TDS is applicable on sale of immoveable property when the sale price of the property exceeds or is equal to Rupees 50 lakh (50,00,000). Sec 194 IA of the Income Tax Act, 1961 states that for all transactions with effect from June 1, 2013, Tax @ 1% should be deducted by the purchaser of the property at the time of making payment of sale consideration. Tax so deducted should be deposited to the Government Account through any of the authorised bank branches. This article explains with pictures How to pay TDS on Property online by filling Challan cum form 26QB. Information on paying TDS on Property online are explained in detail in our article TDS on property.

Step 1: Fill Challan 26QB

Two ways to go to Challan 26QB

Go to https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

OR

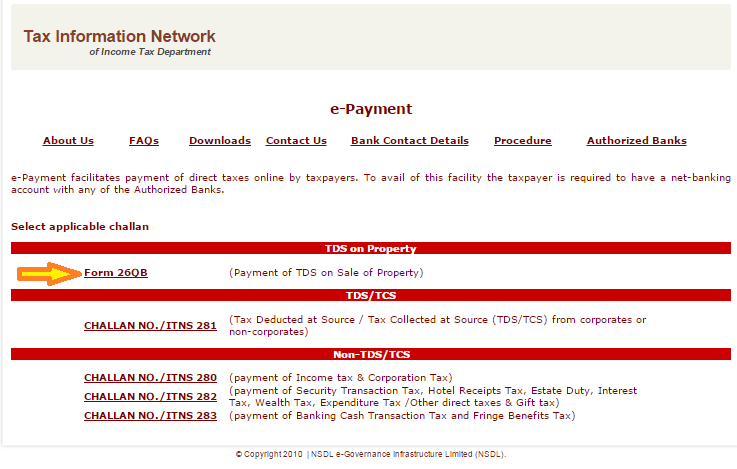

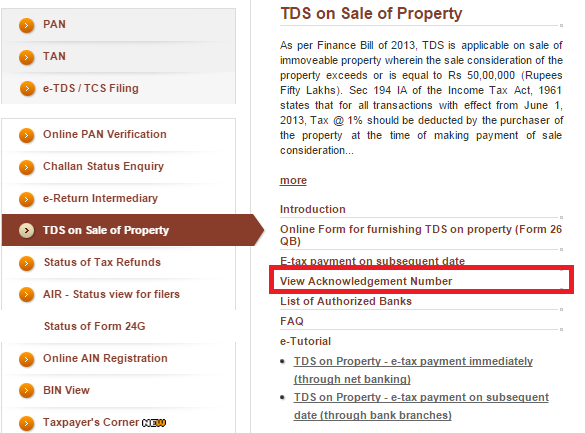

- Go to NSDL-TIN website https://www.tin-nsdl.com. Click on the option TDS on sale of property as shown in image below.

- Under TDS on sale of property, Click on the option Online form for furnishing TDS on property. An e-payment form opens.

In the e-payment Click on the Form 26QB as shown in image below

Instructions on the Form (at the end)

- Enter valid 10-digit Permanent Account Number (PAN) first.

- Fields marked with * are mandatory.

- Do not enter double quotes (“”) in any of the fields.

- e-tax payment immediately will direct the taxpayer to the Net Banking Site.

- In case the taxpayer wish to opt for e-tax payment on subsequent date, ACK No. will get generated and

the same has to be retained by taxpayer and presented to any of the authorized Bank for further payment. - Provision to enter Tax amount (i.e. Basic Tax, Interest and Fee) is given in the Bank’s site.

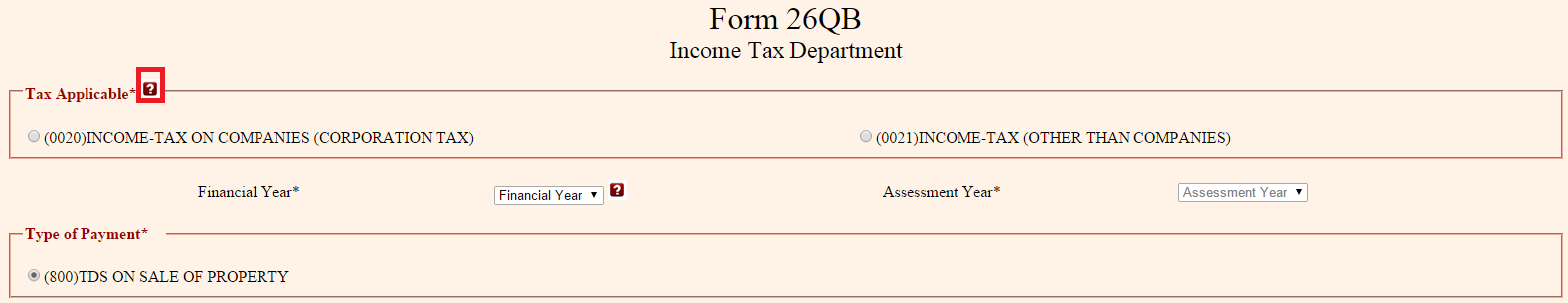

In Tax Applicable select 021 if you are buying property for yourself and 020 if you are buying property on behalf of company i.e corporate. Note: In PAN number for corporate 4th digit is C while for others 4th digit in PAN is not C.

Fill in the Financial Year and Assessment Year automatically gets filled in. In India Financial Year is from 1 Apr of the year to 31 Mar of Next Year. Note that Assessment Year is one more than the Financial Year. So if you are paying tax on 1 Mar 2015 the Financial Year will be 2014-15 while Assessment Year will be 2015-16.

Type of Payment 080 TDS ON SALE OF PROPERTY is already selected.

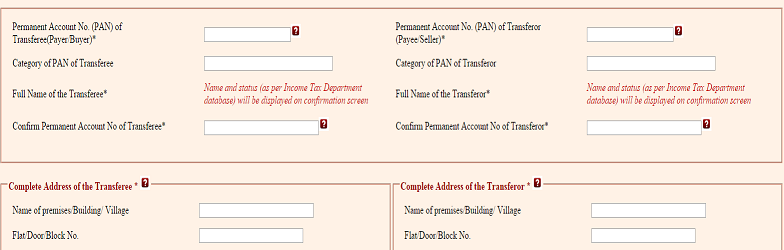

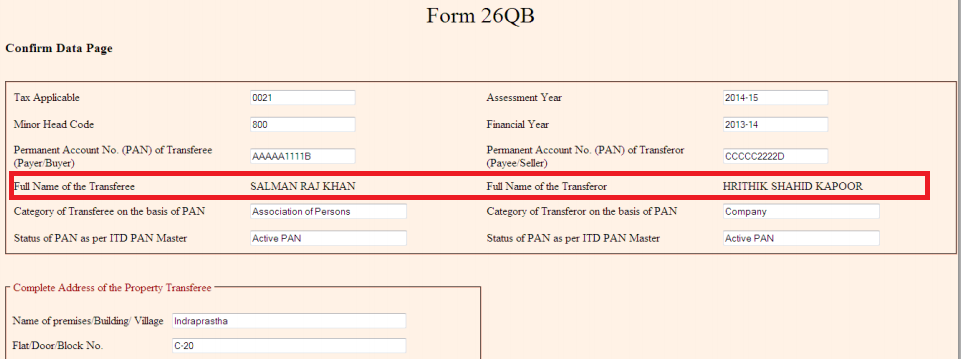

Fill in the details of the Buyer, Seller,(PAN , Address) of Property and transaction. Note that only PAN number has to be entered and not the name. Name and status (as per Income Tax Department database) will be displayed on confirmation screen

- Buyer: PAN number and Complete Address of buyer. Buyer is technically called Transferee.

- Seller : PAN number and Complete Address of seller. Seller is technically called Transferor.

- Property: Address of the property,

- Transaction detail : Date of Agreement, Total Value of Consideration,Payment Type (In Lump Sum or instalment), TDS details.

Note: When you fill in the PAN number the Category gets automatically filled. Category can be Individual , Hindu Undivided Families (HUFs), companies etc. The government levies income tax on taxable income of all persons. Percentage and type of tax varies based on kind of tax payer. Various categories are individuals, Hindu Undivided Families (HUFs), companies, firms, association of persons, body of individuals, local authority and any other artificial judicial person.

An excerpt of the details required for Form 26QB are given below (Click on image to enlarge)

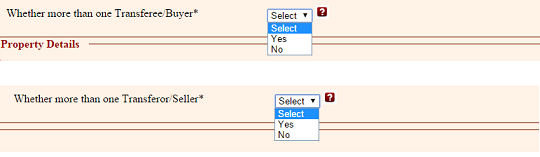

If there are multiple buyers/sellers then Challan Form/ Form 26QB is to be filled in by each buyer for unique buyer-seller combination for respective share. E.g. in case of one buyer and two sellers, two forms have to be filled in and for two buyers and two seller, four forms have to be filled in for respective property shares. This is also reflected in the form

In Property Details enter

- Complete address of Property transferred

- Type of Property : Choices are : Land or Buildings. Building can be Shops,Flats,Apartments,Bungalow etc

- Mention the date of Agreement/Booking of property

- Mention the Total value of consideration (Property Value) : Value of property should be more than 50 lakhs for TDS deduction. Threshold limit of Rs 50 lakh (50,00,000) is value of property, not for the number of instalments, the number of buyers or sellers does not matter at all. The value of property is what is specified in the transfer documents, and is not on the basis of a notional fair market value, such as a stamp duty valuation, even though such valuation may be higher. The property value will include payments to be made to the seller such as legal fees,payment for parking spaces etc. For more details one can refer the article

- Mention if the above payment is done in Lump sum or in Installments

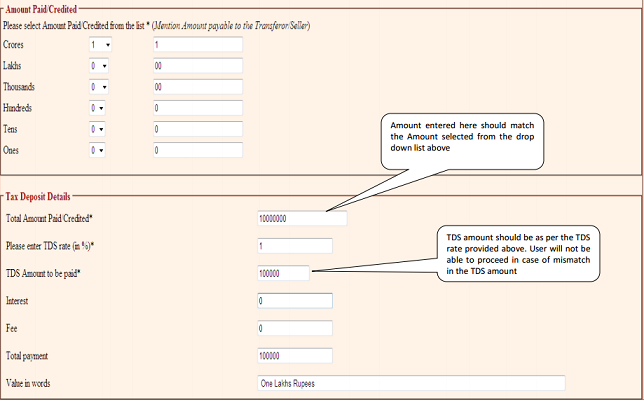

Enter the details about Amount to be paid and TDS to the Seller or Transferor

Value should be entered in Fee only when taxpayer is liable to pay Fee. A Buyer has to pay fee or Late charges when he does not fill in challan-cum-statement in Form No. 26QB electronically within seven days from the end of the month in which the tax deduction is made. This comes under section 234E of the Income Tax Act.

Payment of TDS

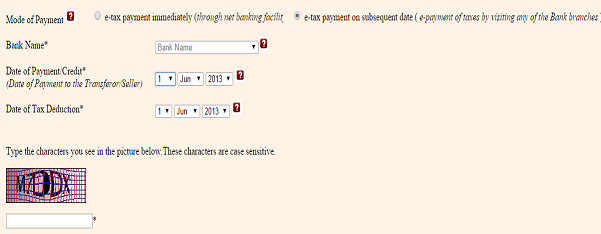

There are 2 modes of payment at the bottom of the page:

- e-tax payment immediately (through net banking facility) : If you choose net-banking, you will be able to login to your bank and pay online. After you have paid, the bank lets you print Challan 280.

- e-tax payment on subsequent date (e-payment of taxes by visiting any of the Bank branches) . If you cannot pay online, an online receipt for Form 26QB with a unique Acknowledgment Number is generated for you. This is valid for 10 days after generation. You can take this toone of the authorized banks along with your cheque. The bank will proceed with the online payment and generate your challan.

Choose the one which you prefer. If you choose e-tax payment on subsequent date (e-payment of taxes by visiting any of the Bank branches) then you would not be able to enter Bank Details.

Enter the captcha ie characters seen in the picture. ( to verify a human is entering the form)

After entering all the above required detail and satisfied with it , click on PROCEED button to continue. A confirmation page is displayed to verify the details entered

If all the above detail including the name displayed (as per PAN details and Income Tax Directory) is correct then, click on Confirm button. In case you have made a mistake in data entry, click on EDIT to correct.

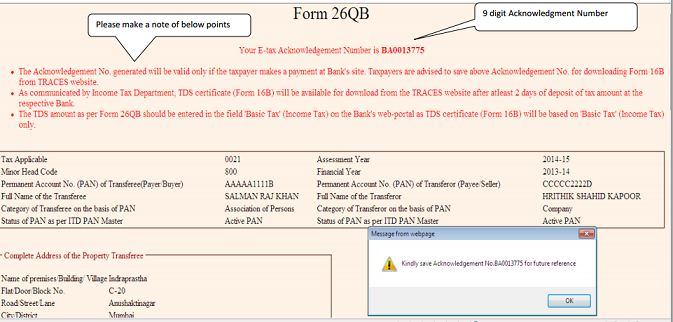

On confirmation, nine digit alpha numeric Acknowledgement number is generated. Please save the Acknowledgement Number for downloading the Form 16B from TRACES website. TDS certificate (Form 16B) will be available for download from the TRACES website after at least 2 days of deposit of tax amount at the respective Bank

If one selects the e-payment option ie on paying TDS online through net banking, On clicking on Submit to the Bank, buyer or deductor will have to login to the net-banking site with the user ID/ password provided by the bank for net-banking purpose. • On successful login, enter payment details at the bank site. • On successful payment a challan counterfoil will be displayed containing CIN, payment details and bank name through which e-payment has been made. This counterfoil is proof of payment being made

View Acknowledgement Number

Click on View Acknowledgment Number under TDS on Property by providing the relevant details for retrieving the Acknowledgment Number

Enter the PAN details and Payment amount, then you will be able to view the Acknowledgement number.

Detailed procedure, user friendly e-tutorials, list of Bank branches authorised to accept TDS and Frequently Asked Questions (FAQs) are available on at NDSL website https://www.tin-nsdl.com/ for reference. e-Tutorial on paying TDS on property are as follows. This article is based on TDS on Property – e-tax payment immediately (through net banking)

- TDS on Property – e-tax payment immediately (through net banking)

- TDS on Property – e-tax payment on subsequent date (through bank branches)

Related Articles:

- TDS on property

- On Selling a House

- Capital Loss on Sale of House

- Tax and Income From One Self Occupied property , Tax and Income from Let out House Property

- Income from House Property and Income Tax Return

- Joint Home Loan and Tax

- How to Calculate Capital gain on Sale of House?

Hope it helped you in understanding How to Pay TDS on property. How has your experience been on paying TDS on property?

I had a query while filing TDS on property online.

Suppose I am going to do the registration and payment next week, but I would like to file the TDS this week itself( today ) . It does not let me.

It says that ‘Date of payment/credit’ cannot be in future.Please advise.

Can I give the date of payment/credit as today itself to avoid this error ( though registration and payment will happen next week )

Thanks for Sharing useful Information on property TDS

Can TDS for a property bought from NRI (in Rupee payment) is paid through Form 26QB

Short answer:While buying property from NRI you have to deduct TDS @20% , irrespective of the amount, using challan 281. You need to apply for apply TAN.

Use form 281,

Type of Payment:-

(200)TDS/TCS Payable by Taxpayer

Long ans:

Things are a little complex when a property is sold by an NRI. TDS rate as mentioned above is not applicable to NRIs. In the case of non-residents, reference has to be made to Section 195 of the income tax act.

After deducting the TDS on Property, the buyer is then required to deposit the same with the Govt. While depositing the TDS, the buyer is also required to quote his TAN No. If the buyer does not have a TAN No., he would be required to apply for a TAN No. This requirement of TAN No. for deposit of TDS is not there if the property is being purchased from a Resident Indian but TAN No. is required if the property is being purchased from NRI.

NRI,the seller. can apply for the income tax officer for lower deduction of TDS. Based on the certificate of lower deduction issued by the income tax officer, the buyer will deduct the TDS at a lower rate

I have purchased a flat in Thane.Our builder himself has paid the TDS and has given me the receipt.

Do i require 26qb form to be filled or builder would be having some system.

Kindly guide me for the above mentioned query.

Thanks in advance

Please verify the receipt.

Ask your builder the process he followed.

Please check whether the amount is reflecting against your PAN.

This month many people have got notices for not paying TDS on property. There is penalty in not paying TDS.

Payment made to seller – Rs.8 lakhs on 5 June 2015 without TDS deduction.

On 8th Apr 2016 – Form 26QB is submitted with TDS deduction for the above payment as Rs.8000 and since I’m aware there is a 1% late TDS deduction interest which is Rs.880, I submitted the form with Rs.8880/-.

Please let me know anymore interest i need to pay? What i understand late TDS payment interest and fee is applicable from the date of TDS deduction not paying in the subsequent 7th of the month. Please clarify.

Is the penalty of RS 200 mandatory? or it can be waived by the assessing officer?

hi sir

We bought a house for 54L on march 2015 , but we dont know about TDS Form26QB,,no one informed us,,two days back mail came inorder to pay tds along with penalty ,, how much we should pay along eith penalty ,,please reply me.

I have got a rectification order and have been asked for interest on late deduction. Are we not suppose to pay through Demand Payment link under Demand Payment for TDS on property instead of challan no. 281.

Also i got the intimation 3 days back but order date in the pdf is mentioned as

7-Feb, does it mean i have to pay extra interest for the delay since the payment was to be done in 30 days.

Please reply soon.

Thanks!!

I have received an intimation from Income tax department to pay late filing charges u/s 234E and Interest on late payment u/s 200A after processing form 26QB.

Can you please guide how to pay these. I can’t enter 0 tds or 0% interest rate in form 26 qb.

Vivek You are not the only one. Many this year have received the notice. (I was not able to get it verified by my CA) but from what I know:

As of now TDS department has not made any arrangement for revision of form 26QB.

Pay using form 280 under the code 400 and post acknowledgement to CPC processing center.

Hi, I came to know today that a new link will be available from 1st May 2015 to make the late payment for TDS on sale of property. Can you please let me know what should be the “type of payment” for “Late Filing fee u/s 234E” and “Interest on late payment” while making the payment?

Under what column do we put the fee and interest. My demand latter says Late fee is 2000 and interest is 500.

On the Bank Challan where do I put these?

I need to put 500 (Interest) under Interest.

What about the Late Fee, does it go under “others”?

I have received an intimation from Income tax department to pay late filing charges u/s 234E and Interest on late payment u/s 200A after processing form 26QB.

Can you please guide how to pay these. I can’t enter 0 tds or 0% interest rate in form 26 qb.

Vivek You are not the only one. Many this year have received the notice. (I was not able to get it verified by my CA) but from what I know:

As of now TDS department has not made any arrangement for revision of form 26QB.

Pay using form 280 under the code 400 and post acknowledgement to CPC processing center.

Hi, I came to know today that a new link will be available from 1st May 2015 to make the late payment for TDS on sale of property. Can you please let me know what should be the “type of payment” for “Late Filing fee u/s 234E” and “Interest on late payment” while making the payment?

Under what column do we put the fee and interest. My demand latter says Late fee is 2000 and interest is 500.

On the Bank Challan where do I put these?

I need to put 500 (Interest) under Interest.

What about the Late Fee, does it go under “others”?

Dear Vivek,

I have also received notice for Interest on Late Payment of TDS on Property

(FY13-14). I also want to know procedure. Please let me know if you come to know how to upload only the Late payment interest

Regards,

Rakesh Kumar

Payment of fees for late filing of TDS return u/s 234E is through Challan 281 . You can download Challan 281 in pdf form form https://www.tin-nsdl.com/download/oltas/Challan-No-ITNS-281.pdf and online at https://onlineservices.tin.egov-nsdl.com/etaxnew/PopServlet?rKey=-480525420

I had never deducted 1% tax on any of the installments that i paid to builder prior to Jun 13 and recently in Jan 15, FEB15 as well, as I was not aware about any such clause.

I just came across this news of 1% TDS recently and came to know that i should have deducted it.

Builder never informed us about any such requirement. Now can i just deduct the TDS rightaway from next demand from builder and pay the interest component myself for all transactions after Jun13.

Would i be liable to pay any delay penalty despite paying interest?

From 1st June 2013 the rule was introduced for compulsory tax deduction( TDS or withholding tax) by a buyer of an immovable property (other than agricultural land) valuing Rs. 50 lakh or more. This rule also covers the property purchased through home loan. It also has to paid when the buyer buys an under construction and part payment is done

Is your property more than 50 lakh?

I had never deducted 1% tax on any of the installments that i paid to builder prior to Jun 13 and recently in Jan 15, FEB15 as well, as I was not aware about any such clause.

I just came across this news of 1% TDS recently and came to know that i should have deducted it.

Builder never informed us about any such requirement. Now can i just deduct the TDS rightaway from next demand from builder and pay the interest component myself for all transactions after Jun13.

Would i be liable to pay any delay penalty despite paying interest?

From 1st June 2013 the rule was introduced for compulsory tax deduction( TDS or withholding tax) by a buyer of an immovable property (other than agricultural land) valuing Rs. 50 lakh or more. This rule also covers the property purchased through home loan. It also has to paid when the buyer buys an under construction and part payment is done

Is your property more than 50 lakh?

I have received an intimation from Income tax department to pay late filing charges u/s 234E and Interest on late payment u/s 200A after processing form 26QB.

Can you please guide how to pay these two charges as i have paid TDS and submitted form 26qb in feb 2014 ?where to enter late filling fee u/s 234E(Rs 5123) and interest on late payment(Rs 306) as system is not accepting this.How and where to enter these amount in Amount paid credited column and Tax deposit details column.Kindly guide

So you think you should not be paying the charges raised.

In case you decide then

Deposit TDS using Challan number 281. But you have to fill code as 400 in Type of Payment.

Did you verify that you paid your TDS in time? Is it reflecting in Form 26AS?

Sec 194-IA deals with TDS on sale of immovable property. Under this section TDS is to be deducted @1% at the time of credit of such sum to the account of the transferor or at the time of payment of such sum whichever is earlier on sale of immovable property –

For example, if you are going to make payment of a installment of Rs. 10,00,000 on 25th March’2015, tax of Rs. 10,000 shall be deducted the same day ie. 25th March’2015 and you should pay the seller Rs. 9,90,000 (net of TDS).

Interest u/s 201 is to be levied and the deductor is to be deemed as an assessee in default for failure to pay or for late payment of any TDS including TDS on immovable property.

Therefore,

a) If tax deducted is not paid by the 7th of next month of the month of deduction but is paid at a later date:

Interest at one and one-half per cent(1.5%) for every month or part of a month on the amount of such tax from the date on which such tax was deducted to the date on which such tax is actually paid.

b) If tax is not deducted at all:

Interest at one per cent for every month or part of a month on the amount of such tax from the date on which such tax was deductible to the date on which such tax is deducted.

For example: If Rs. 10,000 tax was deducted on 25th April 2014, same shall be deposited with the government account till 7th May 2014. But if the same is paid say by 7th June then,

Interest will be calculated as follows:

Months of default: 3 (April to June)

Interest Rate: 1.5%*3=4.5%

Amount of Interest: Rs. 10,000*3*1.5%= Rs.450

Therefore, as per section 234E, late fee of Rs. 200/-per day subject to the amount of tax is to be levied for late filing of any statement of tax deducted/collected at source. Since form 26QB is treated as a statement prescribed u/s 200(3), therefore late filing of the same will attract late fee u/s 234E of Rs. 200/-per day. Continuing with the above example, If Rs. 10,000 tax was deducted on 25th April 2014, same shall be deposited with the government account till 7th May 2014. But if the same is paid say by 7th June then, late fee will be calculated as follows: No. of days from 8th May to 7th June’2014= 31 days Late fee= 31*200= 6200 or Rs.10,000 (amount of tax) whichever is lower Rs. 6200 Therefore, to avoid interest and late fee, pay your TDS on immovable property timely.

Are you sure that we have to pay the late fees through 281 challan form. As per FAQs mentioned on tin site: https://www.tin-nsdl.com/TDS/TDS-FAQ.php, it needs to be paid through the form 26QB only.

Can you please confirm this?

I have received an intimation from Income tax department to pay late filing charges u/s 234E and Interest on late payment u/s 200A after processing form 26QB.

Can you please guide how to pay these two charges as i have paid TDS and submitted form 26qb in feb 2014 ?where to enter late filling fee u/s 234E(Rs 5123) and interest on late payment(Rs 306) as system is not accepting this.How and where to enter these amount in Amount paid credited column and Tax deposit details column.Kindly guide

So you think you should not be paying the charges raised.

In case you decide then

Deposit TDS using Challan number 281. But you have to fill code as 400 in Type of Payment.

Did you verify that you paid your TDS in time? Is it reflecting in Form 26AS?

Sec 194-IA deals with TDS on sale of immovable property. Under this section TDS is to be deducted @1% at the time of credit of such sum to the account of the transferor or at the time of payment of such sum whichever is earlier on sale of immovable property –

For example, if you are going to make payment of a installment of Rs. 10,00,000 on 25th March’2015, tax of Rs. 10,000 shall be deducted the same day ie. 25th March’2015 and you should pay the seller Rs. 9,90,000 (net of TDS).

Interest u/s 201 is to be levied and the deductor is to be deemed as an assessee in default for failure to pay or for late payment of any TDS including TDS on immovable property.

Therefore,

a) If tax deducted is not paid by the 7th of next month of the month of deduction but is paid at a later date:

Interest at one and one-half per cent(1.5%) for every month or part of a month on the amount of such tax from the date on which such tax was deducted to the date on which such tax is actually paid.

b) If tax is not deducted at all:

Interest at one per cent for every month or part of a month on the amount of such tax from the date on which such tax was deductible to the date on which such tax is deducted.

For example: If Rs. 10,000 tax was deducted on 25th April 2014, same shall be deposited with the government account till 7th May 2014. But if the same is paid say by 7th June then,

Interest will be calculated as follows:

Months of default: 3 (April to June)

Interest Rate: 1.5%*3=4.5%

Amount of Interest: Rs. 10,000*3*1.5%= Rs.450

Therefore, as per section 234E, late fee of Rs. 200/-per day subject to the amount of tax is to be levied for late filing of any statement of tax deducted/collected at source. Since form 26QB is treated as a statement prescribed u/s 200(3), therefore late filing of the same will attract late fee u/s 234E of Rs. 200/-per day. Continuing with the above example, If Rs. 10,000 tax was deducted on 25th April 2014, same shall be deposited with the government account till 7th May 2014. But if the same is paid say by 7th June then, late fee will be calculated as follows: No. of days from 8th May to 7th June’2014= 31 days Late fee= 31*200= 6200 or Rs.10,000 (amount of tax) whichever is lower Rs. 6200 Therefore, to avoid interest and late fee, pay your TDS on immovable property timely.

Are you sure that we have to pay the late fees through 281 challan form. As per FAQs mentioned on tin site: https://www.tin-nsdl.com/TDS/TDS-FAQ.php, it needs to be paid through the form 26QB only.

Can you please confirm this?

I have received an intimation from Income tax department to pay late filing charges u/s 234E and Interest on late payment u/s 200A after processing form 26QB.

Can you please guide how to pay these two charges as i have paid TDS and submitted form 26qb in Jan 2014 ?

I would suggest you contact a CA. I assume this is for the property you bought in Jan 2014. Some information about penalty on TDS is as follows. Hope it helps

If TDS is not paid then interest and penalty would be imposed on the buyer. Interest will be charged at the rate of 1% per month or part of the month if one does not deduct tax or deducts less tax from the day tax was supposed to be deducted to the day tax was actually paid. The tax deducted has to be paid within seven days from the end of the month of deduction. Interest will be charged @ 1.5% p.m or part of the month for tax deducted but not paid to the government from the date of deduction till the date of actual payment.

From July 1, 2012, the IT Department has made it mandatory to pay late fee of Rs. 200 per day since the due date, in case of late filing of TDS returns by imposition of new ruling u/s 234E.

Form 26AS tracks the tax paid to government, TDS on salary, advance, self assessment tax. So even TDS on Sale of property shows up in Form 26AS seven days after payment

I have received an intimation from Income tax department to pay late filing charges u/s 234E and Interest on late payment u/s 200A after processing form 26QB.

Can you please guide how to pay these two charges as i have paid TDS and submitted form 26qb in Jan 2014 ?

I would suggest you contact a CA. I assume this is for the property you bought in Jan 2014. Some information about penalty on TDS is as follows. Hope it helps

If TDS is not paid then interest and penalty would be imposed on the buyer. Interest will be charged at the rate of 1% per month or part of the month if one does not deduct tax or deducts less tax from the day tax was supposed to be deducted to the day tax was actually paid. The tax deducted has to be paid within seven days from the end of the month of deduction. Interest will be charged @ 1.5% p.m or part of the month for tax deducted but not paid to the government from the date of deduction till the date of actual payment.

From July 1, 2012, the IT Department has made it mandatory to pay late fee of Rs. 200 per day since the due date, in case of late filing of TDS returns by imposition of new ruling u/s 234E.

Form 26AS tracks the tax paid to government, TDS on salary, advance, self assessment tax. So even TDS on Sale of property shows up in Form 26AS seven days after payment