Property tax or house tax is a local tax levied by municipal authorities for maintaining basic civic amenities in your area. For 2016-17 The city has been classified into A, B, C, D, E and F zones. Property Tax for Bangalore can be paid from 1 Apr 2021 till 30th Apr 2021. If paid before 30 Apr 2021 you get a rebate of 5%. This article gives an overview of Property Tax in Bangalore, How to pay Property Tax in Bangalore Online for FY 2021-22, FAQ on Property Tax in Bangalore

You are entitled to a rebate of five percent, if you pay the entire property tax amount before May 30, every year. If you choose to pay in two installments, no interest is charged on the first installment, if it is paid by May 30 and on the second installment, if it is paid by November 30, every year.

Ensure that the system updates your record and no outstanding amounts are shown against your account. If there are any errors, have them corrected immediately.

Calculation of tax: a property with a total built up area of 4,680 sq ft was paying property tax of Rs 76,047 for the year 2015-16 and with this hike, it has been enhanced to Rs 1,22,825 for the year 2016-17, which is a massive 61.51 per cent hike. But with the 5 per cent rebate and a decision taken by BBMP to restrict the hike to 20 and 25 per cent, this property owner will end up paying 95,059 which saves him Rs 27,766.

Table of Contents

How to pay property tax online?

The most convenient way to pay your property tax, is online on the BBMP website, with your credit or debit card or through internet banking. (https://bbmptax.karnataka.gov.in/)

- You can retrieve your property details through your Base Application Number or Property Identifiers (PID). You can make the payment towards your property tax online only if you have already paid the property tax at least once, by using your Sas Base Application or PID NUMBER.

- An OTP is received. Enter it

- Click on ‘Retrieve’. Once you do that, the owner’s name of the property is displayed on the screen.

- Click on ‘Confirm’.

- Check the details thoroughly and go ahead to make the payment.

- Select the option through which the payment is to be made.

- Visit BBMP Property Tax portal and click ‘Downloads’. Select your option from the drop-down menu. You can print the receipt, Challan or application through this page. You need to enter the assessment year and application ID to view the document you want to print or save.

Workaround if you are getting Form V instead of Form IV

Are you getting the form V instead of form iv? For many people, this is happening. The solution suggested is to proceed to Form 5, in the URL text which is displayed replace Form 5 with Form 4 and then make the payment as explained below

Form V: All applications where Show cause notice/ Demand notice/ Zonal classification mismatch demand notices generated are redirected to file the returns through Form-V for subsequent payments for necessary amendments.

- Step 1: Go to https://bbmptax.karnataka.

gov.in/ and retrieve your account details - Step 2: A OTP is received. enter it

- Step 3: It opens Form 5. Look for “5New” in the URL and replace “5NEW” with “4NEW”.

- Step 4: It opens Form 4

- Step 5: Follow regular steps and hopefully it should work.

Video on How to pay Property Tax Online in Bangalore

Overview of Property Tax in Bangalore

- Property Tax for the financial year 2021-22 starts from April 1, 2021

- You can make the payment towards your property tax if you already paid the property tax at least once, by using your SAS APPLICATION NUMBER for the year 2008-09 or later or PID NUMBER . If you are paying the property tax for the first time kindly wait for a while.(not sure how to proceed ). PIDs or Property Identification Numbers contain information on ward numbers, street ID and new plot numbers assigned to various properties.

- Property tax can be paid either online or at designated Bank branches wyou can find at BBMPTax websitehich . If any changes are made in the structure of the property necessary additions or deletions are to be made in the application. Once the entries are complete, you can generate a challan. This challan along with return has to be used for the payment of property tax in any of the Canara bank branches in jurisdictional area only.

- No payments will be accepted at BBMP help centres or zonal offices.

- Property Tax can be paid in two installments:

- the 1st installment will be interest free if it is paid within 30th May 2021,

- the 2nd installment will be interest free if it is paid within 29th November, 2021.

- 5% rebate can be availed if the entire BBMP Property Taxes for the current year is paid before 30-04-2021.

- If the property tax (for 1st half year) is not paid before 31th May 2021, interest at the rate of 2% per month will be charged thereafter.

- The jurisdiction of BBMP has been classified into 6 value zones based on the published guidance value of the Department of Stamps and Registration. The city has been classified into A, B, C, D, E and F zones.

- If the property tax return for the previous year has not been filed, property tax for the current year shall be accompanied by the return and dues, if any for the previous years. If you are making payment for previous years (arrears payment) , payment shall be made after generating challan for each previous year.

- If you are a defaulter, the system calculates the interest automatically for the defaulted period at the rate of 2% per month.

- If you are paying through DD or CASH, receipt is generated instantly. But for the payment through cheques, a receipt can be generated only after the realization of the cheque amount.

How is Property Tax in Bangalore calculated?

Property Tax in Bangalore is calculated using the Unit Area Value method. The Unit Area Value system is another variant of the earlier Annual Rateable Value (ARV) system.

While the ARV was based on the expected rent from the property, the Unit Area Value is based on the expected returns from the property depending on the location and usage of the property. Since the unit of calculation is based on per square foot per month (UNIT) and for a particular location, street, (AREA) and multiplied by a rate (VALUE), this method of assessment of property is called “Unit Area Value” method. . Our article What is Property Tax, How is it Calculated and Paid talks about different methods of calculation of Property Tax used in Delhi, Chennai etc.

BBMP will move towards implementing property tax based on the Capital Value System. Owners will pay tax based on the capital value of the property.

The formula used to calculate property tax is as follows:

Property Tax (K) = (G – I) x 20%

Where, G = X + Y + Z and I = G x H/100

- G = Gross unit area value

- X = Tenanted area of property x Per sq ft rate of property x 10 months

- Y = Self-occupied area of property x Per sq ft rate of property x 10 months

- Z = Vehicle parking area x Per sq ft rate of vehicle parking area x 10 months

- H = Percentage of depreciation rate (depends upon the age of the property).

How much property tax is collected from Bangalore?

What is PID number?

PID or Property Identification number. In 2012 each property under BBMP was given a new GIS-based PID number. The PID Number is a combination of Ward number- Street Number-Plot number. A unique street number has been assigned to each and every Street and within the street a property number has been assigned .

Visit BBMP official website and select ‘Citizen Services’. You will be redirected to a new page where you have to choose ‘GIS-Enabled Property Tax Information System’. Register through your first number and mobile number. The property mapped on your mobile number will be shown on the map. If your mobile number is not in the records, you can enter your previous payment Application ID, your new PID number will be displayed.

PID will have ward number, new street ID and newly allotted property number. To find your PID number, please follow the steps in the video. The information required to fill the form are PID number or Khata number, SAS 2008-2009 and 2011-2012 application numbers, receipt and date.

What are the various Zones for Property Tax in Bangalore ?

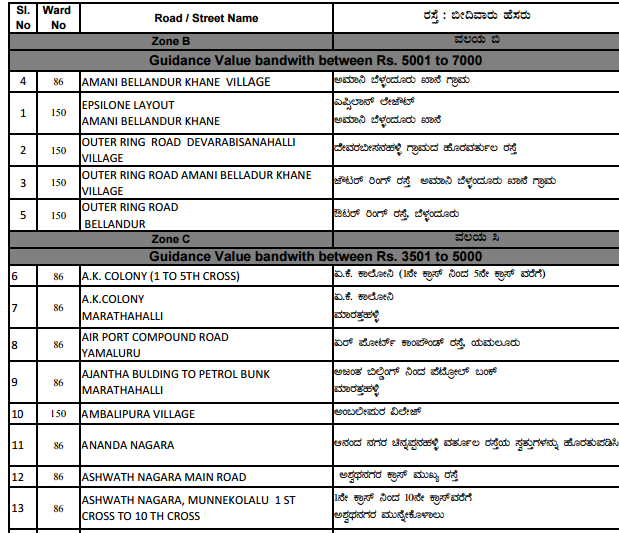

The city has been classified into A, B, C, D, E and F zones. While Zone-A will have guidance value of Rs 7000 per sqft and above, Zone-F will have guidance value of Rs 1,000 per sqft and below. Webpage has Zonal Classification of roads – Zone, Sub-division & Ward wise . An excerpt is given below. Clicking on Residential or Non residential will take you to a pdf file with information about Wards and Streets as shown in image below.

|

l. No. |

Zone |

Sub-Division |

Ward Number & Name |

Zonal Classification |

|

|

1 |

West |

Chickpet |

109 – Chikpet

120 – Cottonpet 121 – Binnypet |

Residential |

Non- Residential |

|

2 |

West |

Gandhinagar |

77 – Dattathreya Temple

94 – Gandhinagar 95 – Subhashnagar 96 – Okalipuram |

Residential |

Non- Resident |

Excerpt from the Residential Zonal Classification Document. So Outer Ring Road Bellundar comes under Zone B with Guidance Value between Rs 5001 to 7000 and Ambalipura Village comes under Zone C with Guidance Value between Rs 3501 to 5000

Has the Property Tax in Bangalore gone up in FY 2016-17?

Yes. Property tax rates were last revised in 2008, based on the 2007 guidance value rates. Ever since, guidance values were revised thrice, but tax rates were not, is BBMP’s argument . under the provisions of the Karnataka Municipal Corporation Act, property tax can be hiked between 15 to 30 per cent once in three years. But since 2008, it has not been revised. After discussion at various levels for the last six months, it was finally decided to increase tax for residential properties by 20 per cent and non-residential by 25 per cent with effect from April 1 2016. Hence, during revision it is normal for the tax to go up. The Unit Area Value(UAV) for Zone E, according to prevailing rates for tenanted residential properties, is Rs 2.40 per sqft per month. The proposed UAV for similar category in Zone A is Rs 6. For a residential property that moves from Zone E to A, this would mean a 150% hike in the levy

However, in order ensure that tax payer is not affected by more than one jump, the jump in zonal classification has been limited to the next higher zone only. For Ex : If an area / street under the SAS 2008 was classified under F zone, but in the present notification is classified in D Zone, then the properties in such street / area shall be restricted. To next higher Zone i.e. E zone., and not the revised rate of D zone for the current block period.

FAQ on Paying Property Tax in Bangalore

From BBMP Property Tax Frequently Asked Questions some FAQ

8. In respect of apartment should super built up area or carpet area be considered?

To keep the measurement objective, the measurement mentioned in the schedule to the sale deed has to be taken as this is irrefutable evidence. Carpet area will always lead to interpretation between the taxpayer and BBMP and hence avoided. To keep the measurement objective, the measurement mentioned in the schedule of the sale deed has to be taken as this is irrefutable evidence. However total area shall not be less than the area mentioned in the ocupancy certificate

If my property has been constructed and occupied in January 2016 for what period should. I calculate the property tax. Is it for the full year or part year?

If the building is completed after 1st October of any year, property tax for the second half year has to be paid. Those completed prior to 1st October have to pay property tax for the full year.

What happens if I short calculate the tax payable?

If you short calculate the property tax payable upon issue of notice you will have to pay twice the difference of tax as penalty along with interest at 2 percent per month.

Can I file a revised return?

Yes you can file a revised return if you want to make any change in the Return Form applicable to you by superscribing on it as “Revised Return”. You can pay the difference of tax along with the revised return.

Is the Occupier of a building also responsible to pay the tax?

If the owner fails to pay the property tax, the liability shall be on the occupier.

If a building that is constructed in the previous year and the property tax has not been paid what is the procedure to pay the tax for that period? Is there a penal interest for the belated payment?

Property tax payable for the years prior to the year 2016-17 (if the tax is not paid even once since the inception) has to be paid at the office of the Assistant Revenue Officer of the jurisdiction under the rates and zone prescribed under the optional SAS 2008-09. For the period from 2016-17, the property tax has to be paid at the rate and zone prescribed now. For the belated payment for the years prior to 2016-17 penal interest at 2% per month is payable.

18. Where do I pay the arrears tax prior to the year 2008-09?

For the years prior to 2008-09 and for old arrears, the tax has to be paid at the office of the jurisdictional ARO only.

Answer to some Common Questions regarding Property Tax in Bangalore

From Times Property on 29 Apr 2016, M Shivaraju, Chairman, Standing Committee on Taxation and Finance, Bruhat Bengaluru Mahanagara Palike (BBMP), response to queries sent

There have been instances where the data retrieved from 2008 is incorrect or incomplete and it is impossible to correctchange it in the application form. What is to be done in this case?

Whatever data has been entered by the taxpayer in 2008 will appear in the application form. In Step II of the process, a property owner has the option to changeadd information regarding new construction (demolition of old building or construction of new building) or addition of a floors, change of use from residential to commercial, or from being self-occupied to letout.

If there have been any changes made in the subsequent years, in any other columns, those changes may not be reflected.Once the data migration is completed and we also make available the facility to pay tax for the financial year 2015-16 and the years prior to it, all the latest updated information will be available online. NIC is helping us out with this.

In some cases, properties which have been transferred or registered in the name of a new owner are still reflecting in the previous owner’s name. How does the present property owner pay tax then?

Firstly, only if the transfer of Khata has been effected in the name of the new owner at the ARO office will this reflect in the system. However, it could also be that since 2008 has been taken as the base year, if a property has been transferred or registered after this, it may not be reflecting in the system. Properties with a B-Khata are especially facing this issue.

For now, such property owners can make the tax payment.They can show the new Khata (if already changed) and payment receipt at the ARO office concerned at a later date, and get the change made in the system.

Due to confusion with the new zoning rules, some property owners have ended up selecting the wrong zone. When they have tried to go back and change it to the right one, the system has locked it since it was saved. How can this be rectified?

Once an application or challan has been generated, it is not possible to change or modify any details. The challan is valid for 10 days, with the last date for payment mentioned on it. If the tax has not been paid by that date, you can change the details and pay the tax later.

A taxpayer should not make the payment until the last date mentioned on the challan has passed as a correction cannot be made before this. After this date, it will be possible once again for the taxpayer to make corrections in the form and then pay the tax.

Many citizens are complaining that the helplines are either busy or no one responds. Complaints made online also go unanswered.What is the solution?

Due to a new system, we have been receiving many complaints.We are doing our best to address all of them. We have a central control room at Yeshwanthpur (080 22660000) with 10 lines, operational from 8 am to 8 pm.We have revenue officers from all the zones across the city working in two shifts so that they can help citizens by offering the right solutions to the issues they are facing. We even receive all the complaints which are made online here at the end of each day and are doing our best to respond to every citizen.

You can report problems to BBMP at:

- Email: contactusbbmp@gmail.com

- Deputy Commissioner,Revenue BBMP : 080-2297-5555

- Phone: 080-2266-0000

- WhatsApp: 94806-85700

Useful Links

- The BBMP website in English.

- The BBMP property tax page has all the information about property taxes

Related Articles:

What is Property Tax, How is it Calculated and Paid

Thanks for sharing such a nice blog with us.I want more information about the Tata New Haven Noida

Great blog created by you. I read your blog, its best and useful information. You have done a grate work. Kanakia Kanjurmarg

Nice post on your blog with nice images and good article. Brigade 7 Gardens

Great job because this is a amazing post thanks for sharing this nice information

Salar Puria Devanahalli

How to 2013, 2014 and 2015 tax. I have not paid these years as i am not staying in india. Please help me.

How to 2013, 2014 and 2015 tax. I have not paid these years as i am not staying in india. Please help me.

Hi, I am facing an issue that my application says expired. But when I go back to fill in the application again, it takes the same expired application number. I am unable to generate a new application. Can someone help please.

Hi, I am facing an issue that my application says expired. But when I go back to fill in the application again, it takes the same expired application number. I am unable to generate a new application. Can someone help please.

Hi,

I tried for online tax for Vacant site. After completing step 1, it says add Category XIII in coloum 7. After adding Category 13 for vacant site, it again ask for “enter Valid area of property in sft for coloum”. It is only vacant site. What to do. Pl help.

Hi,

I tried for online tax for Vacant site. After completing step 1, it says add Category XIII in coloum 7. After adding Category 13 for vacant site, it again ask for “enter Valid area of property in sft for coloum”. It is only vacant site. What to do. Pl help.

One Solution for “The Form Contains Reserve Key Word Please Change and continue”:

In my case, when I selected the appropriate value for the field 4b. “Name of the Road/cross” in page1, this error was resolved and I was able to save.

Hope this helps.

regards,

Anand

Thanks Anand for sharing your solution. It would benefit many.

We appreciate it.

@Anand,

This field 4 b) “Name of Road” is empty for me but its non-editable field (might be root cause of this “Reserver Key Word” issue).

Wondering how it allowed to modify and enter 4 b) in your case, its not allowing to modify for me.

Thanks.

Since 4 b) “Name of Road” is a compulsory field(marked *), default value was “select” in my application form, I had to select a valid value there from the drop down options, and only then i was able to save the page.

I do not have that option enabled. I am not able to select ROAD.

Moreover when I check the dropdown list ( which is disabled for me) in javascript debug. My area is not listed in it.

Looks like they are still developing the application.

The problem is much wider. Field is not editable for many. Anand seem to be a lucky chap.

One Solution for “The Form Contains Reserve Key Word Please Change and continue”:

In my case, when I selected the appropriate value for the field 4b. “Name of the Road/cross” in page1, this error was resolved and I was able to save.

Hope this helps.

regards,

Anand

Thanks Anand for sharing your solution. It would benefit many.

We appreciate it.

@Anand,

This field 4 b) “Name of Road” is empty for me but its non-editable field (might be root cause of this “Reserver Key Word” issue).

Wondering how it allowed to modify and enter 4 b) in your case, its not allowing to modify for me.

Thanks.

Since 4 b) “Name of Road” is a compulsory field(marked *), default value was “select” in my application form, I had to select a valid value there from the drop down options, and only then i was able to save the page.

I do not have that option enabled. I am not able to select ROAD.

Moreover when I check the dropdown list ( which is disabled for me) in javascript debug. My area is not listed in it.

Looks like they are still developing the application.

The problem is much wider. Field is not editable for many. Anand seem to be a lucky chap.

Hi, Excellent article. Appreciate it.

have a query. I notice that the site area is 298 sq ft and built up area is 1489sq ft. This means you must be having more than one floor. Need not be declared under “Number of floors and Plinth area” in section 6?

The reason I am asking is I have a similar problem. Site is 528 sq feet. Ground floor built area 335. First floor built area 335. Duplex house. Occupied by single family only. How to fill “Number of floors and Plinth area” pls?

Hi, Excellent article. Appreciate it.

have a query. I notice that the site area is 298 sq ft and built up area is 1489sq ft. This means you must be having more than one floor. Need not be declared under “Number of floors and Plinth area” in section 6?

The reason I am asking is I have a similar problem. Site is 528 sq feet. Ground floor built area 335. First floor built area 335. Duplex house. Occupied by single family only. How to fill “Number of floors and Plinth area” pls?

I have some excess payment from 2015-16. how can i get that accounted while paying tax for 2016-17?

I have some excess payment from 2015-16. how can i get that accounted while paying tax for 2016-17?

Can someone respond here…seems lot of people have same issue.

I am as well one of them. Seems no one is picking up phone.

Very much helpless.

“The Form Contains Reserve Key Word Please Change and continue”

Can someone respond here…seems lot of people have same issue.

I am as well one of them. Seems no one is picking up phone.

Very much helpless.

“The Form Contains Reserve Key Word Please Change and continue”

FOr vacant site it is asking to enter built up are

it doesn’t take if i enter xero

gives an error

what to do

For vacant site it is asking to enter built up area it doesn’t take if i enter zero gives an error what to do

FOr vacant site it is asking to enter built up are

it doesn’t take if i enter xero

gives an error

what to do

For vacant site it is asking to enter built up area it doesn’t take if i enter zero gives an error what to do

I have just noticed on Page 1 section 4a, Property no under property address, is coming as 0, is that could be the reason for the above error that i mentioned

I have just noticed on Page 1 section 4a, Property no under property address, is coming as 0, is that could be the reason for the above error that i mentioned

Hi ,

I am trying to pay tax for my apartment and filled all the mandatory fields but getting below error while trying to submit first page

The Form Contains Reserve Key Word Please Change and continue

Hi ,

I am trying to pay tax for my apartment and filled all the mandatory fields but getting below error while trying to submit first page

The Form Contains Reserve Key Word Please Change and continue

I too had the same problem with vacant site. How can they expect us to enter built-up area for a vacant site? BBMP should rectify this silly error. Any solutions?

I too had the same problem with vacant site. How can they expect us to enter built-up area for a vacant site? BBMP should rectify this silly error. Any solutions?

what needs to added for vacant site.it asks add category 13 for vacant site.I added category 13,it asks enter valid area of property in sft for column 7.i added 0 for buit up area.still it shows same error.

can you please help

same error for me as well

Same error,any one successful

In 7 a you have to enter vacant site sft after choosing option XIII. change the zone appropriately as per page 1. And ADD. This will appear below 7a the details of vacant site self occupied area…………

Then go ahead and save & move to step 3 … it will work……

Should I enter the dimension in ” Extent of built up area (in sft) ”

Mine is a vacant site residential and there is no built up are

it is an empty plot

Thank you very much!

Just click on ADD after you choose 13 in the first blank

(or)

Directly click on ADD without entering anything in the first blank.

Good luck with crazy BBMP website!

what needs to added for vacant site.it asks add category 13 for vacant site.I added category 13,it asks enter valid area of property in sft for column 7.i added 0 for buit up area.still it shows same error.

can you please help

same error for me as well

Same error,any one successful

In 7 a you have to enter vacant site sft after choosing option XIII. change the zone appropriately as per page 1. And ADD. This will appear below 7a the details of vacant site self occupied area…………

Then go ahead and save & move to step 3 … it will work……

Should I enter the dimension in ” Extent of built up area (in sft) ”

Mine is a vacant site residential and there is no built up are

it is an empty plot

Thank you very much!

Just click on ADD after you choose 13 in the first blank

(or)

Directly click on ADD without entering anything in the first blank.

Good luck with crazy BBMP website!

Thanks for this article. Very well explained.

It has become a pain this year to pay the returns online. So many new fields added.

Appreciate your efforts.

Thanks for this comment. We appreciate it.

Good to know it helped you.

Thanks for this article. Very well explained.

It has become a pain this year to pay the returns online. So many new fields added.

Appreciate your efforts.

Thanks for this comment. We appreciate it.

Good to know it helped you.

EXCELLENT. VERY INFORMATIVE, VERY USEFUL. THANK YOU.

EXCELLENT. VERY INFORMATIVE, VERY USEFUL. THANK YOU.