An uneducated individual armed with a credit card and access to a mortgage can be just as dangerous to themselves and their community as a person with no training who is given a car to drive. Some time back we went to Amity College in Bangalore for a presentation on How to have a great financial future. This article is based on that presentation and is focused on those who are going to start a job or have already started earning, so that they can have a great financial future and life.

Video on YouTube: How to have a great financial future

We have converted the presentation into a video. How to have a great financial future, a 6 minute long video at YouTube. This presentation is focused on those who are going to start a job or have already started earning. We are thankful to Amity College for giving us this wonderful opportunity

Overview of How to have a great financial future

With Money comes Great responsibility!

It’s a big transition,coming from college, not making any money, to coming home with a paycheck. People’s heads spin about what they should do. Your first regular paycheck will probably buy you and your friends a dinner at a nice hotel, gifts for family,some charity However, a regular paycheck and a steady income provide exactly what you need to start making good financial decisions for the future.When you kick-off your professional career, the pay cheque may not be fat, but you also do not have many responsibilities, hopefully.

Right now, your paycheck might cover rent and brunch, but what about five years from now? Ten? You don’t need to know exactly where you’ll be or what you’ll be doing, but thinking about some of life’s biggest and most expensive milestones now gives you time to start turning them into a reality. Do you want to buy a house? Have a wedding? Have a child? Take a trip to Bali? Setting aside some money each month towards those goals for the next few years will make them a lot less intimidating when it comes time to act.

Sadly we do not allow people to drive a vehicle without taking a license test but allow them to enter complex financial world without much financial education.

It’s a Financial Jungle out there

Financial world today is far more complicated than it used to be a decade ago. A decade ago,mobile phone was just used for making calls, not all carried credit cards, money transfer took time, mobile banking, digital wallets were not there. There are too many choices to spend, latest gadgets, places one wants to see. Too many options to save. Mutual Funds,Stocks,Gold ETF,Gold Bonds, Fixed Deposits! There are about 1,605 debt schemes while the total number of schemes, including equities, are at a whopping 2,599.

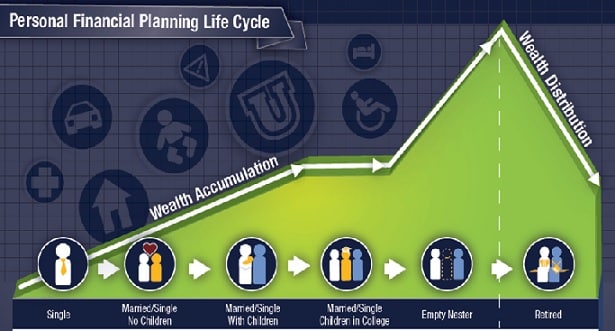

Financial Life Cycle

Your Personal Financial Life basically follows 2 phases:

- Phase of Wealth Accumlation where you transition from Single to Married and Responsibilities And

- Phase of Wealth Spending : When you are retired

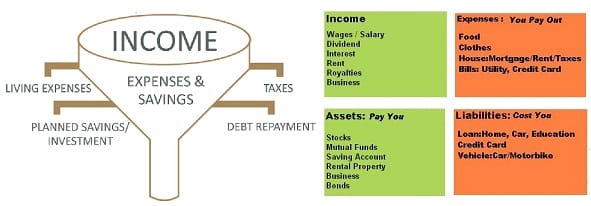

Typical flow of Income

Income is spent in :Living expenses, Taxes, Loan Repayment or Planned Investments. You need to have a balance between your income,spending,saving and investments. Four Corner Stones of Our Financial life are Income,Expenses,Assets,Liabilities

When one becomes an Employee

Most of us start by becoming an employee. The first shock we get is that our first salary is nowhere near the Cost to Company. And we learn the difference between Cost to Company, Gross Salary, Net Salary. As an employee we have to know about

- Provident Fund: EPF, UAN, Member ID, EPS

- Allowances: LTA, HRA ,Gratuity, Medical reimbusrment

- Leaves : Medical, Earned, Casual

- Taxes: Form 16, Form 12B, Tax Saving

Using Credit Card

Credit Card is A Good Servant But a Bad Master. You have been told from your childhood that fire is a good servant but a bad master and that’s why you have always handled fire with caution. The very same principal is applicable to credit cards. When used judiciously credit cards can help you build and improve your CIBIL score, but the moment you go reckless with them, you are inviting a potential debt trap.

- Make the most of interest free days

- Always check your credit card statement

- Always pay off the balance in full each month

- Credit Card reward points are great

Loans and EMI

Don’t be slave to EMI :Don’t live beyond your means.

One is flooded with offers from the bank,stores telling that he can pay in EMI’s. He gets education loan. Completes his degree. Gets a zero percent intrest loan for buying a smartphone or smart TV. Gets a promotion. Buys a car with EMI option. Gets married. Buys a house and keeps paying his loans until he is forty or fifty. It’s like handing over your life in the hands of the banks. Scary. Understand difference between Good and Bad Loans.

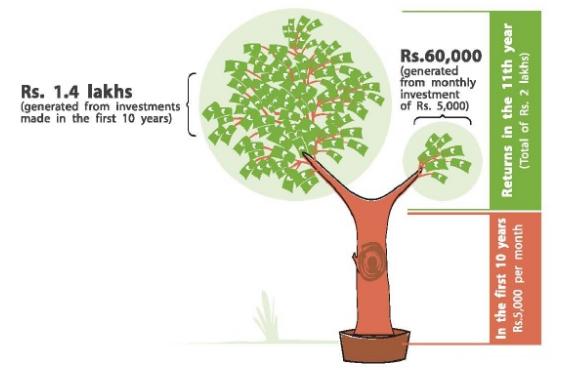

Advantage of Starting Early

Understand the Difference between Saving and Investing Saving means keeping aside a part of your income,Money used for emergencies and specific purchases . Investment means putting that money in financial products to earn returns and grow your wealth

Early investing is very much like growing a tree…if you can take good care of it at the start, it will take care of itself later

Investing is confusing

Word investing conjures up countless different meanings for individuals. For some individuals investing means buying mutual funds,for others buying stocks, or property or investing in Fixed deposits. Just like 6 blind men and elephant.

- Hey, the elephant is a pillar,” said the first man who touched his leg.

- “Oh, no! it is like a rope,” said the second man who touched the tail.

- “Oh, no! it is like a thick branch of a tree,” said the third man who touched the trunk of the elephant.

- “It is like a big hand fan” said the fourth man who touched the ear of the elephant.

- “It is like a huge wall,” said the fifth man who touched the belly of the elephant.

- “It is like a solid pipe,” Said the sixth man who touched the tusk of the elephant.

They began to argue about the elephant and everyone of them insisted that he was right. It looked like they were getting agitated. A wise man was passing by and he saw this. He stopped and asked them, “What is the matter?” They said, “We cannot agree to what the elephant is like.” Each one of them told what he thought the elephant was like. The wise man calmly explained to them, “All of you are right. The reason every one of you is telling it differently because each one of you touched the different part of the elephant. So, actually the elephant has all those features what you all said.

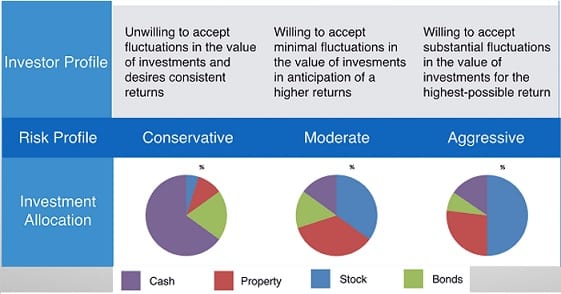

Understanding who you are : Your Risk profile

Risk is a fundamental part of investing, which means establishing your appetite for potential risk and return is an essential step before you invest any money. But before you start investing, the key is to understand your risk profile. Risk appetite is more about understanding your actions in times of adverse situation, i.e., how will you react if your investments meant for six years starts showing negative returns after only three months of investing?

Based on the same, you can decide your asset allocation. Once you know how much spread is to be maintained between risk assets (equity) and low-risk assets (debt portfolio), you can identify the schemes where you would like to invest

Understand different financial products

The world of finance and investing can seem intimidating, but a little knowledge and education can help you find your way.

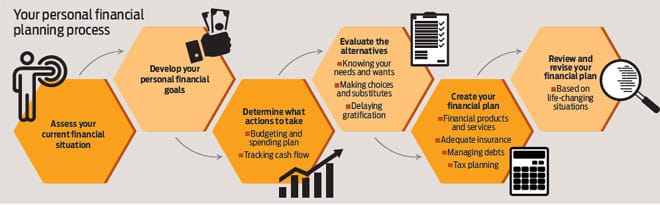

Coming up with a your personal financial plan

When building a house, we recognize it’s a good thing to have a carefully considered blueprint for action before taking on a challenging task. Unfortunately, too many people use the “we’ll work out the details as we go along” approach when it comes to one of the most important projects they’ll ever take on—building a secure financial future. Just as our dream house could end up poorly designed due to a lack of planning, many people reach retirement and find their financial home isn’t what they’ve always hoped for. Make this the year you set aside time to create a personalized financial plan that’s designed to build the kind of future financial home you’ll enjoy living in.

- Ask why money is important to you.

- Guess where you want to go.

- Know your starting point

- Think of budgeting as a tool for awareness.

- Save as much as you reasonably can.

- Buy just enough insurance — today.

Related Articles:

What do you think about how to have a great financial life? What mistakes you committed and how did you rectify them? should you have such sessions in colleges?

Brilliant post But The video link is not opening

Hi, I have questions!!!

I have a ulip where the Policyholdername is Sneh Khattar (my mother) and Insured Person Name is Himanshu Khattar (i.e. me), can I avail tax benefit for this policy?

Looking for your advice