“I propose to increase the limit of deduction of rent paid under 80 GG from Rs 24,000 per annum to Rs 60,000 to provide relief to those who live in rented houses,” said Finance minister Arun Jaitley while presenting the Budget for 2016-17 on 29 Feb 2016 . We have got many questions on whether one will be able to claim higher HRA now. For a salaried employee who gets HRA there is no change in HRA. This HRA limit is all other taxpayers,example self employed professionals ,who are neither getting benefit of House Rent Allowance nor have they claimed the expense for rent paid under any other section of the income tax act and claim deduction under Section 80GG. This article talks about HRA, HRA under section 80GG,conditions for claiming HRA under section 80GG,how to claim HRA under 80GG, who can claim HRA under 80GG,Form 10BA.

Table of Contents

What is HRA? What is House Rent Allowance?

House Rent Allowance or HRA is given by the employer to the employee to meet the expenses of rent of the accommodation which the employee has taken for his residential purpos. Salaried individuals who live in a rented house can claim House Rent Allowance or HRA to lower taxes. This can be partially or completely exempt from taxes. The allowance is for expenses related to rented accommodation. If you don’t live in a rented accommodation, this allowance is fully taxable. House Rent Allowance (HRA) Exemption would be calculated by your employer and shown in Form 16 if rent receipt are submitted on time. Our article HRA Exemption,Calculation,Tax and Income Tax Return covers HRA exemption in detail.

Self-employed professionals cannot be considered for HRA exemption under this act, as they do not earn a salary. However, they can claim benefits on the house rent expenses incurred under section 80GG, which resembles section to 10 (13A) but is subject to certain conditions.

Understanding 80GG

What is section 80GG?

Section 80GG provides for Deductions for House Rent paid, provided that a deduction for payment of House Rent has not been claimed under any other section of the income tax act. In other words, if a salaried employee is being given house rent allowance by his employer and he is claiming a deduction from the same, he won’t be eligible to claim deduction under Section 80GG for payment of Rent. All other taxpayers who are neither getting benefit of House Rent Allowance and nor have they claimed the expense for rent paid under any other section of the income tax act, can claim deduction under Section 80GG. HRA limit under section 80GG has been proposed to be increased from 24,000 to 60,000 Rs.

What if my employer doesn’t provide me with HRA can I use 80GG?

If you are making payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence, but do not receive HRA from your employer,and you meet 80GG conditions you can claim deduction under section 80GG.

What are the conditions one has to meet to claim HRA under Section 80GG?

Under section 80GG of income tax act, 1961, a self employed person, businessman and even a salaried person can claim tax deduction for the expenses that they incur towards there house rent.

- You are self employed or salaried

- You have not received HRA at any time during the year for which you are claiming 80GG. If you are a salary person then you should not be in receipt of house rent allowance

- You or your spouse or your minor child or HUF of which you are a member , do not own any residential accommodation at the place where you currently reside, perform duties of office, or employment or carry on business or profession.

- You should not own a house in the place in which you live, or work or carry on business

- Your spouse, child including minor child, Hindu undivided family (of which you are member )should not own any residential accommodation in that place

- You must reside in that house to claim exemption. Any one with you can also stay with you for the purpose of claiming this deduction under section 80GG.

- If own any residential property at any place, for which you have income from house property under applicable sections (as a self occupied property), no deduction under section 80GG is allowed.So If you own a house in some other city and use that house for your own resident and have not given for rent then also you can not claim deduction under section 80GG even though you stay in a rented house and pay rent at your work location in a different city.

If the taxpayer is claiming deduction under Section 80GG, he would also be required to furnish a declaration in Form 10BA that he satisfies all the conditions stated above.

If finance bill of Budget 2016-17 passed then you can claim deduction of Rs 60,000 under section 80GG for the rent paid instead of earlier limit of Rs 24000. These amendments are proposed to be made effective from the 1st day of April, 2017 and shall accordingly apply in relation to assessment year 2017-18 and subsequent years.

How to calculate HRA under section 80GG?

The lowest of the amount given below will be considered as the deduction under section 80GG before

- Rs 2,000 per month of Rs 24,000 per year. From FY 2016-17 Rs 5000 per month or Rs 60,000 per year.

- 25% of total income

- Actual Rent less 10% of Income

For the calculation of deduction for house rent, total income will be calculated after reducing your tax deduction under different section of chapter VIA except section 80GG, long term and short term capital gain.

How is tax exemption from HRA calculated for salaried employee who receives HRA?

The deduction available is the minimum of the following amounts:

- HRA received

- 50% of basic salary for those living in metro cities (40% of Basic Salary for non-metros)

- Actual rent paid

What is total income for the purpose of Sec. 80GG?

Income usd in 80G calculations means adjusted Gross Total Income which is claimed after deducting long term capital gain, short term capital gain under section 111A ,Income under section 115A or 115D and deductions 80C to 80U.

Total Income=Gross Total Income- Long term Capital Gain(LTCG)- Short Term Capital Gain(STCG) -Income referred under the Sec.115A-Amount deductible under Sec.80C to 80U (except Section 80GG)

Example of claiming HRA under Section 80GG deduction before 1 Apr 2016?

Let’s see an example Rahul’s total income is Rs 5 lakh(5,00,000).He pays an annual rent of Rs 1, 50,000. Then minimum of the below will be applicable for deduction under Sec. 80GG.

Mr. X’s total income (calculated as per above formula) is Rs.4, 00,000. He pays an annual rent of Rs.1, 50,000. Then least of the below will be applicable for deduction under Sec. 80GG.

- Rs 24, 000 per year.

- Rent Paid-10% of Total Income= 1,50,000- 50,000= 1,00,000.

- 25% of Total Income i.e Rs.1, 25,000.

So minimum of the above is Rs 24, 000, which one can claim under Section 80GG for that particular FY.

Example of claiming HRA under Section 80GG deduction after 1 Apr 2016 i.e AY 2017-18?

Let’s see an example Rahul’s total income is Rs 5 lakh(5,00,000).He pays an annual rent of Rs 1, 50,000. Then minimum of the below will be applicable for deduction under Sec. 80GG.

- Rs 60, 000 per year.

- Rent Paid-10% of Total Income= 1,50,000- 50,000= 1,00,000.

- 25% of Total Income i.e Rs.1, 25,000.

So minimum of the above is Rs. 60, 000, which one can claim under Section 80GG for that particular FY. Earlier he was able to claim just 24,000.

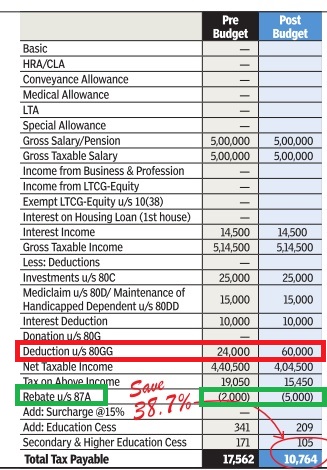

So how much tax would be saved due to increase in HRA under 80GG from 24,000 to 60,000?

The increase in HRA under 80GG from Rs 24,000 to Rs 60,000 is increase of Rs 36,000. This results in saving of following amount of tax for different salaries.

| Income | 5 lakh | 10 lakh | 20 lakh | 1 crore | More than 1 crore |

| Increase of Rs 36,000 under 80GG | 3708 | 7416 | 11,124 | 11,124 | 12792.6 |

Example For a person who is earning 5 lakh of income due to increase in HRA from 24,000 to 60,000 and a rebate of Rs 5000, saving of tax is 38.7%. The calculations for FY 2015-16 and FY 2016-17 are shown below.

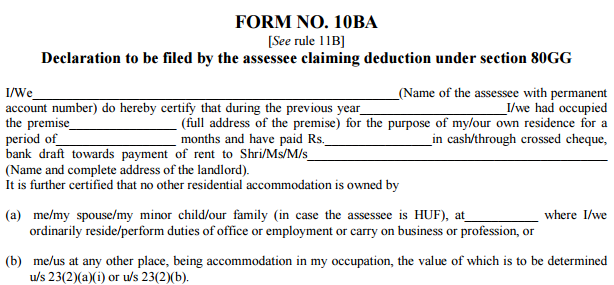

What is Form 10BA?

If the taxpayer is claiming deduction under Section 80GG, he would also be required to furnish a declaration in Form 10BA that he satisfies all the conditions stated above. Image below shows the Form 10BA . You can Download Form 10BA.(pdf).

Where to submit Form No. 10BA?

One has to fill Form No 10Ba and keep it for records. It doesn’t have to be filled online and it is also attached anywhere with the Income tax return. However it is prudent to fill up and maintain record of such form. Submission is required only if your case is picked up by scrutiny by Income tax department.

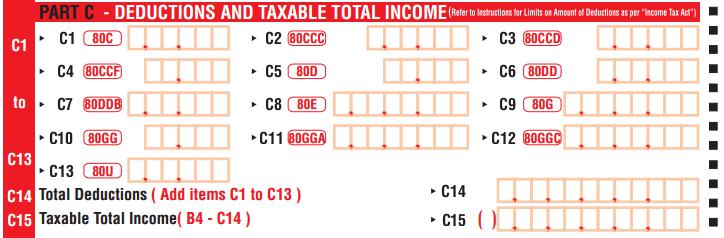

How to claim HRA under section 80GG?

One can claim HRA under section 80GG while filing ITR, just like one does for 80C. Following image shows the various deductions in ITR1. Our article Fill Excel ITR1 Form : Income, TDS, Advance Tax shows how to claim deductions it in detail.

Can an individual claim HRA and 80GG both together?

Yes if he was salaried for part of the year and self employed for rest of the year. For example if he was did not get HRA for 8 months and then received HRA for next 4 months in the same FY. Then he can claim tax deduction for both of HRA as well as 80GG Deduction. Its better if he claims HRA through his employer.

Related Posts:

- HRA Exemption,Calculation,Tax and Income Tax Return

- How To Fill Salary Details in ITR2, ITR1

- How to Claim Deductions Not Accounted by the Employer

- Income Tax for FY 2015-16 AY 2016-17

- How To Fill Salary Details in ITR2, ITR1

Hi, I changed my company during Aug/17 and I did not declare the HRA in the company due to new system. But In my previous organisation I had declared the HRA. Can I claim the HRA from Aug/17 till Mar/18. Please suggest

Can a govt employee who has got unfurnished govt accommodation at concessional rent also avail exemption under section 80 GG if other conditions on not owning house in the same city and not receiving HRA are met?

Can a govt employee who has got unfurnished govt accommodation at concessional rent also avail exemption under section 80 GG if other conditions on not owning house in the same city and not receiving HRA are met?

Hi,

Excellent article. A query-Can a NRI claim 80GG benefits for his residence in India from the Indian taxable income( Only flat in Mumbai has been rented out and presently family resides at a rented place in another city)

Thanks

Hi,

Excellent article. A query-Can a NRI claim 80GG benefits for his residence in India from the Indian taxable income( Only flat in Mumbai has been rented out and presently family resides at a rented place in another city)

Thanks