The Income Tax department is sending this letter to people who have not e-Filed or have not disclosed all incomes according to their records.In short, the Income Tax Department wants you to explain why you haven’t e-Filed your return and may additionally ask you to explain some facts regarding your income. This article talks about Compliance Income Tax Return filing Notice received from Income Tax Department,how Income Tax Departments gets information,How to reply to Compliance notice of Income Tax.

Table of Contents

Notice from Income Tax Department with subject Compliance – Incometax Return Filing

Income Tax Department is collating information from various sources and is sending notice to non-filers of Income Tax return.

As per our records, it is observed that you have not filed your Income Tax Returns. Please login to https://incometaxindiaefiling.gov.in. and submit details under Compliance module.

Procedure:

In the menu “Compliance”, select the “Submit Form” option. There are two tabs.

1. “Filing of Income Tax Return”

If your selection against “Response” is

a) “ITR has not been filed” – you should select any one of the reasons from the dropdown (Return under preparation or Business has been closed or No taxable Income or Others. Please enter the remarks, if you select the option “Others”)

b) “ITR has been filed” – please update details such as Mode (e-Filed or Paper), Date, Acknowledgment Number and Circle or Ward and City (paper filing).

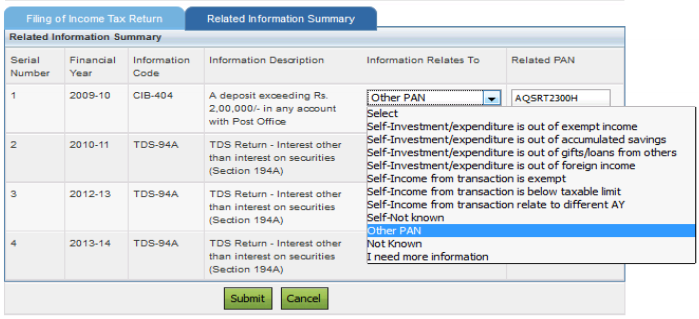

2. “Related Information Summary”

Your selection against “Information Relates” should be either Self or Other PAN (specify the PAN) or Not Known or I need more Information.After filling the information, click on the SUBMIT button. You can view the submitted information in “View My Submission” under the “Compliance” menu.

Why did you get Compliance – Income tax Return Filing notice?

The Income Tax Department sends the Compliance Notice to people who have not e-Filed their income tax return or have not disclosed all incomes according to their records. So it wants to ask why have you not filed your return or explain the discrepancy between your earnings and spendings, or ask you to explain your sources of income. Note that ITR is a way to legitimise your financial standing and maintain a healthy financial transaction.

This is with the help of improved monitoring due to stricter know-your-customer norms and online filing of returns, both of which have made data processing easier and faster with which escape can be easily monitored.

Did you not file Income Tax Return?

According to the Income Tax Act, you’re required to file a Income Tax Return, if your taxable income exceeds basic exemption in a financial year i.e Your gross total income (before allowing any deductions under section 80C to 80U) exceeds Rs .2,50,000 in the financial year that begins on 1st April 2014 and ends on 31st March 2015. This limit is Rs 3,00,000 for senior citizens ( who are more than 60 years old but less than 80 years old) or Rs 5,00,000 for super senior citizens (who are more than 80 years old). Many salaried people assume that as employer, has deducted TDS then they do not have to file Income returns. Even if TDS is deducted by employer you still need to file ITR.

Did you have High value Transactions?

The high value transactions is closely scrutinized by tax department for the individuals. For example in a year cash deposited Rs. 10 Lakh or more, or in a year purchase of debentures and bonds worth 5 Lakh or more, Rs 30 lakh or more purchase or sale property etc. To explain the source of income the income tax departments sends you a notice .

Mismatch in TDS deducted & TDS claimed

Their maybe mismatch in Actual TDS as per your income tax return and TDS as reflected in 26AS .

Non disclosure of Income

The Income Tax Department may send you a notice if you have not disclosed income from all sources for example Income from Shares , Bank Interest

If you want to know reason for which you have received notice you need to login to https://incometaxindiaefiling.gov.in. In the menu “Compliance”, select the “Related Information Summary” and know the reason why you have received the Notice.

How does income Tax Department finds about Non Compliance?

Income Tax department ke jassos charo taraf phele hain (Spies of Income Tax Department are everywhere). Jokes apart, To identify tax evaders, the Income Tax Department has set up a major data centre Centralised Processing Cell- Compliance Management (CPC-CM) which is in line with existing two such centres Central Processing Centre (ITD-CPC), Bangalore and TDS Centralised Processing Cell (CPC-TDS),Ghaziabad. The business intelligence project was set in February 2013 to enabling the I-T department to use technical data to check cases of non-compliance and non-filers of taxes. It enables the department to move from physical verification of a taxpayer to a smart approach of data-based monitoring and checking .

CPC-CM has entire database of the Permanent Account Number (PAN), reports generated by financial snoop agencies and the full assortment of letters and notices issued to non-compliant taxpayers, their replies and the final action in the new centre. They identify PAN holders who have not filed their returns and about whom specific information was available in its databases like the Annual Information Return (AIR), Central Information Branch (CIB) data or TDS/TCS returns.

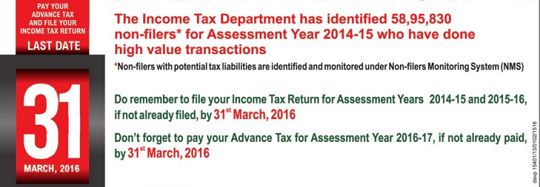

The Non-filers Monitoring System (NMS) under Compliance Management Cell, New Delhi, was implemented as a pilot project to prioritize action on non-filers with potential tax liabilities. The identified non-filers are informed by SMS, e-mails and letters in batches.

In the budget in Feb 2016, Based on specific information available in AIR, CIB data and TDS/ TCS returns, NMS cycle 1(2013), Cycle 2(2014) and Cycle 3(2015) identified 12.19 lakh, 22.09 lakh and 44.07 lakh nonfilers, respectively, with potential tax liabilities. The project led to collection of total tax amounting to Rs 10,439.11 crore till date.

Data collected from various sources are as follows:

Annual Information Return(AIR)

Under income tax laws institutions are required to report the details to Income Tax Authority, specified financial transactions registered by them during the financial year and submit Annual Information Return (AIR) . From April 1, 2004 all the banks, mutual funds and companies issuing shares are required to submit the details. This comes under Section 285BA of the Income Tax Act, 1961, to be read with Rule 114E of the Income Tax Rules, 1962. Part E of your Form 26AS has Details of AIR Transactions reported against your PAN.

- AIR-001: Cash deposits aggregating to Rs. 10,00,000 or more in a year in any savings account

- AIR-002: Paid Rs. 2,00,000 or more against credit card bills

- AIR-003: Investment of Rs. 2,00,000 or more in Mutual Fund

- AIR-004: Investment of Rs. 5,00,000 or more in Bonds or Debenture

- AIR-005: Investment of Rs. 1,00,000 or more for acquiring shares

- AIR-006: Purchase of Immovable Property valued at Rs. 30,00,000 or more TDS-92B: TDS Return -Salaried to Employee (Section 192)

- AIR-007: Investment in RBI Bond of Rs. 5,00,000 or more

2. Central Information Branch (CIB)

Central information branch (CIB) is the nodal office in the Finance department to gather all documents pertaining to transactions in relation to which permanent account number (PAN) or general index register number are given during sale and purchase of property and monetary deposits. It reports following Transactions.

- CIB- 94: Sale of Motor Vehicle

- CIB-151: Transfer of immovable property

- CIB-154: Transfer of capital assets where value declared for the purpose of stamp duty is more than sale value

- CIB-157: Purchase of Immovable property valued at Rs. 5 lakhs or more

- CIB-183: Time deposit of Rs 1,00,000

- CIB-185: Purchase of Bank Draft of more than Rs. 50,000 in cash

- CIB 321: Share Transactions more than Rs. 20,000

- CIB-403: Investment in Fixed Deposit/Time Deposit exceeding Rs. 2,00,000

- CIB-406: Payment made against Credit Card more than Rs 2,00,000

- CIB-410: Cash deposit aggregating of Rs 200000 on a day

- CIB-502: Contract of Rs. 10,00,000 or more in the Commodities Exchange

- CIB-514: Interest paid by co operative credit Society

- CIB: Payment in connection with foreign travel amount exceeding Rs. 1,00,000 at one time

- CIB: Payment to Hotel and Restaurants exceeding Rs. 1,00,000 at one time

3. TDS return

- TDS-94A: TDS Return – Interest other than interest on security (section 194A)

- TDS-92B: TDS Return – Salary to Employees (section 192)

4. Service Tax Return

- EXC-002: Turnover from services reported in Service Tax Return

5. Stock Broker

- STT-01: Purchase of equity share in a recognised stock exchange

- STT-02: Sale of equity Share (settled by actual delivery or transfer) in a recognised stock exchange

- STT-03: Sale of equity Share (settled by otherwise than by the actual delivery or transfer) in a recognised stock exchange

- STT-04: Sale of option in securities (derivative) in a recognised stock exchange

- STT-05: Sale of Futures (derivative) in a recognised stock exchange

How to reply to the Non Compliance Income Tax notice?

Do Not Panic. By sending the notice the department has asked you to furnish the information requested. Please respond to notice within time limit.

Income Tax sends various notices. Our article Income Tax Notice :Sections,What to check,How to reply talks about various notices that Income Tax Department sends. First you need to understand why have you received notice and for which year .

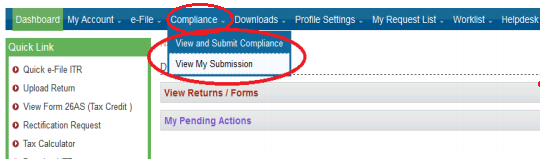

Please login to https://incometaxindiaefiling.gov.in with your user-ID and password. The Income Tax Department has created a new tab in its DashBoard called Compliances. If you are not registered at efiling website, it is easy to get registered. The taxpayer will be provided the information about the third party information received by the ITD

Taxpayers are required to submit the response on the e-filing website following the steps below:

- Step 1: Login to e-filing portal Login to e-filing portal at https://incometaxindiaefilling.gov.in and click on “Compliance Tab”.

- Step 2: View Non-filers information Non-filers Information and Information summary can be viewed under Compliance tab.

- Step 3: Submit online response Submit online response (Follow Step by Step Guide to submit response of non-filing of IT return).

Login or Register at https://incometaxindiaefiling.gov.in

On dashboard, Click on Compliance tab.

- View and Submit Compliance: Select when you want to enter the response for first time.

- View my Submission: This link will allow you to view the response which has been previously entered. The user can take the print out of previously generated response for their record.

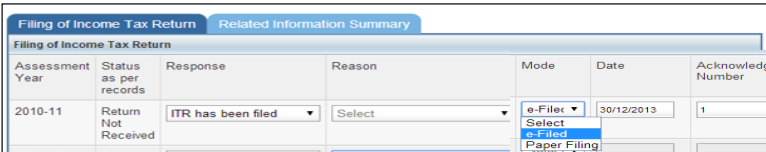

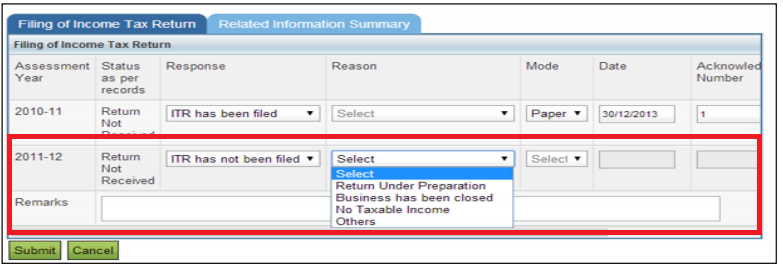

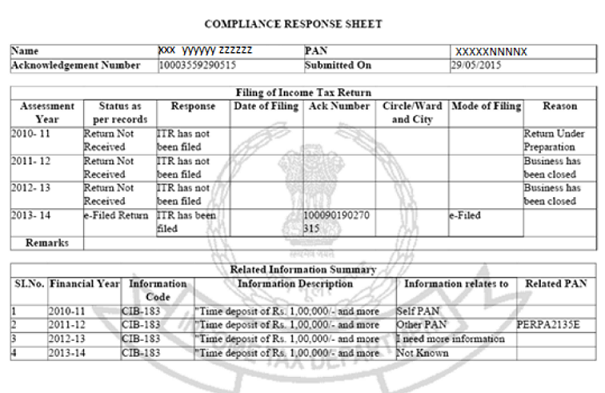

In the View and Submit Compliance tab, shown in image below, you have to fill in details in the tab Filing of Income Tax Return You will be able to view the details of the assessment years for which the return has not been filed and for which the third party information has been received by the Income Tax Department.

You can choose one of the following response options: i. ITR has been filed : ii. ITR has not been filed

i. ITR has been filed : If you choose the option that ITR has been filed then you need to provide the mode of filing the ITR (paper or e-file), date of filing the ITR and the acknowledgement number. In case the ITR is e-filed, the status will be automatically updated.

ii. ITR has not been filed If you choose the option that it has not filed the ITR then you need to choose one of the following options: i. Return under preparation ii. Business has been closed iii. No taxable income iv. Others In case if the taxpayer chooses the option “others” then he has to mandatorily submit the remarks.Take the help of a Tax expert if you need expert advise If there is any shortfall in taxes then for that year it will be good to prepare a return and accordingly pay the taxes.

Related Information Summary: If you want to know reason for which you have received notice you need to select the Related Information Summary and know the reason why you have received the Notice. Check the Financial Year, Information Description. Choose Appropriate Response in Information Relates to

Information code relates to which report,AIR/CIB/TDS, has caught the information under which head. For example

- CIB-404 is for Deposit exceeding Rs. 2,00,000 in any account with Post Office.

- TDS-94A or TDS Return – Interest other than interest on securities (Section 194A) may relates to taxable interest income you may have received. For example many people,such senior citizen have Fixed Deposit and interest was deducted on it, but ITR was not filed.

- AIR-002 or Paid Rs. 2,00,000 or more against Credit Card Bills” relates to your credit card spending

In the tab Related Information Summary you are required to chose of the following correct options. Make sure that you reply correctly or there are chances of department asking for further clarification.

- Self-Investment/ expenditure is out of exempt income: If you have invested or spent out of income exempt from tax under Income-tax Act, 1961. Our article Exempt Income and Income Tax Return talks about Exempt Income in detail.

- Self-Investment/ expenditure is out of accumulated savings: If you have invested or spent out of your accumulated savings.

- Self-Investment/ expenditure is out of gifts/ loans from others: If you have invested or spent from gifts/loans from others. Our article Gift and Income Tax Return talks about Gifts in detail.

- Self-Investment/ expenditure is out of foreign income: If you have invested or spent out of your out of foreign income.

- Self-Income from transaction is exempt: If you have income from transaction that is exempt under Income-tax Act, 1961.

- Self-Income from transaction is below taxable limit: if you have income from transaction that is below taxable limit under Income-tax Act, 1961.

- Self-Income from transaction relate to different AY: If income is from transaction in a different year

- Self-Not Known: If there is any other explanation.

- Other PAN: If the information is actually related to another taxpayer. In this case, the PAN of such other taxpayer is to be mandatorily provided. Our article Investing in name of Wife talks about Investing in name of Wife

- Not Known: If you don’t have has any information about the transaction.

- I need more information: If you need more information to submit response

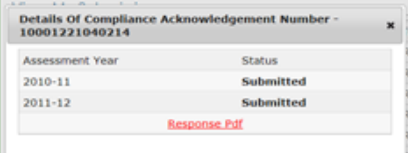

Submission of response: Click on Submit button to submit the response. The Acknowledgement number is displayer along with pdf.

After submission, you can take a printout of the submitted response for your record

Processing of Response

The responses submitted online will be verified by the Income Tax Department and if found satisfactory, the case will be closed. You can check the updated status by logging in to the e-filing portal.

If you do not file Income Tax return, the information will be pushed to the field formation example, Assessing Officers, for further action.

We do not know how much time it takes to process the response. If you have information, please let us know, it would help other readers.

Filing of ITRs after deadline

Last date for filing returns for an individual is usually 31 Jul of the assessment year. One had to file income tax returns for FY 2014-2015 or AY 2015-16 by 7th Sep 2015 but if one missed the deadline one could file returns before March 31, 2016. If due to any reason, the taxpayer is not able to file his income tax return, he can still submit a belated return before the end of the assessment year i.e. before 31st March 2017. Our article Filing Income Tax Returns after deadline discusses it in detail.

If there is any shortfall in taxes then for that year it will be good to prepare a return and accordingly pay the taxes. Take the help of a Tax expert.

| Financial Year | Assessment Year | Last Date for Filing Return | Notes |

|---|---|---|---|

| 2012-13 or before | 2013-14 or before | CANNOT be filed without Income Tax Dept permission | |

| 2013-14 | 2014-15 | Mar 31,2016 |

|

| 2014-15 | 2015-16 | Mar 31,2016 |

|

| 2014-15 | 2014-15 | Mar 31,2017 |

|

Reference: Non-filers Monitoring System (NMS) Step by Step Guide Oct 2015. (pdf)

Related Articles:

- Fixed Deposit in Name of Wife: Clubbing,Tax,TDS, ITR,Refund

- Filling ITR-1 : Bank Details, Exempt Income, TDS Details

- Interest on Saving Bank Account : Tax, 80TTA

- Paying Income Tax : Challan 280

- Filing Income Tax Returns after deadline

- Are ESPP,ESOP in MNC to be filed in ITR as Foreign Assets?

Please file your ITR on time. We all hate paying taxes but take it as necessary evil . You cannot run from Income Tax Department,downside of technology :-(. Hope this article helped you in understanding compliance notice and how to submit response to it. If you have received the notice and can share your experience with us, our readers and we would be obliged.

Sir koyi 1oo laksh ka proparty sell karta h or ohh income tex yani sell tax nahi deyta h to uskey lia Kya kaanun h kya us per incometex koyi karbayi nahi kareygi

Sir agar property bechi hain to capital gains calculate karna padega.

As the property sold will be registered govt will know of the transaction. So don’t ignore

thanking for the above information.

BUT IN “MY PENDING ACTIONS>DETAIL COMPLAINCE>

in “e-sahyog” tab

no records available

in “related information summary” tab shows

for “financial year 2013-14″.”tds 192a salary for employee.”

iam state gov employee.SHOULD i fill return for the FY 2014-15?

i given to a person to fill my returns, he efilled for the assessment years 2015-16 and 2016-17.now he iam unable to contact him.so please

give me suggestion for this issue

i efilled my return for the AY 2015-16,on 22-10-2016.BUT I received complaince notice to mail on 19-12-2016.complaince notice show this way:dear tax payer as per our records you have not filled the ITR for the assessment year 2015-16.

but after 2days i got a mail detailing that

Dear Taxpayer,

If you have already filed return for the Assessment Year 2015-16 (Income earned during the Financial Year 2014-15), kindly ignore the earlier mail on this issue.

Regards,

e-filing Team for Compliance Management Cell

Income Tax Department

iam bit confused about this mails

so please suggest the right solution to me

We think that you have filed your return and compliance notice was ready before you filed.

You can call CPC to confirm at 1800-425-2229(toll free) Monday to Friday between 8:00 AM to 8

PM. The service is available in English, Hindi and Kannada.

thanking for the above information.

BUT IN “MY PENDING ACTIONS>DETAIL COMPLAINCE>

in “e-sahyog” tab

no records available

in “related information summary” tab shows

for “financial year 2013-14″.”tds 192a salary for employee.”

iam state gov employee.SHOULD i fill return for the FY 2014-15?

i given to a person to fill my returns, he efilled for the assessment years 2015-16 and 2016-17.now he iam unable to contact him.so please

give me suggestion for this issue

What is EXC-001?

I received Income Tax compliance notice via email.

I do not have any taxable income.(below Tax limit slab).

I have been trading since 2 years. Futures n options as well. So i have been paying STT quite a lot. (maybe hence i received the notice)

May i know what should i mention in the reply in remarks ?

Just selecting ‘no taxable income’ is enough ? any remarks ??

And in the third column, there are questions abt SST.. what must i select ?

income under excempt limit or not under tax slab ??

Thanks

If you are trading F&O on any recognised stock or commodity exchange, profits or losses have to be considered as business profits or business losses respectively. What this basically means is that if you trade F&O, you have to compulsorily consider yourself as a ” Trader” and not an investor.

You can check Zerodha site for more details on Income tax notice for F&O.

I HAVE FILLED INCOME TAX RETURN A.Y.-2016-17

I received the Intimation mail on 2nd nov 2016 from Incometax dept, ERRoR is Taxpayer having income under the profits and gain of business or profession but has not filled Balance sheet and profit & Loss as per requirement U/S 44AA read with section 139(9)(d)

PROBBABLE RESOLUTION

The Par A of th p & l account and part A of Balance sheet should be entered in the corrected return without which the return filed earlier is liable to treated as invalid

Turnover is above 10lacs i not maintain books of account i prepared income and expenditure A/C and capital A/C so how i file revised return.

within 15days have to file revise the return otherwise its invalid

Sir,

Can i file only part A of p & l Expenditure details

plse reply as soon as possible

Send the ack copy the address received in notice

Send the ack copy the address received in notice

Thank You very much for your very informative article. Will help people who get a compliance notice.

Once a person has filed the reply to the Compliance Notice, what happens thereafter?

Thank You very much for your very informative article. Will help people who get a compliance notice.

Once a person has filed the reply to the Compliance Notice, what happens thereafter?