To deposit Advance Tax, Self Assessment tax and Regular Assessment Tax an individual has to use challan ITNS-280. It can be paid both through internet (online or e-payment) and at designated branches of banks empanelled with the Income Tax Department (offline). Our article Challan 280: Payment of Income Tax discusses the basics of Payment of Income Tax. In this article we shall explain for an individual what is Challan 280, how to pay online?

You can pay advance tax in India through two methods: online or offline. Here’s a breakdown of both:

Online Payment:

- Visit the Income Tax Department’s e-payment website: [income tax e payment ON Income Tax Department portal.incometax.gov.in]

- Enter your PAN and mobile number and proceed after verification with OTP.

- Select the Assessment Year (2024-25 for current scenario) and choose “Advance Tax (100)” under Type of Payment.

- Fill in the challan details like State Code, circle code (refer website for details).

- Choose the payment method (net banking or debit card) and your bank.

- Preview the challan for accuracy and click “Pay Now” to complete the payment.

Offline Payment:

- Download Challan 280 form from the Income Tax Department website.

- Fill the challan with details like your PAN, assessment year, tax type (100 for Advance Tax).

- Mention the installment number (depends on the due date).

- Submit the completed challan at any bank authorized to collect tax payments.

Additional Tips:

- Use an advance tax calculator to estimate your tax liability for accurate payment.

- Keep a copy of the challan (online payment receipt or Challan 280 copy) for record-keeping during ITR filing.

- The last date for the current installment (March 2024) is March 15th, so ensure you pay before the deadline to avoid interest penalties.

Video on How to Pay Advance Tax Online

Watch this video to know how to do Tax Payment using “e-Pay Tax” Functionality

Login to the net-banking site with the user id/ password provided by the bank for net-banking purpose and enter payment details at the bank site.

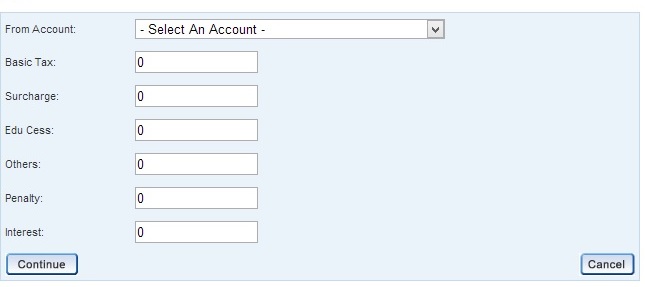

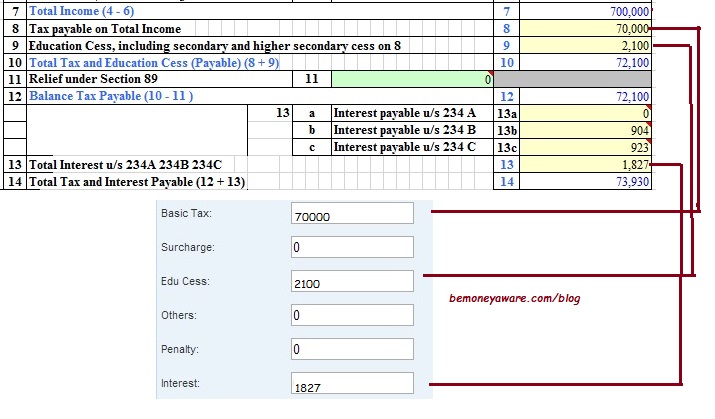

You need to break up the tax payable into its components, i.e. “Income Tax” and “Education Cess” etc as shown in picture below. There is no Surcharge for FY 2012-13 and education cess is 3%.

- Basic tax is tax payable without any cess, interest etc.

- Surcharge : is Not applicable. So Should be 0(zero)

- Penalty :is applicable only if assessment order is passed and you receive a notice from Income Tax Dept. Not applicable for Self Assessment or Advance Tax.

- Education cess. : is 3% of the Basic tax.

- Interest : If one has to fill interest for late payment of advance tax and self assessment tax 234B,234C or any other interest . Then it has to be mentioned here.

- Others: Which does not fit into any of above category Unless specially asked ignore.

For Advance Tax: Filling only basic tax.

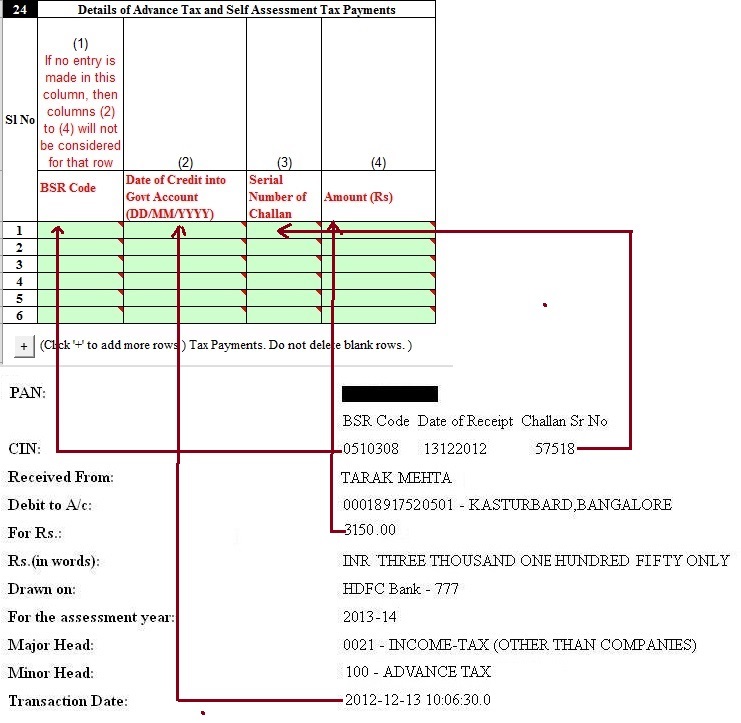

For Self Assessment Tax: One needs to pay education cess and also penalties calculated under Sections 234A/B/C and entered separately in Interest field. If you have detailed calculation say while filing ITR fill in the values from it as shown in image below. Else get the breakup of tax into education cess, interest and Basic tax.

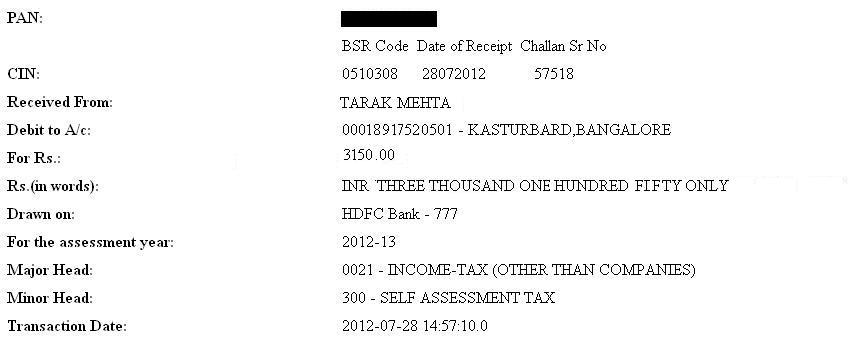

Step 5: Your bank will process the transaction online by debiting the bank account indicated by you and on success generate a printable acknowledgement indicating the Challan Identification Number (CIN). Challan counterfoil will contain CIN, payment details and bank name through which e-payment has been made. This counterfoil is proof of payment being made. You can verify the status of the challan in the Challan Status Inquiry at NSDL-TIN website using CIN after a week, after making payment.

Challan 280 e payment counter foil

If any problem encountered

- at the NSDL website while entering non-financial data then contact the TIN Call Center at 020 – 27218080 or write to at

- While entering the financial details at the net-banking webpage of your bank, then you should contact your bank for assistance.

This system is beneficial as one is not required to personally visit the bank to make the payments. Payment can be made electronically at one’s convenience from any place where an internet facility is available e.g. office, residence, etc. Further, you get the Challan Identification Number (CIN) online, which is required by you when you file your return.

After paying income tax through Challan 280 what next?

You can verify challan using CIN in reciept online through your Form 26AS or through Challan Status Enquiry on TIN webpage. You also need to quote CIN number while filing your income tax. Our article , Challan 280: Payment of Income Tax, discusses verification, correction process in detail

If you have paid Self Assessment tax through Challan 280 fill in the details in Tax paid and make sure that your tax liability is 0 before submitting the return as explained for ITR1 in our article Fill Excel ITR1 Form : Income, TDS, Advance Tax Our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR discusses it in detail.

Fill Self Assessment Tax Details in ITR using Challan 280

Reprint Challan 280

Income Tax Returns can be filed only if we have paid the Tax due to the government. If you submit the ITR without paying then your Income Tax Return can be declared Defective.

After paying Self Assessment/Advance Tax one needs to download the Challan 280 reciept and update Income Tax Return. But at times many people forget to download the receipt. Most of the bank offer the facility of re-generation of Cyber Receipt/ Challan for the e-Payment of Direct Taxes through TIN-NSDL website.

Banks upload challan details to TIN in 3 working days basis after the realization of the tax payment. On the day after the bank uploads the details of self assessment/advance tax to TIN, it will be automatically posted into your Form 26AS.

But what if you want to get details of your challan now and can’t want for Form 26AS Updation. For example filing ITR near the deadline. Then you need facility to regenerate Challan 280/reprint Challan 280. Many Banks provide this facility. We have updated details from SBI, HDFC bank and ICICI Bank in our article Reprint Challan 280 or Regenerate Challan 280

For more queries : Check TIN-NSDL’s Frequently Asked Questions (FAQ) on e-payment

- Advance Tax:Details-What, How, Why

- Filling ITR-1 : Bank Details, Exempt Income, TDS

- Income Tax Overview

- Challan 280: Payment of Income Tax

- Paying Income Tax Offline: Challan 280

Disclaimer: Please do not construe this as professional financial advice. While efforts have been made to provide correct information, this is our understanding of the Income tax law. Apologies upfront for any mistakes. Please let us know and we will correct. Please don’t send us emails asking us to check your income tax detail. But if you have any doubt on the article or some clarification is required or you feel some information is wrong. Please leave it in comment section so that all readers can benefit. For details check our Disclaimer.

[poll id=”33″]

In this article we have tried to cover how to pay income tax using challan ITNS-280. Do you pay Challan 280 online or offline? Do you pay Education cess while filling the Advance Tax? What have been your experience in paying through Challan 280? Did you like the article?

I have tax payable of Rs. 100000 income. Tax payable is total 5150/-. During self assessment tax paid i fill whole amount as basic tax and nill on edu cess. Is there will be problem? Plz suggest me

I filled my income tax for 2016-17 and 2017-18 in March 2018. This was the first time I filled the tax. I am a widow and a family pensioner of BSNL. I filled my income tax online using self assessment ITR-1 Sahaj Individual income tax return.

I paid the tax amount Rs.2200 for 2016-17 and Rs.820 for 2017-18 through SBI challan No. 0011349-050518-00774 dated 05.05.2018 (for 2016-17)and No. 0011352-260318-00023 dated 26.03.2018 (For 2017-18).

Now I have received the intimation U/S 143(1) for both assessment years , but asked me to pay the amount again. The reason given as below:

Table No.A The following are the details of Unmatched Tax payment claimed in the Return -Advance tax and self assessment tax.:

Sl.No. CIN Amount claimed date of deposit Challan No. BSR Code AY Major Head

1. 00113522603201800023 (820) 26/3/18 23 0011352 2017 21

00113490505201800774 (2200) 05.05.2108 774 0011349 2016 21

Please advice me what to do? Shall I have to pay the tax again? In which case shall I claim the tax which I paid already?

Thanking you.

Kamala Nagararathinam.

Sir can you mail all the documents to bemoneyaware@gmail.com

Hi, I want to pay tax online , however my bank is not listed in the site. can I pay the tax using my wife\friend bank account?

Yes you can pay through anyone’s account.(Income tax dept is more worried about tax rather than who is paying from where 🙂

Just enter your details esp your PAN so that it reflects in your Form 26AS

and be careful of the Assessment Year.

From 1 Apr 2017 to 31 Mar 2018 AY is 2018-19

Sir/Madam,

I have deducted an amount of 4500/- towards income tax from salary of an employee instead of 5000/-. This amount routed through BOOK IDENTIFICATION NUMBER (BIN) PROVIDED BY PAY & ACCOUTS OFFICER AND CREDITED TO INCOME TAX DEPARTMENT. HOW TO DEDUCT BALANCE AMOUNT OF RS.500/-. IF I USE CHALANA-280, IS THERE ANY PROBLEM.

Challan 280 is for Payment of Advance tax, Self-Assessment tax, Tax on Regular Assessment, Surtax, Tax on Distributed Profits of Domestic Company and Tax on Distributed income to unit holders.

So you cannot use Challan 280

I have submitted my income tax on 25 July 2017 online (debit card) from home at night and the status was scheduled for 26 July 2017. but still i did not get any update. I have the reference number of transaction but still confused to how i can get the receipt. Can any one tell this how can i regenerate this or where i can contact for this. My mail- mukeshjoshi21@gmail.com

SAME PROBLEM I ALSO FACED

same issue…Please share if you get any solution.

Same iusse. Money got deducted but do not have challan no. Pls let me know how to get it

Thanks a lot for such a nice article.

I have a small query on Chalan 280. I am using ITR Java Utility -ITR 1 for FY 2016-17.Here are my breakups:

Tax Paid–>D12 (Amount Payable) : 42730

Computaion of Tax Payable(d8,D9) –> 234B+324C= 3176

As per above logic, my chalan 280 will be :

Income Tax : 41485 (yes)

Education Cess : 1245(yes)

Interest : 3176 (I don’t think so that I need to pay this, as everything is already covered )

Correct me if I am wrong

If Tax to be paid in financial year is more than 10,000 Rs then 234B+234C comes into play.

As per the Income Tax Act, if you have any outstanding tax payable at the end of a Financial Year (FY), you must pay the balance tax amount and file your income tax returns by July 31st of the corresponding Assessment Year (AY). This is called Self Assessment Tax.

Please note that tax payable should consider TDS so Tax Payable = Income Tax on total Income – Tax Deducted at Source.

So check your tax due , verify using Form 26AS.

Pay Self Assessment Tax , update ITR and then submit it

Our article Section 234A,234B,234C : Interest Penalty for not paying Expected IncomeTax on Time explaining the penalty in detail

Our article Section 234A,234B,234C : Interest Penalty for not paying Expected IncomeTax on Time explains the penalty in detail

Hello sir,

I need some help regarding the demand notice which I had recieved few days back for AY2012-13. I followed the instructions given in the notice and initiated the payment of tax demanded. I paid the tax on my eBanking portal and challan was generated. I saved the Challan but then before eBanking platform redirects me back to IT portal, my connection broke and now I’m not sure what to do. I have already submitted the demand with “Demand is correct” selection on the portal after payment of tax. Now the question is what to do with the Challan that I received. I still see the same outstanding demand in my account on IT portal. Please advise.

Thanks,

Bhavin

Check Form26AS to see if Challan amount is reflected.

As explained in article How to Pay or Reject Outstanding Income Tax Demand under Section 143(1)

What to do after paying the outstanding tax demand?

You check the status of your tax payment by viewing Form 26AS and Select the specific Assessment Year. Go to Part C – Details of Tax Paid. There should be an entry with the details of your Outstanding Income Tax Demand payment.

Whom to inform after making payment of Tax against a demand notice?

In case the demand notice is from CPC Bangalore no further communication will be required. Demand will automatically be adjusted with the tax payments made. You can check the status of demand by logging in to Income Tax e-filing portal after few days of making payment. Go to “Outstanding Tax Demand” and check the status. If your payment is received by the IT department then you may find no records.

Very informative article! This method doesn’t require Digital signature?

Dear sir,

sapose I have 50,000/- rs in my a/c. I will debit & credit same amount again and agnai .so my bank transaction will show nearabout 8 laks in one year.

so tell me sir WHAT I WILL COME UNDER INCOMTAX. AND HOW MOUTCH I PAY TAX

Income tax is payable on Income , not on transactions.

why would you debit and credit the same amount again and again, unless there is some wrong play going on? In that case you have to explain the repeat reason for transactions.

Thanks well said Sir.

C’mon! No one is guilty unless proven. There can be multiple situations where he has to roll the same 50K. For example, a part-time trader can buy something in cash and sell it online for some profit. This way, he has to withdraw cash from the bank, and it will get deposited again once the sale is closed.

Stop assuming everything as a foul play.

It’s in point of fact a great and useful piece of info. I’m satisfied that you simply shared this useful info with us. Please keep us up to date like this. Thanks for sharing.|

HI i want to make paymrnt for ay 2017 18 which option to select 100 or 300 ?

For AY 2017-18 you will be paying advance tax so 100.

Hello!

I am an affiliate program manager for InstaForex Group – the Best Broker in Asia.

We would like to offer you the affiliate program cooperation with InstaForex. If you are interested to get involve in high commission based program, please contact me and I will provide the details.

If you have any queries, do not hesitate to contact me.

Information included in a background test will depend

to some extent on the employer and the job concerned.

I am a govt salaried person. I could not file my ITR for AY 16-17 till now and would be filing it shortly with 1-2 days. Just now I calculated that my interest from saving bank acct is more than Rs 10,000. when I tried to fill the same in online ITR, it says to fill TDS2 form. Now I don’t know how to fill the TAN od deductor and other columns. My queries :

1. Can I pay the tax now? if yes how?

2. Overall, I have get a refund after filling the filing the ITR. Will it make any difference on my depositing tax for interest on saving bank accts?

thank you in anticipation of a prompt reply.

I have paid my self assessment tax through online challan 280, but by mistake i have paid Rs 28000 instead of actually payable Rs 2800, how can I get my money back? also i have paid only flat 28000, i have not paid any educational cess or any surcharge, is it a mistake? will it affect my refund?or i have to re submit my ITR?

When did you file your return? Have you everified the return?

If you have not submitted the return or haven’t everified the return, please update the Tax paid then you would be eligible to get refund.

Our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR talks about how to update ITR after paying self assessment tax.

I have filed my return and e verified. Now what to do? Will i get refund or i need to re submit my IT return?pls suggest solution

I have paid my self assessment tax through online challan 280, but by mistake i have paid Rs 28000 instead of actually payable Rs 2800, how can I get my money back? also i have paid only flat 28000, i have not paid any educational cess or any surcharge, is it a mistake? will it affect my refund?or i have to re submit my ITR?

I have filed my return and e verified. Now what to do? Will i get refund or i need to re submit my return?

Not all background check services provide this additional information, but we were significantly impressed with PeopleFinders ‘ definitions.

Fantastic web site. A lot of usefful info here. I am sending it to some pals ans also sharing in delicious.

And certainly, thanks on yourr sweat!

My father in law paid tax in feb 2011 for fy 2010-2011. By mistake he wrote assessment year as 2010-2011 instead of 11-12. And bank also did the same. Now demand has come for AY-2011-2012 from IT dpt.now how can we sort dis out. As he has paid the same amount but due to wrng asmnt yr it has bin creditd wrong. Pls guide me as he is seniour citizen nd under serious tentn due to dis.

I have two employers. Previous has already paid the tx. So when i move to hdfc payment in the basic tax from ITR website it shows the basic tax including both the employers. On the next page, however it shows the correct amount. How to fill all the blanks of the HDFC challan to give correct sum of amount.? or should i pay all and get return???

I have two employers. Previous has already paid the tx. So when i move to hdfc payment in the basic tax from ITR website it shows the basic tax including both the employers. On the next page, however it shows the correct amount. How to fill all the blanks of the HDFC challan to give correct sum of amount.? or should i pay all and get return??

On 25 July 2016, I have paid self assessment tax through debit card.. Debit amount successfully.. Yet no tax paid showing in my PAN online account.. And I have not got challan copy when I paid tax online. What can I do? And tell me how to get challan copy and how many hours , paid tax amount show in my account of PAN..

It takes 3-5 days for details to show up in Form 26AS.

You can reprint the challan from your bank.

Which bank did you use?

How to Reprint challan from bank,Please explain

sbi

RAM LUBHAYA DOES YOUR QUERY IS SOLVED FACING SAME PROBLEM KINDLY GUIDE ME

Please go through our article Reprint Challan 280 or Regenerate Challan 280 for details on how to reprint Challan 280

Today I paid Self Assessment Tax online through challan 280. My Bank Account got debited with the amount but the transaction is not reflecting on Income Tax Site. I also checked on NSDL site (https://tin.tin.nsdl.com/oltas/servlet/QueryTaxpayerAjax).It is not reflecting in Form 26AS also. I have the receipt of the transaction. How much time does it takes to reflect? All details entered by me are correct.

Hello Sir

I had to pay around 65k and paid it via challan 280.But after completting the challan i forgot to enter those details while entering the income tax and i filed income tax returns form.How can i file my returns again.

Revise your return. Our article How to Revise Income Tax Return (ITR) explains it in detail.

Today 20 July 2016, I have paid self assessment tax through net banking .. Debit amount successfully.. Yet no tax paid showing in my PAN online account.. And I have not got challan copy when I paid tax online. What can I do? And tell me how to get challan copy and how many hours , paid tax amount show in my account of PAN..

No reply for ur side

Today I have got challan frm net banking

But paid tax not showing in my online income tax form

Hi, I have submitted my tax return. But while generating e-chalan, I selected Assessment Year as 2015-2016 instead of 2016-2017. I have e-verified my return also. Now what should I do?

Please correct the challan.

Try contacting the bank if they can suggest.

The process of correcting the Challan from our article How to Correct Challan 280 is as follows

you have paid Challan 280 online then only your Assessing Officer can correct the details. You can correct the details in the challan 280 by

Submitting a letter to your Income Tax Assessing Officer in the specified format.

You can send it through post, but it’s better if possible visit personally and submit the letter.

Also get acknowledgment on another copy of the same letter

The Figures of Salary and Tax credit dont match in Form 16 and 26AS. what should be done?

I have paid online tax under Minor head 400 after calculating the tax to be paid using the excel sheet of ITR 1.

Do I have to file the ITR again?

hello sir. i made payment in form 280 online. amount got debited but site showed transaction not successful. then again i tried again amount got debited and transaction not successful. both the time amount got debited but no challan got generated. kindly guide me in this issue as to whether the tax has been paid twice or amount will be refunded to me.

Please contact your bank

If during the transaction or after completing the transaction bank site encountered any error or get disconnected before generating Taxpayer counterfoil then instead of doing the same transaction again kindly check your Account, if account is being debited then contact your bank for regeneration of taxpayer counterfoil . Please note in the above case donot make the same transaction again which result in account debited more than once for same e-tax transaction.

Now in my 26 as there wil be double tax credit ?

If there is double credit. You can show it in ITR and claim for refund.

I want to pay online ADVANCE TAX for my Brother through my bank account. Is it possible to pay? I tried 2/3 times error message comes. Till last year I have paid through my account, since he is not having net banking facility.

Yes you can pay advance tax for anyone through your bank account. What is the error message that you are getting?

i have told that i could deposit the amount 150000 in 80c section and with this amount the tax is calculated and deducted. but i could only manage to deposit 115000 till 31st march., so there is a shortfall. my question is how could i deposit the rest tax amount and clear the tax. p;ease help.

i wanted to pay the tax of my father who has expired.i am his legal heir.whose pan no, should i quote while payment of tax?

Hi,

While paying the advance tax online through net-banking of state bank of patiala, i got a pop up saying the service could not be accessed at the current time (~11:50 PM) and that the transaction would take effect on the next business day at (8 AM). So, how will i get my CIN number.

A quick reply would be much appreciated.

Thanks in Advance

Same problem here

For State Bank of Patila one is provided with a link to print the e-receipt for this payment, if the transaction is successful. Y

ou can also generate e-receipt subsequently from ‘Status Enquiry’ link under ‘Enquiries’ tab.

first u check ur account statement after 8am if the amount is debited from ur account or not. if it is debited then use “reprint challan” option under “e-tax” section

Thanks Sacnchaita.

You can also wait for few days to verify it in Form 26AS

I paid online tax through challan 280. i paid the same after working hours. so system says same shall be credited next day only. when i check my saving bank account, money is debited however i didnt have any copy of acknowledgment from income tax dept.

From where I get the copy of acknowledgment so that online filling of income tax can be completed.

You can get the Challan copy from the Bank.

You can also get the details in your Forms 26AS. As explained in our article,with pictures,What to Verify in Form 26AS? Check Part C of the form

PART C – Details of Tax Paid (other than TDS or TCS)

If you have paid Advance Tax or Self Assessment Tax, this will be listed here, Whenever you deposit your advance tax / self assessment tax directly to bank, the bank will upload this information around three days after the cheque has been cleared.

I HAVE DEPOSITED AN AMOUNT OF R28980/ under wrong challan I have submitted a request for rectification/correction with ask 712290915077666 on 29/09/2015 in Delhi ward 64 (2) no written communication is recieved Dr Dharam Singh

Did you pay Challan online or offline?

For correction of Challan 280 if submitted online or after 7 days only your Assessing Officer can correct the details.

What will be the password to open the Taxpayers Counterfoil pdf file. Its asking enter password to open the receipt . I tried with my company PAN number and date but its not working. Please give me some suggestions

What do you mean by Taxpayers Counterfoil pdf?

I want to pay a fee of Rs 1000 by income tax challan for registration of valuer Form N. This is a one time fee just as any other registration fee.

1. Which challan to be used?

2. If challan 280,then type of payment will be self assessment tax(300) or advance tax(100) or tax on regular assessment(400)?

3.Why it is not accepting assessment year 2016-17 if I am making payment in FY 2015-16 for 300 or 400 mode.

4. To make assessment year 2016-17 should I pay it in advance tax head(100) or should continue in self assessment tax mode with AY 2015-16?

5. How will I have to show it in my return. I have already filed return for AY 2015-16

i have some interest payable under secion 234- A & B of Rs 1278.But after filling challan 280, the amount 23443 has deducted from my account,which is the total tax after penalty. why this happen? as my tax for the financial year is 22165 and cess tax is 646. already 22165 is deducted from my salary account , so why while filling challan and entering all the values, amount 23443 is deducted?

I paid my tax on 27th august vide challan at the local sbi branch which gave the challan number as 00025 which i mentioned in my return and uploaded the itr on the 31st august. However, a subsequent query regarding the challan status with the nsdl tin OLTAS system shows the number as 00023 although every other detail is correct. Form 26AS is also not showing this tax credit although I don’t know what how much time it takes for the data to reflect in form 26AS for offline payments. Please tell me what time it takes for the data to be updated at the cpc? Do I have to approach the bank and ask an explanation if its a human error or revise my return although ITR V is yet to be sent? Is challan number that important? My guess is that once the amount gets reflected in 26AS, I should be fine unless the return processing system automatically takes the challan number from the xml of itr and tries to search based on that and the bsr code. Please guide me.

By mistake I have paid tax twice through e-tax for self assessment. SO, please let me know how can I claim extra tax paid

I filed ITR return for AY 2015-16 but I missed to pay taxes through Challan 280 (rs. 1560/-).Now I have paid it through Challan. Please let me know if it is a mistake and if yes how can I rectify it.

I filed ITR for AY 2015-16 before e-pay tax by Challan 280. What to do to rectify this mistake or is it a mistake

Sir when you file your tax return your tax liability should be 0.

You can revise your returns and update it with tax paid. You can refer to our article Fill Excel ITR1 Form : Income, TDS, Advance Tax

To revise your return:

Prepare Return just like like you filed the first time, correcting or filling what had got omitted earlier.

Go to part of ITR with Filing Status , for example Income Details in ITR1 shown in image below (Fill Excel ITR form : Personal Information,Filing Status)

For Whether original or revised return select R-Revised.

For Return filed under section select Revised 139(5).

Enter the E-filing acknowledgement receipt number from the ITR-V Which you would have got after filing the original return.

Press Submit button on completion of data . You will get a new ITR-V marked as revised return.

Our article How to Revise Income Tax Return (ITR) explains it in detail

hello ….

i paid self assesment tax through debit card….payment deducted from my account bt i dont have any challan detail…how can i recive my challan detail…

26AS does not showing any amount…what should i do now?

Contact your bank. It would take 3-4 days for amount to reflect in 26AS.

We were not aware that one can pay through debit card. Only netbanking or going to bank are the options we know.

Can you throw light on Which bank, the process.

The option to pay through debit card has been there for quite some time now. I don’t know about other banks but it certainly is there for SBI debit cards.

Hi,

While paying the self assessment tax online, i got a pop up saying the service could not be accessed at the current time (~11:50 PM) and that the transaction would take effect on the next business day at (8 AM). So, how will i get my CIN number.

A quick reply would be much appreciated.

Thanks in Advance.

@ Barath I also encountered with same problem. How did you resolve it?

Did you CIN not get generated?

Which bank did you use?

same here any idea how to generate the challan after the bank deducts the money on the next working day. Since I only got the reference number and no CIN number

Please contact your bank ASAP.

Please help, I have generated challan for online payment but donot have netbanking account. Am I in trouble now. What to do now

You can go to bank and pay physically.

Ask your friend or relative who have netbanking amount to pay.

Please help. I have online paid challan 280 as self assessment tax for assessment year 2015-16 of amount 9500Rs on date 27 August 2015. After payment i got the statement but there was no challan number in it. I have not save the statement and closed the window. Now when i go to tdscpc.gov.in site to check the status of paid tax its not showing on site. Please help how many days it take to reflect paid tax on tdscpc site.

I am facing similar issue. How did you resolve it?

It takes 3-4 days for Form 26AS to get updated

If any problem encountered at the NSDL website while entering non-financial data then contact the TIN Call Center at 020 – 27218080 or write to us at tininfo@nsdl.co.in (Please indicate the subject of the mail as Online Payment of Direct Tax ).

If any problem encountered while entering the financial details at the net-banking webpage of your bank, then you should contact your bank for assistance.

I had sumbit my return of A. Y. 2014-2015. I had 40 rs of tax payble. I forgott to pay self tax. I want to pay 40 RS self tax and Challan. What is process now ?

thanks

I had done the same things for AY 2014-15. What i have done i had efile and and paid the amount later. So you pay your tax with interest by challan 280 for AY 2014-15. and again efile it. But this time say revised instead of original and put ur old acknowledge no. and submit it.

As per one school of thought

The income tax department doesn’t consider any demand or refund upto Rs. 100.

If the net “NET AMOUNT REFUNDABLE” is less than Rs. 100 or “NET AMOUNT DEMAND” is less than Rs. 100, one won’t receive refund or have to pay pending due.

You can also do what Javed suggessted

Can we pay Income tax through Credit card ?

Sorry debit card and credit card are not accepted and Tax can be paid from your friend ,relative,CA, tax consultants netbanking account also.

I use the quick e-file option in the IT website to file my return.. After providing details of salary,interest on savings and TDS, I should pay tax of 5K. Should I just pay 5K as TAX PAYABLE or should i again pay cess on this? I think the quick e-file itself has calculated all things like cess and interest and informed that I need to pay 5K tax? Am I correct?

Your advise on the cess on tax-pending query above would be helpful!

Thanks,

Prabhu

Dear Sir /Madam ,

I have received demand after receiving demand I am pay correct amount but its put in wrong column side mean I am put in interest side but actually they put in Tax side so please suggest what ill do .

As long as you have paid the full amount it does not matter. Income tax department looks at the full amount.

I have paid self assessment tax of Rs 540 by epay tax. But while efiling, there is no column where i can put CIN number or any information regarding self assessment tax.

TDS has Advance and Self Assessment Section

I have some Self Assessment tax to be paid. After computing in excel, I’m getting a total of around 60k to be paid(Total tax and interest payable). However, 25k of this has already been paid via TDS (Taxes paid and verification sheet). So while paying this (Step 4), what should I mention in Basic Tax? Shall I need to mention 35k. I believe the Edu cess and Interest I can take as-is from excel. Please advise. Thanks!

Sir in TDS sheet you have to enter Tax details of TDS deducted.

As explained in our article Fill Excel ITR1 Form : Income, TDS, Advance Tax

Once you enter the TDS details then your tax payable would automatically come down. And you can use values directly from Excel for education cess, interest under section 234b,c

Yes but while paying in net banking site, it asks only for total and the values like interest etc. So the amount already paid as tax is not considered . It means we pay excess in tat case

Sir you pay the tax that is payable. Not tax on entire income.

Suppose you have income from Salary and Income from FD which is considered as Income from Salary.

Then on Income from Salary your company pays tax as TDS. But on interest from saving bank account or from FD , unless you inform your company and they pay tax one may have to pay tax. For example if interest on Saving bank account is more than 10,000 Rs.

You pay the extra tax through Challan 280. This is explained in our article Filling ITR-1 : Bank Details, Exempt Income, TDS Details

What is Challan number in ITR?

Is it Chalan serial number or chalan number (280)

You need to quote CIN numberas shown in our article Fill Excel ITR1 Form : Income, TDS, Advance Tax

I have some Self Assessment tax to be paid. After computing in excel, I’m getting a total of around 50k to be paid(Total tax and interest payable). However, 25k of this has already been paid via TDS (Taxes paid and verification sheet). So while paying this (Step 4), what should be mentioned in Basic Tax shall I mention 25k. I believe the Edu cess and Interest I can take as-is from excel. Please advise. Thanks!

Hi, I have received a demand under section 143(1) on 15/07/2015 for Rs 2200 (AY 2014-15). This is due to a tax credit mismatch for the same AY 2014-15. Do I have to deposit any interest on this demand even if I deposit the demand within 30 days of notice date?

If yes then from which date do I need to calculate the interest?

Regards,

I have an amount of Rs.3600 to be paid as balance Tax under Self Assessment after I generated my return. Return is yet to be filed. How do I bifurcate and show it? Or should I pay it Rs 3600 in full.

If you are using ITR in excel or Java it would mention the education cess etc.

How did you arrive at 3600? If it does not include Education cess you can pay 3% of tax payable as education cess

So 108 will be education cess on 3600

I have a difference of Rs. 3600 to be paid as Self Assessment Tax. How do I show it in terms of Tax + Education Cess – The bifurcation or do I show it only as the total and pay online?

ven filling my IT returns i’m surprised to know tht i have pay interest under 234b & 234c. As i’m salried person & my company has paid the taxes well within the time.

Pl suggest now wht i have to do? should i pay the intrest R need to correct.

If need to correct pl help me how to do (the process)

If i need to pay How should i pay(the process)

Tanx in advance

Did you enter the TDS details in TDS sheet.

You need to use form 16 to fill information about TDS deducted and paid by your company

Let us know if this fixes the problem.

My source of income is salary and interest.While filing the return for this year, i saw that there was a difference (shortage) of Rs.13010 becuase only 10% TDS was taken on my FDs. I paid this amount through e payment using Challan #280, under the head 400-tax on regular assesment. is this correct? Otherwise what should I do now?

Please correct the challan

Code 200 is for TDS/TCS payable by taxpayer and

Code 400 is for TDS/TCS to be paid on regular assessment i.e demand raised by department & paid by the assessee for the same

You should get it corrected.

Please go through our article How to Correct Challan 280

Last year i got “voluntary seperation package” from my previous employee. Can i get tax rebate by filing it now? if so, which foram and which field should i fill?

Hi Sir,

While trying to file the return online, there is a section “Sch IT – Details of advance tax and self assessment tax payments”. There is XYZ appearing there as I paid advance taxes for a gift received from payback online offer under Challan 280.

Now this advance tax is showing under the extra tax that I paid and shows under refunds in “taxes paid and verification” tab.

This ideally shouldn’t show as refund. Where should I mention that under Income if I am not wrong?

Please advice.

Refund will show when taxes paid by you(TDS etc) is more than tax you need to pay.

You also need to show your winning amount as income from other sources.

As per section 194B of Income Tax Act, 1961, if the prize money is not in cash but in kind (Say you won a car) or partly in cash or party in kind then the receiver of the prize is required to deposit the tax calculated @ 30% of the aggregate value of the prize.

You can read article Income tax on Game show for clarification

ncome tax deducted on prize money is not refundable. Taxation of prize money is governed by the Chapter XII of Income Tax Act, 1961 which deals with determination of tax in certain special cases.

As per section 115BB the total income tax payable by a person who is in receipt of a winning from lottery orgame etc. shall be the aggregate of the following:

(a) Income Tax @ 30% on the winnings from lottery/game etc.

(b) Income tax on his rest of income as if there were no such winnings

Example:

Mr. ABC won Rs. 500000/- in a TV Game Show but he received Rs.3,50,000/- after deduction of Tax at source. His other income from salaries and interest is Rs. 350000/- and he is entitled to a deduction of Rs. 100000/- under section 80C.

His income tax obligation for Assessment Year 2015-16 shall be as under:

Computation of Income and Tax

1 Income from Salaries+Interest 350000.00

2 Income from other sources 500000.00

Gross Total Income (1+2) 850000.00

Deduction under Section 80C 150000.00

Total Income (3-4) 700000.00

6 Income Tax:

6.1 Income Tax on TV winnings 150000.00

6.2 Income Tax on rest of Income (Rs. 7 lacs minus Rs. 5 lacs) 150000.00

Education and SHE Cess 4500.00

Gross Tax Liability 154500.00

Less: Tax Deducted at Source 150000.00

Amount Payable 4500.

I have paid the due tax on 19 july 2015 via SBI internet banking and I have the CIN number BSR Code etc but the same is not reflecting in my Form26AS.

Can you please tell me how much time will it take the transaction to reflect in my Form26AS ?

Can I proceed to submit my ITR without waiting for it?

It usually takes 3-4 days. Please verify that money is deducted from the bank account.

We would suggest you to wait for a day or 2.

Thank you..

sir during self assesment tax i have to pay 4000 rs as tax from saving interests in bank .while paying for e tax there are coloumns for basic tax ,surcharge,educational cess etc.Do i have to again pay educational cess on rs4000 as it has already been deducted in form 16

Sir there is no tax on saving bank interest upto 10,000 So just enter 4000 Rs under section 80TTA as explained in our article Exempt Income and Income Tax Return

Sir, I have paid Income Tax of Rs. 4930/= on line but the challan was not generated. What should I do now.

I paid tax. However made a mistake . paid under “400” “regular assessment instead of self assessment (300) now what should I do? I have uploaded the return and got ITR-IV also

Please help

Hi Even I did this mistake could you please help what i suppose to do now

You need to get the challan corrected. You have to approach the Assessing officer for moving it from 1 head to another Within 3 months.

Draft a letter addressing the problem to the AO.

Letter format is given in our article How to Correct Challan 280

Hi,

I have outstanding demand “Indicates interest computed u/s 220(2). This interest u/s 220(2) is liable to be computed till the date of payment/adjustment of this demand.”

In AY 2010-2011 there was some outstanding tax that I paid in 2013 under 400. But I forget to pay interest. and In 2014 I got a demand for interest pending u/s 220(2).

How to pay this interest under 400. There is one option when do payment on bank site “You need to break up the tax payable into its components, i.e. “Income Tax” and “Education Cess”, Interest etc”.

Should I need to enter interest amount in Interest box?? or in Income Tax box.

How to account for the TDS that has already been paid.

I paid my self assessment tax through challan correctly but did not categorize it to basic tax and education cess. However i paid the total amount which includes both basic tax and education cess. Please let me know whether this will create any issue further?

Sir,

Maine 12/07/2014 ko 4140/- ka Income Tax SBI me e-net Payamnet Account se apne hi Account se deposit kiya hai, but i have not recipts & I do not know ke kiska deposit kiya hai. but Trans. Receipts Know # CK48816341 Dt.12/04/2014.

Pl. Gudie me.

Please check your Form 26AS. If you have deposited tax then it should be in Form 26AS.

hi,

actually maine 2 may 2015 ko self assessment tax online pay kiya tha. but mujhe usaki receipt or challan nahi mila. Toh mujhe online challan ya receipt kaise mil sakati hai. mere pass sirf transaction Id hai.

Please guide me..

Aap apna form 26AS check kijiye which would show the self assessment tax paid. You can check status of challan at

Income tax challan Status

G MORNING SIR , I Have made payment tax regular assessment by wrong 400 filling my return online challan 280 . now I come to know there is mistake in my return and in calculation of my self assessment tax. What should be done now? If I file for revision of my return form then should i have to pay the tax difference again in challan 280. please advise as it is all very confusing for me.

Sir Einstein also said that Income tax is confusing so you are not alone 🙂

When did you file the return? I assume you are talking about return for FY 2013-14 /AY 2014-15.

400 : Is for Tax on Regular Assessment for making any payment only when demand has been raised by Income Tax Department.

Please verify your Form 26AS.

You can get payment through Challan 280 corrected.

If you have paid Challan 280 online then only your Assessing Officer can correct the details. You can correct the details in the challan 280 by

Submitting a letter to your Income Tax Assessing Officer in the specified format.

You can send it through post, but it’s better if possible visit personally and submit the letter.

Also get acknowledgement on another copy of the same letter

Hi

I have filed return for AY 2014-15 today.

Realized that the tax on income is say 100 while the amount deducted by my company is 96 as in Form 16

I have already uploaded the xml, but yest to send ITR-V hard copy via post to CPS

What should I do now ??

Do not do anything considering a difference of only 4 rs

Pay additional 4 Rs on my own as tax and submit xml again ?? ow to pay tax, under which head and is it possible to upload xml again !!

please help

Theoretically You have to pay all your due taxes before filing Income tax. I am not sure if there is a difference of Rs 4 or the limit to which you can ignore.

When you still owe taxes to the government. For example: if you have income from other sources, if you have worked in more than one company, etc. You will be liable to pay a penalty of 1% interest on the balance tax payable, under section 234A.

Self Assessment Tax: While filing income tax returns, an assessee does a computation of income and taxes to be filed in the returns. At times,due to incorrect calculation or laziness or ignorance, the tax paid either as Advance tax or in TDS is less than actual tax payable. The difference between tax payable and tax paid is called the Self assessment tax. This needs to be paid before Income Tax Returns are filed.

Our article Fill Excel ITR1 Form : Income, TDS, Advance Tax explains it.

Please remember that Returns filed after the due date cannot be revised.

i have paid the advance tax in online using debit card ,the payment has been transfered but i did not get the counterfoil that has the CIN no..I approached my bank but they are not responding properly.what should i do now.pls reply as soon as possible

I pay through netbanking – debit card I am not aware of. Did you pay offline/online?

That’s surprising. Please check your Form 26AS and verify if advance tax appears.

The transaction should appear in your bank statement. Approach the bank with the statement .

Which bank it is – a public sector bank or private bank

Apply pan card online India

Apply Pan India is a one stop solution for all the individuals who wants to apply for Pan card online.

Query:

In FY 11-12 I sold a house property on which I made long-term capital gains of Rs 400 Lakhs. Out of this I deposited Rs 50 Lakhs in REC Bonds and Rs 250 Lakhs in CGAS. I paid tax on the remaining capital gains of Rs 100 Lakhs for FY 11-12 and filed my return of income for AY 12-13 in Jul’12 declaring the said capital gains. However, subsequent to my filing the return, I purchased a new flat in Nov’12 which cost Rs 320 Lakhs. This was paid to the extent of Rs 250 Lakhs out of CGAS and the balance Rs 70 Lakhs out of the capital gains held by me in my bank account. In these circumstances is it permissible to claim a higher deduction under section 54 and consequent refund of tax by filing a revised return of income ?

You can claim tax exemption under Section 54 on the long-term capital gain on the sale of a house. To avail of this exemption, you must

Use the entire profit to either buy another house within two years or

Construct one in three years.

If you had already bought a second house within a year before selling the first one, you could still avail of the tax exemption,

So from your information it seems you could have used entire 400 lakh for buying house.

50 lakh in REC bonds are locked for 3 years so let’s leave it (else reversal need to be taken care)

For buying house you used :

250 lakh for buying house

remaining 70 lakh you said I paid out of the capital gains held by me in my bank account? Is it part of 100 lakh on which you paid capital gains?

You can revise your returns (assuming it’s not processed yet) but our suggestion is take help of professional for he might be able to save you from being penny wise and pound foolish!

Now for rem

Thank you.

Hello, I have made payment of self assessment tax before filing my return using challan 280. now I come to know there is mistake in my return and in calculation of my self assessment tax. What should be done now? If I file for revision of my return form (it is itr1) then should i have to pay the tax difference again in challan 280. please advise as it is all very confusing for me.

To err is human so it’s okay. Yes you can file the revised return provided the original return has been filed before the due date and provided the department has not completed assessment. However it is expected that the mistake in the original return is of a genuine and bona fide nature. Please take care of following:

Corrected tax returns can be filed only if the original returns were filed on time

You can file a revised return only in case of ‘omission or wrong statements’ and not for ‘concealment or false statements’

Revise tax returns within one year from the end of the assessment year or before the assessment

Returns can be revised when filed pursuant to notice under Section 148

You will have to cough up 100 to 300 per cent of tax due as penalty for concealing income

This apart, revised returns have a higher chance of landing a scrutiny letter from the I-T department. More details at Business Standard Made a mistake in filing I-T returns?