Our article What is Form 15G? What is Form 15H? talked about the form 15G or 15H which is to be submitted to request income provider for not deducting tax or TDS for prescribed income. For example, From 1 June 2015, people who are withdrawing EPF before 5 years of service are required to fill Form 15G. If an employee has rendered service for less than 5 years and has accumulated balance is more than or equal to Rs. 50000, he is required to submit form 15G or 15H along with PAN card to avoid TDS. Otherwise, TDS will be deducted at 10% (if PAN is given) and 20% if PAN is not given. This article explains how to fill Form 15G and how to fill 15H? What information has to be provided in various schedules and how to find information for filling Form 15G or 15H.

Table of Contents

How to save TDS deduction? Fill Form 15G and 15H

What is TDS on Income?

TDS or Tax Deducted at Source, is one of the modes of the collection of taxes, by which a certain percentage is deducted at the time of payments of various kind such as salary, commission, rent, interest on dividends etc and deducted amount is remitted to the Government account. This withheld amount can be adjusted against tax due. Our article TDS, Form 26AS and TRACE explains TDS in detail

What is Form 15G of Income Tax? What is Form 15H of Income tax?

Form 15G or 15H is submitted to request income provider for not deducting tax or TDS for prescribed income.

- These forms can be used only for payments in the nature of Interest of Securities, Dividend, Interest other than Interest on Securities (Bank/Company Deposits) , NSS & Interest on Units. For other types of payments, these forms cannot be used.These days for PF withdrawal one is required to fill Form 15G if one does not want the tax to be deducted.

- One can submit these forms to bank, post office, company ,EPFO etc

- These forms have to be filed in duplicate,at times 3 copies, to the payer which can be bank, post office, company . The payer or the institution takes them on record, the entire interest is to be paid to the depositor or lender without TDS

- While Form 15G is for Indian residents below 60 years of age, HUFs and trusts, Form 15H is for those above 60.

- Only resident Indian,HUF and AOP can submit form 15G / form 15H.

What are conditions to fill Form 15G of Income Tax?What are conditions to fill Form 15H of Income Tax?

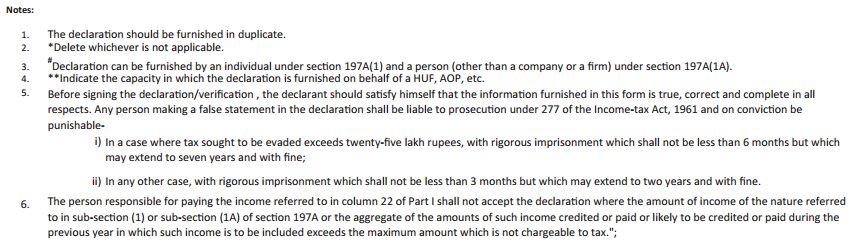

Before filling the Form 15G please verify if you meet the conditions. As not everyone fill Form 15G/15H . You need a valid reason to request the bank or financial institution not to deduct TDS. As Notes in the Form 15G or 15H are shown in image below . Click on image to enlarge.

Interest income may be earned from – savings bank account, fixed deposits and recurring deposits,senior citizen saving schemesAs a thumb rule, all interest income from any of these sources must be reported in your income tax return. Add it under the head Income from other sources.

The basic conditions for filing 15G are :

- The final tax on estimated total income computed as per the Income Tax Act should be nil

- The aggregate of the interest received during the financial year should not exceed the basic exemption slab of that assessment year ex: 2.5 lakh in AY 2019-20,AY 2018-19

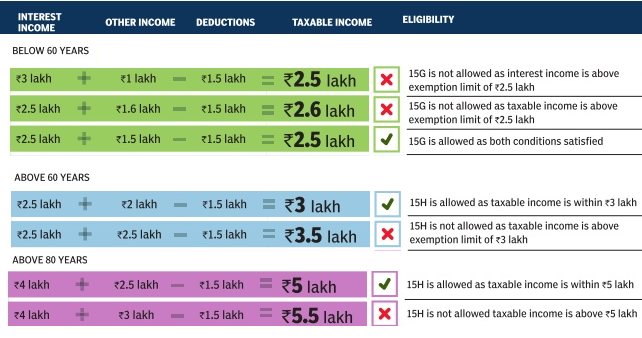

If these criteria are met, you can submit Form 15G and the entire interest income would be credited without any tax cut. Please note that You need to meet both criteria. Even if the interest income is less than the basic exemption allowed during that financial year, but your total tax liability is not nil, you will not be eligible for filing Form 15G. The reverse is also true. Say your income is Rs 4 lakh, of which Rs 3 lakh is earned as interest from your investments such as FDs in the bank. You might invest Rs 1.5 lakh in PPF and be out of the tax net, but you are not eligible for Form 15G as though your tax liability is zero, the interest income is higher than the basic exemption. The refund route is your only recourse.

Form 15H can be only filed by individuals above 60. This form imposes only the first condition, the final tax on the investor’s estimated total income should be nil. So, if you are above 60, your taxable income for the financial year can be up to Rs 3 lakh for you to be eligible for 15H. For super senior citizens above 80 years, this limit is Rs 5 lakh. Image below shows the cases where Form 15G/15H is not allowed.

How to Fill Form 15G? How to Fill Form 15H?

Form 15G and 15H are similar.There is no difference in filling form 15H. The differences are:

- While Form 15G is for Indian residents below 60 years of age, HUFs and trusts, Form 15H is for those above 60.

- For 15G the aggregate of the interest (excluding interest earned on securities) received during the financial year should not exceed the basic exemption slab ex: 2.5 lakh in AY 2015-16,AY 2016-17. Our article Income tax slab rates from AY 1986-87 to covers the basic exemption limit and tax slabs from AY 1986-87 to current Assessment Year.

Change in Forms From 1 Oct 2015

The Income Tax Department has announced new forms and new procedure regarding Form 15G & Form 15H starting 1st October 2015. Key Changes

- Forms have been simplified. Gone are the various schedules like Schedule 1,2 etc

- Introduction of Electronic mode of filing Form 15G & 15H as an Alternate to Paper Form. No procedural rules has been prescribed as regard to filing of Form 15G. However, It seems Form 15G & 15H can be filed using Internet Banking facility or Similar facility for in case of Other institution which are making payment as provided in Section 197(1) or 197(1A) or 197(1C). –

- The person responsible for making a payment or the Deductor shall allot a UIN (Unique Identification Number) to each Form 15G and Form 15H received.

- The Deductor shall mention the particulars of these Form 15G & Form 15H received during any quarter of the financial year along with the unique identification number allotted by him in TDS Quarterly Statements, whether or not any TDS has been deducted by him.

- The Deductor is no longer required to submit physical copy of Form 15G & Form 15H to the Tax Department.

- However, these forms must be maintained by the Deductor for a period of 7 years from the end of the financial year in which these are received

How to Fill Form 15G/15H

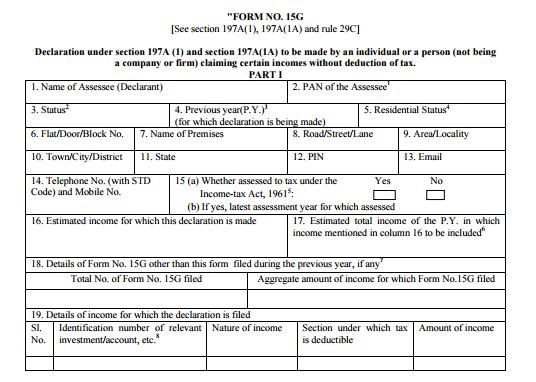

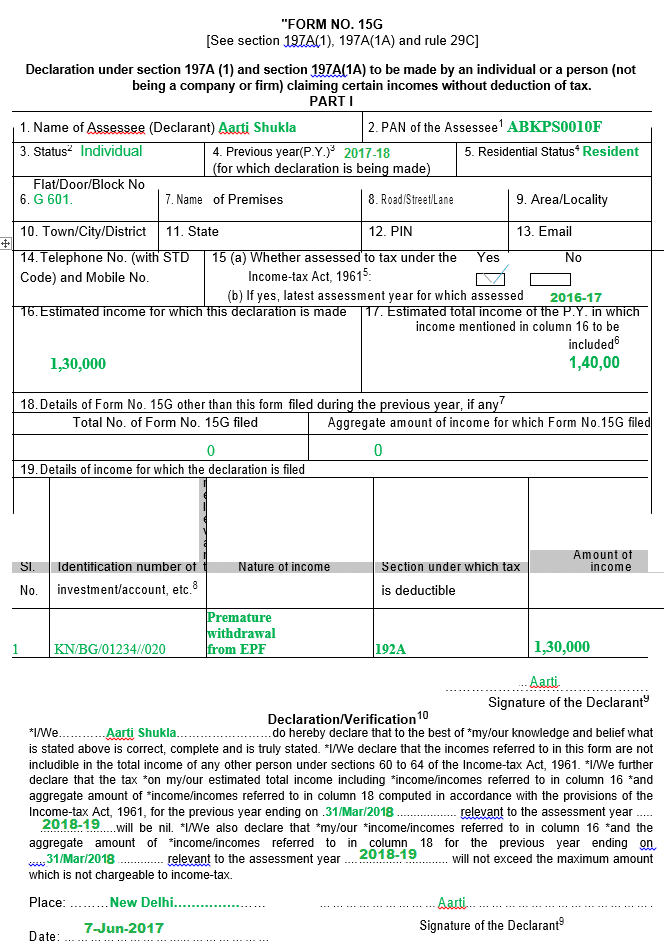

Let’s start by Filling Form 15G, which is shown in the image below

- Field 1, Name: write name as per your PAN.

- Field 2, PAN: write your PAN number.

- Field 3, Status: Your income tax status which can be Individual/ Hindu Undivided Family(HUF)/ AOP as applicable to you.

- Field 4, Previous Year: the year in which you will earn your income for which you want to avoid TDS. So it is the current financial year for which you are filing up the form. If you fill the form between 1 Apr 2018 to 31 Mar 2019 then you have to fill 2018-19.

The calendar year starts on January 1 and ends on December 31 but a Financial year (FY) is from April 1 to March 31. As per the Income Tax Act, income earned in a financial year (FY) is taxed in the next Financial Year. FY to which the income belongs is called the Previous year (PY) and the FY in which the income is taxed is called the Assessment year (AY). Ex: The income earned from 1st Apr 2018 to 31 Mar 2019 , during FY 2018-19 will be assessed for tax in the 2019-20 after you file tax. Here, FY 2015-16 is called Previous Year and FY 2016-17 is called Assessment Year or AY. Our article Income Tax Overview explains terms associated with Income Tax. - Field 5, Residential Status : to be entered ex: Resident Individual. As Form 15G or 15H can be filled only by Resident hence if one satisfies the condition one needs to mention Resident.For income tax purpose residential status of an assessee is classified into, Resident (ordinarily), Resident (not ordinarily),Non resident. Under the Income-tax Law, an individual will be treated as a resident in India for a year if he satisfies any of the following conditions (i.e. may satisfy any one or may satisfy both the conditions):

-

- One is in India for a period of 182 days or more in that year; or

- One is in India for a period of 60 days or more in the year and for a period of 365 days or more in 4 years immediately preceding the relevant year.

-

- Field 6,7,8,9,10,11,12, Current Address details.

- Field 13, Email Id, your email ID

- Field 14, Telephone number, Phone number both LandLine number with STD code and Mobile No. If you don’t have a Land line just fill Mobile Number.

- Field 15 (a) , Whether assessed to tax under the Income-tax Act, 1961. Yes or No, Check the appropriate Box. Mention Yes if assessed to tax under the provisions of Income-tax Act, 1961 for any of the assessment year out of six assessment years preceding the year in which the declaration is filed.

- Field 15 (b), If yes, latest assessment year for which assessed , Mention the last Assessment Year, the year in which you filed Income Tax return.

- Field 16, Estimated income for which this declaration is made, Mention the estimated income for which you are filing the Form. For exam,ple if you have opened a Fixed Deposit and you don’t want TDS to be deducted on FD then mention interest on FD you will earn this year.

- Field 17, Estimated total income of the P.Y. in which income mentioned in column 16 to be included, Please mention the amount of estimated total income of the previous year for which the declaration is filed including the amount of income for which this declaration is made

- Field 18, Details of Form No. 15G other than this form filed during the previous year, if any, In case any declaration(s) in Form No. 15G is filed before filing this declaration during the previous year, mention the total number of such Form No. 15G filed along with the aggregate amount of income for which said declaration(s) have been filed

Total No. of Form No. 15G filed , How many Form 15G have been filled before the form 15G in this Fina ncial year or Previous Year. - Aggregate amount of income for which Form No.15G filed, Total amount of income for which Form 15G have been filled in this year.

- Field 18, Details of Form No. 15G other than this form filed during the previous year, if any, In case any declaration(s) in Form No. 15G is filed before filing this declaration during the previous year, mention the total number of such Form No. 15G filed along with the aggregate amount of income for which said declaration(s) have been filed

- Field 19. Details of income for which the declaration is filed, Mention the distinctive number of shares, account number of term deposit, recurring deposit,

National Savings Schemes, life insurance policy number, employee code, etc.- Sl. No.

- Identification number of relevant investment/account, etc.

- Nature of income

- Section under which tax is deductible

- Amount of income

- Various TDS Rates, sections,cut off rates are given below

TDS rates for F.Y. 2015-16 Nature of Payment Made To Residents

Cutoff (Rs.)

Company / Firm / Co-operative Society / Local Authority

Individual / HUF

If No / Invalid PAN

Section – Description

Rate (%)

192A-Premature withdrawal from EPF ( wef 01.06.2015) Upto 31-05-2016 Rs. 30,000 w.e.f. 01-06-2016 Rs. 50,000 NA 10 20 193 – Interest on securities – 10 10 20 194 – Dividends 2500 10 10 20 194A – Interest other than interest on securities – Others 5000 10 10 20 194A – Banks(Time deposits) 10000 10 10 20 194A – Banks (Recurring deposit)(01.06.15) 10000 10 10 20 194A – Deposit in Co-op Banks (01.06.15) 10000 10 10 20 194D-Insurance Commission Upto 31-05-2016 Rs. 20,000

w.e.f. 01-06-2016 Rs. 15,000Up to

31-05-2016 10%From 01-06-2016 5%

Please remember that two conditions given below need to be satisfied for filling Form 15G . Details about these need to be filled in Field 22,23 and schedules.

- The final tax on estimated total income computed as per the Income Tax Act should be nil

- The aggregate of the interest received during the financial year should not exceed the basic exemption slab of that assessment year ex: 2.5 lakh in AY 2018-19,AY 2019-20

Estimated total income from sources below: The income from following sources needs to be added: Interest on securities , Interest on sum other than securities ( interest on FD etc.), Interest on mutual fund units., withdrawals of NSS. Do sum of the total income from all sources

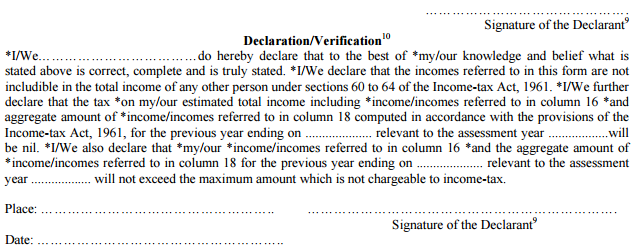

Declaration/Verification . Fill in the details and place your signature within the given space as Signature of Declarant . Image below shows the information to be submitted for FY 2015-16 or AY 2016-17, when Form 15G/15H is submitted for non deduction of TDS between 1 Apr 2015 – 31 Mar 2016.

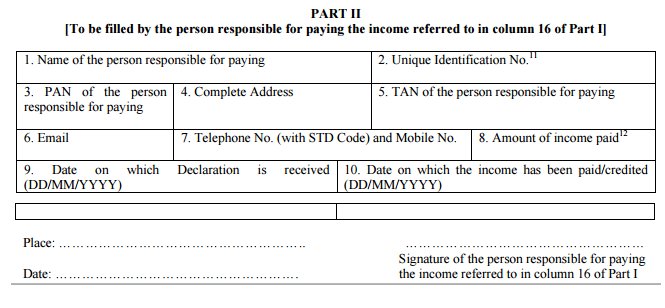

Part II of form 15G/15H [For use by the person to whom the declaration is furnished]

Don’t fill any thing in part 2. The person whom you are furnishing declaration ( BANK, POST OFFICE ETC.) will fill this part. Don’t fill it

OTHER IMPORTANT THINGS TO KNOW:

- Declaration under form 15G/ form 15H is not alternative of income tax return. No matter whether you have given declaration to bank or others for non deduction of TDS, you are required to file income tax return if required in income tax act. Do note that this is not a way to save tax on income but only a means to prevent TDS deduction on it. It saves you from the hassle of seeking a refund later.

- Attach PAN card copy with declaration:

- WHAT TO DO WHEN TDS DEDUCTED THOUGH 15G/ FORM 15H SUBMITTED: If your income payer deducts TDS from income though submission of the above forms, you can file return and claim tds refund as per your tax liability. No need to worry about it. Don’t ask him to refund TDS because he has already deposited it in government department through TDS return.

- You can download Forms 15G and Form 15H from here 15G and 15H or from Income tax India website http://www.incometaxindia.gov.in/Pages/downloads/most-used-forms.aspx

Download the Form 15G in word format and Form 15H in word format

You can download the forms 15G in word format from New Form 15G

You can download the forms 15H in word format from New Form 15H

Sample Filled Form 15G for EPF Withdrawal

Sample filled form 15G for Aarti Shukla, who is withdrawing on 7 Jun 2017 , her EPF of Rs 1,30,00 and has 10,000 other income is given below. If you withdraw between 1 Apr 2017 to 31 Mar 2018

- then Previous Year or PY( Pt 4 in the Form) is 2017-18 and Assessment AY would be 2018-19.

- For 15(a) Mention latest Assessment Year for which Income Tax Return has been submitted and processed. If you have filed return for FY 2016-17 or AY 2017-18 last date for which is 31 Jul 2017 mention AY 2017-18.

- Else mention the last Assessment Year in which your ITR was submitted. For example if You filed return for FY 2015-16 or AY 2016-17 then mention AY 2016-17.

- In declaration, part Assessment Year would be 2018-19.

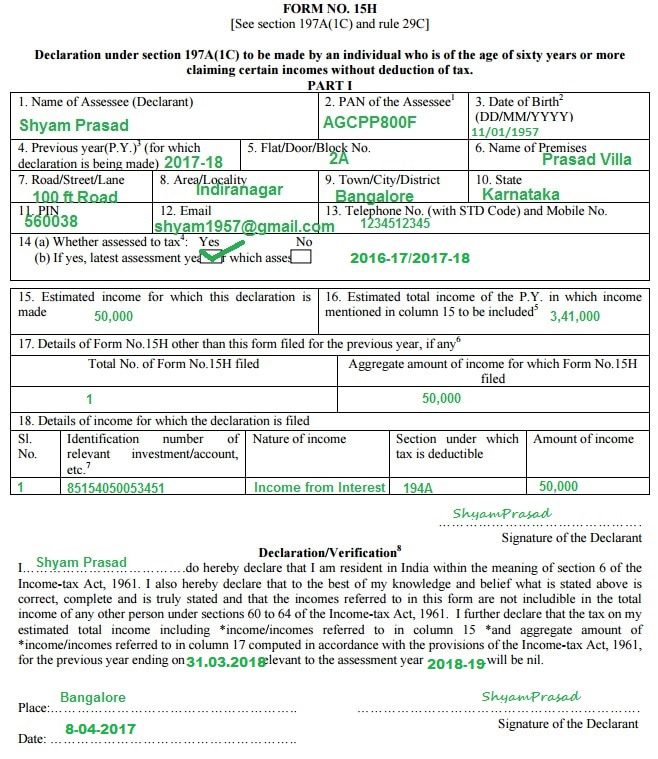

Sample Filled Form 15H for Senior Citizen for Fixed Deposit

Sample filled Form 15H for Senior Citizen for Fixed Deposit

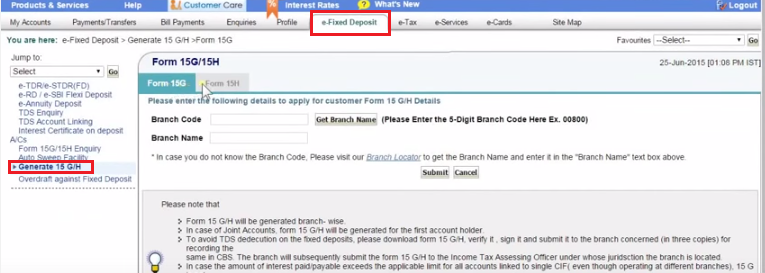

Banks which allow submission of Form 15G & Form 15H Online

Banks like State Bank of Indiaand ICIC Bank allow for online submission of Form 15G & Form 15H.

Please note that

• Form 15 G/H will be generated branch- wise.

• In case of Joint Accounts, form 15 G/H will be generated for the first account holder.

The YouTube Video on How to Fill Form 15G/15H online from State Bank of India Tutorials shows how to Submit Form 15H/Form 15G online. This video was published in Sep 2015 before the New Guidelines for Form 15G/15H were introduced. So it shows how to fill the old form

Related Articles:

- Video on Fixed Deposit, TDS on FD and how to show Interest income from FD in ITR

- Income From Other Sources :Saving Bank Account, Fixed Deposit,RD and ITR

- NRI : TDS,Tax and Income Tax Return

- Fixed Deposit in Name of Wife: Clubbing,Tax,TDS, ITR,Refund

- Tax on EPF Withdrawal

This article covered How to Fill Form 15G & How to Fill Form 15H. If you have filled Form 15G or Form 15H , please do share your feedback. If you can share the filled form with us then it would be great help for our readers. (Your details will be kept confidential)

I’m filling Form 15G for a Corporate bond, What to fill in “Identification number of relevant investment/account, etc.” box?

Some people say ISIN, some Say DP ID.

I’m confused, Please Help.

DP ID is wrt to the Demat account which can hold shares , ETF etc.

ISIN uniquely identifies the corporate Deposit.

That is what we think ( we are not from financial background)

Form 15G filling

16th field—- 55000 (my PF withdrawal amount)

17th field—- what should i fill (because its been almost 3 years that i’m not earning)?

should leave this blank empty?

thanks in advance

sham

Working in a Pvt firm. I am a regular contributor in EPF from 2009, so as pension contribution in my account. My question is : my pension contribution is eligible for withdrawal after leaving Job or it can not be withdrawn after completion of 10 yrs in EPF enrollment OR I can leave my pension contribution till attain the age of 60 yrs to be eligible for any pension against it. A wise and best advise would be appriciated.

Hi,

Please help with Form 15G, I have 5.8 Lac in my PF account. I have quit my previous company 28th Nov 2019 and currently in Dubai. its been 2 months hence i can claim my pf amount.

1. Should I put Non-Resident ? I am here from 8th Dec 2019 and I still have the 2019-20 assesment to be done which I already paid tax for salary I took till Nov 2019. I have made declaration for all the previous years correctly.

2. Estimated Income (16) will be 5.8 Lac and Estimated total (17) – will this be PF now claiming (5.8lac) + salary (7.8 lac) I took till Nov ? will this put more tax if I put complete amount ?

Your response is very valuable.

Thanks

Sir / Madam,

I am a housewife and I am receiving some money from my husband (govt. servant) regularly as gift in a monthly interval. Using the money, I am making short term online FD in my bank account . My query is, do I need to file form 15G for tax exemption every time I renew my FD. Please answer my query and give your comment on my investment method.

Do you have a PAN?

Your FD interest income will be clubbed with that of your husband!

Hello team, I am not working since last 2 years as I have just delivered a baby. I dont have any income source nor any FD. Should I fill in 15G form? I want to withdraw my PF. Last time my claim was rejected with this reason “1) PAN CARD DETAILS NOT FURNISHED IN CLAIMS/KYC 2) FORM 15 G / 15H, PAN CARD NOT SUBMITTED BY MEMBER” . My PF amount is 47 thousand.

As your amount is less than 50,000 no TDS should be deducted.

Form 15G/H is submitted so that TDS is not deducted.

EPFO asks for Form 15G to be on the safe side.

So if you want your EPF proposal to be accepted

please try to link PAN with UAN and submit form 15G while withdrawing!

Hii Sir,

i left job in last year nov 2018. Last pf duration was from May 2016 till Nov 2018. My last year total income was 5.5 Lacs. i have already applied for the pension settelement and got the same i.e 30,000/- ,

Now i want to make this Form 15G, please suggest me what are the necessary steps to write down.

hy this is sani ,

and I have been worked for two companies. Now i want to be withdraw both of companies PF money amount but i can not be withdraw through umang app the amount of two companies. i can withdraw only and 2nd PF amount, so let me help regarding this that how can i withdraw the PF……..

informed me also at sanisharm6@gmail.com…

You must first transfer from 1st employer old employer

Only then will you be able to withdraw both in one go

Else you will have to withdraw from old employer in offline mode only

Hi,

I want to withdrawal from EPF (work from 2003 to 2015):

1. I have an UAN number and active online login

2 I am now in abroad (2015 – till now)and not earning money from India.

3. My PF amount is around 4L INR.

4. I tried thru online portal but it demand form 15g submission.

6. How do I fill the form 15g, especially the following

Field No: 5(residential status) and Field No. 15(), 16(Estimated income) and 17(aggregated income).

your replay is much appreciated ..

Thanks in advance

As you are non-resident you are not eligible to file Form 15G.

If you have to submit Form 15G please enter your status as Non resident.

Field 15 (a) , Whether assessed to tax under the Income-tax Act, 1961. Yes or No, Check the appropriate Box. Mention Yes if assessed to tax under the provisions of Income-tax Act, 1961 for any of the assessment year out of six assessment years preceding the year in which the declaration is filed.

Field 15 (b), If yes, latest assessment year for which assessed , Mention the last Assessment Year, the year in which you filed Income Tax return.- When did you last file ITR?

Field 17, Estimated total income of the P.Y. in which income mentioned in column 16 to be included : Total income in India include EPF.

As you have worked for more than 10 years you cannot withdraw Pension. So don’t fill form 10C.

You can claim pension after you turn 58 years and return to India.

He is crossed more than 5 years continuous service. Still he required to submit form 15g?

Theoretically No

But often Claims are rejected because Form 15G is not submitted

I have worked in a govt organisation for 3 years and 3 months.i left the job on 8.11.2018.now today is 17.6.19.i am not employed anywhere.i dont have any other source of income.no fix deposit nothing.eating fathers money.only 30000/- in account from the salary accumulated.i have 80000/-,30000/-,and under pension-49000/- as written in epf passbook. My salary when i leave is aprox 20000/-(gross).get 17000/-(net) in account every month when doing job.i have never file income tax as it does not come under taxable limit for the 3 yr i worked.now if i withdraw epf all the 3 amount mention in passbook.how to fill the 15g.mainly the year and income columns. How much tax i have to give.

I want to withdraw now on july 2019.have not withdrawn yet.

Hi Team,

I am not working or earning from past two years , so I want to withdraw my PF amount which turns around 3.5 lakhs

Question: What should I fill in column number 15,16 and 17.

Hi ,

Thanks for your help . i have few doubts about filling form15h for Fixed deposit in multiple banks .

Query 1: Field 16, Estimated income for which this declaration is made:

==========================================================

Suppose if a senior citizen(age:65 ) has Fixed Deposit in 3 banks say bank A, bank b ,bank c

interest from bank A for Rs 1 lakh -> 15000

interest from bank B for Rs 1 lakh -> 15000

interest from bank B for Rs 1 lakh -> 15000

then the person should submit 3 form15h in 3 banks right ? so should we mention 45000 under Field 16 in all 3 banks form 15h or should we mention 15000 under Field 16 in all 3 banks form 15h

Query 2:Field 17, Estimated total income of the P.Y. in which income mentioned in column 16 to

===============================================================================

be included .

==========

if person get pension 10,000 per month

Should what amount should we mention under filed 17

[

120000(pension amount of 1 year )+

300000 (amount deposited in 3 banks )+

15000 (interest from bank A)+

15000 (interest from bank B)+

15000 (interest from bank C)]= Rs 465000

or

[120000(pension amount)+

15000 (interest from bank A)+

15000 (interest from bank B)+

15000 (interest from bank C) ] =Rs 165000

TDS for senior citizens: For those who are 60 years or older, TDS will only be deducted if the interest income exceeds Rs.50,000 in a given financial year. Earlier, the limit was Rs.10,000 but this limit was increased to Rs.50,000 in the Union Budget 2018.

So I don’t think you have to fill Form 15G

Under 80TTB, if the gross total income of a senior citizen assessee includes income from interest on deposits, a deduction of up to Rs50,000 shall be allowed on this income

FYI

Field 16 is for income for which you are filing Form 15G. So in each of the Form for Field 16 enter 15,000

Field 17 is total income including the amount of income for which this declaration is made . Field 17 165000

Field 18 2 forms, 30,000

Hi,

Thank you for your time. You have taken so much of efforts in explaining this step by step. I have a query. Under 15G form guidance, you have mentioned that “Ex: The income earned from 1st Apr 2018 to 31 Mar 2019 , during FY 2018-19 will be assessed for tax in the 2019-20 after you file tax. Here, FY 2015-16 is called Previous Year and FY 2016-17 is called Assessment Year or AY”.

Is this correct? If FY is 2018-19, shouldn’t 2018-19 be called as Previous Year and 2019-20 as Assessment Year? I’m not sure from where FY 2015-16 and AY 2016-17 came in this context?

Thanks,

Rajesh

In form 15G please advice how many signs are to be done.

Who will sign in “Signature of the person responsible for paying the income referred to in Column 22 of Part I

I filed for pf withdrawal a couple of months ago and I received my forms back asking me to submit form 15g and PAN card copy.can some please assist me on how to fill Form 15G online to withdraw PF amount. i am not able it find it in my EPFO Account portal.

One cannot file Form 15G online.

Please raise an EPF grievance and submit the Form 15G.

You can also send the copy to your regional EPFO office.

how to fill form 15H in case of SCSS

I filed for pf withdrawal a couple of months ago and I received my forms back asking me to submit form 15g and PAN card copy.can some please assist me on how to fill Form 15G online to withdraw PF amount. i am not able it find it in my EPFO Account portal.

Please update your PAN KYC under “Manage Account” ‘ and upload form 15G, amd submitt again.

Hello,

I worked for company A from May 2015 to April 2018.

PF account shows –

Employee Share 53,195.00,

Employer Share 16,270.00

Pension 33,375.00

Now, I want to withdraw complete amount and clear the PF account, as I am now paying a Home loan.

Also, After new days of leaving the company A, I got another offer from a different company with annual ctc of 4.5Lacks.

I have not linked or transferred the previous PF account of Company A to new company.

Please, I need urgent help me for fields of form 15G, Fields I need assistance with is – 4, 15, 16, 17, 18, and 19. Previously I have not withdrawn any PF, never had it actually. And I have no other income source.

URGENT HELP PLEASE.

Sir,

My work period is 2010 to 2014 and till now I am no where employed. I had done a FD in Feb. 2014 of 5 yrs (for tax benefit), please help me to fill the form 15G. Do I need to authorize the form (for PART-II) to the bank where I have done the FD?

Regards,

Sony

Part II will be filled by the bank

Hello,

I worked in a company from July -2011 to May 2014. Employee share 47,313 employer share 23,012 pension 18,627 .In this duration my salary was 25,000- 30,000/Month. I did not work after May 2014 and currently i am not working and don’t have any source of income . I want to withdraw all of my pf amount now. I started a claim request but the request was rejected and asked me to submit two copies of 15G and PAN card copy.

What should be filled in following columns

4. ?? what is the year do I need to mention??

14. …?

15.. ?

16…?

17 ……?

18….?

Last time I remember filing tax was year 2013 -2014. I did not file tax after that year.

Please help me with claiming my epf money. It would be really great and appreciate your help.

Thanks

Your comment is awaiting moderation.

Hello ,

I worked in a company from Aug -2016 to jan 2018. Employee share 27122 employer share 8288 pension 18834 .In this duration my salary was 16500/Month. Currently i m not working and dont have any source of income . I want to withdrawl all of my pf amount now. Is it mandatory to filled up 15G for me ??

What should be filled in following columns

4 .should it be 2016-2018?

15. Coluumn ??

15 b latest assesment year 2016-2018.?

16 sum of emp , emplyr share and pension (54244)?

17 is it the same amount as 16 since i dont have any income now (54244) or should i add my annual income in 2016-2018 year to column 16 (annual income 2 lakh+54244)

19. ??

what is PART II???

How much time it takes to credit Pf amount in my Bank A/C for Offline process ??

4. It means the year you withdraw which is 2018-19

15(a). Did you file your ITR any year? Mention Yes if filed ITR for any of the assessment year out of six assessment years preceding the year in which the declaration is filed.

15(b) Assessment year for which your last filed ITR

16. Yes sum of all the income (27122+8288+18834)=54244

17. Field 17, Estimated total income of the P.Y. in which income mentioned in column 16 to be included

As you don’t have any other income in the year you are withdrawing it would be 54244

19.

SNO 1

Identification number: Your Provident fund number/Member Id

Nature of income: Premature withdrawal from EPF

Section: 192A

Amount of income: 54,244

Don’t fill any thing in part 2. The person whom you are furnishing declaration ( BANK, POST OFFICE ETC.) will fill this part. Don’t fill it

My father filed nil income tax return after deductions in past years. What should he put in “whether assessed to tax” yes or no? Kindly give response as soon as possible.

Whether Assessed to Tax means whether he filed his ITR. So please say Yes and Mention the latest assessment year in which your father filed income tax return.

which for last year will be 2017-18

We have a joint Savings A/c in SBI. The first A/c holder is myself; and the 2nd holder happens to be my wife(both are senior citizens). Therefore, we have two different CIF, one for myself and the other for my wife. There are a few Fixed Deposit in my name; and one FD in the name of my wife. Now, my problem is as follows:

When I generate online 15 H, it is showing my CIF only. Accordingly, it is showing the list of deposits which are in my name only. In other words, I can submit the 15 H form for me only. But, it seems, there is no provision for online submission of 15 H form by the 2nd A/c holder. Even it is there, I could not locate it.

Can you please guide me as to how I can overcome this problem? Thanks.

CIF stands for consumer identification file.

You will get all of your accounts (savings & deposits e.g. FDs) listed in onlinesbi under oneCIF. One bank One CIF.

Netbanking allows generate form 15H only for first holder only.

You need to go to the bank and submit for your wife.

Sir I will verify about two CIF number for a joint account.

Sir, please tell me email address is also mandatory for filling 15G form or not..

Not necessary but good to put.

Hi there ,

I have got three FD :

The interest for this year 2-17-2018 is

Rs29526 + 61703+19947.64 = Rs 111176.64

So , I have filled the 15G form with

Field 16, Estimated income for which this declaration is made is Rs 111176.64

I need help to fill the field 17

Field 17, Estimated total income of the P.Y. in which income mentioned in column 16 to be included ?

Please assist.

Field 17 includes the total income you are expecting to earn this year including this FD income.

So if you earning through salary, house property, rent you have to mention that including this FD income.

Sir I have to fill 15H form for my relative’s account….my case is…

1-He is a pensioner of state govt so he is getting a fixed pension in this account.

2- He also has one FD in the same account.

3- when I was filling form 15 H online….

A-column 15 showing estimated income for which this declaration is made was already filled with 66251.32

B- So what should i fill in column 16 in this case…..should i fill only FD amount or FD+66251.32 or total pension amount of one year+ FD+66251

16 should include his total income including the FD so it is Total pension + Interest on FD.

FD amount should not be included as it is not his income.

Interest from FD is income from other sources.

Sample Filled 15H form is shown here

Sir please tell, what to fill in column no. 14…

Whether to assessed to tax…. Yes or No

As he is retired to he is not filling tax return since 2015….

Say Yes and mention the last year when he filed ITR.

Now due to PAN/Form 26AS the Govt/Income tax department can cross check.

I would like to know about form 15G. I am not working anywhere and I will receive interest from FD – expected Rs 30000 in this financial year by March 2019. TDS is deducted over and above Rs 10000 interest amount, Am i eligible for 15G and what should I fill in column 16 & 17.

Trisha is interest from Fixed Deposit your only income?

If Yes then please submit Form 15G ASAP.

Please do check your Form 26AS to show if TDS has been deducted or not till now?

Sample filled 15H form for senior citizen for Fixed deposit is shown in the image here

You have to fill 15G form and

16 should mention just income from interest ie 30000

17 should be 0 and 0.

Send the filled form to our email id bemoneyaware@gmail.com and we will verify it

Hi

I worked in a company from jan 2014 to jan 2016. I want to withdraw PF now(2018) .Pf balance is 90000. Currently i m not working ,have savings bank account with 7000 annual interest and dont have any other source of income .

What should be filled in following columns

4 .?

16 ?

17 ?

19 ?

It would be of great help if you could answer these questions

Hi

I worked in a company from jan 2014 to jan 2016. I want to withdraw pf now 2018.epf balance is 90000 Currently i m not working, i have savings bank account with 7000 annual interest and dont have any other source of income .

What should be filled in following columns

4 . PY

16 ?

17 ?

19. ?

It would be of great help if you could answer these questions

Hi

I need your help and clarifications to fill up “Form 15G for withdrawal of my PF”, where I had worked for an organisation between July 14 till June 16 as a salaried employee . I have been filling my returns , however as was travelling within India, couldn’t file my returns in AY-17-18 . Also would like to bring in to your notice that I had never filled up 15 H earlier , as except for bank interest (between 10-15K per annum)

Part 1 , point 15(a) – Do I tick “Yes” or “No”

pt.15(b) – latest assessment year was 16-17 (should I put that?)

pt. 16 – Here under estimated income , does it mean from “Interest or dividends

etc” or my gross salary income ? Also that the PF contribution is for 2

years between July 14 to June 16 , “what does estimated income for

which declaration is made” mean ?

pt.17 – Estimated total income of PY (is is 15-16??) in which income mentioned in

column 16 to be included – can you pls. , help me understand this ?

pt. 18 – I haven’t filed any 15G earlier, so would it be “Zero / 0”

18(a &b) – Zero / 0

Pt.19 – Guess that should be Zero / 0

Also there is a section Part II

Does that need to be filled also

First please file your ITR for AY 2017-18 or FY 2016-17 before 31 Mar 2018.

Please note that EPF withdrawal before 5 years is taxable.

If you have UAN linked to Aadhaar then you can withdraw online without submitting Form 15H.

Sample Form 15H for EPF withdrawal is shown here.

Our answers to your question start with BMA.

Part 1 , point 15(a) – Do I tick “Yes” or “No” :

BMA: Put Tick Yes

pt.15(b) – latest assessment year was 16-17 (should I put that?)

BMA > Last when you filed ITR. Which in your case AY 2016-17.

pt. 16 – Here under estimated income , does it mean from “Interest or dividends

etc” or my gross salary income ? Also that the PF contribution is for 2

years between July 14 to June 16 , “what does estimated income for

which declaration is made” mean ?

BMA: Estimated income from EPF. how much amount do you estimate you will get from EPF. Check your EPF balance.

pt.17 – Estimated total income of PY (is is 15-16??) in which income mentioned in

column 16 to be included – can you pls. , help me understand this ?

BMA : Total income for this year. Logic is only if your income is below the taxable limit of the year you are withdrawing no TDS should be deducted.

But in case of EPF many regional EPFO offices are asking for 15H.

pt. 18 – I haven’t filed any 15G earlier, so would it be “Zero / 0”

18(a &b) – Zero / 0

BMA: Put 0 for 18(a) and (b)

Pt.19 – Guess that should be Zero / 0

BMA: Field 19 is Details of income for which the declaration is filed,

Identification Number: Fill in your PF number,

Nature of Income: Premature withdrawal from EPF

Section: 192A

Amount of income: Your EPF balance which you will be getting.

Hi,

Firstly, thanks for the information. You are saying 15G can be submitted if

“The final tax on estimated total income computed as per the Income Tax Act should be nil”. I have seen this in many other blogs as well.

In my case it won’t be true, and column 17 will be taxable (am assuming column 17 includes taxable salary as well), so i cant submit form15g for pf withdrawal, but people say the claim gets rejected if I don’t submit 15g.

Can you please help me on how to handle this situation?

Also, I would like to highlight that we are declaring that “*I/We further declare that the tax *on my/our estimated total income including *income/incomes referred to in column 16 *and aggregate amount of *income/incomes referred to in column 18 computed in accordance with the provisions of the Income-tax Act, 1961, for the previous year ending on ……………….. relevant to the assessment year ………………will be nil.’ which means we are stating that earnings from interest is not taxable, so I don’t know from where did the other requirement “The final tax on estimated total income computed as per the Income Tax Act should be nil” come.

Why are you not submitting the request for EPF withdrawal online?

Are you withdrawing EPF before 5 years of contribution?

Yes, many times claims have got rejected when form 15G is not submitted.

Take this declaration The final tax on estimated total income computed as per the Income Tax Act should be nil with a pinch of salt.

If your income is above the taxable limit and you withdraw EPF before 5 years of contribution then you can pay the tax on it while filing ITR.

Thanks a lot. Nice Information

Dear Sir,

I am a small service provider individual having Total turnover of 15.00 Lac a year. I file return on presumption basis of 8% of turnover. Can I request service receiver for non deduction of TDS by giving them 15G? Though I am supposed to earn profit of 1.20 lac in a year but I am filling return of 2.50 Lac as actual profit.

Dear Sir,

I need some clarification regarding PF withdrawal. I was working for an Organisation in India for close to 3 yrs (October’13 to July’16). As I am now an NRI, I would like to know whether I can submit Form 15G for TDS exemption. I was told that Form 15G is only applicable for residents of India. If that is the case how do I go about with my PF withdrawal, should I let TDS be deducted and submit for a TDS refund during filing of my IT returns. Kindly provide a solution for my case.

Thanks & Regards,

Prasad

Dear Sir,

I have around Rs. 70000 in my PF account. My employed submitted my Premature claim which was returned citing that I didnt attach form 15G. As I don’t have my PAN Card or cannot produce it due to a typical situation, Shall I re-submit the form asking EPFO to deduct 34% TDS and credit the balance into my bank account? Will it work out?

Regards,

Sujith.

My Annual Salary is 325000 after PF contribution. I do invest 150000 every year in PPF . Upto Which Amount I can do FD With Submitting 15G form To get Tax Benefit .. FD interest Rate 8% per annum ? My Age < 60

Dear Sir,

I want withdraw my epf of (14th April 2015-31 Sep 2015).

but i don’t know that how many form need to be fill.

In the epf my name is not correct .

Please help me also to fill 15 g form column no 16, 17, 18 , 19.

because i don’t know which income to be fill there .

Thanks

Hello Sir,

I was working for a firm only for 6 months and I want to withdraw my PF so I want to know what should be filled in the column 16, 17 and 19 in the form 15G in my case. I do not have any sought of FD. my Gross salary as on last working day was Rs. 151908 per annum as per my relieving letter. So, kindly help me with this query of mine.

Please check the Sample filled form 15HG for Aarti Shukla, who is withdrawing on 7 Jun 2017 , her EPF of Rs 1,30,00 and has 10,000 other income is given below. Image

Field 16, Estimated income for which this declaration is made, Your PF amount

Field 17 is the total income of this Financial Year (FY 2017-18 or AY 2017-18). are you working somewhere?

Field 19. Details of income for which the declaration is filed,

Sl. No.: 1

Identification number of relevant investment/account, etc.: PF account number

Nature of income : Premature withdrawal from EPF

Section under which tax is deductible: 192A

Amount of income : Amount of PF

If you withdraw between 1 Apr 2017 to 31 Mar 2018

then Previous Year or PY( Pt 4 in the Form) is 2017-18 and Assessment AY would be 2018-19.

For 15(a) Mention latest Assessment Year for which Income Tax Return has been submitted and processed. If you have filed return for FY 2016-17 or AY 2017-18 last date for which is 31 Jul 2017 mention AY 2017-18.

Else mention the last Assessment Year in which your ITR was submitted. For example if You filed return for FY 2015-16 or AY 2016-17 then mention AY 2016-17.

In declaration part Assessment Year would be 2018-19.

Hello sir,

Your reply was very helpful an prompt. Thank you for your help. I am currently not working anywhere and so what will be there in 17th blank and where can I find my amount of PF for 16th blank? And what should i tick for the 15th blank as I dont know whether I am assessed to tax under the Income Tax Act, 1961?

I really got into this post. I found it very interesting and loaded with unique points of interest. I like to digest material that makes me think. ThanksThank you for writing this great content.

Thanks a lot for the blog post. Really looking forward to reading more.

Hi,

I have a unique issue related to EPF withdrawal.

I am presently working overseas since March 2017. Prior to that I have been working in India with a Company A (Apr 2000 to Jun 2015) and Company B (Jul 2015 to Feb 2017).

I want to withdraw EPF from both companies. As I understand the EPF account from Company A was not transferred to Company B due to a administrative lapse and hence I do not have a consolidated EPF amount. I want to to withdraw my EPF amounts and have been told to apply separately for both corresponding companies. Is this correct?

I want to know how the Form 15G needs to be filled in my case. I do not have any income in India and possibly a small interest amount not exceeding 5-10K INR is likely earning.

Can you help with Form filling?

Also, by the Income Tax rules, what is my current status? Resident / Non Resident /other etc? Can you advise correctly?

It is simpler to withdraw from both the organizations separately.

Note: EPF Withdrawal is tax-free if total contribution in EPF is more than 5 years. So though in one organization you have worked only for 2 years as the total contribution to EPF & EPS is more than 5 years total EPF withdrawal is tax-free.

Do you have UAN number?

Please fill Form 15G for second company surely else TDS will be deducted and only way to reclaim TDS deducted is through ITR submission.

Most of employers are asking Form 15G even when total number of years is more than 5 years.

Please see the sample filled form in the article.

If you are not coming then this year then you would be Non resident this financial year FY 2017-18 or AY 2018-19

Thanks for sharing the very descriptive and knowledgeable information.

Now we can file online the form 15G and 15H

Procedure is as below-

http://taxbaniya.com/2017/05/02/how-to-upload-15g-and-15h-in-income-tax/

Sorry Sir,

In my query (ANIL on May 8, 2017 9:59 AM), Please read Col. 16 instead of col 17 in last line of my query)of form 15 G.

Thanks again. Waiting for reply.

Dear Sir,

My Estimated Income for FY 2017-18 is as follows :

Income from FD interest (all Banks FDs) : 128130

Income from Savings Interest (all Bank accounts)(Expected) : 75395

Income from Dividend – Shares of all companies (Expected) : 6531

Total Income (of all above) : 210056

In have no other income, no other investments.

What amount should I mention in col. 17 of 15G for FY 2017-18.

Thanks for your help.

Anil

Your estimated taxable income for Column 17 is : 128130 + 75395 =203525

Field 16, Estimated income for which this declaration is made, Mention the estimated income for which you are filing the Form. For example, if you have opened a Fixed Deposit and you don’t want TDS to be deducted on FD then mention interest on FD you will earn this year.

So you have to mention FD interest of the bank to which you are submitting the form 15G. You would have to submit Form 15G to each of the bank for which your interest income is more than 15,000.

In Section 18 you have to mention 194A as interest from banks.

Lets start from beginning

How much is interest in FD of banks exceeding 10,000 yearly for FY 2017-18?

Have you submitted Form 15G in other banks?

I am a resident Indian would get US Dollars $250 as interest on my RFC Fixed deposit account in 2017 (FY 2017-18).

How to convert this US Dollars interest amount to INR for purpose of form 15 G Col 16 and/or col 19.

Best Regards

Tony

A returning Indian who has been a Non Resident for 9 years or more, shall be a Not Ordinarily Resident (NOR) for 2 successive years upon permanently returning to India.

A person is said to be “not ordinarily resident” in India in any previous year if such person is an individual who has been a non-resident in India in nine out of the 10 previous years preceding that year; or has during the seven previous years preceding that year been in India for a period of, or periods amounting in all to, 729 days or less.

Once you become R&OR, all your foreign (global) income will also be taxable in India subject to concessions and exemptions granted under the Double Taxation Avoidance Agreement, if any, between India and the country of your original residence.

RNOR are almost treated like NRIs when it comes to taxation.

As per Section 10(15)(iv)(fa) of the Income Tax Act, interest of foreign currency deposits in Indian Banks is exempt for non-residents and RNOR.

Hence, interest on FCNR deposits will continue to be exempt from tax as long as you remain RNOR. Similarly, interest earned on RFC account will be exempt from income tax as long as you are RNOR.

For ROR you have to convert into Rs and then file for 15G

Sir ,

I am about to file Form 15 G for FY 2017-18. Shall I included Dividend income and Interest income from all SAVINGS accounts in FY 2017-18. Do these income have to be included in 15 G col. 17. (Estimated income)

My question is how to correctly calculate income(s) such as above to be include(if at all) in Estimated income (Col.17) of form 15 G.

Thanks in advance for your help in this regards

Regards

Harish

You have to show your taxable income after deductions (80C,80D) etc which should be less than 2.5 lakhs(<60 years) or 3 lakhs(60-80 years)

Dividend income mostly is tax-free.

Interest income from all the saving accounts (upto 10,000 is tax free under 80TTA)

Ex:

Example: Mr Ajay is a salaried employee below 60 years of age. Basic salary is Rs 2,75,000. He has received Rs 5,000 as interest from Saving Bank Account and 5000 as dividend income. His contribution towards Employee Provident Fund is Rs 35,000.

Income from salary Rs. 2,75,000

Income from other sources

Interest on Saving Bank Account Rs 5,000

Dividend Income : 5000

Total Income 2,85,000

Exempt Income : 10,000(Interest from Saving Bank Account + Dividend Income)

Total income : 2,75,000

Deductions:

Under Section 80C :Employee Provident Fund 35,000

Total Taxable Income 2,40,000

He will enter 2,40,000 as his estimated income. For more examples you can read Examples of Income Tax Calculation

Thanks for the reply. I think I did not correctly put my question .

I was referring to EXPECTED Saving Interest income & EXPECTED Dividend income that MIGHT/MIGHT NOT be earned (is not yet earned while filing 15 G ) in FY 2017-18 to be included in estimated income . How can I estimate such incomes ?

Thanks again

Regards

Sorry Harish.

Dividend income mostly is tax-free so it won’t add to your taxable income.

Regarding Saving Interest you have to guess whether it will be less than 10,000 Rs or not in the year.

If it’s less than 10,000 a year it’s tax-free. Else amount above interest above 10,000 is added to your taxable income.

I am 68 years old. My interest income is Rs 4,42,000 and there is no other income. However I may earn something out of consultancy which is not sure. I deposit Rs 1,50,000 to my PPF account every year and I shall do the same this year also. So my taxable income may be less than Rs 3,00,000 for the FY 2017-18. Can I submit Form 15H? What I shall show as estimated income in column 15 & 16, income Rs 4.42-1.5=Rs 2.92 Lac?

Thanks for advice in advance.

Yes, Sir, you can and should fill form 15H.

You have to mention your taxable income which is below exemption i.e 2.92 lakhs.

Hi

What do I fill in column no.17 of Form 15 H

a. Total pension earned for the year +interest earned on FDs

or

b.Total pension+interest earned( -) Deduction under 80C i.e 1,50,000

Can u please clarify

Sir,

Your total taxable income which is below basic exemption limit.

So it should be Total pension+interest earned( -) Deduction under 80C.

Deduction under 80C should be to the limit you have invested.

If you have just invested 1.2 lakh under various schemes for 80C then that is the maximum that you can claim.

Thank you for your immediate response. atlast I got a clear idea regarding this. Thank you once again.

Thanks. Do let us know whether your form 15G was accepted or not?

I have a doubt, i need to fill form 15g for withdrawal of 7 years (2009-2016 )of my pf amount

Divya your doubt is justified.

Theoretically, you don’t need to fill Form 15G for EPF Withdrawal as you have completed 5 years.

But many employers/EPFO insist on it.

You can try contacting your company and then see whether they ask for form 15G.

Hello ,

I submitted the 15g form , the interest amount was 2.4 lakhs and no additional income .

Now when i checked the status online it says NA , what does it mean , will tax be deducted or not.

Which bank did you submit 15G?

Where are you checking the status online?

SBI

So let me get the query right:

-You filled Form 15G online on SBI (You are less than 60 years of age)

-You submitted the form at SBI branch

-When you check the status of Form 15G submitted it show Not Applicable.

You are checking the status using eFixedDepoist->Form 15G/15H enquiry as explained in the YouTube Video SBI INB: Checking submission status of Form 15G or 15H using OnlineSBI

Did you get acknowledgement from the bank?

yes , i got an acknowledgement from d bank . and below 60

Check in your Form 26AS. If it doesn’t show then maybe the bank has not updated its info.

Please do verify with the bank.

SBI , Yes online

Sir can you explain how to calculate Aggregate income by example. in above case i have seen 0 for 15g and 50000 for Seniot citizen 15h.

The you tube video is Unavailable.

Although got a good help.thanks.

Thanks for appreciation.

Thanks for informing that video link does not work. We have updated it.

Hi, My question is for Form 15G – Column 15(a) that says “whether assessed to tax”

Here the term ‘Whether assessed to tax” implies 1) whether you had an actual tax liability and therefore paid income tax in past six years ? OR 2) whether you filed for your IT returns as per norms in past 6 years (and were not necessarily liable for tax) ?

The language of this column confusing.

Good question. It means If your income was above the taxable limit in any of the past 6 years, and you filed Income Tax Return answer this question with ‘yes’.

Hi,

I want to withdrawal EPF (work from 2008 to 2011) it was managed by a trust:

1. How i will know the balance as

2 I am now in abroad and not earning money from India.

3. The PF amount is around 4L INR.

4. How do I withdraw my pf since the account should be inactive now.

5. is it I can submit the form online or I have to go to PF office.

6. Did I have to pay tax or what are the form I need to submit.

7. Do i need to go to the same PF office where the PF was managing or any office I can go ?

your replay is much appreciated ..

Thanks,

Hi, i used to get scholarship of Rs 28000 per month since August 2013 to July 2016.

From august 2016 i am getting Rs 12000 per month.

I have FD of Rs 5,45,000/- and Rs 30000/- in savings. Interests generated is more than Rs 10000/-.

Banks deducting 10% TDS

Can i file income tax return for previous years? Also, can i fill form 15G?

Add your yearly income from scholarship and intrest gained from FD, if it is below 2.5 lacs you may fill 15 G form.

You may file ITR of last three years anytime.

Hi,

I want to withdrawal EPF (work from 2012 to 2016)have some doubts:

1. How i will know the balance as UAN portal is not working

2. I have get the balance through SMS that is around 45k as I want to know is it included EPS and interest amount?

3. i want to fill 15th column in 15G by yes or no as i have not filled income tax return till now.

4. what should be fill column in 18th column of 15G form as i had submitted earlier in banks.

5. what amount should be fill in 16th and 17th column of 15G.

6. what should be fill in 19th column as identification number, section under and amount of income.

Please reply as soon as possible..

need to submit the form.

Thanks,

Hi,

I resigned during August 2015, currently unemployed( but earning scholarship for studies). I need to withdraw my EPF amount(12000). What is the Assessment year to be entered and PY?

Yu need to enter the emp[loyment tenure

hi

Dear Sir,

i want to fill form 15G for PF withdrawal but little confuse on some filed.

Kindly guide me so that i can correctly filled.

I leave my job before 5 year in 29 Aug 2016 and i want to withdraw my PF.

1>What should i filled in filed 3 ie assessment year(for which declaration is being made

2>filed -22-Estimated total income from sources mention below (i have no shares,no interest on securities,no interest on sums,no mutual fund,no withdrawal from NSS

3>what should i mention in field 23 if my last year total salary earned is 524590 for year 1st Apr 15 to 31st Mar 16 & total PF amt will be Rs268464/ and in pension it will be Rs46000

I was made Rs.200000.00 fd on november 2015 for 1.6 year 7.8% & I am workng a pvt job & monthly salry is 8500 per month no other source of income

Click here to know how to fill form 15g and to download sample filled pf form 15g.

http://www.hrcabin.com/sample-filled-form-15g/

Sir,

I am applying for pf withdrawl after resigning on 6th Apr’2016.while filling 15G,these are the queries.kindly help me.

4.P.Y:

15.Wheather assessed to tax under the income tax,1961..

(I filled zero income return on assessment year2015-16,what should i write on this column)

17.Estimate total income ( I have no FD & after resignation i joined govt.job on July, so other than salary no income,what amount i should write)

And what year i filled on declaration column,kinly help me.

Hello,

I have a Home loan so because of it, i dont get to pay any tax, and i dont have any other income, i am claiming my PF what amount should i fill in 16 and 17

Hi Sir,

I left job on 13th April 2016. Can you please let me know if I can submit form 15G for withdrawing my PF before completion of 5 years?

I have no securities, shares and mutual funds.

Please let me know if I can calculate my estimated total income as below and submit form 15G if it is below 250000?

Estimated total income = income from salary + PF amount + FD interest + SB account interest – 10000 deduction for SB account interest.

I am not considering 80C deductions while calculating estimated total income.

Should I include interest on FD and SB account interest also in schedule III of column 24?

Thanking you in advance,

PV

Hi Sir,

This is Nagesh, I have been working in USA on H1B for 2 years. I had opened few fixed deposits in my India Savings account through online. I noticed there was a link available for Form 15G in NetBanking, clicked on that link with curiosity to see what’s inside and accidentally submitted the form. I was completely unaware of what exactly Form 15G was by then. Later I read in some communities/forums to understand, I realized being not resident Indian I was not supposed to submit Form 15G, It looks I did a big mistake. My Fixed deposits interest is more than 10000. It was not my intent to skip the tax. Can someone please guide me how to reverse Form 15G submission and also let me know how to skip not to face any complications in future?

My employment duration is from 06/02/2015 to 31/07/2015. My employer deducts their part of contribution from employees salaries which is Rs: 1800 (employer share) + 2000 (employer share) = Rs: 3800/- total deduction towards PF from employees salaries.

My employer has registered two PF different Accounts on my name within this duration of employment i.e from Feb/2015 to July/2015. I came to know about below issues after inquiring at PF office:

1) Out of 2 accounts on my name, one has got settled already in Dec/2015 with very less amount as the duration for this 1st settled PF account was from Feb/2015 to Apr/2015 as per their records

2) The 2nd PF account duration they created again was from (May/2015 to July/2015) and the PF balance is very less in this second account too.

I’ve been chasing my employer for more than a year and never got proper response. Please let me know whom should I approach and what is that I can do to settle my claim.

Please Note: This is not just my case with this employer there are many other employees of this company who are facing issues in filing PF Claim.

Thank You!

Hi,

I left my job in july-2015., what should I update in Assessment year (for declaration is being made) and in Part II should I update my name and details, my company is insisting to do that.

Kindly update me on this.

Thanks.

Hi there colleagues, its great post regarding cultureand

fully explained, keep it up all the time.

I left my job Jan 2016, My PF amount is 3.5 lac INR and I’m withdrawing it (within 5 years). What exactly should I mention in Column 16 and 17 for 15G ? Am I even eligible to fill 15G? Should I have mention the total salary I received from April 2015 to Jan 2016 in Column 17 and Mention the Entire PF withdrawal amount in Column 16. And also the amount mentioned in column 19, is 10% of the amount mentioned in Column 16? Can someone please help me on this ASAP. Thank You.

-jeni

Hello Jeni,

As you PF amount itself is more than the basic exemption limit , technically you should not fill Form 15G.

Form 15G is to tell the EPF not to deduct TDS on EPF withdrawal.

But many companies are insisting on getting form 15G filled.

So if you have to fill Form 15G

– Field 16 is PF withdrawal amount which is 3.5 lakh

Estimated income for which this declaration is made, Mention the estimated income for which you are filing the Form. For example if you have opened a Fixed Deposit and you don’t want TDS to be deducted on FD then mention interest on FD you will earn this year

Field 17, Estimated total income of the P.Y. in which income mentioned in column 16 to be included

So Field 17 is the total income of this Financial Year (FY 2016-17 AY 2017-18), so it does NOT include your income from April 2015 to Jan 2016 . It would include any FD or your salary for this year(if you have rejoined ) including PF withdrawal amount.

Field 19 you again have to put full PF withdrawal amount. (It is not 10%) That’s mistake on our part and we will correct it ASAP.

Thank You for the response, I got it cleared. Really a good site.

Thanks Jeni. Please spread the word around.

I was suggested this website via my cousin. I am not

certain whether or not this put up is written via him as no one else realize such unique approximately my trouble.

You’re incredible! Thanks!

I joined in aug-16-2011 i left april 30-2012 after i joined other organsation sep-1-2012 ,First organsation pf amount transferred new pf account & i left sep 30-2016 nw can i apply my pf

You can apply for withdrawal of PF after 2 months of unemployment. You need to submit Form 19 and Form 10C.

Hi, worked from July 2014 -Aug 2015 and now want to withdraw PF. Need help with columns 16, 17 & 19

Column 16: Do I mention estimate of annual PF amount?

Column 17: —?

Column 19:Is it PF account details or FD a/c number (or PPF details) that need to be mentioned here?

Also I have contributed towards VPF. Is PF withdrawal combined with VPF?

Please advise. Any information would be greatly appreciated.

Hi,

I withdrew my PF when i was moving from my previous company and then worked in another company for 4 years. Now I have left the company in May 2016 for higher studies and want to withdraw my PF. My last IT Filed year was for the previous year, though IT was getting deducted for till May 2016. Please advise as to what would be my ‘assessment Year’ and ‘Last assessement year’ in form 15G. Also, I dont have any investments except for couple of LIC policies. Do I need to fill anything in the Schedules. Appreciate your response.

Thanks,

Abdul

Congratulations and best wishes for higher studies.

Please fill the form as per the form 15G in our article. There are no schedules..Form 15G has been updated.

Hello there,

Please consider my situation:

I left my job for higher studies preparation in June 2016.

Work Ex: Approx. 4 years

I need to withdraw PF in Oct’16 (Approx. 130000/-INR). Will file today if answers help me out.

What I can’t figure out is as follows:

Q1. In #4. Previous Year: What to fill in this?

Q2. In #15. Assessment year: What to fill in this? I worked for 3 month in FY 2016-2017(from April to June’16)

Q3. In #Declaration: Its all messed up in my head.

Q3a. “previous year ending on …….”

Q3b. “relevant to assessment year ……”

Q3c. “incomes..previous year ending on ….”

Q3d. and again “relevant to assessment year ……”

Considering my situation, what all years need to be filled in these?

Q4. What will happen in I fill ‘NO’ in #15?

PS: I am using the latest form 15G shown in the example above.

In case you are on the lookout for a web based free recreation like Pokémon, then you

possibly can’t do better than the fan-made Pokémon Dawn of Darkness.

Hi,

I worked for 1 year with this company and my Pf Amount is approx. 25000/-

As far as i have understood that in my case form 15G is not required bcoz the withdraw-able amount is less than 30,000/- and service is also less than 5 years. Hence no TDS will be deducted if i do not submit form 15G. Am I RIGHT ????

Regards,

AG

It’s remarkable to pay a visit this web site and reading the views of all friends regarding this paragraph, while I am also

zealous of getting knowledge.

Hi, I’ll be withdrawing my pf in Oct 2016,left my previous company in June2016, my total pf amt is 48000 and my salary for year march 2015-dec 2015 was 212184,which got appraised in Jan 2016 to 241080 ,I’m confused what amt should I mention in column 15,16,17,and the 19th column ,also in 19th column what is to be mentioned for identification number of relevant investment/account header? Nature of income header, and amount of income header..thanks

Suppose, I am withdrawing on 30 Sep 2016, EPF of Rs 1,20,00 and no other income & I have not filled income tax returns since last 2 years. What should be filled for:

Field 4 – Previous year (PY)

Field 15a – Whether assessed to tax under Income tax act

Field 15b –

Field 16 – Estimated income for which this declaration is made

Field 17 – Estimated total income of the P.Y. in which income mentioned in column 16 to be included

Also in the Declaration – what to filled for previous year & assessment year.

Thanks.

Hello Fenil,

We have updated the form for FY 2016-17.

Field 4 , Previous Year: 2016-17

Field 15A:Yes

Field 15B:Last AY when you filed the return

Field 16:1,20,00

Field 17:1,20,00

For declaration please check the image

Thanks for the quick reply. really appreciate it.

Just one more thing – for Field 15A & 15B – if I have not filed income tax return in any of the last years till now, then can I select no.

If you haven’t filed the return ITR ever then yes you have to say No.

Else mention that AY when you had filed ITR

Also in my case i am withdrawing my PF before 5 years of service, so I need to fill Form 19 (UAN), Form 10C (UAN) & Form 31 (UAN). Is that correct?

In Form 31 (UAN), Do i need to specify any particular purpose for which advance is required field.

Thanks,

Sir,

I served in previous organization for 2.5 years and my epf withdrawal application has been rejected by epf office.

On enquiry they told me that the TDS was calculated @ ~24% (which comes out to be around 65,000). They asked me to resubmit the form alongwith copy of pan card and Form-15G.

Currently I am in 10% tax slab.

Kindly guide whether I am eligible to submit form-15G for epf withdrawal??

At what rate TDS will be calculated if I submit only pancard?

What documents/forms I have to submit in this situation.

I want my pf withdrawal I filled 15g form but I have dought column 16 and 17 what is amount to be filled in that column

My total pf contribution 55000 so what amount to be filled

Sir,

My PF withdrawal from 10 C and 19, both are rejected by EPFO stating that “Form 15-G is not submitted”. Since it has already been rejected, kindly advise me a way so that I can go ahead with my PF withdrawal.

Can I just download form 15-G and post to the office of EPFO? Or should I have to re-initiate the whole process? Kindly reply.

whole process has to be reinitiated.

Hello Sir,

I would need your suggestion very urgently. Kindly help me.

I would like to withdraw my PF before 5 years and I don’t have any investments also to mention in 15G. Could you please tell me how much the tax deduction will be on my PF amount 370000. Kindly suggest

I am trying to withdraw my PF and filling form 15G in relation to that. In Field 22, Schedule III, does it refer to any persons that I have lent money to or does it refer to FDs in banks? Please advise.

You are referring to old form.

Maam Please read the article and see the sample filled form for withdrawing PF.

Money lent to any person does not count but FD in banks does

Hi Sravani. I just got my pf withdrawl done a week back from bandra mumbai branch and i personally went to epf ofice in pune camp to get the 15 g form filled since my questions were not answered by anyone in the forum. They gave me the form where the box 22 and 23 is for amount.if it is the old form then the pf office is still using it.they told me clearly not to fill anything in box 22 and 23 and only fill the addres pf number ward etc which is at the beginning of the form. I suggest you do the same and you will get the amount. My only problem was name in the bank account and name in pf and pan for which i also attached my bank statement along with cancelled cheque.

Thanks for information Veena

Sir,

I am getting confused in few points,

my situation is as follows :

i have 2 FD

Bank A : FD of 100000, interest earned of 7717

Bank B : FD of 100000, interest earned of 7523

1> my interest earned per bank is below 10000, do i still need to file 15G ?

2> there is no other source of income so what will be the values for 16,17,18

i know i need to file 2 forms for both banks,

Bank A : 16= 7717 17= ? 18= this is the first time i am filing 15G, so previous yr is 0 ?

Bank B : 16= 7523 17= ? 18= 0

kindly advise

If Interest from FD is less than 10,000 TDS would not be deducted.

So if interest earned per bank is less than 10K you do not need to file 15G

My father is coming under Super senior citizens category. Retired Government servent. Having pension 3.5 lakhes par year approximately. Age 80 and above are exampted from TDS up to 5 lakhes. Pension amount is included in this 5 lakhes limits?

Investment maid in the name of my mother is also illegible for another 3 lakhs exemption?

How to calculate interest from some FD’s with different bank and some FD’s with private company?

Yes Pension is considered as Income from Salary.

Investment in name of wife, if wife has no income is clubbed with husband. Please go through article Fixed Deposit in Name of Wife: Clubbing,Tax,TDS, ITR,Refund for more details.

If he had made FD in name of your mother, interest from FD is taxable not amount invested.

You can get Form 16A which shows TDS deducted on interest from FD. Interest from FD is deducted at rate of 10% if interest income is more than 10,000 in year.

You can get details about interest earned from FD every year from each bank.

Sir,

I fixed Rs, 1,00,000 and my monthly income is 10,000/- per month. What i filled in 16,17 & 18 column.

please take the latest form. the form you are referring to is incorrect. you will have to refer the form which has only 22 and 23 columns for amount.

Hi,

i am confused about what to fill in 15,16,17,18 & columns of latest Form15G. Let me give you some background, i worked for a company from Dec 2010 till 21st Mar 2016. Last time i filed my IT returns is in 2015 for AY 2015-16., i am yet to file my it returns for FY 2015-2016. Now i want to withdraw my PF amount which could be around 2 lacs and i have this pf account for more than 5 years. I dont have any income from April 2016. No FDs and nothing. Do i need to fill form 15g as below,

1) Column 15 (a): Yes, 15 (b): 2015-16

2) Column 16: 2 lacs(PF amount)

3) Column 17: 2 Lacs

4) Column 18 (a): 0

5) Column 18 (b): 2 lacs

6) Column 19: None

Please suggest me.

Thanks for your valuable time.

please take the latest form. the form you are referring to is incorrect. you will have to refer the form which has only 22 and 23 columns for amount.

Hello Sir, My PF withdrawl amount is about 440000 rupees. I would like to know if i need to fill 15g form since i have not completed 5 years in the pf account.

Also i am not working since 5 months. i left my job in jan 2016

i also wanted to know if i will be exempted from tax if i wait till november 2016 for withdrawing EPF since i will be completing 5 years of epf account by then. Also will i be allowed to withdraw if i wait upto that time because of the new rules.

i am not investing in PPF in year 2015. Should interest on PPF for previous years is to be added in total income in 15G Form.

No you should add income from PPF interest, as income from PPF is exempt income.

should or should not : as written in your reply pls elaborate to clear my confusion.

Hi,

Please help me with few queries.

1. I want to withdraw PF and worked for 2.4 years in the company.

2. Do you mean taxable income in this case is the total PF balance for AY2016 or total salary income for AY 2016 for 15G?

3.If I submit PAN but not 15G,will 10% will be deducted on 50K or on the total PF balance?

4.If I take th example of the above case,Is 1,30,000 is the total PF amount?

5.Is it a new rule implemented to deduct tax in EPF? Never filled this previously.

6. Is there any deadline to apply for the withdrawal or date set

Appreciate a quick response.

Regards

Partha

i also wanted to know if i will be exempted from tax if i wait till november 2016 for withdrawing EPF since i will be completing 5 years of epf account by then. Also will i be allowed to withdraw if i wait upto that time because of the new rules.

Also i am not working since 5 months. i left my job in jan 2016

Hello Sir, My PF withdrawl amount is about 440000 rupees. I would like to know if i need to fill 15g form since i have not completed 5 years in the pf account.

Thanks for the details for 15 G/15 H

I have no such option to fill Form 15G in onlinesbi. What to do now?

Submit it manually. Please either take printout of Form 15G or visit the bank and obtain the form.

Fill in the details and submit.

i would like to withdraw my PF of my previous organization, i Left the job Feb-2015 and joined another organization, I worked in my previous organization for 4.5 yrs. Do i need to fill 15G form. if yes can you please help me out what exactly to filled in columns 16 & 17, i understand i need to enter the PF amount to be withdrawn in column 16 , But in column 17 what i should enter.

Hello, Thanks for such a detailed article on how to fill up form 15G. I am withdrawing my PF after over 10 years of leaving the company. I have one point where am confused – does AY and FY apply to the current date/year which is the date of withdrawal or to the year dating back to the employment period for said PF?

AY,FY refer to the year in which you withdraw.

Field 4 , Previous Year: year in which you will earn your income for which you want to avoid TDS.

Calendar year starts on January 1 and ends on December 31 but a Financial year (FY) is from April 1 to March 31. As per the Income Tax Act, income earned in a financial year (FY) is taxed in the next Financial Year. FY to which the income belongs is called the Previous year (PY) and the FY in which the income is taxed is called the Assessment year (AY). Ex:The income earned from 1st Apr 2015 to 31 mar 2016 ,during FY 2015-16 will be assessed for tax in the 2016-17. Here, FY 2015-16 is called Previous Year and FY 2016-17 is called Assessment Year or AY.

I was an employee of a private company for 3 years and was drawing total salary of rs 2.15 lacs per annum. Now in april 2016 i have resined from job and doing my own farming.I wish to withdraw entire amount of PF.Please guide me regarding entire procedure and forms to submit and where to submit.

i wish to withdraw PF amount. i worked in that company for 3 years. i have applied for withdrawal after 8 years. i am still working with another company. i have taxable income from salary above basic exemption limit. the company is insisting that i submit form 15-G for non deduction of TDS. am i eligible to submit this form 15-G. kindly advise.

Theoretically you are eligible to submit Form 15G if your total taxable income(i.e income with deductions) is less than 2.5 lakh .

Theoretically you cannot withdraw if you are working , you need to be unemployed for 2 months.

Do 2 negatives make a positive?

Most of the companies are asking for people to fill Form 15G to avoid TDS being deducted as per income slab. That does not make EPF tax free

I have one more query though.

One of the deductor has provided me with a partly pre-filled form 15G, with a note tagged to points 15 and 19 (column for investment / account wise amount of income). Note says, “including interest arising out of renewal of existing deposits and new deposits placed on or before 31.03.2017”

I am of the view that such a note will be against the very schema of this form. Who will held responsible if the income-tax department finds it objectionable ? deductee right ?

You are right, if there is any problem in TDS deduction the deductee is held as Income Tax Department thinks its deductee responsibility.

But the language in pre filled form generated is limited by the software generating the form.

Did you ask the deductor about the explanation for the note in prefilled form?

Kindly guide if my understanding as mentioned here under is correct regarding few fields of form 15g