Many ITR, such as ITR2 have multiple schedules. Selection of ITR depends on kind of income one has. For example one having capital gain or two houses cannot file ITR1. ITRs have many schedules and not all will be applicable. For example if one has Salary Income and Capital Gain, but does not have Income from House Property then he does not need Schedule HP. This articles talks of how to Customise ITR so that you can remove schedules not applicable to you. How to add rows in ITR?

Table of Contents

Which ITR to fill

Every tax payer is required to declare to the Income tax Department of the Government of India, summary of income, tax paid which he earned during the year(between April to Mar of next year) n a form prescribed by the Government something like report card in school. The form which one needs to fill in is called Income Tax Return.

There are various ITR forms such as : ITR-1 (Sahaj) ,ITR-2A,ITR-2 ,ITR-3, ITR-4 and ITR-4S( Sugam). ITR-5 and ITR-6 which differ in information required and hence number of pages.

- There are different Income Tax returns form based on

- Who has to fill (individual, Hindu Undivided Family(HUF), Business etc). Did you know that Fourth Character in PAN specifies the type of tax-payer. For Individual’s it’s P , HUF it’s H, Firms F etc.

- Whether a resident of India or not Our article Non Resident Indian – NRI explains who is NRI?

- On types of Income earned ex: Income from Capital Gains or Income from House Property.

- On whether losses are carried forward or not.

- These forms are released every year by Income Tax Department as there are some modifications in income tax law in the budget or Finance Bill ex: exemption limit is modified, new tax saving option is introduced (80TTA ftom AY 2013-14), some tax saving option is removed (20,000 under 80CCF from AY 2012-13).

- For income less than 5 lakhs one can file ITR manually. In case of physical filing the return, an individual needs to fill the printed form or the hard copy and submit it to the nearest Income Tax Office (ITO) and get an acknowledgement.

- If income exceeds Rs. 5 lakhs one has to furnish the Return electronically.

- The process of electronically filing Income tax returns through the internet is known as e-filing. One can file directly(incometax website) or through an e-Return Intermediary such as Taxsmile,Taxspanner. While the I-T department lets you file your returns online for free, most other portals charge a fee.

- To e-file the returns one can fill the Excel utility/Java Utility/Prefilled form provided by the income tax department. Our article E-Filing of Income Tax Return covers e-filing in detail.

- Forms for the Financial Year 2015-16(assessment year 2016-17) can be downloaded from Income tax website(http://incometaxindia.gov.in/) Downloads->Income Tax returns ( http://www.incometaxindia.gov.in/Pages/downloads/income-tax-return.aspx). Income Tax’s Download also provides instructions in Hindi and English with forms. It also has forms for earlier Assessment Year.

Use the right form and right Assessment Year. For the income earned between 1 Apr 2015 to 31 Mar 2016 the Assessment Year is 2016-17 (or Financial Year 2015-16) and income tax return by individual must be filed before 31st Jul 2016.

The only difference between ITR 2 and ITR 2A is that if one has income from capital gains, Details of foreign assets or Details of Income accruing or arising outside India then one can furnish only ITR 2, one cannot file ITR 2A.

Many Schedules in ITR

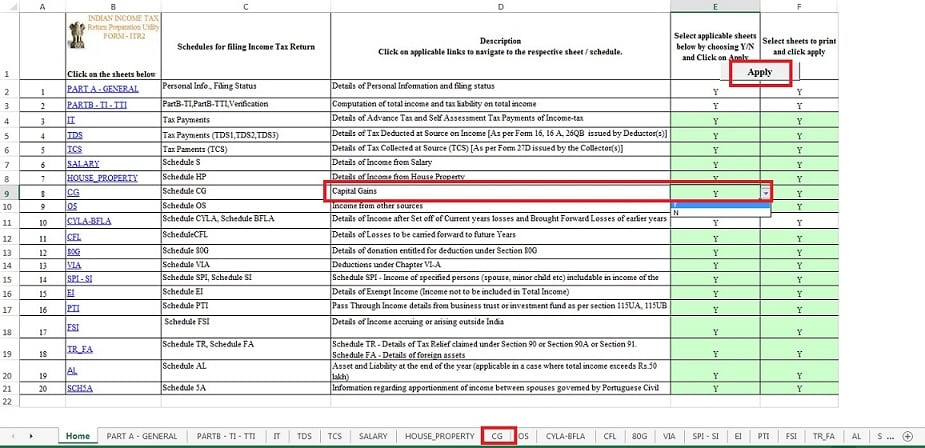

For example ITR2 is divided into 20 schedules as shown in image of Excel Utility below.

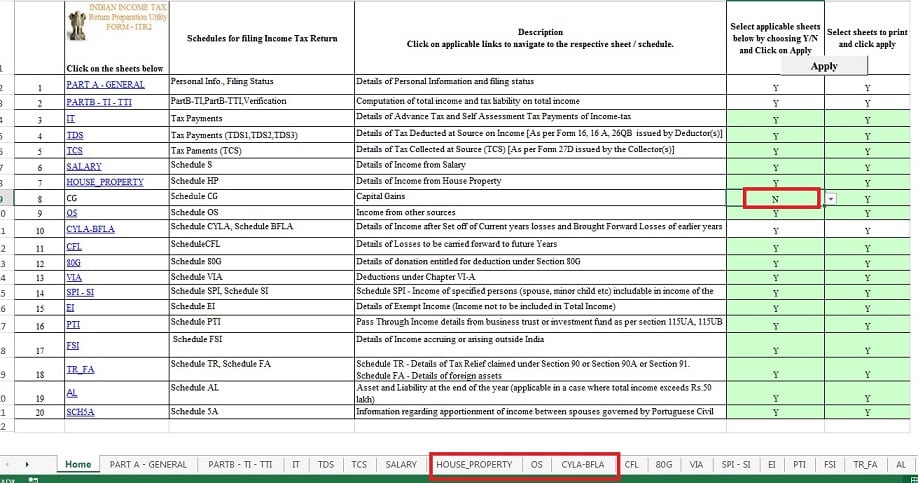

But you don’t have to work with all schedules. For example if you don’t have Capital Gains,CG schedule. i.e you haven’t sold any property or gold or debt mutual funds then you can customise your ITR to not have the schedule. All you have to do is on the Home Tab , Select N in the column Select applicable sheets below by choosing Y/N and then click Apply. The Excel Utility will then appear as follows

How to Customise ITR

Customising ITR can mean simplying ITR by removing Non Applicable schedules or Adding Rows or Deleting Rows. Lets look in detail. Note Some of the schedules can’t be removed. These are in white color in Select Y/N column and don’t give Yes/No Option.

Customise ITR in Excel to remove Non Applicable schedules

- Go to the Home Tab or Home worksheet ,

- Select N in the column Select applicable sheets below by choosing Y/N

- click Apply.

The corresponding worksheet or tab will be removed.

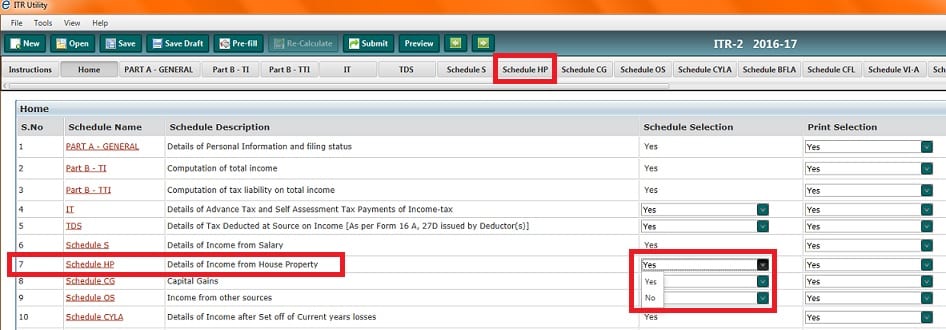

Customise ITR in Java Utility for ITR

- Go to the Home ,

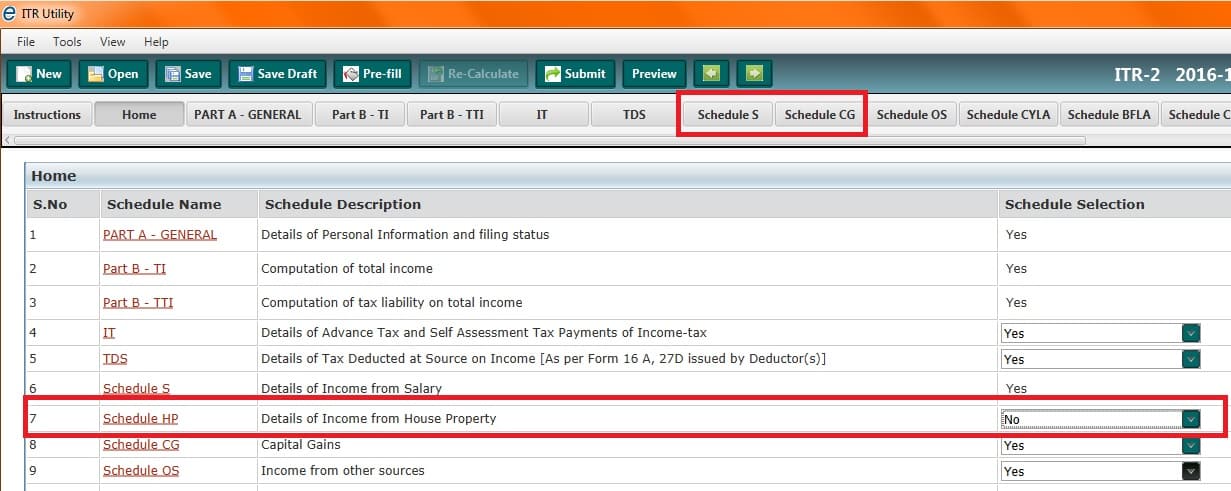

- For the Schedule Not Applicable to you Select No in the column Schedule Selection. Image below shows selection of Schedule HP .

The Selected Tab will be removed. The image shows the Home page after the Schedule HP is removed.

Adding New Rows to Table in ITR

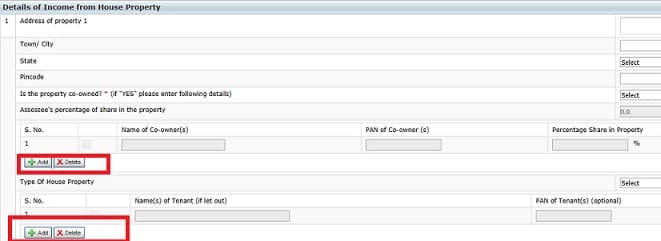

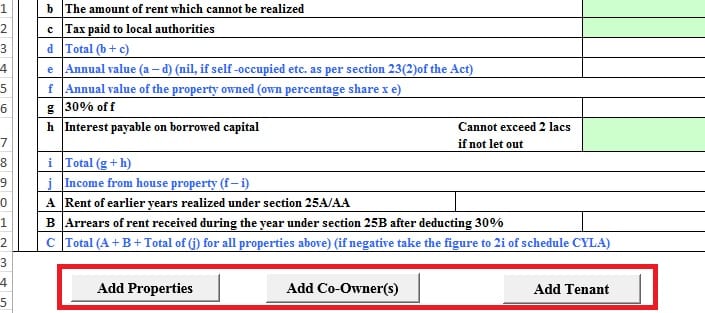

In ITR wherever information is captured in tables , such as Employers, Number of Houses, one can add multiple rows if required.

- Adding new Row : Click ADD button to insert a new row and then enter values in the field provided. Make sure you provide information in all mandatory columns ( * ) marked

- IN many cases you might get error Please fill in all the mandatory fields in the last row before adding another row.

- Deleting Row : Select the row to delete from the list and click DELETE button

- Remove unnecessary blank rows from the table by selecting the row and clicking on DELETE button.

Add/Delete Rows in Java ITR

Add/Delete Rows in Excel ITR

Related Articles:

- How to fill ITR1 for Income from Salary,House Property,TDS

- How to show Long Term Capital Gains on sale of House in ITR

- Comparison of Income Tax Filing Websites:IncomeTaxEfiling,ClearTax,etc

- Articles to Understand Income Tax, How to Fill ITR,Income Tax Notice…