Education is expensive and Higher education is all the more expensive especially foreign education. Hence the need for an education loan, which is a financial aid given to meritorious but needy students for meeting the expenses of their higher education in India or abroad. In this article, we shall explain education loan, what it is, the process of getting education loan, repayment, tax benefits under section 80E.

Table of Contents

Higher Education is expensive!

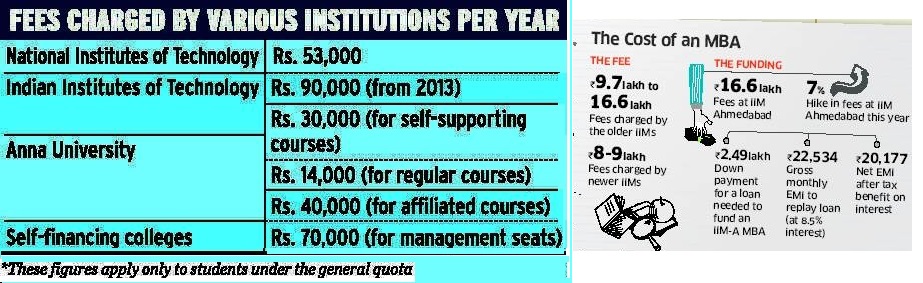

Education has become very expensive and Higher education is all the more expensive. Our article Rising Education costs ! covers survey which shows school education for a child in 2011 cost Rs. 94,000 annually for a single child. Example of fees of higher education is given below.

What is education loan?

Educational loans are available for the purpose of higher education. Higher education means any course of study pursued after passing the Senior Secondary Examination or its equivalent from any school, board or university recognised by the Central Government or State Government or local authority or by any other authority authorised by the Central Government or State Government or local authority to do so.

- The course should necessarily be full time.

- It can be graduate or post-graduate course in technology, engineering, architecture, medicine, management and applied or pure sciences, including mathematics and statistics etc.

- It can be pursued in India or abroad.

- One gets tax deduction for education loan taken.

Who gives out education loans?

Most of the financial institutions and banks give out educational loans. As the Reserve Bank of India (RBI) has included education loans as part of the priority sector lending of banks, the public sector banks are at the forefront of such loans.

What is covered under the Education loan?

Education loans take care of all expenses incurred such as :

- Admission, tuition, examination and library fees

- Cost of purchasing books, computers and other equipment.

- Some banks like State Bank of India also offers a loan for two-wheeler if hostel and college are far.

If the loan is being taken for studies overseas, travel expense is also included in the loan amount. As medical expenses are high in countries such as the US, the loan also accounts for health insurance. Although the bank is in India, the student gets his amount in dollars for studies overseas, and the amount is paid directly to the institution abroad. The banks charge students a fee for this service, strictly as per RBI norms.

What is the eligibility criteria for an educational loan?

Eligibility criteria vary from bank to bank. Some common criteria are:

- The institution must be recognized

- Confirmed Admission Letter from college or institute

- Age of the student must be 16-26 (for some banks 16-35 years)

- The student should have a good academic record

- Regular income of parent/co-applicant

What is the maximum amount lent by the bank?

Under the education loan scheme, one can avail of a loan up to Rs 10 lakh for studies in India and Rs 20 lakh for studies abroad.

What is the interest applicable on Educational loans?

The interest rates vary from bank to bank and depend on the amount of the loan taken.

Education loans are usually on floating rates where the interest rates may change. Some banks such as Bank of Baroda, offer a fixed rate of interest, which is usually 2-2.5% above the bank’s base rate. Special concessions on interest rates of 0.5/1 per cent are available for women students. Typically, interest rates on educational loans range between 9% to 14%. The rate may vary depending on the course, college/institute and university. Banks usually offer concessions to students who have secured admission to premier institutions. For instance, if someone joins an IIT or IIM, one’s loan might be cheaper by half a percentage point.

Educations Loans are very common in the US, where students take Student Loans to finance their studies. Even Ex-President of USA, Barack Obama and his wife Michelle Obama took Educational Loans.

It is very necessary to compare the loans. One can compare the rates at Deals4loans compare educational loans. Verify it with the bank.

(Note: We have no affiliation with any of the sites mentioned here, We are not recommending them. It is for informational purpose only)

Where can the loan be availed from ?

Loans can be availed usually from the native place of the student because of the KYC (Know Your Customer) requirements.

Does one need to provide a guarantor or any other kind of security?

Every education loan requires co-applicant or joint borrowers such as a parent, spouse, siblings, in-laws. For smaller amounts of loans (amounts up to Rs. 4 lakh) banks do not ask for any guarantor or security. However, most banks ask for either a guarantor or for some kind of security such as government securities, gold, shares, fixed deposits, LIC policies and real estate other investments etc. At times banks ask for Third party guarantee. It means one’s uncle, father’s friend or any of the relatives can make this third-party guarantee. (First being the applicant, second being co-applicant). This is to ensure if the first/second guaranteed person is unable to pay then 3rd party person has to bear the loan.

- For a loan up to Rs 4 lakh, co-obligation of parents is required

- For loans above Rs 4 lakh and up to Rs 7.5 lakh, co-obligation of parents together with third party guarantee is required.

- For loans above Rs 7.5 lakh, co-obligation of parents together with tangible collateral security of suitable value.

Are there any other fees applicable while taking this loan?

Banks may charge fees for approving the loan and doing the paperwork called as the Processing fees. These fees range between 2.25% and 2.50%. Usually, the banks(especially public sector banks) do not charge any processing fees for education loan.

A student may need to bear the margin amount. A margin amount is an amount that the applicant bears himself/herself. For example, if a Bank offers an education loan and the margin is 10 per cent. Then 90 per cent of the cost of the course will be borne by the bank and the balance 10 per cent has to be borne by the student/applicant. Normally, banks do not approve the loan that would cover the entire cost of your education. Margins are usually required for loans more than Rs 4 lakh and 5 per cent and 15 per cent respectively for study in India and abroad on loan above Rs. 4 lakhs.

What are the documents required while applying for the loan?

The required list of documents may vary from bank to bank. The most common documents are:

- Proof of admission. An educational loan cannot be applied without proof that admission has been secured in the selected institution,

- Schedule of fees from the institution

- Mark sheet of the last qualifying examination

- Photographs

If the applicant is earning then:

- Bank account statement

- Income tax assessment order of the last 2 years

- Proof of income

- A brief statement of assets/liabilities

When the loan is required for studies abroad, one also need to have a passport and visa ready along with the admission letter.

How much time does it take for education loan to be sanctioned?

Loan applications are received either directly at bank branches or through online. Sanction or rejection of a loan is supposed to be communicated within 15 days of receipt of a duly completed application. Students can demand reasons for rejection of loan application in writing from banks.

How is the loan amount disbursed?

Disbursement of the educational loan is made directly to the institute or college to which the student has applied for admission. In the case of mess and hostel charges, the relevant amounts are given to the concerned authorities. Initially, while applying for a loan, the bank will verify the tenure of the course, and determine the cost of the entire course, as applicable at that point of time. Then, each year, the applicant is required to submit a form available from the bank that gives the details of the money required, and then the bank directly disburses the loan to the college/institute.

In the case of airfare, which is also available for studies overseas, the amount is given directly to the airlines. Some banks do give the students themselves a certain amount on a monthly or quarterly basis for purchasing books, equipment and other related material associated with the course. This, again, depends on the discretion of the bank.

However, if a student has already taken admission and incurred expenses, banks reimburse these if the original receipts are produced within one month for studies in India and six weeks if the applicant is going overseas.

What is the process of education loan?

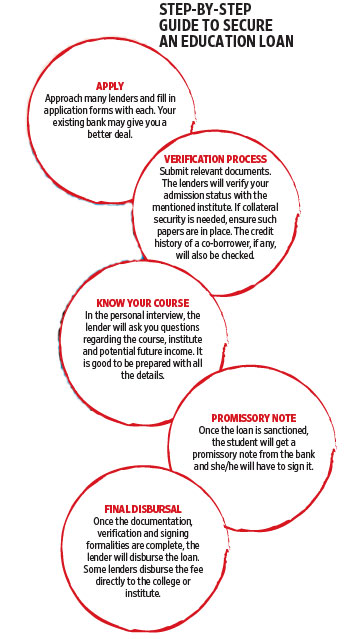

Livemint MBA too costly? Take an education loan step by step process of education loan is shown below :

When does the repayment of the loan starts?

Normally, the repayment begins after the loan is disbursed and the payments(Equated Monthly Installments (EMI)) have to be made each month. But for Education Loans Repayment usually starts six months after the course completion or the starting of a job, whichever is earlier. The period during which borrower is not required to make any repayment is called holiday period or moratorium period.

- Interest calculations start as and when amounts are disbursed and not on the entire loan amount at once.

- During the moratorium period, on an education loan, the bank will calculate interest on your loan on a simple interest basis. This interest will be accumulated until the end of the moratorium period.

For example, if a loan amount of Rs 1 lakh is released at the start and interest rate is 11% per annum, a total interest of Rs 11,000 per annum or Rs 33,000 for a three-year moratorium period will be accumulated. At the end of the moratorium, Rs 1,33,000 will be the amount on the basis of which future interest and EMI will be calculated.

There are some banks that offer a concessional interest rate (of 1%) if one agrees to pay the interest portion of the loan during the moratorium period.

Are there any tax benefits for educational loans?

The tax benefit on education loan is available under the Income Tax Section 80E.

- The deduction is only on the interest component. One can deduct the entire interest paid (without any limit)

- There is no deduction available for repayment of principal

- Anyone who has taken an education loan for self, spouse or children, is eligible to claim the tax deduction.

- The education loan should only be taken from an approved charitable trust or a financial institution. In case you have taken loan from your relatives, friends or employer that amount would not qualify.

- The deduction is applicable for the year you start paying your interest called as the Initial Assessment year.

- The deduction is available in respect of the initial assessment year and seven assessment years immediately succeeding the initial assessment year or until the interest is paid in full, whichever is earlier.

- The deduction is available for individual only and not for other types of assessee such as Hindu Undivided Family .

Interest certificate from the bank can be submitted to the Employer in which case Form 16 will show the tax benefit. Else one can claim it while filing Income Tax return. In any case, one needs to show it in Income Tax return.

Example of education loan

| Loan Amount (released in4 instalments of Rs 2.5 lakh each) | Rupee 10 lakh |

| Assumed rate of Interest | 14% |

| Tenure | 10 years |

| Estimated accumulated interest of moratorium period (3 years) | Rupee 3,15,000 |

| Total amount to be repaid | Rupee 13,15,000 |

| EMI | Rupee 20,418 |

Repayment and Tax benefit

If you have an education loan of Rs 5 Lakh at 11% interest rate per annum and the repayment tenure is 5 years. So your EMI would be Rs 10,871.The breakup of your payment for 5 years and the tax benefit you can get:

| Year | Total EMI | Principal | Interest | Tax Benefit at 20% | Tax Benefit at 10% |

| 1 | 1,30,455 | 79,378 | 51,077 | 10,215 | 5,108 |

| 2 | 1,30,455 | 88,563 | 41,892 | 8,379 | 4,190 |

| 3 | 1,30,455 | 98,812 | 31,643 | 6,329 | 3,164 |

| 4 | 1,30,455 | 1,10,246 | 20,209 | 4,042 | 2,021 |

| 5 | 1,30,455 | 1,23,003 | 7,452 | 1,491 | 745 |

What is the education loan subsidy scheme?

On 24th June, 2010 Government of India approved a Scheme to provide full interest subsidy during the period of moratorium on loans taken by students belonging to economically weaker sections under the Educational Loan Scheme, for pursuing any of the approved courses of studies in technical and professional streams, from recognized institutions in India. The interest will be paid to the banks by the Government of India. It is applicable from the calendar year 2009-10. The benefits under the Schem are applicable to those students b with an annual gross parental/ family income upper limit of Rs. 4.5 lac per year (from all sources). Income proof shall be required from the students from public authorities as authorized by the State Governments for certification of income status for the scheme.

Is there a penalty for pre-payment?

It depends on the bank. Nationalized banks usually do not have any pre-payment charges, but private and foreign banks usually charge a penalty, which usually ranges from 0.25 per cent to 2 per cent of the outstanding loan amount.

Is there any documentation required post the sanction of the loan?

Progress reports to be provided at the time of every disbursement. The progress report includes mark sheets or a letter from the Institute, in case the mark sheets are not available while processing the fresh disbursement.

If one is unable to pay the education loan?

In case the student is not able to pay the loan, the default gets reported to the Credit Information Bureau Limited (CIBIL) and will be reflected in his credit information. This can affect the credit history of the student. Legal proceedings take place in case of defaults. Collateral can be also be confiscated.

What happens if one takes a break from studies?

If for any untoward reason, one is unable to complete the course, one will have to start paying the EMIs immediately. Some banks might give the students some grace period, either to continue his/her studies or to start repaying the loan. But this is entirely the bank’s discretion.

What if one doesn’t get a job?

For exceptional and genuine cases where the student is not getting a job due to macroeconomic conditions, lenders may consider extending the repayment period. Usually, education loans have tenures of five-seven years. However, as per the guidelines, the tenure can be extended up to 10 years for loans up to Rs 7.5 lakh and 15 years for loans above it.

References : myiris FAQs Educational Loans, Livemint MBA too costly? Take an education loan

Related articles:

- Life of Debt – Responsibly

- Understanding Loans

- Understanding CIBIL CIR report

- CIBIL CIR : Account and Negative Factors

- Rising Education costs !

Should parent pay for the higher education of the child or should a child take the education loan? Have you taken an education loan? How was the process? How easy or difficult was it to pay education loan?

Thank you for sharing this post. The above information was of great help for those who want to pursue higher education! This blog clearly describes the steps to study abroad. procedure for going abroad for studies

Great post, thanks for sharing part of important information about education loan for studying abroad needs.You know how in education loan. You have kept important information about how to studying, great article!

Education, nowadays, has become a necessity especially for the economically weaker sections of the society to stand and flourish so as to lead a happy and successful life. In this scenario, various national and private banks provide educational loans for higher studies. To find more relevant information in this context, refer to https://www.gyandhan.com/blogs/abroad-education-loan-with-collateral

Great Blog ! Thanks for sharing this valuable information with us – https://ambium.in/education-loans/

Education from a prestigious institution is a dream of every aspiring professional. But the cost of education in the present age, especially in the esteemed institutions is beyond the means of many. Leave alone thousands, in recent times the cost has rolled over into lakhs per annum including boarding and lodging.

So, in such you must go and look to for your educational loan as it is charged with the lowest interest rate all over the world. For that apply here at Antworksmoney and get your loan approval within a day. Click here at:https://www.antworksmoney.com/education-loan

Informative article. One major change, now we need to apply online. https://youtu.be/slLocAfugK4

Thank you for sharing me useful information

http://www.fundmaker.in

Thanks for sharing this article, this will be helpful for the students who would be applying for education loan.

Very very useful to understand educational loan…..thank you!

Good post. Usefull information , which will really help for the students to learn more about it.Thank u

As you say, education becomes costly and most of the students need education loans. This post is very informative, covering all the aspects of the EL.

As you say, education becomes costly and most of the students need education loans. This post is very informative, covering all the aspects of the EL.

Have earlier applied for executive education loan but still stuck .

Great post. Very exhaustive and covers almost all aspects education loans.

Thanks Annapurna for encouraging words

Very informative blog and your posts are thoroughly explained

Travel India

I have a query regarding loan repayment.

If suppose I didn’t get job and not able to pay the loan EMIs on time, then who will be liable to pay the amount? My parents who were the guarantors of the loan? What if I get married? Still my parents will be liable to pay or my husband?

Nice Article

Nice Article

Thanks. Glad you found it helpful.

Very informative blog and your posts are thoroughly explained

Travel India