The Goods and Services Tax bill or GST Bill, touted to be India’s biggest tax reform, will simplify the current system of taxation. The bill will convert the country into a unified market by replacing all indirect taxes with one tax. Hailed as the biggest tax reform since independence, the one-nation-one-tax regime will convert 29 states into a single market. GST Bill was finally passed by Rajya Sabha on 3 Aug 2016. What is GST Bill? What problems GST solves? What becomes expensive and what becomes cheaper under GST? Benefits of GST.Timeline of GST Bill. What happens after passing of GST Bill? Impact of GST Bill on Modi Government

Table of Contents

GST Bill

GST Bill was passed by Lok Sabha on 29 Mar 2017 raising hopes of the new tax regime coming into force from 1 July, 2017. The Centre is likely to meet July 1 deadline. But, even if it fails, the Modi government has time till September 15 to roll out GST.

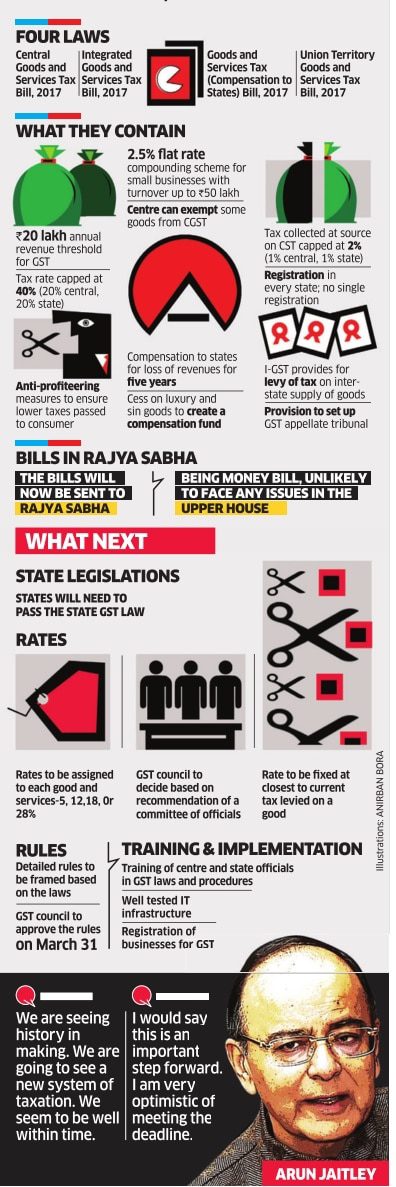

Once the Parliament session is over, the GST Council has another task to perform – to categorise about 5,000 goods and services in the four GST slabs before what Finance Minister Arun Jaitley called a ‘revolutionary’ reform is rolled. The image below gives info about GST bill to become reality.

GST Slab Rates

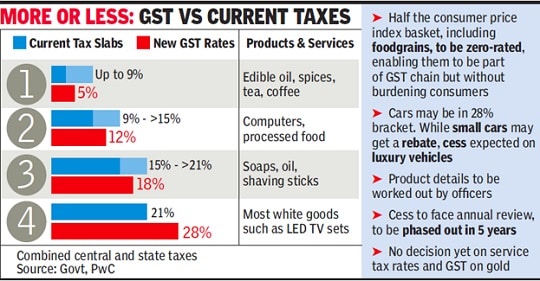

GST does away with indirect levies charged when goods cross state lines and unifies India into a single market. In Nov 2016 GST council has agreed on rate structure as 0%, 5%, 12%, 18% and 28%. Having a slab rate structure in GST is a departure from popular international practice of having one rate of tax for all goods and services.

The tax rate must be now be approved by Parliament, which meets from November 16 for the winter session. Parliament has to pass two bills related to GST in the winter session to be on track to roll out of the new indirect tax regime from April 1 next year.

- According to Finance Minister Arun Jaitley, items that are used by the aam aadmi, that is which qualify for mass consumption, will be taxed at 5%. Around 50% of the items that form part of the consumer price index basket (such as daily food consumption items) will not be taxed at all under GST.

- The peak rate of 28% will apply to luxury goods.

- Luxury cars, tobacco products and aerated drinks will attract an additional cess on top of the highest tax rate.

- It is likely that Service Tax will go up from 15% to 18 %

- Liquor/Petroleum doesn’t come under GST.. it will be controlled by state governments.

The following image shows GST vs current Taxes (ref StudyDhaba)

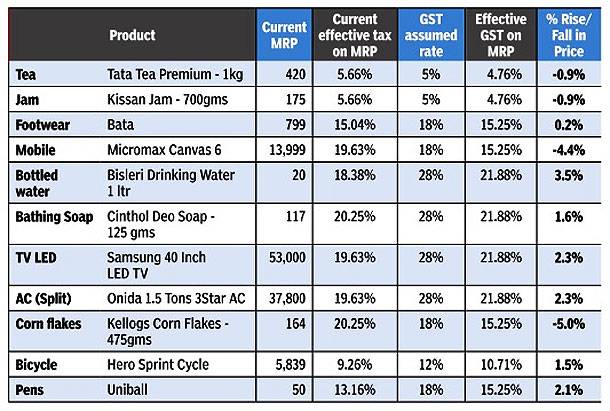

The likely impact on MRP of the products can be summarised below (ref Times of India):

What is GST?

GST is Goods and Services Tax, a an indirect tax levied when a consumer buys a good or service. The GST is a single indirect tax for the whole nation, which will make India one unified common market. It is a single tax on the supply of goods and services, right from the manufacturer to the consumer ,removing several layers of taxation such as purchase tax, VAT or Sales Tax, state-level taxes like, entertainment tax, excise duty, entry tax, luxury tax and octroi. As per various analysts, GST Bill can increase India’s GDP by 2%.

- Direct tax mean a tax paid directly to the government by the person or company on whom it is imposed for example individual/corporate earnings like salary, investments, business, property etc.

- Indirect taxes such as sales tax, excise duties etc. which an individual bears because of his consumption, though he is not directly involved in submitting that tax to the authorities. For example, when we purchase any product we pay VAT, when we eat in restaurants we pay service tax which are ultimately deposited in government’s kitty by the service providers.

How much would be tax as per GST?

Today, one pays Excise Duty of 12%, VAT of 14% on goods (totaling to 26%). 12% service tax on services. So, the rates may be anywhere between 12% and 26%. The average worldwide GST rate is around 18%. In Nov 2016 GST council in India has agreed on rate structure as 0%, 5%, 12%, 18% and 28%. Having a slab rate structure in GST is a departure from popular international practice of having one rate of tax for all goods and services.

What problems GST solves?

Currently we pay different types of taxes. For example when you buy biscuit, it includes Excise Duty, VAT or CST, Customs duty on the imported raw materials, etc. So, currently you pay multiple taxes on the same product. For example the food you buy at hotels has VAT as well as Service Tax.

GST is a single tax on the supply of goods and services, right from the manufacturer to the consumer. GST will help usher-in an era of a transparent and corruption-free tax administration. It is set to weed out the current shortcomings of the supply chain owing to the complicated, multi-layered policies.

Credits of input taxes paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each stage. The final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages. Image below shows the price of good with and without GST as it moves from Manufacture to Wholesaler, From Wholesaler to Retailer and from Retailer to Consumer

What becomes expensive and what becomes cheaper under GST?

The adoption of the GST regime will make manufacturing cheaper, leading to lower prices of a number of manufactured goods. On the other hand, services are likely to become costlier under the GST.

For manufactured consumer goods, the current tax regime means the consumer pays approximately 25-26% more than the cost of production due to excise duty and value added tax. With the GST rate expected at 18%, most goods are expected to become cheaper.

The effective service tax rate at present is 15% and it applies to almost all services other than essential ones such as ambulance services, cultural activities, certain pilgrimages and sports events. If GST is implemented, this rate will increase to 18% making services more expensive. Consequently, eating out, staying at hotels and air travel will turn costlier. Similarly, insurance premiums and investment management which attract a service tax currently, will also become costlier with the higher rate of GST.

According to experts, these items are expected to become cheaper under GST:

- Auto: Prices of entry-level cars, two-wheelers, SUVs may fall

- Car likely to get cheaper. For example, a Rs 5 lakh car attracts excise duty of 12.5 per cent, and along with VAT roughly comes to Rs 6.25 lakh. Now under the GST it is expected to go down as much as Rs 35,000 if the rate is fixed at 18%, so the price will be Rs 5.9 lakh rupees

- Paint, cement prices likely to fall

- Wood articles and Plyboard: With the applicable of only one tax instead of VAT, Excise and Service Tax, the prices of plyboards will decline. Presently, around 26% of tax is applicable on plyboards, but after GST only 18% of tax will be applicable.

- Electronics items like fans, lighting, water heaters, air coolers, etc. will get cheaper

- Movie ticket prices may come down due to lower entertainment tax

- Satellite TV- Presently, DTH TV pays tax around 20-21%. Once the Bill is cleared, the prices of DTHs will decline.

- Batteries- Battery sector is presently an unorganised sector, which has to pay overall tax at around 40-45%. But once the Bill is passed, the battery prices will come down too

And these items could become costlier under GST:

- Cigarette prices likely to go up as GST rate for tobacco will be higher than current duties

- Hotel and restaurants may become dearer

- Mobile phone calls may get costlier as service tax will go up

- Buying bags, shoes, electronics online will be getting more expensive as the e-commerce industry comes into a tax net and will have to pay tax deducted at source for every purchase from its sellers.

- Textile and branded jewellery may become costlier. For jewellery currently only 2 per cent of effective taxes is passed on to the consumers but as per the GST model, at least 6 per cent rates could be imposed, impacting the jewellery purchase.

- Airline, train tickets may become more costlier due to increase in service tax

- Insurance premiums, investments would be more expensive

Three kinds of GST

Cascading effect of taxes is caused due to levy of different charges by state and union governments separately. GST will do away with multiple tax-rates.The GST will basically have only three kinds of taxes

- Central,

- State

- Integrated GST to tackle inter-state transactions.

Under the current GST tax reform, all forms of ‘supply’ of goods and services like transfer, sale, barter, exchange, and rental will have a CGST (central levy) and SGST (state levy).

The Central GST (CGST) and the State GST (SGST) would be levied simultaneously on every transaction of supply of goods and services except on exempted goods and services. Exempted goods which are outside the purview of GST and the transactions which are below the prescribed threshold limits. Both would be levied on the same price or value unlike state value added tax, which is levied on the value of the goods inclusive of central excise.

Benefits of GST

Benefits of GST are as follows:

- For business and industry:

- Easy compliance

- Uniformity of tax rates and structures

- Removal of cascading

- Improved competitiveness

- Gain to manufacturers and exporters

- For central and state governments:

- Simple and easy to administer

- Better controls on leakage

- Higher revenue efficiency

- For the consumer:

- Single and transparent tax proportionate to the value of goods and services

- Relief in overall tax burden (hopefully)

Taxes that GST will replace

- Central taxes That The GST will replace

- Central Excise Duty

- Duties of Excise (medicinal and toilet preparations)

- Additional Duties of Excise (goodsof special importance)

- Additional Duties of Excise (textiles and textile products)

- Additional Duties of Customs (commonly known as CVD)

- Special Additional Duty of Customs (SAD)

- Service Tax

- Cesses and surcharges in so far as they relate to supply of goods or services

- State taxes That The GST will Subsume

- State VAT

- Central Sales Tax

- Purchase Tax

- Luxury Tax

- Entry Tax (all forms)

- Entertainment Tax (not levied by local bodies)

- Taxes on advertisements

- Taxes on lotteries, betting and gambling

- State cesses and surcharges

Timeline of GST Bill

- In 2003, the Kelkar Task Force on indirect tax had suggested a comprehensive Goods and Services Tax (GST) based on VAT principle.

- A proposal to introduce a national GST by April 1, 2010, was first mooted in the Budget Speech for the financial year 2006-07.

- Since the proposal involved reforms and restructuring of not only indirect taxes levied by the Centre but also the states, the responsibility of preparing a design and road map for the implementation of GST was assigned to the Empowered Committee (EC) of State Finance Ministers.

- Based on inputs from the Centre and states, the empowered committee released its first discussion paper on GST in November 2009.

- In order to amend the Constitution to enable introduction of GST, the Constitution (115th Amendment) Bill was introduced in the Lok Sabha in March 2011. As per the prescribed procedure, the Bill was referred to the Standing Committee on Finance of Parliament for examination and report.

- The Parliamentary Standing Committee submitted its report in August 2013, to the Lok Sabha. Most of the recommendations made by the Empowered Committee and the Parliamentary Standing Committee were accepted and the draft Amendment Bill was suitably revised.

- The 115th Constitutional (Amendment) Bill, 2011, for the introduction of GST introduced in the Lok Sabha in March 2011 lapsed with the dissolution of the 15th Lok Sabha.

- In June 2014, the draft Constitutional Amendment Bill was sent to the Empowered Committee after approval of the new government.

- Based on a broad consensus reached with the Empowered Committee, the Cabinet on December 17, 2014, approved the proposal for introduction of a bill in Parliament for amending the Constitution to facilitate the introduction of GST in the country.

- The Bill was introduced in the Lok Sabha on December 19, 2014, and was passed by the Lok Sabha on May 6, 2015.

- It was then referred to the Select Committee of Rajya Sabha, which submitted its report on July 22, 2015.

- Monsoon and Winter Sessions 2015, Budget Session 2016: Bill not tabled in the face of opposition led by the Congress and persistence of sticking points.

- Aug 3 2016, GST Bill passed by Rajya Sabha

What happens after passing of GST Bill?

The GST will be implemented from April 1, 2017.

- The bill needs to be approved in the Rajya Sabha by a two-thirds majority, as it is a constitutional amendment. GST Bill was passed by Rajya Sabha on 3 Aug 2016.

- After it is approved, the bill needs to be approved by 50 percent of the 29 state assemblies. BJP-led government is in power in 11 states. Except for AIADMK in Tamil Nadu and the CPI (M) being the leading party in coalition governments in Tripura and Kerala, all other major political parties are on board.

- Three pieces of enabling legislation need to be approved – a central GST law (by Parliament), state GST law (by state government), and an integrated goods and services tax law (by Parliament).

- Setting up of IT infrastructure, which has already begun with initiation of the Goods and Services Tax Network (GSTN), a non-government private limited company set up on March 28, 2013. The GSTN has received bids from five IT companies, including Microsoft, TCS and Infosys, to build the IT infrastructure.

Impact of GST Bill on Modi Government

Most of the countries implementing the GST have encountered major inflationary situations. Because of GST inflationary tendencies, the governments implementing it across the globe have lost the next elections or fared badly.

- Canada’s Progressive Conservative Party leader, Prime Minister Kim Campbell lost the 1993 national elections because his government had become unpopular after implementing the GST

- In Australia, the John Howard government narrowly scraped back into office in the 1998 election soon after implementing the GST.

- Even Singapore saw a spike in inflation in 1994 when it introduced the GST

The passage of the Constitution (122nd Amendment) Bill in the Rajya Sabha, enabling Goods and Services Tax (GST), may increase the worries of the Narendra Modi government. The GST will be implemented from July 1, 2017. And inflation spurred by the GST will take about a couple of years to settle down If the BJP-led NDA government at the Centre fails to handle the inflationary pressures, it will also be in deep trouble, not just in the 2019 Lok Sabha elections but also some of Assembly elections.

Related Articles:

[poll id=”89″]

What do you think of GST Bill? Will it bring down the prices? Will it be as beneficial is it is talked about? Will it be implemented by 1 Jul 2017?

Thanks for sharing information!

Uksandassociates has provided company registration and other CA’s services since 1993. We offer a wide range of CA’s services including return filing,auditing serives tailored to help your organization. you might visite our site we are doing the same things.

http://uksandassociates.com/

GST Rate Structure Finalized: 10 Things You Must Know.

More info@ https://www.moneydial.com/blogs/gst-rate-structure-finalized-10-things-you-must-know/

I recently saw a video by Pallavi Joshi explaining GST. It was a perfect example and explanation about GST.

Yes I saw it too..but is has over simplified. Kids and chocolates.

I hope principal is fair enough.

FACT Solutions India hailed the passing of the Goods & Services Tax (GST) Bill by Rajya Sabha (Upper House of Parliament) as the most progressive and far reaching tax reform measure ever undertaken by the Govt of India.

“The impact will be unprecedented and will transform India into a single unified marketplace”, says Mr. Arvind Agarwalla, Founder & CEO of the FACT Group of Companies worldwide. He added “GST will subsume the plethora of taxes at the central and state levels. This alone will add 2% to the GDP, propelling the country into double-digit GDP growth”.

With the government pushing for an aggressive deadline of 1 April 2017, companies in India have a very short time frame to upgrade their accounting systems and ERP Software to comply with the new GST regime. FACT Solutions India announced that their flagship FACT ERP.NG Software will be ready well in time to help companies migrate smoothly to the new tax regime.

Mr. Agarwalla said “We have more than 22 years of experience handling GST, having upgraded our software to comply with Singapore’s GST implementation as far back as 1994”. He added “Recently, we incorporated Malaysia GST in FACT ERP.NG, now being used by hundreds of companies in Malaysia. We have been amongst the first companies to deliver GST compliant software, both in Singapore and Malaysia”.

FACT Solutions India has been working with Goods and Services Tax Network (GSTN) to incorporate the various

requirements in it’s ERP software. GSTN has been set up to provide IT infrastructure and services to the Central and State Governments, tax payers and other stakeholders for implementation of GST.

Companies using FACT ERP.NG will be able to generate the GST Return by a simple click of a button, doing away with all manual work. Users will be able to upload the GST File straight into the GSTN System.

“We’re proud to bring our extensive GST knowledge to India and play our role in helping Indian companies plug into an increasingly digital world”, said Mr. Agarwalla, from the FACT Software Headquarters in Singapore.

“We are deeply committed to the India, having founded the first FACT Group company in Kolkata in 1987. As we continue to take FACT worldwide, we are focused on the Small & Medium Enterprises (SMEs). We are excited at the possibilities which technology brings to the SMEs, helping them compete strongly with their much larger competitors.”

Mr. Agarwalla says that the Hon’ble Minister of Finance, Mr. Arun Jaitley has his work cut out in terms of the details of how GST will be rolled out and implemented across the country.

“Having incorporated GST in Singapore, Malaysia and other countries we are aware that there be several changes as GST is rolled out in India. We are fully geared for it and I assure the Indian companies that FACT ERP.NG will be continually upgraded as the changes come into force.”

GST Tax Codes will be pre-populated in FACT ERP.NG software, meaning that SME owners will avoid making mistakes and will not need to manually enter figures into a separate GST software to prepare the GST file for upload.

FACT Solutions India’s announcement follows on from Finance Minister’s announcement yesterday that GST will help strengthen tax compliance and tighten the tax collection regime.

“Taken together, FACT ERP.NG will help SME owners run their businesses with peace of mind and meet their tax compliance obligations,” says Mr. Agarwalla.

“A lot of FACT’s innovation and research takes place in India. We are committed to bringing more innovations in compliance to the Indian market, to help Indian businesses grow and succeed.” Mr. Agarwalla says.

For more information about the FACT Software Group, see: http://www.factsoftware.com

You may also contact :

Ms Sujata Rao

General Manager – PR

Email : pr@factsoftware.com

Phone : +65-62208832

Singapore