If you could not submit ITR-V of years from AY 2009-2010 to AY 2014-15, you can E-VERIFY past income tax returns by 31st August 2016. These returns shall then be processed by the income tax department by 30 Nov 2016. Lets look at the information from Income Tax Office of how to E-Verify Past Income Tax Returns in detail.

Table of Contents

Overview of Income Tax Return Process

Income Tax Return process consists of three steps

- Filing of Income Tax Return : First you have to fill your Income Tax Return or ITR for given year by deadline, usually 31 st July.

- Verifying your ITR You have to verify your ITR submitted. This could be by physically sending ITR-V or be Electronically verifying the ITR. If you forget to e-verify your ITR or fail to dispatch ITR-V to CPC Bangalore then it will be considered as if you have not filed your income tax return and the IT department will not process your ITR.

- E Verification facility was introduced by Income Tax Department in FY 2014-15 or AY 2015-16. Our article E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking explains the process in detail.

- If you have not verified your ITR electronically then you are supposed to send signed copy of ITR-V to CPC, Bangalore within 120 days of e-filing.ITR-V stands for Income Tax Return–Verification ITR-V is generated when you file your I-T return online—without using a digital signature.It is a one page document, pdf file. ITR-V is the acknowledgement form that you get after filing your ITR. It must be signed and sent to CPC, Bengaluru within 120 days of e-filing your ITR. The address to send via ordinary post or Speed Post is:

- Income Tax Department-CPC,Post Box No-1, Electronic City Post Office,Bangalore-560200, Karnataka

- Processing of ITR submitted. After the income tax return is processed another mail is sent to the assessee or person who has filed ITR, which is called Intimation under section (u/s) 143(1). The intimation under section 143(1) is sent by the IT Department in response to tax return filed by the tax payers. The intimation as the name suggests intimates the tax payer about, any tax and interest payable or if the assessee is eligible for refunds after providing all the necessary adjustments relating to tax deducted at source, advance tax paid, any tax paid on self – assessment or any other amount in the nature of tax or interest. Our article After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1) explains the step in detail.

E-Verify Past Income Tax Returns

Unfortunately, a large number of taxpayers, skipped Step 2 i.e Verifying ITR and therefore their return process is incomplete. Past returns could only be verified by sending the physical ITR-V to CPC, Bangalore. This process was rid with many problems, postal delays and misplaced envelopes etc. EVC or Electronic verification was introduced in Year 2015 for filing of returns from FY 2014-15.

To reduce the backlog of incomplete processing of ITR, now you can e-Verify your incomplete tax returns filed online from assessment year 2009-10 to 2014-15 by 31 August 2016. If you have not filed your return for earlier years you cannot file them. You can only verify the returns you had filed electronically for AY 2009-10 to 2014-15. So you can verify your Income Tax Return for following years. These returns shall then be processed by the income tax department by 30th November 2016.

- AY 2009-2010 (Return for FY 2008-2009)

- AY 2010-2011 (Return for FY 2009-2010)

- AY 2011-2012 (Return for FY 2010-2011)

- AY 2012-2013 (Return for FY 2011-2012)

- AY 2013-2014 (Return for FY 2012-2013)

- AY 2014-2015 (Return for FY 2013-2014)

Interest on Refund: If you had not sent ITR-V and are claiming refund , after ITR processing you would get your refund if information is correct. But Interest will not be paid for the period of delay due to the taxpayer as ITR was not processed .

How to know that past Income Tax Returns are processed

- Log in to incometaxindiaefiling.gov.in . Fill in your PAN, password,captcha code(number on the image shown) and click Login.

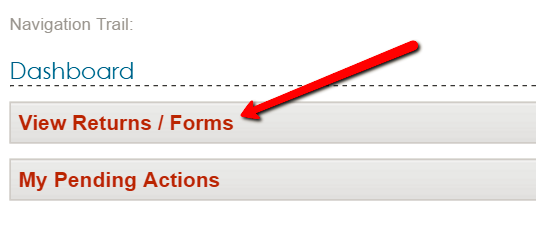

- Click on View Returns/Forms as shown in Image below

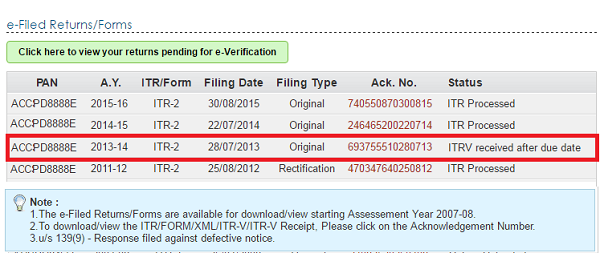

- Status of your filed Returns shall be displayed. So if you have ITR-V received after due date you need to resend your ITRs

How to check status of receipt of ITR-V

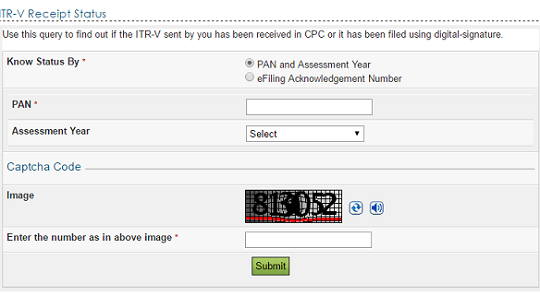

If you are unsure whether your ITR-V was received or not, you can check call call CPC helpline 1800-425-2229 from 9AM to 8PM.status or check the ITR-V receipt status at https://incometaxindiaefiling.gov.in/e-Filing/Services/ITRVStatusLink.html

Fill in your PAN and Assessment year or your e Filing acknowledgement number, Captcha code and click on ‘Submit’.

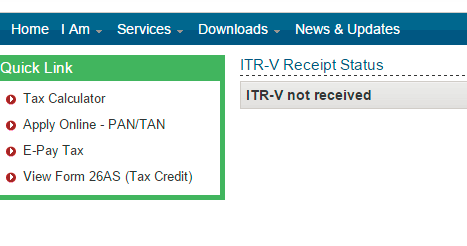

Your ITR-V receipt status would be displayed, as shown in image below.

- If you see, ITR-V not received , it means you have failed to send your ITR-V and will have to e-verify your return using EVC or physically sending your ITR-V to CPC, Bangalore.

- If you see the ITR-V received , no need to do any thing.

- And if you have not filed your return at all for that assessment year, it will show No E-Return has been filed for this PAN and Assessment Year or e-filing Acknowledgement number . If ou did not submit your tax return, Income Tax department can send you a notice for non-filing.If the department has already initiated the process by sending you a notice, you must continue to follow the course of action as per that notice.

How can you E Verify you Income Tax Return through EVC

Your income tax return can be e-verified by using ONE of the following ways. Our article E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking explains it in detail.

- EVC through the Income Tax Website.

- EVC using Aadhaar OTP

- EVC using Net banking account

- EVC using ATM

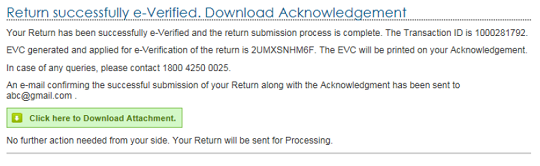

Once you do E-Verification of your ITR, screen showing success message is displayed as shown below. If you download the acknowledgement form ,Click here to Download Attachment, mentioned in the Success message. You would see it’s similar to ITR-V except now it has message printed in the bottom as shown in image below,Do not send this Acknowledgement to CPC, Bengalaru,

Related Articles:

- Understanding Income Tax Notice under section 143(1)

- How To Fill Salary Details in ITR2, ITR1

- Video on Which ITR to Fill

- Interest on Saving Bank Account : Tax, 80TTA

- Challan 280: Payment of Income Tax

Please make use of this opportunity of putting your ITRs in order.