When it comes to loans, paying the last Equated Monthly Installment (EMI) does not mean that loan is closed. To ensure that the loan is fully closed you need to take few steps. Lets look at steps necessary to close a car loan.

Table of Contents

Formalities to be observed for closure of Loans

It is a common misconception that once the loan is repaid or pre-closed, the borrower’s obligation is over. One needs to through formalities on closing a loan. These vary depending on the loan type.

- First step in closing any loan is to take No Dues Certificate (NDC) or No Du from the lender. Banks issue a No Due Certificate (NDC) or Closure Letter while closing loans stating that the loan stands closed. In fact, if the borrower does not have a No Dues Certificate (NDC) or No Objection Certificate (NOC) or Closure Letter from the lender, they cannot prove that they are free of obligation.

- For Personal, credit card and other loans: The procedure of closure ends with obtaining the Closure Letter (or NDC) and unused cheque leaves, if any.

- For Home Loan one needs to update the Encumbrance Certificate (EC) by removing the mortgage. An EC is evidence that the property is free from any monetary and legal liabilities, and that the property can be sold as a free title. Also, recover all important documents that were submitted to the lender at the time of availing the loan.

- Loan against property: The procedures here are the same as that of a home loan. If it is a registered mortgage, re-registering of the property is required.

- Car loan: When you buy a car on a loan, the car is hypothecated to the lender. You have to approach the regional transport office (RTO) for getting this hypothecation removed. You have update the RC book/RC card at the RTO and the auto insurance (from the insurance company) by removing the hypothecation.

After closing any loan, it is a good idea to know the credit score, to ensure that there are no errors. This is not mandatory, but recommended. For instance, while closing out a home loan, the individual can request the bank or the housing finance company to inform CIBIL about his or her loan closure. This could take about 30 days. Once the bank informs you that the CIBIL database has been updated, you can directly approach CIBIL for the updated credit score.

What are Secured and Unsecured Loans? What is Hypothecation?

There are basically two kinds of loans : Secured and Unsecured Loans.

When you take out a secured loan, you provide something of value that you own, like your car, home, or other valuable personal property, called collateral, to lender. The lender holds the title or deed to the collateral or places a lien on the collateral until you pay the loan off in full. If you do not repay the loan, the lender has the right to take possession of the collateral and use the proceeds of the sale to recover the outstanding debt. A car loan, home loan or mortgage are the most common types of secured loan. Because collateral offers some security to the lender in case the borrower fails to pay back the loan, loans that are secured by collateral typically have lower interest rates than unsecured loans. A lender’s claim to a borrower’s collateral is called a lien. Hypothecation is the practice of a borrower offering an asset as collateral for a loan, while retaining ownership of the assets and enjoying the benefits . The debtor, usually does not have to turn over physical custody of the collateral although the lender is “hypothetically” in control of the collateral. If you default, the lender will seize control of the collateral.

An unsecured loan is not protected by any collateral. An unsecured loan is a loan that is issued and supported only by the borrower’s creditworthiness. If you default on the loan, the lender can’t automatically take your asset. The most common types of unsecured loan are credit cards, student loans, and personal loans.

Car Loan and Hypothecation

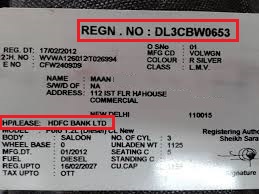

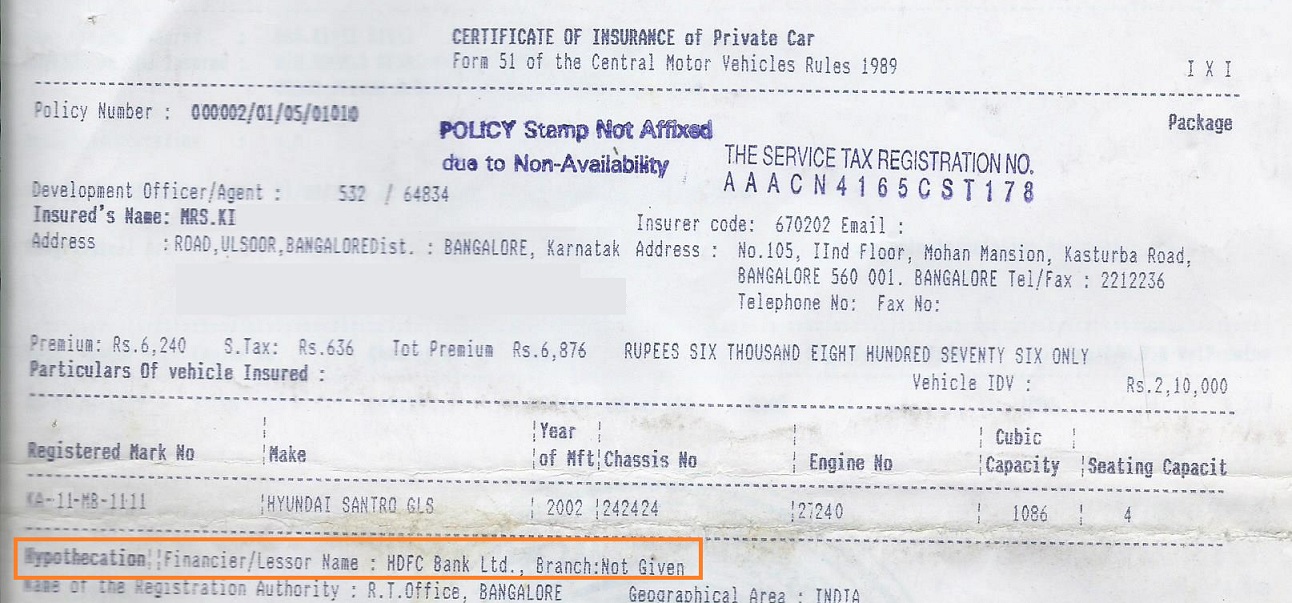

When you buy a car via a loan, the car is hypothecated to the lender. The hypothecation is an endorsement in your car’s registration book , since the vehicle is in the lender’s name for example a bank, the bank’s name will be endorsed on the registration certificate (RC). Though the Car or Vehicle remains with the borrower but is hypothecated to the bank / financer. If borrower, defaults i.e. does not pay the EMI, banks can take possession of the vehicle after giving notice. Banks can then sell the same and credit the proceeds to the loan account. Following images show the hypothecation in the Registration Card and Insurance papers.

What is difference between Lien, Pledge, Hypothecation, Mortgage?

Terms like Lien, Plegde, Hypothecation, Mortgage are used when one takes a secured loan. Lets look at the difference between Lien, Pledge, Hypothecation, Mortgage

Loan is when someone gives you money and you promise to pay it back.

Lien is a legal claim by lender on the asset of borrower as security for payment of a debt. For sale of the asset lien holder must approve any transfer of ownership. For example Customers having savings Bank Accounts need to maintain stipulated minimum balance in their accounts . If they fail to maintain minimum balance the bank will charge minimum balance charges. When minimum balance charges are run, if sufficient balance does not exist in the accounts, charges are not debited to the respective customers account but a lien for amount is marked for the accounts for which charges are pending. The system will note a lien on this amount and allow withdrawals only on the balance amount available in the account after excluding the lien amount.

Pledge is used when the lender takes actual possession of assets ex gold, National Saving Certificates. The lender retains the possession of the goods until the borrower repays the entire debt amount. If borrower cannot pay back the loan, ie there is default by the borrower, the lender has a right to sell the goods in his possession and adjust its proceeds towards the amount due , the principal and interest amount. Lender is called the pledgee and borrow is called pledgor. Some examples of pledge are Gold /Jewellery Loans, Advance against goods,/stock, Advances against National Saving Certificates etc. Pledge is used for movable assets.

Mortgage is used for creating charge against immovable property which includes land, buildings or anything that is attached to the earth or permanently fastened to anything attached to the earth . It does not include growing crops or grass as they can be easily detached from the earth. An example of when mortage is created is when someone takes a Home Loan. In this case house is mortgaged in favour of the financier but remains in possession of the borrower. The Borrower can use for himself or even may give on rent.

Closing a Car Loan

- You will have to pay prepayment penalty if you close your the car loan before the end of the loan tenure. Prepayment fee of 2% is what banks usually charge on the principal outstanding or the amount you want to prepay. Get all the cancelled post-dated checks that you had issued to the bank/finance company when you took the loan.

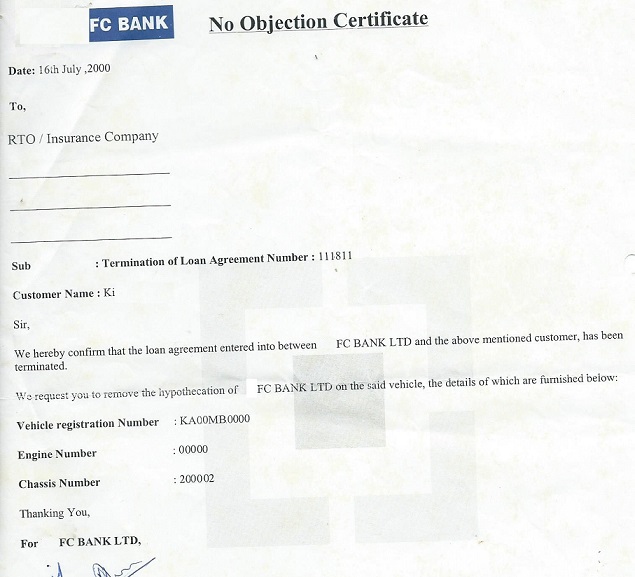

- Get the No Objection Certificates (NOC) or No Due Certificate which means that the bank has no objection to removing the hypothecation. Note that the bank NOC is generally valid only for 3 months or 90 days. You must submit your application to the RTO, before the NOC’s expiration. The process of collecting documents from the bank is very tedious especially from a public sector bank.

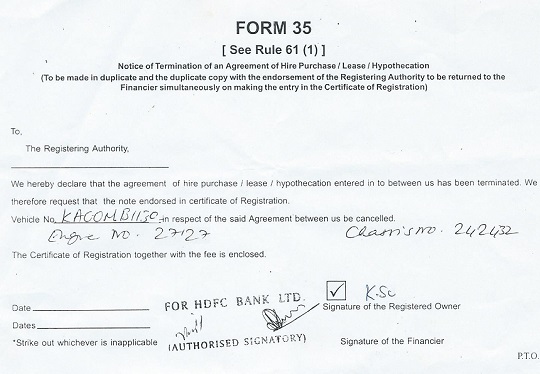

- 2 copies of Form 35 which will mention the termination of the hypothecation agreement between you and the bank, shown in the image below.

- Get the hypothecation/lien registered in the RC Book cancelled at the Regional Transport Office (RTO) where your vehicle has been registered.

- Get hypothecation removed from your insurance. You will have to submit a copy of the No Dues certificate, Form 35 received from the bank to the insurance company that covers your car for comprehensive insurance so that the hypothecation is removed from their books also.

Visit Bank to get No Objection Certification, Form 35

Lenders such as Bank issue a No Due Certificate (NDC) or No Objection Certificate (NOC) or Closure Letter and Form 35 while closing loans stating that the loan stands closed. In fact, if the borrower does not have a No Dues Certificate (NDC)or No Objection Certificate (NOC) or Closure Letter from the lender, they cannot prove that they are free of obligation. So please retain the No Dues Certificate

- It is a legal proof for closure of a loan

- It is required for endorsing property documents (in case of a home loan) and vehicle documents (in case of a car loan)

- It is required to be produced in case of any possible disputes with the bank in future

- It is required for filing claim with the insurance company

- If there are any errors in the credit report, the NDC can be used to get the errors rectified

- For selling a property or car, this needs to be handed over to the seller if he is taking the loan

Getting Hypothecation Removed from RC

Since the vehicle is in the bank’s name, the latter’s name was endorsed on the registration certificate (RC), and you will need to change this after closure of the car loan. Update the RC book at the RTO and the auto insurance (from the insurance company) by removing the hypothecation. Hypothecation is a practice where a borrower pledges collateral, in case of car loan, car to secure a debt. While the borrower retains ownership of the collateral, the creditor has the right to seize possession if the borrower defaults.

Get the hypothecation/lien registered in the RC Book cancelled at the Regional Transport Office (RTO) where your vehicle has been registered. You need following documents when you approach RTO. The application along with documents need to be submitted at Registration Section. Karnataka RTO says Deliver of Documents between Same day between 4:30pm and 5:30 pm, but in many cases you may be asked to at specified date or asked to submit an self addressed envelope with stamps.(Easily available outside the RTO)

You could do it yourself or get it done through agent. Most of the RTOs are open on Sat (except 2nd Sat). The RTOs process have improved, there is a reception desk which tells you the process and which rooms to visit. But you still have to stand in queues for there are so many people. When I had gone in Feb 2016 to get my duplicate license in Bangalore, even those with agents had to stand in line to pay.

- Application form CMV 35 in Duplicate along with Confirmation letter from the financier.

- Registration Certificate (RC Book).

- Fitness Certificate in case of Transport vehicle.

- Tax Card.

- Insurance Certificate.

- Pollution Under Control Certificate or Emission Test Certificate.

- Fee Rs 100 (to be paid at RTO Cash Counter)

- Fee of Rs 200 for smart Card. (not sure about this)

- if you current address is different form the one in RC, you also need Form 33

Also carry

- Copy of PAN Card

- Copy of Address Proof

- And if you current address is different form the one in RC, you also need Form 33

Getting Hypothecation Removed from Insurance

Apart from the trip to the RTO, you will also need to get Hypothecation removed from your insurance papers . You will have to contact the Insurance company that covers your car for comprehensive insurance so that the hypothecation is removed from their books also. Not getting it done means the insurance money will not go to you but to the bank because of the hypothecation not being removed, in case of any accident.

Submit a copy of the No Dues certificate that you received from the bank to the insurance company.

Once all the due diligence is done, you will obviously receive written confirmation from the Insurance company that this has been done.

Selling a Car which still has Car Loan

A car can be sold even if taken on loan. As a seller – you need to do following:

- Get your loan repayment track record from Bank – which is called Loan SOA (Statement of Accounts)

- Get a Foreclosure Statement – though this may change a bit on date of sale, which you can obtain it again

Buyer will make split payments

First payment : will go to bank, for closure of loan (based on loan Fc statement on date of sale)

Second Payment : which is the balance payment (Car Value – Loan Prepayment Amount) will go to seller.

Bank will issue you a NOC Certificate, on closure

You can submit NOC along with Form 29,30 and Insurance copy along with Form 35 for effecting RC transfer in favour of buyer. Official transfer charges including new RC issuance is less than 1000 Rs.

Related Articles:

- Understanding Car : Box,Segment,Specifications

- Understanding Ex Showroom Price and On Road Price of Vehicle

- Cost of owning a Car

- What is Car Insurance

Anyone has had any experience on removing the hypothecation after closing down your car loan, good or bad, please share with others here.

How to get form 35 and NOC if my finance company is closed?

Will I be able to get an noc if I clear my vehicle loan but still the personal loan pending

dear sir

a insurance company ( the new india insurance co) demanding no due certificate and and form no 35 because, for sattlement of a claim, the insurance company giving undertaking that claim amount will remit to bank after sattlement of claim, today oustanding amount in the car loan is 2.50 lacs, kindly guide us can we give no due certificate and form no 35 to insurance company without closing loan account .

Hi,

I took a loan through a DSA informing him that I would like to buy a commercial cab. He said that he will give me the best deal. Later on, I came to know that the DSA has availed me the loan in name of private car. When I asked him, he said that I should not worry about it.

Now, as I am willing to sell the car, what should I do in that case? Could bank make any objection about the loan availed and if so, how could I overcome this whole mess? Will they overcharge me for the loan as the loan was taken for private car, but the car purchased was a commercial car?

Please suggest any solution. Loan was taken from HDFC bank.

Thanks for sharing this article

Some Informative Note:-

If you have taken a loan from the same bank, where you have your own savings account then you can also do an online transfer from your account to your car loan account and then reach bank with your all documents and close the loan as well. The process may take 1 hour if you have your all documents ready and collect NOC.

Or else you don’t have same bank saving account, then you need to give draft/check on the day you first visit the bank and once the amount is cleared then you need to visit the bank again to collect NOC.

Thanks for sharing this article

Some Informative Note:-

If you have taken a loan from the same bank, where you have your own savings account then you can also do an online transfer from your account to your car loan account and then reach bank with your all documents and close the loan as well. The process may take 1 hour if you have your all documents ready and collect NOC.

Or else you don’t have same bank saving account, then you need to give draft/check on the day you first visit the bank and once the amount is cleared then you need to visit the bank again to collect NOC.

Sir , I was looking for getting a car loan online but was unable to determine the best website for it. Can you please do a review of the best website to avail a car loan ?

Regards

Abhay

Sir , I was looking for getting a car loan online but was unable to determine the best website for it. Can you please do a review of the best website to avail a car loan ?

Regards

Abhay