Free Free Free…There is some charm in the word, just like Free discount! Pay for a service or get it for free,what would you choose? Free of course, no brainier question right. After all, why shell out money for something that can be done at no cost? This is why a majority of taxpayers opt for filing their tax returns for free.But what is the cost of free Income Tax filing? are they paying a heavy price for it?

Income Tax efiling site is free but

The Income Tax Department offers free filing as government wants to encourage more and more people to file their returns.

One must have working knowledge of computers and software like Excel or Java. For ITR1 and ITR4S One can simply log on to the website and file his return for free.

But Income Tax efiling website does not offer any guidance, it expects you to know the rules. Many get the Assessment Year wrong or file the wrong ITR.

If you miss a certain deduction or exemption, the portal will not point out the error nor suggest a solution. It will happily keep the extra tax paid.

Are you paying more tax than due?

Many taxpayers miss out benefits because they are not aware of the rules. Many of my friends were unaware the Rs 10,000 exemption for interest under Section 80 TTA is only for savings bank interest and not fixed deposits. A reader who had changed jobs during the year had claimed tax benefits from both employers and ended up getting notice from the Income Tax Department. Many did not send their ITR-V on time and their returns were not processed. TaxSpanner found that 68% of such taxpayers pay more tax than their peers. They could save thousands of rupees if they took help from a tax expert and optimised their tax planning. A tax expert will analyse your income tax return and see if all the relevant exemptions and deductions have been availed of. He will also remove mistakes in the tax form, which means your income tax return will be error free. Don’t file your return in haste and repent later!

Many private portals also offer free filing facilities as well as investment advisory services. These portals hope that the commission on taxsaving investments by these free customers will help them make money some day. This can lead to a serious conflict of interest.

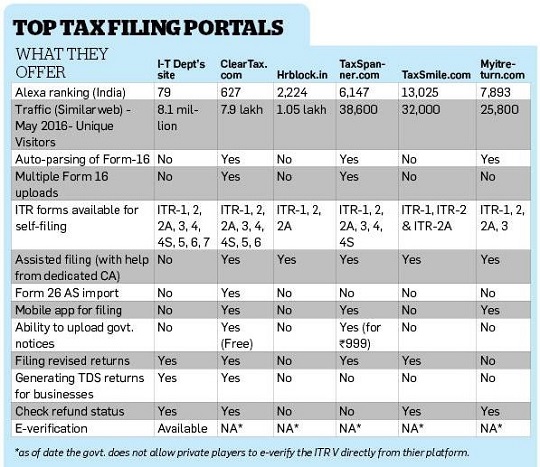

Comparison of Income Tax websites with other websites from our article Comparison of Income Tax Filing Websites:IncomeTaxEfiling,ClearTax,etc is shown in image below

Cost of Free Income Tax Filing For employees of a corporate

Checklist before submitting ITR

We have given a basic list that you should check before submitting ITR. Our article Mistakes while Filing ITR and CheckList before submitting ITR discusses it in detail.

- Select the Correct Assessment Year. For filing Income Tax return for Income earned between 1 Apr 2015 to 31 Mar 2016 AY is 2016-17

- Select the correct ITR or Income Tax return Form.

- Mention Correct Details, Personal Details,Bank Details

- Claim All Deductions: Claim HRA(if not claimed ), 80C deductions

- Report Exempt Income : Income from PPF,Tax free bonds , Long term capital Gains on Equityetc

- Report Interest from Saving Bank Accounts under section 80TTA.

- Report Interest from Fixed Deposit and Recurring Deposit.

- Match TDS with Form 26AS

- Fill correct TDS details

- Pay Self assessment Tax and update ITR. You should owe Zero or Nil tax to Government while filing your ITR

- After submitting ITR ITR-V or E verification

There are lots of information about latest technology and how to get trained in them, like this have spread around the web, but this is a unique one according to me. The strategy you have updated here will make me to get trained in future technologies.

Hi, I am a salaried employee and received some professional income also, i have filed ITR-1 sahaj, and shown prof. income in income from other sources, as the amount was very small without any TDS, i want to revise the return and file correct form, how to get original return cancelled, please help.

That should be fine.

If you have income from Salary, you may treat it as income from other sources. You can not deduct expenses for earning it.