31 2016 are EEE.When you withdraw from EPF, the 60 per cent of the corpus, accumulated post April 1,2016, will attract tax and the remaining 40 per cent will not.It is expected that the employees of private companies will place the remaining 60% of the Corpus in Annuity, out of which they can get regular pension. When this 60% of the remaining Corpus is invested in Annuity, no tax is chargeable. So what it means is that the entire corpus will be tax free, if invested in annuity.The annuity pays you a monthly amount. This monthly amount is taxable.When the person investing in Annuity dies and when the original Corpus goes in the hands of his heirs, then again there will be no tax.Small salaried employees with up to Rs 15,000 per month income will be kept out of purview of proposed taxation of EPF.He proposed a monetary limit for contribution of employer in recognised Provident and Superannuation Fund of Rs 1.5 lakh per annum for taking tax benefit.The budget has also proposed to increase the threshold for deducting tax deducted at source (TDS) on payment of accumulated balance due to an employee in EPF Rs 50,000 from existing Rs 30,000. In 2015 budget had provided that the members of private provident fund trusts will not have to pay tax on pre-mature withdrawals provided the amount is either less than Rs 30,000 or their tax liability is nil even after including the withdrawn sum to their income.The minister also proposed to exempt from service tax the Annuity services provided by the National Pension System (NPS) and Services provided by EPFO to employees.The government has also proposed that 14 per cent service tax on services provided by Employees’ Provident Fund Organisation (EPFO) to employees, being exempted.

Official Clarification about Changes made in the Tax Treatment for Recognised Provident Fund & National Pension System (NPS) at Press Release

On 10th February 2016, the Ministry of Labour and Employment, Government of India, changed norms on withdrawal of provident fund (PF). These changes have been rolled back. Now, you would be able to withdraw your full EPF corpus,the employer’s contribution. in any circumstance before the retirement as discussed in our article Changes in EPF Withdrawal Rules from 10 Feb 2016

Employer contribution is tax free till 1.5 lakh per annum

Until now the employer contribution at 12% of basic & dearness allowance and was tax free. Now if the employer contributes more than Rs 1.5 lakh per annum, it would be considered income on employee and taxed accordingly.

Why was EPF being taxed?

As per Finance Ministry, The idea behind this mechanism is to encourage people to invest in pension products rather than withdraw and use the entire Corpus after retirement.

In order to bring all retirement schemes at par with each other. This was done to bring EPF on par with NPS where 40% of the withdrawals on maturity have been made tax free. NPS scheme was taxable on maturity (on retirement), while the other products such as EPF were not. Due to this, many taxpayers, didn’t opt for the NPS despite being offered an additional deduction of Rs 50,000 on it under Section 80CCD (1B).

Under the existing provisions of section 80CCD, any payment from National Pension System Trust to an employee on account of closure or his opting out of the pension scheme is chargeable to tax. Annuity fund which goes to the legal heir after the death of pensioner will not be taxable .

How much tax would one have to pay on EPF if EPF would have been taxed?

All Contributions made before 1st April 2016 + interest are tax exempt as they fall under EEE

All Contributions made after 1st April 2016 + interest -will be taxed as follows: 40% tax free + 60% taxed if pension plan is not bought.

Though In an interview to PTI, Revenue Secretary Hasmukh Adhia had said that the tax is on the interest accrued on PF contributions made after April 1, 2016. “The principal amount will not be taxed and will continue to remain tax exempt on withdrawal. What we have said is 40 per cent of the interest accrued on contributions made after April 1 will be tax exempt and its remaining 60 per cent will be taxed.”

But as per the Press notification, it’s 60% of the whole corpus, not only interest which will be taxed.

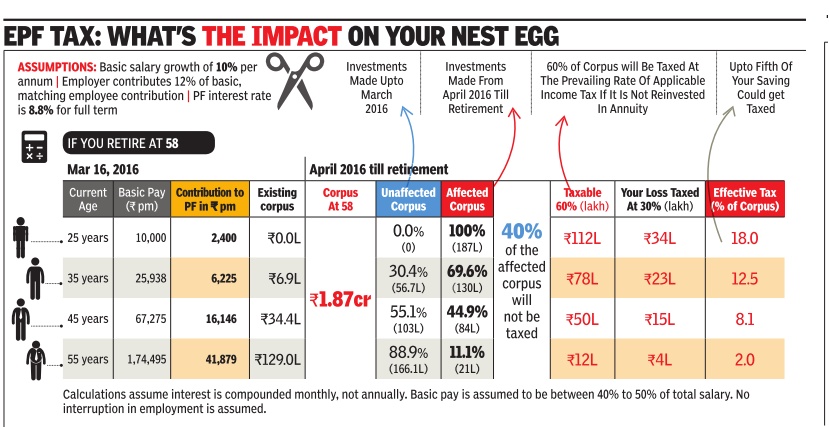

Thus, those with just decent salaries — often in the last few years of their working lives — would end up having their contribution taxed in the first instance and then 60% of it taxed again at the stage of withdrawal. As for those starting their careers now, calculations show they could stand to lose nearly a fifth of their retirement savings to tax. This is grossly unfair. As per Times of India, Impact of Tax on retirement is as shown in image below.

How many people would this have affected?

As per Finance Ministry, Main category of people for whom EPF scheme was created are members of Employee Provident Fund Organization (EPFO) who are within statutory wage limit of Rs 15,000 per month. Out of around 3.7 crores contributing members of EPFO as on today, around 3 crore subscribers are in this category,no change for them.

“In EPFO, there are about 60 lakh contributing members who accepted EPF voluntarily and are highly paid private sector employees. For this category(highly paid private sector) of ppl,amount at present can be withdrawn without any tax liability. We are changing this. What we are saying is that such employee can withdraw without tax liability provided he contributes 60 per cent in annuity product.”

What was the reaction to the tax on EPF ?

The proposal has come as an unexpected shocker for the salaried class. There has been a lot of backlash from the public at large. #EPF and #RollBackEPF were trending on twitter entire day after budget 2016. With the concerns over EPF heightening, minister of state for finance Jayant Sinha was forced to tweet that the government will come out with an FAQ

However, employee unions have vowed to escalate their protest if the Government does not roll back the taxes. The Congress-affiliated INTUC, as well as the BJP-linked Bharatiya Mazdoor Sangh raised objections, calling it a draconian measure which is similar to taxing an employee twice.

Clarification released on 1-Mar-2016 Government has said “We have received representations today from various sections suggesting that if the amount of 60% of corpus is not invested in the annuity products, the tax should be levied only on accumulated returns on the corpus and not on the contributed amount. We have also received representations asking for not having any monetary limit on the employer contribution under EPF, because such a limit is not there in NPS. The Finance Minister would be considering all these suggestions and taking a view on it in due course.”

The government’s argument that the move is aimed at encouraging people to plan for pension for their old age ignores the fact that EPF already has a pension component, in the form of the employees’ pension scheme,whose flawed design has resulted in low payout. Instead of forcing people to move to the national pension system, it should revamp the EPS. This would ensure competition between EPS and NPS and investors would have the option to choose. If the idea is to promote competition and free market across the economy, why go back to the regulated regime of old?

Related Posts:

- Should you Invest in NPS the National Pension Scheme for additional 50,000 and save tax

- Understanding National Pension Scheme – NPS

- Investing:Think about Liquidity,Safety,Returns,Risk,Tax

- Goals Based Financial Planning

- Saving For Retirement : Pension Plans,NPS,EPF,PPF

- Changes in EPF Withdrawal Rules from 10 Feb 2016

Tax laws change! Never invest as per tax laws. Invest as per your requirements. People are asking Every time middle class why? In any democracy, Budget proposals are not cast in stone and become law only after debate and discussion. The government should pay heed to the outrage the proposal of taxation of EPF has evoked and let it go.

Only interest accrued on 60% contribution to EPF after April 1, 2016 will be taxed. The principal amount to remain tax exempt.

I think even the principal is taxed.

There is so much confusion. Finance Minister saying one thing MOS saying something other.

As of now what you have said, that principal will also be taxed is correct.

Have updated the article. Thanks for input

Only interest accrued on 60% contribution to EPF after April 1, 2016 will be taxed. The principal amount to remain tax exempt.

I think even the principal is taxed.

There is so much confusion. Finance Minister saying one thing MOS saying something other.

As of now what you have said, that principal will also be taxed is correct.

Have updated the article. Thanks for input