What should you do if you have already bought an insurance policy. Should just let the policy lapse or surrender it or make it paid up or take a loan against the policy. How should you decide which policies should be in your portfolio and the ones that you should get rid off at the earliest. Decision depends on various factors such as:

- How much cover does it offer?

- If the policy is surrendered today, what will be the surrender value?

- How many premiums are paid and how many remain?

- Can you afford the premium?

- What is the expected rate of return from your existing policy?

- Can you claim tax benefit on the policy? Will your benefits on maturity be taxed?

- Does policy offer a ‘paid-up’ feature?

- Does your existing policy offer a loan?

- Should your surrender or make policy paid up?

- How much is the revival period in case you skip premium payment?

- What is your alternative investment plan? i.e. if you are not paying premiums, where will you be investing the saved premium amount? What kind of returns will it give? What are the ratings of new investment and, hence, risks associated with it? Are those assured returns or expected returns?

- If you give up on your existing insurance policy, you will need some insurance to cover your risk. What would that be?

Let’s go through these questions in detail.

Table of Contents

When is the policy maturing?

When your policy matures what is your age is an important factor in separating the chaff from the grain. An insurance policy should ideally cover a person till he is earning. If a 25-year-old person buys a 15-year policy that will mature when he turns 40, it will not serve much purpose. This is because his financial responsibilities will not end when he is 40. In fact, this is the age when the liabilities are peaking and his need for insurance is the highest. If you have a policy that is scheduled to mature when you are in your 40s, it should be on your hit list. Try to retain policies that extend till your retirement and beyond.

If your policy will earn bonus then the policies that are close to maturity should not be on the chopping block as well. Why get rid of policies that are maturing in 2-3 years and lose the terminal benefits? Target those policies that are not too close to maturity but also not too far away. Rank them in order of residual maturity and exit those where the impact cost (in terms of surrender charges and fund value) is the least. Our article Surrendering Life Insurance Policy talks about how to calculate the surrender value of your policy.

Tax implications

What would be the tax implications on discontinuing the policy? Tax benefits on life insurance policies fall under two categories :

- Deductions under 80C section :Insurance products give you deduction of up to Rs 1,00,000 from taxable income under 80C.

- Tax benefit on benefits received under section 10(10D) . Tax treatment of policy on maturity or death of policyholder, on receipt of surrender or paid-up value, is similar.

Under Section 10(10D), any amount received under a life insurance policy,from the maturity or claims on a life insurance policy, including bonus, is not taxable provided some conditions are met.

- For policies bought before 1 Apr 2012, The proceeds from the maturity or claims on a life insurance policy were exempt under Section 10(10D) if the premium was not more than 20% of the sum assured or the sum assured was at least five times the premium paid.

- For policy bought after April 1, 2012 the sum assured needs to be at least 10 times the premiums paid,

- For policies bought after April 1, 2012 whose premium is greater than 10% of Sum Assured getting money on maturity or even surrendering them early means you will be subject to tax on whatever you receive.

An insurance plan that doesn’t give you a cover of at least 10 times(or 20 times for policies bought before Apr 1 2012) the annual premium should be the first to exit your portfolio. Typically, you should get at least five times the premium you pay for single premium policies, and 10 times otherwise.

Reversal of 80C benefits: If you have claimed 80C benefits then check if those tax savings would be reversed? According to 80C rules, tax savings on traditional life insurance plans will have to be reversed if :

- you do not keep single premium policy in force for two years after the date of commencement of the policy OR

- regular premium policy premiums are not paid for two years.

For ULIPS time frame is 5 years. Our article Surrendering Life Insurance Policy discusses it in detail.

Can you afford the premium?

You must check if you can afford the premium. You might want equity exposure through a Ulip or guaranteed returns from an endowment plan. However, if the premium is so high that it comes in way of your other financial goals , it does not make much sense to continue with such policies. Ideally, one should not allocate more than 10% of one’s income to life insurance. This means that a person with a monthly income of Rs 50,000 would have annual income of 6,00,000(50,000 * 12) should not have policies that require a premium outgo of more than Rs 60,000 in a year.

Due to uncertainties in life and especially customers with high-ticket premium are not sure of their capacity to pay premiums regularly over a period of time. If somehow policy lapses. most of the insurers including LIC do offer the flexibility of revival within three-five years of first unpaid premium. If you are short of paying premium temporarily then you can explore option of taking loan or letting policy lapse and reviving it later. But remember that during the lapse period protection will not be there.

Is it part of your financial plan?

All insurance policies serve some purpose or the other. Money-back policies give out periodic payments. Endowment plans help build a tax-free nest egg. Ulips help create wealth through equity investments. Find out if your insurance policy too has a role to play in your overall financial plan. If you have a steady job and a rising income, your money-back policy is of no real use.

Are you insured enough?

Are you in same boat as Madhukar and Leena Avhad, Mumbai . From EconomicTimes How to find out if you have wrong insurance policy and what you should do (Jan 2012)

They have 10 life insurance policies, including 3 endowment plans, 3 money-back policies, one whole life plan and 3 Ulips. Annual premium: 1.25 lakh Risk cover: 20.6 lakh But they are not fully insured especially not for 1.25 lakh of premium payment. Madhukar’s insurance of Rs 13.6 lakh is not even enough to cover his outstanding home loan of nearly Rs 15 lakh.

Their life cover is grossly inadequate. They should consider turning the endowment and money-back plans into paid-up policies. The three Ulips should also be turned into paid-up plans after the mandatory period for paying premium. To increase the cover, they should buy term insurance.

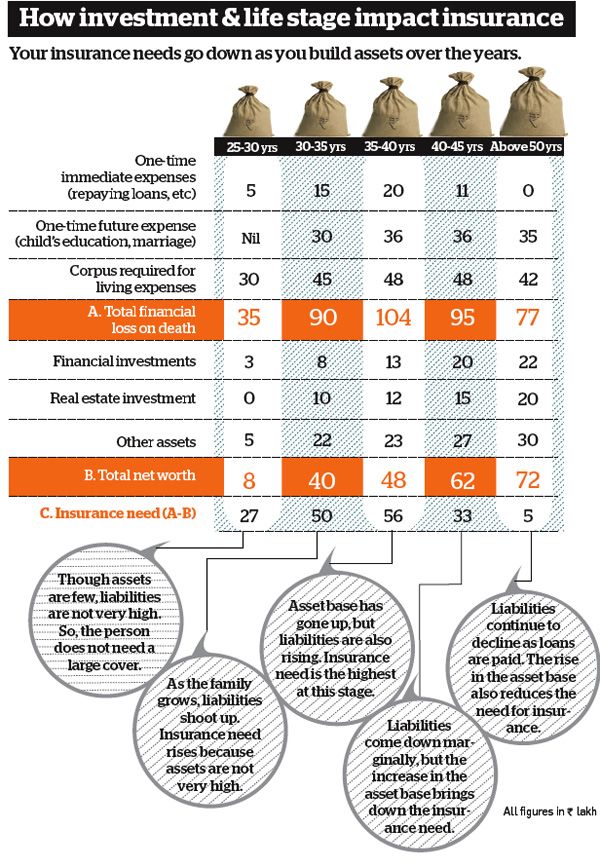

The Avhads are not alone. After bank deposits, life insurance is the most favoured financial investment for Indians. Almost 20% of their total household savings flow into life insurance. The question is whether this money goes into the right policies. The average cover offered by life insurance policies bought in 2010-11 was Rs 1.83 lakh, which is woefully low. Need-based approach is often used to find the amount of money a family would require to sustain its current lifestyle and meet future expenses. Add your expenses,the immediate ones, such as the repayment of outstanding loans, future expenses like children’s weddings, and day-to-day household expenses. When you have added these up, deduct from this figure the value of your current assets and investments. The difference between your expenses and assets is the amount you need to insure yourself for. Image below shows how investment and lifestage affects insurance. (Click on image to enlarge)

There is no benefit in surrendering term plan as no maturity or surrender benefit is offered on these plans. If you feel that the existing term cover is not sufficient for you and you need more life cover as per your financial liabilities, then you should go for a new policy. You can do it with the same insurance company or with another insurance company as well.

When you surrender a traditional insurance policy or it lapses protection on your life ends. On making policy paid up your life insurance protection is reduced. In any case you will have to compensate it by buying another life insurance policy. Please remember that with increase in age, the risk premium increases and one will have to pay more for the same cover as time passes. Do not exit a life insurance policy, if you do not have any other life insurance. If you want to discontinue your traditional policy, get your life covered first for appropriate amount and then go for the discontinuing the policy.

Who should be insured?

The logic is that the family suffers financial loss due to the death of the income earner. Hence, if there are policy which insures children and housewives, they should be considered for exiting.

Which is better: Surrender or “Paid Up”?

Should you surrender your life insurance policy, or make it paid up? People argue that the amount you receive when you make a policy paid up is far more than the surrender value, and therefore, surrendering should never be done. However, let’s not forget that you only get the amount at the time of maturity of the policy – which can be years away. And although the amount looks bigger, its actual value (purchasing power) can be very less due to the effect of inflation. There is no clear cut answer.The solution depends on the plan you want to discontinue and the situation you are in. This is especially true for long-term life policies, such as Ulips and endowment plans which have a savings component.

Alternative to the policy

If you plan to exit an insurance policy and wish to reinvest the proceeds in an alternative investment,it would make sense only if the amount (surrender value) received on doing so and invested in another product can generate a better return than the policy would have on completion of tenure. Buying a bank FD at 9% p.a will not be an option as the post-tax returns will be only 6.3% (assuming you are in the 30% tax bracket). So when does your policy break-even? Taking example from PersonalFn Is Your endowment policy as waste of your money

Let’s take the case of Mr Shah who has an endowment policy for annual premium of Rs. 24,632 . The premium paid for an equal sum assured (Rs. 5 lakhs) term plan is Rs. 2,059. The difference is Rs. 22,573 of additional premium every year. The table above examines whether it makes sense for Mr. Shah to drop the policy and invest the surrender value received and the remaining premiums (that he would have paid) into mutual funds, assuming a return of 12% per year from the mutual fund. Maturity Value incl. Bonus (Rs.) for the policy is 1,070,000. Column Benefit in the table is Return from MF minus Endowment policy Maturity Value i.e by how much investing in Mutual fund would have been more than endowment. For 0 Year Benefit is 1,821,613 – 1,070,000 = 751,613,

| Years | Premium | Surrender Value | Term Premium | Invested in MFs | Return from MF @12% | Mutual Fund-Maturity |

| 0 | 24,632 | – | 2,059 | 22,573 | 1,821,613 | 751,613 |

| 1 | 24,632 | – | 2,059 | 22,573 | 1,603,867 | 533,867 |

| 2 | 24,632 | 24,893 | 2,059 | 22,573 | 1,600,877 | 530,877 |

| 3 | 24,632 | 51,354 | 2,059 | 22,573 | 1,588,464 | 518,464 |

| 4 | 24,632 | 69,138 | 2,059 | 22,573 | 1,504,721 | 434,721 |

| 5 | 24,632 | 89,341 | 2,059 | 22,573 | 1,431,511 | 361,511 |

| 6 | 24,632 | 112,249 | 2,059 | 22,573 | 1,367,515 | 297,515 |

| 7 | 24,632 | 138,147 | 2,059 | 22,573 | 1,311,429 | 241,429 |

| 8 | 24,632 | 167,422 | 2,059 | 22,573 | 1,262,400 | 192,400 |

| 9 | 24,632 | 200,422 | 2,059 | 22,573 | 1,219,362 | 149,362 |

| 10 | 24,632 | 237,516 | 2,059 | 22,573 | 1,181,352 | 111,352 |

| 11 | 24,632 | 274,896 | 2,059 | 22,573 | 1,135,863 | 65,863 |

| 12 | 24,632 | 316,940 | 2,059 | 22,573 | 1,095,690 | 25,690 |

| 13 | 24,632 | 364,504 | 2,059 | 22,573 | 1,060,870 | (9,130) |

| 14 | 24,632 | 418,623 | 2,059 | 22,573 | 1,031,454 | (38,546) |

| 15 | 24,632 | 480,461 | 2,059 | 22,573 | 1,007,348 | (62,652) |

| 16 | 24,632 | 555,533 | 2,059 | 22,573 | 994,972 | (75,028) |

| 17 | 24,632 | 640,292 | 2,059 | 22,573 | 984,875 | (85,125) |

| 18 | 24,632 | 735,995 | 2,059 | 22,573 | 976,829 | (93,171) |

| 19 | 24,632 | 844,008 | 2,059 | 22,573 | 970,571 | (99,429) |

| 20 | Maturity Value incl. Bonus (Rs.) | 1,070,000 |

Consider Year 7, the year of his 8th premium (as the count starts at Year 0).

If he surrenders the policy in this year, he will receive Rs. 138,147 as the surrender value. He can invest this surrender value and also invest the remaining premium amounts (Rs. 22,573 per year for the remaining years) into mutual funds, and the money he invests would grow to Rs. 13,11,429 by the end of the 20 year period. This is a surplus of Rs. 2,41,429 over Rs. 1,070,000 what the endowment policy would have paid him.

Consider Year 17 i.e. the year of his 18th premium.

If he surrenders today, he will receive a surrender value of Rs. 6,40,292. He can invest this corpus and the remaining premiums into mutual funds, and the corpus accumulated within the next 3 years would be Rs. 9,84,875. This is less than he would receive is he simply continued with the endowment policy. The benefit of continuing the policy is Rs. 85,125.

In this particular case, the break-even year was Year 12. If he surrendered anytime up to and including Year 12, it would make financial sense for him to drop the policy and invest the surrender value and remaining premiums into mutual funds. Anytime after Year 12, it would be more financially prudent to keep the policy.

Better product in the market

This is the pitch from agents. They egg you on to surrender your policy and to put the proceeds in a new product.Intermediaries get 30%-40% commission in the first year of selling a traditional plan. The unwritten understanding is that they share a good part of what they pocket with the client(which is illegal). That should not be an incentive to buy a traditional plan. Remember Traditional products are front-loaded—the agents get instant gratification from the first year’s commission of the new product. It is wrong advice and it only boosts the agent’s revenue.

You are not alone: MoneyLife Survey

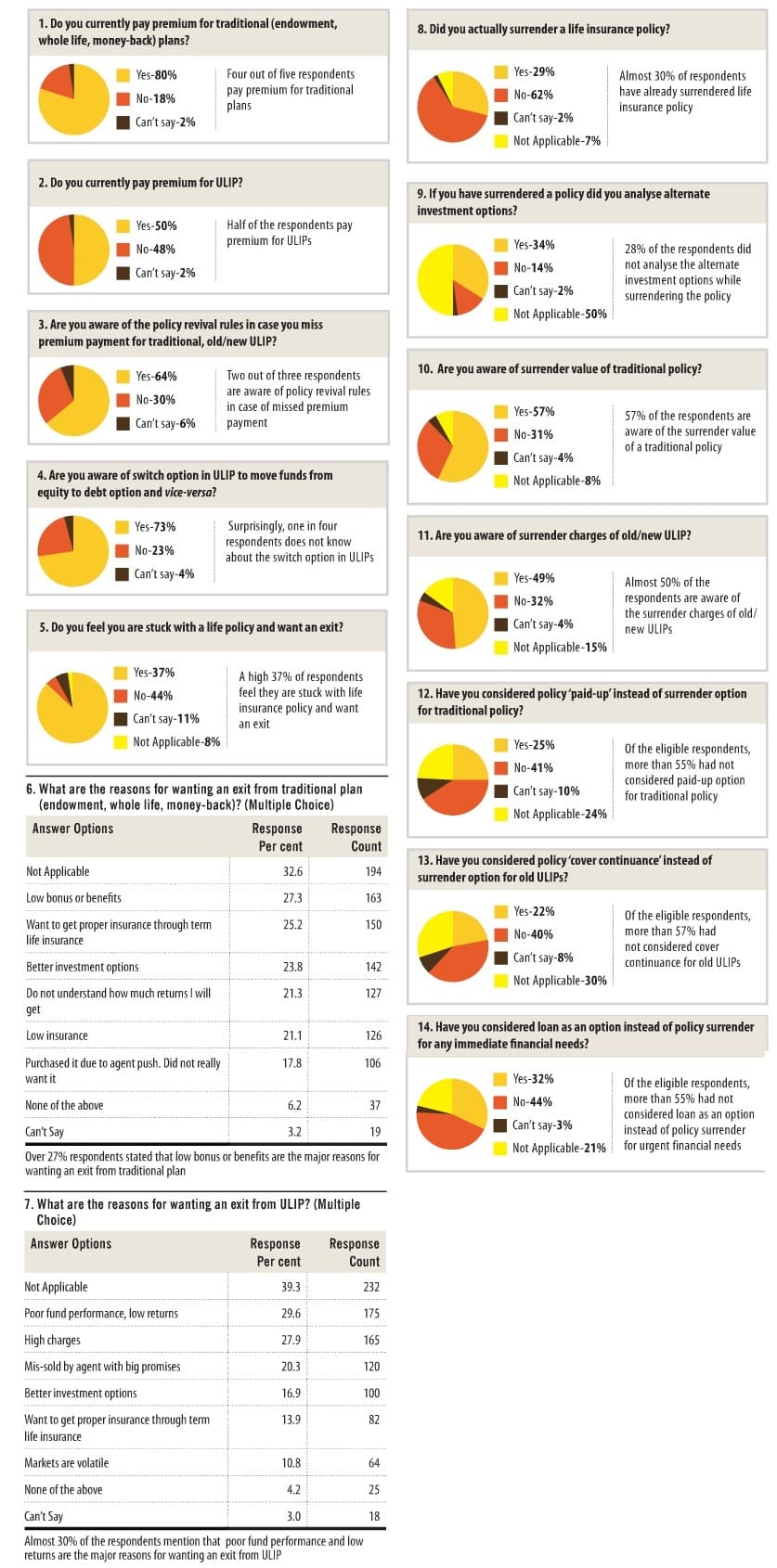

MoneyLife did an online survey on insurance policies and related questions.. Moneylife’s online survey in Mar 2012 received responses from 617 readers. As per Moneylife Survey:

- Almost 80% of the respondents are paying premiums towards traditional policies while 50% pay for ULIPs. It is in line with the penetration of insurance-cum-savings products which are popular with Indians. The trend of buying a term plan, which will give nothing if you survive, is slowly but surely catching on as awareness of risk protection increases.

- Two out of three respondents were aware of policy revival rules in case of missed premium payment.

- It is surprising that almost one in four does not know about the switch option in ULIPs—to move funds from equity to debt option and vice-versa.

- As much as 57% of the respondents are aware of the surrender value of a traditional policy while almost 50% are aware of surrender charges of old/new ULIPs,

- 37% Feel they are stuck with their Policies and want an exit. Of those for whom policy surrender was applicable, more than 50% had not considered the paid-up option for traditional policies, cover continuance for old ULIPs as well as the loan feature for their immediate financial needs.

- Almost 30% of respondents have already surrendered life insurance policy and, of those who surrendered, 28% did not analyse alternate investment options. It shows that surrender decision is often whimsical and without any sound logic.

Survey questions and results (page 3 in article) are shown in picture below. Click to enlarge.

What should you do if you have bought the wrong insurance policy?

All insurance policies serve some purpose or the other. People who have a number of insurance policies, having been sold multiple identical policies with different tenures by their agents. Deciding how should they discontinue their insurance policies is not be an easy task Each case is different and the investor need to evaluate their idea of surrendering or making policy paid up and buying new investment and insurance. Some pointers are :

Free Look Period: The earliest exit option provided by insurance companies is the free look period. The free look period is 15-days from the receipt of the policy to let policy holder rethink over the purchase. Go through the policy document in detail and understand the fine print. So in case you feel you have been mis-sold, or are not happy with the policy you can cancel the policy within the free-look period. The insurance company returns the premium amount after deducting charges towards medical tests, stamp duty and service charges. BuyandHoldBlog’s Update on My LIC Jeevan Saral Policy talks about how he got his LIC Jeevan Saral policy cancelled during the free-look period. Quoting from his experience The cancellation notice as well as the email communication with LIC’s customer service was not received well by the local branch. They approached my family and tried to explain how bad of a mistake I was making. They also did not like that I approached directly to their customer service of headquarters, then regional office, as well as the branch manager

Let the policy lapse. If one stops paying the premium, the policy lapses automatically. Do remember,in the first three policy years, you would not receive anything if the policy lapses and all your premiums would be lost.This should be the preferred option if you had bought the insurance policy just 1-2 years ago. You will have to forego the premium paid in the first couple of years, but it is better than continuing with it and compounding the error.

Surrender the policy If three years’ premium has been paid, you can surrender the plan and get some of the money back. The money you get,surrender value, is a fraction of what you paid. In the early years of the policy, this value remains pretty low. It increases as the policy moves closer to maturity. Insurance companies offer a guaranteed surrender value of around 30% of the total premiums paid subsequent to the first year. Please remember that Surrendering a policy also ends the life cover. If you terminate an insurance plan prematurely, the tax benefits availed of on the premium paid till then may also be reversed.

Turn it into a paid-up plan : As in the case of surrendering, this is possible only if three years’ premium has been paid. The policy does not go void but continues at a reduced sum assured, known as the paid-up value,. All additional benefits, future bonuses and dividends attached to the policy would be lost in such a policy. Any bonuses accrued in the years policy was in force would be paid on maturity. This feature was used to mis-sell Ulips. The new Irda rules say that if you stop paying the premium for a policy bought after September 2010, the plan will be discontinued.

Continue with it :If the policy is just 2-3 years away from maturity, it’s best to pay the premium for the full term. If you surrender it at this stage, you lose several maturity benefits . Turning a policy into a paid-up plan at this stage will not be of much use.

Loan : Taking a loan against 90% of a traditional policy’s surrender value and reduction of policy term are good options, if you need the money.

Remember: Your life should be covered at all times. So please get your life covered before discontinuing the policy. If you plan to exit an insurance policy and wish to reinvest the proceeds in an alternative investment, make sure your new option earns you superior returns.

Related Articles:

- Mixing Insurance with Investment

- Surrendering Life Insurance Policy

- Discontinue Life Insurance Policy: Surrender,Paid Up,Loan

- Life Insurance

- Basics of Insurance

Reading recommended: Steps and Tips WhyI surrendered my LIC Jeevan Anand Policy. MoneyLife Life Insurance: Surrendering policy? Think again Jagoinvestor What to do with your Junk Insurance Policies, Business Today To exit a life insurance policy or not?

Discontinuing the policy should not be the case of Bad Partner who are Worse in Divorce. Buy an insurance policy for the right reason: protection. Have you discontinued a policy?Which option did you choose? Why? How easy(difficult) was the process of discontinuing.

Nice details. My few thoughts on surrendering insurance policy

rel=”nofollow”Surrendering insurance policy without concrete plan – Its cure is worst than the disease.

made mistake in html..please correct.

Link is correct it takes to your website!

once again a very good information. i would like to some info on equity MFs . Can I have these on your blog. if yes please mail me the important links on vcr1976@gmail.com

What kind of information on equity MFs are you looking for. A comprehensive website about Mutual Funds is Valueresearchonline.com