The fiscal cliff. It’s everywhere you look — in the papers and on TV. What is the fiscal cliff, and how is it going to help or hurt US economy and other world economies come 2013? This article talks about it.

Table of Contents

Fiscal Cliff

In USA a combination of expiring tax cuts and across-the-board government spending cuts is scheduled to become effective Dec. 31, 2012 . If the federal government allows these to proceed as planned, they would have a detrimental effect on an US’s shaky economy, perhaps sending it back into an official recession as it cut household incomes, increased unemployment rates and undermines consumer and investor confidence. Fiscal cliff is the popular shorthand term used to describe the conundrum that the U.S. government will face at the end of 2012, when tax cuts expire and government spending kicks in. President Obama and congressional leaders are struggling to come up with a long-term deficit reduction plan to avert the year-end “fiscal cliff”. Expiry of tax benefits and lower government spending would help reduce the federal budget deficit but could temporarily arrest economic recovery, possibly even driving the US into a recession during the first half of the next year.

The term “fiscal cliff” was used by U.S. Federal Reserve Chairman Ben Bernanke in testimony before Congress in February 2012. He said “a massive fiscal cliff of large spending cuts and tax increases” would occur Jan. 1, 2013, if Washington didn’t act. The phrase caught on. Who actually first uttered the words “fiscal cliff” is not clear. Some believe that it was first used by Goldman Sachs economist, Alec Phillips. Others credit Federal Reserve Chairman Ben Bernanke for taking the phrase mainstream in his remarks in front of Congress. Others credit Safir Ahmed, a reporter for the St. Louis Post-Dispatch, who in 1989 wrote a story detailing the state’s education funding and used the term “fiscal cliff.”

Bush Era and Other Tax Cuts

At the heart of the fiscal cliff are the Bush Era Tax cuts passed by Congress under President George W. Bush in 2001 and 2003 and extended for the last two years because of the weak economy. These are set to expire at the end of 2012.

The potential expiration of the Bush-era tax cuts also affects tax rates on investments. The long-term capital gains tax rate will increase from 15 to 20%, and qualified dividend rates will increase to the individual’s marginal tax rate up from a fixed 15% under the current plan. This not only affects Wall Street investors, but also retirees and retail investors, who are withdrawing funds from qualified retirement plans and brokerage accounts.

The ‘payroll tax holiday’ expires – which will force workers to pay an additional 2 percent of their salaries in Social Security taxes. The average take-home income of nearly all wage-earners, in other words, will fall by 2 percent.

Federal unemployment extensions expire – further hitting consumer spending power.

The alternative minimum tax exemption returns to the level it was at in 2001.

Spending Cuts : Debt Ceiling Deal of 2011

In August 2011 Obama and the Congress fought over raising the debt ceiling, which is the amount of money the U.S. can borrow. Normally Congress raises the ceiling without much fanfare. In 2011, Republicans said they would not agree to raise the debt ceiling unless the U.S. started to look at its spending. A bitter fight ensued – gold prices rose to their all-time high of $1,921 an ounce that September – and the U.S. came close to not paying its obligation. The deal that was struck allowed the debt ceiling to rise in exchange for a plan to cut the national deficit. In August 2011, Obama signed into law The Budget Control Act of 2011. It allowed for an increase in the debt limit to be matched by spending cuts. The plan called for a Joint Select Committee on Deficit Reduction to present a plan that would be voted on by the Congress. The law stated if the bill by the Joint Select Committee on Deficit Reduction is not enacted or if it contains less than $1.2 trillion in deficit reduction, then the remaining amount would be sequestered (across the board spending cuts). Congress failed to enact the spending cuts so the automatic cuts will take place.

Sequestration is the congressional procedure created by the Gramm-Rudman-Hollings Deficit Reduction Act in 1985. Under sequestration, if the deficit exceeded a set of fixed deficit targets, automatic spending cuts kicked in. Theoretically, cuts should be across-the-board and equal, but Congress often exempts certain programs, which means other programs are hurt. However, sequestration rarely occurs since Congress raises the spending caps.

Implications for US and Rest of the World

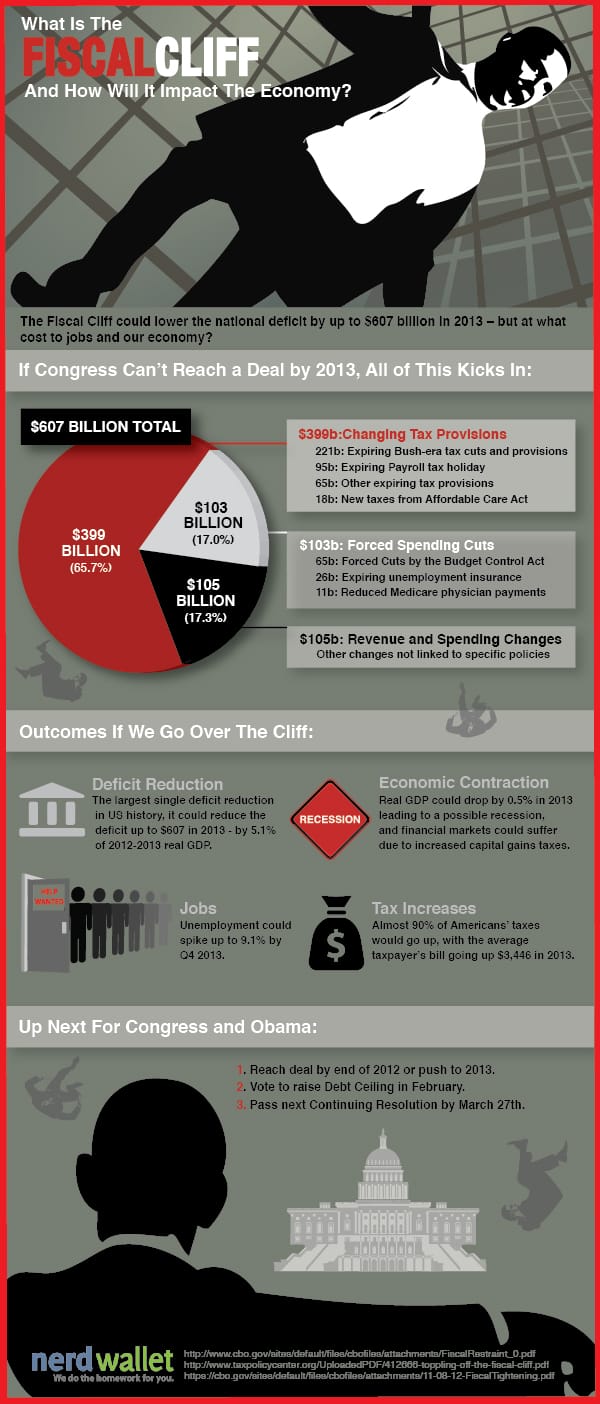

The fiscal cliff could lower the US deficit by about $607 billion in 2013 – and even more in the years to follow if current policies are allowed to take place – but this would all happen at a likely high cost to jobs and US economy. Combined economic effect of the two could send the U.S. economy back into a recession. If Congress and President Obama do not act to avert this perfect storm of legislative changes, America will, in the media’s terms, “fall over the cliff.” Among other things, it will mean a tax increase the size of which has not been seen by Americans in 60 years.

The current fiscal policy in the US has raised concerns over the country’s long term fiscal stability and solvency. The increase in taxes and lower government spending are part of the solution. But if the tax increases and spending cuts are allowed, the resulting recessionary climate would then cloud the prospects of even the fastest-growing economies, China and India. It can spark an outflow of money from emerging markets, including India, which are considered risky, in the near term. Foreign investors have invested over Rs 1,27,500 crore ($24 billion) so far in 2012, with Rs 22,523 crore ($4 billion) coming in December alone. The Sensex, which has rallied 26 per cent this year, is poised to post its biggest annual jump since 2009 helped by healthy foreign inflows and encouraging policy action from the government.

Dealing with Fiscal Cliff

Republicans want to cut spending and avoid raising taxes, while Democrats are looking for a combination of spending cuts and tax increases. Although both parties want to avoid the fiscal cliff, compromise is seen as being difficult to achieve. In dealing with the fiscal cliff, U.S. lawmakers have a choice among three options, none of which are particularly attractive:

- They can let the current policy scheduled for the beginning of 2013 – which features a number of tax increases and spending cuts that are expected to weigh heavily on growth and possibly drive the economy back into a recession – go into effect. The plus side: the deficit, as a percentage of GDP, would be cut in half.

- They can cancel some or all of the scheduled tax increases and spending cuts, which would add to the deficit and increase the odds that the United States could face a crisis similar to that which is occurring in Europe. The flip side of this, of course, is that the United States’ debt will continue to grow.

- They could take a middle course, opting for an approach that would address the budget issues to a limited extent, but that would have a more modest impact on growth.

Quoting from About’s What is Fiscal Cliff

It’s important to keep in mind that while the term “cliff” indicates an immediate disaster at the beginning of 2013, this isn’t a binary (two-outcome) event that will end in either a full solution or a total failure on December 31. There are two important reasons why this is the case:

1) If all of the laws went into effect as scheduled and stayed in effect, the result would undoubtedly be a return to recession. However, Congress continues to work toward a deal that will alleviate the effects in some form.

2) Even if the deal does not occur before December 31, Congress can – and almost certainly will – act to change the scheduled laws retroactively to January 1 after the deadline.

At the same time, even a “solution” isn’t necessarily positive, since a compromise will likely involve higher taxes or reduced spending in some form – both of which would help reduce the debt, but would be negative for economic growth.

With this as background, it’s important to keep in mind that the concept of “going over the cliff” is largely a media creation, since even a failure to reach a deal by December 31 doesn’t mean that a recession and financial market crash would necessarily occur.

Unfortunately, the fiscal cliff isn’t the only problem facing the United States right now. At some point in the first quarter, the country will again hit the “debt ceiling” – the same issue that roiled the markets in the summer of 2011 and prompted the automatic spending cuts that make up a portion of the fiscal cliff.

Even if the US will reach its debt limit of $16.4 trillion on December 31, it has another buffer of $200 billion that could give time to US Congress till February to raise the debt ceiling.

The Infographic from NerdWallet explains the Fiscal Cliff

Related Articles:

The fears over fiscal cliff will continue to loom. How this will impact US and rest of world is to be seen? Do you think that it will impact India?