Public Provident Fund (PPF) is a long-term, government-backed small savings scheme. Public Provident Fund is an ideal vehicle for long term investment in debt category, an important retirement saving tool for individuals, more so for those who are not salaried employees Our post Understanding Public Provident Fund, PPF explains in detail about the investment amount, interest rate, power of compounding, who can open, where can one open etc. In this article, we shall only focus on how to pay the PPF amount in different scenarios such as in Post Office, State Bank of India and related banks and online.

Table of Contents

Overview of Public Provident Fund

PPF comes under the PUBLIC PROVIDENT FUND ACT, 2019. On 12th December 2019, the Government of India notified the Public Provident Fund (PPF) Scheme, 2019 Features of PPF are as follows :

- PPF works on a financial year basis (April 1st – March 31st).

- The interest rate is 7.1% (Apr 2020)

- You need to deposit a minimum of Rs. 500 per year in a PPF account.

- The maximum amount which you can deposit in a PPF account is Rs. 1,50,000. (The earlier limit was Rs 70,000, it was increased to 1 lakh from 1.12.2011 , then to 1.5 lakhs in 2015). If you have opened a minor account for which you are guardian then the maximum you can deposit in both the accounts together is 1.5 lakhs. This change has been brought in Dec 2019. Explained below and Details are discussed in Public Provident Fund Scheme, 2019, New PPF Rules

- Deposit amounts should be in multiples of Rs. 50.

- You can deposit lump sum or multiple instalments. Amount of each instalment in a month and also in different years can vary.

- Ex: In a year one can remit Rs 500 in the month of Apr, then 2000 in the month of July, 5000 in the month of Mar. In the next year, one can deposit Rs 5000 in the month of Jun.

- PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of the month, however, the total interest in the year is added back to PPF only at the year-end. So if you don’t deposit on/before the 5th of a month, you don’t earn interest for that month. It is recommended that you invest in PPF before 5 Apr to get maximum benefit.

- Amounts can be deposited online, in cash, cheque or via demand draft. If you are depositing a cheque or demand draft, then the date of the deposit that will appear in your PPF account will be the date of cheque clearance and not the day you present the cheque. Say if you deposit the cheque on the 1st of the month but it fails to clear by the 5th for whatever reasons, you will lose out whole month’s interest

- For remitting in PPF account by cash or cheque or demand draft one needs to fill Form B or Challan B. One needs to fill the same information three times i.e triplet

- Now one can pay through internet banking using Fund Transfer or Third Party Transfer if PPF account is in the bank.

How to Deposit Online in PPF

One can transfer money online from saving bank account to PPF account using Funds Transfer or Third Party Fund Transfer. This enables one to transfer funds from one’s accounts to other accounts in the same branch or other branches or a different bank. To make funds transfer, one should be an active Internet Banking user with transaction rights.

- Transfer funds within your own accounts called as Fund Transfer.

- Transfer funds to a third-party account held in the same bank. It which is used to transfer funds to another account that belongs to somebody else but in the same bank (not necessary to be in the same branch as yours) which is called Third Party Transfer.

- Make an Interbank funds transfer to any account held in any bank called as Interbank Transfer to transfer money to anyone having an account in any bank (or branch) in India. Interbank transfer is usually done through NEFT transfer or RTGS transfer.

Usually, Third Party Transfer is used for transferring funds to a third-party account in the same bank and Inter bank transfer. Our article Third Party Fund Transfer : NEFT,RTGS discusses it in detail.

How to deposit when PPF Account is in SBI and Saving Account is also in SBI (Same branch)

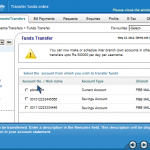

If you have your PPF account and savings account at same SBI branch, then you can see your PPF account already linked with your Bank account in NetBanking and you can transfer the money. You can transfer money through Funds Transfer

If you don’t see your PPF account linked, submit the letter to SBI bank by visiting the bank to link the account.

Steps are:

- Log on to Personal Banking of SBI’s Internet Banking site with your details (user id, password)

- Select Payments/Transfers and then Funds Transfer : Now you can see your accounts associated with your userid.

- Select the account from which you wish to transfer funds and the account into which the amount is to be transferred or credited.

- Enter the amount and remarks. Remarks can be seen as description for this transaction in your bank account statement. Helps in recalling.

- Confirm the transaction. On confirming the transaction, you will be displayed a confirmation page with the details of the transaction and the option to submit or cancel the fund’s transfer request

- On submitting A reference number will be generated for the transaction.

Pictures from SBI PPF Online Transfer for the process (Click on image to enlarge)

How to deposit when PPF Account is in SBI and Saving Account is also in SBI (different branch)

In case you have your PPF account and savings account with SBI but in different branches, then you should call Customer care or visit branch and ask them to link the accounts. Once linked you can use Fund Transfer. In the meantime, you can transfer funds using the option of adding Third Party Beneficiary.

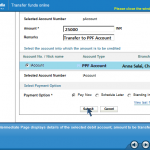

How to deposit when PPF Account is in SBI and Saving Account is in another bank

- Logon to your Savings account netbanking (ICICI/ HDFC/ any other bank)

- Add your PPF account as Third party Beneficiary so that you can transfer funds to it

- a) Enter Payee Name – Same as Name in PPF Account

- b) Select SBI branch where PPF account is maintained

- Enter Payee Account number – same as your PPF Account number

Once you have completed these steps you can see your PPF account as the 3rd party account where you can transfer the money just like you send it to any account.

Images from JagoInvestor’s Online transfer to your

Public Provident Fund (PPF) account (Click on image to enlarge)

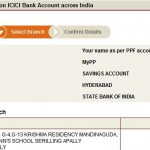

How to deposit in PPF account in ICICI Bank and Saving bank account also in ICICI

Through ICICI Bank Internet banking, you can:

- View your PPF account under your ‘My Accounts’ section in the logged in section

- Transfer funds from linked Savings Bank Account online

- View and print mini and detailed statement online

How to deposit in PPF account in HDFC Bank and Saving bank account also in HDFC Bank

Log in to HDFC Bank Internet banking, you can:

- View your PPF account under your Transfer to your own Accounts

- Transfer funds from linked Savings Bank Account online

How to deposit in PPF in Other Banks

IDBI Bank : PPF account holders of IDBI Bank have the benefit of accessing their PPF account online. Through Internet banking, they can view their PPF account details, print statement of accounts and also make subscription to PPF by way of online transfer of funds from the savings bank accounts.

How to Deposit in PPF by cash or cheque in Post office

Steps to pay using Cash/Cheque in Post Office

- Fill Form B (pdf format view or download here) shown below with appropriate details.

- If paying by cheque , cheque should be in the name of Postmaster, <name of Post office>, (PPF Account Number). Remember that date of deposit that will appear in your PPF account will be the date of cheque clearance and not the day you present the cheque

- Get the passbook updated (which may take a week if paying by cheque)

If you opened your PPF account through agent in Post office, your agent may not provide remittance into PPF account and you might have do it yourself.As from 1-Dec-2011 payment of commission to agents on Public Provident Fund Scheme (1%) and Senior Citizens Savings Scheme (0.5%) was discontinued.(Ref)

Deposit in PPF by cash or cheque in Bank

Steps to pay using Cash/Cheque in Bank (SBI, ICICIBank, IDBI) same as in Post Office (except name on the cheque)

- Fill Form B (pdf format view or download here) shown above with appropriate details. Fill the Date, Account No, name of subscriber, address,details of cash or cheque number.

- If paying by cheque , cheque should be in the name of <PPF account holder name> – PPF Account Number. Remember that date of deposit that will appear in your PPF account will be the date of cheque clearance and not the day you present the cheque

- Get the passbook updated (which may take a week if paying by cheque)

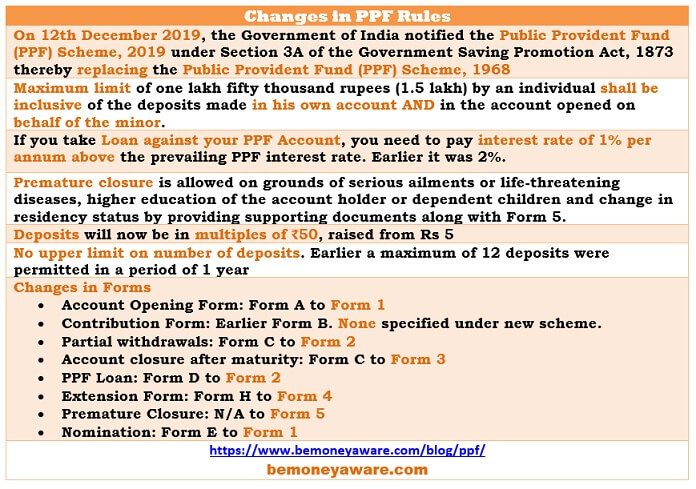

New PPF Rules 2019

On 12th December 2019, the Government of India notified the Public Provident Fund (PPF) Scheme, 2019 under Section 3A of the Government Saving Promotion Act, 1873 thereby replacing the Public Provident Fund (PPF) Scheme, 1968. The new PPF rules as per the notification are in Public Provident Fund Scheme, 2019, New PPF Rules . The image below shows the difference between PPF 2019 and PPF 1968.

Related Articles

- Understanding Public Provident Fund, PPF

- On Maturity of PPF account

- PPF Account for Minor and Self

- Choosing Tax Saving options : 80C and Others

- Third Party Fund Transfer : NEFT,RTGS

In this article we have shown different ways to remit into PPF account. How do you pay into your PPF account, lump sum or installments, use internet banking or go to the bank to deposit into PPF account.

I want to deposit money in my father PPF account , is it possible to trasfer money directly from ICICI to his PPF account of SBI? If YES/NO the HOW?

i need to ask about PPF partial withdrawal… after 7 years if i withdraw partial al ppf amount once in financial year , can i withdraw again in next financial year following the same rule of 50% of the 4 th financial year ??? pls let me know the answer . thanks

I have a PPF account in a post office in Hyderabad, I stay in Mumbai now, how much amount of cheque can I deposit at a post office in Mumbai?

if by mistake missed 31 st march , can we pay in first week of april for past year, to get tax benifit of previous year.?

To claim tax benefits you need to pay before 31 Mar 2018.

You need to pay 500 Rs min amount for your PPF account to continue.

If you do not deposit the minimum amount, then account will be termed as discontinued account. Interest would however continue to accrue.You could regularize the account again by paying the penalty fee of Rs 50 for each year of the minimum amount has not been deposited along with subscription arrears of Rs 500 per Financial Year. For example, if you paid in Rs. 400 in year 1, Rs. 10,000 in year 2 and Rs. 0 in third year. You would need to pay into your PPF account fees of Rs. 50 per year where you did not pay the minimum Rs. 500. In the example, you would have to pay Rs. 100 as fees (50 for 1st year on 400 Rs investment, 50 for 3rd year on 0 investment). Additionally, you would have to deposit Rs. 100, Rs. 0 and Rs. 500 as arrears for year 1,2 & 3 as the amount deposited fell short of Rs. 500.

Our article How to activate Dormant PPF account? explains the process in detail.

Hi,

I want to deposit money in my father PPF account , is it possible to trasfer money directly from ICICI to his PPF account of SBI? If YES/NO the HOW?

Yes it is possible.

The first step is to add SBI PPF account to your Bank account as third-party so that you can do a money transfer to them.

Step 2 : Choose the SBI branch Address

Next step is to choose the exact location of the BANK where the account was open . Note that if you opened a PPF account at a SBI branch where netbanking is not available , it will not be listed.

Step 3 : Add your PPF account as the Payee Account number

The last step is to add your PPF account as the Payee Account number and then click on the confirmation link . In ICICI you will first get an activation code which you will have to put to activate the account for first time

Once you have completed these 3 steps you can see your PPF account as the 3rd party account where you can transfer the money just like you send it to any account.

Can we deposit 1.5 lakh in PPF account opening year and next year? I am going to open PPF account in March 2018 and want to avail tax benefits under 80C. So, can I deposit 1.5 lakh in March 2018 and then deposit 1.5 lakh again in April 2018?

Yes, you can.

If you deposit in Mar 2018 after 5 mar is that you will not get any interest for FY 2017-18.

It is recommended to deposit in PPF within 5 Apr so that you can get maximum interest.

PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of month, however, the total interest in the year is added back to PPF only at the year-end. So if you don’t deposit on/before the 5th of a month, you don’t earn interest for that month.

HI, my PPF account is in SBI main Home Branch in my Town, may i paid cash upto 10000/- per month in nearest SBI sub branch …..pls reply urgently…. is it possible

Transfer of funds from your online savings account to your PPF account is possible whether you have your PPF account and savings account in the same bank or whether you have your savings account and PPF account in different banks.

How to transfer funds to PPF account?

1. Login to your Net banking (SBI, ICICI, HDFC)

2. Go to Third Party- Add your PPF account number.

3. Enter name as in PPF account

4. Select the branch where your ppf account is held

Once, the above mentioned details are filled in and submitted, your PPF account will be added as a third party account. You can now transfer funds from your online banking account to your PPF account via the standard online banking process.

If you use Online banking facility in SBI then check this video INB: Crediting Public Provident Fund (PPF) accounts in other branches

I have opened in post office ppf as a yearly one time deposit for 2017, can you pl help me for 2018 when the next payment for the month ? Pl advise

You can invest any time from 1 Apr 2017 to 31 Mar 2018.

Max amount that you can invest in PPF is 1.5 lakh.

You can investment multiple times of variable amounts but not more than 12 times.

I had opened my PPF account in post office in Chennai in 2001 through an agent – deposited money for next 3 years. After that I went to US and came back – didnt deposit any money after 2004. I am in Mumbai and want to deposit money but cant travel to Chennai just to do that. Please suggest how to either transfer account to Mumbai post office or way to deposit money in Chennai Post office. Also is there anything that i have to do if the PPF account is treated as inactive?

f you do not deposit the minimum amount, then account will be termed as discontinued account. Interest would however continue to accrue.You could regularize the account again by paying the penalty fee of Rs 50 for each year of the minimum amount has not been deposited along with subscription arrears of Rs 500 per Financial Year. For example, if you paid in Rs. 400 in year 1, Rs. 10,000 in year 2 and Rs. 0 in third year. You would need to pay into your PPF account fees of Rs. 50 per year where you did not pay the minimum Rs. 500. In the example, you would have to pay Rs. 100 as fees (50 for 1st year on 400 Rs investment, 50 for 3rd year on 0 investment). Additionally, you would have to deposit Rs. 100, Rs. 0 and Rs. 500 as arrears for year 1,2 & 3 as the amount deposited fell short of Rs. 500.

Our article How to activate Dormant PPF account? explains the process in detail.

Post office doesn’t provide online facility for small savings scheme like Public Provident Fund. To avail it, transfer your account to a bank that provides online services. For this, you need to submit an application at the post office for transfer mentioning details of bank where you wish to transfer your PPF account. Once the application is processed, the post office will send the required documents to the bank. Once the bank receives the documents, you will be asked to submit a fresh PPF account opening form, along with your original PPF account passbook.

Parag you would have to visit the Chennai Post office once.

You can only have one PPF account. You have to take a call whether amount in PPF is worth going to Chennai or not.

Else you can open a new PPF account in a bank.

All about PPF is explained in the article Understanding Public Provident Fund, PPF

Process of transfer of PPF account as explained in our article Transferring PPF account is as follows

As per the PPF scheme of the Government, subscribers can transfer their PPF account from one authorised bank or Post office to another. There is no difference in process whether the existing PPF account is in bank or post office. Please note While transferring though one has to close an existing PPF account and open a new one, the PPF account will be considered as a continuing account and one should not loose out any interest. Process of transferring PPF account is as follows :

Get the PPF passbook updated and make sure all the interest accrued till the date are duly credited.

Approach the bank or the Post office where your current PPF account is held and makes an application for transfer of PPF account to the specific branch of the bank. For post office one needs to use the form SB 10(b) and for bank an application letter. The details of the account, including the names and addresses of the branch/bank/post office where it is held, as well as the location where the transfer is sought, needs to be mentioned in the application. Suggested format is given here.

Once the application is processed, for example signature verified, the existing bank or Post office arranges to send the original documents such as a certified copy of the account, the account opening application, nomination form, specimen signature etc. to bank branch address provided by the customer, along with a cheque or DD for the outstanding balance in the PPF account.

Once transfer in documents are received at bank branch one has specified, one

If i deposit rs 1.5 lacs in my ppf account on 1st april 2017 will it b considered in FY 2017-18 ?

Yes if you deposit Rs 1.5 lakhs in your PPF account on 1 Apr 2017 it will be considered from FY 2017-18 or AY 2018-19.

Technically because of year-end most of the banks are closed and NEFT/RTGS does not work on 1 Apr.

Hello,

1.I have a daughter based outside India but she holds PPF account here. She is not minor. If I put 1.5 L by cheque to her account, then who would get benefit of Tax? Me or Her?

Saving account in Icici and axis and ppf account in post office. So can I transfer online from saving account to ppf ??

Hello,

At the moment, you can’t deposit online for you PPF account in post office using NEFT. This facility will come sooner, better you can transfer your PPF account to ICICI itself, so you can deposit anywhere from the universe.

How much maximum cash money can be deposited at a time? Can we use 500 and 1,000 notes which have been withdrawn for payment?

I have paid amount Rs.1000 by cash as an initial amount which opening PPF in branch. While downloading the PPF receipt, Rs.1000 is not showing up in it. Any clue abt it?

Since PPF a/cs are backed by Govt.of India, the SBI is not interested to entertain the PPF subscriber if he/she does not hold a savings a/c with them. Is it mandatory that the PPF a/c holder necessarily open a SB a/c with the same bank/branch? (other than practical ease of operation), Is there any rule mandates the subscriber to open an another SB a/c in the bank/branch where PPF a/c is kept? Is there any rule, Govt.of India or RBI insists so?

Hi,

Is it necessary that if I have a PPf Account in S.B.I., I have to deposit the contribution through S.B.I. cheques only I mean I can deposit other bank cheques in S.B.I. PPf Account

Please reply.

No you can deposit it through any other bank cheque or NEFT for that matter.

Day of contribution would be day money gets credited into your PPF account not the day you wrote cheque.

It would take a day or two more than if you had bank account in SBI.

I have to deposit PPF by cheque… So pls guide me chq in favour of whose.

can any person deposit Rs1,50,000/- in another person’s PPF a/c ?

will there be any Gift tax or any other tax applicable?

Hello, Sir/Madam,

I do have ppf account in Bank of Baroda and Net banking facility in SBI.

Can I transfer money through NEFT through third party beneficiary. If Yes then what is extra charges?

Yes you can. Regular NEFT charges will apply. Typical NEFT charges are

Amounts up to Rs. 10,000 – Rs.2.5 (exclusive of taxes) per transaction.

Amounts from Rs.10,001 to Rs.1 lakh – Rs. 5 (exclusive of taxes) per transaction.

Amounts above Rs. 1 lakh up to Rs. 2 lakh – Rs. 15 (exclusive of taxes) per transaction.

i have opened new ppf account in post office shimla.

can i pay instalment in UP. or there is online payment option.

pls rply

Can i invest more amount than declared at the time of opening ppf account ?

I mean to say is if yearly my declared amount while opening ppf is “x” and if i deposit “x + Y” for that year then ?

You can invest upto 1.5 lakh in PPF. Minimum amount one can invest in PPF is Rs 500. There is no fixed amount that one can deposit in PPF, it can range from Rs 500 to 1.5 lakh . It can vary every year.

You can claim tax deduction upto 1.5 lakh under section 80C which includes EPF,Insurance Premium, PPF etc.

Hi,

Very informative webpage!

I have the following question:

I have PPF account in SBI Delhi and have online access to the account for viewing. I wish to transfer 1.5Lakhs from my HDFC account. I tried to setup my PPF account in HDFC as a new NEFT Payee. I entered Name, Account no. and SBI IFSC code as found from my SBI login. However my SBI account type is PPF, whereas while registering new payee in HDFC, there is no option to change the payee account type as “PPF”. It only gives the standard options like Savings or current account type. In such as case, can I mention the account type as savings? Will then my NEFT payment transfer from HDFC to SBI PPF account?

(This is also shown in your screenshots while explaining online transfer setup.

Second – Is there any possibility to Access / NEFT to PPF accounts held in Post office?

Manoj

Theoretically it should. Sir why don’t you try it with small amount. If it works for small amount then only go for big amount.

Please do let us know for it may help other readers from practical experience.

I have not tried is personally as I have my PPF and saving account in SBI.

Yes Sir now Post offices have become modernized by moving to Core Banking Solution or CBS. You can register for Internet Banking in your Post Office, get your CIF number.

Then NEFT to Post office should work.

Our article Post Office :Internet Banking, Mobile Apps and Core Banking Solution explains it in detail.

Dude do it as savings wouldnt matter. PPF A/c is classified as saving account.Money will be transferred!

I have PPF Account in SBI. My company has directly transfer the amount of Rs.30,000/- to my PPF account. Whether i will get the exemption U/s 80c for the same.

I have my PPF account with PNB at x city. Now I transferred to Y location .Can I deposit money at PNB branch located at Y city

Bank official could not reply satisfactory.

Not sure about Punjab National Bank. Are you in City Y for some time only? Else you can transfer your PPF account to City Y.

You can pay through NEFT to PPF account. As explained in our article How to Deposit in PPF amount

Logon to your Savings account netbanking (ICICI/ HDFC/ any other bank)

2. Add your PPF account as Third party Beneficiary so that you can transfer funds to it

a) Enter Payee Name – Same as Name in PPF Account

b) Select PNB branch where PPF account is maintained

Enter Payee Account number – same as your PPF Account number

Once you have completed these steps you can see your PPF account as the 3rd party account where you can transfer the money just like you send it to any account.

Just try this option with Rs 500

I got a PF account in Post office at my native place, but i am presently not there in my native place, so is there any way to make the payment other than going to my native post office??

This blog is very useful and full of information for PPF beginners like me, Thanks for your wonderful contribution.

Thanks. Such comments are very useful and full of encouragement for bloggers like us. Thanks for your wonderful comment.

Hi,

I have a PPF account and SB account in a X Bank due to some reason i need to close my SB account in X bank. Can I transfer my PPF account form X bank to Y bank?

If Y bank provides PPF facility you can.

Process of transferring PPF account from our article Transferring PPF account is as follows :

Get the PPF passbook updated and make sure all the interest accrued till the date are duly credited.

Approach the bank or the Post office where your current PPF account is held and makes an application for transfer of PPF account to the specific branch of the bank. For post office one needs to use the form SB 10(b) and for bank an application letter. The details of the account, including the names and addresses of the branch/bank/post office where it is held, as well as the location where the transfer is sought, needs to be mentioned in the application. Suggested format is given here.

Once the application is processed, for example signature verified, the existing bank or Post office arranges to send the original documents such as a certified copy of the account, the account opening application, nomination form, specimen signature etc. to bank branch address provided by the customer, along with a cheque or DD for the outstanding balance in the PPF account.

Once transfer in documents are received at bank branch one has specified, one has to submit

Fresh PPF account opening form ( Form A)

Original passbook as a new passbook is issued with the past credit in the account shown as a balance transfer.. .

Fresh set of Know your customer (KYC) documents. The KYC documents are for the government and have to be submitted even if one has a account(savings etc) in that branch.

One should nominate (Form E) if not done earlier or change the nomination (Form F)

On transfer, the PPF account is considered a continuing account, not a new one. But a new account number and a new passbook will be issued with the past credit in the account shown as a balance transfer.Before submission, take photocopy of your old PPF pass book. This will come handy for several purposes like claiming income tax deduction under 80C, keeping record of earlier transactions etc.

The entire process may take more than 2-3 weeks, it is advisable to check the status from your end by visiting to the post office or bank branch where it is to be transferred. It is better to have photocopies of documents and forms that you need to submit.

Hi,

I have my PPF Account with my hometown Head Post Office. Since for this year i am out of the country so till now unable to pay the required installment. Could you please suggest can i use NEFT transaction to such PPF accounts? If Yes what information will be required to do so & what will be the process?

Regards,

Ashish Jaiswal

Unless someone can pay in the post office on your behalf its ok if you miss a payment for this year.

For the year missed you only need to pay penalty of Rs 50 per year along with the PPF amount.

Now SBI,ICICI Bank and IDBI bank offer online way of managing PPF.

So when you are back, you can transfer your post office to any of these banks.

Post office is also moving ahead technologically. So soon you may have NEFT transfer to PPF account in Post office.

I have scheduled a deposit into PPF account for 8000 every month 3rd from my account. So total 12 times in a year, it will be 96000. I want to deposit the another 54000 to meet the 150000 deposit. I came to know that i can deposit only 12 times in a year. If i deposit 54000 in the 2nd of Jan or FEB what will happen?Can I deposit more than 12 times in a year , means 13times in a year?

Yes you are right only 12 times contribution is allowed in PPF.

In PPF year is from Apr to Mar of next year. So for FY 2015-16 now you have made 9 contributions . You can pay increased amount in remaining 3 contributions.

If you try to make 13th contribution it is not accepted.

Hi, Thanks for your reply.

I am in USA and can’t discontinue the scheduled payments. My scheduled payment is on 3rd of every month. As I am in USA, I can’t stop the payment as I have to go to SBI bank to stop the payment. Can I do online transfer(using NEFT) to my PPF account before 3rd(either 1st or 2nd), so that the scheduled payment on 3rd will get stopped and my NEFT transfer will be considered. Please suggest how to take this forward.

They can’t automatically stop the payment for it takes time and they also have to note it.

Once they realise They will not credit interest on 13th instalment.

So if you are ok with that you can do NEFT transfer and worse come worse let the instalment go. And when you visit State Bank update the installment amount.

But doesn’t SBI has online banking and setup to start and stop instructions online?

I have to deposit PPF in GPO, New Delhi thru cheque payment. Please guide me, in whose favour, I have to issue the cheque. In September 2014, I had issued in favour of The Director, GPO, New Delhi. Is there any change in current Financial year.

There is no change in rules. You can still issue the cheque to Director GPO

I have PPF account with SBI, Roing Branch, Arunachal pradesh. Can I withraw my PPF amount from other branch of SBI. Please reply.

Hi,

Thanks a lot for this very informative article. I had some queries though.

1. All the money that I invest in PPF account is tax free at maturity, irrespective how large the amount is right?

2. And is there any advantage opening multiple PPF accounts in mine and my wife’s name? Or is it smarter to open only one?

1. Yes PPF account is tax free.

2. You can have one account for yourself and open account for children as guardian. You can have another account for your wife.

A detailed article on NEFT and rtgs transactions in india, i use IFSC codes to transfer funds, but got aware of many intrinsic details by this info

What if an NRI opened a PPF account (of course unknowingly of law) and account is matured.. All the time person was an NRI (since opening of account till maturity).. What will happen to the matured amount/account?

We cannot undo the past. The concerned person should not extend the account and withdraw if 15 years are over.

Hello Kirti,

Thanks for posting all the PPF investment information for everyone.

I have few queries-

1. Can i change the PPF deposit amount monthly?

EX. In a year one can remit Rs 2000 in month of Apr, then 5000 in month of July, 3000 in month of Mar. In the next year one can pay Rs 4000 in month of Jun.

2. Can i change monthly deposit to half-year deposit? If YES means, Is there any procedure?

3. Have to continue deposit upto 15 years? (If it NO means, Is there any minimum duration limit? Or can i stop any of the year?)

EX. Suppose not able to deposit PPF after 3 years.

Hello Sir,

For 1 & 2

You need to deposit a minimum of Rs. 500 per year in a PPF account.

Maximum amount which you can deposit in a PPF account is Rs. 1,50,000 effective Sep 2014. (Earlier limit was Rs 70,000 it was increased to 1 lakh from 1.12.2011 )

Deposit amounts should be in multiple of Rs. 5.

You can deposit lump sum or multiple installments.

Maximum number of installments in a year can not be more than 12.

Amount of each installment in a month and also in different years can vary.

Ex: In a year one can remit Rs 500 in month of Apr, then 2000 in month of July, 5000 in month of Mar. In the next year one can pay Rs 5000 only in month of Jun.

3. Yes the minimum duration of PPF is for 15 years.

If you do not deposit the minimum amount, then account will be termed as discontinued account. Interest would however continue to accrue.You could regularize the account again by paying the penalty fee of Rs 50 for each year of the minimum amount has not been deposited along with subscription arrears of Rs 500 per Financial Year. For example, if you paid in Rs. 400 in year 1, Rs. 10,000 in year 2 and Rs. 0 in third year. You would need to pay into your PPF account fees of Rs. 50 per year where you did not pay the minimum Rs. 500. In the example, you would have to pay Rs. 100 as fees (50 for 1st year on 400 Rs investment, 50 for 3rd year on 0 investment). Additionally, you would have to deposit Rs. 100, Rs. 0 and Rs. 500 as arrears for year 1,2 & 3 as the amount deposited fell short of Rs. 500.

Thank you…

You are welcome

Hi,

Dear Sir,

Even I have a doubt for question no.3. what if i would like to pay the maximum allowed subscription for the years in which I didnt pay.

Example, I have kept my account inactive for four years. I know the minimum allowed amount is 70000/year, so can I can deposit 280000 into my PPf a/c in the current financial year.

Thanking in you for your reply please

The minimum deposit for a PPF account is ₹500 and the maximum is ₹1.5 lakh per year. If you don’t make at least the minimum deposit in a financial year, the account becomes inactive. Reactivating a dormant PPF account

We are trust and we have to deposit PF for employees. Now EPFO has made it mendatory that PF contribution is to be deposited through Ebanking. Problem is we are based in rural area andthe internet is not functioning well here. in this circumstances, is there any other mode of payment available for us? Is RTGS is possible?

Hi,

I have 2 confusions regarding PPF investment in name of my wife, and would be grateful if you clarify these.

1. If I DONT invest any amount in my PPF a/c, but I invest RS 1.5 lakhs from my income into PPF a/c of my wife (Who is a housewife with no taxable income) then I can claim benefit under section 80C for this investment.

Am I Right??

2. Now I continue to do this for 15 years (till the time the PPF account of my wife matures) and keep on claiming tax benefit under section 80C, but after 15 years I close my wife’s PPF account and then all the amount accumulated in her PPF account will be treated as her income and not mine, so if that amount is invested in some FDs then that income from FDs will be treated as her income and not mine. So from tax point of view that income from FD will be clubbed in her income and not mine.

Am I right??

Regards,

Ankit

Good questions. We will verify but from what we know.

Under Section 80C of the Income tax Act, an individual is eligible to claim deduction from total income in respect of contributions to any PPF (belonging to self, husband, wife, any child) subject to an overall limit of Rs. 1,50,000 for a Financial Year (FY). Hence, the deduction could be claimed in respect of contributions made in his own PPF account or in the account of spouse or any child.

2. Yes you are right. Income from FD will be treated as her income if proceeds from PPF are invested in FD.

Hi Kirti!

Thanks for your prompt reply. Waiting for your final and verified answer.

Regards,

Ankit

Checked with the CA Akshay Mehta. He confirmed whatwe had mentioned

Also found the article 80 C SAVINGS – WHO’s NAME CAN BE DONE ,MINIMUM HOLDING PERIOD

Hope it helps!

Wow Thanks a lot.

You are welcome

Just wanted to add

One can put money in PPF or Senior Citizens Savings Scheme (SCSS) in the name of spouse/parents and earn tax-free returns. If you have exhausted the Rs 1.5 lakh limit under PPF, you can gift money to spouse, parents, adult children or siblings, who can invest it in PPF. Though you won’t be eligible for deduction in such cases, your money will earn a tax-free return of over 8% a year.

As I understand, SCSS returns are not tax free.

Yes Sir you are right. Interest on SCSS is taxable as per the income slab

Is there any restriction to open PPF account in the name of one adult, but having no income of his/her own (for example a student)? Can a parent deposit Rs. 1.5 lakh in his son/daughter’s PPF account separately and avail the benefit of tax free investment?

i wants to diposit monthly 1000*12=12,000/-

i wants to diposit yearly once 12,000/- which one is better option ?

Sir depositing yearly once 12,000 as early as possible , for maximum benefit before 5 Apr, would be a better option

As explained in our article Understanding PPF

PPF works on financial year basis (April 1st – March 31st). The interest rate is currently 8.80% p.a. which is subject to change. PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of month, however the total interest in the year is added back to PPF only at the year-end.

Dear Sir,

I have PPF acount in post office, Dehradun and presently I am living at Gurgaon.

Can I pay PPF amount online.

Regds

V K Sharma

Sir,

For Post office one cannot pay online. We would suggest moving your PPF account to bank like SBI or ICICI then you can pay online.

Our article Transferring PPF account talks about it in detail.

l & my wife and my two minor son have separate ppf account and my total investment is not more than 3 lacs in all the 4 accounts 1 lac in my account 1 lac in my wife’s account and 50 thousand each of my both minor son’ s account my question is when my both sons will be 18 years of age then can I invest 1.50 lacs in each of 4 accounts I mean total 6 lacs and at maturity all 4 accounts will get taxfree amount on maturity

Yes Sir you are absolutely right.

You can deposit 1.5 lakh each in your account or combination of self/minor

You can deposit 1.5 lakh each in your wife’s account or combination of self/minor

When your sons become adult you can deposit

1.5 lakh in each of the account.

So as you said 6 lakh of investments for tax free on maturity

I have PPF in SBI and my salary account is in some other bank, so to get the benifit of PPF on tax, do I need to direct transfer(online) money from my salary account to PPF in SBI or I can transfer to my SBI saving then into my PPF? Please reply.

Maam apologies for delay in replying, somehow the comment got missed

You can do direct transfer from your salary account to PPF, no need to transfer to SBI account.

Which bank account do you want to transfer from?

I am genuinely delighted to glance at this website posts which

includes lots of useful facts, thanks for providing such statistics.

Informative post. My personal experience with SBI has been that they insisted that I open a savings a/c with them when I approached them to open PPF a/cs for my kids. They said it was mandatory as per rules, and also explained the ease of operation part. This was 4 years ago. My savings a/c remains dormant with just the minimum credit balance, and each year when I go to the bank and deposit an other bank cheque towards PPF, not ONCE has anyone objected, or even asked me if I hold an a/c with them !

Thanks Annapurna . Yes it is usually the case but I there is ease of operation no standing in line for PPF account

Informative post. My personal experience with SBI has been that they insisted that I open a savings a/c with them when I approached them to open PPF a/cs for my kids. They said it was mandatory as per rules, and also explained the ease of operation part. This was 4 years ago. My savings a/c remains dormant with just the minimum credit balance, and each year when I go to the bank and deposit an other bank cheque towards PPF, not ONCE has anyone objected, or even asked me if I hold an a/c with them !

Thanks Annapurna . Yes it is usually the case but I there is ease of operation no standing in line for PPF account