Investors are disappointed with HDFC Mutual Fund, they had invested in these schemes based on good fund house, good scheme and their Fund manager Prashant Jain comes with a good track record. But its performance over recent past not well, but can they ignore the fact that the fund house has a sound 20-year track record . Questions which are going through investor mind are :

- Whether investment in HDFC Top 200 or HDFC Equity should be continued?

- What to do with accumulated corpus in HDFC Top200 or HDFC Equity Fund? Should one redeem it or should wait for NAV to appreciate?

- Why are HDFC Funds like HDFC TOP 200, HDFC Equity not performing well?

Table of Contents

Performance of HDFC Funds

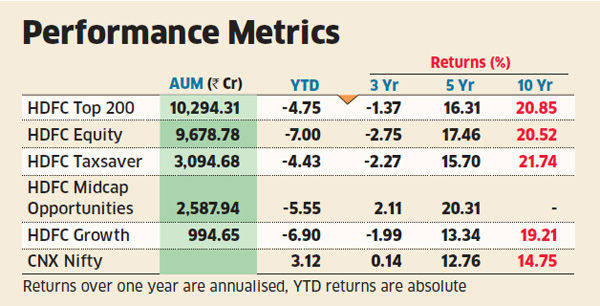

Equity schemes such as HDFC Top 200, HDFC Equity and HDFC Growth account for Rs 21,000 crore of retail investors’ money, which is almost 13 per cent of the total equity assets managed by Indian mutual funds. HDFC Top 200 Objective is To generate long term capital appreciation from a portfolio of equity and equity-linked instruments primarily drawn from the companies in BSE 200 index. It has been around since October 11, 1996

- HDFC Top 200 scheme, which has a corpus of Rs 10,300 crore, has returned – 4.15% year-to-date (YTD), against the CNX Nifty’s 3.12 % return during the period,

- HDFC Equity, which manages assets of Rs 9,700 crore, has returned – 6.57 % YTD, much to the disappointment of investors.

But over a longer time frame, these schemes have a sound track record. Both HDFC Top 200 and HDFC Equity have posted over 20 per cent annualized returns over a 10-year time frame, beating the category average of 16% annualised and the CNX Nifty’s gains of 15% annualised during the period.

How are funds rated?

Most of rating agencies rate only those schemes that are older than three years and have a corpus of above Rs 5 crore. They takes monthly returns into account. For each month it calculates the risk-free rate—returns over and above the risk-free rate of return. For instance, if the risk-free return (say, a short-term fixed deposit, where the risk potential is virtually zero) is, say, 7% and the fund’s return is 10%, the risk-free rate of return is 3% (10% less 7%). Returns of all the months are averaged out and a “return score” is arrived at.

Similarly, a risk score is arrived at by adding all negative risk-adjusted returns (those months where the fund’s returns were less than the risk-free instruments) and dividing it by 36. The risk score, subtracted from the return score gives the ratings score for a three-year period. Similarly, a five-year rating score is also arrived at for those schemes that are at least five years old.

For schemes that are at least five years old, Value Research assigns 60% weightage to its five-year rating score and 40% to the three-year rating score. For schemes that are more than three years old but less than five years, 100% weightage is assigned to its three-year rating score. Ref Livemint

Why funds do not perform well?

Past performance may or may not be sustained in the future says any mutual fund-related literature. The investment environment is constantly changing with respect to government policies, interest rates, disposable income, inflation and also economic growth. And all these factors have a bearing on the performance of mutual funds, stocks, bonds, gold, real estate, etc, so the sectors or stocks. The reasons for which a product performed well the previous year have almost certainly been replaced by a new set of factors, some of which are completely different to each other. For example In 2007, Reliance Vision was among the most highly recommended diversified equity funds. Today, it is floundering, having consistently under-performed its benchmark in the past 1, 3 and 5 years.

Different sectors outperform at different times. FMCG and pharmaceuticals, for instance, are known to be defensives and do well during recessionary phases. On the other hand, sectors such as capital goods and commodities do well during bull runs. For instance, infrastructure funds, at the helm during the bull run of 2007, fell flat after the financial crisis that began in late 2008 with many languishing in the bottom quartile today. More at our article Not All Mutual Funds Do Well -the Laggards

Why ratings for HDFC funds dropped?

Investment objective of HDFC Top 200 is The scheme seeks capital appreciation and would invest up to 90 per cent in equity and the remaining in debt instruments. Also, the stocks would be drawn from the companies in the BSE 200 Index as well as 200 largest capitalised companies in India.As on Sep 30, 2013 it has 64 stocks with 56.50% in Giant companies,21.13% in Large companies and its top holdings are in Finance,Energy,Technology sectors with individual holdings given below.

| Company | Sector | % Assets |

|---|---|---|

| Infosys | Technology | 8.73 |

| ITC | FMCG | 6.87 |

| ICICI Bank | Financial | 5.73 |

| Reliance Industries | Energy | 5.70 |

| Tata Consultancy Services | Technology | 4.95 |

| Tata Motors DVR | Automobile | 4.60 |

| State Bank of India | Financial | 4.50 |

| Larsen & Toubro | Diversified | 4.29 |

An analysis of the portfolio selection of these schemes shows that heavy exposure to Banking and Finance, Oil & Gas, Auto and Engineering has resulted in them underperforming broader markets. High single stock exposure to banks such as SBI and Bank of Baroda in the financial sector and companies operating in core sectors such as L&T, Rural Electrification, Tata Steel, Bharat Electronics, Coal India, Jaiprakash Power Ventures and Jaiprakash Associates, which have delivered double-digit negative returns in this year, has contributed further to the loss. Some index heavy consumer non-durable names are missing from the portfolios.

Has ratings of HDFC funds dropped earlier?

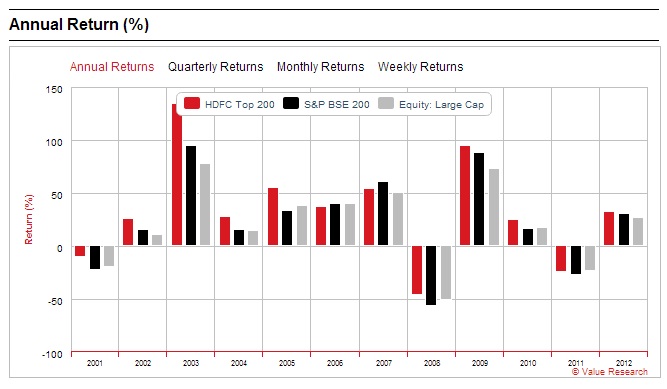

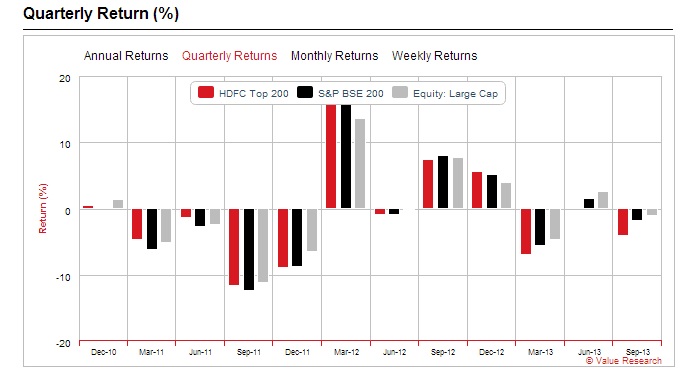

Throughout 2007, HFDC Top 200’s rating had dropped to four stars, but it bounced back later. Picture given below shows the returns of HDFC Top 200 annual returns from 2001 to 2012 and quarterly returns from Dec 2010 to Sep 2013 along with BSE 200, Large Cap Equity funds are given below . One can check out HDFC Top 200 Performance at HDFC Top 200 at Value Researchonline HDFC Equity Performance at HDFC Equity at Value Researchonline

One can check out the Valuereserachonline best equity funds in last 1 year

While HDFC Funds may not be doing well. HDFC Asset Management Co. Ltd, India’s largest fund house with assets ofRs.1.03 trillion, was the most profitable money manager in the year ended 31 March.

So what should an Investor do ?

These funds carry relatively stable portfolios. In the short term, funds can be volatile and may even underperform the broader markets. Fund Manager Prashant Jain, is consistent and has conviction in his strategy. But Dhirendra Kumar of Valuereserachonline says , “it would be advisable to diversify one’s portfolio by investing in equity schemes of various other fund houses and not allocate all the money to just one fund house

Comparing to hindi movies it’s like saying movie of Salman Khan or Aamir Khan or Ranbir Kapoor has flopped? Will you rule out Salaman Khan/Aamir Khan/Ranbir Kapoor from top Bollywood heros? Or you know that he would bounce back in the next few movies?

As I have invested in HDFC Top 200 fund for next 5 years,I shall not not withdraw my money from it as of now. I will be tracking it for another quarter to decide if SIP has to be discontinued.

Related Articles :

- Investing in Mutual Funds for Beginner

- Not All Mutual Funds Do Well -the Laggards

- Understanding Returns: Absolute return, CAGR, IRR etc

- Returns of Stock Market, Gold, Real Estate,Fixed Deposit

Remember buying popular funds doesn’t guarantee you any success . Current under performance may be just a blip but please be watchful of their performance over a little longer time horizon. Consistent underperformance would highlight weakness of the funds. What are you doing with your investment in HDFC Top 200 or HDFC Equity Fund.

Hi Kirti,

Sorry to post something out of context of this article.

What is the impact of the new rule regarding HRA as mentioned in the article below.

http://economictimes.indiatimes.com/personal-finance/tax-savers/tax-news/income-tax-department-puts-hra-exemption-under-scanner/articleshow/24488081.cms

Can you also let me know how to post comments/queries to bemoneyaware. Some times there is no provision to post comment below the article though u can mail/share/like the article.

Thanks,

Gagan

Article says Salaried taxpayers who claim HRA exemption will now have to report their landlord’s PAN if the total rent in a year exceeds Rs 1 lakh Till now, if the total rent paid was less than Rs 15,000 a month, there was no need to submit the landlord’s PAN details

This is being seen as an attempt to plug tax evasion by salaried professionals who submit fake rent receipts to maximize their HRA exemption.

Did confusion get cleared ?

Can you let me know the article where there is no provision to comment?

When I searched for an article, I did not find the option to comment. I think you need to to click Read More on an article in search results to be able to comment on it.

I live with my father who owns the house and is a senior citizen. In this case, can I show rent being paid to him. If I can show rent paid to him, will that rental income become part of my father’s total income and on the rental income does my father has to pay tax on it.

Thanks,

Gagan

Dear Gagan, if you pay rent to your father in whose house you leave, you need to “pay” the rent to your father every month and obtain “receipts” from him. While you can avail of the HRA tax benefits, the rent that you paid will be added to the income of your father and he is liable to pay tax on it. Thanks.

You are right Gagan you need to click on Read more when you are on the main page bemoneyaware.com/blog.

As Kapil pointed out what you pay to your father as rent would be counted as his income and it would be taxed.

See limit is if total rent in a year exceeds Rs 1 lakh i.e 8333 a month so if you pay less than that PAN is compulsory.

You can gift money to your father which will not be counted as his income so you need to work out how much tax

you save in different scenarios

Hi Kirti,

Sorry to post something out of context of this article.

What is the impact of the new rule regarding HRA as mentioned in the article below.

http://economictimes.indiatimes.com/personal-finance/tax-savers/tax-news/income-tax-department-puts-hra-exemption-under-scanner/articleshow/24488081.cms

Can you also let me know how to post comments/queries to bemoneyaware. Some times there is no provision to post comment below the article though u can mail/share/like the article.

Thanks,

Gagan

Article says Salaried taxpayers who claim HRA exemption will now have to report their landlord’s PAN if the total rent in a year exceeds Rs 1 lakh Till now, if the total rent paid was less than Rs 15,000 a month, there was no need to submit the landlord’s PAN details

This is being seen as an attempt to plug tax evasion by salaried professionals who submit fake rent receipts to maximize their HRA exemption.

Did confusion get cleared ?

Can you let me know the article where there is no provision to comment?

When I searched for an article, I did not find the option to comment. I think you need to to click Read More on an article in search results to be able to comment on it.

I live with my father who owns the house and is a senior citizen. In this case, can I show rent being paid to him. If I can show rent paid to him, will that rental income become part of my father’s total income and on the rental income does my father has to pay tax on it.

Thanks,

Gagan

Dear Gagan, if you pay rent to your father in whose house you leave, you need to “pay” the rent to your father every month and obtain “receipts” from him. While you can avail of the HRA tax benefits, the rent that you paid will be added to the income of your father and he is liable to pay tax on it. Thanks.

You are right Gagan you need to click on Read more when you are on the main page bemoneyaware.com/blog.

As Kapil pointed out what you pay to your father as rent would be counted as his income and it would be taxed.

See limit is if total rent in a year exceeds Rs 1 lakh i.e 8333 a month so if you pay less than that PAN is compulsory.

You can gift money to your father which will not be counted as his income so you need to work out how much tax

you save in different scenarios

Kirti, I have been investing in HDFC Equity Fund since the last about 4-5 years but have not been regular. Same with HDFC Top 200. People seem to be betting on two things: (1) Over the long term, both funds have given decent returns (short term returns are to be ignored, according to them), and (2) investors have faith in the manager, Prashant Jain.

Kirti, just about a year back, people were saying these 2 schemes are one of the best. Now they are full of praise for Quantum Long Term Equity Fund, Franklin Templeton Bluechip Fund and ICICI Pru Focussed Bluechip Fund. But what if one year onwards, they start recommending some other equity schemes? We will then just be running from pillar to post, knowing not what to invest in! I think I will stay on with HDFC Equity and HDFC Top 200 for the time being but NOT only with them. Thanks.

Kapil you have hit the nail. No one can come number 1 everytime, even Sachin gets out at 0 some times. So there will always be funds who will be better performers than HDFC funds. But what is getting people worried is no turn around in these funds and for some patience is running out.

One must not stick to fund and must review the performance of the fund. When should one exit the fund is as difficult decision as selecting the fund. Depending on how much time one has, how much money has one invested, how much loss one can take people will move in and out of funds.

We have written an article called Rantings of a Mutual Fund Investor which also talks about investor thoughts and feelings about investing in mutual funds Quoting from it

A star mutual fund manager made wrong bets aur mera paisa dhoob gaya..meri ankhoon ke samne aur mein kuch na kar saka. But when you see that funds have done no better than banks deposits and probably destroyed value leave alone adjusting for inflation , dil pei kya gujarati hai tum kya jaano Sandeep Babu, Prashant Babu. Should I leave the fund if yes where should I put it?Newton’s Inertia (or so I thought till I came to know that behavioral economics calls it Loss aversion ) made me maintain status quo. Maine tu long term ke liye invest kiya hai, I console myself..I ignored the voice that asked me Par kitna lon…g intezaar karooge..

Kirti, finally it’s our money. But someone has suggested that while we do continue with the HDFC funds, to get into another equity scheme of another fund house doesn’t seem to be a bad idea. Don’t the experts call it “diversification to minimise risks”? Diversification by investing in an additional fund house to minimise the risk if HDFC equity schemes continue not to deliver…I’m thinking aloud 🙂

Yes Kapil you are right. Thanks for thinking aloud (my blog articles are also thinking aloud)

That is what many experts are suggesting also. Catch is because of this diversification one at times end up having many mutual funds and it becomes difficult to track then. If total number of funds are around 6-8 then one should do it.

So which fund would you consider investing in if not HDFC fund?

If it has to be large cap and diversified in order to form the core portfolio, what do you think of Quantum Long Term Equity and FT India Bluechip? (Ofcourse, these could be in addition to HDFC Equity and HDFC Top 200.) So, you still have only 4 equity schemes in the portfolio.

In addition, add a midcap like ICICI Pru Discovery.

So, totally you have 5-6 schemes (total monthly investment per month remains the same as before) but atleast you are not at the mercy of the two HDFC Funds if they continue to perform badly.

Now you have to track and handle 5-6 schemes but doesn’t the risk reduce because you have spread your investment across different schemes and different mutual fund houses? Thanks.

Core portfolio and 4 equity schemes seem a good idea. But what is the overlap in Quatum Long Term Equity, FT India bluechip and HDFC funds one needs to see. ICICI Pru fund is also doing well.

Yes risk reduces by diversifying so instead of say putting 10,000 in HDFC Equity you put 5000 in HDFC Equity and 5000 in Quantum. But if HDFC continues to do bad say for another 1 or 2 quarter one can stop SIP in HDFC Equity and either move to Quantum or start inn FT India bluechip?

How long have u been investing and how do you invest directly or through online platforms or through distributors

Dear Kirti, I have been on and off SIPs for the last 6 to 7 years. I have had most number of SIPs in Fidelity Equity Fund; I got out of it when L&T AMC took it over. The second most number of SIPs I have had is in HDFC Equity Fund. Kindly note I’m saying “number of SIPs” is because I have not invested consistently and continuously (which is really bad).

I was investing in SIPs through ICICI Direct (online trading) but since around February 2013, I have been investing entirely in the direct plans (no distributors). Thanks.

Kirti, I have been investing in HDFC Equity Fund since the last about 4-5 years but have not been regular. Same with HDFC Top 200. People seem to be betting on two things: (1) Over the long term, both funds have given decent returns (short term returns are to be ignored, according to them), and (2) investors have faith in the manager, Prashant Jain.

Kirti, just about a year back, people were saying these 2 schemes are one of the best. Now they are full of praise for Quantum Long Term Equity Fund, Franklin Templeton Bluechip Fund and ICICI Pru Focussed Bluechip Fund. But what if one year onwards, they start recommending some other equity schemes? We will then just be running from pillar to post, knowing not what to invest in! I think I will stay on with HDFC Equity and HDFC Top 200 for the time being but NOT only with them. Thanks.

Kapil you have hit the nail. No one can come number 1 everytime, even Sachin gets out at 0 some times. So there will always be funds who will be better performers than HDFC funds. But what is getting people worried is no turn around in these funds and for some patience is running out.

One must not stick to fund and must review the performance of the fund. When should one exit the fund is as difficult decision as selecting the fund. Depending on how much time one has, how much money has one invested, how much loss one can take people will move in and out of funds.

We have written an article called Rantings of a Mutual Fund Investor which also talks about investor thoughts and feelings about investing in mutual funds Quoting from it

A star mutual fund manager made wrong bets aur mera paisa dhoob gaya..meri ankhoon ke samne aur mein kuch na kar saka. But when you see that funds have done no better than banks deposits and probably destroyed value leave alone adjusting for inflation , dil pei kya gujarati hai tum kya jaano Sandeep Babu, Prashant Babu. Should I leave the fund if yes where should I put it?Newton’s Inertia (or so I thought till I came to know that behavioral economics calls it Loss aversion ) made me maintain status quo. Maine tu long term ke liye invest kiya hai, I console myself..I ignored the voice that asked me Par kitna lon…g intezaar karooge..

Kirti, finally it’s our money. But someone has suggested that while we do continue with the HDFC funds, to get into another equity scheme of another fund house doesn’t seem to be a bad idea. Don’t the experts call it “diversification to minimise risks”? Diversification by investing in an additional fund house to minimise the risk if HDFC equity schemes continue not to deliver…I’m thinking aloud 🙂

Yes Kapil you are right. Thanks for thinking aloud (my blog articles are also thinking aloud)

That is what many experts are suggesting also. Catch is because of this diversification one at times end up having many mutual funds and it becomes difficult to track then. If total number of funds are around 6-8 then one should do it.

So which fund would you consider investing in if not HDFC fund?

If it has to be large cap and diversified in order to form the core portfolio, what do you think of Quantum Long Term Equity and FT India Bluechip? (Ofcourse, these could be in addition to HDFC Equity and HDFC Top 200.) So, you still have only 4 equity schemes in the portfolio.

In addition, add a midcap like ICICI Pru Discovery.

So, totally you have 5-6 schemes (total monthly investment per month remains the same as before) but atleast you are not at the mercy of the two HDFC Funds if they continue to perform badly.

Now you have to track and handle 5-6 schemes but doesn’t the risk reduce because you have spread your investment across different schemes and different mutual fund houses? Thanks.

Core portfolio and 4 equity schemes seem a good idea. But what is the overlap in Quatum Long Term Equity, FT India bluechip and HDFC funds one needs to see. ICICI Pru fund is also doing well.

Yes risk reduces by diversifying so instead of say putting 10,000 in HDFC Equity you put 5000 in HDFC Equity and 5000 in Quantum. But if HDFC continues to do bad say for another 1 or 2 quarter one can stop SIP in HDFC Equity and either move to Quantum or start inn FT India bluechip?

How long have u been investing and how do you invest directly or through online platforms or through distributors

Dear Kirti, I have been on and off SIPs for the last 6 to 7 years. I have had most number of SIPs in Fidelity Equity Fund; I got out of it when L&T AMC took it over. The second most number of SIPs I have had is in HDFC Equity Fund. Kindly note I’m saying “number of SIPs” is because I have not invested consistently and continuously (which is really bad).

I was investing in SIPs through ICICI Direct (online trading) but since around February 2013, I have been investing entirely in the direct plans (no distributors). Thanks.

HDFC EQUITY – SIP

1st Jan 2010 – 31 Dec 2010 : 2.37%

1st Jan 2011 – 31 Dec 2011 : 1.45%

1st Jan 2012 – 31 Dec 2012 : 5.74%

1st Jan 2013 – 30 Sep 2013 : 1.67%

I took the data from Value research online for the above data points. The returns % might vary depending on the data points that we take but this should give us a general picture of the fund’s performance.

I started investing in this fund since 2010, hence I took data points from that period onwards. This fund has not been performing as expected since last 4 years now. The credibility of the fund manager is the only reason why I stuck to this fund for this long.Do you think its time to move on because there are funds that delivered above 10% during this period and we are already at loss since this fund did not even give returns that equal to the inflation adjusted capital leave alone good returns.

Sindura many are in your position. it is a call that you have to take and it depends on various factors such as how much is your equity allocatio,how much is your investment in SIP in equity, in HDFC, how much time you have for it to turn around. Many of people I know have discontinued their SIP in HDFC and have started SIP in ICICI Pru Focussed Bluechip Fund., Quantam Equity fund but have not withdrawn their money from HDFC Top 200. But these people have a time frame of 5 years more and invest around 5000 to 10,000 in SIP every month.

So what do you intend to do?

Hi Kirti, I am all for equity allocation, 90% of my savings go into equity and I am investing for super long term and have no intention of withdrawing the money. I also invest in BSL Frontline Equity Plan A and ICICI PRU Discovery funds.My only hope with HDFC Equity is that somehow in long term the fund will catch up and that I will be in a safer place.But, as you mentioned in your response to Mr.Kapil, I am really not sure how long should I wait to understand that this particular fund is never going to get back to its previous performance levels, or will it?, thats the confusion that I have in my mind right now.

Sometimes I think about discontinuing SIP for a while in HDFC Equity, but again I think this is the right time to pick the stocks at lower prices and only if we continue SIPs now will we gain from the SIPs later when the fund does well.so lots of thoughts crossing my mind but still not sure about what needs to be done.

PS: I invest 4k per month in HDFC Equity.

Sindura difficult question to answer and depends a lot on personal assets allocation, age, risk capability.

Regarding HDFC funds how long have you been investing? I have been investing for 3 years now and have given it a time limit till Dec.

If I don’t sign of improving I shall stop my SIP. If things don’t improve till Mar 2014 I shall withdraw my money.

Hi Kirti, I have been investing since early 2010.

HDFC EQUITY – SIP

1st Jan 2010 – 31 Dec 2010 : 2.37%

1st Jan 2011 – 31 Dec 2011 : 1.45%

1st Jan 2012 – 31 Dec 2012 : 5.74%

1st Jan 2013 – 30 Sep 2013 : 1.67%

I took the data from Value research online for the above data points. The returns % might vary depending on the data points that we take but this should give us a general picture of the fund’s performance.

I started investing in this fund since 2010, hence I took data points from that period onwards. This fund has not been performing as expected since last 4 years now. The credibility of the fund manager is the only reason why I stuck to this fund for this long.Do you think its time to move on because there are funds that delivered above 10% during this period and we are already at loss since this fund did not even give returns that equal to the inflation adjusted capital leave alone good returns.

Sindura many are in your position. it is a call that you have to take and it depends on various factors such as how much is your equity allocatio,how much is your investment in SIP in equity, in HDFC, how much time you have for it to turn around. Many of people I know have discontinued their SIP in HDFC and have started SIP in ICICI Pru Focussed Bluechip Fund., Quantam Equity fund but have not withdrawn their money from HDFC Top 200. But these people have a time frame of 5 years more and invest around 5000 to 10,000 in SIP every month.

So what do you intend to do?

Hi Kirti, I am all for equity allocation, 90% of my savings go into equity and I am investing for super long term and have no intention of withdrawing the money. I also invest in BSL Frontline Equity Plan A and ICICI PRU Discovery funds.My only hope with HDFC Equity is that somehow in long term the fund will catch up and that I will be in a safer place.But, as you mentioned in your response to Mr.Kapil, I am really not sure how long should I wait to understand that this particular fund is never going to get back to its previous performance levels, or will it?, thats the confusion that I have in my mind right now.

Sometimes I think about discontinuing SIP for a while in HDFC Equity, but again I think this is the right time to pick the stocks at lower prices and only if we continue SIPs now will we gain from the SIPs later when the fund does well.so lots of thoughts crossing my mind but still not sure about what needs to be done.

PS: I invest 4k per month in HDFC Equity.

Sindura difficult question to answer and depends a lot on personal assets allocation, age, risk capability.

Regarding HDFC funds how long have you been investing? I have been investing for 3 years now and have given it a time limit till Dec.

If I don’t sign of improving I shall stop my SIP. If things don’t improve till Mar 2014 I shall withdraw my money.

Hi Kirti, I have been investing since early 2010.

Hi, I understand that you have invested in HDFC Top 200 for the next 5 years. You will track the performance for another quarter. If the performance is not okay, will you just stop the SIP or withdraw your money and reinvest in another MF equity scheme?

When you say you have invested for 5 years, does it mean, you will stay invested in HDFC Top 200 for 5 years irrespective of the performance of the scheme in the short term? Maximum action you will take is to stop your SIP?

And again in the future, when the scheme begins to perform well once again, will you re-start your SIP?

Thanks.

Kapil yes as of now what I think is that if in another quarter the performance does not improve, I will stop my SIP. After Dec quarter I shall review the decision of what to do with my invested money.Anything else I will decide later. No I want to invest in Equity Mutual fund for next 5 years but being tied to HDFC fund is not sure.

Kapil have you also invested in HDFC funds? If yes for how long?

Hi, I understand that you have invested in HDFC Top 200 for the next 5 years. You will track the performance for another quarter. If the performance is not okay, will you just stop the SIP or withdraw your money and reinvest in another MF equity scheme?

When you say you have invested for 5 years, does it mean, you will stay invested in HDFC Top 200 for 5 years irrespective of the performance of the scheme in the short term? Maximum action you will take is to stop your SIP?

And again in the future, when the scheme begins to perform well once again, will you re-start your SIP?

Thanks.

Kapil yes as of now what I think is that if in another quarter the performance does not improve, I will stop my SIP. After Dec quarter I shall review the decision of what to do with my invested money.Anything else I will decide later. No I want to invest in Equity Mutual fund for next 5 years but being tied to HDFC fund is not sure.

Kapil have you also invested in HDFC funds? If yes for how long?