One can make online contributions to NPS account using eNPS. The National Pension System (NPS) allows its subscribers to open NPS Tier I and Tier II accounts online through the eNPS. Subscribers who have also not opened accounts online can also make contributions to NPS online, using the e-NPS portal. The eNPS facility has made the NPS registration and contribution easy .This article gives an overview of eNPS and talks about How to make do Contribution to NPS using eNPS.

Table of Contents

Overview of How to make contribution to NPS online using eNPS

One can contribute to NPS online through eNPS for those who have NPS account opened online or even offline. Overview of steps is given below. It is explained in detail in the article.

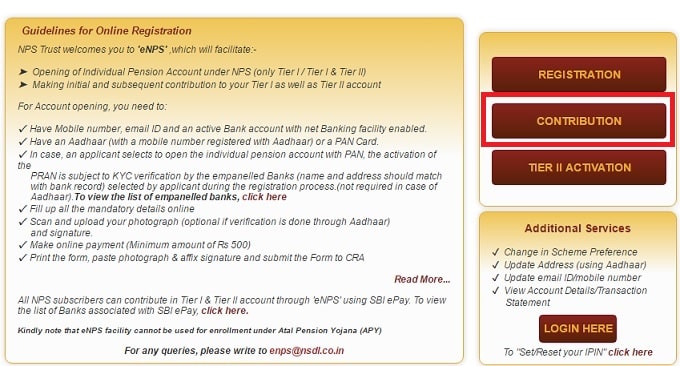

- To make an online contribution, the NPS subscriber is required to go to the eNPS website and click on the Contribution button.

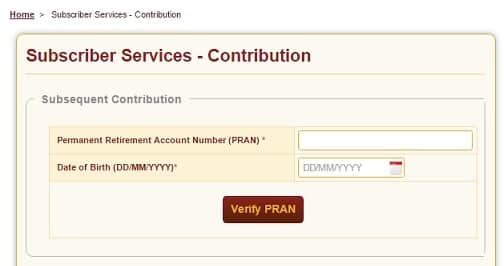

- Enter PRAN and Date of Birth

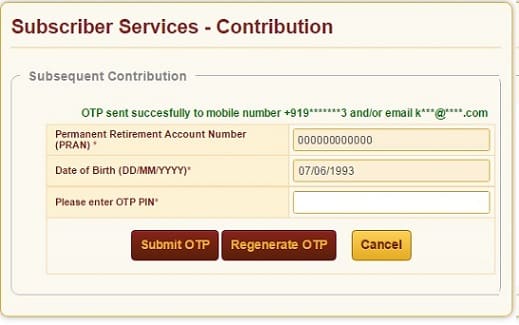

- Upon successful verification, an OTP(One time password) will be sent to your registered mobile number and your email. Note that the OTP is valid for next 10 mins after you click the button. Enter the OTP and click on Submit OTP.

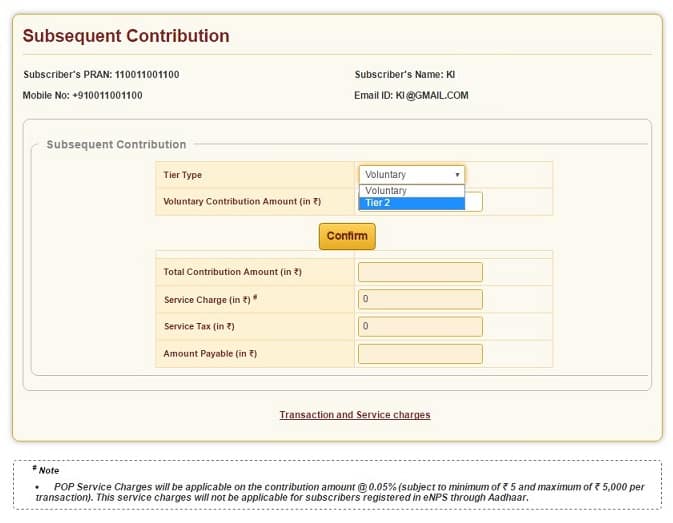

- The payment can be made for the Tier I or Tier II account through your debit or credit card or by using the Internet banking option. Fill in the amount and click on Confirm.

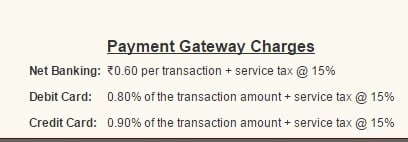

- The screen is updated with Service Charges and Service Tax and Amount Payable details. NetBanking has cheapest charges independent of amount, Credit Card has maximum .9% of transaction amount

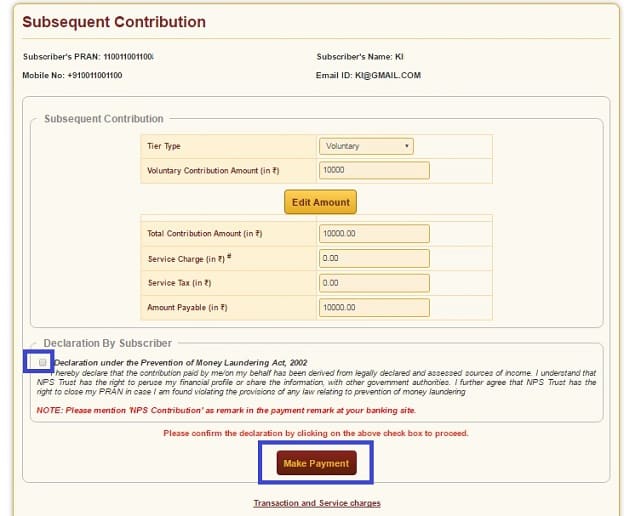

- In Declaration by Subscriber, Click on the box Declaration under the Prevention of Money Laundering Act 2002. Click on Make Payment button.

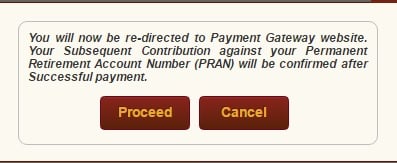

- You will be redirected to Payment Gateway which is currently SBI ePay. Click on Proceed

- On successful contribution, you will be able to download Payment Receipt.

- You would get an email from eNPS-alerts@nsdl.co.in and SMS about contribution.

- Credit of units in your NPS account will take at least two working days and is subject to receipt of clear funds from Payment Gateway Service Provider. Once units are credited in your account, SMS and Email will be sent to you.

- All articles related to NPS can be found at All About NPS

Overview of eNPS

What is eNPS?

eNPS or electronic National Pension Scheme at https://enps.nsdl.com/, is the online platform through which you can open an NPS account and make contributions to it.

- Open Individual Pension Account under NPS (only Tier I / Tier I & Tier II). You can open this account online by using your using PAN or Aadhaar. Our article eNPS : Open NPS account online, contribute to NPS online discusses how to open eNPS account in detail.

- If you are using the PAN, you also need to give your bank details for completing the know-your-customer (KYC) process. And you can only do it if your bank is empanelled with PFRDA. According to the NPS Trust website, PFRDA or rather SBI ePay,payment gateway for NPS, currently has empaneled with 40 banks, you can find your bank on the PFRDA website at:http://bit.ly/2bvRYeL .

- Opening the account with Aadhaar is simpler. Just give your Aadhaar details on the online platform and verify the details with a one-time password (OTP). Supreme court has allowed usage of Aadhaar for the pension scheme under the National Social Assistance Programme (Old Age Pensions, Widow Pensions, Disability Pensions), apart from MGNREGS, PMJDY and EPFO. On 17 February 2016, PFRDA decided to allow the use of Aadhaar as e-KYC, which makes opening an account online much simpler.

- You can make initial and subsequent contribution to your Tier I as well as Tier II account. Points to note

- There are no limits or restrictions to making contributions to your NPS using the e-NPS platform.

- It is important to have an active Tier I or Tier II account in order to make an online contribution.

- NPS Lite or Atal Pension Yojana subscribers cannot avail of the facility of making contributions through e-NPS.

For queries on eNPS please contact : 022 – 4090 4242 or write to: eNPS@nsdl.co.in

How to make Contribution to NPS account using eNPS

To make an online contribution, the NPS subscriber is required to go to the eNPS website and click on the Contribution button as shown in image below.

Authentication for Contribution to NPS using eNPS

Once the link is accessed, a form will be displayed wherein your PRAN (Permanent Retirement Account Number) and date of birth are to be entered. PRAN is an acronym for Permanent Retirement Account Number, which is the unique and portable number provided to each subscriber under NPS and remains with him throughout. On successful registration to NPS, a PRAN (Permanent Retirement Account Number) is allotted to the subscriber

Payment of Contribution to NPS using eNPS

The payment can be made for the Tier I or Tier II account through your debit or credit card or by using the Internet banking option.

Tier Type options are Voluntary( for Tier1) and Tier2.: Subscribers (Govt and Corporate) covered under NPS can also use eNPS for making voluntary contributions in their Tier I account (over and above the regular contributions) towards their PRAN to avail tax benefits to an extent of Rs. 50,000 under section 80CCD(1B) of Income Tax Act, 1961. Further, they can also contribute for their active Tier II account.

Charges on Contribution to NPS using eNPS

In Declaration by Subscriber, Click on the box Declaration under the Prevention of Money Laundering Act 2002 . Click on Make Payment button.

You will see the screen as shown in image below. Click on Proceed.

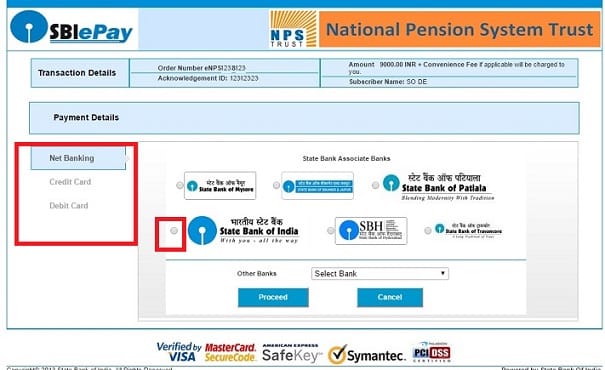

SBIePay Payment Gateway

The payment gateway integrated with eNPS is SBIePay. You can select NetBanking, Credit Card or Debit Card (marked in red in image on left hand side). If you click on NetBanking then you select the bank through which you can pay. For example to pay through State Bank of India, Click on the round box (marked in red in image).

Click Proceed. It would take you to the online banking website of State Bank of India. Then one has to do regular net banking transaction using OTP.

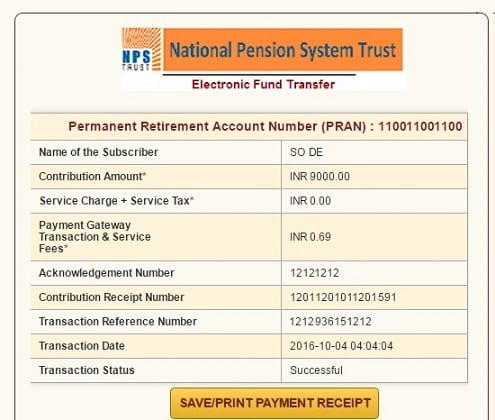

At the end of successful online transaction, one can see the receipt as shown in image below.

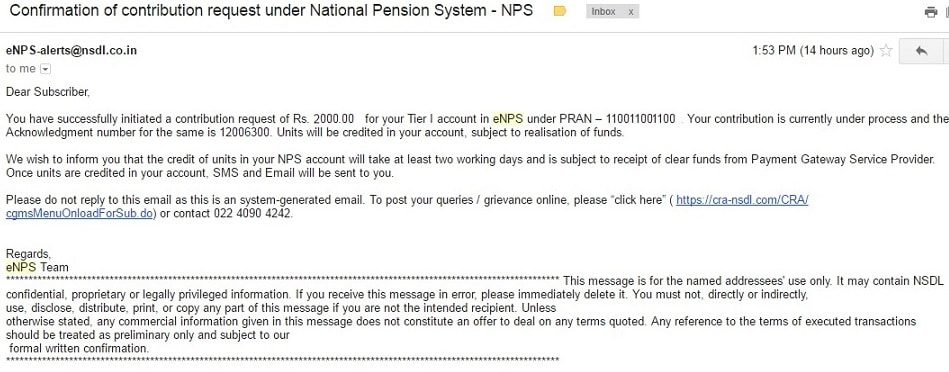

You would get an email and SMS about contribution.

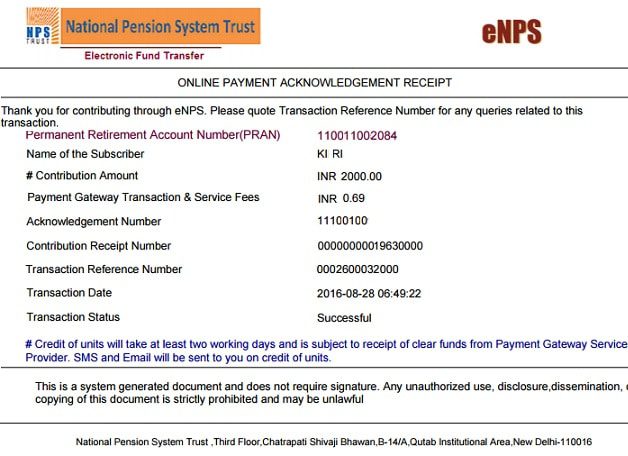

Payment Receipt on Contribution to NPS

You would get Payment Receipt on Contribution to NPS which is shown in the image below.

Mail from eNps on Successful Contribution

If your contribution is successful you would get mail similar to one given below after successful contribution.

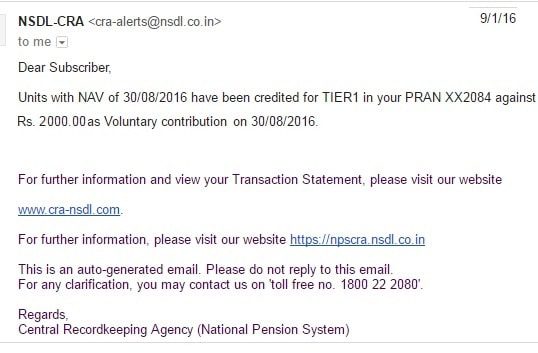

CRA Mail on Units credited on eNPS account

Mail from CRA on UNits credited in eNPS account. Date on which your units are credited is the date of your investment in NPS. It would be reflected in your holding statement which is proof of your investment.

Service Charge of Opening/Contribution to NPS account (eNPS and offline)

PoPs or point of presence are intermediaries such as banks that help you subscribe to NPS, carry out KYC verification and also receive NPS contributions from you. There are about 63 PoPs, and almost all the bigger banks provide this service. See the full PoP list on http://bit.ly/1TlvCxJ .

- When a PoP opens your account offline

- You pay it a subscriber registration charge of Rs 125, and a distribution fee of 0.25%(minimum Rs 20 and maximum Rs 25,000) on all subsequent contributions.

- When you open you account online using PAN

- You pay it a subscriber registration charge of Rs 125,

- Subscribers who opened their accounts online using PAN, would pay 0.05% of the contribution (maximum Rs 5,000) as service fee to the empanelled bank,the associate PoP in this case. This charge was extended to subscribers who opened their accounts with a PoP but made contributions using eNPS.

- When you open eNPS using Aadhaar from Oct 2016.

- one time account opening fee of Rs 50.

- You pay service charge of 0.05% on it. The money thus collected will go to the subscriber education and protection fund.

SBI ePay

SBI ePay is a payment gateway launched by State bank of India (SBI) in early 2014. SBIePay is an aggregator service which allows online merchants to accept Credit cards, Debit cards, Net banking and mobile payments as payment instruments for transactions happening online. It is similar to payment gateways like CCAvenues, Bill Desk, Citibank , PayTM, PayUMoney and ICICI bank.

- The SBIePay Payment Gateway follows a T + 2 days settlement cycle i.e where funds would be transferred within 2 working days of transaction.

- SBI ePay is highly secure & compliant with necessary certifications in place e.g. PCIDSS compliant with PCIDSS 2.0, protection by hardware firewalls including regular testing and audits.Supports 3DSecure – Verified by Visa and MasterCard Secure Code

List of Banks associated with SBI ePay

| Sr.No. | Bank Name | Sr.No. | Bank Name |

|---|---|---|---|

| 1 | Allahabad Bank – Retail | 21 | Kotak Mahindra Bank |

| 2 | Andhra Bank | 22 | Lakshmi Vilas Bank |

| 3 | Andhra Bank – Corporate | 23 | Oriental Bank of Commerce |

| 4 | Bank of India | 24 | Punjab and Maharashtra Co-operative Bank Ltd |

| 5 | Bank of Maharashtra | 25 | Punjab and Sind Bank |

| 6 | Catholic Syrian Bank | 26 | Saraswat Bank |

| 7 | City Union Bank | 27 | South Indian Bank |

| 8 | Corporation Bank | 28 | State Bank of Bikaner and Jaipur |

| 9 | DCB Bank Personal | 29 | State Bank of Hyderabad |

| 10 | Dena Bank | 30 | State Bank of India |

| 11 | Dhanlaxmi Bank-Retail | 31 | State Bank of Mysore |

| 12 | Federal Bank | 32 | State Bank of Patiala |

| 13 | IDBI Bank-Retail | 33 | State Bank of Travancore |

| 14 | Indian Bank | 34 | Syndicate Bank |

| 15 | IndusInd Bank | 35 | Tamilnad Mercantile Bank |

| 16 | ING Vysya Bank – now Kotak | 36 | UCO Bank |

| 17 | Jammu and Kashmir Bank | 37 | United Bank of India |

| 18 | Janata Sahakari Bank Ltd. Pune | 38 | Vijaya Bank |

| 19 | Karnataka Bank Ltd | 39 | YES Bank |

| 20 | Karur Vysya Bank | 40 | Canara Bank |

I mistakenly closed the NPS while epay. Now I didn’t get mail from NCRA. But payment succeeded. Till now I didn’t get NAV units.

how to get details w.r.t NPS service provider’s account details. My NPS service provider is LIC

What is the eligibility for making subsequent contribution in my account. I was trying to make subsequent payment and the website shows the subscriber is not eligible for making payment.

Dear Sir, my Permanent Retirement account No. 110122261765, I am unable to make subsequent contributions and I am getting the error “User not eligible for subsequent contributions”. I have KYC alreaday submitted at nps CRA Office on 04th FEB, 2019. So what can I do.Please help me.

Im unable to make subsequent contributions and I am getting the error “User not eligible for subsequent contributions”. I have just recently opened a tier I/Tier II account online and sent the forms to the CRA. Is the error something to do with KYC? I see that the KYC status in my account is still Unverified

So you opened a Tier1 account offline? How did you open offline?

Did you get PRAN?

What is the eligibility for making subsequent contribution in my account. I was trying to make subsequent payment and the website shows the subscriber is not eligible for making payment.

What kind of NPS account do you have?

Can you share details at our email id bemoneyaware@gmail.com

How to get and re print my ONLINE PAYMENT ACKNOWLEDGEMENT RECIEPT for eNPS account.

Did you not see the ONLINE PAYMENT ACKNOWLEDGEMENT RECIEPT?

Did you get the email from eNps on Successful Contribution?

I have started my NPS tier 1 investment today, but not printed the payment reciept. how can i re print

You can download the NPS statement

To avail the facility, you may login into your account by using the login id and password.

Now go to the ‘Transaction Statement’ section and click on ‘Holding Statement’ which reveals the specifics of your NPS fund’s accumulated balance. To see the particulars of your transactions, including contributions, click on the ‘Transaction Statement’ option and you are done.

What a great article it is!

Learned too many new things about NPS and eNPS from this article.

A proper step by step process with screenshots helped me a lot.

Thanks,

Sir,

My PRAN no.500003325029.I will have to pay my contribution to NATIONAL PENSION SYSTEM. But SBI says this that this type of work isn’t doing here.So what can I do.Please help me. My Email ID is nakum09@yahoo.in

anilnakum26mail.com

Thanks

You can pay for NPS online as explained in the article.

To make an online contribution, the NPS subscriber is required to go to the eNPS website and click on the Contribution button.

Enter PRAN and Date of Birth

Upon successful verification, an OTP(One time password) will be sent to your registered mobile number and your email. Note that the OTP is valid for next 10 mins after you click the button. Enter the OTP and click on Submit OTP.

The payment can be made for the Tier I or Tier II account through your debit or credit card or by using the Internet banking option. Fill in the amount and click on Confirm.

The screen is updated with Service Charges and Service Tax and Amount Payable details. NetBanking has cheapest charges independent of amount, Credit Card has maximum .9% of transaction amount

In Declaration by Subscriber, Click on the box Declaration under the Prevention of Money Laundering Act 2002. Click on Make Payment button.

You will be redirected to Payment Gateway which is currently SBI ePay. Click on Proceed

On successful contribution, you will be able to download Payment Receipt.

You would get an email from eNPS-alerts@nsdl.co.in and SMS about contribution.

Credit of units in your NPS account will take at least two working days and is subject to receipt of clear funds from Payment Gateway Service Provider. Once units are credited in your account, SMS and Email will be sent to you.

Wow! Thank you! I continually wanted to write on my website something like that. Can I take a portion of your post to my blog?