People say that none can avoid death or taxes. But it seems a large number of Indians do know how to avoid taxes. Only 3% of Indians pay income tax, in a population of more than One Billion pay taxes. This article tries to answer the question how many Indians pay Income tax and how many eFile their Income Tax Returns. It looks at the data made public by the Government , analyse the data. Sadly the data hasn’t changed over the years!

Salary-earners pay highest per cent of income in taxes, get little in return and see their tax rupee get used for votes

Social equity in India means that a clerk earning Rs 6,000 each month in Mumbai must pay income tax but a strawberry farmer in Punjab’s Gurdaspur netting Rs 1.5 lakh every month should enjoy tax-free status.

Table of Contents

How many Indians pay Income Tax

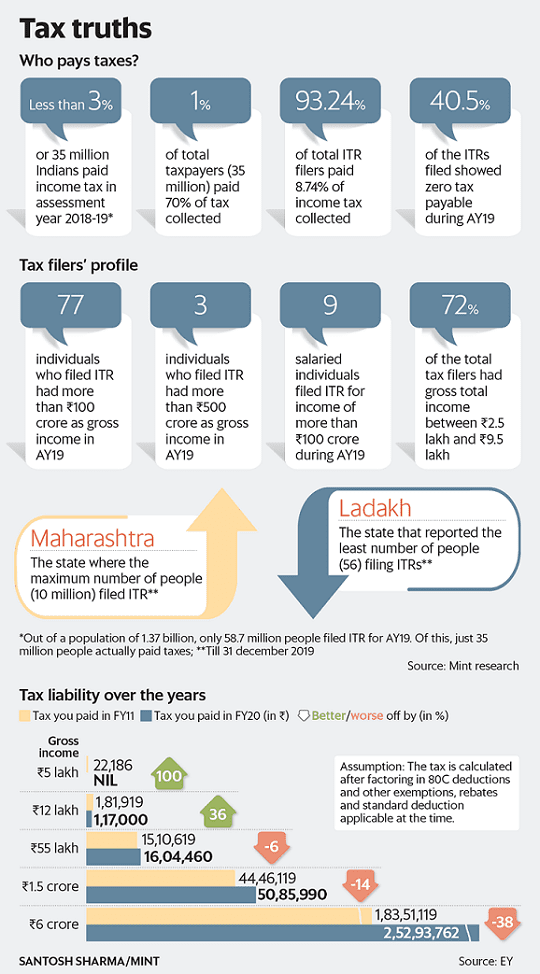

Less than 3% of Indians paid income tax in AY19. The average tax paid by these taxpayers was ₹2.3 lakh. Just 1% account for 70% of the total tax paid, indicating that high-income earners contribute to the bulk of taxes paid.

In the last 15 years, the number of people filing tax returns has grown four times faster than the number of taxpayers. A large section of these ‘filers-but-not-payers’ is non-salary income earners. In fact, as a percentage of population, number of income taxpayers has been falling indicating, among other things, even heavier burden on the salaried class.

Nearly 72% of the total ITR filed in AY19 had gross total income between ₹2.5 lakh and ₹9.5 lakh. Over the past 10 years, the tax incidence on this income band has gone down, whereas it has gone up for high-income earners.

PM Narendar Modi on 1.5 crore Indian’s paying tax

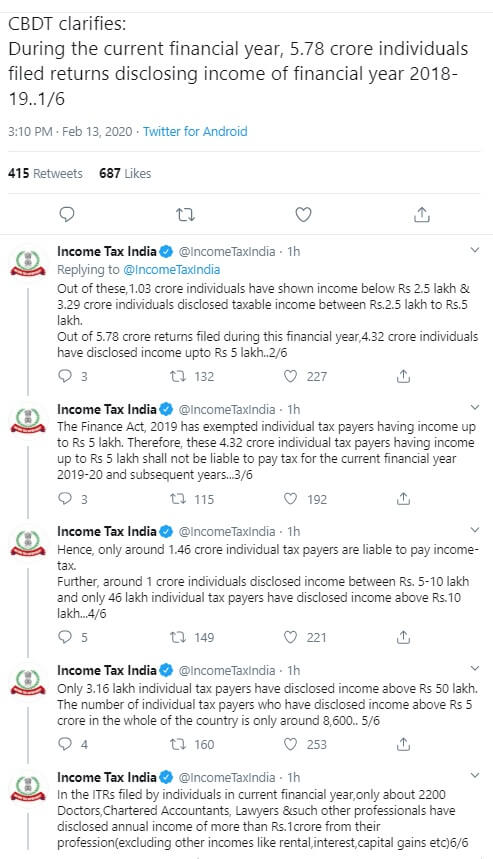

In the last five years, over 1.5 crore cars were sold in India – that too expensive ones. Over three crore Indians went abroad for business or tourism. But in a country of 130 crore people, only 1.5 crore people pay income tax. Those persons declaring an annual income of Rs 50 lakh is just three lakh. We have so many professionals – big doctors, lawyers, chartered accountants, etc. But only 2,200 professionals declare their annual income of over Rs 1 crore. Just 2,200 professionals! There would be more like this in the Supreme Court itself.

Income Tax Department explanation on the number of Taxpayers in India

Salaried Class suffers

How much tax you pay on income depends less on how much you earn and more on how much you can hide – or show income as non-taxable. The salary-earning class is the most disadvantaged because 100% of income tax is taken away even before the salary reaches them. It is also not allowed certain tax-free expenses that non-salary earners are allowed.

The 2018-19 budget speech noted that an average salary earner pays three times more income tax (Rs 76,306) than a non-salaried taxpayer (Rs 25,753). If non-salary income earners pay even 70% of what the salaried class pays government earnings would go up by Rs 50,000 crore a year. Finance ministers down the years have failed to correct this anomaly, surrendering to a system that penalises the honest.

Income tax payers are forced to pay for clean water, breathable air, private security and – now increasingly – road use in the form of toll. The majority of salary earners are in the private sector, and the tax they pay doesn’t entitle them to pension, unemployment support or post-retirement healthcare. The income tax for this class of people is increasingly becoming a forced charity, alienating them from the state. In India. Public education – from school to college – and public healthcare have disappeared from the lives of the urban middle class. Private expenditure on education and health in India is one of the highest in the world – this is in a country where the richest 10% of the population is poorer than the US’s poorest 10%.

Farmers, even the richest of them, enjoy tax free income. This leads to rampant leakages – an RTI query revealed that in 2012 over 8 lakh individuals declared agriculture income running into crores and paid zero tax on it. Several government panels have advocated taxing agriculture income, but clarity without courage is wasted wisdom.

Lawyers, doctors and coaching centres among the most profitable and fast-growing professions – are exempt from service tax. Then there are MPs who enjoy privileges no taxpayer does – they decide their own salary, and tax on their income is not deducted at source. Much of their income is in the form of tax-free perks – 34 free flights a year with companion, free limitless first class train travel, free healthcare, rent-free house, Rs 20,000 monthly pension. None of this is to be grudged if MPs were to ensure that their paymasters – the taxpayers – are getting the basic services they are paying taxes for. But that is hardly the case.

One possible reason income taxpayers are uncared for is that they don’t matter as voters. Only 7% of Indian voters pay income tax

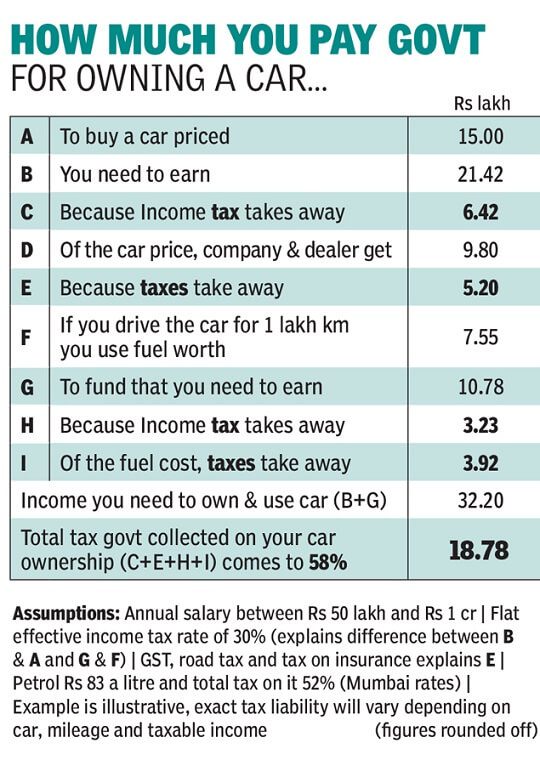

Buyer of a mid-level car in India has to pay 58% of his total expenses to the government

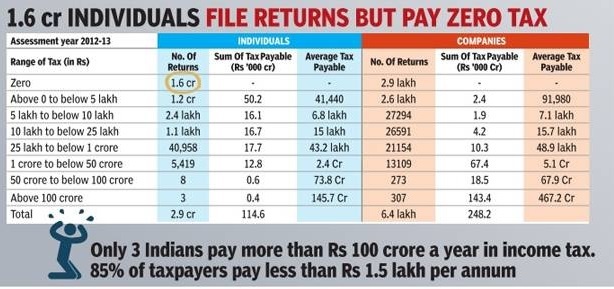

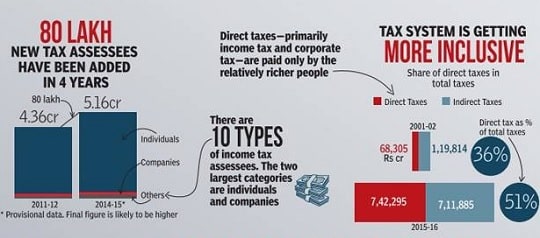

As part of a transparency drive, the government has made public direct tax data for last 15 years. Data for individuals has been published only for 2012-13 assessment year, which shows taxes for income in financial year ended March 31, 2012. A total of 2.9 crore individuals filed income tax returns for that year, Only 3 individuals paid tax of over Rs 100 crore, while 63 companies had tax bills of over Rs 500 crore in AY 2012-13. The number of effective assesses has increased to 5.17 crore in assessment year FY15 from 4.36 crore in 2011-12. The number is based on income-tax returns plus number of cases where tax has been deducted at source. You can find the details of Income Tax Data at following locations. The image below shows returns filed by individuals and companies.

- Income Tax Department Time Series Data Financial Year 2000-01 to 2014-15

- Income Tax Department PAN Allotment Statistics Financial Year 2013-14

- Income Tax Department Income Tax Return Statistics Assessment Year 2012-13

Why only 3% of Indians pay income tax, in a population of 1.2 billion. One explanation for this is that agriculture is exempt and two-thirds of Indians live in rural areas. A large chunk of the economy is also informal, unorganised labour, for which it’s harder to collect taxes. Those who earn Rs 21,000 and more (per month) have to pay taxes, but many small businesses, professionals (such as doctors and lawyers) and rich farmers do not pay taxes. The number of people who declare annual income of over Rs 1 crore is abysmally low at just around 50,000 in the country.

- 60% of population is not part of workforce

- 25% of the workforce are farmers who don’t have to pay tax

- 76% of rest of the workforce earns less than 2.5 lakh per annum who don’t have to pay tax

- 50% of the tax payers evade tax

- Only 3 out of every indian pays Income

The government has been taking measures to address this issue by proposing to deduct tax at source, using analytics to identify taxpayers and making PAN number mandatory.

How different is Income Tax Collection in India from other countries?

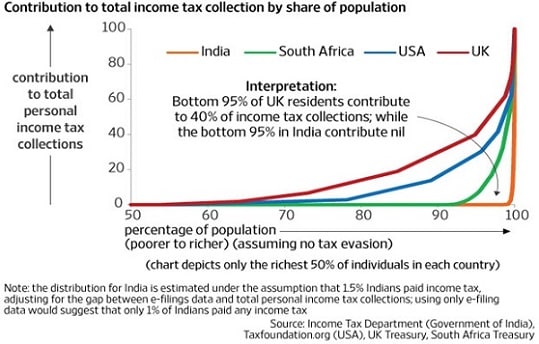

The image below Livemint compares Income tax collection in India with that in USA, UK and South Africa. n the US, around 45% of residents pay income tax, while in South Africa it is around 10%—way more than India’s tax base of around 1-1.5%.Do note that the proportion of population that pays income tax is much higher in three other countries that have been taken for comparison—the US, the UK and South Africa. The shape of the curve of cumulative tax contributions is much more skewed in case of India, showing that only a very tiny fraction of the population contributes to almost all of India’s income tax collections.

Direct Taxes contribution to Total Tax

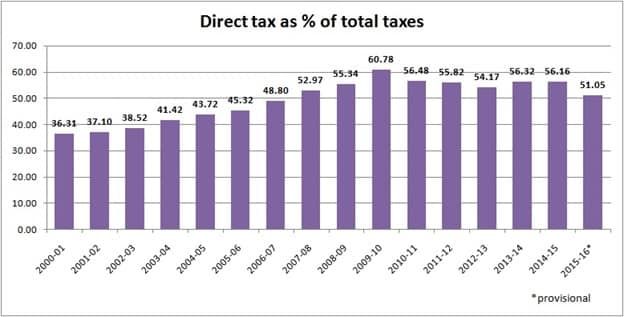

Direct taxes primarily income tax and corporate tax is increasing as shown in image below. Direct taxes made up for 36.31% of the total taxes in 2000-01 and the ratio has risen to 51% in 2015-16.

Share of direct taxes to GDP touched a high of 6.3% in 2007-08 and has since declined to 5.47% in 2015-16. It was 3.25% in 2000-01. The image below shows the Percentage that Direct Taxes are contributing to total tax.

States and Income Tax

If we look at the tax collection state-wise, then we see that Just two states pay 53% of India’s total income tax. Maharashtra had the biggest share in direct taxes at RRs 2.77 lakh crore in 2014-15 when total collections were Rs 6.96 lakh crore. DELHI was second biggest contributor at Rs 91,248 crore followed by Karnataka. Delhi, a half state, generates more income tax than Gujarat, Punjab, Haryana and UP combined. The following image shows Income Tax collection state wise.

How many Indians efile their Income Tax Returns

A significantly large number of returns are e-filed and gradually the income tax department is hoping to bring all returns online. The Central Board of Director Taxes (CBDT) and Central Board of Excise and Customs (CBEC) are making optimum use of technology for expeditious disposal of assessment and refunds as well as for addressing the issues relating to custom clearance and facilitating trade among others. It is compulsory to e-file your Income Tax Return if .

- you have to claim a refund

- Your gross total income is more than Rs 5,00,000

- You want to claim an income tax refund. Those who are over 80 years old and are filing ITR-1 or ITR-2 can still file a paper return to claim a refund.

- ITR-3, 4, 5, 6, 7 have to be mandatorily e-filed.

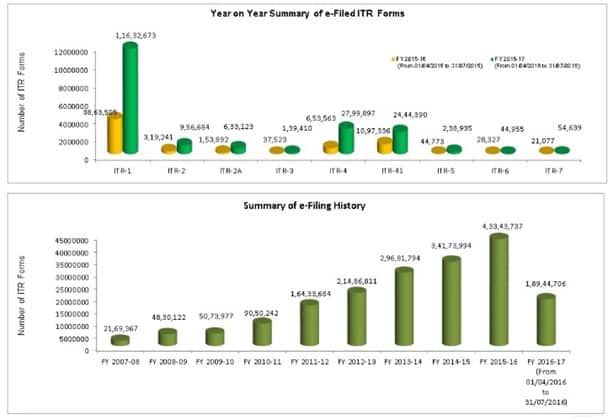

In Aug 2016, CBDT released Income Tax e filing Statistics which reveals surging growth in electronic filing of Income-tax returns during FY 2016-17.

- 98 lakh e-returns had been filed in FY 2016-17 as compared to 70.97 lakh for the same period in FY 2015-16. In 2015-16, more than 94% of income tax returns were filed online and 4.14 crore returns were processed by the Central Processing Centre (CPC), Bengaluru, without any human intervention.

- Tax refunds of Rs 14,332 crore have been issued this year till August 5 2016. The Central Processing Centre (CPC) Bengaluru has already issued over 54.35 lakh refunds totaling to Rs 14,332 crore which includes 20.81 lakh refunds for AY 2016-17 (current year returns) totaling to Rs 2,922 crore till August 5, 2016,

- During FY 2015-16, more than 2.10 crore refunds amounting to Rs 1,22,425 crore were paid compared to Rs 1,12,188 crore in the Financial Year 2014-15 and Rs 89,664 crore in the Financial Year 2013-14,

- Aadhar based e-verification was used by 17.68 lakh taxpayers during the current year as against 10.41 lakh taxpayers during the same period in 2015-16

- 32 lakh income tax returns were digitally signed

The Statistics from income tax e filing websites on How many income tax returns have been efiled over years and type of ITRs that are filed are as follows

Reference : Times of India , First Post

Related Articles:

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

- Understanding Income Tax Notice under section 143(1)

- Income Tax Notice :Sections,What to check,How to reply

- How to Revise Income Tax Return (ITR)

- Compliance Income Tax Return Filing Notice

- Notice for Adjusting Refund Against Outstanding Tax Demand, Section 245

- Defective return notice under section 139(9)

[poll id=”90″]

When the government is unable to tax people, it starts to tax goods and services and resorts to levying additional cess on such taxes whenever it needs revenue. The income tax department shows why widening the income tax net is important to tackle this trend of increasingly regressive taxation. Do you feel you are paying more income tax? What suggestions you have for Government to increase the tax collection.

Government should explore better methods than filing returns and processing them for tax collection.

TDS should be replaced by deduction at the hands of the receiver. It will save companies and others huge money spent on compliance of tax liability of others.

Instead the AS26 should be fine tuned to assess the income based on receipts in bank accounts and the assessee allowed to pay tax after making required adjustments. This will also remove all hassles of mismatch.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2495527

अगर किसी व्यक्ति की accidental death होती है और वह व्यक्ति पिछले तीन साल से लगातार इनकम टैक्स रिटर्न फ़ाइल कर रहा था तो उसकी पिछले तीन साल की एवरेज सालाना इनकम की दस गुना राशि उस व्यक्ति के परिवार को देने के लिए सरकार बाध्य है । सही सरकारी नियम है ?

Is this true ??

No

I also don’t aware of this.

If this is the rule, it should be informed to all…..