Cheque is like a written instruction to the bank asking it to pay the person’s whose name is written on cheque the sum of money. Cheque is just a piece of paper, To get the money it has to be cleared Beginning January 1, 2013 Cheque Truncation System (CTS) would be implemented, whereby flow of the physical movement of cheque will be eliminated in the truncation process. Instead an electronic image of the cheque will be sent along with the relevant key information. In this article we shall explain about how the cheques were getting cleared before January 1 2014, new CTS 2010 clearing process, new CTC 2010 compliant cheques, old cheques. Banks have stopped accepting non CTC 2010 cheques after Dec 31, 2013. Cheque is like a written instruction to the bank asking it to pay the person’s whose name is written on cheque the sum of money. The person who writes the Cheque is called drawer and to whom it is paid is called as payee. Cheque is just a piece of paper, To get the money it has to be cleared. Lets check out the steps in processing the cheque, also called as clearing. Lets say Ram gave a A/C payee cheque to Shyam. Let us see the sequence of events how Shyam get’s the money to his account:

- Shyam deposits cheque to his bank.

- Shyam’s bank processes the cheque and sends a request to Ram’s bank for payment

- If Ram’s bank has funds in his account, his bank will process the payment and release the funds to Shyam’s Bank

- Shyam’s Bank will processes the payment and credits the funds into his bank account.

Table of Contents

Clearing process for non CTC 2010 cheques

- The Payee would deposit the cheque is his/her bank. If the payee or beneficiary of cheque has an account in the same bank in the same city the funds are credited into his account through internal arrangement of the bank

- If the beneficiary has an account with any other bank in the same or in any other city, then his banker would ensure that funds are collected from the payer’s banker through a clearing house. A clearing house is an association of banks that facilitates payments through cheques between different bank branches within a city / place. There are more than 1000 clearing houses operating all over the country facilitating cheque payments. These are managed by the RBI, State Bank of India and other public sector banks. To identify the paying bank, the clearing house looks at check’s routing number, MICR, the nine-digit number at the bottom of your cheque, to the right of your account number. It identifies postal code/city and state of the origin of the cheque.

-

MICR of cheque

- The clearing house presents paying bank with the cheque along with a payment request to drawee’s bank, which checks if there are sufficient funds in the account of drawer to pay money.

- If the drawer’s bank decides to pay then the clearing bank proceeds to settle the check, debiting drawer’s bank and crediting the payee’s bank for the value of the check.The paying bank debits the amount from the drawer’s account.

The clearing process is shown in following picture

Cheque Clearing Process before Jan 1 2013Time taken to clear the cheque How fast the money would be deposited into Shyam’s account depends on whether the whether bank of Ram and Shyam cheque’s are of same city. Based on this cheques are of two kinds:

- Local Cheques – These are cheques whereby the cheque issuer bank branch and the receiver bank branch are in the same city

- Outstation Cheques – These are cheques whereby the cheque issuer bank branch and the receiver bank branch are in different cities

Local Cheques – All Local Cheques must be cleared on a T+1 basis. i.e., If I Deposit a local cheque into my bank account today (irrespective of which bank the cheque is drawn or deposited) the funds must reach my account by End-Of-Day Tomorrow. Of course, this is only if the deposit happened before the cut-off time for today. For ex: Lets say ICICI Bank has a cut of time of 1:00 PM. So, all cheques deposited after 1:00 PM the previous day and those deposited before 1:00 PM today are processed in one batch and sent for payment. If you deposit your cheque after 1:00 PM, it will be processed only tomorrow and funds will be available one day after that. Outstation Cheques – Processing of Outstation Cheques depends on location of drawee’s bank.

- Banks in State Capitals – Max 7 days

- Banks in Major Cities – Max 10 days

- Banks in Other Locations – Max 14 days

RBI’s Collection of Instruments has answers to questions likeWhat happens if cheques / instruments are lost in transit / in clearing process?, My bank refuses to accept outstation cheques for collection. Is there any remedy?

Cheque Truncation System CTS 2010

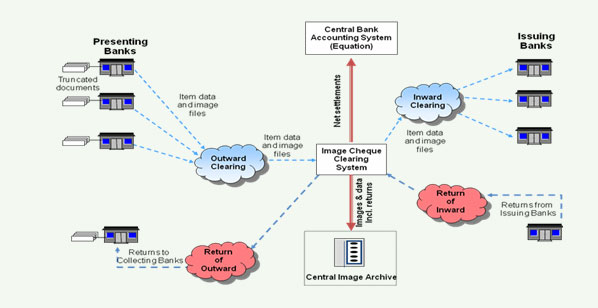

Cheque Truncation System (CTS) or Image-based Clearing System (ICS), in India, is a project undertaken by the Reserve Bank of India – RBI, for faster clearing of cheques. CTS is basically an online image-based cheque clearing system where cheque images are captured at the collecting bank branch and transmitted electronically. Truncation means, stopping the flow of the physical cheques issued by a drawer to the drawee branch. The physical instrument is truncated at some point en-route to the drawee branch and an electronic image of the cheque is sent to the drawee branch along with the relevant information like the MICR fields, date of presentation, presenting banks etc. So the process now becomes:

- In CTS, the presenting bank (or its branch) captures the data (on the MICR band) and the images of a cheque using their Capture System (comprising of a scanner, core banking or other application

- The collecting bank (presenting bank) sends the data and captured images duly signed and encrypted to the central processing location (Clearing House) for onward transmission to the paying bank (destination or drawee bank). For the purpose of participation the presenting and drawee banks are provided with an interface / gateway called the Clearing House Interface (CHI) that enables them to connect and transmit data and images in a secure and safe manner to the Clearing House (CH).

- The Clearing House processes the data, arrives at the settlement figure and routes the images and requisite data to the drawee banks. This is called the presentation clearing. The drawee banks through their CHIs receive the images and data from the Clearing House for payment processing. The drawee CHIs also generate the return file for unpaid instruments.

For customers clearing process of CTS 2010 is no different from the use of traditional clearing infrastructure for clearing paper cheques. Customers continue to use cheques as at present, except to :

- Use image-friendly-coloured-inks while writing the cheques

- Avoid any alterations or corrections thereon. For any change in the payee’s name, amount in figures or in words, fresh cheque leaves should be used by customers, as this will facilitate smooth passage through image based clearing system.

As images of cheques (and not the physical cheques) alone need to move in CTS:

- It is possible for the removal of the restriction of geographical jurisdiction normally associated with the paper cheque clearing. Hence cheques would be multi-city.

- This would result in effective reduction in the time required for payment of cheques, the associated cost of transit and delays in processing, etc.

Cheque truncation eliminates the need to move the physical instruments across branches, except in exceptional circumstances, thus speeding up the process of collection or realization of cheques. The Reserve Bank had implemented CTS in the National Capital Region (NCR), New Delhi and Chennai with effect from February 1, 2008 and September 24, 2011. After migration of the entire cheque volume from MICR system to CTS, , the traditional MICR-based cheque processing has been discontinued in these two locations. Based on the advantages realised by the stakeholders and the experienced gained from the roll-out in these centres, it was decided to operationalise CTS across the country by Jan 1 2013. For more details read RBI’s FAQ on Cheque Truncation System

Cheques for CTS 2010

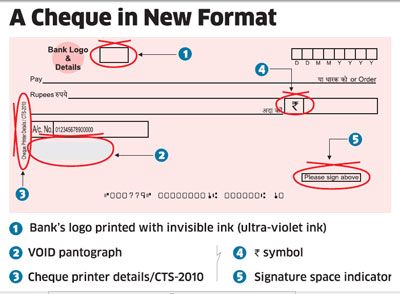

All types of cheques can be presented for clearing through CTS. But to achieve standardisation of cheques issued by banks across the country and to reduce cheque frauds set of benchmarks called as CTS-2010 standard are introduced.These include provision of mandatory minimum security features on cheque forms like quality of paper, watermark, bank’s logo in invisible ink, void pantograph, etc., and standardisation of field placements on cheques. As shown in picture below (Ref: Economic Times Check your cheque status)

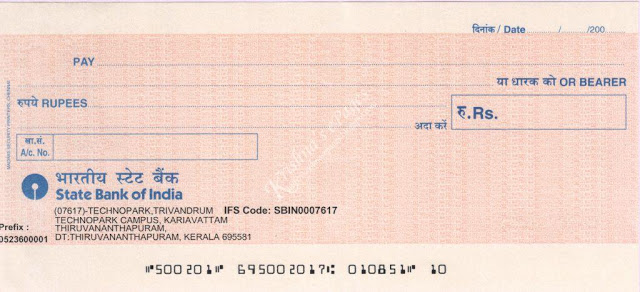

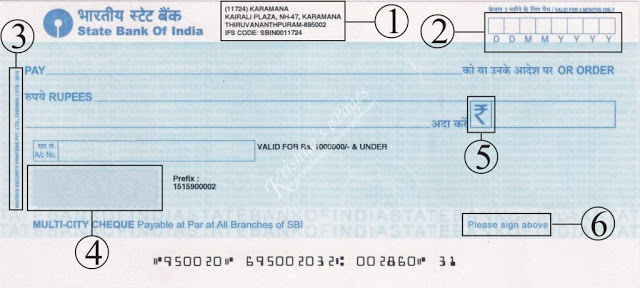

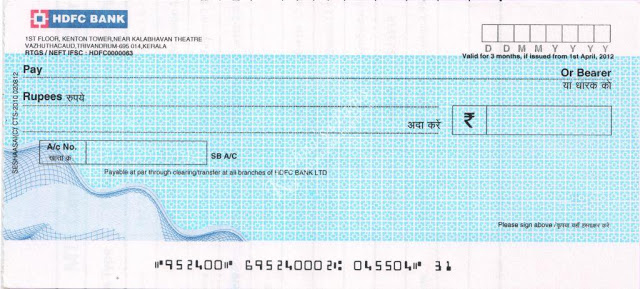

Sample old and new(CTS 2010 compliant) cheques issued by State Bank of India (SBI) are shown below

- Branch address with IFSC code printed top of the cheque

- Date in dd/mm/yyyy format with boxes

- Printers name with CTS-2010 in left side of cheque

- A pantograph which shows VOID/COPY while taking photocopy of the cheque below the account number

- New rupee symbol instead of bilingual format

- “Please sign above” is mentioned on bottom right of the cheque

- Watermark “CTS INDIA” to be visible cheque is held against any light.

- Ultra Violet logo of Bank printed at upper left corner of cheque to be visible in UV lamps

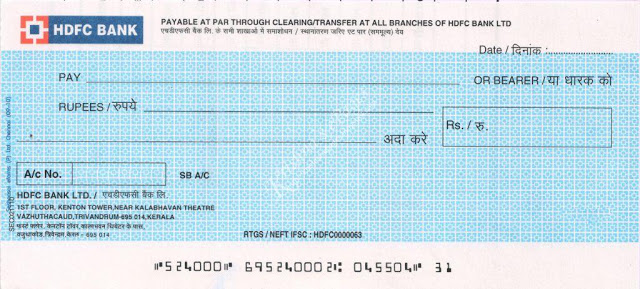

Sample old and new(CTS 2010 compilant) cheques issued by HDFC bank are shown below

HDFC bank cheque for CTS 2010

Krishna has collected CTS-2010 Standard and Old Bank Cheques of India of Canara Bank, IndusLand Bank etc.

How does CTS 2010 affect customers

- If you have issued post-dated cheques (PDCs)(say for your home or auto loan EMIs), you will have to issue fresh cheques.

- If you have opted for the ECS (electronic clearing system) mode the new system will not impact you.

- For issuing cheque after Mar 31 2013 you need cheques which are CTS-2010 compliant.

Banks have stopped accepting non CTC 2010 cheques after Dec 31, 2013. Related Articles:

- Bemoneyaware Cheque: explains Parts of cheque, Kinds of cheque(Blank, Bearer, A/C Payee), Alternatives to cheques(Demand Draft, Travellers Cheques,Money order, ECS, NEFT, RTGS)

In this article we explained how the cheques were getting cleared before January 1 2013, new CTS 2010 clearing process, new CTC 2010 compliant cheques, old and new cheques.

Please give 20mm margin on all sides (especially date and crossed bar) so that cheques can be printed by any low cost inkjet printer. This will be very useful for small business.

An undated old cheque was issued by me to company. I don’t have any outstanding to it . But still if it is presented, is there any possibility that it would come to my bank for clearing? Will bank accept it ?

I’ve deposited a account payee cheque to Citibank on 12th Feb. Still the cheque is not cleared. I’m an account holder of the same bank…

I have doubt… please suggest me..I get vechile loan name of xyz.. bank give me a demand draft name of xyz ….xyz is also my company & authorised signatory are same ..in that case is there any problem to clearnce in demand draft

Great post! Have nice day ! 🙂 clpcb

Sir my cheque is cashed that means deducted from sender’s account but not credited in beneficiaries account so what i should do now…

Check with your beneficiary. If still not credited Contact your bank to find status of the cheque.

i have entered wrong drawee bank and branch name in the challan..will clearing cheque be returned?

i have written drawee bank name and branch wrong in the challan..will the cheque be returned

http://www.gkindiaonline.com/

Famous GK Questions website

Hi! Is there any limit on the amount which I can pay to third party by means of a bearer cheque?

No as long as you have balance in your account.

A bearer cheque can be issued to a third party in his name or in the name of the firm, who can draw the amount across the counter of the bank. A bearer cheque is always a bearer cheque and payment of the cheque across the counter cannot be refused by the banker as per law.

But, in case of a cheque in favour of a firm or a business entity, the banker may require the payee to affix the seal or rubber stamp of the firm on the reverse of the cheque and the signature, thereby safeguarding the interest of the accountholder. This is practice and not law. If proper identification is established, the banker may release the payment across the counter without any hassles.

For example, if a cheque is made out in the name of M/s. Tree & Co., a full reading of the cheque would then be “Pay Tree & Co or bearer”. The words “or bearer” would assume significance and the cheque can be en-cashed across the counter. If Tree & Co loses the cheque and the cheque falls in to the hands of unscrupulous elements the finder can as well walk into the bank and collect cash.

Safeguarding the interests of the accountholder is an accepted practice of a banker. Insisting on the signature and the rubber stamp or seal of the payee by the bank would be in the best interests of both the payer and the payee.

Notwithstanding the fact that a bearer cheque is always a bearer cheque, if it is drawn up in favour of a business entity, the cheque is purported to have the crossing effect. Though not law, requirement of seal of the payee is a normal practice.

I deposit cheque on Tuesday still not cleared outstation cheque how long bank take to clear cheque

Sir I have received a non CTS cheques from my borrower at the time of getting the cheque I didn’t observed it.so what can I do? To get money.Now he is not accepting to replace the cheque with CTS.so please give me solution

sir, my friend do not have cheque book and he has to pay his electricity bills, as there is direction from NHPC that only bills are to be paid through cheques payments only. now my query is that can i pay his bill from my cheque which has my name on it, but i have to pay his bills?

Yes you can pay bill using your cheque on his behalf. There should not be any issues

Sir I receive cheque in punjabi language it’s vaild or not ?

It is valid. From Apr 2015 A customer can fill in details such as her name in any scheduled regional language and can even sign the cheque in that language.

All cheque forms should be printed in Hindi and English. The customer may, however, write cheques in Hindi, English or in the concerned regional language. says the announcement

Use of Regional Languages in Banks

If some one have opened a bank account on 20th January’17 and submit a cheque of prior date i.e. 28th December’16.

If this this cheque will be honoured and it is legal.

Yes a cheque is valid for 3 months. So you can deposit cheque issued for Dec 2016 in your account without any issues

I issued a HDFC bank Non CTS Cheque on Dec 6th to another bank in the same city. Status in Netbanking shows ‘CHEQUE PAID’.

However, the Payee says amount was not credited to his account.

Please suggest on how to proceed in this case.

Are you sure the person you paid to is telling truth?

Did you talk to the bank official/manager of your bank?

my chq was from sbi kolkata, which i dropped in allahabad bank drop box. on 7/1/17. till today it has not been credit to my a/c. i dnt understand what should i do?

sir,

i have deposited a cts chq of rs8000/ in drop box of allahabad bank dunlop branch. on7/1/17. till today it has not credited to my a/c. . bank has not given any answer. what will i do?

same problem

Try asking the question on the social media channel, facebook/twitter of bank.

Please check if the amount has been debited from the person’s account who issued you that cheque or you can also show the slip of the challan which you have filled during deposit the cheque.

I have a query. If I am paying someone through a cheque, e.g. my monthly rent to my landlord through a cheque, can I know the account number of the payee (landlord in this case) once the payment is transferred into his account? If yes, how can this be done?

Thanks

Why would you like to know your owner account number?

Bank statements do not reveal the account number paid to.

Because my landlord is not giving me receipts of my rent, which I need for claiming HRA exemption at my employer. As a proof of my payments made to him, I need to know the account number (which can later be asked by the IT department while filing IT return).

sir,

i have deposited a cts chq of rs37000/ in drop box of pnb noida sector 18 bank branch. till today it has not credited to my a/c. . bank has given answer it is unpaid. what will i do? I can issue a new cheque for it.

Thanks

Ghanshyam Singh

Mo 8860251854

Did you write cheque for yourself?

Did you write the account number on back side of the cheque?

If you are sure that money has not been credited into your account, you can write another cheque/transfer money using NEFT/IMPS.

You can stop payment on the cheque (but that maybe charged)

SIR,

I DEPOSITED CHEQUE INTO SOMEONE ACCOUNT BUT THERE IS NOT SUFFICIENT FUNDS INTO MY ACCOUNT..HOW MUCH TIME PERIOD SHOULD I GET TO TRANSFER FUNDS INTO MY ACCOUNT BEFIRE CHEQUE GETS DISHONURED.

Hi, thanks for sharing this article. I have a doubt though..

Suppose, Ram owns a company. Shyam works for Ram. Due to some reasons, his salary didn’t got credited to this account. So, Ram decides to write a cheque and in the Payee section he writes complete name of “Shyam XYZ”.

Shyam doesn’t goes to cheque counter because he works in night shift, and deposits the cheque in the “drop box” (he doesn’t writes/add anything to the cheque). How does bank process this request? I want to add up that Shyam has a new salary account opened by the bank correspondence on behalf of the Ram’s company.

i deposited a cheque of icici on 20 th dec in my sbi account.bank persons said that it will be clear within 15 days but i did,nt received that amount into my account.what is the reason for that? could u please provide information…

Sir,I am deposited canara bank check in my own SBH branch on 20-12-2016.not clearing check how many days take time plzzz

It should not take that much time.

Just check with the bank. Maybe because of demonetization there is a delay.

I am 79yrs & having a/cs with OBC , Axis , HDFC , Andhra & ICICI bank opened from time to time for various reasons

In 2011 my trading A/c at Std Chartered Bank had to be closed as THEY had used my Forged Signatures on some documents at the time of A/c opening .

Since then I have a 3in 1 Account with ICICI Bank in Feb 2012. Now in my long life span I never faced any problem due to single incidence of signature mismatch . Generally I transfer my credits recd. in ICICI bank to my Flexi A/c with OBC Bank Branch as it is quite near to my residence as compared to ICICI Bank Branch .

A sum of Rs 11875/ was credited to my ICICI a/c on a/c of interest on an FDR with ICICI Bank. On 21st Dec I wrote a chq for Rs15,000/ on ICICI Bank & deposited it in OBC Bank Branch as usual .

Due to lots of work on a/c of Demonetisation this chq was sent for collection on 28.12.16 by OBC Bank at 4.55pm .

On 29th ICICI Bank informed that chq 027709 issued from my a/c xxxxxxx1842 has been dishonoured on 29DEC for reason DRAWERS SIGNATURE DIFFERS at 12.42 pm .Likewise OBC informed that Rs15,000/- is debited to my a/c on cheque rejection.

I checked the signatures on the return slip f cheque deposit m/c at OBC & found signatures to be perfectly matching my signatures which I can sign blindly with so many years of practice

I took up the matter with ICICI Bank thru emails but so far there has been no response Today I visited the OBC branch but could not collect the rejected chq as the person having same was not available

I planned to deposit a fresh chq but I was advised better to check with ICOICIC Bank reasons for rejectipon of earlier to avoid frequent chqs . I tried to get in touch on both movbile & landline no while sitting in OBC bank but failed inspite of repeated attempts pl

The OBC Bank has also levied a charge of Rs29/on 29.12 though no postal expenses will be incurred by them as i shl collect the chq by hand & rejection is not on a/c of paucity of funds in my a/c pl.

Pl. advise with your valuable comments

Sir ji bank of Baroda give me check book but he is not update system penalty 288 rupees two time

Sir,

Yesterday iam receiving a axis bank post dated (20/01/2017) non cts cheque. This cheque is valid or not

Sir,I received Axis bank cheque from Max life insurance,I drop the cheque in SBI drop box & slip sing by bank manager,on Tuesday.but no credit in my account till date.how many days credit in my account

Please check with Bank. It should have been credited by now

have received a message like this.inr 5000 dr to acc .no(something) towards to micr cts val.what is the meaning of that. actually what happend. i have hdfc cheque.i deposited in sbh bank.at that tme i filled the deposite form and check directly put the check into drop box without stamp.

I am a customer of Madhya Bharat Bank. After issuing cheque book i gave cheque to other party

during collection of cheque they not accept cheque because bank manager said sign not scanned and they take panalties against cheque..

who is responsible to make this mistake customer or bank

How to recover my panalties

Sir last Friday I deposit a outstation cheque from Punjab in Delhi how much time it’s take to clear

Banks have networked their branches by implementing Core Banking Solutions (CBS). In CBS environment, cheques can be paid at any location obviating the need for their physical movement to the Drawee branch.

So now cheques can be cleared within 48 hours. Further Savings Bank customers need not incur any service charge for collection of outstation cheques (value up to Rs.1 lakh)

But cheque not cleared yet current situation local cheque also taking 3-4 days to clear nd my cheque outstation cheque

Demonetisation affect?

I think ys my local cheque taking 3/4 days to clear I called bank of Baroda customer care they saying bank have work load

Dear Sir

I have deposited Hdfc cheques of HDFC Account in my own HDFc savings bank account on 15/12/2016 acutually my hdfc account blac.kindly give suggestion.

Sorry did not understand the question

My Cheque has been returned by bank citing ” reason 88- other reason ( please specify)” as a reason and also my balance had been reduced by Rs.172.5 as bank charge.

Charges would be due to return of cheque. Please contact bank and ask them for clarification and reversal of charges.

With the adoption of Uniform Holiday Calendar under Cheque Truncation System (CTS), a new Return Reason, 88, has been introduced.

Under CTS, inward clearing is generally processed in a centralised manner by banks at the CTS location.

However, in exceptional cases, where the reference to base branch is required and the base branch is closed on account of local holiday, the drawee bank at the grid location may return the instrument to the presenting bank under return reason code 88 as enumerated in annexure D of Uniform Regulations and Rules for Bankers’ Clearing Houses with the description “need reference to the drawee branch which is closed on account of local holidays/issues”.

Return Reason 88 will be a technical return reason, and will have to re-present by the Presenting Bank, without the physical cheque being returned to the customers.

Drawee Banks have to be very careful while choosing this return reason as the onus will be on them, to prove that there was a holiday in the Base Branch state, in case of any dispute.

MY CHEQUE HAS BEEN DISHONOURED DUE TO LINK FAILURE AND BANK CHARGE RS 172.5 FROM MY ACCOUNT BALANCE. I WANT TO KNOW WHETHER THERE IS ANY PROVISION TO GET THE MONEY DEDUCTED FROM MY ACCOUNT BACK.

KINDLY REPLY AS SOON AS POSSIBLE

Talk to the bank and found out why they deducted?

RETURN OF CHEQUES BY BANK BRANCHES CITING “LINK FAILURE” AS A REASON

Link failure is an operational disruption and such instances are mostly observed in remote locations

where the cheque volumes are not significant. In situations of link / network /connectivity issues,

branches are advised to proceed as under: –

Branch should explore other alternatives before returning the cheques viz. processing at the service /

drawee / nearby branch as feasible.

After exhausting all avenues if it is necessary to return the cheque due to link failure, it may be returned

under Reason Code 84 (Other reasons-Connectivity Failure), with no charges to be debited to the

payee’s account.

No charges shall be recovered from the payee for return of the cheque in such cases. Such cheques

should be re-presented in the next clearing without waiting for a request from the payee

What is Link failure:

Now a days every bank have its Core Banking system.

Core Banking system need a Server-Client network hierarchy module.

Means In this system every branch is connected with Its Data Center, using a separate leased line.

Whenever this leased line is not working banks Core Banking system CBS unable to connect with Its Data Center. So In banks whenever a link is down or not working its called as link failure.

Hi

myself shrikant,i have deposited cheque in my account other than home bracnch, should there any charges deduct from my account?

please reply

No there are no charges for cheque clearance as all banks are now connected by CBS(Centralised Banking System)

For local cheques : No there are no charges for cheque clearance as all banks are now connected by CBS(Centralised Banking System)

For oustatation cheques there may be charge depending on your bank

Sir pf online but not bank account mesteke ho gaya lekin Paisa nai aya

settle ho gaya kya?

Kitne din ho gaye?

Aap complaint raise kar sakte hain epf site par How to register EPF complaint at EPF Grievance website online

I have to deposit 10L from my exisiting bank – cooperative bank to ICICI . Can i do thru cheque of cooperative bank ?

Yes you can do it and you should do it through cheque only.

Sir,

I have non-CTS cheque(HDFC Bank) which was issued on 2008. Can i withdraw money through self cheque(non-CTS) in any branch of HDFC bank?

Regards,

Ajit

I have an account in parkcircus brank united bank of india.. And i deposite the cheque in same bank but not same branch.. So i want to know is the cheque clear or bounce back. . plz rply as soon as possible..

As banks are all connected through CBS, you can deposit cheque in any branch of the bank. Please write the bank account and your contact number on the reverse side of cheque.

Dear Sir

I have deposited two A/P cheques of SBI Account in my own SBI savings bank account on 25/10/2016 after 3 pm but till date it has not cleared, kindly give suggestion.

I have HDFC bank account in TamilNadu and Citi Bank Account in Bangalore. I would like to deposit HDFC bBnk cheque in Citi Bank in Bangalore; Is this Acceptable and cheque will be cleared?

I am asking this question due to an incident happened in CITI Bank. I gave Citi Bank chque to one of my friend who is in Chennai and cheque got returned back due to different zone. I called Citi Bank customer care and they replied, the clearing will be accepted only within Bangalore as it is local cheque. Shall I face the same issue with HDFC Bank as well.

Please suggest. Thanks.

This is first time I am coming across with such reply from citi bank.

Since a long I had a/c with citi, never faced such incidence.

Don’t know how it happened with you

Please can anyone confirm whether cheque should are cleared on bank holiday/ national holiday?

What is central clearing procedure and rules?

can any body tell me about the intercity cheque and how much time it will take for clearing. urgently

Take around 2 days

Sir I hd given a cheque of 1 lakh to builder and he deposited yesterday on 24th aug. I dont have sufficient balance in ac but I hv cash money wid me..till wt tym cn I make my balance good?? Will d cheque gt cleared as soon as bank opens today? Do I hv tym to deposit cash?? Plz help..its urgent

You can check status of your cheque if its cleared or not.

Try to deposit money ASAP so that cheque does not bounce.

Sir I have deposited my salary cheque tdy around 2:30 my account is in Indian Bank and the cheque is frm icici bank so how many days will it take to transfer to my account

i submitted check on 16th august 2016 on my account branch in dehradun.

How long time it will take to transfer amount in my account

(Check is from Noida Karur Vyasa bank and transfer to punjab national bank dehradun)

Outstation Cheques From RBI site

Maximum timeframe for collection of cheques drawn on state capitals/major cities/other locations are 7/10/14 days respectively.

If there is any delay in collection beyond this period, customer is entitled to receive compensation at the rate specified in the Cheque Collection Policy (CCP) of the concerned bank.

Now most of banks have gone for speed clearing so

Outstation cheque collection through collection basis takes around one to three weeks’ time depending on the drawee centre. Under Speed Clearing, it would be realised on T+1 or 2 basis, say, within 48 hours. Further Savings Bank customers need not incur any service charge for collection of outstation cheques (value up to Rs.1 lakh) in Speed Clearing which they may have to incur if such cheque is collected under collection basis.

sir, I am facing very much problem. I submitted one cheque(130442) in Bangalore, in AECS layout branch but that get returned due to little mismatch in name, I submitted that cheque on 4th Aug….before 1 week I got a message as RETURNED cheque resent to MALLESHPALLY branch but I asked there also they telling its not yet reached here…..HOW MANY DAYS IT TAKE TO RETURN, hardly 1 week but….still now I not received that….please help me sir…..I mentioned the cheque no also 130442… ….I commented here with d expectation that at least any one will respond to me……please full fill this sir……it shouldn’t be like just giving option for commenting and no response only for advertisement. it shouldn’t be like so plz sir…….

Hello I deposited cheque today at 10.15am may I knw when it will be cleared as I’m going outstation tommo will be able to use tht money

hello

i am deposit cheque in monday in delhi icici bank how many days this amount credit in my bank of india account odisha.

hi I am choudhury rakesh

I am deposit a cheque in delhi axis bank

how many days the amount in credit in my bank of india account odisha.

I issued a cheque of 1 lakh to property dealer on 20.6.16. He deposited it to his bank on 22.6.16. The amount was credited to his account on 28.6.16. Now on 21.06.16 dealer is saying that cheque has bounced. No mony has been credited to my account yet. Pls resolve my problem

Well a bounced cheque simply means a cheque that the bank refuses to pass or honour and is intimated to the issuer and the receiver and a nominal penalty is charged.

Sir please verify with your bank . You can also check the status through online banking.

Hi I received a cheque and the date on it is 30-7-16, it’s a 4th Saturday so banks will have holiday. What should I do now?

From 1 April 2012, cheques, drafts, pay orders and banker’s cheques are valid for three months. You can deposit it after 30 Jul and it will be honoured.

It is 21.7.16

Hello Sir,

I want to know that if i deposited post dated cheque in bank and due to this reason cheque will be returned than bank what amount charged to payee as well as payer?

A bank can charge the same rate as for incorrect cheque. It can charge you return fee for the cheque. Charges may vary from bank to bank. You can go to bank and talk to them.

A post-dated cheque is a cheque issued with a written date in the future or dated after the date of issue.

If a bank notices a post-dated cheque presented for payment before the date appearing thereon, the cheque will be returned marked post-dated or the bank will hold on to the cheque until it is able to be cashed in. The greatest danger lies in the banker paying a post-dated cheque and subsequently dishonouring another cheque which ought to have been paid but had to be returned due to lack of funds.

The bank will not honour your cheque since the date mentioned on the cheque has not arrived yet.

People write post dated cheques because sometimes they do not have that amount in their account and they might be expecting money in their account some time before the date they mentioned on the cheque. Suppose they draw a cheque on 25/6/2016 and mention the same date on the cheque, for an amount of 20,000 and the balance in their account is less than 20k then the cheque gets bounced and owner(person who gives/writes/draws the cheque) has a bad remark on his account.

The cheque can be cleared only on or after of the date mentioned on the cheque. You can deposit it within 3 months of the date mentioned. Anytime before or after those 3 months, the instrument cannot be cleared.

If you don’t deposit it after 3 months then it becomes a stale cheque.

I hav a hdfc preferred cheque of Rs.50000 as security but now i need to use it. What happens if the cheque is blocked? Can the account holder stop the transaction? He is suppose to pay me. Please guide.

sir, if any person from outstation have to diposite an amount in my bank acc. througg cheque (which is diff. bank and outstation). then how can he diposit in my acc. . plzz provide me all solution. and where he has to diposit cheque. in her bank acc. or other bank acc.

Hi, i have a question reg clearance of check..I got a check from a friend who is having account in x city and I am having account in y city and unfortunately am in z city…what is the procedure to clear the check

U CAN go to any of the ATM in z city & u can deposit that cheque in that atm, it will credit to u r account..

any of the atm means ,u r friend bank ATM

our society like start the check clearing process…..but i dont know how to start this process

I deposited an outstation cheque to icici bank on 15 dec 2015 for an amount of 2,78,337/-. They lost the cheque in branch itself and gave me a false message it was lost in transit. Cheque was issued to me by Embassy of India tajikistan when i was on deputation there. It was a cheque of SBI , Parliament street new delhi. I deposited my cheque in jalandhar icici bank, since my account was with icici. Finally with my efforts i had to get it reissued from tajikistan nd got it after 85 days. Icici bank didn’t do any satisfactory work to get my cheque back. My query is as per RBI guideline how much penality compensation should i get from icici? I have already lodged a complaint with ombudsman nd police also.

I had issued a cheque of 2,60,000 in favour of a builder dated 23.12.2016.But due to non commitment of the builder I had got the cheque blocked for payment of the cheque by the issuing bank on the said date.

Is there any validity date of the such cheques issued to the builder from the date of issue ?

Can the builder present the cheque even after non delivering the flat ?

Is the cheque considered outstation cheque even if the cheque is issued from another district but from the same state

What is the solution to get the cheque back or avoid legal complications ?

Hi, I have a strange problem with cheque deposit with ICICI bank. I am an NRI and have a NRE Account. A NRI friend of mine has given me a NRE cheque. Yesterday, when we went to deposit that cheque, bank employee says, He needs the confirmation from Drawee ( A NRI who lives in Africa), before accepting the cheque for deposit. I never heard in my 20 years of banking experience any thing like this.

Any advise.

my branch is at akhbarngar bt it far away from my resident so can I submit this cheq in nearest brabch if yes than sugges me procedure

Yes Ronit if bank is same then you deposit your cheque in any branch of the bank.

The process is same as depositing in home branch.

You have to go to branch fill the challan and deposit the cheque.

SIR THANKS FOR GIVING US THE DETAIL

I deposited a cheque @ 21st november in SBI khagaria, again when i asked after 25 days for cheque @ 15th dec. they said that it was bank mistake they did not send the cheque to related bank and they send the cheque to releted bank. again i complaind against it but no response , @ 5 jan i asked about the cheque status,

they said abut cheque return, cause : they had to sent it @ state capital patna but by mistake they sent it to hyderabad, now they will send it to patna.

now i have a issue cheque validy is 12th january today is 6th january it will be cleared or not . 2nd : can a bank cleaer the cheque after the validity lapse if it is the mistake of bank .

if it will not clear ,who will pay me money because it is a schoarship cheque they will not give me again .. .. will bank take responsiblity ..?

If any customer has a complaint against a bank due to non-payment or inordinate delay in the payment or collection of cheques, complaint can be lodged with the bank concerned. If the bank fails to respond within 30 days, a complaint with the Banking Ombudsman may be lodged. (Please note that complaints pending in any other judicial forum will not be entertained by the Banking Ombudsman). No fee is levied by the office of the Banking Ombudsman for resolving the customer’s complaint. A unique complaint identification number will be given for tracking purpose.

Complaints have to be addressed to the Banking Ombudsman within whose jurisdiction the branch or office of the bank complained against is located. Complaints can be lodged simply by writing on a plain paper or online at http://www.bankingombudsman.rbi.org.in or by sending an email to the concerned Banking Ombudsman. Complaint forms are available at all bank branches also.

Complaint can also be lodged by authorised representative (other than a lawyer) or by a consumer association/forum acting on customer’s behalf. If the complainant is not satisfied with the decision of the Banking Ombudsman, an appeal can be made to the appellate authority in the Reserve Bank of India (Deputy Governor of Reserve Bank of India in charge of Consumer Education and Protection Department)

I Have to get rs 40000 from my friend and he has drawn acheqe of bank of India and deposited today ie 23.12.2015 in his bank of India branch cochin. My ac is with Federal bank kottayam. Will i get the money tomorrow

Shouldn’t the cheque be deposited in your Account of Kottayam?

If you want money fast then ask your friend to send it through NEFT. Our article Third Party Fund Transfer : NEFT,RTGS explains it in detail

Thanks a lot for such detailed and well described information in simple language.

I was looking for CTS-2010 cheque clearing procedure and timeline and came across your blog, to be honest it clarified what I was searching for.

Actually I recently deposited cheque in SBH, the cheque is CTS-2010 compliant but from another bank and another city. When cheque was not cleared in 10 Days, I revistied branch and asked the reason, the reply I got is my cheque has been sent to original branch as it was not compliant. Now its more than month I am still hearing same answers, I was looking for complaint and escalation of it to higher autorities/RBI. May be if you could suggest me on this matter.

First verify that cheque is CTC 2010 compliant – if yes why is bank saying it is not compliant.

Here are the steps you need to take to redress your grievance.

Step 1: Complain to your bank

You can visit the bank and meet the officials to sort out the issue. Banks have a dedicated toll-free customer care number, which you can use to lodge your grievance and get a complaint ID. You can also register a complaint on the bank’s website. Once the complaint is lodged, the customer needs to wait for 30 days for the bank to offer a solution or give a suitable reply.

Step 2: Approach the banking ombudsman

If your bank does not address your complaint within a month, you can approach the banking ombudsman. This is a senior official appointed by the Reserve Bank of India to redress customer complaints against deficiency in banking services, as per its scheme introduced in 1995. All scheduled commercial banks, regional rural banks and scheduled primary cooperative banks are covered under the scheme. So far, there are 15 ombudsmen, whose offices are located mostly in state capitals. Their addresses and contact details are available on the RBI website.

The ombudsman tries to effect a legally binding settlement between both the parties within a month. However, if a settlement is not possible, it will pass an award after allowing both the parties to present their cases to him.

You have to file the complaint at the office of the ombudsman under whose jurisdiction your bank branch is located. The grievances relating to credit cards and other types of services with centralised operations are to be filed with the ombudsman in whose territorial jurisdiction the billing address of the customer is located.

You can put it down on a plain paper, send an e-mail, or fill the complaint form on the RBI website. There are no charges for filing a complaint. Grounds for rejection

The ombudsman can reject a customer’s complaint if he has not approached his bank for grievance redressal first, or if the subject is pending for disposal, or has already been dealt with at any other forum, such as a court of law or consumer court. Also, the complaint will not be considered if more than one year has passed since the customer has heard from the bank, or 13 months since the date of representation to the bank. Compensation limit

The scheme caps the amount of compensation that can be doled out to Rs 10 lakh or actual loss suffered, whichever is lower. The ombudsman may choose to award the compensation, not exceeding Rs 1 lakh, to the complainant for mental agony and harassment. However, so far, this has been limited to complaints regarding credit card operations.

Legal route

If you are not happy with the settlement offered by the ombudsman, you can file an appeal before the appellate authority within 30 days. The appellate authority in this case is the deputy governor of the RBI. Alternatively, you can approach consumer redressal forums, which take up bank-related complaints, or even the courts.

I am new to banking. I had fd in co operative bank, which matures and I took pay order for such amount from bank . I deposit the pay order to my another bank account. How much time it shall take to clear such pay order in my account.

It should be fast because you have the payorder. It should be cleared in 2 days.

Both pay orders and demand drafts are used by individuals to make transfer payments from one bank account to another. The main difference between the two is that while a demand draft is a written order directing the payment to be made to a third party outside your city, a pay order is drawn for the third party within your city. They both are, however, different from cheques in that they don’t require a signature in order to be cashed.

While making a Demand Draft, the Bank deducts the amount from the Bank Account of the Individual who has requested for making the Demand Draft and deposits the same in their own account. And when the DD is presented for clearing, it is the responsibility of the Banker to make the Payment.

I have deposited the cheque on 30.09.2015 bu

My cheque has has been not cleared.. plz hehehelp me

Please ask your bank why it has not been cleared. Many reasons could be there-mismatch of sign,amount,insufficient funds

Dear Sir

Please confirm my cheque : 225754 status . I had dropped on dated 22.08.15 in your IMT Manesar SBI branch in the name of Dhanjit Kumar Das, but after 5 days cheque not clear . I am try to contact on mobile no: 9868636583 but response found wrong no .Need your support in this regards.

i had given a cheque on 14 and the next day is bank holiday when will the amt will be debited form my account

I had given the cheque on 14 and next day is bank holiday then will be my amt debited from my account

pls let me know if the cheque isuee the name of ramesh and another ramesh will get the cheque by mistake. does he used the issued cheque?

I have given a cheque for Rs 16000 but i have on 15000 in my account. What will happen to the cheque process??

Two things will follow if you issue a cheque to your friend and it bounces.

You will have to pay a penalty.

Your friend, too, will be penalised by the bank where s/he deposits the cheque. And, if your cheque towards repayment of a loan bounces, then, in addition to the penalty for the bounced cheque, (charged by both banks), you will also pay late payment charges.

f your S/B account is with ICICI Bank, the penalty is Rs 350 for the first month and Rs 750 thereafter, if it is due to insufficient funds (Rs 50 for technical reasons). If your friend deposits the bounced cheque in a local branch of ICICI Bank, the penalty is Rs 100. If deposited in an outstation branch of ICICI, the penalty is Rs 150. Banks will also charge for expenses such as returning the cheque by post, service charges, etc. If the cheque towards your home loan repayment bounces, you will also have two per cent as late payment charges in case of both ICICI and SBI.

it is not clearing it is transfer

Hai.. I have a hdfc check of Hyderabad branch and i have to deposit into my sbi branch (xxx) of another state..can I deposit into any nearby sbi branch (AAA)?

If yes, what should I write at branch name (XXX) or (AAA)?

Also what is the check number from “HDFC bank cheque for CTS 2010” above?

Please help me ASAP

Thanks in advance

Quick query; I was supposed to give a pdc of 5/6/2015. But, by mistake I wrote 5/6/2014. The person deposited the cheque on 1/6/2015 in his bank for clearing. I got to know this when I saw the statement of return charge. Any idea what can be done?

The Cheque that was deposited has been returned ,as you noticed due to return charges. You now need to call the person to whom you gave the cheque and apologise.

You can also transfer amount through NEFT.

whether the drawer & payee holds a/c in same bank( ex;hdfc to hdfc ) with different branches…

is the clearing happens in same day or with in 2 hours ????

Very Informative article….

I could find another on:- http://moneyexcel.com/2530/non-cts-cheques-will-be-out-of-circulation-from-december-2012

Thanks Shreya for comment and link. Found the link useful,

Sir/mam I have a doubt

sir i give a chque for hdfc (PDC) dated at 25th sseptember. but deposit the cash the same day morning is it possible to clearance

Yes it should be. Because cash should be credited the same day while clearing of cheque takes time