If you are unemployed after leaving your old job after 2 months you can withdraw EPF by submitting EPF Withdrawal Form to your old employer or EPFO. You can withdraw From EPS(even for scheme certificate) by submitting form 10C. This article talks about EPF Withdrawal, how to withdraw from EPF and EPS in detail, Forms to be filled, check claim status, SMS, Tax on epf withdrawal

Table of Contents

Overview of Withdrawing EPF and EPS of the old job

The rules are that an employee should not be in employment for two months after resigning if he has to withdraw his Provident Fund amount.

- You have an option to withdraw 75%of your funds after one month of unemployment and keep their PF account with the body. Announced on 26 Jun 2018

- You would also have an option to withdraw remaining 25% of your funds and go for final settlement of account after completion of two months of unemployment. Announced on 26 Jun 2018

EPF Withdrawal online

From 1 May 2017, you can do EPF Withdrawal online which does not require any previous employer’s involvement. To claim your EPF Full Withdrawal

- You have UAN registered and can log in to UAN portal.

- KYC details(PAN, Aadhaar) verified.

- Your Aadhaar and PAN Verified

- Your previous employer should have updated your Service History with Date of Exit(DOE) of EPF and EPS.

- Please verify your bank account number, IFSC code. As money is transferred to your bank account.

Our article Online EPF Withdrawal: How to do Full or Partial EPF Withdrawal Online explains it in detail.

EPF Withdrawal Offline

Approach EPFO directly only for unexempted organisations ie you are not contributing to EPF Private Trust. For EPF trust you have to approach the organization where you worked.

- Submit EPF Withdrawal forms(with UAN or without UAN) to the previous employer or EPFO.

- Two types of new common withdrawal form have been introduced i.e. new CCF (Aadhar) and new CCF (non-Aadhar).

- EPF Composite Claim Form (Aadhar) : APPLICABLE IN CASES WHERE UAN HAS BEEN ACTIVATE AADHAR NUMBER AND BANK ACCOUNT DETAILS ARE AVAILABLE ON UAN PORTAL. The attestation of the employer is not required and this form can be submitted to EPFO directly.

- EPF Composite Claim Form (Non-Aadhar) : If you don’t have UAN? If your UAN is not seeded with Aadhar or bank details are missing, this form can be submitted for all types of PF withdrawals. The attestation of employer / attested by Manager of a bank/Any gazetted officer/Member of the Central Board of Trustees./ committee/ Regional Committee (Employees’ Provident Fund Organization)/Magistrate/ Post/ Sub Post Master/ President of Village Panchayat/ Notary Public. Note EPFO looks at such applications in detail, to prevent PF fraud and rate is rejection is higher.

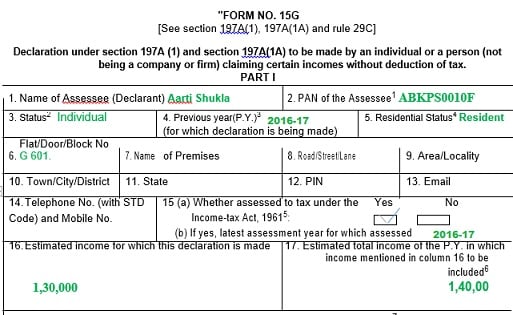

- Fill Form 15G to avoid TDS deduction. our article How to Fill Form 15G? How to Fill Form 15H? explains the Form in detail. A Sample filled form for Aarti Shukla, who is withdrawing on 30 Apr 2018 and who filed her ITR of AY 2017-18 (FY 2016-17) ,her EPF of Rs 1,30,00 and has 10,000 other income is here.

- Attach a cancelled cheque leaf of the bank account mentioned in the Forms.

- Write your Mobile Number on top of the form to get SMS alerts. You will get SMS updates

- EPFO normally takes around 20 days to process your claim.

- Track EPF Withdrawal

- You’ll receive two different amounts in your account. One is for your EPF withdrawal and one is for Pension contribution.

- Check out your tax liability.

Revenue Stamps Re. 1 each are required to be affixed on the forms and duly signed. (Not available in Karnataka so just sign in the location where it has been requested for revenue stamp)

EPF Withdrawal through Employer

If you have UAN then you have to submit Composite PF Claim Forms (Aadhar based and Non-Aadhar based) which replaced forms No. 19, 10C, 31, 19 (UAN), 10C (UAN) and 31 (UAN). Now you can submit the form to your previous employer or to your EPFO. On 20 Feb 2017 EPFO(Employees’ Provident Fund Organisation) had introduced Composite PF Claim Forms.

If you don’t have UAN You have to submit Non-Aadhar based forms

- The employer will attest the form and send it to the regional PF office.

- The regional PF office takes about one month(20 working days) to process your application.

- EPFO deposits PF amount directly to the employee’s bank account.

You can track your application status through http://www.epfindia.com/site_en/KYCS.php. You can also give SMS number in the application form and receive updates.

EPF Withdrawal directly to EPFO without Employer

Approach EPFO directly only for unexempted organisations ie you are not contributing to EPF Private Trust.

- If details such as Aadhaar and bank account number are linked to your Universal Account Number (UAN) and know-your-customer (KYC) verification is done by the employer, then an employee can directly approach EPFO for withdrawal using UAN based Forms.

- If no UAN then you can still submit Non-Aadhaar to EPFO attested by Manager of a bank/Any gazetted officer/Member of the Central Board of Trustees./ committee/ Regional Committee (Employees’ Provident Fund Organization)/Magistrate/ Post/ Sub Post Master/ President of Village Panchayat/ Notary Public. Note EPFO looks at such applications in detail, to prevent PF fraud and rate is rejection is higher.

You can track your application status through http://www.epfindia.com/site_en/KYCS.php. You can also give SMS number in the application form and receive updates.

When can one withdraw from EPF?

It is important to note that withdrawal of the EPF account by a salaried employee is illegal. Many employees withdraw their EPF account at the time of leaving the organisation. Legally Right thing it to transfer the EPF account from old employer to new employer . Financially EPF is saving for retirement, you lose out on compounding and disruptions will affect the final returns. Transferring EPF account is easier now. Give your UAN to the new employer, using EPF Form 11/13. As per PF withdrawal rules, a person who has EPF account can withdraw from the provident fund account

- if he or she has no job

- if two months have elapsed since his or her last employment (unemployed for 2 months).

Exceptions.

- A woman who quit their job for getting married, pregnancy or childbirth will not have to wait for two months to withdraw. They can do so immediately.

- if you are quitting due to health reasons.

Note: You can withdraw PF amount even after absconding as EPF money is your money. The employer cannot withhold it. You would have to approach EPF office directly.

- If you are taking break for higher studies and plan to join job after the studies, you can choose NOT to withdraw from EPF. When you join the new organisation you can transfer the PF account. With UAN it has become easier. Now EPF accounts don’t become dormant and continue to earn interest

EPF Withdrawal Forms with active UAN without employer attestation

You can apply (in certain cases after a waiting period of 2 months).

Withdrawal Benefit of Pension is not permitted if you have > 10 Years of eligible service. Only Scheme Certificate will be issued.

You can also wait for some time to get a new job and then you can get your PF Account transferred to the new Account.

However, in case of not getting the job, apply for the settlement before 36 months from leaving the last job as no interest will be paid after 36 months and the account will become inoperative. The website says so but as per latest order inoperative account earns account but interest earned on it is taxable.

New EPF UAN based forms. If details such as Aadhaar and bank account number are linked to Universal Account Number (UAN) and know-your-customer (KYC) verification is done by the employer, then an employee can directly approach EPFO for withdrawal using UAN based Forms. Please in such cases payment is in the bank account mentioned in the UAN portal. A cancelled cheque (containing member’s name, bank account number and IFS Code) is still required. Write your Mobile Number on top of the form to get SMS alerts

There are two versions of the form Aadhar based form and Non-Aadhar based Forms.

Our article EPF New Composite Claim Forms for Full and Partial Withdrawal Aadhar and Non Aadhar based explains these forms in detail

Aadhar Based Full Withdrawal Forms: These forms are applicable in cases where employee’s Aadhaar Number and Bank Accounts details are available on UAN Portal and UAN has been activated. So one can withdraw by submitting these forms directly to EPFO without the attestation of the Employer. These forms were earlier called as UAN-Based Forms.

Non-Aadhar Based Full Withdrawal Forms: These forms can be used when Aadhar has not been attached with UAN. So one needs to get attestation of the employer and then employer will submit Full Withdrawal form to EPFO. Our article EPF New Composite Claim Forms for Full and Partial Withdrawal Aadhar and Non Aadhar based explains these forms in detail

You can also Download EPF related Forms from EPFO website at Which Claim Form to Submit

Final Settlement of PF AND Withdrawal benefit or Scheme Certificate from Pension Fund through COMPOSITE CLAIM FORM (Aadhar)

EPF Withdrawal Forms without UAN or without going the employer

You can apply (in certain cases after a waiting period of 2 months) for : Download EPF related Forms from EPFO website at Which Claim Form to Submit

Final Settlement of PF AND Withdrawal benefit or Scheme Certificate from Pension Fund through COMPOSITE CLAIM FORM (Non-Aadhar)

Withdrawal Benefit is not permitted if you have > 10 Years of eligible service. Only Scheme Certificate will be issued.

Write your Mobile Number on top of the form to get SMS alerts

You can also wait for some time to get a new job and then you can get your PF Account transferred to the new Account.

However, in case of not getting the job, apply for the settlement before 36 months from leaving the last job as no interest will be paid after 36 months and the account will become inoperative. The website says so but as per latest order inoperative account earns account but interest earned on it is taxable.

Earlier you had to submit following forms

- Final Settlement from EPF :Form19 (pdf) To see the filled sample form Sample Filled Form19_English

- Withdrawal Benefit/ Scheme Certificate from Pension Fund through Form-EPS-10C Instructions on how to Fill Form-EPS-10C-Instructions-Eng

- Apply for Pension Form Form-EPS-Pension-10D. Instructions on how to fill Form-EPF-10D-Instructions-Eng

How much would you get on EPF Withdrawal?

You would get employer’s contribution, employee contribution and interest earned on it. To refresh

You would get employer’s contribution, employee contribution and interest earned on it. To refresh Normally, both the employer and employee contribute 12% each of the basic salary of the employee plus DA (if any) to EPF. (Employee can contribute more towards EPF voluntarily which is called VPF)

-

- The entire 12% of employees contribution is added towards PF.

- 8.33% out of the total 12% of the employers contribution is diverted to the EPS or pension scheme and the balance 3.67% is invested in PF. However, if the basic pay of an employee exceeds Rs. 6,500 per month, the contribution towards pension scheme is restricted to 8.33% of Rs. 6,500 (i.e. Rs. 541 per month) or 8.33% of 15,000 ie 1250 pm after Oct 2014. The balance of employers contribution goes into EPF. EPFO has now raised the eligibility ceiling for EPS to Rs 15,000 a month.

- The employer contribution is exempt from tax and employee’s contribution is taxable but eligible for deduction under sect

TDS on EPF Withdrawal, Filling Form 15G/15H for EPF withdrawal

The EPFO can deduct tax on source (TDS) in conditions given below.One can submit form 15G during EPF Withdrawal If one wants to avoid TDS. Many employers are asking for Form 15G to be submitted to be on safe side. Note no TDS doesn’t mean that you don’t have any tax liability. EPF deducts TDS

- One has not completed total 5 years of contribution to EPF. If EPF withdrawal is made before the completion of five years of continuous service, the amount withdrawn will be taxable

- The EPF withdrawal amount is more than 50,000. Earlier this limit was Rs 30,000.

Following image shows the Form 15G for EPF Withdrawal made during FY 2016-17(AY 2017-18) from our article How to Fill Form 15G? How to Fill Form 15H? Sample filled form for Aarti Shukla, who is withdrawing on 30 Aug 2016 ,her EPF of Rs 1,30,00 and has 10,000 other income is given below. Please click on image to enlarge. If you withdraw between 1 Apr 2016 to 31 Mar 2017 then details of PY and AY can be used as filled in the form.

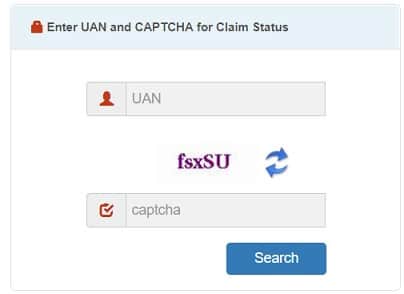

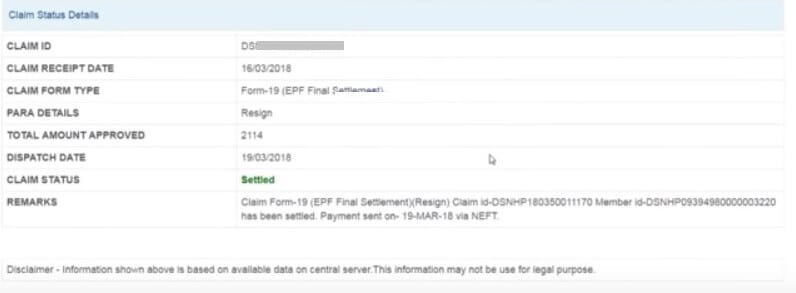

Tracking EPF Withdrawal

Know your EPF Claim Status facility is meant for EPF Members/subscribers/pensioners who have submitted a claim in any of the EPFO offices across India. Using this facility one can track the status of a claim so submitted. The only prerequisite is you must know your UAN. You can go and check your EPF Claim Status by visiting member claim status at link https://passbook.epfindia.gov.in/MemClaimStatusUAN/

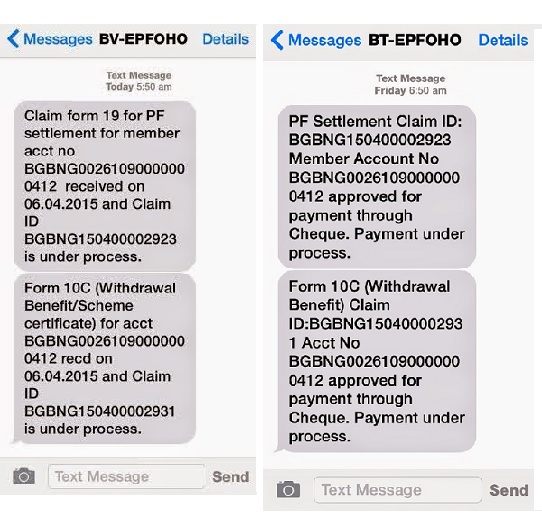

SMS while EPF Withdrawals

While submitting your claims, write your mobile number on the top of the application forms. You will get SMS on your mobile number and/or an email, about the status of your claim. In claim settlement requests, usually one gets two SMSs.

- a) First SMS – would be for intimating that the EPFO has received their application.

- b) Second SMS – when the claim is settled, applicant would get another message stating the amount is credited in the specified bank account.

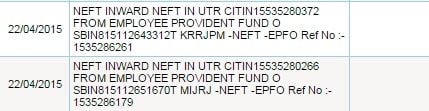

Verify the amounts of EPF Withdrawal in the bank account

You’ll receive two different amounts in your account. One is for your EPF withdrawal and one is for Pension contribution.

You can compare the received amounts with the contribution made by you to your EPF with previous employer. Check with UAN Passbook or Ask for Form 3-A from your previous employer. It should have all the information about the contribution made towards the EPF.

You will get Form 23 (Annual PF Statement) by post from the Regional Provident Fund Office, by which you can verify the claim credited in your account. You would receive this at your address, which you’ve mentioned in your withdrawal form.

EPFO’s Grievance

If you get the message that the claim is settled but money has not come to your account. Read our article When you don’t get your EPF Withdrawal money due to Incorrect bank details etc

What to do if I won’t get the claim within 60 days?

If you won’t find status of your EPF claim then submit your grievance at the EPF website. The EPFO’s Grievance Redressal Website is epfigms.gov.in

- Click on the “Register Grievance” link.

- Fill up your EPF Account related details in the first section titled “Enter EPF Details”

- Then fill up your personal details in the second section titled “Enter Personal Details”

- Once done, scroll down to the third section on the page which is titled “Enter Grievance Details”

- Select your Grievance Category correctly and clearly explain your Grievance and submit your request.

- Once your request is submitted, the EPF Organizations Grievance Redressal Team will look into your request and will respond to you within 30 days.

Our article How to register EPF complaint at EPF Grievance website online explains the process in detail.

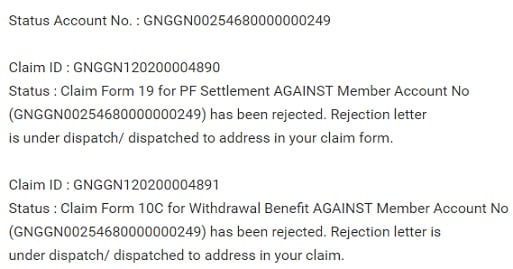

Reasons for Rejection of EPF Claim

Many times EPF Claim is rejected. When checked on EPF website the status message is shown in the image below.

- Provide all the information which matches your previous employer records such as Father’s name, Date of Birth.

- Mention your mobile number and email id clearly without any overwrite.

- Mention your bank account details

Tax on EPF Withdrawal

No tax is levied if you withdraw after completion of 5 years of your service. In calculating the 5 year term, the period of previous employment is included if the EPF balance from the previous employer is transferred to the current employer. If PF withdrawal is after 5 years then it is exempt from tax. You can still show it Income Tax Form under exempt income section like we show PPF Interest (as shown in our article Filling ITR-1 : Bank Details, Exempt Income, TDS Details)

If you withdraw your EPF amount before 5 years of service, it is taxable though you can claim relief under section 89.

- The employer’s contribution and interest, thereon, would be fully taxable as as profits in lieu of salary or ‘salary income’ in the hands of the individual.

- The employee’s contribution would be taxable to the extent of deduction claimed under Section 80C, if any, under the Income-tax Act,1961 and

- The interest earned on employee’s total contributions would be taxable as ‘income from other sources’ in the hands of the employee.

If TDS is deducted for EPF Withdrawal then you can claim for refund on TDS of EPF withdrawal for the year in which EPF is withdrawn. This is helpful if you withdraw in the year when your income is less than the taxable limit, for example you are studying or not working.

Rebate under section 89 on EPF Withdrawal

The rebate under section 89 is basically to even out the tax liability across the years by allocating the arrears received now to the years they pertain to.For example, if EPF is received for the financial years 2010-11 to 2014-15. Then the tax liability for each year will be calculated by adding this income to the returned / assessed income for these years. The difference between the tax liability for the assessment year 2015-16 by including arrears and the tax liability for the assessment years 2011-12 to 2015-16 by spreading out the arrears will be allowed as rebate under section 89. The effect of this rebate is to even out any difference in tax liability due to changes in income slabs. The workings for the rebate u/s 89 are complicated. I suggest that you should do it with the help of a CA to avoid errors.

All About EPF,EPS,EDLIS, Employee Provident Fund

Related Articles:

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

- Withdrawal or Transfer of Employee Provident Fund

- EPF Private Trust, the Exempted EPF Fund

- Tax on EPF withdrawal

- Transfer EPF account online : OTCP

- How much EPS Pension will you get with EPS Pension Calculator

- How EPFO Manages Money, EPFO invesment in Stock Market

Dear sir last month 20-july-2019 i am sending in online PF FULL Settlement applied but now till 13 August 2019 not settled my amount .my uan no 100051759661.

I have transfered old epf account to my new employer and now left this new job also before 3 months. my old eps amount doesnt show in new passbook. now i have withdrawibg eof and eps so can i get both passbooks eps amount in a single 10C form??

online without empolyer signature

Hi.Its been 55 days that I had submitted my PF claim for final settlement to my previous employer but I don’t ha Aadhar. I had been regularly checking my claim status in epfo site which states ‘no claim found under your UAN’ .I had been trying to contact PF department of my old employer but its been 7 days and they are not responding.Kindly help me what I should do .Regards

Hi.Its been 55 days that I had submitted my PF claim for final settlement to my previous employer but I don’t ha Aadhar. I had been regularly checking my claim status in epfo site which states ‘no claim found under your UAN’ .I had been trying to contact PF department of my old employer but its been 7 days and they are not responding.Kindly help me what I should do .Regards

i apply epf and eps full settlement but only credit epf amount eps amount not credit how many days credit my eps amount any idea and how to check online my eps amount credit, or under posses and reject how to check

Hi,

My last employer did a partial withdrawal in spite of requesting a full PF withdrawal. Now, I have submitted a request for PF with my second-last employer. But they say that EPFO does not take offline claim requests anymore. I am unable to submit an online claim because my last employer has already used this provision once.

Please advise what should be done.

Thanks.

I changed from EPF to nps as my new employer has only nps facility . I have withdrawn an amount of 1.3 lakh as EPF contributions(after TDS ,10 percent already deducted ) and 36000 as EPs . And my gross in new employer is nearly 3.3lakh . Should I have to show the pf withdrawal too as income ? And how ?

I applied for pf withdrawl with all the required documents. I checked the claim status online .and there it was showing

“Your request is rejected.

Remarks: Claim-Form-19 (EPF Final Settlement)(Resign) Claim id-

GNGGN170600022581 Member id-GNGGN00005540000004398 has

been rejected due to :- BANK DETAIL NOT GIVEN OM CLAIM FORM,

FORM NOT ATTESTED BY EMPLOYER/OK

What i have to do now???

I applied for pf withdrawl with all the required documents. I checked the claim status online .and there it was showing

“Your request is rejected.

Reason of rejection: INCOMPLETE BANK DETAILS

Remarks by DA/AO:

CANCELED CHQUE NOT SIGNED BY MEMBER/TAKE FOLLOW UP WITH MEMBER AND ESTT.

Now again i am appling for pf withdrawl.so plz tell me where to sign on a cancelled cheque.bcz as far as i know signature on this is not required.

This is the correct blog for anybody who wants to seek out out about this topic. You notice a lot its nearly exhausting to argue with you (not that I actually would need…HaHa). You positively put a brand new spin on a topic thats been written about for years. Great stuff, just nice!

Hi,

I have migrated from India. How can I withdraw my EPS, I have already withdrawn my PF. Is there a separate account for EPS or consolidated with EPF only?

Thanks in Advance

Sudip

There used to be a separate form for EPS earlier.

In 2017 EPFO came out with composite form.

If an employee has NOT completed 10 years in service, he can either withdraw the EPS amount or take the scheme certificate.

The option to withdraw or take the scheme certificate has to be submitted by filling Form 10C.

Definition of Inoperative PF account Would be Changed.

More info@ Definition of Inoperative PF account Would be Changed

EPFO Claim Settlement Time: Death Claim in 7 days and Retirement Claim on Retiring Day.

More info@ https://www.moneydial.com/blogs/epfo-claim-settlement-time-death-claim-7-days-retirement-claim-retiring-day/

Really very informative, thank you for sharing.