Since Demonetization many rumours have been making rounds such as that all gold jewellery including ancestral jewellery shall be heavily taxed. Government said that during search operations, conducted by Income Tax Department, there would be no seizure of gold jewellery and ornaments to the extent of 500 grams per married women, 250 grams per unmarried women as also 100 grams per male member of the family. The Bill has not introduced any new provision regarding chargeability of tax on jewellery. This article discusses Income Tax Law on gold jewellery,Income Tax Raids or search and seizure and how much Gold can you keep and whether Gold in your locker, your house is safe.

Table of Contents

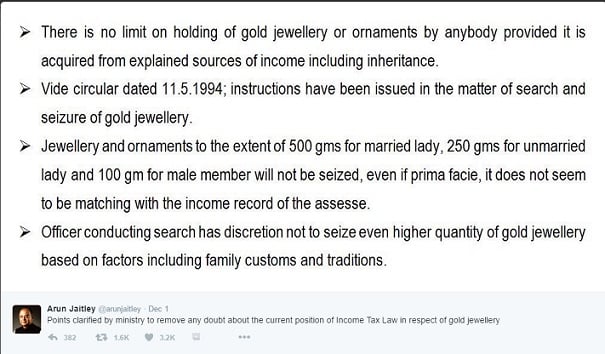

How much Gold can you keep : Finance Ministry clarifications

Demonetisation came as a rude shock to many. The Lok Sabha on 29 Nov 2016 passed the Taxation Laws (Second Amendment) Bill, which proposes a steep up to 85 per cent tax and penalty on undisclosed wealth that is discovered by tax authorities during search and seizure.

Dispelling rumours that jewellery would be covered under the amended law, the Central Board of Direct Taxes (CBDT) said the government has not introduced any new provision regarding chargeability of tax on jewellery. The government has often clarified that only unaccounted money or black money hoarders have reasons to be concerned after the amendments. It clarified that the jewellery/gold purchased out of disclosed income or out of exempted income like agricultural income or out of reasonable household savings or legally inherited which has been acquired out of explained sources is neither chargeable to tax under the existing provisions nor under the proposed amended provisions.

Points clarified by Finance ministry to remove doubts about the current position of Income Tax Law in respect of gold jewellery from Twitter are shown in image below. Hence the rumour that the jewellery with the household which is acquired out of disclosed sources or exempted income shall become taxable under the proposed amendment is totally unfounded and baseless. There is no rule for opening of Gold Lockers unless Government suspects you of holding black money and conducts Income Tax raid or Search and Seizure operation.

Why the panic on Gold?

- to increase financial inclusion, the government came out with the Pradhan Mantri Jan-Dhan Yojana in August 2014. As of now, the total number of Jan-Dhan accounts is close to 26 crore.

- Next step was the amnesty scheme for black money hoarders (i.e.Voluntary Disclosure of Income Scheme or VDIS) with only 45% tax that ended on September 30 2016.

- Now, government has introduced one more amnesty scheme with harsher measures.

Prime Minister Modi also mentioned that he has more tough plans in his mind and will implant it in future if needed. The government has often clarified that only unaccounted money or black money hoarders have reasons to be concerned after the amendments. Will it be a Gold or Real estate surgical strike ? Many people feel that since real estate and gold are the other places where people hoard black money, the government is expected to switch focus to them now. India’s gold hoard is estimated to be 20,000 tonnes and at current market price, this works out to be a massive Rs 60 lakh crore – four times the total value of the withdrawn Rs 500 and Rs 1,000 notes. We are not saying that the entire gold hoard is black money, but just like the withdrawn notes, a part of it will be black money.

Sometime back there was rumour about e-registration of property.

About the New Income Tax Bill for Undisclosed Income

The Bill was brought in as a Money Bill requiring consent of Lok Sabha alone. On 29 Nov 2016 amid a din, the bill which seeks to tax money deposited in banks post demonetisation was passed in the Lok Sabha within minutes without any debate. The Bill, which is currently under consideration of the Rajya Sabha, will amend Section 115BBE of the Income Tax Act to provide for a steep 60 per cent tax and a 25 per cent surcharge on it (total 75 per cent) for black money holders. So as per bill, discussed in our article, Tax on Undisclosed Income and Pradhan Mantri Garib Kalyan Yojana 2016 One who declared his undisclosed income under the Pradhan Mantri Garib Kalyan Yojana 2016 shall be required to pay

- tax @ 30% of the undisclosed income,

- penalty @10% of the undisclosed income.

- Further, a surcharge to be called Pradhan Mantri Garib Kalyan Cess @33% of tax is also proposed to be levied.

- totalling to approximately 50%

- In addition to tax, surcharge and penalty (totalling to approximately 50%), the declarant shall have to deposit 25% of undisclosed income in a Deposit Scheme to be notified by the RBI under the ‘Pradhan Mantri Garib Kalyan Deposit Scheme, 2016’. No interest will be paid to the owner for this. After four years the owner can reclaim his money (25%)

The Bill only seeks to enhance the applicable tax rate under section 115BBE of the Income-tax Act, 1961 which provides rate of tax to be charged in case of unexplained investment in assets. The chargeability of these assets as income is governed by the provisions of section 69, 69A & 69B which are part of the Act since 1960s. The Bill does not seek to amend the provisions of these sections. Tax rate under section 115BBE is proposed to be increased only for unexplained income as there were reports that the tax evaders are trying to include their undisclosed income in the return of income as business income or income from other sources. The provisions of section 115BBE apply mainly in those cases where assets or cash etc. are sought to be declared as ‘unexplained cash or asset’ or where it is hidden as unsubstantiated business income, and the Assessing Officer detects it as such.

Tax on Undisclosed income is detected in search conducted after Presidential assent to Bill

| Particulars | Existing Provisions | Proposed Provisions |

| General provision for Penalty | Under-reporting –50% of tax Misreporting – 200% of tax. | No changes proposed. |

| Provisions for taxation & penalty of unexplained credit, investment, cash and other assets. | Tax (Section 115BBE)-Flat tax Rate of 30% + Surcharge + Cess (No expense, deductions and set-off is allowed) | Income Tax (Section 115BBE) – Flat tax rate of 60% + Surcharge of 25% of tax(i.e. 15% of such income). So total tax impose 75%. (No expense, deductions and set-off is allowed)Penalty (Section 271 AAC) if Assessing officer determines income referred to in section 115BBE, penalty @ 10% of tax payable in addition to tax (including surcharge) of 75%. |

| Penalty for search seizure cases | Penalty (271 AAB)(i) 10% of Income, if admitted, returned and taxes are paid.(ii) (ii) 20% of Income, if not admitted but returned and taxes are paid.

(iii) 60% of Income in any other case. |

Penalty (271 AAB)(i) 30% of Income, if admitted returned and taxes are paid.(ii) 60% of Income in any other case. |

Search and seizure operations, Income Tax Raids

- Search operations are carried out by a team of members from investigation wing and usually it takes place in the morning.

- The search team carries a search warrant with it for verification.

- The search team usually cover all the business premises of the assessee (in India) and the residential premises of the important and key persons of the assessee like the partners of the assessee firm; directors of the company etc. and can extend upto 2-3 days.

- It may also cover residential premises of close relatives, friends, business associates etc.

- The search team usually checks cash, stock, Jewellery, other assets, books of accounts, loose papers.

- Government has clarified during search operations, conducted by Income Tax Department, there would be no seizure of gold jewellery and ornaments to the extent of 500 grams per married women, 250 gm per unmarried women as also 100 gm per male member of the family.

- Besides the checking of records the search team records statements of personnel, management and at times questions any person present at the searched premises, which may include even visitors, customers and guests. Search team generally does not allow use of telephones and mobiles during raids.

Status of Income Tax Raid

- During 2015-16, the Income Tax Department conducted 445 searches which discovered undisclosed income of Rs 11,066 crore. Total assets seized were Rs 712.68 crore.

- Also 545 searches conducted in 2014-15 have led to admission of undisclosed income worth Rs 10,288 crore. Total assets seized amounted to Rs 761.70 crore.

- Besides, 569 searches in 2013-14 saw admission of undisclosed income of Rs 10,791.63 crore and asset seizure of Rs 807.84 crore.

- This took the total undisclosed income which was admitted during searches to Rs 32,146 crore.

Related articles:

- How to declare Unaccounted Cash in Demonetized Notes Options and Tax

- Tax on Undisclosed Income and Pradhan Mantri Garib Kalyan Yojana 2016

- Tax and penalty on Cash Deposit due to Demonetization

- Giving Cash and Deposit money into Bank Accounts and Tax on Gifts

- Transactions reported to Income Tax Department

- Black Money : What is Benami Property and Benami Act?

- How to Exchange Rs 500 and Rs 1000 Notes ?

- New Rs 500 and Rs 2000 notes : Features,Comparison

The government has often clarified that only unaccounted money or black money hoarders have reasons to be concerned after the amendments. If you have income or Gold which you can explain then there is no tension. And Govt is not going to open Lockers. At least not yet!