The government has announced gold monetization scheme that aims to cut down gold imports in the country. This article explains the Gold Monetization Scheme , why the Government wants it, How the scheme works, did the Gold Monetization schemes announced earlier worked.

What is Gold Monetization Scheme?

The Union Finance Minister ,Arun Jaitley, in Budget 2015 announced several steps for monetizing gold. These are as follows:

- Gold Deposit Scheme –Gold Monetisation Scheme or Gold Deposit Scheme. This scheme will replace the existing Gold Deposit and Gold Metal Loan Schemes.

- Sovereign Gold Bond – a Sovereign Gold Bond, as an alternative to purchasing metal gold.

- Gold coins with Ashok Chakra – Government will introduce Indian Gold Coin, which will carry the Ashok Chakra on its face.

Why were the Gold Monetization Schemes announced?

Indians are among the world’s largest consumers of gold, importing at least $34.3 billion worth of the precious metal for the fiscal year ended March 31, 2015 . India imports as much as 800-1000 tonnes of gold each year. Though stocks of gold in India are estimated to be over 20,000 tonnes, mostly this gold is neither traded, nor monetized.

The gold monetization scheme aims to encourage Indians to vest the gold in their possession with banks and earn interest on it.

Do Indians love Gold?

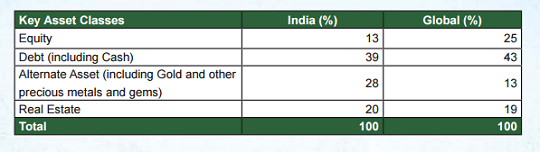

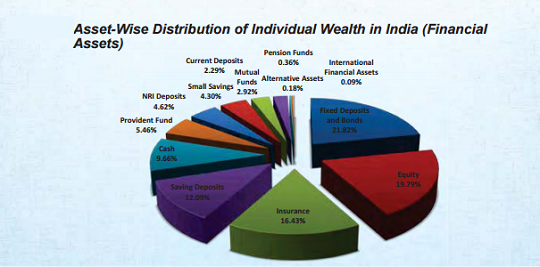

Yes . Indians adore gold. Newly wed brides are given enough jewellery to break their necks. Peasants store their pitiful savings in trinkets and tycoons with broken balance-sheets offer gold at temples in return for redemption. As per Karvy Wealth Report of 2014, Comparison of how Indians invest compared to rest of World is given below.

Why do Indians love Gold?

From rural Indian housewives and the 27-year-old wannabe bride to those who generate black money, gold is not merely a store of value or an international currency -– it’s part of a way of life, a showing-off of wealth, status, position, etc, besides its safe haven status in time of need. For centuries certain Indian festivals have been the time for splurging on gold. Festivals such as Akshay Trithiya and Dhanteras are considered auspicious times to buy the precious metal. Proponents of modern finance consider gold as an archaic investment c. Modern finance with its sophisticated tools,everything is a click away, is used to make savvy investments these days. But millions of Indians don’t understand yields and much of the financial jargon.They don’t understand how to invest like Buffett or others and make more money.

What they do understand is that they have to buy gold and pass it on to their children. They do understand gold will have some value in dire times. They do understand that gold is a traditional unit of value and will always remain so. And so they will keep buying, even if it’s just a little. And it’s easy to buy and sell gold. Opening a bank account in India is difficult. Gold, on the other hand, is widely accepted without any documentation. It is also a fine way to store wealth without paying tax—along with property,. The only thing that might keep Indians from gold is if the metal is abundantly available and if there’s a prolonged slump in its price.

Indians invest primarily in Fixed Deposits, Equity, Saving Deposits and very less in Mutual Funds.

What is the Timeline of Gold Monetization Scheme?

- Announcement was made in Budget 2015.

- The government put out a draft on 19 May for comment.

- The last date for submitting comments on the draft was 2 June. You can see the comments at https://mygov.in/group-issue/share-your-views-draft-gold-monetization-scheme/

How will the Gold Monetization Scheme works?

- One visits the purity testing centres which will tell the approximate amount of pure gold. Our article Understanding Gold:Purity,Color,Hallmark explains purity of Gold in detail.

- If one agrees to the amount as valued by the centre, one will have to fill up a bank/KYC form and give consent for melting the gold.

- The purity centre will then clean the dirt, studs, etc from the ornaments. The studs will be handed-over to the customer the jewellery will be melted.

- If one decides to take back the gold, one can do so in form of gold bars after paying a nominal fee.

- If one agrees to deposit the gold a certificate by the collection centre certifying the amount and purity of the deposited gold will be given.

- With this certificate, one opens a Gold saving account and credit the quantity of gold into this account for a period of 1 year and renew thereafter.

- The bank will pay an interest after 30/60 days of opening of the Gold Savings Account. Both principal and interest to be paid to the depositors of gold, will be valued in gold. For example if a customer deposits 100 gms of gold and gets 1 per cent interest, then, on maturity he has a credit of 101 gms

- On maturity, one will have the option of redemption either in cash or in gold.

- One will get exemption from Capital Gains Tax, Wealth tax and Income Tax, etc.

- Banks can have another stream of income through Gold Monetisation deposit scheme.

- Banks have the freedom to set their own interest rates on the gold deposits.

- Banks can also use the deposited gold to make coins and sell them to the public.

- Banks can lend the gold deposits to Jewellers at higher rates and earn margin (income).

- There is also a proposal to allow the banks to use the deposits to meet statutory requirements like CRR & SLR.

Has such Gold Monetization Scheme been introduced earlier and what happened?

Morarji Desai in 1960s launched the various acts related to Gold.

- In 1962 the border dispute with China accentuated the FX reserves. Morarji Desai, then finance minister of India, came out with Gold Control Act 1962. It recalled all gold loans given by banks and banned forward trading in gold.

- In 1963 production of gold jewellery above 14 carat fineness was banned.

- The gold bond scheme was launched with tax immunity for unaccounted wealth in 1965.

All these steps failed to yield results. Morarji Desai finally launched Gold Control Act 1968. It prohibited citizens from owning gold in bars and coin form. Goldsmiths were not allowed to own more than 100 grams of gold for jewellery making. Licensed dealers were not supposed to own more than 2 kg of gold depending upon the number of artisans employed by them. They were banned from trading with each other.

Morarji Desai believed that Indians will respond positively to his steps and stop consuming gold. What happened thereafter was unexpected. Demand for gold remained firm. Gold smuggling became the order of the day accounting between 30-70% of actual imports as per unofficial estimates.

SBI had launched the Gold Deposit scheme (GDS) earlier in November, 1999, but was discontinued. The scheme was re-launched in 2009. However, the scheme is available only at 50+ selected branches of SBI. When the gold deposit scheme was launched in 1999, the target was to mop up around 100 tonnes but the goal is yet to be achieved despite the plan undergoing changes, resulting in a marginal increase in rates on offer.

- Eligibility :Any Resident Indian of the following categories: Individuals, singly or jointly (as Former or Survivor), HUFs,Trusts, Companies

- Minimum Quantity : 500 gms (gross) (No upper limit for deposit)

- Period of deposit: 3 yrs,4 yrs or 5 yrs

- Rate of Interest & Payment : The current interest rates w. e f. 01.09.2010 are: 0.75% p.a. for 3 years, 1.00% for 4 years and 1.00% for 5 years. Interest is calculated in Gold currency (XAU) and paid in equivalent rupees. Interest rate is subject to change. Option for Interest Payment: Non-Cumulative (on 31st March) every year or Cumulative (On Maturity)

- Acceptance of gold : Gold i.e. Gold bars, Coins, Jewellery etc. will be accepted in scrap form only.

- How to Apply : Customers to submit Application Form, Identification Proof, Address Proof and Inventory Form. Provisional Receipt issued at the time of acceptance of gold.

- Issue of Gold Deposit Certificate :Gold Deposit Certificate will be issued by Nodal Branch (i.e. Bullion Branch, Mumbai) after the gold is melted, assayed and minted at India Govt. Mint (IGM). The certificate will be issued for pure gold contents (i.e. in 999 fineness). Multiple certificates (max 5) can be issued. Gold Deposit Certificate (GDC) will be sent to the depositor within 90 days from the deposit of gold.

Has Gold Monetization scheme worked somewhere?

Yes in USA. The US followed silver or gold or a bimetallic standard since 1785. During the Great Depression the US needed to print more dollars to reflate their economy. To print more dollars, the US needed more gold which was in short supply. Any buying by the US would have pushed gold prices higher. Franklin Roosevelt, president of the US in 1933, issued an executive order no. 6102 prohibiting private holding of gold. Not only he banned fresh purchases but also ordered Americans to give away their private holding to government at below-market prices. After a lot of hue and cry, he raised the purchase price to market levels. He created enough deterrent in the form of severe penalty of $10,000 (in 1933) or ten years in jail. Americans responded positively partly by patriotism and partly by the fear of the law.

Do you think Government Gold Monetization Scheme will work? Will you invest in Gold Monetization Scheme? Do you buy Gold? Why do Indians love Gold?

#OnlineShopping, #OnlineRecharge, #ShopMore #CashbackOffer, #BestDiscountOffer, #TodayOffer, #TodayDeal, #TopOffer http://www.shopmore.jogati.com

#OnlineShopping, #OnlineRecharge, #ShopMore #CashbackOffer, #BestDiscountOffer, #TodayOffer, #TodayDeal, #TopOffer http://www.shopmore.jogati.com