Fixed Deposit(FD) is an investment product which allows you to invest a lump of money for a fixed time period and at a fixed rate of interest. It is quite popular form of investing in India especially in last few years when equity is not doing well and interest rate on Fixed Deposits offered are high. Overview of Fixed Deposits give an overview of Fixed Deposits, while Fixed Deposit and Interest Rates discussed the interest rates in FDs. Our article Fixed Deposits and Tax had details about the tax on Fixed deposits but based on the questions asked on tax on Fixed Deposit we decided to write this article featuring the questions and replies. Let’s first refresh basics of Tax on Fixed Deposit for a resident individual.

Tax on Fixed Deposit: Overview

Interest on Fixed Deposit is taxable as per your income slab whether TDS is deducted or not.

Tax Deducted At Source or TDS: TDS is deducted every time the interest earned for the financial year in the bank is more than Rs 10,000 in a single branch, whether it is paid or not. If you have a Fixed Deposit which spans multiple years and you have opted for cumulative option. Then even though you don’t get interest bank will cut TDS and deposit it with central government if interest on that year is more than 10,000.Note: For Fixed deposit with NBFC TDS is cut when interest income that you are likely to earn for all your deposits is greater than Rs. 5,000/-

Amount of TDS : The bank will deduct TDS at the flat rate of 10% if you have provided your PAN details.If PAN details have not been provided TDS shall be deducted at the rate of 20% .

Proof of TDS, Form 16A: A consolidated TDS Certificate in Form 16A, for TDS deducted during a financial year will be issued in the month of April of the following financial year. TDS Certificate shall specify valid Permanent Account Number (PAN) of the deductee, valid Tax Deduction Number (TAN) of the branch, Challan identification Number and receipt No of the quarterly statement. Please check that TDS shows in your Form 26AS.

How to avoid TDS not Tax (Form 15G/15H). If you believe that your total interest income for the year will not fall within overall taxable limits and you don’t want Bank to cut TDS you need to fill Form 15G/15H every year at the beginning of financial year . Form 15H is for senior citizens while form 15G is for Individuals below the age of 65 years. The aggregate of the interest etc. received during the financial year should not exceed the basic exemption slab for Form 15G while no such condition exists for Form 15H. It is explained in detail in Bemoneyaware : Avoid TDS : Form 15G or Form 15H

How to claim TDS: Once TDS is cut the only way to claim it back is by filing Income Tax return and asking for refund.

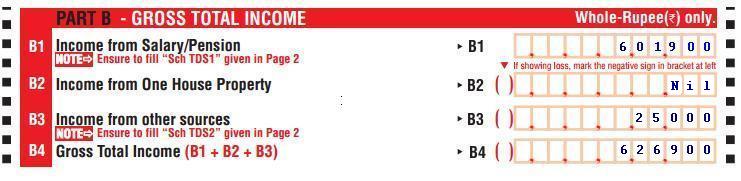

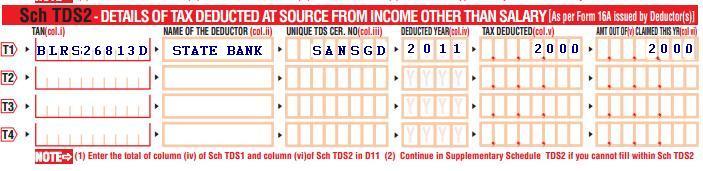

Income Tax Return: Interest from Fixed Deposit comes under Income from other sources. TDS cut is shown in DETAILS OF TAX DEDUCTED AT SOURCE FROM INCOME OTHER THAN SALARY. Sample images from Filling ITR-1 : Bank Details, Exempt Income, TDS Details are shown below for Mr. Mehta who had income Interest on saving bank account (Rs 5000) and Interest from Fixed Deposit(Rs 20,000) and bank deducted 10% TDS i.e 2,000 Rs on FD.

Method of accounting: This is to be taken into consideration when Fixed Deposit spans multiple Financial Years. Ex: You opened Fixed Deposit for 3 years in Aug 2011 then interest from Fixed Deposit will be in Financial Year 2011-12(Assessment Year 2012-13), Financial Year 2012-13(Assessment Year 2013-14),Financial Year 2013-14(Assessment Year 2014-15). How to account for it?

As Interest on Fixed Deposit comes under Income from other sources (like business profits, professional income and investment income other than capital gains), we have the choice of accounting for them on either basis–cash or mercantile.

- Cash method of accounting means incomes and expenses are taken into account on actual receipt or payment ex:For example, if you pay your telephone bill on say 15th April 2012, it will be accounted for in the financial year 2012-13 (1-Apr-2012 to 31-Mar-2013) although the bill may be pertaining to the month of March 2012.

- Mercantile or Accrual method: Under this method transactions are considered as and when they are incurred or earned whether they are are received or not. For example: Salary relating to a particular year is taxable in that year itself irrespective of whether it is actually received or not.

If interest on the fixed deposit in a financial year is more than Rs 10,000 and TDS is deducted then it’s better to show it in income tax return for that year as TDS deducted will come in Form 26AS. Else i.e when TDS in a year is less than 10,000 Rs or TDS is not cut(because you submitted Form 15G/15H) you can choose when to show in the income tax-return, every year or at the end of the term of fixed deposit when you receive it. Bemoneyaware : Methods of Accounting discusses it in detail. Now let’s go through some questions and replies on Fixed Deposits that Tax that have been asked on my website.

Pay Tax: Tax to be paid for interest on Fixed Deposit is Self Assessment Tax. It is to be paid by filling Challan 280

Questions on Fixed Deposits and Tax

I have some Fixed Deposits in SBI at 9.5%.The Bank deducts TDS . I am in the 30% income tax slab. Since 10% is already paid for at source, do I still have to show the entire interest income as my income in my IT Return and pay a further income tax on the interest income?

Yes entire interest on Fixed Deposit is taxable. Yes you have to show entire interest as income from other sources. As bank only deducts TDS at 10% and you are in 30% income slab so you have to pay remaining 20%.

My income under Head salaries is 490000 and Fixed deposit interest is 21430 for which 2152 tax has been deducted at source by bank. In this regard i have 2 queries. Plz clarify

1. Should include 21430 as income from other sources or (21430-10000) = 11430?

2. If i add 11430 or 21430, i am moving into slab 20% from 10% as total income > 500000. but the bank has deducted only 10% Tax. Should i need to pay the extra tax my own. If so, by what form (like for 280 or 282)

1. You should include 21430 as the income from other sources.

2.If you come into 20% slab you need to pay extra tax on your own as only 10% has been deducted. Use challan 280 to pay tax.

Just clarify that you have done required deductions from salary. Ex under 80C your EPF contribution , your PPF contribution or under 80CCF is you bought infrastructure bonds etc so your net salary can be less than 490000.

I have received form 16A from my bank stating the interest credited against the TAX SAVING FD as Rs. 13418/- with TDS deducted as Rs. 1342/-. I have to file my IT return now.

a). Do I have to include this interest amount under Income from Other Sources?

b). If I include this interest amount under Income from Other Sources, the Income Tax Payable is being calculated as Rs. 1422/-. Does that mean that I have to pay this as additional tax. FYI, I fall under 20% tax bracket for salaried male. And the income tax from salary has already been paid and matched.

a) Yes you have to include 13418 as Income from other sources.

b) As you are in 20% slab you should be paying 20% of 13418 as tax = 2683.6

c) TDS at 10% has already been deducted to you can claim the TDS of 1342 = 1342.6

d) You have to pay tax on remaining amount i.e 1342.6 before you file Income tax return.

My bank has deducted TDS for Rs.1200 towards interest accrued on FD. the TDS is 10% only and 3% cess has not been deducted. since the interest is accrued and not paid does this TDS can be considered as advanced TAX. do i need to show this in my present IT returns or can I show it in next years returns when the interest amount is actually paid. if i need to show this amount in present year as 3% cess has not been deducted how should i account for it? can i pay it now? if so then who? pl help.

Your observation is correct, Bank just cuts TDS at 10% but does not cut 3% cess.

Yes this tax can be claimed as TDS already deducted not as Advance tax( which is paid by individual before specified dates)

Is 10% only TDS due to you. The interest on FD is based on your income slab. This is explained in detail in If TDS is cut you still may have tax liability in our article Basics of Income Tax Return.

Whatever tax is due(if it is only 3% cess also) you need to pay it.

I have an FD with an NBFC and the yearly accrued interest income comes to about Rs 9761 as per 26AS form. The NBFC deducted TDS as the amount is more than 5000. Since the interest is less than exemption limit of Rs 10000, Should I pay tax on this amount.If no, can I claim a refund on the TDS deducted by the NBFC.

First about NBFC are Non banking financial companies. NBFCs are financial institutions that provide banking services without meeting the legal definition of a bank, i.e. one that does not hold a banking license such as The Peerless General Finance & Investments from Kolkata,Bajaj Finance Ltd from Mumbai .RBI:FAQ on NBFC has some great information on NBFC.

For Fixed deposit with NBFC , If the aggregate interest income that you are likely to earn for all your deposits is greater than Rs. 5,000/- in a financial year, you become liable for TDS, subject to submission of Form 15G for individuals and 15H for senior citizen

TDS simply means Tax has been deducted at source. If your total income (after various exemptions and deductions) comes less than minimum exemption limit you can claim refund on TDS. Please see whether your income is less than minimum exemption limit if not then you might have to pay MORE tax as per the income slab

My father is retired. He has only income from Fixed deposit. Bank has taken tax from him. He is a senior citizen. He didn’t submit 15H form and pan card with them. What document do i need to attach while reclaiming this tax. He is not come in any income tax slab and if the interest rate is greater than 10,000 still can bank cut TDS from his account?

Yes the bank is right in deducting the tax as interest was greater than 10,000 and your father had not submitted Form 15H and PAN Card.

To reclaim the tax you need to file Income tax return . No document needs to be attached. I hope the bank has given you Form 16A for TDS.

I also had the same problem. But my bank gave me Intrest Certificate only, which shows the interest given to me by bank. In that case how to get refund from IT Dept. ? whether Bank can give Form 16A / TDS certificate as they had deducted 20% of intrest given without PAN number ?

If not, Then How I can get my 20% TDS refunded as my income is lesser than 1.8 lac ?Now, I get the PAN Card, this problem is rectified by me.

Once the bank cuts the TDS amount, it’s not in bank’s hands to reverse as it’s submitted to the tax authorities. As tax has already been deducted and deposited by the bank, the only recourse for the assessee is to file a refund claim in Income Tax return. Similar query has been answered at CAClub

What to do if the tds on bank interest is not reflected in 26AS of it department. My total tax deducted at source by the office is also not properly reflected in 26as. What is to be done?

Bank does not cut TDS on interest in saving bank account or Recurring Deposit but bank deducts TDS for interest on Fixed Deposit.

If TDS in Form 26AS does not match Form 16 given by your employer, please get it fixed by your office ASAP. Your office just has to revise return.

Similar query discussed here SimpleTaxIndia has details about the Form26AS Mismatch. Please go through it.

Bank has deducted income tax on accrued interest on my FD during FY 2011-12 thought the deposit is due for payment with interest in FY 2012-13. I would like to show the income Under “mercantileor cash” and not on accrued basis. I intend not showing any accrued interest during 2011-12 (FY), which will be shown in the year of receipt and use the TDS for computation of tax (to get refund) during 2011-12 FY. Is it allowed? I prefer to opt for ‘receipt’ basis as I have retired in April 2012 and my income has come down by about 50%!

Bank has to deduct TDS at the rate of 10% if interest on FD in year is more than 10,000 unless Form 15H/G is submitted. You also have to pay Tax on interest of FD as per your income slab. As your FD spans multiple financial years you can pay Tax each year on interest earned and claim TDS. It is possible to choose method of accounting but we suggest that if TDS shows up in Form 26AS account for it in the same year. Methods of Accounting throws some light on it.

Related articles:

- Avoid TDS : Form 15G or Form 15H

- Methods of Accounting

- Overview of Fixed Deposits

- Filling ITR-1 : Bank Details, Exempt Income, TDS Details

- Fixed Deposit Calculator

Hope this helped in answering some Frequently asked questions on Tax on Fixed deposit. If there is some other question which you think should be here please let us know we would add it. If you have some query please ask in the comments section don’t send us email.

world femous makeup artist in india

http://fizamakeupandhair.com/

nice,,,,,,,,,,,,,,,,,,,,,,,,