Companies often reward their employees with their stock, either in the form of employee stock option plans (ESOP),Restricted Stock Units(RSU), or employee stock purchase plans (ESPP). This article covers ESOPs in detail. It explains What are Employee Stock Options, what is granting & vesting of ESOP, How are ESOP taxed? Capital gains of ESOPS?

What are Employee Stock Options or ESOPs?

An ESOP is an employee benefit plan offered by a company to its employees. ESOPs provide an opportunity to employees to acquire a stake in the company. ESOPs confer a right and not an obligation on the employees to buy shares of the company at a future date at a pre-determined price.

Why are ESOPs given?

Apart from giving financial gains to the employees, ESOP also creates a sense of belonging and ownership amongst the employees. The objective of ESOP is to motivate the employees to perform better and improve shareholders’ value. For Employers ESOPs are a tool to attract talent and also to retain and compensate employees.

How many ESOPs can one get?

It depends upon the company’s management to decide how many options to give to an employee. These options are allocated to individual employees based on performance, pay structure, seniority, and so on.

What are the terms or actions associated with ESOPs?

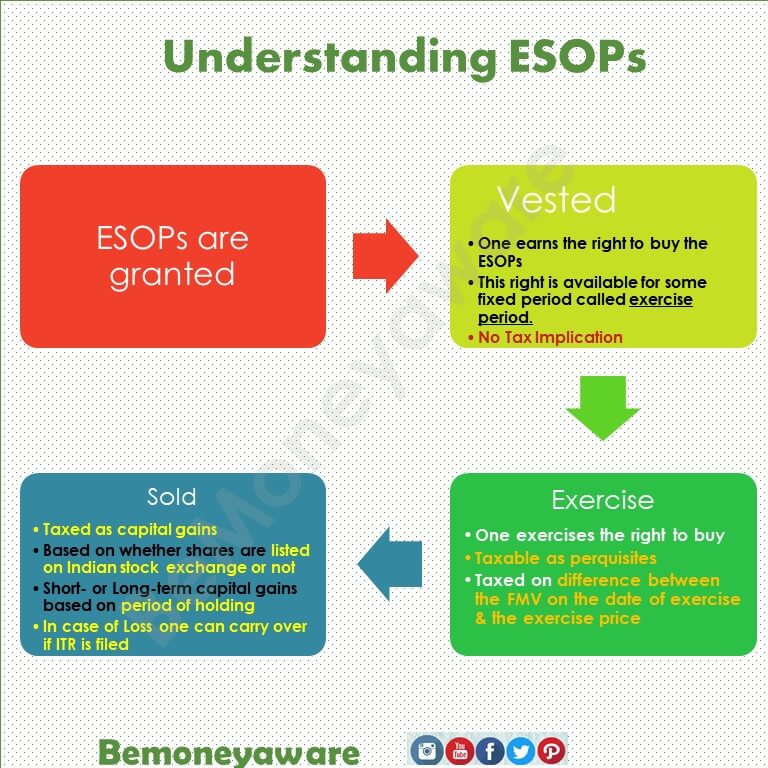

Granting of ESOPs, Vesting, Exercising, and selling are the actions associated with Employee Stock Options (ESOPs).

- Grant is a process by which an employee is given an option. It is the delivering of the options to the employee. The grant shall specify the number of options given, the time of vesting, etc

- Vesting is a process whereby the employee acquires the right to exercise the options

- Exercising: The activity of converting the options granted to employee into shares by paying the required exercise price is known as exercise of options. It is like buying of shares.

- Selling: It is the selling of shares like normal shares.

In most companies in India, options vest for a period of 3-4 years from the date of grant of options and can be exercised anytime within a period of 2-5 years from the date of each vesting. ESOPs are structured in a way that they are exercised over three-five years. This is to ensure that the employees remain with the company for a longer period.

Example of ESOP

On April 1 2012, a company grants an employee 100 ESOP, at an exercise price of Rs 100 per share, which is also the market price that day with the vesting period is two years and exercise period of 1 year.

- At any point between 1 April 2014 – 31 Mar 2015, he can pay Rs 100 a share and get the shares.

- If the market price on 1 June 2014 is Rs 200, he can sell the shares and make a neat profit.

- However, if the market price is Rs 50, he need not exercise the option. He can instead wait till 31 Mar 2015 to buy the shares.

What is Granting of ESOPs?

Grant is a process by which an employee is given an option. It is the delivery of the options to the employee. The grant shall specify the number of options given, the time of vesting, etc. There are no tax implications when the shares are granted.

- Option: An option is a right but not an obligation granted to an employee under the ESOP to apply for and be allotted shares of the company at a price determined earlier, during or within a specific period of time

- Grant: Grant is a process by which an employee is given an option. It is the delivering of the options to the employee. The grant shall specify the number of options given, the time of vesting, etc.

- Grant date – The date on which the company grants an option to its employee.

- Option price – The price at which the shares are offered. It is also known as strike price or grant price. The grant price is determined be employers in different ways such as averaging the stock’s market price for a period, for example, a month before the issue date OR It could also be the average market price on the issue date.

What is the Vesting of ESOP?

Vesting is a process whereby the employee acquires the right to exercise the options. It has two components:

- Vesting percentage: portion of total options granted, which employee will be eligible to exercise.

- The vesting period refers to the minimum period for which an option must be held before it can be exercised. It provides incentives to the grantees of an option to remain employed with the company during such period. The vesting period can be a single time period or a series of time periods.

- There are no tax implications when the shares are vested.

What is Exercising of ESOP?

Exercise :The activity of converting the options granted to employee into shares by paying the required exercise price is known as an exercise of options. Mostly the company fixes exercise price based on the market price of that particular share on the date of grant. An employee typically buys the shares only if the market price is higher than the exercise price.

- The exercise period is the period within which you can decide to exercise your options. i.e buy the shares by payment of the option price on the options vested in him. This period starts from the date of vesting.

- If the exercise period lapses the vested option lapses and no right shall accrue to the employee thereafter.

- The employee may exercise all the options vested in him in one stroke or choose to exercise a number of options within the exercise period.

- The date the employee exercises his shares is the day considered the day of buying the shares.

- In the event of resignation or termination of employment, all options not vested in the employee as on that day shall expire. However, the employee can exercise the options granted to him which are vested within the period specified in this behalf, subject to the terms and conditions under the scheme granting such options as approved by the Board.

- The value of a stock option is the difference between the stock’s current market price and its option price or the price at which an employee acquires the stock option.

- Esops are taxable as perquisites in the hands of the employees. The tax implication during the exercising of options is discussed below.

What are tax implications during the exercising of ESOPs?

Currently Esops are taxable as perquisites in the hands of the employees. Earlier in Fringe Benefit Tax regime, an employer was required to pay a fringe-benefit tax on the benefit derived by employees from Esops, which in turn could be recovered from employees.

- The perquisite value is derived as the difference between the Fair Market Value (FMV) of the share on the date of exercise and the exercise price.

- For listed companies, the market price on the exercise day is usually considered as the fair market value.

- For non-listed companies, the fair market value is determined by a Category I merchant banker registered with the Securities and Exchange Board of India, the stock market regulator.

- The perquisite tax needs to be paid on date of exercise even though the shares are not sold.

- The perquisite tax depends on the tax bracket of the employee.

- Although the taxable event would be triggered by the actual date of allotment of shares, the perquisite would be valued with reference to its date of exercise.

- The employer has to compute and deduct the tax on prerequisite resulting from allotment of shares under ESOP. Either by withholding the amount from the salary income or by disposing of off the specified number of shares to meet the tax liability, subject to the terms and conditions under the plan.

- The income and the perquisite tax deducted by the company are reflected in Form 16 and the employee should report the same as part of his salary in his personal tax return.

Ideally ESOP should be exercised when the company’s shares are trading at a low price, but the employee is confident of the company’s long-term prospects. Since it is difficult to predict the stock price movement, it also advisable to exercise the ESOPs in a phased manner.

Quiz on ESOP

How are ESOP taxed on Selling?

Selling the shares: Once the employee exercises the options those shares becomes his. He can sell them at any time he wants just like the regular stocks.

The gains arising from the difference between sale consideration and the FMV on the date of exercise are taxable in the hands of employees as capital gains just like regular shares on sale and purchase of stocks from the market.

The capital gains tax treatment depends on the holding period and whether the shares are sold on a recognized stock exchange in India. Taxation rules are

- Cost of acquisition is taken as the market price on the date of exercise.

- If the holding period is more than 12 months for a listed company(STT paid), it is considered as long term and attracts no capital gains tax.

- However, if the same is held for less than 12 months, it is considered as short-term and taxed accordingly (currently at 15%).

- If you don’t pay STT (for foreign shares and off-market transactions), STCG will be taxed as such and LTCG will be taxed either at 10% or at 20% after indexation is applied.

Our article RSU of MNC, perquisite, tax, Capital gains, ITR covers it in detail

From Financial Year 2020-21, an employee receiving ESOPs from an eligible start-up will be able to defer the payment of perquisite tax until certain events occur.

Example of Tax implication on ESOP for listed companies

The employer has given the ESOP of a total of 400 shares, for the next 4 years, to his employees. The vesting price is Rs 100 and the vesting date starts from 1 June 2020. The employee exercises 100 shares on 1 July 2020, when the price of the share is Rs 500. He sells these shares at Rs 1500 on 1 December 2021

TAX at the time of exercising: (500 – 100) * 100 * Tax bracket of employee = (500-100) * 100 * 20% = Rs 8000

TAX at the time of sale: (1500 – 500)*100*15% = Rs 15000

What if ESOPs are of the company abroad?

This depends on whether you are a resident or non-resident Indian. If you are a non-resident, it will not be taxable, as the gains occur outside India, unless the money is received in India.

If you are a resident in India, then you will be taxed on the gains.

- Long-term capital gain: either you can pay 10% income tax on gains without indexation benefit Or you can pay 20% income tax on gains with indexation benefit.

- Short-term capital gain is added to your overall income and taxed according to your slab rate.

If you have suffered a loss in ESOP?

If you have incurred a loss, you are permitted to bring forward short-term/long term capital losses in your tax return and set them against the gains in the coming periods

What are the alternatives to ESOP?

Alternatives of ESOPs are Restricted Stock Units (RSU), Employee Stock Purchase Plan (ESPP), Stock Appreciation Rights Plan (SAR).

What are Restricted Stock Units (RSUs)?

Recently, there has been a growing trend of rewarding employees with Restricted Stock Units/ shares (RSUs). Restricted Stock Units represent an unsecured promise,i.e no strings attached, by the employer to grant an employee a set number of shares (at zero strike price) on completion of the vesting schedule or other conditions.

What is Employee Stock Purchase Plan (ESPP)?

The employee is allowed to directly buy the company’s stock on a monthly basis at a certain discount to the market price. For example, if the market price is Rs 150, the company will offer this to their employees at Rs 135, a 10 percent discount.

What are Stocks Appreciation Rights?

A right, usually granted to an employee, to receive a bonus equal to the appreciation in the company’s stock over a specified period. Unlike employee stock options, the employee is not required to pay the exercise price, but just receives the amount of the increase in cash or stock.

Related Articles :

- RSU of MNC, perquisite, tax, Capital gains, ITR

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

- Variable Pay

- It’s not what you earn that makes your financial position!

- Understanding Form 16: Part I

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

If you liked the article share it with your friends, colleagues, family through Facebook, twitter, Instagram

I am holding the exercised ESOP of a foreign unlisted company, it’s been now more than 3 years and I want to sell it. I want to understand the tax implication on capital gains. Will the indexation works here?

The difference between the sale price and FMV on the exercise date is taxed as capital gains.

Starting FY 2016-17, UNLISTED equity shares shall be

short term capital assets – when sold within 24 months of holding them and

long term capital assets – when sold after 24 months of holding them

The period of holding begins from the exercise date up to the date of sale.

short-term gains are taxed at income-tax slab rates and

long-term gains are taxed at 20% after indexation of cost.

You can refer to our article for taxation http://bemoneyaware.com/rsu-tax-perquisite-capital-gains/

Hi, I am a US citizen and filing taxes in india as a resident for this year. I had stock options From the US which i sold this year. I see the entire stock option value coming in as perks in my form 16 (which gets added as income). I am little confused here

Just ogive an example –

1000 stocks at a price of 100 rupees grant

Let us say market value is 110 the day i sold

The amount i got when i sold these options – (1000*110) – (1000*100)- taxes = 10000-taxes

But i see this amount as perks in form 16 – 1000*110 = 110000

Is this correct?

Can someone explain whats going on here

thanks

Prasanna

sir

If after selling ESOP shares , if the sold price is less than FMV , capital loss can be taken account in tax calculation , if so how it can be taken into form c/B/16

you can claim capital loss in the income tax return. The tax treatment would be different for both short term and long term capital loss.

Couldn’t understand which form you are referring to c/b/16?

An employee (India Resident) of an Indian Company is awarded stocks (guess RSUs – as employee did not pay) of the Parent Company (USA), these have vested. Same has been included as perk in form 16, dividend on shares also withheld by Parent Company. Employee holds balance stocks as on 31/3/15.

=> Whether employee needs to show both stocks & dividend under FA schedule in ITR 2 ??

=> Is form 2 (disclosure of Foreign assets) applicable? (since the stocks have vested after considering it as perk in form 16 plus Dividend withheld)

Section 5 of the Income Tax Act, 1961 provides for “Scope of Total Income” in case of an individual ordinarily resident in India. As per the said section, all income received or is deemed to receive in India, accrues or arises or is deemed to accrue or arise in India or accrues or arising outside India, during a previous year from all sources in included and hence liable to taxation.

However, Section 10 of the Income Tax Act, 1961 provides for Incomes which do not form part of Total Income. Section 10 (34) of Income Tax Act, 1961 provide exemption to income received by way of dividend only from a domestic company in the hands of the recipient, however all income received by way of dividend from a foreign company is liable to be taxed in India.

Therefore, Dividend received from foreign Company is taxed under the head “Income from other sources” under the Indian Income Tax Act of 1961.

Relevant provisions of the said DTAA need to be examined to determine taxation of Dividend Income received by an Indian Individual from a Foreign Company. Usually many DTAA’s contain a provision of Withholding tax (i.e. tax deducted at source) on dividend incomes. The rate of tax on such dividends in many cases is 15%.

In the above mentioned case, where tax is levied in both the countries, in respect of the same dividend income, DTAA between India and the other country provides relief from effect of such Double taxation. As per the provisions of the DTAA, Indian individual will get a deduction on the Tax already deducted in such other country on such dividend Income. Therefore it can be concluded that though the dividend income received by an Indian Individual from investment of shares in a Foreign Company will be included in his “Total Income” (i.e. Section 5) and is taxable in India, tax already paid in the foreign country on such dividend income will be deducted from tax calculated on such dividend income in India

Thanks Kirti, very informative note, appreciate your response..

Very informative, thanks!

Very informative, thanks!