From this week we are starting a review of week gone by with links to good articles that we came across and we think our readers will benefit. This week we came across interesting articles on: 2008 vs 2011 , Return on investment for 5 years, Asset Allocation which covers FMPs, Gold Fund and about penny wise and pound foolish. On a lighter vein: on occasion of Big B birthday: Which companies would you compare to Amitabh Bachchan blockbuster movies ?, Chetan Bhagat’s new Book Revolution 2020

Table of Contents

What happened in the week that went:

- The Sensex rallied 850.15 points or 5.24% for the week to settle at 17082.69.whereas the Nifty closed at 5132.30, up 244.25 points or 5%.

- For the week, the Dow Jones industrial average gained 4.9%, the S&P 500 added 6%, and theNasdaq Composite rose 7.6%.

- Gold rose on Friday, posting its biggest weekly gain in six weeks, as optimism about European plans to contain the region’s debt crisis and a dollar drop lifted bullion with riskier assets in a broad rally.

- IIP for the month of August came in at 4.1% (consensus: 4.8%) . India’s food inflation for the week ended October 1, declined to 9.32% on a week-on-week basis from 9.41% for the week ended September 24.

- Spain had its credit rating cut by one notch by Standard & Poor, which cited a likely deterioration of the nation’s bank assets and weaker economic growth prospects that will keep unemployment elevated.

- The Slovakian President passed a measure to approve the extension of the EFSF bailout fund.

Week that may be

- With one-third of the Dow components and crowd favorite, Apple, reporting results next week, US stocks are setting the stage for another week of gains.

- Economic numbers, expected at a certain point in the summer to show the US economy was sliding back into recession, have generally come in above those lowered estimates.

- But despite Greece’s slow crawl toward a default and rising borrowing costs in Spain and Italy, the perception of efficient action in Europe has restored confidence in investors that equity market (worldwide) will rally.

2008 vs 2011

Read an interesting post Nifty and Sensex Stop Guessing the Bottom on moneyworks4me.com which compares the stocks in 2008 vs 2011.

Bse Midcap is down 42.6% in comparison to 2008 highs and down 33.13% from 2010 highs. Is now equal to what it was in May 2006 ( Sensex equivalent high of 12700 )

The indices that have performed well are: BSE FMCG 48.5% , BSE Auto 41% , BSE Healthcare 29%.

Table below is a nice snapshot of Nifty 50 stocks and how there has been a major variance in performance and some quick comments.

Returns on Investment for 5 yrs

Capitial Mind did an article on rolling 5 yr of returns Nifty. Quoting:I mean the reason you invest in stocks is that in the long term, they make you money. Even if in the short term, they can lose you some serious cashola.

So let’s test this theory in the 5 year term:

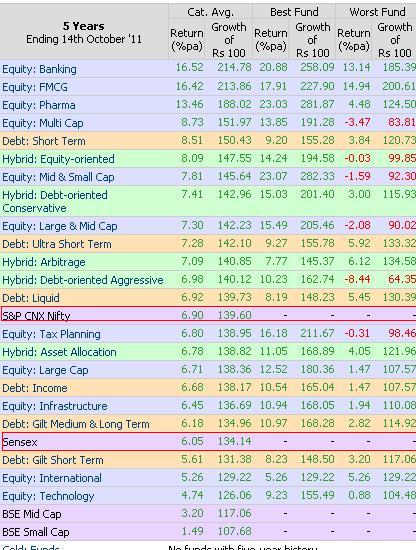

We compared the returns of various kinds of funds on valueresearchonline.com on 5 yrs time frame. Results are given below

Asset allocation

Asset allocation is the key and one needs to invest in Debt too. Currently Fixed Maturity Plan (FMP) seem to be good option for debt. Use these links to know more about FMPs

Gold Funds: Everyone is coming out with the gold fund and HDFC also joine d the bandwagon. To know more about why you shouldn’t buy the fund read HDFC Gold Fund Review on Onemint.

As the financial maze is becoming complex day by day and one seems to need help so that we can be penny wise but not pound foolish. TFLguide.com did an post on A penny-wise consumer – A pound-foolish investor which had discussion on what one should look in financial advisor.

On Lighter Side

Moneycontrol paid tribute to Amitabh Bachchan on his 69th birthday by picking companies/groups that define some of his blockbuster movies, albeit in the passing. Sholay-Infosys, Coal India-Kaala Pathar, Reliance Industries: Mr Natwarlal Read more…

Inflation Inflation, Chetan Bhagat’s books which were earlier prized at Rs 95 are now priced at Rs 140. His new book Revolution 2020 is now available. An overview:

Once upon a time, in small-town India, there lived two intelligent boys.

One wanted to use his intelligence to make money.

One wanted to use his intelligence to create a revolution.

The problem was, they both loved the same girl.

We read it and were disappointed and would rank is similar to One Night @ the Call Center and Three Mistakes of my Life.

Did you find this post helpful? What part you liked or didn’t like?What more would you liked to see?

Wow, great blog structure! How lengthy have you ever been running a blog for? you produced blogging glance quick. The total appear of your web site is magnificent, let alone the content material!

Thanks for your encouraging comments. We have been running the blog for last 7 months !

Great subject matter. I’ve discovered a lot interesting things here. Carry on.

Thanks a lot.

Thanks for the mention – it seems to me that the link to the Stop guessing the bottom article is broken. It opens up some sort of a search screen.

Thanks Manshu for reading the article and for informing the problem in link. I have fixed the link. And well i found your article good so mentioned in. You have so many reader(7000+) which is a proof enough that yes you help them in making better financial decisions.