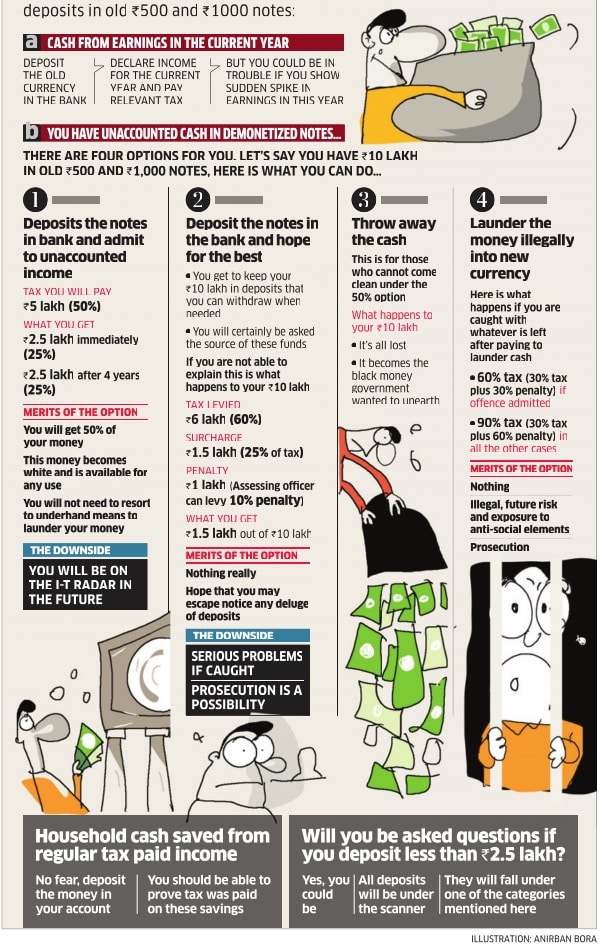

How the cash deposits of undisclosed income will be dealt with , how much tax one would have to pay. People should ideally opt for the voluntary compliance, declare the cash deposits from their undisclosed income in their tax returns, pay the tax and escape protracted litigation. This article talks about Options to declare Unaccounted Cash in Demonetized Notes , what is tax impact, what are downside

Various options available for Undisclosed Income or Unaccounted Cash. Ref Economic Times These are the only 4 tax options if you hold black money. Analysis is by assurance and tax advisory firm E&Y. The analysis also spells out under which option immunity from other laws would be available and where it would not be.

- Taxpayer, who has not reported cash deposit as income, is able to satisfactorily explain nature and source of cash deposit

- Taxpayer is unable to explain nature and source of cash or deposits

- i) Owns up income in form of cash or deposit in Income Tax Return to be filed for tax year 2016-17, pays tax before 31 March 2017 but does not opt for Scheme.

- ii) Makes a declaration in respect of cash or deposits under Pradhan Mantri Garib Kalyan Yojana and pays tax, surcharge, penalty and makes deposit of at least 25% of undisclosed income by specified date. Immunity from reopening of past income/wealth tax assessments .

- Neither owns up income in Income Tax Return nor opts for declaration under Scheme and addition is made by Tax Authority without detection in search

- Undisclosed income is detected in search conducted after Presidential assent to Bill and

- Taxpayer owns up income in the course of search, substantiates manner in which income was derived and pays up tax (with interest, if any) and includes income in Income Tax Return

- In any other case

Notes:

1. Interest may be levied separately if there is any default in payment of tax including advance tax in all scenarios except when income is declared under Pradhan Mantri Garib Kalyan Yojana

2. Risk of prosecution also exists in all scenarios except when one is able to explain income and income is declared under Pradhan Mantri Garib Kalyan Yojana.

Image below, from Economic Times, shows the tax on various ways one has to declare Cash,Tax and Unaccounted Cash in Demonetized Notes

Table of Contents

Declare Unaccounted Cash in Demonetized Notes when one can explain source of cash deposit

Taxpayer, who has not reported cash deposit as income, is able to satisfactorily explain nature and source of cash deposit. No consequences. You can be asked questions even if you deposit less than 2.5 lakh.

Ex : I am a housewife with no taxable income and I do not file my return of income. I have saved Rs 2.2 lakh over past years from the money given by my husband for household expenses and this amount is in high-denomination notes. I have a PAN card. Can I deposit this amount? Do I have to pay any tax?

You can deposit Rs 2.2 lakh in your savings bank account.The bank will not share this information with the IT department, Rule 114E of IT Rules have been changed. Thus, banks have to give information only if a deposit in savings bank account is of Rs 2.5 lakh or more between 09.11.2016 to 30.12.2016. As your income is below taxable, there will not be any tax liability in your hand as regard the deposit of Rs 2.2 lakh.

I earn monthly salary of Rs 1 lakh, file my return regularly, and deposit every month the salary net of tax in my bank account. I withdraw every month Rs 50,000 for my household expenses, including education and medical expenses of family. By-and-large, every month my expenditure is about Rs 42,000 – Rs 46,000. I have with me Rs 3 lakh in high-denomination notes. This amount is out of my past savings.Can I deposit this amount in my personal savings account? Will there be any enquiry?

If you deposit Rs 3 lakhs in your savings bank account, the information will be sent to the Tax department which will ask you to justify your claim of savings of Rs 3 lakh. Tax officials would probably say that if you had Rs 3 lakh, why did you withdraw Rs 50,000 every month from the bank and did not use your savings. Your claim that Rs 3 lakhs is out of savings may be genuine and reasonable, but you may find it difficult to explain. If possible you may deposit Rs 2.5 lakh (from your savings) into your savings bank account and the balance Rs 50,000 into savings bank account of your wife in order to avoid confrontation with IT officials.

Declare Unaccounted Cash in Demonetized Notes when one unable to explain Source of Cash

A Tax payer who is unable to explain nature and source of cash or deposits has two options:

- Owns up income in form of cash or deposit in Income Tax Return to be filed for tax year 2016-17, pays tax before 31 March 2017 but does not opt for Scheme. (Income may pertain to earlier year/s)

- Makes a declaration in respect of cash or deposits under Pradhan Mantri Garib Kalyan Yojana and pays tax, surcharge, penalty and makes deposit of at least 25% of undisclosed income by specified date. (Income may pertain to earlier year/s)

Tax impact on Taxpayer who is unable to explain nature and source of cash or deposits and owns up in Income Tax Return

| Particulars | Tax Rate |

| Tax | 60% |

| Surcharge(25% of tax) | 15% |

| Cess (3% of tax and Surcharge) | 2.25% |

| Total | 77.25% |

Tax impact on Taxpayer who declares income under Pradhan Mantri Garib Kalyan Yojana 2016

One who declared his undisclosed income under the Pradhan Mantri Garib Kalyan Yojana 2016 shall be required to pay

- tax @ 30% of the undisclosed income,

- penalty @10% of the undisclosed income.

- Further, a surcharge to be called Pradhan Mantri Garib Kalyan Cess @33% of tax is also proposed to be levied.

- totalling to approximately 50%

- In addition to tax, surcharge and penalty (totalling to approximately 50%), the declarant shall have to deposit 25% of undisclosed income in a Deposit Scheme to be notified by the RBI under the ‘Pradhan Mantri Garib Kalyan Deposit Scheme, 2016’. No interest will be paid to the owner for this. After four years the owner can reclaim his money (25%)

- One gets Immunity from reopening of past income/wealth tax assessments. One also gets Immunity from certain other laws barring exceptions

| Particulars | Tax Rate |

| Tax | 30% |

| Surcharge(33% of tax) | 9.9% |

| Penalty | 10% |

| Total | 49.9% |

Tax and Unaccounted Cash in Demonetized Notes when Income Is detected by Tax Authority without search

Tax Payer neither owns up income in Income Tax Return nor opts for declaration under Scheme Pradhan Mantri Garib Kalyan Yojana 2016 and addition is made by Tax Authority without detection in search then tax impact is as follows

| Particulars | Tax Rate |

| Tax | 60% |

| Surcharge(25% of tax) | 15% |

| Cess (3% of tax and Surcharge) | 2.25% |

| Total | 77.25% |

| Can also levy penalty on tax | 10% |

Undisclosed income is detected in search conducted after Presidential assent to Bill

Taxpayer owns up income in the course of search, substantiates manner in which income was derived and pays up tax (with interest, if any) and includes income in Income Tax Return.

| Particulars | Tax Rate |

| Tax | 60% |

| Surcharge(25% of tax) | 15% |

| Cess (3% of tax and Surcharge) | 2.25% |

| Total | 77.25% |

| Can also levy penalty on undisclosed income | @ 30% |

b) In any other case

Tax impact

| Particulars | Tax Rate |

| Tax | 60% |

| Surcharge(25% of tax) | 15% |

| Cess (3% of tax and Surcharge) | 2.25% |

| Total | 77.25% |

| Can also levy penalty on undisclosed income | 60% |

Comparing Tax Impact of Undisclosed Income under Declaration Scheme and as part of Income Tax Return

Snapshot of comparative tax consequences of voluntary offer of undisclosed income under Scheme vs. as part of Income Tax Return is given below

Related articles:

- Giving Cash and Deposit money into Bank Accounts and Tax on Gifts

- Tax on Undisclosed Income and Pradhan Mantri Garib Kalyan Yojana 2016

- Tax and penalty on Cash Deposit due to Demonetization

- Transactions reported to Income Tax Department

- Black Money : What is Benami Property and Benami Act?

- How to Exchange Rs 500 and Rs 1000 Notes ?

- New Rs 500 and Rs 2000 notes : Features,Comparison

Very Soon all Card Transactions will replace with Your 12 – Digit Aadhaar Number – Demonetisation Update.

More info@ https://www.moneydial.com/blogs/very-soon-card-transactions-will-replace-with-your-12-digit-aadhaar-number-demonetisation-update/

5 Points to know: Ancestral Jewellery Will Not Be Taxed Under New Changed Income-Tax Law.

More info@ https://www.moneydial.com/blogs/5-points-to-know-ancestral-jewellery-will-not-be-taxed-new-changed-income-tax-law/

Where the Indian Government will put the Black Money?

More info@ https://www.moneydial.com/blogs/where-the-indian-government-will-put-the-black-money/

So far the method of operating the Pradhan Mantri Garibi Kalyan Yojana scheme has not been explained anywhere.

Yes Govt is working on it.