At times one needs to pay income tax to the government for example Advance Tax, Self Assessment Tax. One can pay it through Challan 280 online or offline. This article discusses about when does one need to pay Income tax, how to pay through Challan 280, verify tax paid, how to correct details if required, how to mention it in Income Tax Return.

Table of Contents

How does the Government collect Income Tax from an individual?

It is the constitutional obligation of every person earning income to compute his income and pay taxes correctly. Taxes are collected throughout the financial year by three means:

- Voluntary payment by persons into various designated Banks. For example Advance Tax and Self Assessment Tax

- Taxes deducted at source (TDS) on your behalf from the payments receivable by you.

- Taxes collected at source (TCS) on your behalf at the time of spending.

What is Advance Tax?

If the tax payable, in a financial year, is Rs. 10,000 or more(after taking TDS in consideration), then the tax is paid in the previous year itself. This is called as Advance Tax. Our article Advance Tax:Details-What, How, Why discusses it in detail.

- Ist installment (30% of estimated tax) before 15 Sep,

- IInd installment ( 60% of estimated tax) before 15 Dec,

- Final installment (100% of estimated tax) before 15 Mar

What is Self Assessment Tax ?

If at the time of filing of return you find that you have some balance tax to be paid after taking into account your advance tax, TDS and TCS, the short fall is to be deposited as Self Assessment Tax. Self assessment tax must be deposited before filing return. For FY 2012-13 last date of filing return is 31 July 2013. In many cases one has not deposited full tax or Tax deducted at Source (TDS) has been deducted less ex: Interest on Fixed Deposit (FD) is deducted at the rate of 10% if interest income is more than 10,000 a year. But actual tax on interest on FD is as per one’s income Slab . In such cases there is balance tax liability or due to interest u/s 234B, 234C if advance tax not paid or due to other reason.

If you pay less than what you should pay as per your computation of tax before filing Return , your return may be treated as defective return as per Section 139(9) and may be liable to penal consequences. You will be sent an intimation which is a demand notice in itself. You may be charged with penalty under section 220 if the new demand is not paid within 30 days of service of notice.(Ref: TaxWorry Self Assessment Tax must be paid before filing the return)

What is Regular Assessment Tax?

Tax one needs to pay when demand is raised by Income Tax Department during assessment. Such tax is called as Regular Assessment Tax. For Ex: I am working in a company and don’t have any extra source of income.Due to some mistake company didn’t deducted tax in AY2010-11 and later I have received an intimation (actually received a demand u/s 156 ) under section 143(1) (India) to pay income tax. (Ref: Yahoo question)

How to pay Income Tax due – Advance Tax, Self Assessment Tax etc?

Tax Payment Challan, ITNS 280 Challan is used to pay Income Tax due, if any.

- It can be paid by going to designated branch and paying through cheque or cash, called as Offline or physical payment. Our article Paying Income Tax offline : Challan 280 explains it in detail.

- It can also be paid through online if you have net-banking. Our article Paying Income Tax : Challan 280 explains it in detail.

What is Proof of Paying Income Tax through Challan 280?

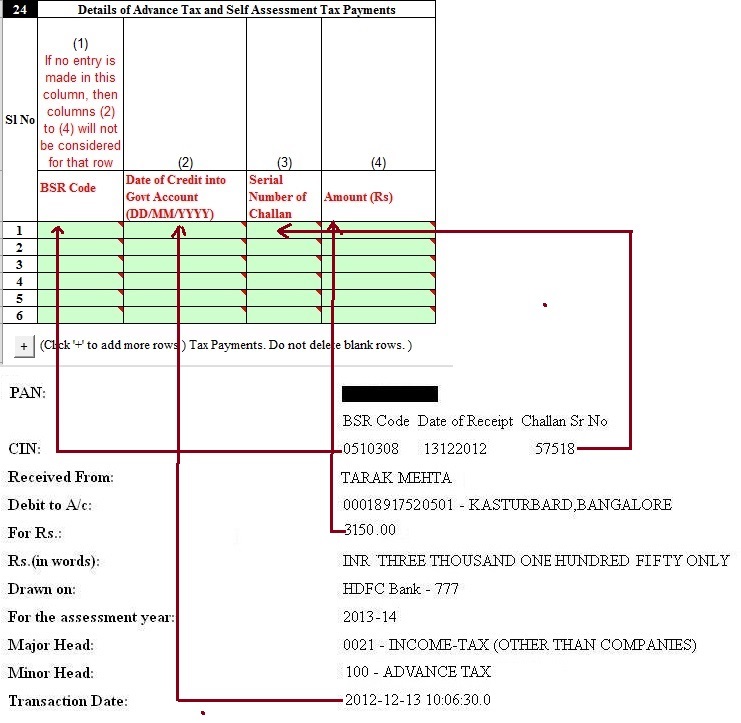

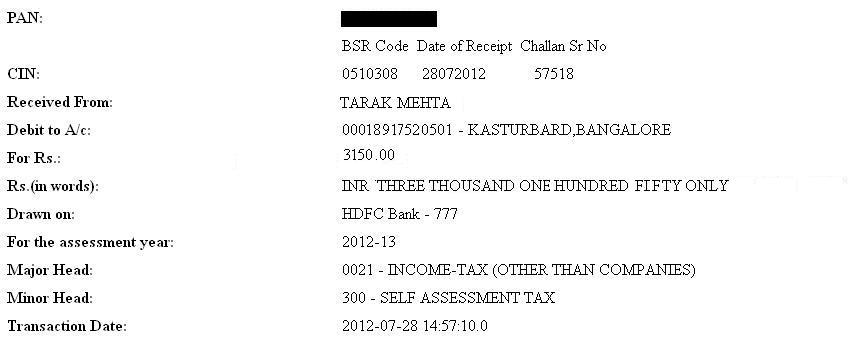

After the taxes are paid through Challan 280,you will get a receipt or counter foil as acknowledgement for the taxes paid. Receipt has details of person paying the tax, amount, type of payment etc and Challan Identification Number (CIN) as shown in the receipt of e-payment of Income Tax below.The challan identification number has to be cited in the return of income as of tax payment. CIN can also be cited in any further queries about the tax payment. CIN comprises of the following :

- Seven digit BSR code of the bank branch where tax is deposited

- Date of Deposit (DD/MM/Year) of tax

- Serial Number of Challan

- Example of CIN: 0000762 020208 32

When should I pay the tax?

Avoid paying the tax on last day. Quoting from Livemint’s Why paying advance tax on last day could be a problem usually if paying by cheque

If you are liable to pay advance tax by 15 September, but pay it even a day late, you would end up paying interest on the entire instalment of advance tax for a period of three months till the next due date, that is 15 December usually if paid by cheque.

Very often, such payment is made by a cheque drawn on a bank other than the bank receiving the advance tax payment. In such cases, the payment of advance tax is tendered on 15 September, but realised after 15 September. In such cases, earlier the Central Board of Direct Taxes (CBDT) had clarified that the date of tender was to be taken as the date of payment, in accordance with the Treasury Rules, and accordingly no interest was chargeable for late payment in such cases. That is why the receiving bank would normally enter both the date of tender as well as the date of realisation in the stamped copy of the challan acknowledged by the bank.

The Central Government Treasury Rules were replaced by the Central Government Account (Receipts and Payments) Rules, 1983, which provide that when the payment is made by cheque or draft, the payment shall be deemed to have been made on the date on which it is cleared and entered in the receipt scroll. Since then, the tax authorities have been trying to levy interest in such cases where the cheques have been realised after the due date of payment.Centralised Processing Centre (CPC) while processing tax returns picks up the date of payment of taxes from the Tax Information Network (TIN) server. In many cases, TIN records the date of clearance of the cheque as the date of payment and not the date of tender.

Verifying Challan

You can verify the challan online. On receipt of the amount, receiving bank will upload the details in the Challan to Government via NSDL through its OLTAS (Online Tax Accounting System) return within 3 working days. To verify visit TIN webpage click on Challan Status Enquiry which will take you to TIN’s Challan Status Enquiry webpage. You can select either

- CIN Based View : Where one enters CIN and amount (optional), deductor can view the following details:

- BSR Code

- Date of Deposit

- Challan Serial Number

- Major Head Code with description

- TAN based view: By providing TAN and Challan Tender Date range for a particular financial year , the tax payer can view the following details

- CIN

- Major Head Code with descriprtion

- Minor Head Code

- Nature of Payment

- Name of Tax Payer

If the tax payer enters the amount against a CIN, the system will confirm whether it matches with the details of amount uploaded by the bank.

If the entry is missing over here, after 3 working days [from the date of issuing counter foil], deductor should contact the Bank Branch to check the matter.

After paying income tax through Challan 280 what next?

You can verify challan using CIN in reciept online through your Form 26AS or through Challan Status Enquiry on TIN webpage. You also need to quote CIN number while filing your income tax. Our article , Challan 280: Payment of Income Tax, discusses verification, correction process in detail

If you have paid Self Assessment tax through Challan 280 fill in the details in Tax paid and make sure that your tax liability is 0 before submitting the return as explained for ITR1 in our article Fill Excel ITR1 Form : Income, TDS, Advance Tax Our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR discusses it in detail.

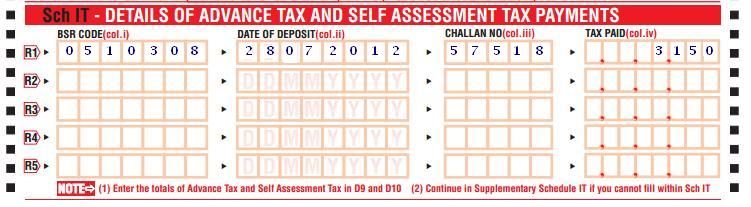

Fill Advance Tax Details in ITR using Challan 280

Reprint Challan 280

Income Tax Returns can be filed only if we have paid the Tax due to the government. If you submit the ITR without paying then your Income Tax Return can be declared Defective.

After paying Self Assessment/Advance Tax one needs to download the Challan 280 reciept and update Income Tax Return. But at times many people forget to download the receipt. Most of the bank offer the facility of re-generation of Cyber Receipt/ Challan for the e-Payment of Direct Taxes through TIN-NSDL website.

Banks upload challan details to TIN in 3 working days basis after the realization of the tax payment. On the day after the bank uploads the details of self assessment/advance tax to TIN, it will be automatically posted into your Form 26AS.

But what if you want to get details of your challan now and can’t want for Form 26AS Updation. For example filing ITR near the deadline. Then you need facility to regenerate Challan 280/reprint Challan 280. Many Banks provide this facility. We have updated details from SBI, HDFC bank and ICICI Bank in our article Reprint Challan 280 or Regenerate Challan 280

Correction of Challan 280

Quoting from IncomeTax webpage Challan Correction (pdf)

The physical challans of all Direct Tax payments received from the deductors / taxpayers are digitized on daily basis by the collecting banks and the data transmitted to TIN (Tax Information Network) through link cell. At present, the banks are permitted to correct data relating to three fields only i.e. amount, major head code and name. The other errors can be corrected only by the assessing officers. Under this mechanism, for income tax payments made on or after 1.9.2011, the following fields can be got corrected through the concerned bank branch

Assessment Year, Major Head Code, Minor Head Code, TAN or PAN, Total Amount, Nature of payment ( TDS Codes )

The time window for the correction request by tax payer is as follows :

| S.No | Correction required in Field name | Period of Correction Request(from Challan Deposit Date) |

| 1 | TAN/PAN | 7 days |

| 2 | Assessment Year | 7 days |

| 3 | Amount | 7 days |

| 4 | Other fields (Major head, Minor head,Nature of payment) | Within 3 months |

The time window for correction by the bank is 7 days from the date of receipt of correction request from the tax-payer.

Procedure of Challan correction by Assessing Officers (both physical and e-payment challans)

After the window period available to banks for challan correction, the assessee can make a request for correction to his or her assessing officer, who is authorized under the departmental OLTAS application to make such correction in challan data in bonafide cases, to enable credit of the taxes paid, to the concerned assessee.

Income Tax credited to your PAN: Form 26AS

If you are a taxpayers, you need to check your Form 26AS to ensure the tax deducted at source (TDS) is reflected correctly in the income tax records. Form 26AS is a consolidated tax statement issued under Rule 31AB of the Income Tax Rules to PAN holders. This statement will include details of:

- Tax deducted at source (TDS)

- Tax collected at source (TCS)

- Advance tax, self-assessment tax, regular assessment tax etc deposited in a bank by taxpayers (PAN holders)

Any Tax paid by PAN holder should be reflected in Form 26AS. So verify Form 26AS also for Advance tax, self-assessment tax, regular assessment tax etc deposited . Our article Viewing Form 26AS on TRACES explains it in detail.

How is income tax paid such: Advance Tax , Self Assessment Tax accounted for?

While filing the income tax return one has to fill information about the Advance Tax, Self Assessment Tax paid. For example from our article Filling ITR-1 : Bank Details, Exempt Income, TDS Details one needs to the tax paid.

Related Articles:

- Advance Tax:Details-What, How, Why

- Viewing Form 26AS on TRACES

- Income Tax Overview

- Paying Income Tax Online: Challan 280

- Paying Income Tax Offline: Challan 280

- Reprint Challan 280 or Regenerate Challan 280

Very useful info. Thanks for sharing

I have paid self assessment tax & updated ITR, but mentioned incorrect challan serial no (instead of 5 digit challan serial no, I wrote 280 mistakenly). I have mentioned other things correctly like BSR code, Date, Amount. I have submitted online and e-verified the return. How can I correct it. I am still under due date of filing. Or, there is no need to correct it?

hi,

i want to pay my income tax thru cheque in sbi bank so what should i have to write in cheque…

As per income tax guidelines given below

Tax payers may please draw/issue Cheque/DDs towards payment of income-tax as under:

Pay _________________ (Name of the bank where the Challan in being deposited)

A/c Income-tax

I have paid the self assessment tax through challan 280 and added the challan details during efiling and submitted it . Should i send a hard copy of the challan receipt to CTC along with Acknowledgement for eVerification?

As you have filled in challan details in ITR nothing more has to be done.

Sir,

I paid the tax liability on behalf of my father through the OLTAS website.Since it was after 8 pm challan was not generated. All the details entered was as per my father’s details. The amount was paid through my SBI debit card.

Issue is I don’t have any references apart from SBI reference number. If I go to regenerate chalane in my SBI account it shows no documents(I am guessing it’s because the account is mine not my father’s).How do I get the chalane record now.

Thanks

same issue ….. pls help anyone!!

I have made the transaction for advance tax . But I did at 8:20pm 15th September , so the amount is not debited from account but it was showing your transaction is reschedule to 16th September ,but in my bank account there is no schedule payment showing . I have to cancel the payment . Will it debit from account automatically tomorrow or I will get notified before transaction .

How will I cancel my payment?

Why do you want to cancel your payment?

Which bank are you using for Advance payment?

Amount paid twice for the self assessed tax, because Challan no. could not be generated for the first time and it was showing ” no transaction……………………………”,though Money was deducted from bank account . ITR submitted with second challan number only.Now how to recover or get refunded the amount deducted first?

Hello, i have two quries

1. can i pay self assessment tax for my father ITR using my SBI account’s intenet banking?

2. Can i generate EVC for my father ITR using my SBI account’s intenet banking?

thank you

1. You can pay the self asst tax for your father through your online account, no problem at all. just be careful about the PAN & AY.

2. There are many other ways to generate EVC

– Through Bank Account Number

Electronic Verification code using Aadhar One Time Password (Aadhar OTP)

Which challan to be filled to pay tax for Other income i.e. interest from saving balance.

When you have money in bank savings account, your money earns interest. That means that you get paid for keeping your money in the account. As you earn money you have to pay tax on it. But Income Tax Department gives deduction upto 10,000 Rs under section 80TTA on interest earned on all your saving bank accounts.

Interest earned on Saving Account is considered as Income from other Sources. This needs to be declared in your income tax returns. No TDS is deducted from the interest on Saving Bank Account.

From FY 2012-13 under the new section 80 TTA of the Income-tax Act, deduction up to an extent of Rs 10,00 in interest from all the bank accounts is allowed to an individual or Hindu undivided family, Interest over Rs 10,000 will be taxed at marginal tax rate of an individual.

Our article Interest on Saving Bank Account : Tax, 80TTA,ITR discusses it in detail. Image below shows how ITR reflects Interest on Saving Bank account of more than 10,000 Rs

Before filing the ITR one has to make sure that one owes no tax . If after calculating the income, taking care of deductions and deducting the tax already paid (TDS) one realises that one has paid less tax than due then one has to pay the balance tax. This tax is called Self Assessment Tax. One has to calculate the self assessment tax, pay the Self Assessment tax,update the ITR and then submit it. You pay Self Assessment Tax using Challan 280 Our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR describes in detail.

If you have some income tax due because of any reason such as long term capital gain/income from other sources you need to pay tax using Challan 280

Interest from Saving Bank account comes under 80TTA and you can claim deduction till Rs 10,000. Checkout Our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR for more details.

As a website developer I believe the content here is truly fabulous, regards.

What’s Happening i am new to this, I stumbled

upon this I have discovered It positively helpful and it has helped me out

loads. I’m hoping to give a contribution & help different users like

its helped me. Good job.

Dear Sir,

Income Tax is deducted from my salary by my employer (Govt). But I want to pay income-tax on my fixed deposits (FY 2016-17) online by myself . Should I pay the same in through Challan 280 (i) in self assessment category ? (ii) before or after 31st March 2017 ?

Today 15 Dec, 2016 at around 8:30 PM, while I was paying the third installment of advance tax, I found that OLTAS only allows to make transaction uptil 8:00 PM of the day. Please guide me how should I proceed since I do not want to incur interest penalty under section 234. Can I get to pay the TAX by some other means by today itself?

Sir,

I have paid excess TDS on Contractors..actually it is 1% but i deducted 10% and paid for the month of November 2016. Can I used the excess amount in other sections for ex. 194I or J…… Need urgent help.

Paid Amt 19432

Actual to be paid 1943

Excess amt: 17489

What is to be done……?

Excess TDS deposited can be used in the following quarters of the relevant year and the balance amount, if any, can be carried forward to the next year. Excess TDS deposited can also be used for payment of tax default of the preceding year. Relevant extract from TDS-CPC Communication No. 27, dated 10.09.2014. – To view, visit traces webpage .

In case tax has been deposited more than the required tax deducted at source for a particular assessment year, the excess amount of tax can be claimed in the following quarters of the relevant year. The balance amount if any, can be carried forward to the next year for claim in the TDS statement. . Example: If excess payment of tax has been made in Q1 of FY 2013-14, the same can be used for Quarter 2, 3 & 4 of FY 2013-14 as well as for Q1 to Q4 of FY 2014-15. The excess amount of tax paid in Q1 of FY 2013-14 can also be used for payment of tax default of Q1 to Q4 of FY 2012-13.

Sir,

Ours is a newly started company and we dont pay tds on contractors more because we are dealing in Bio Stimulants and growth enhances. So 17489 will not be in use for next three to four years also. But we pay TDS on professional more than 10k to 12k per month………. so whatever amt i paid excess will be of no use for this FY 2016-17? Because we cannot pay tax defaults and nothing……..Sir give me solution for this……

Hi Sir,

I am an individual tax payer. I have been asked for major head change from 24 to 21 for the AY 2015-2016. I still have to visit AO and hand over the correction form. Will it get corrected if I go after an year i.e. in AY 2016-17 for this challan change request now? Please help.

Sir while filing my return online for FY 2014-15 that around 4750 more tax i have pay so i paid it on line through uco bank and filed my return with 250 rupees fund from IT after 3 months when i checked my return online i found that IT has raised one demand notice for the same amount which i have paid earlier.the paid tax of Rs 4750 was also showing/reflecting in my 26AS as self assessment tax for the same FY 2014-15 and i have also mentioned in my tax return.Now i have replied their tax demand 2 times whith disagree with demand and given all required details of self assessment tax and as attachment but now 5 days latter also the same demand is showing.Please help.

I am also facing the same issue. what is the next step to rectify this request?

I found your blog website on google and examine a few of your early posts. Continue to keep up the excellent operate. I simply further up your RSS feed to my MSN News Reader. Searching for ahead to reading more from you in a while!…

Dear Sir,

I have paid my tax for the year 2007 and 2008 from my employer tht is BSE limited . Now I have got intimation from Income Tax Dept that I have dues for 2007 and 2008 demand raised under section 143(1), how can I submit proof for the payment that I have done?

Thanks,

omprakash

I have paid my due amount of Tax through SBI online netbanking. But didn’t received any chalan 280 receipt, so don’t have my chalan number. But my balance has been deducted from the account. How can get my chalan number to e-verify it?

Please help me out here guys. Thanks in advance.

Hi,

First of all very big thank you for the article.

I did my e-file on 28th July 2016 for assessment year 2016-2017 and e-verified successfully with out paying my due tax Rs. 1230.

But I paid this due tax with option Self Assessment tax using challan-280 on 01 Aug 2016.

How to send this challan info to Income Tax Department?

Will I receive notice that Income Tax Return was defective?

Is there any thing to avoid the defective return ?

Please provide me your suggestion on this.

Thanks

Hi

I started working around 6 months back(Jan 2016). Am I eligible to pay self assessment tax?

You have to pay self assessment tax before filing ITR if you have paid less tax than due.

As you have just started working, your income would be from salary and your employer would be deducting TDS on it.

Ex of self assessment tax, when one has made FD , interest from income is income from other sources so one has to pay tax as per income slab on it before filing ITR

When I add certain amount in other source income (bank interest, whose TDS is already detected and the amount is reflected in 26AS), my cess is increase by Rs.30 and same Rs.30 is shown in payable tax.

Should I made Challan and paid it online, or leave it to next financial year.

As amount is less than 100 you can ignore.

Dear Sir,

I have paid DTAX through NSDL site and used ICICI netbanking. This was in 2008 for FY2006-07. I have lost my challan PDF and CIN number. Now I have got intimation from Income Tax Dept that I have dues for FY2006-07. Since I don’t have the challan, how can I submit proof for the payment that I have done?

Thanks,

Balaji

I tried to submit my tax returns through Cleartax. Since i had additional tax, paid the self-assessment tax through Axis bank. But unfortunately, could not get the Challan details downloaded correctly. Now, without the details i cannot submit my returns.

Please help me by suggesting the way to retrieve the challan details of my self-assessment.

If Challan details are unable to be retrieved and i have to pay the amount again then how can i get the additional amount paid to be refunded.

Things are not lost. You can reprint the challan. Please go through the link on Axis Bank

Thanks a lot!It really helped and i could complete by return submission.

Hi! I am experiencing the same problem. What option did you choose? “Payments through Corporate iConnect”???

i am trying but i am not able to . do we need to select coprporate. what does iconnect means ?

iconnect payment id iconnect id

that page is not at all loading is any one facing this ?

Hi,

I paid my tax through net banking using challan 280. But somehow I missed to provide CIN while uploading my return. I have not yet e-verified it. Please let me know whether I can add CIN at this point?

Yes you can CIN details in TDS2 and then submit the return.

Please everify the return.

A catch:

Theoretically If you have no e verified your return then actually your return will not be counted.

But after submission do you call the return as submitted or not is a debatable question.

So while filing the return if you face a problem the revise the return using following. Please do update us also as many people will be benfitted

In the form under FILLING STATUS

•For Whether original or revised return i selected ‘Revised’.

•For Return filed under section i selected ‘Revised 139(5)’.

•Entered the E-filing acknowledgement receipt number from the ITR-V which I got after filing the original return.

•Then I e-verify both original and revised return ITR-V forms.

i have done the same mistake today but i also e verified it. Wat should i do now ????

Sir

I made challan 280 online last evening through sbi net banking. Since it was over 8 pm it was not accepted. Again i made a challan this morning and filed return accordingly. However the amount has been deducted twice for 2 challans. How can i recover the amount.

Thanking u

Mk sahoo

Show both the entries in TDS section and ask for extra tax to be refunded.

Should i file revised return?

I paid my due tax online through SBI netbanking. Since it was over 8 pm it was scheduled for the next day. The next day amount got debited from my account. But I didn’t get the chalan receipt. Now I need my chalan number for e-verifying. I don’t know how can I get this number. Please help me out on this one. Thanks in advance.

After paying Self Assessment/Advance Tax one needs to download the Challan 280 reciept and update Income Tax Return. But a ttimes many people forget to download the receipt. Most of the bank offer the facility of re-generation of Cyber Receipt/ Challan for the e-Payment of Direct Taxes through TIN-NSDL website. Article, Reprint Challan 280 or Regenerate Challan 280, talks about how to how long does it take for Form 26AS to be updated, how to regenerate or reprint Challan 280 paid through internet banking of SBI,HDFC,ICICI Banks.

Thank you so much for your help !! 🙂 It really helped me out 🙂

Good to know it helped. Thanks a lot for dropping the comment

Sir,

Just now I also faced the same issue, it says payments scheduled for 29th. Do the payments get debited without otp.

By what time next day they debit the amount.

Sir,

Just now I also faced the same issue, it says payments scheduled for 29th. Do the payments get debited without otp.

By what time next day they debit the amount.

Pl intimate

Hi,

I have submitted the tax details in E-filing site and i dint pay the tax payable amount but i have got the acknowledgment. Please help me to pay the tax payable amount through online.

Hi Sir/Madam,

I fall in 20 % IT slab. I got 83,429 as interest from fixed deposit. Bank has not paid tax for the interest since I have submitted form 15.

What I should do know to pay the tax for the interest obtained and how much should I pay. Please advise

Shall I pay 10 % of the interest amount using Challan 280?

Thanks a lot for the quick reply. I have not filed ITR for this financial year. My doubt was

[1] How much amount I need to pay as tax

[2] For Challan 280 I hope I need to select option self assessment tax

Hi,

I filed my tax returns and even e-verified it. I realised later that i have not declared the savings interest amount (around 5000/-) while filing. My account is the same as that of my salary. How can i pay the tax (if liable) for this amount?

Sir interest upto 10,000 from Saving Bank account is tax free.

So as your interest is less than 10,000 you don’t have any additional tax to pay.

In case you have additional tax to pay that is called self assessment tax. Our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR for more details.

Hi,

I have already filed my return with the income tax department. But later I realised that the savings bank income is around 13000 which makes it a candidate for income tax. I know that challan 280 is there to file the remaining tax , my question how to link this self assessment tax with the IT Return which I have already submitted.

Thanks in advance.

Dear Sir,

You will be required to pay the tax amount on the same.To link the payment with ITR you will be required to refile the return as revised.

i paid tax through online mode but did not segregate the tax in the form of basic and cess. i paid it directly in the column of income tax and no amount in cess column. will it be a problem?????

No. You would not face any problem. Govt wants full payment of tax. If you do segregation well and good but otherwise its fine too.

Thank you so much for this quick repy… 🙂

I paid Self Assesment tax for my father.

After payment i didnot download the PDF of challan details. It was a bad mistake.

How can i download the challan details?

Thanks for simplifying the process and explaining the steps in details.

Which bank did you use to pay self assessment?

I used SBI Net banking facility to pay the tax.

I have the reference number from the transaction statement via net banking.

Is there anyway i can get the challan details?

Unlike normal net banking transactions, here the challan was not sent to my mail id.

Try this and see if it works

Click on the link e-Tax, reprint Challan

Let us know if it works

It worked like a Charm.

I went to SBI Internet banking. there was an option called reprint challan

I gave the date, clicked on the reference number.

And there it was. The Challan. Downloaded the PDF.

Thanks a lot for your help.

I Really appreciate it 🙂

Good to know we were able to help. Thanks for appreciation.

Do verify that Form 26AS of your father reflects the TDS after 3-4 days.

Do spread the word around about bemoneyaware.com. It will mean a lot to us.

Want to share my experience

I had a similar situation and I was looking for an answer . However , in my case , the payment was made through an ATM card and had no internet banking enabled.

Finally , I found this page https://www.onlinesbi.com/personal/tax_retail.html

CLick on “Generate Receipt” for taxes paid through ATM cum Debit Cards . Need to select OLTAS , enter PAN Number , Bank Account Number and the dates for transaction

You will get Transaction details & the following option

“Click here to see the challan details” to get your challan

My Question is when I pay Self assessment tax for F.Y. 2015-16 in F.Y. 2016-17 thru challan. will i get the tax credit in F.Y. 2015-16?

While paying Challan 280 you have to mention AY 2016-17 and that gets reflected in Form 26AS.

You need to update ITR with the challan details.

That you claim. You can read our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR for more details.

I have a shop , depreciation was claimed in 2013 , now I wish to sell it in 2016 , will it be a long term capital gain or short term ?

I paid the income tax of my father through net banking. But at the end, it showed EOD processing is in progress. Try after some time. What does that mean? The money has not been debited from the account.

EOD means End of Day. At End of Day banks have lot of work to do. Ex:Accumulate Daily Balance this process aggregates the accounts’ balance. The aggregate balance shall be used in the computation of average daily balance and accrued

When you were trying to pay income tax, bank software was busy with its EOD work.

Hi, I calculated my Self Assessment Tax and made the payment online through challan 280. However, later on, calculating in the utility, I realised my income was lesser by around Rs. 1500, which meant that tax payable was lesser than what I had actually paid. So I wanted to know, what is the process now, I have not filed my returns yet,so can I file my returns with the revised income and expect the refund to be made, OR do I need to get the amount (and cess, interest ) corrected in the challan. Thanks

You can file your returns and ask for refund. There should not be any problem in getting your money back if your calculations are OK.

My father does not have online bank account access. So can I pay his income tax online by paying from my own savings account?

Yes it should be possible. Because it asks for net banking details.

If you try it will you update us as it will benefit other readers

Yes it is possible. I paid on behalf of my cousin who doesnot have Net Banking access. We open the challan ITNS 280 and enter the PAN No and other details of the the person whose tax is being deposited. When we are directed to Bank’s site, we use our user id and password and pay the amount.

Thanks for sharing

You are really very helpful to people like us.

Would you please advise me in the following? I am a salaried person in the 30% IT bracket with full TDS. I had some fixed deposits in a cooperative bank. On 22 Sept 2015 I closed some of the FD and got interest amount of Rs. 142009; and on 28 Oct 2015, i again closed some of the FD and got interest amount of Rs. 203952; finally, on 28 Jan 2016, I got again from some FD interest amount of Rs. 191275. The bank did not deduct any income tax and I also missed to pay. I want to clear all these dues by Challan 280 through some bank. How much income tax with interest and penalty (if any) I have to pay? Is there any final date? Would you please help me with a reply? Thanks so much.

how can i pay by cheque means by witch name ?

I’ve paid 51,000 using challan but my actual tax was 7,000. I calculate it wrongly and paid. The extra amount will be return by tax department or not.

What will happen to the extra amount which I paid.

If one pays excessive tax one can ask for refund while filing Income tax return.

If you have paid for FY 2014-15 or AY 2015-16 and you have filed your return but the return has not been processed then you can revise your return and ask for refund.

IF income tax department agrees with your calculation they will refund the amount.

Dear Sir,

I received a notice to pay Rs. 176130 under section 143. Please let me know how I can pay it online….

Our article How to Pay or Reject Outstanding Income Tax Demand under Section 143(1) explains it in detail.

Hi,

I happened to see that there is a pending demand notice for AY 2007-08. So far I totally overlooked it.

I looked into Form-16 of FY2006-07 and balance tax is zero. Maybe market trade transactions in NSE using icici direct online could be possible source of additional tax (In fact I am not sure what it could be)

But not sure why it is around 44K? Is it the tax payable plus the interests so far?

Please suggest a way to rectify this.

Thanks you.

Please try to get information on why the pending notice. Yes interest is added to outstanding tax demand. Interest is payable @ 1% per month or part of month on the tax due to be paid from the 1st April of the Assessment year till the date of assessment is done.

You can check Outstanding demand and details by Logging in to the Income tax website and Click on My Account and then Outstanding Tax Demand.

The income tax e-filing portal has an option to send request to the IT people to send the demand notice by email to you for the years in which the return was electronically filed. For the years when you did not file IT return electronically, you need to contact and ask for the demand notice from your jurisdictional assessing officer of the year of Demand, with whom you had filed your IT return. They will provide you the copy of notice, by which you can choose the course of action needed to clear the demand.

Please do keep us updated as it would help other readers too!

1) Demand notice amount you see is only principal amount. Once you agree and pay, then interest till current year will be next demand notice.

2) AO said that 2006-2009 period is when IT was computerized. So AO said that the demand notice I see for 2007-2008 could be a result of wrong data during that period and asked me to submit a correction request.

3) I submitted request for correction, and rejected demand notice with details from AO on IT web page for 2007-2008.

Waiting whether they accept my rejection. It may take few weeks.

I filed my ITR on 29th Aug 2015,but my employer deducted my complete tax till mar’15.After my filing of ITR in excel,an interest of 1490 was calculated for AY 2014-15..How this is so..I had payed my tax before due date..then why interest..and now how to pay this interest…can you provide me the link

Sorry the information is not sufficient for us to find out.

Before filing one gets the Form 16 from the employer which shows all the income and tax deducted.

Did you quit your job in Mar 15?

While filing return for AY2015-16 , I paid tax on bank interest by challan 282 under Major Head 24 (Interest Tax) and minor head (300: self assessment tax). But IT dep has rejected this tax payment on interest and sent a demand of same amount. I wanted to know whether I have not paid my bank interest tax under correct head and also the procedure to get it rectified.

Sir Self Assessment Tax has to be paid using Challan 280.

Challan 282 is for payment of Gift-tax, Estate Duty, Expenditure Tax and Other miscellaneous direct taxes

So IT Dept is right in rejecting as it has not got Payment using Proper Challan.

We are not sure about solution.

You can meet your Assessing Officer to request change of challan

I faced similar situation.

I sent a requisition (on plain paper with full particulars of mistake & the remedy required) to the AO cercerned to correct the challan from ITNS282 to ITNS280. The same was corrected by AO and an intimation was also sent after correction.The change can be seen in 26AS also. Major Head gets corrected from 24 to 21. After correction, I submitted Rectification Request. Finally the ITR was processed; resulting refund was adjusted againt other outstanding demand. A communication “RECTIFICATION ORDER UNDER SEC.154 OF INCOME TAX ACT, 1961” reflecting “ITR – Rectified” is also sent by IT Department.

A new feature, “Challan Correction is seen in ITD’s website. I have not tried so I am not sure if it serves the same process explained above.

Thanks for sharing your experience. It will surely help other readers

Hi,

I have a same issue like yours. Could you please tell me that you sent your requisition to AO via courier/mail or submitted yourself? also, how do you find it has been received by the AO and how long it took for the correction? Also, while rectification, which option do you select for rectification. any help in this regard shall be highly appreciated as I am very much confused about this matter.

Hello

Hope your problem of TDS mismatch due to use of wrong Challan is settled by now. I visited this page yesterday and found your post. Here is my reply:

I handed over my application personally at the IT Office.

A good acknowledgement procedure is followed at the receipt section. You have to carry two copies of letter. A sticker with reference number is generated in duplicate and on sticker is affixed on your copy and is given back to you as acknowledgement.

It took nearly one year to correct the discrepancy. The corrections are affected by Jurisdictional Officer only. Persuasion may hasten the process.

You expressed that you are not aware of the Rectification and Response Processes. You will find two publications in the web site of Income Tax Department. Read coolly you feel you are better equipped and it is quite likely you will solve your problem on your own. The link and other details are given below.

Go to opening page by typing http://incometaxindiaefiling.gov.in/# in address bar.

You will find “Help” tab at right hand side top corner of the page. Click on it, a window shows 6 help topics. Look for “User Manuals”. Under “User Manuals” you will see 21 manuals in pdf format. Please download “Rectification” manual and “Response to Outstanding Tax Demand” manual. These two manuals will answer many of your queries.

Thanks for the help Sir

my salary is ₹10,000/- should i need to pay tds on it??

TDS means Tax deducted at source. Your employer first deducts the tax as per your income slab and then pays salary to you.

Below 2.5 lakh there is no tax hence your employer would not be deducting TDS

I have the filed the IT-return with nil amount as payable. But later after e-verifying, I noticed that the money i payed as Self Assessment Tax is not reflecting in the Return acknowledgement.

I paid Rs.1270 as Self assessment tax and added the challan and BSR details in the online form. While filing the tax payable showed to be Rs.0, but right now it is showing the amount to be RS.1270.

I have already e-verified by return.

Request your help in correcting my return

Where did you add the TDS details for Self Assessment Tax. TDS details have to be added as shown in our article Filling ITR-1 : Bank Details, Exempt Income, TDS Details one needs to the tax paid.

Hi Sir

I pay self assessment tax of 120 rs on 31 aug 2015 night through onlinesbi,but due to night online payment not made and its shows that this transaction will happen on 1 sep 2015.120 rs is deducted from my online account,and i can not file ITR timely on 31 aug 2015.Problem is that sir–that when i made payment through sbi its only show a single reference number,not BSR code and challan serial number.now i can not understand how to complete and submit my ITR without both of those,and with only eference number.plz plz give a suggestion.waiting for your reply.thanks a lot.

Is the amount of only Rs 120?

Check with the bank today.

Check the tax calculation again. Due to 1 Sep interest etc might have changed.

Please don’t postpone filing tax till last day.

thanks thanks a lot for your quick reply and so kind suggestion.today i check with bank,and got challan no and bsr code,and file my ITR.i again check tax calculation again,due to 1 sep,4 rs added,but 4 rs was neglected due to ten rupees rounded off IT DEPT Rule.

thanks

Thanks for getting back. Good to know you could complete your ITR filing

Hi,

I have payed my tax through online but I havn’t received any challan no or Tax Payers counterfoil. I only have the reference no 000432934429 IK89238304 and transfer made to OLTAS. Can you let me know who is responsible to give me these details, and how can I know if the tax have been sent to Government.

Thanks

I filled and signed and forwarded the ITR returns for AY 2010-2011 actually i filled the wrong data and wrong AY 2010-2011 and i dint earn any for the AY 2010-2011 as per my half knowledge i filled the application with wrong AY 2010-2011 and wrong data , i filled it in 2013 for Ay 2010-2011 and for the filled application i generated itr-v and forwarded with an pending amount of tax.now they had send me the demand note to pay the amount whether i have to pay the amount if so i dint have income i failed wrongly and submitted.

if i have to pay the demand note amount using challan 280 after paying the amount of the demand note raised where i have to upload the cin number in website.

Sir,

One of my friend has pending ITR e-filing for AY 2011-12, 2012-13 & 2013-14. Is it possible to file now? If there arises some pending tax to be paid (his employer deducts tax at source) can it be paid now. Please provide me the complete details. But as of now my friend has not got any notification for the pending ITR filing or any other thing.

Thank you.

I calculated my Self Assessment tax and made the payment online through Challan 280. However, later on calculating in the Excel, I came to know there was still some interest showing up (around Rs.230). This happened because I calculated Tax on 31st Jul and paid on 1 Aug, so there was still some interest from Aug showing up. I want to know if I can pay the remainder through Challan 280 again? I haven’t filed my tax yet.

Yes Swapnil you have guessed it right. Under section 234B interest calculation will be different on 31 Jul and 1 Aug.

You can pay remainder through Challan 280 again.

234B In simple words, interest @ 1% per month is payable on the amount of income tax paid after the end of the financial year.

Ex: You have to pay 10000 as income tax before filing ITR.

Before 31 Jul

Calculation of Interest Payable u/s 234 B

1 Number of months for which interest is payable on shortfall amount @ 1% per month 4

2 Interest Payable under Section 234 B 400

Between 1 Aug to 31 Aug

Calculation of Interest Payable u/s 234 B

1 Number of months for which interest is payable on shortfall amount @ 1% per month 5

2 Interest Payable under Section 234 B 500

sir

i have received form-16 from my employer total income from salary 450308 -80c-98082 and planned to fill according that,

as i found in form26a tds2 income 11185

i have found that i received income from my fd saving and bank paid the tax also .so i need to show that also in tds-2

it is shown in 26a like this transaction date-31 march 2015 ,date of booking 14 may 2015 ,amount paid/credited -11185 and tax deducted -1119.

pls help me how to fill in tax details column for tds 2 .which year should i need to fill .what should i fill for tax deducted (5) and amount out of (5)claimed this year.

when i filled somewhat i got total payable as 30 rs.

am i rightly filled .pls help any one

You need to fill in information about TDS (Tax Deducted at Source) from Salary as per Form 16 given by the employer, and/or on

Income from Other sources on Form16A issued by the deductor such as bank if bank has TDS details on interest in Fixed Deposit.

Our article Fill Excel ITR1 Form : Income, TDS, Advance Tax explains it in detail with pictures

sir i have submitted the efiling process.

but it is showing as 30rs as tax payable

i also everified my submitted form

what should i do now.

is that i need to pay the tax of 30 rs

if so how

pls help

If payable is more than 100 Rupees then only Income Tax Department send Demand Notice,

In Your case Liability is very less, Don’t worry about it.

But now a days if it shows a Payable of Even Rs 10 then you will receive a Demand Notice under Section 143(1) better to Pay it off after receiving Notice, otherwise no need to pay Demand Raised below Rs 100

thank you so much for the responce people.

happy days ahead.

I paid a tax challen 280 as a self assessment but.. i didn’t get any CIN number by mail or SMS and not even on screen also..now i m getting confuse ..is that amount get paid or no.. i called Bank, NSDL . NSDL saying bank will provide challen counterfoyil and bank saying NSDL will provide and i paid the ITR on 4/8/2015. Please help me now what i will do

That’s surprising.

One doesn’t get any SMS or mail but get CIN number as shown in image above.

Has money been debited from your account : If not you can repay.

If money has been debited from your account then you can wait for it to appear in Form 26AS.

It has details of tax deducted/collected on your behalf by the deductor/collector and also details of any advance tax, self assessment tax deposited by you.

It will be good if you can check in your internet banking. There will be option reprint challan..

Sir,

I have received a demand notice u/s 143 on 30.06.2015 for AY 2014-15, I have paid the demand notice amount of 990 as was mentioned on 06.07.2015 under interest section in challan ( I have receipt of challan with me), but as i was unaware that i have to first acknowledge the demand notice which i did later wards on 20.07.2015. On 20.07.2015 i acknowledge the demand notice by accepting it is correct . Now my concern is till date i have not received any intimation from ITD and when i am logging on e-filling it is still showing demand notice under actions pending.

Now i want your suggestions that should I wait some more time so that my demand notice will be cleared by ITD or do I have to re pay the amount.

Kindly revert with your expert suggestions.

Thanks in advance.

Was checking with our CA Akshay. His comments are:

first of all challan which has been paid by him, it should not be paid under field of Interest until and unless it is specifically raised for interest only. So do check the same .

Secondly , Under field of My pending action, these demand will be reflected there. So click to Submit field and

select disagree with demand and with selecting that option, you will be asked to provide challan details.

It will solve your problem.

At last if that still shows as demand, its not at all matter of worry. It will get resolved by passage of time.

Challan paid by me under field of interest was because it was reflected in intimation received by cpc under sec 143(1) as i have paid my tax under Part C and interest calculated and paid by me was less then what CPC mentioned in intimation.

But I checked my form 26as and it is showing tax paid under Part C (Tax paid other then TDS or TCS).

So what shall i do further now ?

Hi kirti,

While filling up challan 280. I have put the whole tax payable amount of 60 rupees in front of basic tax field. Insteading of breaking into 58 and 2 as cess.

Will it cause any issue and should be highlighted to ao.

Regards

Surajit Roy

Hi Team,

In the below scenario I have paid the self assessment tax online

Regards,

Surajit Roy

sir,

On filing ITR 1, MY TAX LIABILITY shown in auto filled form from the system of IT Deptt is as follows:

Total interest u/s 234A- Rs 0

u/s 234B- Rs 908

u/s 234C- Rs 839

Also tax to be paid as computed automatically by system is Approx Rs 22800/-

Which Chalan form should I fill and sumit before uploading my return?

thanks

You have to pay Self assessment tax through Challan 280.

Enter these details in Advance Tax and Self Assessment Tax as explained in our article Fill Excel ITR1 Form : Income, TDS, Advance Tax

I am a Central Govt.employee and I got form 16 from my office, which shows the TDS . According to that I have to get refund of Rs. 80/-.

One bank deducted tax on my FD and issued me another form 16.

Both the above TDS are reflecting in my form 26AS.

Now I collected my interest certificate (on FD) from another Bank which shows paid interest of around Rs. 8000/-. I have to deposit tax on this interest amount. Which challan form I should have to fill up?? Is it 280 or 283 or another one. Both of these forms requires PAN. Whether only PAN is sufficient or I have to mention my office TAN also.???

Please help.

Or whether I have use Bank’s TAN.. I am completely confused this year in A.Y. 2015-16. Please also describe how the fill up the Challan form suggested to me.

Sir you have to pay tax you owe to the Govt. You would have to mention your PAN number as you are paying tax.

You have to pay Challan 280.

You can go through our article Paying Income Tax Online, epayment: Challan 280 to understand how to pay

State Bank Of India Main Branch, Ranchi(Jharkhand) is not accepting I Tax Challan No. 280 trough Cash Payment and saying that Itax Department has issued circular that cash payment of Challan will not be accepted. They are at neither giving in writing that cash payment will not be accepted nor posted any notice/orders in bank premises which is causing great trouble to general public. What is fact ?

That’s news to us. We couldn’t find any notice for it. We have raised it in our twitter account.

Hi,

I have changed jobs in the FY 2014-15. (total 2 Employers),

Employer 1(April to Sept mid), not considered my rent receipts so it is not reflected in form 16 also.

Employer 2(Sept mid to March), not considered my rent (my mistake, I missed the deadline) and not considered to previous income from employer 1.

Now at the time of filing ITR-1 ( AY 2015-16),

I understand that I need to pay the tax after combining the both form-16, since it changes the tax slab.

I need guidance for,

1) claiming the rent which got missed out in both form 16.

2) What I have to do the rent receipt proofs which are with me?

Yes you can claim HRA.

Be careful in calculation of salaries

Our article HRA Exemption,Calculation,Tax and Income Tax Return should be of help to you.

Our article How to Fill ITR when you have multiple Form 16 discusses it in detail

hi,

I paid the Self Assessment Direct Tax online (Challan 280). However by mistake, I paid a higher amount. Can I mention this while filing the returns and get the refund.

Thanks,

Manish

Yes you can do that.

Hello,

For AY 2014 – 2015, I received a refund greater than what shows in Form 26AS. I received a demand notice U/S 154. I am a salaried individual.

1. Which challan should I use?

2. If 280, should I select radio button 0021?

3. Would this be Tax on Regular Assessment?

Help would be greatly appreciated.

Thank you.

Hello,

I got an outstanding demand for the AY 2009-10 under section1431a, i paid that now when I open the site it is showing another outstanding demand under section 220(2). I think this amount is the interest of that outstanding demand which was raised 5 years back.Am I right?

I need to pay CPC demand under section 220(2) and I am planning to pay this amount using Challan280 but Could you please tell me what will be the payment details mode from the following?

Income Tax ,Surcharge, Education Cess, Interest, Penalty, or others.

And once I pay this amount do i need to do anything like need to file any revise return(my friend was telling)? I dont have any idea on this.

Please help me out.

Regards,

Joyanta

I got TDRs from office as well bank on June 9. While computing I saw some money has to be deposited through 280. I will pay within 30th June – Is any interest claimed ?

Hi,

I have a joint bank a/c with my wife being primary a/c holder. The bank has deducted tax against interest on FDs and deposited it against my PAN number instead of my Wife. Now the Income & interest is being shown under my Form 26 AS. How to get this rectified?

Thanks in advance for guidance.

In case of joint accounts or joint FD holders – it is the first account holder against whose PAN TDS is deducted.

Inform the bank about the discrepancy in TDS deduction and request them to revise the TDS return they submitted. Anyone who deducts TDS has to submit a TDS Return of all the TDS deducted by them and that is how this information reaches your Form 26AS. When they revise their TDS return and include your wife PAN details, this TDS will then get reflected in your wife’s Form 26AS correctly.

Please do it ASAP so that it is reflected by the time when you file the income tax returns

Sir

While making EPayment of TDS for salaries in a month we have paid the total TDS amount in Tax column instead of breaking up the it in Tax amount and cess amount please tell me whether any problem will arise out of it

Dear Sir

One of my friends Advance tax payment for Asst Year 2005-06 is not linked to his PAN and he has been denied the credit for Advance tax paid. In the Challan enquiry status in TAx Network..there is a note that ‘in the Challan PAN is not available/incorrect’. Now after many years, when a refund is due for Asst year 2013-14, they have raised a demand for that year 2005-06+ and the refund due for AY 2013-14 is adjusted now. I have got challan copy, and the Banks have also uploaded in OLTAS correctly, but no one is resolving the issue.. what I have to advise my friend to do further.

Ask him to be patient and have hope.

A friend of ours is also in the same boat.

Income tax department will send a notice saying that is so much outstanding due and meet the Assessing Officer. If there is refund then it will say that it is adjusting refund against Outstanding due.

You can refuse it and If you can meet the Assessing officer or send your CA to meet Assessing officer within the time limit given in notice.

They will ask you to submit the hard copy of related documents.

Get acknowledgement and wait.

SIR,

i have filed my ITR 3 as on 29 march 2015 for the A.Y 2014-15 and i have paid my self assessment tax but forget to enter detail income tax return now the return show tax payble what should i do.

Please help.

Hmm . Typically when one makes the mistake in filing return one can revise it.

Original return is filed under section 139(1). If a return is filed after the due date,called belated return, then it cannot be revised.

Having said that as you have already paid the Self Assessment Tax, Verify that it shows up in Form 26AS. Our article Understanding Form 26AS explains it in detail.

Keep the record of the Self Assessment Tax paid. As you have paid your tax hopefully Income tax department will use it in assessing your returns.

Hi,

I changed job in December. My earlier employer had deducted X amount as Income tax, My new employer did not consider my earnings till December and hence on earnings from December to March they deducted an amount Y as income tax. Now I realized that I have paid less tax than what I should have paid. Since it is already March 26th today, can I still pay advance income tax thru Challan 280? Or should I be following a different way? Please suggest.

Thanks!

Virendra

Virendra it happens to most of people who change job. Our article Changing Jobs:Take Care Of Bank Account,Tax Liability

As you have realised that you need to pay tax which you were supposed to pay you can pay now with small penalty or later with bigger penalty.

If you owe more than Rs.10,000(after deducting TDS) while filing your returns, you will be penalized with Interest under sections 234A , 234 B & 234 C

Under section 234B, penalty arises when the total amount of advance tax paid along with the amount of TDS is less than 90% of the total tax liability. In such case interest is calculated at 1% per month of the amount of shortfall for time period from April to the month in which the return is filed.

Under Section 234C, there are three components. For the first installment, the shortfall penalty is calculated for 3 months @1% p.m. Similarly, in the second installment, the shortfall penalty is also calculated for 3 months @1% p.m and the final installment is calculated at a flat rate if 1% for 1 month only.

This is explained in detail in our article Advance Tax:Details-What, How, Why

Finotax has great Advance tax calculator. Check it out here

Sir, I have filed my income tax return for the year 2013-2014 before paying tax through online challan and now I have paid the same, but how should i enter the challan detail in my itr-v or is there any other way to intimate income tax office. please help me on this.

Thanks in advance.

One should pay self-assessment tax before filing the returns. If you have filed your return before 5-Aug-2013 then you can revise your return.

Our article How to Revise Income Tax Return (ITR) explains the process in detail.

For detail on how to fill Advance Tax and Self Assessment Tax, refer to Fill Excel ITR1 Form : Income, TDS, Advance Tax

All tax related information is collated at our section Income-Tax

Thanks a lot for the information, i will revise my returns online.

Sir, I have filed my income tax return for the year 2013-2014 before paying tax through online challan and now I have paid the same, but how should i enter the challan detail in my itr-v or is there any other way to intimate income tax office. please help me on this.

Thanks in advance.

One should pay self-assessment tax before filing the returns. If you have filed your return before 5-Aug-2013 then you can revise your return.

Our article How to Revise Income Tax Return (ITR) explains the process in detail.

For detail on how to fill Advance Tax and Self Assessment Tax, refer to Fill Excel ITR1 Form : Income, TDS, Advance Tax

All tax related information is collated at our section Income-Tax

Thanks a lot for the information, i will revise my returns online.

Dear Sir we have made Online payment of Self Assessment Income Tax ( Challan 280 ) for FY 2012-13 (AY 2013-2014) on 11-09-2013 , by mistake while making online payment AY 2012-2013 has been entered by us. Tax CounterFoil generated also indicate AY 2012-2013. Now we need to correct the same to AY 2013-2014 , kindly inform how it can be corrected.Also we have uploaded ITR1 next day after making online payment. Kindly advise in the matter.

Hello Bhavesh

As you have paid Challan 280 You need to go to your Assessing Officer and get it corrected. The procedure has been explained in our article How to Correct Challan 280

Hope it helps. Do let us know how was the experience.

Dear Sir,

Thanks for information. As per suggestion we have drafted request letter to AO for required correction. Once submitted and needful being done we will update our experience. Thanking you.

Regards,

Bhavesh

Dear Sir we have made Online payment of Self Assessment Income Tax ( Challan 280 ) for FY 2012-13 (AY 2013-2014) on 11-09-2013 , by mistake while making online payment AY 2012-2013 has been entered by us. Tax CounterFoil generated also indicate AY 2012-2013. Now we need to correct the same to AY 2013-2014 , kindly inform how it can be corrected.Also we have uploaded ITR1 next day after making online payment. Kindly advise in the matter.

Hello Bhavesh

As you have paid Challan 280 You need to go to your Assessing Officer and get it corrected. The procedure has been explained in our article How to Correct Challan 280

Hope it helps. Do let us know how was the experience.

Dear Sir,

Thanks for information. As per suggestion we have drafted request letter to AO for required correction. Once submitted and needful being done we will update our experience. Thanking you.

Regards,

Bhavesh

Hi Kirti,

I had filed my income tax by e-filing and sent the ITR-V/Acknowledgement by speed post to

Income Tax Department – CPC,

Post Bag No – 1,

Electronic City Post Office,

Bangalore – 560100,

Karnataka

My sister had also sent her acknowledgement by speed post on the next day.

She has received the confirmation of receipt of acknowledgement from Income Tax 10 days back.

But I haven’t. How do I check whether my acknowledgement has been received.

Regards,

Gagan

I would suggest don’t get worried. From our article After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

Upon receipt of ITR-V, Central Processing Centre (CPC) Bangalore dispatches an email acknowledgement. It should reach within a month of sending ITR-V to Bangalore.

Hi Kirti,

I had filed my income tax by e-filing and sent the ITR-V/Acknowledgement by speed post to

Income Tax Department – CPC,

Post Bag No – 1,

Electronic City Post Office,

Bangalore – 560100,

Karnataka

My sister had also sent her acknowledgement by speed post on the next day.

She has received the confirmation of receipt of acknowledgement from Income Tax 10 days back.

But I haven’t. How do I check whether my acknowledgement has been received.

Regards,

Gagan

I would suggest don’t get worried. From our article After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

Upon receipt of ITR-V, Central Processing Centre (CPC) Bangalore dispatches an email acknowledgement. It should reach within a month of sending ITR-V to Bangalore.

Hi kirti,

hOw can I reprint the callan 280? unfortunately I forgot to save and don’t have cin.

Thanks.

Atul your tax paid would be reflected in Form 26AS so if three days are over after paying the tax check your Form 26AS

Hi kirti,

hOw can I reprint the callan 280? unfortunately I forgot to save and don’t have cin.

Thanks.

Atul your tax paid would be reflected in Form 26AS so if three days are over after paying the tax check your Form 26AS

Found the necessary information I have been looking for. Thank you so much for your efforts.

Thanks Sriram. Glad to know you found it helpful.

Found the necessary information I have been looking for. Thank you so much for your efforts.

Thanks Sriram. Glad to know you found it helpful.

My wife is doing home based work from internet – how she pay the tax and which details needed to fill the IT returns? For online tax pay which is the right option (i.e. ITNS 280 – what is Type Of Payment*)?

Thanks,

Is her salary above 2 lakhs only then she MUST file her tax returns. How is she paid,does her employer give her FORM 16 or she earns project wise

in which her income is as Income from business and she would need to file ITR4. Our article Which ITR Form to Fill? explains it in detail.

For paying Income Tax challan online our article PPaying Income Tax Online, epayment: Challan 280 explains with detail and pictures

Yes, her salary is above 2 lacks (2,09,000). She is not employee of any firm she is doing her work individually at home. She is earning by IT related works (i.e. website development).

Chirag From WorkNHire INCOME TAX IMPLICATIONS FOR A FREELANCER IN INDIA

Within Indian Law any individual running a business where he/she is the sole owner is termed as a Sole Proprietor, the same applies with a Freelancer. A person earning on his own is considered a Sole Proprietor and needs to file income tax returns using the ITR-4 return form .

Letslearnaccounting Taxation for Business or Profession are covers it in detail

From what little I know (please please get it verified) as her income is from business she can claim expenses ex: Courier, internet charges, electricity charges, client meeting, assistant and hence have her income below exemption limit. So her income can be shown to be less than 2 lakh and hence she does not need to file the returns.

Hi Kirti,

Thanks for detailed information. Last thing, so first, she needs to pay tax online from following link with Chalan 280 option, And use ITR4 to fill IT return right?

https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

Chirag

Right Chirag! As no tax would have deducted (TDS) she needs to calculate tax ability of her income (income -expenses for entire year of which she has proof) for ex for 2,09000 she is in 10% bracket so 10% of 2,09,000 + 3% education cess.

She then needs to pay it by filling Self Assessment Tax using Challan 280

If she can bring down her income after taking care of expenses she does not need to pay any Tax then no Challan 280.

My wife is doing home based work from internet – how she pay the tax and which details needed to fill the IT returns? For online tax pay which is the right option (i.e. ITNS 280 – what is Type Of Payment*)?

Thanks,

Is her salary above 2 lakhs only then she MUST file her tax returns. How is she paid,does her employer give her FORM 16 or she earns project wise

in which her income is as Income from business and she would need to file ITR4. Our article Which ITR Form to Fill? explains it in detail.

For paying Income Tax challan online our article PPaying Income Tax Online, epayment: Challan 280 explains with detail and pictures

Yes, her salary is above 2 lacks (2,09,000). She is not employee of any firm she is doing her work individually at home. She is earning by IT related works (i.e. website development).

Chirag From WorkNHire INCOME TAX IMPLICATIONS FOR A FREELANCER IN INDIA

Within Indian Law any individual running a business where he/she is the sole owner is termed as a Sole Proprietor, the same applies with a Freelancer. A person earning on his own is considered a Sole Proprietor and needs to file income tax returns using the ITR-4 return form .

Letslearnaccounting Taxation for Business or Profession are covers it in detail

From what little I know (please please get it verified) as her income is from business she can claim expenses ex: Courier, internet charges, electricity charges, client meeting, assistant and hence have her income below exemption limit. So her income can be shown to be less than 2 lakh and hence she does not need to file the returns.

Hi Kirti,

Thanks for detailed information. Last thing, so first, she needs to pay tax online from following link with Chalan 280 option, And use ITR4 to fill IT return right?

https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

Chirag

Right Chirag! As no tax would have deducted (TDS) she needs to calculate tax ability of her income (income -expenses for entire year of which she has proof) for ex for 2,09000 she is in 10% bracket so 10% of 2,09,000 + 3% education cess.

She then needs to pay it by filling Self Assessment Tax using Challan 280

If she can bring down her income after taking care of expenses she does not need to pay any Tax then no Challan 280.

Hi Kirti,

Thanks for a very informative post. My query is while filing Challan 280 for self assessment tax, I need to put the breakup of tax, cess, interest etc. From the ITR1 xls, I get the total tax payable amount which includes all the above. From #12 in 1st worksheet, section 234A/B/C, I get the interest details. How do I calculate the breakup? The main query is should the 3% cess be calculated on the total of tax + interest (under 234A/B/C) or only on tax ? From the xls calculation, it appears it should be on total of tax + interest. Then accordingly, the field Education Cess should come after Interest instead of before it!

In the challan form the fields are –

Income Tax

Surcharge

Education Cess

Interest

Penalty

Others

Total

Could you pls explain the calculation considering 10,000/- as total tax payable calculated at #17 of Taxes Paid worksheet, 1000/- as total interest at #12 (under 234)?

Thanks in advance.

Regards,

Sonal

You need to break up the tax payable into its components, i.e. “Income Tax” and “Education Cess” etc.

There is no Surcharge for FY 2012-13 and education cess is 3% on total tax.

For Self Assessment Tax: One needs to pay education cess and also penalties calculated under Sections 234A/B/C and entered separately in “Interest” field. For example: So if total tax payable Rs. 10,000, the Income Tax component is (10,000 / 1.03) i.e. Rs. 9,709, and Education Cess is Rs. 291 (3% of Rs. 9709).

From 9709 deduct your Interest under 234 A/B/C section and enter it.

Please make sure tax payable (including education cess ) is the total amount you pay (including interest,education cess) (correct break up is not that important as the total amount) YOUR NET TAX LIABILITY SHOULD BE 0.

Hi Kirti,

Thanks for the super quick response!

So the cess is being calculated on (Tax + Interest) @ 3%.

Yes, I pay the total amount including cess and would ensure that net tax liability is 0.

Regards,

Sonal

No Sonal education cess is on tax due not on interest under section 234A/B/C.

I have updated the article with the picture on how to fill. I hope it’s not late.

Thanks for your query, I would have not done it otherwise!

Hi Kirti,

Thanks for a very informative post. My query is while filing Challan 280 for self assessment tax, I need to put the breakup of tax, cess, interest etc. From the ITR1 xls, I get the total tax payable amount which includes all the above. From #12 in 1st worksheet, section 234A/B/C, I get the interest details. How do I calculate the breakup? The main query is should the 3% cess be calculated on the total of tax + interest (under 234A/B/C) or only on tax ? From the xls calculation, it appears it should be on total of tax + interest. Then accordingly, the field Education Cess should come after Interest instead of before it!

In the challan form the fields are –

Income Tax

Surcharge

Education Cess

Interest

Penalty

Others

Total

Could you pls explain the calculation considering 10,000/- as total tax payable calculated at #17 of Taxes Paid worksheet, 1000/- as total interest at #12 (under 234)?

Thanks in advance.

Regards,

Sonal

You need to break up the tax payable into its components, i.e. “Income Tax” and “Education Cess” etc.

There is no Surcharge for FY 2012-13 and education cess is 3% on total tax.

For Self Assessment Tax: One needs to pay education cess and also penalties calculated under Sections 234A/B/C and entered separately in “Interest” field. For example: So if total tax payable Rs. 10,000, the Income Tax component is (10,000 / 1.03) i.e. Rs. 9,709, and Education Cess is Rs. 291 (3% of Rs. 9709).

From 9709 deduct your Interest under 234 A/B/C section and enter it.

Please make sure tax payable (including education cess ) is the total amount you pay (including interest,education cess) (correct break up is not that important as the total amount) YOUR NET TAX LIABILITY SHOULD BE 0.

Hi Kirti,

Thanks for the super quick response!

So the cess is being calculated on (Tax + Interest) @ 3%.

Yes, I pay the total amount including cess and would ensure that net tax liability is 0.

Regards,

Sonal

No Sonal education cess is on tax due not on interest under section 234A/B/C.

I have updated the article with the picture on how to fill. I hope it’s not late.

Thanks for your query, I would have not done it otherwise!

Hi Kirti,

I have a question related to Tax Liability. My sister and mother have a joint Monthly Income Scheme (MIS) account in post office. The first name is in the name of my sister. Who has to pay tax on the interest income from the MIS. My sister or mother.

Is it not that tax liability for this interest income gets divided between them. Say total tax from the interest income comes out to be Rs 7200. Then my sister would have to pay Rs 3600 and mother Rs 3600.

Thanks

Gagan

A first holder/primary account holder is the person who is listed first on the account. This person is the main user of the account and is responsible for the account. The primary account holder can add secondary account holders who also are authorized to perform transactions according to some rules.

Usually its a practice to show it in the name of the person who is the primary holder of the account

So your sister would be liable to pay tax on it. But as CAClubIndia Joint Bank Account Taxibility Query says

Income tax officials look at the source of the funds for determining taxes and so, as long as the person can explain his/her part of the income, he/she would have to pay taxes on that part only

Joint account is for convenience in operating the account. If both individuals are liable to pay taxes on their individual incomes, they should opt for opening two separate joint accounts and, thereby, maintaining clarity in their sources of funds.

Hi Kirti,

I have a question related to Tax Liability. My sister and mother have a joint Monthly Income Scheme (MIS) account in post office. The first name is in the name of my sister. Who has to pay tax on the interest income from the MIS. My sister or mother.

Is it not that tax liability for this interest income gets divided between them. Say total tax from the interest income comes out to be Rs 7200. Then my sister would have to pay Rs 3600 and mother Rs 3600.

Thanks

Gagan

A first holder/primary account holder is the person who is listed first on the account. This person is the main user of the account and is responsible for the account. The primary account holder can add secondary account holders who also are authorized to perform transactions according to some rules.

Usually its a practice to show it in the name of the person who is the primary holder of the account

So your sister would be liable to pay tax on it. But as CAClubIndia Joint Bank Account Taxibility Query says

Income tax officials look at the source of the funds for determining taxes and so, as long as the person can explain his/her part of the income, he/she would have to pay taxes on that part only

Joint account is for convenience in operating the account. If both individuals are liable to pay taxes on their individual incomes, they should opt for opening two separate joint accounts and, thereby, maintaining clarity in their sources of funds.

Hi Kirti,

The Tax on salary has been deducted by Employer but I have still to pay some extra tax on other sources of Income like Post Office Monthly Income Scheme, Savings Account and FD interest.

What is the last date of paying this Income Tax. Is it July 31 2013 for Assessment Year 2013-2014 or has the date passed and I have to pay interest on tax now? What I know is that 31 July is last date for filing ITR.

I have filled the ITR form , it has sections 234 A, 234 B,234 C. What are these ?

These are the entries in my ITR-1 form

Balance Tax Payable (10 – 11 ) 12 26,055

Interest payable u/s 234 A 13a 0

Interest payable u/s 234 B 13b 1,040

Interest payable u/s 234 C 13c 962

Total Interest u/s 234A 234B 234C 13 2002

Total Tax and Interest Payable (12 + 13) 14 28060

Can you please let me know whether I have to pay amount in section 12 ie 26055 or 28060.

Thanks,

Gagan

Short ans:

You need to pay Rs 28060 using Challan 280, enter the challan details in ITR have net tax payable as 0 and then upload the ITR. i.e pay before submitting ITR