Employee Provident Fund (EPF) is one of the main platforms of savings in India for nearly all people working in Private sector Organizations. This article is about what is Employee Provident Fund(EPF), Employee Pension Scheme(EPS), Employees Deposit Linked Insurance Scheme (EDLIS), how the contributions are calculated based on basic salary and dearness allowance, what are the EPF interest rate, how much would one save in EPF, how would one know about the amount accumulated in PF.

0n 5th Mar 2020, EPF Rates for FY 2019-20 were Slashed to 7-Year Low of 8.5% from 8.65% of 2018-19.

Table of Contents

Overview of Employee Provident Fund

What is Employee Provident Fund?

A provident fund is created with a purpose of providing financial security and stability to elderly people. Generally one contributes in these funds when one starts as employee, the contributions are made on a regular basis (monthly in most cases). It’s purpose is to help employees save a fraction of their salary every month, to be used in an event that the employee is temporarily or no longer fit to work or at retirement. The investments made by a number of people / employees are pooled together and invested by a trust. Typically 12% of the Basic, DA, and cash value of food allowances has to be contributed to the EPF account. When one says EPF it means

- Employee Provident Fund(EPF) : Employee’s contribution is matched by Employer’s contribution(till 12%). The employer contribution is exempt from tax and employee’s contribution is taxable but eligible for deduction under section 80C of Income tax Act. The EPF amount earns interest as declared by Government.

- Employees’ Pension Scheme (EPS) of 1995 offers pension on disablement, widow pension, and pension for nominees.

- Employees Deposit Linked Insurance Scheme (EDLIS) provides for a lump sum payment to the insured’s nominated beneficiary in the event of death due to natural causes, illness or accident, while in job.

The EPF & MP Act, 1952 was enacted by Parliament and came into force with effect from 4th March,1952. A series of legislative interventions were made in this direction, including the Employees’ Provident Funds & Miscellaneous Provisions Act, 1952. Presently, the following three schemes are in operation under the Acts:( Click on the link if interested in reading the acts which are in pdf format)

1. Employees’ Provident Fund Scheme, (EPS)1952

2. Employees’ Deposit Linked Insurance Scheme,(EDILS) 1976

3. Employees’ Pension Scheme, 1995 (replacing the Employees’ Family Pension Scheme, 1971)(EPS)

Table below gives the rates of contribution of EPF, EPS, EDLI, Admin charges in India.

| Scheme Name | Employee contribution | Employer contribution |

| Employee provident fund | 12% | 3.67% |

| Employees’ Pension scheme | 0 | 8.33% |

| Employees Deposit linked insurance | 0 | 0.5%(capped at a maximum of Rs 15,000) |

| EPF Administrative charges | 0 | 0.85% (From Jan 2015) |

| PF Admin account | 1.1% | |

| EDLIS Administrative charges | 0 | 0.01% |

Difference between EPF and EPF Private Trust?

For an employer there are three ways he can contribute to Provident Fund of his Employees if number of employees is more than 20. Exempt means free from an obligation, duty, or liability to which others are subject.

- One is to save in an un-exempt fund like the EPF under the EPFO. Un-exempted firms are those firms which maintain the PF accounts of their workers with EPFO. There are over five crore active subscribers whose accounts are being managed by EPFO.

- Save in a company-run exempt fund, EPF Private Trust, recognised by the EPFO and which pays at least the same interest as the EPF. EPF Trust has to do the duties and responsibilities like EPFO. EPF Private trusts are formed by firms that manage the money and accounts of their workers themselves and have exemption from filing PF returns. The members of these trusts enjoy income tax and other benefits at par with EPFO subscribers. Such establishments who seeks exemptions and create EPF Private Trusts are called exempted establishment. However, the pension is payable only by the EPFO. Companies like TCS, Accenture have their Private PF Trust. Our article EPF Private Trust, the Exempted EPF Fund discusses it in detail.

- Put money in a company-run excluded fund, which is not EPFO regulated, but is set up with approval from the resident income tax commissioner. This type of fund looks after all investments and fund management itself and is self-regulated.

How does one join EPF under EPFO?

Employees working in private sector, drawing basic salary upto Rs 15000(From Sep 1 2014 salary limit has been increased to Rs 15,000 before it was Rs 6500) have to compulsory contribute to the Provident fund and employees drawing above Rs 6501 have an option to become member of the Provident Fund. It is beneficial for employees who draw salary above Rs 15001(Before Sep 1 2014 minimum was Rs 6501) to become member of Provident Fund as it is deducted from the salary before it is deposited on bank or given hence compulsorily saving happens.

Those who started job after 1 Sep 2014 and earning more than 15,000 Rs in basic and DA will not be contributing to the EPS or Pension scheme.

From 10 Feb 2016 one is not allowed to withdraw Employer share of EPF contribution and retirement age has been change to 58 years. Our article Changes in EPF Withdrawal Rules from 10 Feb 2016 discusses it in detail.

Every employee needs to submit a declaration,Form 11, when he takes up new employment in an organisation which is registered under the EPF Scheme of 1952. This form, EPF Form 11, contains basic information regarding the employee and it is mandatory for an employee to fill it upon joining an organisation . EPF Form 11 is a self declaration by new joinee about his status whether he is a member or non member of EPF / EPS in earlier employments and opt out of EPF. This article EPF Form 11 on Joining a New Job explains what is EPF Form 11, goes through contents of EPF Form 11 and instructions on how to fill it.

To become a member of the Employee Provident Fund one has to fill Form 11 and Nomination Form. For more details check out EPFI webpage for Employees. Sample images of the Form 11 and Form 2(front and back) are given below. Click on the image to enlarge.

Government Employees do not contribute to EPF but to NPS from 2004

Government employees, do not contribute to EPF. Contribution to Tier-I is mandatory for all Government servants joining Government service on or after 1-1-2004 (except the armed forces in the first stage), whereas Tier-II will be optional and at the discretion of Government servants. In Tier-I, a Government servant will have to make a contribution of 10% of his basic pay plus DA, which will be deducted from his salary bill every month by the PAO concerned. The Government will make an equal matching contribution. However, there will be no contribution from the Government in respect of individuals who are not Government employees.

How is UAN related to EPF?

UAN is Universal Account Number. The UAN is a 12-digit number allotted to employee who is contributing to EPF. Universal number is a big step towards shifting the EPF services to online platform and making it more user-friendly. Please note that The universal account number remains same through the lifetime of an employee. It does not change with the change in jobs. Now one has UAN number and PF number also called as Member Id.

An employee will have one UAN or Universal Account number, which as the name implies will remain the same. It will maintain all your Member Ids. Its like you can have multiple Saving Bank account but all these are tied to your one Permanent Account Number or PAN. So when you change your job and the new employer, if contributing to EPF, gives you a new Member ID. This new Member ID has to be linked to your UAN number.

Through Universal Account Number (UAN) driven Member Portal ,http://uanmembers.epfoservices.in, EPFO provides a number of facilities to its members through a single window. Member has to activate his registration to avail various facilities such as UAN card download, member passbook download, updation of KYC information, listing all his member ids to UAN, file and view transfer claim. Following articles explain UAN in detail.

- UAN or Universal Account Number and Registration of UAN

- FAQ on UAN number and Change of Job

- UAN Problems, Password,Mobile Number,Incorrect Details and Help Desk

Who runs EPF?

Employee Provident Fund (EPF) is implemented by the Employees Provident Fund Organisation (EPFO) of India. An establishment with 20 or more workers working in any one of the 180+ industries ( given here) should register with EPFO. EPFO is a statutory body of the Indian Government under Labour and Employment Ministry. It is one of the largest social security organisations in the world in terms of members and volume of financial transactions undertaken.

Interest on EPF

Q. What is the interest on the PF accumulations ?

A : Compound interest as declared by Central Govt. is paid on the amount standing to the credit of an employee as on 1st April every year.

The EPF interest rate of India is decided by the central government with the consultation of Central Board of trustees. In the past several decades, the interest rate has ranged from 8-12 % of the balances maintained in the fund. The EPF interest rate notification is available on the official website of EPF India on an annual basis. The same is communicated through major dailies in all cities. To see Interest rate over the years from 1952 please click the image to enlarge. Following table shows Interest rate of EPF for last few years. You can check out interest rate and how EPFO pays interest in our article EPF Interest Rate from 1952 and EPFO

| Financial Year | Interest Rate |

| 2012-13 | 8.5% |

| 2013-2014 | 8.75% |

| 2014-2015 | 8.75% |

| 2015-16 | 8.8% |

| 2016-17 | 8.65% |

How EPFO manages to pay the interest?

The EPFO ‘declares’ the annual interest paid out to subscribers each year. In the last four years, the returns have been around 8.75 per cent a year. This interest is decided based on the surplus of its income over expenses. The fund earns income from the interest on government deposits, gilts, corporate bonds and the other securities it holds in its portfolio. It incurs costs on subscriber payouts and expenses. n 2015-16, EPFO invested 5% of its incremental corpus, or a little more than Rs.6,000 crore, in stocks. Labour ministry officials estimate that in 2016-17, the amount would rise to as much as Rs.10,000 crore. Our article How EPFO Manages Money, EPFO invesment in Stock Market discusses it in detail.

At the beginning of each year there would be opening balance, the amount accumulated till then. Contribution is made monthly but interest is calculated yearly. One gets interest on opening balance and monthly contribution. So for next year the new opening balance would be: old opening balance + contribution throughout the year + interest on the (old opening balance + contribution)

To see the calculation for each year in above example click on the image below. You can also play with EPF calculator here.

Q. How much would one save by investing in EPF?

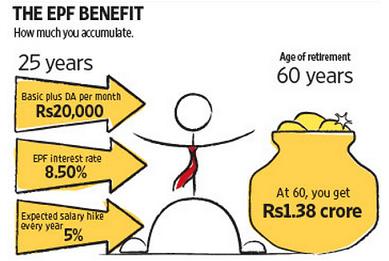

Let’s say Swayam starts with a basic salary of Rs. 20,000. Every year, on an average, he gets a 5% increment. He started at 25 years and worked till 60 years so his working life is, 35 years. He contributes 12% of his basic salary towards PF which is matched equally by one’s company, (EPF contribution is 3.67%, EPS 8.67%).

In this case, over the course of 35 years of his working life, his total contribution is Rs. 26.01 Lakhs. Of course, his company makes a contribution of Rs. 7.955 Lakhs, total contribution of Rs 33.967 lakh. And this amount grows into – Rs. 1.38 Crores at the time of his retirement!

EPF Benefit

Q. Can I voluntary contribute more than the statutory limit to EPF?

You can contribute additional amount (over and above 12%) to Provident Fund by depositing VPF (Voluntary Provident Fund). However, employer is not bound to do a matching contribution.The employer is liable to pay contribution only on 6500/15000 whatever is the basic salary. This is called voluntary contribution and a Joint Declaration Form needs to be filled up where the employer and the employee both have to give a declaration as to the rate at which PF would be deducted. Our article Voluntary Provident Fund explains it in detail.

How to check EPF balance?

EPFO has been using technology to turn into a more professional and nimble organisation. Now you can check your EPF balance through SMS, see your passbook. It has introduced online facility for transferring the balance to a new account. Going forward, all members will have a Universal Account Number(UAN) which will be portable across employers and cities. UANs have already been allotted to active contributors to the EPF

You can check your EPF balance through various ways. Our article How to get information about EPF balance : Annual Statement, SMS, E-Passbook explains the various methods of getting EPF balance in detail.

- Annual Statement : EPFO used to send an annual statement through the employer to the employee which gives details about the PF accumulations. It is wide slip of paper. The statement contains details like, Opening balance, amount contributed during the year, withdrawal during the year, interest earned and the closing balance in the PF account.

- EPF balance by SMS : From July 2011 one can check the EPF Account balance online.

- Go to http://epfindia.com/site_en/KYEPFB.php

www.epfindia.com/MembBal.html.Select EPFO Office - Enter PF Account Number which is in the format : EPFO Office Code/Establishment Code(Max. 7 Digits)/Extension(Max. 3 digits)/Account Number (Max 7 digit) (PF Account Number may not have Extension code, in that case leave it blank).

- Enter your Mobile and Name, Accept Terms and condition and Submit.

- You will get SMS alert from EPFO : EE amount : Rs XXXXX and ER amount Rs:XXXXX as on <Today’s Date>(Account updated upto Date).

- Sequence of steps is shown in the images below. Click on image to enlarge.

You will get SMS alert from EPFO : EE amount : Rs XXXXX and ER amount Rs:XXXXX as on <Today’s Date>(Account updated upto Date).

EE = Employee Contribution and ER = Employer Contribution on date(shown in Account updated date) mentioned in your SMS. It does not show current balance of PF Account as on Today

- Go to http://epfindia.com/site_en/KYEPFB.php

- EPF Passbook : On 30 Nov 2012 EPFO launched e-passbook facility. The online EPF or EPF ePassbook is an online version of the employee’s provident fund account. You need to register at members.epfoservices.in to get the passbook. Note it takes time for registration to become active. You will get an SMS when you would be able to download the passbook. It shows information in detail, opening balance, contribution every month from employee and employer, how employer contribution is being split into PF and EPS. Withdrawals if any that has been made from the EPF account.

-

EPF passbook with UAN

The UAN is a 12-digit number allotted to each Employee Provident Fund member by the Employee Provident Fund Organization(EPFO) which gives him control of his EPF account and minimises the role of employer. UAN number activation started in Oct 2014. You can download the EPF passbook if you have activated your UAN number. Our article UAN or Universal Account Number and Registration of UAN talks about how to register for UAN.

-

EPF and Mobile You can also view it through the Mobile App launched by EPFO in Sep 2015, as explained in our article EPFO Mobile App , SMS Service and Missed Call : Employee Provident Fund

Withdrawal and Transfer of EPF

Q. At the time of change of Job what happens to EPF? Can one withdraw the entire amount?

A: Yes, legally it is mandatory to transfer EPF Account at the time of job change. But, people generally don’t do it; instead of transferring, they withdraw the amount. From 10 Feb 2016 You cannot withdraw Employer contribution to EPF before 58 years. Our article Changes in EPF Withdrawal Rules from 10 Feb 2016 discusses it in detail.

In case of EPS, if the service period is less than 10 years, you’ve option to either withdraw your corpus or get it transferred by obtaining a ‘Scheme Certificate’. Once, the service period crosses 10 years, the withdrawal option ceases.

Q Are there in any tax implications, if I withdraw the EPF balance before 5 years?

A: In case you are a member of recognized provident fund it depends on if contribution is over 5 years or not, including transfers from different companies. If you withdraw before completing a period of 5 years, then all your previous years income gets recomputed as if the fund was unrecognized from the very beginning (i.e., the tax benefits you received on your own contribution u/s 80C/88 in earlier years will get forfeited) and further the employer contribution and interest received will be added to your current income subject to relief under section 89.

Q. What is TDS on EPF withdrawal? What is Form 15G?

- Provident fund withdrawal is before five years of completion of service attracts tax deducted at source (TDS) at 10 per cent from Jun 1 2015.

- TDS will be deducted at 34 per cent if one does not submit PAN.

- Exemption from TDS has been given to subscribers with no taxable income, provided they submit 15G/15H form. To avoid the levy of TDS, 15H (for senior citizens) or Form No. 15G (other than senior citizens) can be submitted, provided the provident fund amount payable is up to basic exemption limit which for AY 2016-17 is 2,50,000 and Rs 3,00,000 for senior citizens respectively.

- Our article How to Fill Form 15G? How to Fill Form 15H? explains how to fill the form 15G/15H in detail.

Q Are there in any tax implications, if I withdraw the EPF balance after 5 years?

No if you withdraw after 5 years of total contribution to EPF(which includes multiple jobs) then your EPF withdrawal becomes tax free. Show it as exempt income in Income tax return.

Q. Can I withdraw from EPF while working?

Q How to transfer EPF?

Ideally, you should initiate the process of transferring your EPF balance as soon as you join your new organization and are allotted a new PF account number. From Oct 2014 most of employees have been alloted Universal account number or UAN , a 12-digit number by the Employee Provident Fund Organization(EPFO) which gives him control of his EPF account and minimises the role of employer. Universal Account Number (UAN) Member Portal (www.uanmembers.epfoservices.in) was launched in September 2014. This portal offers lot of facilities to employees or EPF members. But, EPF Online Transfer Claim is still not available. For time-being you have to submit online EPF Transfer claims through http://epfindia.com/Employee_OTCP.html or Click on Online Transfer Claim link ar EPF website http://memberclaims.epfoservices.in/ .

Employee Pension Scheme

Employees’ Pension Scheme (EPS) of 1995 offers pension on disablement, widow pension, and pension for nominees. EPS program replaced the Family Pension Scheme (FPS). It is financed by diverting 8.33 percent of employer’s monthly contribution from the EPF(restricted to 8.33% of 6500 or Rs 541. From Sep 1 2014 salary limit has been increased to Rs 15,000 so Rs 1250 per month) and government’s contribution of 1.17 percent of the worker’s monthly wages. Our article Understanding Employee Pension Scheme or EPS discusses it in detail.

The purpose of the scheme is to provide for

1) Superannuation Pension:Member who has rendered eligible service of 20 years and retires on attaining the age of 58 years.

2) Retiring Pension:member who has rendered eligible service of 20 years and retires or otherwise ceases to be in employment before attaining the age of 58 years.

3) Permanent Total Disablement Pension

4) Short service Pension: Member has to render eligible service of 10 years and more but less than 20 years.

Q: When can an employee start receiving a Pension?

A: A employee can start receiving the pension under EPS only after rendering a minimum service of 10 years and attaining the age of 58/50 years.However, no pension is payable before the age of 50 years and early pension after 50 years but before the age of 58 years is subject to discounting factor @ 4% (w.e.f. 26.09.2008) for every year falling short of 58 years. In case of death / disablement, the above restrictions doesn’t apply.

Q: How long the pension is available?

A: Lifelong pension is available to the member and upon his death members of the family are entitled for the pension.

Q: What is the formula for calculating the monthly pension?

A:Under Employees’ Pension Scheme, the monthly retiring pension is decided on the basis of ‘Pensionable Service’ and ‘Pensionable Salary’ and is worked out as follows

Monthly pension=( Pensionable salary*Pensionable service)/70

Pensionable Salary is arrived at by considering the average contributing salary immediately preceding 12 months from the date of exit from the scheme, normally this would be limited to Rs 6,500 p.m. unless certain enhanced contributions are made by the employer with permission. Pensionable Service is the service in years rendered by the member for which contributions have been received maximum cannot exceed 35 years

Q: What is the maximum amount of Pension available under EPS?

A: The government has also fixed monthly pension benefit at Rs 1,000 from the financial year 2014-15 . Those who started job after 1 Sep 2014 and earning more than 15,000 Rs in basic and DA will not be contributing to the Pension scheme. Before Sep 1 2014 it was Based on a maximum employment period of 35 years, and maximum contribution of Rs 6500, the maximum amount of pension as per the Pension formula would be = 6500 * 35)/70 = Rs 3,250 per month or Rs. 39,000(3250 * 12) per year. Our article How much EPS Pension will you get with EPS Pension Calculator explains it in detail.

- Maximum Pension one can get is Rs 7,500 per month.

- Minimum Pension one can get is Rs 1,000 per month.

Q. Is the Monthly Pension paid under EPS just?

The amount of pension is meager. If one would have invested Rs 541 in a recurring deposit at the rate of 8% for 35 years one would get 12,49,263 as maturity amount. If this maturity amount is put in buying the Pension plan say LIC’s Jeevan Akshay VI and put the above amount Rs 12,49,263 in the premium calculator of LIC with option as Annuity payable for life, one would get montly pension of Rs 10,150 which is much more than Rs 3250.

Employees Deposit Linked Insurance Scheme (EDLIS)

Under the EDLI scheme life insurance cover is provided to the PF members. The cost of the scheme is borne by the employer but as the amount of life coverage under this statutory scheme is very low, usually employers opt out of the EDLI scheme by going for group insurance scheme which usually provides higher coverage to employees without any increase in cost to the employer. Premium for the EDLI is entirely funded by the employer, which contributes 0.5% of monthly basic pay (capped at a maximum of Rs 15,000) as premium for life cover in case the organization does not have a group insurance scheme for its employees.

In Sep 2015, the EPFO announced increase in the maximum amount assured under its Employees Deposit Linked Insurance Scheme (EDLI) to Rs 6 lakh from the existing Rs 3.6 lakh. The claim amount of the EDLI is decided by the last drawn salary of the employee. The claim amount would be

- 30 times the salary.For this calculation salary is basic pay plus DA or Dearness Allowance. The upper limit of wage for the EDLI is Rs 15,000.

- Along with this, the bonus of Rs 1.5 lakh is also given.

- Thus, the maximum EDLI claim amount would be Rs 6 lakh [(30 x15,000) + 1,50,000].

The condition of continuous employment of one year under current employer before being eligible for insurance benefits was also removed.

Our article EDLI, Employee Deposit Linked Insurance Scheme discusses it in detail.

Related Articles:

- What are EPF,Pension and Insurance Changes from1 Sep 2014

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

- Understanding Employee Pension Scheme or EPS

- Voluntary Provident Fund, Difference between EPF and PPF

- Tax on EPF withdrawal

- Transfer EPF account online : OTCP November 10, 2013

- Articles related to Salaried on EPF, Variable Pay, ESOP,NPS, Income Tax, MBA, Changing jobs

In this article we covered about EPF, EPS, the calculation etc. In the next article we shall cover about how to withdraw or transfer from EPF, EPS. Difference between EPF and PPF? If you find something missing or incorrect please let us know, we shall correct is As Soon As Possible(ASAP). Hope you found this article helpful. What are you thoughts on EPF? Does it make sense to contribute to EPF?

Thanks for this useful Post

This article is very informative, and updated.

What a useful information provided by this blog! It’s remarkable. Thanks for sharing!

Nice Post, Thanks for sharing this information via post about EPF Registration Online.

Thanks a lot for sharing this information via this post. Awesome content of this post, so I’m very impressed by your post. & Knowledgeable content about EPF Registration.

Thanks for the sharing complete information EPF because i recently join in job and i didn’t know about this but by reading your post i know well.

@Bemoneyaware, This is great post. Thanks.

I have a question. I am working abroad now and Have worked in india long enough for being eligible for the PF claim. My 2 claims are rejected due to calculation of NCP days which I understand as I was working abroad for 3 years from 2010 – 2013. Question is if I have to re-submit the claim, Online service does not allow me to provide reason for NCP. What should I do?

Thanks

Anand

Recently I applied for the job on jobads site and got selected. As of now, my company is not deducting pf. Why I don’t, all the employees getting deductions.

Well written content. I believe you did good research putting this down

Please keep posting about such

Cheers,

my date of Joining of service dated 28/03/2006 please provide me pension list if we resignation from my job

EPS Pension = (Average Salary X Number of Years Service)/70

The Average Salary here means pensionable salary in the scheme.

Pensionable Salary here means amount you were contributing in EPS which is restricted to Rs 15,000 per year after 1 Sep 2014 and was Rs 6500 per year before 1 Sep 2014.

It is arrived by considering the average contributing salary preceding 60 months from the date of exit. (Earlier it was preceding 12 months)

Assuming 12 years of service

So 15,000 X 12/70 = 2571.428 per month

Thanks for taking the time to share this post, I feel strongly concerning it and love reading additional on topics.

use for the this website lot of information and gathering so use full for it.

Thanks for leaving a comment

Hello Dear ,

Hope you are fine,

I have three quries regarding my current PF account as below:

FIRST

I worked for a company in 2014 and left the same in 2015 total PF deduted as per column wise

INR 9200 INR 2400 and INR 5600

The question is how much i get at the time of withdrawal.

SECOND

I switch from first company to other now I in the current company I use the same UAN in for PF deduction , new account is also update in the system and properly deduction going on. But in the column of previous company DATE OF RESIGNATION is not reflecting and the same company and when I try to transfer the amount message reflect no employer available or something like that information.

also note that i had applied (APPLIED EARLIER IN 2016) for claim online status and when i check online claim status then message reflect as below.

Claim-Form-13 (Transfer Out)(Transfer (Unexempted to Unexempted in other region or to Exempted Establishments)) Claim id-DSNHP—————– Member id-DSNHP—————– has been rejected due to :- CALL FOR FORM 9/OK

Also note when i apply for ONE MEMBER ONE EPF ACCOUNT then message reflect

Details of previous account are different than present account. Hence claim request cannot be processed.

THIRD

Please confirm if I apply for withdrawl for Mother illness then the same amount will withdrawn from both or current. As I dont want to withdraw from the current company.

Please help if you have understand the same situation.

Thanks for sharing the informative article. It is helpful indeed.

Article itself reflects great and hard work behind it. Just read the post 2-3 times and still require to read more times to grasp it completely. i also bookmark this page

Basics of Employee Provident Fund: EPF, EPS, EDLIS, great article thanks for sharing this .

Hi,

in previous company, I have not completed my Notice period, total Notice period is 30 days but I have given only 10 days, that’s why my previous organization not ready to release my PF.

kindly suggest what can I do,

also I have tried to transfer PF with my current organization but same our previous organization has rejected online request..

Oh thats called a great post that i am waiting for from your end.Thanks for sharing this.

Keep blogging….

I worked for a private company for 8 Year and left the job and sit at home for 2 years, (withdrawal PF but not EPS) , after 2 year join another company and serve 3 years. (so total 11 year service from last 13 years), will I get pension.

I want to upload ECR for the month of March, 2012 (mannual challan and payment already made in March 2012).

We have prepared the xls file in the new filed as per ECR of EPFO and edited the data of gross wages, EPF wages, EPF_wages and EDLI wages as Rs.6500/- in both coloumn, EPS contribution as Rs.541/- based on the already approved data against which mannual challan submitted in March 2012.

However, as per the new format of ECR by EPFO, error is mentioning as :

‘Error EDLI wages should be less than or equal to EPF Wages, subject to max of 15000’

In view of above, may please guide that how much EDLI wages shall be there based on our already submitted challan @ Rs.6500/-, so that correct ECR can be uploaded in EPFO website.

Hi Sir I’m praveen, your article is very helpful to me. i want monthly wages details as per 2016 to 17. i know that minimum wages of epf ₹6500. but any changed the monthly wages rate.please tell me..,

Inicialmente si no se omite ningun paso en la revision y no cambiamos piezas para ver si acertamos, podemos llegar a una reparacion exitosa y no muy neveras con placas electronicas en venezuela han tenido mas exito por su diseño que desempeño y duracion. Singapur es un férreo paraíso fiscal con un secreto bancario más protegido que el de Luxemburgo.

Hi,

Im working in an organization from 2 years, now i am leaving company as i am moving out of INDIA.

Should i withdrawal my PF or continue?

Until which time my PF account will be working and will i get interest on my PF amount

priyanka are you finised degree in annamalai university

WILL PF BE DEDUCTED IF A EMPLOYEE IS ABSENT FOR A WHOLE MONTH?

NEED OT KNOW

no it is not required

Dear Sir,

I like to ask you that is Housekeeping contract staff what is the minimum wages PF.ESI other detais.

Please explain with examples

I hope i will wait for your reply

कर्मचारी भविष्य निधि संगठन में ई पी एस के तहत प्राप्त होने वाले पेंशन से निजी क्षेत्र के कर्मचारियों को फायदा कम नुकसान ज्यादा हो रही है !

कर्मचारी भविष्य निधि संगठन के तहत पेंशन फंड में नियोक्ता द्वारा कर्मचारी के मूलवेतन का 8.33% राशि योगदान की जाती है । जिसमें सरकार नाममात्र का 1.16% राशि योगदान करती है । पेंशन फंड में जमा राशि पर ब्याज प्रदान नही की जाती है । कर्मचारी का न्यूनतम 10 वर्ष सेवा पूर्ण होने पर 50/58 वर्ष बाद पेंशन प्रदान की जाती है । किन्तु यह पेंशन कर्मचारी की पेंशन फंड मे जमा राशि के तुलना में बहुत ही कम दी जा रही है । जिसे हम नीचे दिये गए उदाहरण के द्वारा समझ सकतें हैं ।

माना की रमेश 23 वर्ष की उम्र में 4000 रुपये मूल वेतन के सांथ किसी कम्पनी में नौकरी शुरू कि । यदि मूलवेतन में प्रतिवर्ष 300 रूपये वृद्धि होती है तो रमेश की 58 वर्ष की आयु तक 35 वर्ष की सेवा पूर्ण हो जायेगी तथा मूलवेतन 14200 रुपये हो जायेगी ।

पेंशन सूत्र अनुसार रमेश को 58 वर्ष की आयु के बाद उसकी 35 वर्ष की सेवा एवं 14200 रुपये मूलवेतन के आधार पर – 35*14200/70=7100 रुपये प्रतिमाह पेंशन प्राप्त होगी ।

उपरोक्त्त उदाहरण के ठीक विपरीत यदि रमेश प्रतिमाह पेंशन फंड में जमा होने वाली राशि के बराबर PPF या किसी अन्य सेविंग स्कीम में निवेश करेगी तो 58 वर्ष की आयु तक ब्याज सहित लगभग 12 लाख 55 हजार रुपये जमा हो जायेगी। उस 12 लाख 55 हजार रुपये को यदि पोस्ट ऑफीस की मंथली इन्कम स्कीम में निवेश करेगी तो 8000 रुपये प्रतिमाह ब्याज प्राप्त होगी तथा उसके मूलधन 12 लाख 55 हजार रुपये खाता में सुरक्षित रहेगी।

जबकि सरकार पेंशन फंड में जमा राशि पर प्रतिमाह 7100 रुपये ही पेंशन के रूप में प्रदान करेगी तथा पेंशनर एवं उसकी पत्नी के मृत्यु के बाद यदि उसके बच्चों की उम्र 25 वर्ष से कम है तोे बच्चों को पेंशन मिलेगी हालाँकि कर्मचारी की 58 वर्ष उम्र होते तक बच्चों की उम्र भी 25 वर्ष से ऊपर होगी अतः पेंशन पूर्णतः बंद हो जायेगी। कर्मचारी के जिंदगी भर की मेहनत की कमाई से जमा पेंशन फंड की राशि नॉमिनी को नही लौटाई जाती है यह पूर्णतः सरकार की हो जायेगी ।

उपरोक्त उदाहरण के अतिरिक्त 10 वर्ष से कम सर्विस का एक अन्य उदाहरण प्रस्तुत है…..

माना की श्याम ने 23 वर्ष की उम्र में 4000 रूपये मूलवेतन से नौकरी शुरु की और 9 वर्ष 5 माह में 7000 रुपये मूलवेतन पर नौकरी छोड़ दी तो वह पेंशन का हकदार नही होगा क्योंकि उसकी सेवा 9 वर्ष मानी जायेगी ।

श्याम को EPS नियमानुसार 9 वर्ष की सेवा पर 9.33% * अंतिम 12 माह की औसत मूलवेतन (9.33*6825) = 63677 रूपये पेंशन फंड की राशि वापस कर दी जायेगी ।

यदि श्याम 9 वर्ष 5 माह के स्थान पर 9 वर्ष 6 माह की सेवा के बाद नौकरी छोड़ देती है । तो उसकी पेंशन योग्य सेवा 10 वर्ष मानी जायेगी और वह पेंशन का हकदार हो जायेगा । तथा 50 वर्ष की आयु के बाद उसकी 10 वर्ष की सेवा एवं अंतिम 12 माह की औसत मूलवेतन के आधार पर कुल {10*6850/70} =979 रुपये प्रतिमाह पेंशन बनेगी । हाँलाकि सरकार ने न्यूनतम मासिक पेंशन 1000 रूपये कर रखी है अतः श्याम को 50 वर्ष की आयु पूर्ण होने पर 1000 रुपये प्रतिमाह मासिक पेंशन प्राप्त होगी ।

इसी उदाहरण के ठीक विपरीत यदि श्याम 9 वर्ष 6 माह की नौकरी न कर 9 वर्ष 5 माह बाद नौकरी छोड़ कर पेंशन फंड से मिली एकमुश्त राशि 63677 रुपये को 17 वर्ष के लिए (वर्तमान ब्याज दर 7.25% पर ) फिक्स डिपॉजिट कर देती है तो श्याम को 50 वर्ष की आयु पूर्ण होते ही F.D.की मैच्यूरीटी राशि 2 लाख 9 हजार रूपये प्राप्त होगी ।

इस राशि को पोस्ट ऑफीस की मंथली इन्कम स्कीम में निवेश करती है तो प्रतिमाह 1340 रूपये ब्याज प्राप्त होगी ।साथ ही 2 लाख 9 हजार रूपये उसके खाते में सुरक्षित रहेगी ।

जबकि सरकार श्याम को 10 वर्ष की सेवा पर 50 वर्ष की उम्र के बाद मात्र 1000 रूपये ही प्रतिमाह पेंशन प्रदान करेगी । न तो इसमें प्रतिवर्ष महँगाई राहत के रुप में किसी प्रकार की वृध्दि होगी और न ही कर्मचारी की मृत्यु के बाद पेंशन फंड में जमा राशि उसके नॉमिनी को वापस लौटायेगी ।

EPFO की इस EPS स्कीम से कर्मचारी को फायदा कम नुकसान ज्यादा हो रही है । EPS स्कीम सिर्फ उन्हीं कर्मचारीयों के परिवारों के लिए फायदेमंद है! जिसकी आकस्मिक मृत्यु अल्प सेवा के दौरान हो गई हो या जो 40 वर्ष की उम्र के बाद EPF की सदस्य बनें हैं जिनकी पेंशन फंड में कम योगदान है ।

अतः सरकार को निम्न बिंदुओं पर जवाब देना चाहिये ..

1. निजी क्षेत्र के कर्मचारियों की मेहनत की कमाई से जमा पेंशन फंड की राशि पर इतनी कम पेंशन क्यों दी जाती है । जबकि दी जाने वाले पेंशन राशि से अधिक सरकार पेंशन फंड में जमा राशि पर ब्याज प्राप्त कर रही है।

2. कोई कर्मचारी लम्बी अवधि तक EPF का सदस्य है तथा 58 वर्ष में पेंशन प्राप्त करती है। यदि कुछ दिनों बाद पति-पत्नी दोनों की मृत्यु हो जाती है और उनके बच्चों की आयु भी 25 वर्ष से ऊपर है तो उनकी पेंशन पूरी तरह बंद हो जायेगी । तब कर्मचारी के पूरी जिंदगी की कमाई से जमा पेंशन फंड की राशि को सरकार उसकी नॉमिनी को क्यों नही वापस करती है ।

जबकि NPS में पूरी राशि कर्मचारी के नॉमिनी को लौटा दी जाती है ।

2. पेंशन फंड में जमा राशि पर EPF की तरह ब्याज क्यों नहीं प्रदान कि जाती है तथा ब्याज सहित कुल जमा राशि के अनुसार प्रतिमाह पेंशन क्यों नही दी जाती है ।

3. पेंशन की राशि में प्रतिवर्ष महँगाई राहत के रूप में वृद्धि क्यों नही की जाती है ।

4.पेंशन सूत्र में परिवर्तन क्यों नही क्या जाता है

Why not file an PIL in court for this

sir, can I break up minimum wages limit into baic salary and allowances for calculation of pf contribution by employee and employer, e.g. if minimum wages limit is Rs.10000/pm can I break up this limit and offer wages as Basic pay Rs.8000 and HRA Rs.2000. in this case pf contribution will be calculated on Rs.8000. is it correct as per minimum wages and pf act?

MY FATHER DIED WHILE ON SERVICE LAST YEAR.HE WAS 59.HE WAS WORKING IN NTPC LTD.WILL MY MOTHER(NOMINEE) IS ENTITLED FOR THE BENEFIT OF EMPLOYEES DEPOSIT LINKED INSURANCE SCHEME,1976.what are the other benfits will she receive?please do mention since i am a layman in this area.

Hi,

I want to entire process of setting EPF & ESI (Including Mandatory requirements /Registration and documentation as employer.

I am looking for set the entire labour enforcement guidelines in a eCommerce pharmacy company having register office at Jaipur Rajasthan. Can administration guide on the above process.

hi.,

i had left in may’15 from organisation”A” and joined in organisation “B” in Aug’16.

i had left in aug’16 from organisation”B” and joined in organisation “C” in Sep’16.

1) I have a UAN allocated to me during the tenure in organisation”A”, later PF account related to organisation”A” is only listed under my UAN login and the PF accounts of organisation”B” & organisation”C” are not listed in UAN login.

2) Also, statement of organisation”A” is having details upto Mar’15 only and not having the details of Apr’15 & May’15.

3) Also i had PF accounts related organisation”X” & organisation”Y” previous to organisation”A” which i had withdrawn from organisation”X” & not with drawn from organisation”Y”

Can you tell me —>

1) what should i do to reflect my PF accounts of organisation”B” & organisation”C” under the same UAN.

2) what should i do to update the details of Apr’15 & May’15 PF account related to organisation”A”

3) what should i do to reflect my PF accounts of organisation”X” & organisation”Y” under the same UAN.

4) can i transfer the PF amount from organisation”Y” to organisation”C”

Sir. I have been working in Axa Business Services for 1yr there have created my UAN & then joined a new organization & the new company opened a new UAN no, so totally I have 2 UAN one from previous company & another from new, so o asked my old company that I want to withdraw PF but they said according to govt norms we carnt withdraw PF if we have another PF acc it can only be transfered. So my old company given me UAN no for that when ever am trying to check the balance the message is displaying as follows ” Member ID BGBNG0Xxxxxxxxxxxxx pertain to exempted establishment. PF Balance service is not available for Trust.” I don’t know what does it mean. & please let me know what are the possibilities to transfer the amount from old to new UAN No. If I transfer do the total amount will be transfered or partial amount. Please reply waiting for ur reply

Respected sir/mam

I recently left my first job in pvt company working less than 3 months & joined new government job as assistant manager in union bank. I did not share anything about previous job. During previous job pf number was allotted to me Nd UAN number was no allotted. so I don’t want my new employer to know about my previous work .so my question is—

1.Can the new employer can know about my previous job details by during generating pf number/UAN number.??

Please do the needful ,I am very upset regarding this.it is very important for my good future.thanku sir/mam.

It is better to tell the employer.

But if you don’t want employer to know about your previous job, you don’t submit the old UAN number. A new UAN number will be generated.

You can withdraw from old PF.

First of all ..THANKU VERY MUCH SIR for giving good response. i know ..aisee cheeze chupana kuch bi accha nai hota ….but I dont have appointment letter in firt job now i am very late to tell emloyer any thing about first job .during this job UAN number is not alloted to me AND only pf number is alloted to me.this pn account only have 1999 Rs. so money is does not matter.I am thinking about onLy career prospects in future.

dear Sir.,

I am working in a telecom industry and i would like to know that.,break up details of employee contribution between employer contribution.

1.is that EPFO allows private company to take employer contribution from employee salary?

2. Both EM and ER contribution Deducted from my salary ., this is what guidelines talks about?

Eg: My basic salary is 17,781 and my pf contribution is 2134 . but both EM and ER contribution deduction happening in my annual payout or CTC.

Pls help me to understand

Cost to company means its is cost that the company spends on employee every year. All the cost are added into your annual package when it is designed like the grautity, contribution towards PF, medical insurance premium if any, meals and cab service provided.You real salary is your net take home salary. For help contact us on support@taxache.com we can guide you about your salary structure

Hello,

How to remove the PF linked by myself , because already my previous added it. so i need to remove the pf account linked by myself.

Sir, i have a doubt regarding PF withdrawal. Say my contribution is Rs. 1000/month to PF and similar contribution from my employer i.e Rs.367/month to PF and Rs. 833/month towards pension fund. I have worked for 2 years in the organisation (the organisation is exempt establishment) and now I wish to quit for higher education. How much money can I withdraw from PF. I’ve heard that some amount of PF money lapses if I quit job before 5 years. Kindly guide.

Could you please share some notes related to maternity benefit act…

We have covered maternity benefits in detail in our article Maternity Leave :Duration, Wages,Maternity Benefit Act

My Gross salary is 10933/- but my net salary is 9056/-, pls give me the clarification

It is very likely that the employer deducts PF, professional tax from your salary. please contact us on support@taxache.com, we will assist you.

My Gross salary is 10933/- but my net salary is 9056/-,when i ask them the break ups, am not getting the clarification from my organisation, pls help me out with this issue….

Hi,

I had worked in TCS for 2 years and 6 months. There, both EPF & EPS accounts were created with an UAN. Then I switched to some other company and they created my another EPF account with another UAN. Then they initiated EPF account transfer process and its around 1 year and 3 months, my account didn’t get transferred. Now I am going to join some other organization, so which UAN should I need to share with them for further PF deduction.

How EPS account of TCS can be tranferred or is there any other way so that I could withdraw the amount of both EPF accounts and EPS account?

Thanks.

Share the latest UAN with new organization.

Then transfer both your accounts , from TCS and other company to new organization.

Along with EPF, EPS also gets transferred.

If you want you can withdraw from TCS and other organisation but remember EPF is for retirement.

And withdrawal below 5 years is taxable.

Thanks for the response.

My earlier organisation had initiated the transfer from TCS but its not yet transferred. I tried to track it from EPFO portal but its showing “no claim transfer initiated”. Its not even allowing me to download passbook.

Could you please let me know how to check its status and balance.

hi,

I have worked in my previous organization for 5 month 28 days (This is as per epf transferred to new a/c, duration is 8 – jan – 2007 to 6-july-2007) and i have epf a/c in my current company from last one and half years.

so am i eligible to apply for scheme certificate and what is my membership duration.

kindly clarify.

You get Scheme certificate when you withdraw from EPS after 10 years of contribution to EPS.

As you have contributed less than 10 years to EPS and you are still working you cannot get Scheme Certificate?

Why do you want Scheme Certificate?

Hi, i have started manpower/labour contracting service and so i got EPF registration,but did not get any contract/offer till now. Should i submit challan every month. If yes, what is the minimum fee.

Hi ,

After 4 Years and 4 months of employment with a company where there was an EPF account ,I am shifting to a company that has less than 20 emloyees that does not have an EPF scheme. Can i voluntarily contribute to 5 years so that i am not taxed at withdrawal ?

Congratulations on your new job.

Sorry you can’t contribute yourself to EPF.

If you don’t need money don’t withdraw from EPF. You can let your EPF account earn interest. In due time when your new company joins EPF or you change a new job you can start contributing to EPF again.

I was working with an organization who has EPF facility. Now i am moving to central government organisation where we have NPS facility. Can i still contribute to my EPF account? Can i avail the facility of both EPF and NPS together? If yes then what is the disadvantage of having both the accounts?

Sir we want to participate Govt canteen tender for initial period of one year. Organizer need the EPF number as well ESI and we not yet member of EPF OR ESI. Please suggest whether we need to register for EPF AND ESI just for one year contract what is the procedure please let me know the earliest.

If the Total salary Rs. 7750/- per months, then get how many pension and EDLI ? while total Service time is 17 years.

PENTION AMT. WILL BE 1882 CALCULATION : 7750*17 / 70 = 1882 AND EDLI WILL BE RS.382500 ( IF ASSUME THAT BASIC+DA=7750 THEN (7750*30)+150000 =382500 )

Hi Sir I’m jebasingh, your article is very helpful to me

Sir I Want to start a PVT LTD company, BPO sector. Required strength will be 70 employees. Should i need to contribute PF for my employees. To what basic salary will the company be exempted from the rule to contribute PF and ESI.

Please clear my doubt.

what is the minimum members for a firm to join EPF.

i know a firm which has only 7 workers and another one has only 11 worker.

are they eligible to join EPF or not

please tell

At present, all those firms employing 20 or more workers are covered by the retirement fund body Employees’ Provident Fund Organisation (EPFO) for providing a social security net.

The government is considering a proposal to reduce threshold limit for coverage of firms under the EPF Act to 10 persons.

Hi Sir,

thanks for explaining these terms in detail that helped to understand them better.

but still i have 1 doubt, i have changed my company recently and i got my PF account linked to UAN and from UAN member portal i could see the entire transaction history right from the month of joining.

is there any similar way/portal where i can look into the EPS status, i curious to know if the same has been transferred or not.

is it mandatory to serve the same company at least 10 years to avail the EPS amount

thanks

Excellent article ……. I really liked it as everything has been mentioned in a very simple language and covers details from basic to advance. Its just one of my favorite article.

Thanks a lot for this wonderful article.

Does employee has an option to switch or change the PF contribution amount from statutory wage ceiling to 12% basic with same employer?

Yes using Voluntary Provident fund. In EPF, an employee has to contribute 12% of his basic pay towards his provident fund account. An equal amount is contributed by his employer. Apart from contributing the normal 12% of his basic pay, employee may choose to put in contribute more than this, voluntarily he can do so at any rate he desires upto 100% of basic and D.A. The contribution will earn the same rate as normal EPF contribution. But the employer is not bound to contribute at the enhanced rate. Employer’s will contribute an amount matching only the 12%. Our article Voluntary Provident Fund, Difference between EPF and PPF discusses it in detail.

Thanks for the information. I have an another question, I requested my employer to switch the contribution from statutory wage ceiling to 12% basic but I my comp & ben team is stating that it is not possible as per EPFO guideline, is that true or Do I have a provision to change to 12% basic without VPF?

Hi,

Thanks for writing this article. A lot of really useful information.

one question sir I am working as a teacher in cbse school and getting 23100 monthly as my salary please calculate and tell me the monthly PF deduction from my side and from the institution.

I am waiting for your reply.

Thank you

Very helpful article!

Just one more question, hope you could point me in the right direction.

I just checked my passbook online (on the site uanmembers.epfoservices.in) and found no entries for 10 months (Jan-Apr, Sept-Feb) of the 20 months I have worked in my previous company.

They had deducted the amount from my salary and taxes were calculated assuming the contributions were made.

What should I do now?

the three methods have been explained with a lot of clarity. Is it possible for an establishment to adopt two methods of calculation? that is one method for a few employees and another for the rest? As in some senior employees having joined before 1991 contribute 12% of total basic over and beyond 15000, along with an equal contribution from the employer and those who joined after 1991, contribute 12% of 15000 only with an equal contribution from the employer.

Regarding Pension

Suppose Organisation deduct an amount Rs 4350 as a pension 7 I work with the Organisation for last 8 years .

Shall I avail pension ?

Dear Sir,

In my organization the salary structure for freshers is as below:

Basic 4500

HRA 2250

Conveyance 2100

Special allowance 4230

Total 13080

ESI 621

Employers PF contribution 1299

CTC 15000

Company is deducting 1299 as employees contribution to PF stating that the calculation is 12% of all salary components minus HRA. Is this correct. If not what should be the correct deduction?

Please guide.

Dear sir,

The rates you had mentioned in the table is not par with the rate mentioned by EPF India site. http://www.epfindia.com/site_docs/PDFs/MiscPDFs/ContributionRate.pdf

As per the document given in the link there is nothing called as EDLI Charges it is EDLI Contribution Account only. As the document the computation would by

The employer contribution ie (EPS @ 8.33% + EPF @ 3.17% + EDLI @ 0.5%) = 12%.

As per your chart it is (EPS @ 8.33% + EPF @ 3.67% + EDLI @ 0.5%) = 12.5%.

Kindly correct me if am wrong.

Hi,

I am going to join a safari company? What kind of fund I can apply? Is it necessary for company to generate a pf/epf account for me?

Looking forward to your reply.

Mohan

I have resigned from a private company and i am going to join a public sector company in few days. I have UAN and PF no. with my previous company and employee contribution,employer contribution and pension contribution is Rs 1,00,000 approx. for my 2.5 year of service. So, how much i will get if i opt for withdrawal of these after tax please give an approx figure only.

Let’s say Swayam starts with a basic salary of Rs. 20,000. Every year, on an average, he gets a 5% increment. He started at 25 years and worked till 60 years so his working life is, 35 years.

can you explain me the calculation of it.

How did it sum upto 33 lakhs?

Sir

In my EPF account have Rs 66200. Now I am resigned. 3 months after I am going to withdrawal my amount. So how much rupee will come ? This is my doubt plz clear me

I left work after 2 years service and withdrew the EPF amount. I did not avail my EPF contribution under Sec 80C for tax exemption. Now, my understanding is employer contribution and the entire interest from EPF is taxable. My contribution can be exempted. kindly advise/confirm.

When did you withdraw the EPF ? From what you have written you just have worked for 2 years.

Are you working now?

From our article Tax on EPF withdrawal

When the PF amount is withdrawn before five years of continuous service, it is be taxable in the hands of the individual as if the fund was not recognised from the start of the contributions.Provident Fund would be treated as an Unrecognised Fund from the beginning.

The employer’s contribution and interest, thereon, would be fully taxable as as profits in lieu of salary or ‘salary income’ in the hands of the individual.

The employee’s contribution would be taxable to the extent of deduction claimed under Section 80C, if any, under the Income-tax Act,1961 and

The interest earned on employee’s total contributions would be taxable as ‘income from other sources’ in the hands of the employee.

I left my job after 24 months of working in end of June 2015 and now studying MBA. I withdrew and got the PF amount in Dec 2015. Now is the time to file my return.

You had salary income from 1 Apr 2015 to Jun 2015

You had EPF withdrawal which would be taxable if it is less than 5 years of contribution to EPF.

Its good to file ITR .

In the following situations the Income Tax Act its mandatory for you to file an Income Tax Return in India if any one of these is applicable to you:

As per the Income Tax Act, in the following situations, it is mandatory for you to file an Income Tax Return in India:

Your gross total income (before allowing any deductions under section 80C to 80U) exceeds Rs.2,50,000 in the financial year that begins on 1st April 2015 and ends on 31st March 2016.

You want to claim an income tax refund.

You want to carry forward a loss under a head of income.

Return filing is mandatory if you are a Resident individual and have an asset or financial interest in an entity located outside of India. (Not applicable to NRIs or RNORs).

Or if you are a Resident and a signing authority in a foreign account. (Not applicable to NRIs or RNORs).

You are required to file an income tax return when you are in receipt of income derived from property held under a trust for charitable or religious purposes or a political party or a research association, news agency, educational or medical institution, trade union, a not for profit university or educational institution, a hospital, infrastructure debt fund, any authority, body or trust.

A proof of return filing may also be required at the time of applying for a loan or a visa.

For more details you can refer to How to File Tax Returns For Future & Options Trade

Sir,

Govt has recently enhanced the amount of EDLI to Rs 6 lac and

published the guzzet on 24.5.16 wherein clearly mentioned that it is amendment of last year september 2015. some people says that enhanced

amount will be applicable from 24.5.2016,but in my openion it should start from september 2015,so that many death cases nominee to be benefitted by govt scheme both EPF and P.F.trust member,so kindly look into the matter and press to govt for applicable date september 2015 instead of 24.5.2016.

Hi Basavaraj Tonagatti,

I do have a query regarding my tenure,

I started my job from apr-2006, my pf account created on May-2006.

My contribution made from (you can say May-2006)

Organization I

1. May-2006 – Sep-2008 (29 Months)

2. From Sep-2008 – Jul-2011 (I was out of india, under the same organization and no contribution made during this period) (2 Years 10 Months around)

3. Aug-2008 – June-2015 (47 Months)

Organization II

1. Oct-2015 – Till Now (Still serving)

I did my pf transafer from my first org. to my Second Org. In comment of my pf transfer it stating like (09 Years, 02 Months, 02 Days). So my query is am I eligible for scheme certificate after 3-4 months (Since as of now I already served around 9 months in my current organization) ?

Second query is untill when my pension part will be deducted from the emplyee share…?

What is this PF admin account-1.1%?Kindly elaborate.

Is the scheme EPS 1995 applicable to State Govt. employees? Is there any contribution from Govt . employees towards

EPS 1995?

hi

myself worked in a organisation for 5 months only , i got to know that ,we are eligible to apply pf only if we complete 6 months only , can anyone suggest me on this

Yes what you heard is correct. You have to work for minimum 6 months to get the withdrawal benefits from EPFO. But there is a catch.

for Employee contribution there is no limit of minimum period to be worked. but for Employer contribution to Pension you must work minimum 6 months.

So you can withdraw your contribution to EPF.

You can transfer both to new job as well.

I am not able to submit query on this site. It is showing me javascript not enabled. Although, the same is enabled. Also, the Toll free number – 1800118005 is not getting through

My Father was working in a company since 1990 but due to some reasons he has to quit job in 2011.When I check EPF balance it shows account inoperative ,so what he should do to withdraw all the money.

Process remains the same whether the EPF account is inoperative or not.

Visit the previous employer and submit Forms

You can withdraw EPF both the employee and employer contribution by submitting Form 19.

For EPS withdrawal/Pension fill form 10C/10D

These forms and details about them are in article Forms to avoid TDS,15G, 15H, and EPF Withdrawal Forms Form 19, Form 20,Form 10C,Form 10D,Form 51F

if i take early retirement means at the age of 55,original retirement age is 58,what is the procedure whether employer can accept, if accepts what are benefits we loose.

one employee can have two or more pension ids,if employer allots like that PF department can accept or take any action against for such act

How much money I will get if I close my EPF account in this condition?

can you please help?

Employees Contribution= 44746

Employer’s Contribution= 13079

pension is = 26451

hello friends,

Kindly advice me on below.

I like to withdraw PF balance on my current working organisation, Is possible ?

HOW ?

Thanks in advance

HI,

I HAD BEEN READING ALL THE ABOVE QUERIES AND YOUR REPLIES, GREAT YOU TAKEN TIME IN ANSWERING THE QUERIES.

MY QUERY IS I HAD STARTED WORKING IN THE PRESENT ORGANISATION SINCE AUG’2007 AND QUITTING THIS JOB BY 30TH JUNE’16. IT DOES NOT COMPLETE 10 YEARS OF SERVICE, HENCE I WILL NOT QUALIFY FOR PENSION. PRIOR TO THIS ORGANISATION I WORKED WITH ANOTHER COMPANY FROM APR’06 TO AUG’07 -WHERE I HAD WITHDRAWN MY EPF, I HAVE NO IDEA OF EPS WHETHER COMPLETELY PAID TO ME NOT REGARDING PREVIOUS ORGANISATION.

SECONDLY – WHAT IS THE POSITION OF EPS AMOUNT OF THE PRESENT ORGANISATION.

i’M PLANNING TO START UP MY OWN BUSINESS WHEREIN I WILL NOT GET ANY FUTURE CONTRIBUTIONS FOR PF.

PLEASE CLARIFY.

Sir,

All your Articles are awesome(Padh k Maza aa Jata hai :-).I cordially wanna thank you for such an helpful article.

Keep posting….

All the comments are awesome (humme bhi padh kar maja aa jata hai). We thank you for such encouraging comment.

Keep getting aware, keep posting

Hello Friend,

PF Total Amount Rs. 1,15,621. From April 2011 to July 2013 – Full time employee, after Aug 2013 to till date working as freelancer. I recently submitted PF documents in the month of April 2016 2nd week.Received less amount Rs.12,300. Kindly advice.

Did you ask your employer for break up?

PF means what : EPF or EPS too?

Which forms did you fill Form 19 and/or Form 10C?

Kindly let me know the effective date of implementation of the latest rules of EDLI scheme which has been raised from Rs. 3.60 lakh to Rs. 6 lakh.

Has the notification been issued by the government for the latest changes in the EDLI scheme? If yes, then kindly provide me the link to the notification.

We could not find notification. But found 2 documents on EPF webpage which mentions it.

newsletter Oct 2015(pdf)

Agenda for Meeting

Hope it helps

Please verify, if this is correct?

If employee is eligible for PF now as their Basic salary + DA < 15000, but later after increment, if their basic + DA has exceeded 15000, then PF will still be continued as its registered and employee is still working in the organization and both the employee and employer contribution will be deducted from employee salary only.

Employer contribution is part of CTC of the company.

It does not come from the basic salary of the employee.

Correct Mr. Vishal

Does this restriction of withdrawing of employee share + interest apply for advance amount for house construction/land purchase(advance withdrawal)?

I am a Defence contractor. Of late Military Engineer Services ( MES) is asking for EPF account to compete in E- Tendering. EPE document to be uploaded for completion of tender application. Our job is not of regular nature. Half of the year we remain without any work. More over we are not principle employer and our nature of jobs do not permit to keel labour permanently.Time is passing out we are unable to participate in tender.

Kindly advicew the future course of action.

very good article

hi sir,

im working in last 8 years my PF also dedecting

my qustion is last Apr-1st-16 my pf Balence checked its showing is updated till Feb-16.yasterday checked the balcence is showing only Mar-2105 with interst.

so i can draw my pf upto 2015 March or not pls tell me

regards

shiva kumar BM

Hi,

My basic salary is above 15000, however my employer is deducting both PF contributions on 15000/-, I am asking them to restructure my salary and do PF contribution on actual basic salary (both the contributions), this way my employer’s PF will also be increased and i will save on tax on that part. will there be addition on admin charges, if my emplyer’s contribution goes up and will that be ok that I bear any additional admin charges on account of increased employer’s contribution?

Hi,

I have below query please guide me.

Can person opt out of PF having basic salary above 15k? What is the declaration filled? If the person was previously in PF.

PF is not deducted now by new employer is it correct.

After resigning this job where no PF was deducted will there be problem in registering in PF again after a gap of year in new company.

regards.

Richa

one has to opt out of Provident Fund in the start of his job. If a person has been part of EPF even once in his life, then he can’t opt out of it.

If he fulfills the condition in form 11 – that is he has starting salary of over 15000 basic + da and he does not have any existing pf account! he can opt out of pf.

However, he can not ask the company to pay him the employers contribution to him

Hi,

I had a query regarding EPF. I had worked for about 4 years and have about 3.2 lakhs in my EPF account (employee and employer contribution included).

I had two queries,

1) Govt has recently proposed to divert money lying in unclaimed EPF accounts towards senior citizen’s welfare fund. I have not made any contributions in last 4 years as I’m presently unemployed. So will my EPF account be treated as unclaimed?

2) Can I withdraw it fully and will it be taxed? If yes, approx how much would I need to pay as tax?

1. Your EPF account is termed as inoperative as there has been no contribution for last 3 years.

2. Yes you can withdraw full as the Govt has postponed not being able to withdraw employers contribution till 1st May. As you have contributed towards EPF for less than 5 years entire amount is taxable under various sections.

The aggregate of employer’s contribution to PF and interest earned thereon will be taxable as salary.

Further, to the extent of the deduction claimed by you under section 80C of the Income-tax Act, 1961, on your own contribution to the recognized PF shall be taxed as salary.

Also, the interest earned on your own contribution to PF shall be taxed as “income from other sources”. The tax rate would depend on your applicable income slab in each of the FY(s) during which the PF contributions were made. Further, the surcharge (as applicable) and education cess, shall be applicable, for each of the FYs will also be payable in addition to the basic income tax.

You would be entitled to avail relief under section 89.

Tax will be deducted at source at 10% if the taxable PF amount is more than Rs. 30,000 and provided the Permanent Account Number (PAN) of the individual is available. If PAN is not available, then tax would be deducted at maximum marginal rate.

Hi thanks for the clarification… My main concern as of now is – if I do not withdrawalw my epf will government divert it to senior citizens welfare fund? I had read in news tat those accounts which are unclaimed for over 7 yrs will be diverted… Since I’ve not contributed for last 4 yrs my acc is unclaimed for 4 years only nd thus will not be touched by govt? Please do clarify this…. I want to withdraw only if the epf is expected to be diverted…

There is no imminent danger. But you might have to claim your EPF.

Details of scheme announced are as follows:

According to a Finance Ministry notification on March 18, deposits, unclaimed for over seven years, of EPF, PPF and small saving schemes such as Post Office Savings Accounts, Post Office Recurring Deposit Accounts and National Savings Certificates subscribers will be diverted towards setting up a Senior Citizens’ Welfare Fund. According to the rules, the concerned government office “shall try to contact” every account holder of the unclaimed deposits through written notice, e-mail or telephone at least two times in 60 days before transferring the amount to the Senior Citizens’ Welfare Fund.

The EPF board had, earlier this week, rolled back a 2011 decision to stop interest credits on inoperative PF accounts. Now, while such accounts will continue to get interest credits, the entire balance could be lost to the Senior Citizens’ Fund after seven years of inactivity, though it’s not clear how this will be implemented.

Legal experts are also skeptical. “The rules, notified on March 16, by the Finance Ministry need to be placed before both Houses of the Parliament. Also, there will be no immediate danger (to people’s savings) as the rule says a list of unclaimed inoperative accounts has to be prepared by the ministries concerned by September 30 and prior intimation of at least 60 days is required. Anyway, the EPF Act doesn’t contemplate any diversion of PF dues for other purposes,” said labour law advocate and International Labour Organisation consultant Ramapriya Gopalakrishnan.

Dear Sir

With my Previous Employer1 I see I have 30000 Rs as Pension Fund (EPS) and I have served 4.5 Years and I am able to manage transfer my PF amount

With my Previous Employer 2, I see I have 15000 Rs as Pension Fund (EPS) and I have served 3.5 Years and I am able to manage transfer my Pf amount

With Current Employer 3, I see I have 15000 as Pension Fund (EPS) and I am serving 1.5 Years

Overall I see 60000 Rs for 9 years of Service Length. Can I withdraw 60 K from EPS without Withdrawing EPF or when can I withdraw this 60K

Kindly let me know

Thanks

Dinkar

You can withdraw from EPS when your combined years of service is less than 10 years. After than you get Scheme Certificate which you need to submit when you turn 58 to withdraw the pension

You can withdraw EPS from each of the account.

Dear Sir,

Kindly let me know procedure to withdraw.

Thanks

Dinkar

Thanks! I was looking for this only… Thanks a lot.

Hi,

EPF has deducted TDS by mistake from my my final settlement though I have competed my 5 years. Can you please advise how can I get refunded.

I hari join a firm march-08 and resigen jun-16 and join a new mnc firm june-16 to till now and I transfer my previous pf in new pf no.can I know that I can take benefit of eps scheme complete both service 10+ year.

thanks

Dear Sir,

I Have Been Working With An Organisation For Last 11 Years. Out Of 11 Years I Have Been Based On A Foreign Location (Singapore) For The Last 5 Years- The Country I Am Currently Based In Doesnt Have Social Security Agreement With India.

As Per My Contract For Foreign Deputation My EPF Is To Continue In India. My Monthly Basic Salary Is USD 5000/ Month.

My Question Is – What Should Be My Employers And My Contribution To EPF India ?

What Basic Salary Should Be Used For Calculation To Determine Contribution.I Have No Salary Component Paid In India – And I Do Not Pay Any Income Tax In India.

My Contract Has The Following Wording Regarding Pension- \” Company Will Maintain Your Indian Pension Contribution

Dear Sir,

i am working ad a designer under contract basis.i have doubt in my pf account

in my EPF account, i downloaded my accounts details. in that it has mentioned employee share , employer share , and pension contribution.

here the doubt is employee share = employer share + pension contribution ? (or) all amounts are separate amount ?

kindly clarify my doubt.. please…

Rishikesh

Dear Sir/Madam,

I have query about Pension Contribution so request you to pls give me clarification of this query.

What is Pension Contribution.

Thanks in advance Your response is greatly appreciated.

Regards,

Jaimin Patel

9909948293

Patel bhai shall try to answer.

In EPF a part of your salary(12%) gets deducted . Employer pays Rs 1250 (since Oct 2014, before that was Rs 650) for pension fund and rest in EPF.

When you retire at age of 58(changed from 10 Feb 2016) you can apply to EPS for pension. The pension amount will not be big min of Rs 1000

Hi bemoneyaware,

Is there possible to get pension amount now(before 58 age )

Can i opt out of EPS ? Max pention we can received is approx. 3500 pm which is very low also i am not receiving any interest on EPS amt. So if i can out out of EPS atleast i can earn interest on the that portion same as i earn it on EPF

when i receive ans for my qus

What’s the question Sir?

Sir, I m leaving my job from a PVT organization after 6 years.Now I m not joining other company and want to withdraw EPS.what is the procedure.I know my UIN.

hello sir,

i am working in a pvt. ltd. company.from my salary pf deducted monthly INR 2400 but my company is not provide me any type of documents related to pf and not monthly pf slip.how can i confirm that through my salary deducted amount is originally pf. They have not given me any pf account number.

please suggest me how can i check my pf balance.

Sad to hear that. The company should provide you with a provident account number.

In Form 16 issued there should be amount mentioned for PF deduction.

Talk to your friends and colleagues. Try to get more information whether it is a EPFO trust or not etc.

You can check for your company or establishment at http://search.epfoservices.in/est_search.php

If you find anything foul play straight approach your Regional Provident Fund Office(RPFC) to check and can lodge a complaint if necessary.

Best of luck. Do keep us updated.

my retirement in feb 2018. my present salary is 16000/- p.m. my date of joining in company is 1-7-1980. what is my expected pension? please send calculation sheet with new formula.

in my total salary i’m Paying 912 X 02 = INR 1824, when i login into UAN its mentioned Employee share: 912 & Employer Share 279 & Pension Contribution: INR 633.

So which means Now Company will not pay anything ? for PF ??

awaiting your commend.

My Email: Karthislkk@live.in

Company will continue paying .. there is no change in employer’s contribution

Correct me if I am wrong,I guess the amounts in your examples are not calculated correctly.

Also, let me know whether PF Admin charges are 0.85% or 1.10% of basic as your table states both.

Request you to publish a similar article ( with definitions and examples) on other employee benefits payables such as ESI, Bonus, Gratuity and Leave Encashment.

Recently,one of my friend transferred PF online.In the Passbook the PF fund is reflecting but not the Pension fund.Could,anyone guide in this regard.

That’s expected. As mentioned in our article UAN Problems, Password,Mobile Number,Incorrect Details and Help Desk

“WHILE TRANSFERRING PF FROM ONE ESTABLISHMENT TO ANOTHER, THE SERVICE DETAILS INFORMATION (VIZ LENGTH OF SERVICE, NON-CONTRIBUTORY PERIOD, LAST WAGES DRAWN ETC) ARE FURNISHED TO THE RECEIVING PF OFFICE IN ANNEXURE-K WHICH WILL BE USED TO CALCULATE PENSION BENEFITS. AMOUNT IN PENSION FUND IS NOT REQ”.

Hi,

I was checking my member passbook in EPF website and not finding interest calculation as per the excel file you have given in your blogs. So need to understand if there is any thing wrong…

My passbook says…

OB Int. Updated upto 31/03/2010 Deposit – employee share Rs x, Employer Share Rs Y

Total Cont from 042010 to 032011 – Deposit – employee share Rs A, Employer share Rs B

Int. Updated upto 31/03/2011 Deposit – employee share Rs L, employer Share Rs M

EPF interest rate in 2010-11 was 9.5%

So this L should be equal to (x+A)*9.5%

And M should be equal to (Y+B) *9.5%

But L and M values are less and not as per this calculation…

Any idea, what is the issue and if this is not correct, then where I can report this for correction ??

Thanks a lot for your help.

Give the numbers in passbook or

If its ok with you, scan the entries in the passbook and email to bemoneyaware@gmail.com

We shall not share information with anyone

Hi ,

I am going to join new organization from next month and I want to withdraw my EPF amount . So in this case I have to open a new account in new organization or can I use same account ?

Also my new organization is contributing X amount toward my EPF in that case I have to pay 12 % of my basic salary or It will be X less ?

Short ans: New organization will get EPFO to generate another member id for you. Your UAN number will not change.

To withdraw from EPF theoretically one should be unemployed for 2 months and if one withdraws before 5 years one would have to pay tax.

As EPF is for retirement purpose and to use power of compounding it is strongly recommended that you transfer your EPF rather than withdrawing.

Lets understand difference between Member ID and UAN from our article UAN or Universal Account Number and Registration of UAN

What is Member ID?

Employer submits the EPF(Employee Provident Fund) money to the EPFO (Employee Provident Fund Office) on behalf of the employee. This includes both the employee contribution, employer contribution, Employee Pension scheme. Member Id or Member Identification Numbers is the number given by EPFO to allow the employer to submit EPF money of employee. It’s like Employer opens an EPF account for its employee and contributes to that account every month. Member ID is the account number of employee in the EPFO. When the employee changes the job then the new employer will open a new account number for it’s employee in EPFO. So a new Member ID will be allotted to employee. Member ID is same as PF number earlier. So you would have as many Member ID’s as the number of employers contributing on your behalf to EPFO.

Member ID or PF Account Number is in the format given below. PF Account Number may not have Extension code. Ex: For someone who works in Bangalore the code can be BG/BNG/012345//789.

What is Universal account number or UAN?

The UAN is a 12-digit number allotted to each Employee Provident Fund member by the Employee Provident Fund Organization(EPFO) which gives him control of his EPF account and minimises the role of employer

How does Member ID differ from UAN number?

An employee will have one UAN or Universal Account number, which as the name implies will remain the same. It will maintain all your Member Ids. Its like you can have multiple Saving Bank account but all these are tied to your one Permanent Account Number or PAN. So when you change your job and the new employer, if contributing to EPF, gives you a new Member ID. This new Member ID has to be linked to your UAN number.

Hi sir,

before 2 month government also change EDLI contribution rate, So, please update me about new amendment about EDLI contribution rate. please help me ASAP.

Sir we could not find the new contribution rate. From what we know It is still 0.5%.

Could you please help us out by telling us where did you get info from?

Hello,

I worked in India until Jun 2011 having less than 5 years of service in India.

After Jun 2011, I have become NRI and working abroad. Could clarify my below points.

1. Am I still earning interest on my PF?

2. Can I withfdraw my EPF and EPS ?

3. Is there any tax implecation in my case?

Thanks,

Abhishek

Hope you are getting a great exposure.

1. 3 years after last contribution in EPF , the account stops earning. After Jun 2014 your EPF account has stopped earning interest.

2. Yes you can.