Savings Bank Account is the most common account for individuals. When you have money in bank savings account, your money earns interest. That means that you get paid for keeping your money in the account. As you earn money you have to pay tax on it. But Income Tax Department gives deduction up to 10,000 Rs under section 80TTA on interest earned on all your saving bank accounts. This article explains how is the interest calculated on saving bank account, how interest on Saving Bank account is considered Income from Other sources and taxed, what is section 80TTA? How does it impact tax on interest from saving bank account? What is the 10,000 limit deduction? Is it for one account or multiple accounts?

Table of Contents

Overview of Saving Bank Interest, 80TTA

The interest is calculated on the daily balance in your account. Before Apr 2010 the interest was calculated on the lowest amount in the bank account between the 10th of every month and the last business day of the month. In Apr 2010 RBI moved to calculation on daily basis

- Though interest rate calculations are done on a daily basis it is credited to the account only at the end of each quarter or the half year.

- Interest earned on Saving Account is considered as Income from other sources. This needs to be declared in your income tax returns.

- No TDS is deducted from the interest on Saving Bank Account.

- it is taxed based on your income slabs.

- As per Section 80TTA of the Income Tax Act of 1961 which provides Deduction up to Rs. 10,000 to an Individual / HUF from Gross Total Income towards Interest on all the saving bank Accounts (not the Fixed deposits)

- You need to add interest from saving account to Income from other sources and then claim deduction under section 80TTA. If your total interest income from ALL your saving bank accounts

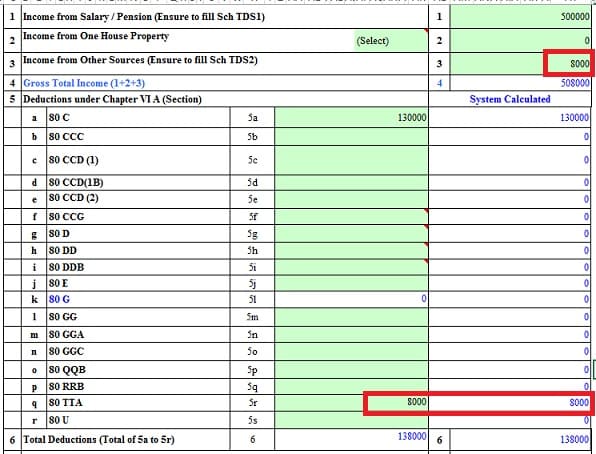

- is less than or equal to Rs 10,000 For example if your interest from ALL saving bank accounts is Rs 8,000 you need to show 8000 in income from other sources and then show Rs 8000 for section 80TTA .

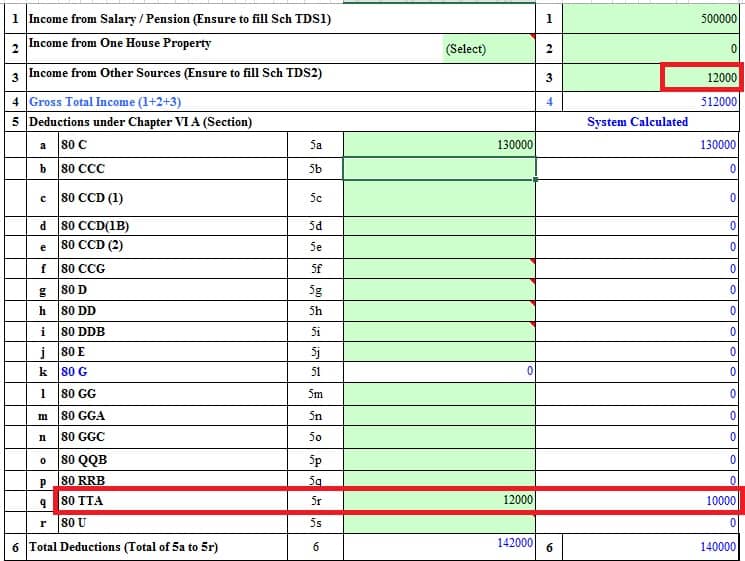

- is more than Rs 10,000 say 12,000 then add 12,000 to Income from other sources and then show Rs 12,000 in Section 80TTA. ITR should automatically give you deduction for 10000 and calculate tax on rest as shown in image below

How to show Interest on Saving Bank account in Income Tax Return?

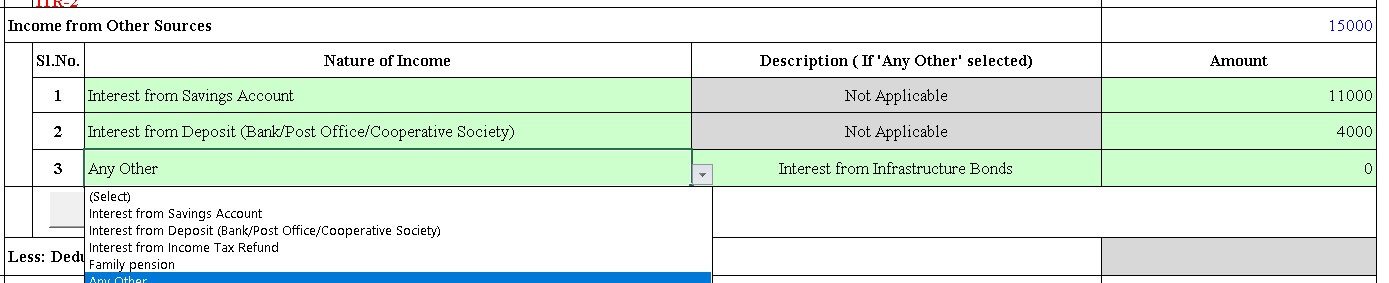

As discussed in our article, How to Calculate Income Tax, tax on Income earned in India depends on type of Income for example: Income from Salary or Pension, Income from House Property etc. Income Interest from Saving Bank Account comes under the category of Income from Other Sources as shown in picture below from ITR2 and ITR1. Our article Income from Other Sources discusses it in detail.

Income Tax Return Forms have the section 80TTA in Deductions under Chapter VI-A along with 80C, 80D as shown in picture below for ITR1.(It’s similar for ITR2)

You need to add interest from saving account to Income from other sources and then claim deduction under section 80TTA. If your total interest income from ALL your saving bank accounts

- is less than or equal to Rs 10,000 For example if your interest from ALL saving bank accounts is Rs 8,000 you need to show 8000 in income from other sources and then show Rs 8000 for section 80TTA .

- is more than Rs 10,000 say 12,000 then add 12,000 to Income from other sources and then show Rs 12,000 in Section 80TTA. ITR should automatically give you deduction for 10000 and calculate tax on rest as shown in image below

Note: If your interest income from Saving Bank account is more than 5000 you can still use ITR1 as this is a deduction and not exemption For details on exemptions read Exempt Income and Income Tax Return

Interest on Saving Bank Account

How is the interest on Saving Bank account calculated?

The interest is calculated on the daily balance in your account. Before Apr 2010 the interest was calculated on the lowest amount in the bank account between the 10th of every month and the last business day of the month. In Apr 2010 RBI moved to calculation on daily basis

Say on 1st Aug Rs 70,000 is credited into your account. On 5th August after some withdrawals balance in your account is Rs 55000. You had Rs 70,000 for 4 days. Suppose interest is 4% per annum. So how much interest did you earn? The formula is:

Interest = Principal or amount in the account * Number of days * Daily Interest Rate

Daily Interest Rate = Interest rate per annum /365 days

At 4% Daily Interest Rate is: 4%/365 = 0.010958%

Example of calculation of interest on Saving Bank Account?

Say Sodhi had an balance of Rs 85,000 on April 1. He received a payment of Rs 300,000 on April 15 from the sale of some mutual fund units. On April 29, he made a payment of Rs 320,000. This resulted in his account balance reducing to Rs 65,000.

- For the first 14 days of April, interest to be paid would be calculated on Rs 85,000 i.e 130.41

- For the next 14 days of April, interest to be paid would be calculated on Rs 385,000 i.e 590.68

- For the balance 2 days, interest to be paid would be calculated on Rs 65,000. i.e 14.25

- Total interest earned is 735.34 Rs

Our article Saving Bank Account:Do you know how interest is calculated and more explains it in detail.

When is the interest credited to the account?

Though interest rate calculations are done on daily basis it is credited to the account only at the end of each quarter or the half year. At present, each bank follows its own schedule including monthly, quarterly and and half yearly for paying interest rates on savings accounts. For example HDFC banks credits interest on 31st Oct and 31st Mar, State Bank of India on 30 June and 31 Dec.

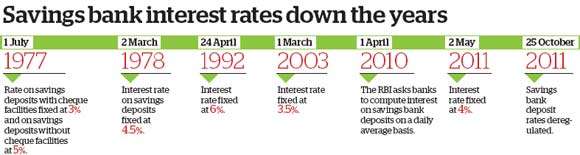

How interest rate on Saving Bank account have changed over the years?

Interest rate on Saving bank account has been around 4% but was about 6% in 1992. From 2003 to Jul 2011 Interest rate was constant at 3.5 %. Every bank had to offer the same interest rate to all it customers. It was regulated by Reserve Bank of India till Oct 2011

Deregulation: On 25th Oct 2011 Reserve Bank of India(RBI) deregulated the saving bank interest rates. The banks will have to offer uniform interest rate on deposits in saving account up to Rs 1 lakh. For savings deposits above this amount, the banks will be free to offer differential interest rate. In 2011 RBI set the minimum interest rate as 4% for upto 1 lakh amount in Saving Bank.

Interest Rate on Saving Bank Account over the years

Why do different Banks offer different interest rates?

Reserve Bank of India deregulated interest rates on savings accounts in India in October 2011 and banks are now free to decide the same within certain conditions imposed by RBI. From Best Interest Rates on Saving Account Maximum Rate of Interest on Saving Accounts for balance up to 1 lakh is given in table below :

| Name of the Bank / Institution | Interest Rate |

| Yes Bank | 6.00% |

| 5.50% | |

| IndusInd Bank | 5.50% |

| The Ratnakar Bank | 5.50% |

| Other banks | 4% |

Interest on Saving Bank Account and Income Tax

Is Interest in Saving bank account taxable?

Interest earned on Saving Account is considered as Income from other Sources. This needs to be declared in your income tax returns. No TDS is deducted from the interest on Saving Bank Account. Before 1st Apr 2012 it was taxed based on your income slabs.

From FY 2012-13 under the new section 80 TTA of the Income-tax Act, a deduction up to an extent of Rs 10,00 in interest from all the bank accounts is allowed to an individual or Hindu undivided family, Interest over Rs 10,000 will be taxed at the marginal tax rate of an individual. This is applicable from the assessment year 2013-14(Financial Year 2012-13) and subsequent assessment years. Note: This deduction is just for interest on Saving Bank account and not on Fixed Deposit or RD.

Is TDS deducted on the interest on Saving Bank account?

No TDS is not deducted on interest on Saving Bank account, irrespective of the amount of interest earned. As TDS is not deducted, interest from Saving Bank account does not show up in Form 26AS.

What is Section 80TTA of Income Tax Act?

The Finance Bill or Budget 2012 inserted a new section 80TTA in the Income Tax Act of 1961 which provides

- Deduction up to Rs. 10,000 to an Individual / HUF from Gross Total Income towards Interest on saving bank Account (not being time deposits)

- This deduction is not provided to saving account of a firm, an association of persons or a body of individuals,

- Saving bank account should be maintained with a bank or society or post office.

- The deduction allowed is interest received or Rs. 10,000 whichever is lower.

- If interest earned is more than 10,000 then balance amount will be taxable as before i.e considered as Income from Sources and taxed as per your slab rate.

- The deduction is in addition to deduction of Rs. 1 Lakh of section 80C of the Income Tax Act-1961.

- Please note that Interest from Saving Bank Account is not exemption but a deduction. Our article Exempt Income and Income Tax Return explains exempt Income in detail.

- The interest earned on savings account is exempted from TDS under Section 194 A of Income Tax Act i.e No TDS is deducted on interest from saving account.

- The section is applicable from April 01, 2012 and will apply from AY 2013-14 and onwards.

For example , If the interest on saving bank account received is Rs. 12,500, then effectively only Rs. 2,500 will be taxable.

The deduction available under Section 80TTA makes the scheme of non-filing of returns by salaried taxpayers in case of salary income plus savings bank interest up to Rs 5 lakh more friendly.

Is the deduction per saving bank account or all saving bank accounts together?

The deduction towards interest on all saving accounts taken together cannot exceed Rs. 10,000. This deduction is available on interest income from all savings bank accounts that a taxpayer might have in banks, cooperative societies or post offices.You cannot have multiple deductions for multiple savings bank accounts

Example : If you get Rs. 21,250 from three saving accounts, you will be entitled for Rs. 10,000 only as deduction under section 80TTA & the balance amount of Rs. 11,250 will be taxable as earlier.

How much money should be in the account(s) at what interest to earn 10,000 interest income?

To earn an interest income of Rs 10,000, one needs to have

- Rs 1.6666 lakh at 6% (.06 * 166660)

- Rs 1.42 lakh at 7%

- Rs 2.5 lakh at 4%

YouTube Video on Interest on Saving Bank Account, Tax, 80TTA and ITR

The 5 min video explains

- How is the interest calculated on saving bank account?

- How is interest on Saving Bank account taxed?

- What is section 80TTA? What is the 10,000 limit deduction? Is it for one account or multiple accounts?

Self Assessment Tax

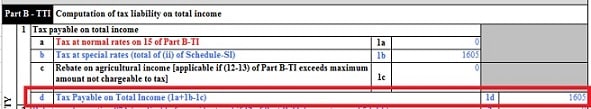

If your saving Bank interest is more than 10,000 then for balance amount you might have to pay Income Tax as per your Income Slab. You would know this in Tax Payable in the ITR. Image shows Tax Payable for ITR2. Note: Many times it may get cancelled due to loss due to House property or Capital Gain.

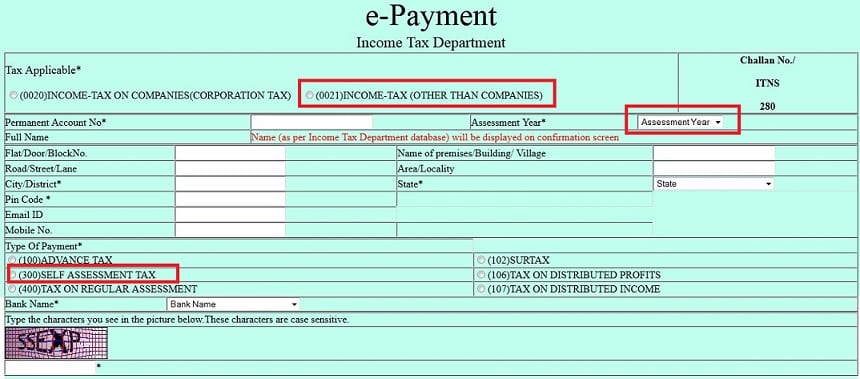

When one needs to pay tax , Advance Tax, Self Assessment or Regular Assessment tax,Tax Payment Challan, ITNS 280 Challan is used to pay Income Tax due, if any.

Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

- It can be paid by going to designated branch and paying through cheque or cash, called as Offline or physical payment. Our article Paying Income Tax offline : Challan 280 explains it in detail.

- It can also be paid through online if you have net-banking. Our article Paying Income Tax : Challan 280 explains it in detail.

- Select Challan No./ITNS 280(Payment of Income Tax & Corporation Tax)

- Select Tax Applicable as (0021 – Income Tax – Other than Companies)

- Select Assessment Year . Please be very careful in selecting Assessment Year. For filing ITR before 31 Jul 2016 for income earned between Apr 2015 to 31 Mar 2016 FY is 2015-16 and AY is 2016-17

- Then select type of payment as (300) Self Assessment Tax, and fill rest details. (You don’ t have to fill Name. It will be filled based on PAN and address entered.

Thanks to our reader Vaibhav for asking about how to show in Income Tax Return. And Vicky for correcting that it is deduction and not an exemption.

Related articles :

- Saving Bank Account:Do you know how interest is calculated and more

- Best Interest Rates on Saving Account

- Income from Other Sources

Don’t forget to take advantage of section 80TTA and save tax on interest income upto 10,000. Is interest on your saving bank account is more than 10,000? How much do you keep in your saving bank account?

I have transferred 20 lakhs to my wife’s savings account. My wife is a home maker and she does not work (does not have any income). From that amount, I have invested 10 lakhs in FD and retained the remaining 10lakhs in her savings account.

10lakhs in savings account has accrued 40000rs as interest.

10lakhs in FD has accrued 60000rs as interest.

I will be considering the interest accrued for FD in my taxable amount while filing returns (clubbing of income).

Should I consider the interest accrued for savings account also in my taxable account?

Yes, as it’s your income

I am doing trading business . I have also saving a/c or current account.

both are account come in balance sheet or not ?

last 10 yr saving account came into balance sheet but this yr auditing my accounts. Now CA sir tell me that this is the wrong possess , SB A/C not come in balance sheet.

which is actual treatment of saving account . Please reply as soon as possible …..

Me and my wife both are working .we have a joint saving A/c in which saving bank interest for 2018-19 is 22000. Can both of us take interest equally in our ITR and take 80TTA deduction 10000 each? Please guide!

No, you cannot.

Only the first holder can claim the deduction of interest up to 10,000 Rs.

Rest 10,000 is taxable for the first holder.

Second holder is not liable for either interest or deduction.

Thank you so much for this article on how to post entries in ITR 2 for income from SB interest and claim deduction under 80TTA. I was desperately looking for this. Thanks once again 🙂

Dev

Thanks a lot, Devkant for taking the time to write encouraging words.

Please spread the word.

If there is some topic which you are looking for do let us know.

Was looking for details on where to add bank interest in ITR-1. Once again, your article was a big help.

Hi,

I have received a notice U/S 143(1) for Rs.780. This was because of the interest generated on savings account which was not mentioned in Form 16. Now I don’t have any other saving account so this was the total interest and this will be non taxable.

Now when I go to the IT website to submit a response for this and when I choose “Disagree to Addition”, I get a new row with some columns to fill and a reason to choose for disagreement. I am totally confused on how to fill this.

Can you please help me out on this?

Article is incomplete. A major questions which has been asked by many people in the comments has not been answered:

Under Income Details: (B3). Income from Other sources (Ensure to fill Sch TDS2) – I have entered Saving Bank Account Interest which is more than Rs 10,000 from 4 saving accounts and the same amount is mentioned as a deduction in (C17). 80TTA.

What do I need to fill in Tax Details section Sch TDS2 if TDS has not been deducted by banks.Why does income from other sources state ” Ensure to fill SCHTDS2″ if it is not compulsory?

I tried to submit the form without filling SCH TDS2 since no TDS has been deducted.However,a pop up from the e filing website says its compulsory to fill sch tds 2.

Can you explain the steps

-Which ITR did you file?

-Where did you enter the Income from Other sources

-How are you claiming 80TTA?

Can you send the excel/image to bemoneyaware@gmail.com

I am filing return through ITR1:

Under Income Details: (B3). Income from Other sources (Ensure to fill Sch TDS2) – I have entered Saving Bank Account Interest which is more than Rs 10,000 from 4 saving accounts and the same amount is mentioned as a deduction in (C17). 80TTA.

What do I need to fill in Tax Details section Sch TDS2 if TDS has not been deducted by banks.Why does income from other sources state ” Ensure to fill SCHTDS2″ if it is not compulsory?

I tried to submit the form without filling SCH TDS2 since no TDS has been deducted.However,a pop up from the e filing website says its compulsory to fill sch tds 2.Kindly guide me what to do?

That’s my doubt as well. Did you find a way to do it?

Hi

Thanks for such a useful information. I have one query. Today when i was submitting my ITR i got an info for tax payment under section 234 B, and C. for amount like 2000, 3000 respect.(approx). I thought i need not to pay any advance tax as i am salaried employee and my employer has paid full TDS so i submitted my ITR making them zero. So zero tax payable and submmitted. But later i realized i need to look at this, then i landed on your informatory page. I have not shown till now any of my interest from saving bank/salary account in recent years. I had some interest in saving bank/salary account. So can u please suggest me what to do..? Should i calculate or see the interest recived in every year and re-submit my all ITRs for the computed Tax or just the recent one is sufficient enough. One more thing if i had submitted all my bank information then why it does not show interest amount as my salary while submitting ITR.

First, for the ITRs that are done don’t do anything. It would be like opening Pandora box.

You would have to pay advance tax if total tax due from you is more than 10,000 Rs in year.

if you don’t pay that you would have to pay penalty under section 234B/C.

Is your interest from all your Saving Bank Accounts(salary or non-salary more than 10,000 rs).

Interest earned on Saving Account is considered as Income from other Sources. This needs to be declared in your income tax returns.

No TDS is deducted from the interest on Saving Bank Account.

From FY 2012-13 under the new section 80 TTA of the Income-tax Act, deduction up to an extent of Rs 10,00 in interest from all the bank accounts is allowed to an individual or Hindu undivided family,

Interest over Rs 10,000 will be taxed at marginal tax rate of an individual

No TDS is not deducted on interest on Saving Bank account, irrespective of the amount of interest earned. As TDS is not deducted, interest from Saving Bank account does not show up in Form 26AS.

what is auto sweep?

Auto Sweep is a facility which interlinks saving bank account with a Fixed Deposit account. In Auto Sweep account, the amount in the bank above a limit is automatically transferred to Fixed deposits and earns a higher rate of interest. If the balance of saving account becomes low and there is a need then Fixed Deposit will be broken and the amount will be moved back to Saving Account. Auto Sweep account provides the combined benefits of a Savings Bank account and Fixed Deposits.

Our article What is Auto Sweep Bank Account? discusses it in detail.

When I look at my bank statement of savings account, it has a column named date, and a column named “value date”, apart from other columns. Here is the query: Against a 6-monthly interest entry in my bank statement, I see the “date” is mentioned as 1-Apr-2016, and “value date” is mentioned as 31-Mar-2016. So, in which financial year’s income should I consider that interest, FY 2015-2016, or FY 2016-2017?

Another bank in which I have another savings account pays interest on 30 or 31 December & 30 June. So, the interest earned on 30th June 2015 is for the period from 30 Dec 2014 to 29 June 2015. Should whole of this interest earned on 30th June 2015 be considered as income of FY 2015-2016, or, does it have to be somehow broken into two parts (income of FY 14-15, and income of FY 15-16)?

I’m not really getting the same results as you are.

Dear Sir,

I’m sending money from Saudi Arabia and deposited to my father saving account (there is Not NRI Account) in State Bank of India. So please tell me shall I pay income tax or not if yes then what is the minimum amts required in the Account. Please give me answer in detail.

Thanks.

Yes you can deposit money into your father’s saving bank account which does not have NRI status(i.e not an NRO/NRE account).

As you giving it to your father there is no income tax liability.

Are you giving this money for gift or your father has to return it?

As per FEMA rules, There is no restriction on NRIs sending money to India. NRIs can send money to relatives or friends without any FEMA related restrictions. Assuming of course that the transfers are done in a legal manner of legally obtained money

.Under the Income Tax Act, 1961. NRIs can gift money to their relatives and this money is exempt from tax regardless of the gift value. However, if money is gifted to a non-relative, then the tax exemption is only up to Rupees 50,000 per financial year

Dear Sir,

I’m sending money from Saudi Arabia in my Saving Account in State Bank of India also (this is not NRI Account). Please tell me shall I pay income tax also or not if yes then what is the minimum amounts required in the Account. The tax will be deducted from interest money we have got it or deduct from our total Amount? and minimum how much money I can keep in my saving Account without any tax. Please Answer in detail.

Thanks & Regards

Hi

I m working in a software company and my package per annum is above 2.5lakhs, i have my salary account and i only use that salary account for just my needs. i have submitted my tax returns through my company.but i have one more savings account and i have 10lakhs in that account which was given my grandmother as a gift to me and she was died last year. i am getting interest of 30k per year for that account. will IT consider my salary account as my tax returns or will they consider all my savings accounts?

Dear Sir,

My Income is 240000.I have Bank Account in State Bank Of India. I have 3 Lakh 70000 thousand of saving in my account that saving is from last three years. I have also a Joint Account in other bank With my Wife that is housewife. in that account I am the Second Account Holder. In that Account 40000 thousand Rupees.Can I have to pay Income Tax or Not.

Please give me answer of this question.

Thanking You.

Dear Sir,

I’m sending money from Saudi Arabia and deposited to my wife saving account (No NRI Account) in one of private bank in India. So please tell my Shall I pay income tax or not if yes then what is the minimum amts required in account.

Hi,

I am having a query regarding TDS on saving bank account’s interest.

What if i have deposited 10 lakh in my saving bank account and i will get around 40000 inr as an interest on it for a year. Will bank deduct TDS on it automatically ?

I have got some rumors that from this financial year, banks will deduct TDS on saving account’s interest.

Is that true ?

Please tell if you have any updated info on this topic.

Your question is not clear about the type of deposit.

If its Fixed Deposit then, yes TDS will be deducted at 10%, i.e. Rs.4000 out of Rs.40,000. Again you have to pay more Tax based on your Tax bracket.

If you just keep Rs.10,00,000 in your Savings Account then you get 4% interest which comes around Rs.40,000 (which you mentioned). Bank won’t deduct any TDS on Savings Account. But you have to show Rs.40,000 in Income from Other Sources and you will get deduction of Rs.10,000 under 80TTA. You have to pay Tax for the remaining Rs.30,000 as per your Tax bracket. If your annual income is below Rs.2,50,000 (including interest that you earned from Savings Account) then no need to pay any Tax.

However, you might be questioned for the Source of income by IT Dept. for such big amount.

Hi,

If i am getting some money credited to my savings account and i have no income at all , do i have to pay any tax on it?

Lets take a rendom figure 5 lac

i got notice from income tax on 2-sept-2016 for not showing/less showing interest on saving account for FY 10-11. I checked ITR for FY 10-11. interest is not shown. so now how much penalty i will have to pay ? i am confused about penalty since notice is for FY 10-11 . ( 6 years back )

Whether the interest earned on tax saver FD to be included every year in the Income of that year? if interest not be include in income can be all year interest add on maturity year income.

Yes Interest earned on Tax Saver is to be included in income preferably for that year.

If TDS is deducted for the year it is best to claim it in the same year.

Else you can claim interest at maturity

Very Nice Article.Kindly guide what will be last date of depositiing advance tax on interest, so earned on more than Rs.10000/- on savings accounts.Is it before 31st March of any finacial year but usually banks provide interest on savings balance on last date ie. 31stMarch only and then calculating total interests & depositing on last date of any financial year is an herculean task being so much rush in Bank’s branches ot bank’s website getting usually choked due to overloading. Pls guide.

If you estimate that you will owe more than Rs.10,000 on March 31 in taxes (after deducting TDS) then you should pay advance tax. Our article Advance Tax:Details-What, How, Why discusses it in detail.

Advance tax dates and tax payable

From FY 2016-17 For both individual and corporate taxpayers

Due Date Advance Tax Payable

On or before 15th June 15% of advance tax

On or before 15th September 45% of advance tax

On or before 15th December 75% of advance tax

On or before 15th March 100% of advance tax

Very informative.

For savings deposit interest, is it the period or the date interest is credited to be considered. I have received interests of Rs. 5425 on May 4, 2015 for the period 1-11-2014 to 30-4-2015; Rs. 745 on Nov 4, 2015 for period 1-5-2015 to 31-10-2015; and Rs. 6504 on Apr 1, 2016 for period 1-11-2015 to 31-3-2-16.

Will the interest received for 2015-16 be Rs 5425 + 745 = 6170; or

745 + 6504 = 7249; or 5425/6 + 745 + 6504 = 8153.17?

Banks should actually give the interest per financial year. else it becomes difficult for person.

Saving bank interest is calculated on the daily balance in your account.

No tax is paid on Interest upto 10,000 . So if your interest is less than 10,000 it is OK. Else it becomes slighlty tricky.

Thank you.

Whether the interest earned on tax saver FD to be included every year in the Income of that year? Since the interest is reinvested is it exempted like NSC interest and the whole interest earned on maturity will be added to income. Pl. clarify

Jagatheesan

Interest earned on FDs even if tax saver is taxable.

Dear Sir,

Please inform if interests earned in salary accounts also taxable just like savings bank account.

Salary account is a saving bank account with privilege of having 0 balance.

So yes interest earned on Salary account is taxable.

Thanks

I have missed claiming medical bills of 15000/- with the employer. Now how should I claim that amount while filing IT return?

1. I have an auto sweep SBI account, I have got interest of 1,300 in my main saving account whereas I have got an interest of rs 1,00,000 from my auto sweep deposit account. Is deduction under section 80TTA 1,300 or 10,000

2. I have got statement interest accrued and interest paid for this year. Now as per the accrual accounting, I need to pay tax on both interest accrued and interest paid. My question is “Do I have to subtract the interest accrued in previous year, because I have already paid tax on the accrued interest of last year”

So Tax to be paid on which of the two –

a. Interest paid (Current Year ) + Interest Accrued (Current Year)

or

b. Interest paid (Current Year ) + Interest Accrued (Current Year) – Interest accrued (Previous Year)

it should be: Interest paid (Current Year ) + Interest Accrued (Current Year) only

But what about the interest accrued last year. I paid tax for it last year, it might be paid this year. Why to give tax twice ??

Lets get the facts:

-You should pay interest for this year only, whether accrued or paid.

-You need to pay tax on it only once.

Now Interest accrued this year is shown how: is it interest accrued over last year + this year or only this year?

If you could get answers to these questions or send us an email with details we can look into it.

Let me give you the facts :

My interest for FY 15 was – Interest paid during fy 15 – 52000 & interest accrued during fy 15 – 40000.

In FY 15 I paid tax on 920000 (52000 + 40000)

Whereas for FY 16: Interest Paid during FY 16 – 60,000 & Interest accrued during FY 16 – 34000

Now how much to pay tax on FY 16…

I am filling return ITR1:

1. Under Income Details: (B3). Income from Other sources (Ensure to fill Sch TDS2) – I have entered Saving Bank Account Interest which is more than Rs 10,000 from 3 saving accounts and the same amount is mentioned as a deduction in (C17). 80TTA.

What do I need to fill in Tax Details section Sch TDS2 if TDS has not been deducted by banks.

2. Under Taxes Paid and Verification Page: D20. Exempt income only for reporting purpose – Do I need to show interest I’m getting on PPF, EPF account and Dividends received from Shareholding.

Thanks

If someone could please answer my questions –

I am filling return ITR1 through Quick File menu:

1. Under Income Details: (B3). Income from Other sources (Ensure to fill Sch TDS2) – I have entered Saving Bank Account Interest which is more than Rs 10,000 from 3 saving accounts and the same amount is mentioned as a deduction in (C17). 80TTA.

Do I need to fill anything in Tax Details section Sch TDS2 if TDS has not been deducted by banks.

2. Under Taxes Paid and Verification Page: D20. Exempt income only for reporting purpose – Do I need to show interest I’m getting on PPF, EPF account and Dividends received from Shareholding.

Thanks

you have mentioned that TDS will not be deducted from bank side ,but in my form 26S my bank has shown the TDS under section 194A(is it not the TDS deducted on saving bank account interest).

and do bank deduct TDS only on the amount above 10000 of interest

This is the best site for guys like me who are not from accounting background. Kudos to you for such a wonderfully compiled information on single page. All my queries got resolved in this.

Thank you once again.

Few questions :

1. I have an auto sweep SBI account, I have got interest of 1,300 in my main saving account whereas I have got an interest of rs 1,00,000 from my auto sweep deposit account.

2. I have got statement interest accrued and interest paid for this year. Now as per the accrual accounting, I need to pay tax on both interest accrued and interest paid. My question is “Do I have to subtract the interest accrued in previous year, because I have already paid tax on the accrued interest of last year”

So Tax to be paid on which of the two –

a. Interest paid (Current Year ) + Interest Accrued (Current Year)

or

b. Interest paid (Current Year ) + Interest Accrued (Current Year) – Interest accrued (Previous Year)

1. I have an auto sweep SBI account, I have got interest of 1,300 in my main saving account whereas I have got an interest of rs 1,00,000 from my auto sweep deposit account. Is deduction under section 80TTA 1,300 or 10,000

2. I have got statement interest accrued and interest paid for this year. Now as per the accrual accounting, I need to pay tax on both interest accrued and interest paid. My question is “Do I have to subtract the interest accrued in previous year, because I have already paid tax on the accrued interest of last year”

So Tax to be paid on which of the two –

a. Interest paid (Current Year ) + Interest Accrued (Current Year)

or

b. Interest paid (Current Year ) + Interest Accrued (Current Year) – Interest accrued (Previous Year)

Sir i have amount of about 3.5 lac in saving account

So the intrest earn on it is taxable or not???

Yes Sir amount in Saving bank account earns interest at the rate of 4%(most banks) Some banks like Kotak,Yes Bank give 6%.

This interest comes under Income from Other sources.

Deduction of Rs 10,000 is available on interest of Saving Bank account.

Hi,

I have a savings bank account & have got aroung 10500 as interest. So can i get an incometax exempt via 80TTA

I have earned 11000 as savings account interest in last financial year. Before filing return , can I deposit the tax online? Is it through challan no 282? What should be type of payment?is it 300 Self assessment tax?

When one needs to pay tax , Advance Tax, Self Assessment or Regular Assessment tax,Tax Payment Challan, ITNS 280 Challan is used to pay Income Tax due. For income earned between 1 Apr 2015 to 31 Mar 2016 Please select Assessment Year as 2016-17.

Thanks for question. We have also updated the article.

Thanks for quick response.

Sir, should i have to pay tax for the interest accrued also or only for the interest received?

Hi,

I have a savings bank account & have got aroung 10500 as interest. So can i get an incometax exempt via 80TTA??

but i have received about 9500 of it from FD

Can i get an exempt via section 80TTA??

No. Deduction of Rs 10,000 is available ONLY on interest of Saving Bank account. Not on FD or RD interest

my wife has left job in year jan 2015. and started beauty parlour shop in june 2016. For last AY 15-16 we filed income tax has per her form 16 from the company.

income from her parlour is less than 1.5 lakhs upto march 16. can we file return ourself or need the accounts to be audited by CA?

A very interesting question and lot depends on the interpretation of law.

When you have income from Business or Profession you can either file ITR4S or ITR4.

Sec. 2(13) Business means and includes any trade, commerce or manufacture or any adventure or concern in the nature of trade, commerce or manufacture

Term profession is not clear for things like beauty parlour. It means having some degree of learning. There are some professions for which you are required to maintain books and get audited.

If you see the discussion at CaclubIndia it says beauty parlour should be a business

But if you see Query related 44ad it says beauty parlour is a profession.

Do let us know what you decided?

Information for maintaining accounting records

The following professions should maintain accounting records if their gross receipts are more than Rs. 1,50,000 in 3 preceding years for an existing profession. This also applies to a newly set up profession whose gross receipts are expected to be more than Rs. 1,50,000. The accounting records to be kept have been prescribed in Rule 6F:

Legal

Medical

Engineering

Architectural

Accountancy

Technical consultancy

Interior decoration

Authorized representative — A person who represents someone for a fee before a tribunal or any authority constituted under law. It does not include an employee of the person so represented or someone who is carrying on the profession of accountancy.

Film artist — This includes a producer, editor, actor, director, music director, art director, dance director, cameraman, singer, lyricist, story writer, screen play or dialogue writer and costume designers.

Company secretary

Audit of accounts is compulsory by a Chartered Accountant for the following persons

Tax Payer Compulsory Audit required when

A person carrying on Business If total sales, turnover or gross receipts are more than Rs. 1 crore

A person carrying on Profession If gross receipts are more than Rs. 25 lakhs

A person covered under presumptive income scheme section 44AD If income of the business is lower than the presumptive income calculated as per Section 44AD and the person’s total income is more than the minimum income which is exempt from tax.

A person covered under presumptive income scheme section 44AE If income of the business is lower than the presumptive income calculated as per Section 44AE.

I have some FDs in SBI & two saving accounts in SBI and UBI banks. As per Form 26AS My TDS has been deducted from SBI bank for my FDs even i have not fall in TAX slab. Accordingly i submit ITR-1 in online mode & added savings interest (Rs. 6730/-) in other income(total Rs. 69k) but forget to deduct it under 80TTA . Will it create any problem ?

Sir, I had earned total interest of 10,623 from Bank FD in FY 2015-16. I submitted form 15G so no TDS is deducted from Bank. This interest earned is reflected in 26AS. Now, I fall under 20% tax slab. While filling ITR1 for FY15-16 AY16-17, what should I fill in the field ” Income from other sources. 10,623 or 623 only … as 10,000 is exempted and tax free. Please clarify this.

Also, Can I claim 10,000/- under 80TTA here

10,000 exempted is only for interest on saving bank account NOT FD interest.

You need to show interest earned on FD which is 10,623.

Please go through our article Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund for more details.

Hello sir,

I have a joint bank account with my wife. Our bank interest for the year from that account is 12000rs. Is it possible to show the whole interest amount in my wife’s ITR as she is a housewife so there is no income in her return, to decrease my total taxable income.

And if not, then in what proportion the interest amt will appear in our Tax returns.

Interest on saving bank account upto 10,000 Rs is tax free.

You owe tax on only 2000 Rs.

As your wife is not working, her amount you transfer to her would still be clubbed with yours.

Will you file ITR for your wife for just 2000 Rs?

We would recommend you to show 12,000 under 80TTA, claim Rs 10,000 deduction and pay tax on Rs 2000.

Ok sir thanks,

but what if the intt. Amt is 30,000. Then may i show the balance amount(20,000) in her nil return by showing tution fee as her only income ( as i’ll show her total income <2,50,000)

I mean is there any particular rule regarding joint bank account intt?

Joint bank interest is to credited to the first account holder.

Ok…tnku so much sir… i was in this confusion for a long time… now get an excellent answer with explanation..

Thank you ..mangne se bhagwan mil jaata phir question kya cheez hai bhaiya!

Sir, I have abt 18 lakhs in my hdfc savings account, I’m working on ship and completing 183 days for nri requirement, understand the interest I earn is considered as income from other sources, how much tax do I need to pay ?

There was a change of rule of calculation Indian seafarers, sea period spent by a ship in Indian coastal waters is also taken into account for computing the non-resident status and the resultant tax concessions. Livemint article So please check if it affects your NRI status.

If your status is ‘resident’, your global income is taxable in India.

If your status is ‘NRI’, your income which is earned or accrued in India is taxable in India.

Interest income from fixed deposits and savings accounts held in Indian bank accounts is taxable in India. Interest on NRE and FCNR account is tax free. Interest on NRO account is fully taxable.

What kind of account do you have in HDFC- A simple saving bank account?

Interest on ordinary saving bank account is tax exempt upto 10,000 and remaining is taxed as per your income slab,its considered Income from other sources.

Please check your HDFC account to see the interest deposited. It would be deposited on 30 Sep/1 Oct and 31 Mar,

You get 4% interest on HDFC Saving Bank account. Our article Saving Bank Account:Do you know how interest is calculated and more explains it in detail.

If a person is a Non-Resident Indian (NRI), he can open two kinds of account in India –

a non-resident rupee accounts (NRE), and

non-resident ordinary rupee accounts (NRO).

An NRI can have Non Resident External (NRE) accounts, Foreign Currency Non Resident (FCNR) or Non-Resident Ordinary Rupee Account (NRO Account). Our article, Bank Accounts for NRI:NRO,NRE,FCNR, Their comparison, talks about it in detail.

Interest earned on Non Resident External (NRE) accounts and Foreign Currency Non Resident (FCNR) accounts are tax free in India. Hence, there would be no TDS.

NRO accounts may be opened in the form of current, savings, recurring or fixed deposit accounts. Interest earned on the Non Resident Ordinary Account (NRO) is taxable and will be subject to a TDS of 30%. This holds true for Post office also. There is no basic exemption limit. For example, interest earned by resident Indians from bank deposits is subject to TDS only over and above a limit of Rs 10,000. No such limit applies for NRIs.

Thank you very much for reply. I’m working on foreign flag ships not sailing in Indian coastal waters so I will continue to meet nri requirements as before.

I have consulted the bank and they said I have ordinary savings resident account .

On the other hand , I also asked Citibank ( wife’s account ) and they mentioned no tax applicable for interest earned on savings account, 4% quarterly payments , but she is not salaried. is that correct ? ( suppose if I transfer funds to her account )

If I change my account now to NRE or NRO I can avail tax benefit, however the moment I stop sailing and retire, what will happen to the fund in this account ?

Thank you again for ur time

Saving interest upto 10,000 Rs is tax free. As she is not working, her income will be clubbed with yours.

Unless she invests in PPF or tax free bonds.You can read our article clubbing of Income for more details.

If you change your account to NRE and NRO then from the date of change you can avail tax benefit.

You can change the status when you come back. You can read Business standard article for more detail.

During the period that an individual is a NRI, they may hold assets, investments, and bank accounts in India. Special accounts exist for NRIs who hold investments in India. Generally an Indian bank account held by an NRI would be either a Foreign Currency Non-Resident (FCNR) account or a Non Resident External Rupee (NRE) account.

These accounts are opened for the purpose of depositing income earned overseas. The funds held in these accounts can be remitted back overseas freely, subject to terms and conditions of the resident country. Upon re-establishment of residency, an NRI must re-designate Indian banking accounts from FCNR/NRE to the RFC accounts mentioned below.

Similarly, returning NRIs must inform companies in which they have shares of their change in residency status, as well as firms in which they may own partnership interests.

Resident Foreign Currency (RFC) Accounts

Indian residents may maintain an Resident Foreign Currency (RFC) account for foreign currency assets which were held outside India at the time of their return. Foreign exchange amounts received as pension or benefits from employers outside India, gifts, or proceeds of life insurance policies in foreign currency may also be credited to this account.

RFC accounts can be maintained in the form of current or savings or term deposit accounts. The funds in RFC accounts are free from all restrictions regarding utilization of foreign currency balances, including any restriction on investment outside India. Residents can use their RFC accounts to reinvest sale proceeds of overseas assets abroad.

my income is 4 laks per year how much tax i have to pay

Hi, For year 2013-14 I was working in UK. Because of Dual Taxation benefits where a person is required to pay tax in only one country at a time. my company needs refund from Indian Tax authority. They applied for Refund but, now Tax authorities are scrutinizing my case and called me to come in person to meet them and produce lots of documents- complete year bank savings account statements, Shares and Mutual fund statements, Salary Slips, Asset details, Foreign bank statements. Since all this are old for 2013-14, I am unable to collect some of the documents. Why are tax authorities Scrutinizing now after 3 years and requesting so many documents ? Also at that time I forgot to mention my savings bank account interest components. Will there be any fine and penalty for this case? What will they do after collecting all this information? how many such scrutinizing cases are coming per year? Can you please let me know more details.

Awaiting your response.

Sir that’s typical scrutiny process. I have personally gone through that.

You are supposed to keep your documents for 6 years.

Interest on Saving Bank account till 10,000 is tax free under section 80TTA . It depends on the Assessing officer and how serious he thinks it is, whether that was intentional or accidental.

Best of luck.

was bank sb interest taxed from 80TTA was introduced. If yes what was the limitation or slab for the years prior to the introduction of 80TTA

80TTA was introduced in Budget 2012 and was applicable from 1 Apr 2013 i.e for FY 2013-14.

Before than entire interest earned on SB account was taxable as per your income tax slab

Hi, I just want to know if I sell a land of Rs.95,00,000 and pay the tax to govt. and then keep Rs.70,00,000 to my only one savings account then what I should do next and what are the ways of saving any extra tax on interest from that money. Also I need to know what amount I get as interest after tax deduction. Please answer me as soon as possible.

if u sell ur propery income is calculated by Income for capital gain head (see calculation in Google-capital gain) after calculation u will get some amount as income that is added to your total yearly income and you need to pay tax on total income(which comprises of salary, capital gain, income from profession and etc.) – this for year of sale

2) 70 lakhs in savings ACC after one year u will get interest of 2,80,000 from Bank so from this 10000 is exempt form tax then remaining 270000 will be added to ur total income and u need to pay tax on total income.

Total income = salary any + professional income + capital gain + income from other sources.

Sales of property – capital gain

Interest – other sources.

Hope clear.

Hi, I just want to know if I sell a land of Rs.95,00,000 and pay the tax to govt. and then keep Rs.70,00,000 to my only one savings account then what I should do next and what are the ways of saving any extra tax on interest from that money. Also I need to know what amount I get as interest after tax deduction.

Hey, I don’t know if you will see this but I really hope that you do. I can really use ur expert advice. Please help me out with ur advice since this is my 1st time dealing with a bank–>

I have graduated this year & want to devote the next 1.5 yrs in preparing for IAS. So won’t join a job. Now my father has asked me to open a Savings Bank Account where he will be sending me 3.9 lakhs to sustain myself during that time (accommodation + food + grocery + electricity + maid + tuition + books, in short, for everything). So I have 3 short questions –>

1) Do I have pay income tax on the interest (considering that I am jobless)?

2) Will my father have to pay interest for the money he will be sending me from his account?

3) I don’t think that I will need the whole amount. So where can I invest (say 1 lakhs) to get maximum return after 2 years?

Please reply & clear my doubts…

Sorry. I seem to have made a silly mistake in my post.

* I meant “Will my father have to pay TAX on the money transferred from his account to mine”. (Not interest).

U don’t have to pay any tax because u r jobless that means u don’t have income. Income tax is paid only when income is above 250000, Interest u get on 3.9 lakhs will less than 250000 so no tax.

Dear Sir, I want to remind you if interest rate getting more than ₹10,000.00 . That will be Taxable. So please let me clear again.

Thanks with regards.

Best of luck for your IAS preparation.

As you are adult your father can gift any amount to you. There will be No tax issue.

1. No as it is not income you don’t have to pay any tax on it it.

2. As your father is sending from taxable income, it would be accounted in his Income. No specific tax for sending money to you

3. Maximum return is possible only in equity or stock market but it comes with greatest risk. You have to decide when you will require the money, at specific intervals or lump sump. You can invest in Fixed Deposit or Debt Mutual Funds or divide money between equity and debt, based on your risk profile.

Is the money in saving bank account only . Then it will earn 4% interest.

1. Total interest would be less than 2.5 lakh so you won’t have to pay any income tax.

2. No. You are an adult and your father is paying from his taxable income. So he gifts the money to you and then its your money.

3. As you don’t need the whole amount and you have 2 years either FD will be ok or debt mutual fund. FD interest will be taxable so you would have to fill Form 15G so that bank does not deduct TDS if interest is more than 10,000 Rs in a year

If I got 55,000 interest on saving, its clear to show it under ‘Income from other sources’ and claim under sec 80TTA while filing ITR1. But its mention under ‘Income from other sources’ to ensure to fill ‘Sch TDS2’. How to fill that? i dont have any details.

TDS2 has to be filled when TDS is deducted for ex on interest on FD if interest on FD is more than 10,000 Rs.

For Saving bank account no TDS is deducted so just fill it as shown in images in the article, as Income from other sources and claim it under section 80TTA

Is 80AAt deduction applicable on FD’s interest also

No it is only applicable on interest from Saving Bank account

Hi team,

i was overseas for 2 years and transferred my money in regular saving accounts in India in batches.In the bank they transferred the money to MOD accounts or term deposit accounts periodically on every 10th of the month. I am getting interest for this.For those two years,i did not filed my IT returns as i was not in the country.I came back last year and am filing my IT returns.I got a letter from IT department for filing IT returns for last year.Can you please tell how much is the tax we have to pay on interest earned from term deposited money in bank.Do the bank also cut some interest at source.

i have a joint account and total interest earned in saving bank category is Rs5586. and total interest urned from Fixed deposit is Rs7899. please tell me that should i add both of these and show under income from diff source column or should i only show my fixed deposit interest under this column.

and how to claim an exemption u/s 80tta and how much????

thank-you

TDS deducted by Axis bank as shown in form 26AS is 2600 (for interest of 26000)

Interest received on savings account(from same Axis bank) is 7000 as seen in axis bank account statement

in this case,should i show 33000(26000+7000) as income from other sources and show 7000 in 80TT???

or

should i show 26000 as income from other sources and show 7000 in 80TT???(assuming 26000 mentioned in form 26AS includes both FD and savings bank interest)

plz clarify

Income from Other sources : 33000(26000 + 7000)

Claim 7000 under 80TTA

Claim TDS deducted in TDS section.

The net income would become 26000 . Interest on it is taxable as per your income slab.

How to find the interest earned on saving bank account?

For example I have interest deposited to my account 6106.00 on 30/06/2014, 6175.00 on 31/12/2014 and 6682.00 on 30/06/2015. So should I consider those amounts which are deposited in between 01 Apr 2014 and 31 March 2015 or I will have to calculate it on monthly basis. My assumption on basis of above amounts is that my interest earned for Assessment year 2015-16 is 12281.00.

Please let me know is it right?

Thanks.

Process of interest calculation is as given below.

Typically banks credit interest from 1 Apr to 31 Mar in two chunks. HDFC does it on 1 OCt and 31 Mar but SBI does it in June and Dec.

So you can either use or calculate it the way given below.

I typically show the interest credited in bank .

The interest is calculated on the daily balance in your account. Lets show it by an example

Say on 1st Aug Rs 70,000 is credited into your account. On 5th August after some withdrawls balance in your account is Rs 55000. You had Rs 70,000 for 4 days at 4% per annum. So how much interest did you earn? The formulis:

Interest = Principal or amount in the account * Number of days * Daily Interest Rate

Daily Interest Rate = Interest rate per annum /365 days

At 4% Daily Interest Rate is: 4%/365 = 0.010958%

Can i declare interest on a saving account on receipt basis i.e. declare them in the financial year in which they are recieved in my account instead of calculating for every respective month, as its a tedious task.

Please tell.

Thanks!

Yes. It keeps things simple.

I am under 20% tax paying slab. I have submitted ITR 1 without declaring the interest appr:4k on SB accounts for the tax year 2014-15. Is it fine to send ITR V without amending it. Advise me if I have to use ITR 2. Anyway amount less 10000 is not* deductible, so is it fine to ITR V (based on ITR 1).

Sometimes ignorance is not bliss.

Income from Saving Bank account is considered under Income from Other sources. So you don’t have to use ITR2. ITR1 is fine.

As you said, interest upto 10,000 is tax exempted.

So it’s upto you to whether you want to revise your return.

You can add interest from Saving bank account as Income from other sources and then claim deduction under 80TTA. Net result same .

How to revise return for ITR1 when its not sent to CPC or e-verified it.

I am under 20% tax paying slab. I have submitted ITR 1 without declaring the interest appr:4k on SB accounts for the tax year 2014-15. Is it fine to send ITR V without amending it. Advise me if I have to use ITR 2. Anyway amount less 10000 is deductible, so is it fine to ITR V (based on ITR 1).

I left my job last year in june end, so i have following queries.

1. I closed my ULIP plan which was 7 years old and i received Rs.196000 on closure. Do I need to declare this amount , if yes,the under which part and will it be taxable?

2. I received my PF closure amount of Rs 67000 approx. Do I need to declare this amount , if yes,the under which part and will it be taxable?

3.I am currently not working so I invested my above received amount in the form of FDs and RDs. So my question is do i need to show the interest from these savings as Income from Other sources? However the RDs which i have opened in my ICICI bank are non taxable. Please advise

1. As you have surrendered ULIP after 5 years the surrender value received is tax free. You show it in exempt Income

2. If PF closure happened after 5 years it’s tax free. Show as exempt Income

3. Interest from FD and RD are taxable as per your income slab whether TDS is deducted or now. You have to show these as income from Other sources.

I have two accounts in SBI and HDFC banks. As per Form 26AS My TDS has been deducted from HDFC bank even i have not fall in TAX slab. But in SBI account I also get interest for which TDS was not deducted. Now if I shall file the ITR-1 for Tax refund should I show both interest (income other sources) from SBI and HDFC or I need to follow the Form 26AS which shown only HDFC interest.

Sir TDS would be deducted on Interest in FD not on saving bank account.

TDS would be deducted as Interest on FD when interest exceeds Rs 10,000.

You have to show all your bank accounts.

My TDS is already deducted BUT when i fill online return form so notice that i forget to mentioned my interest on saving account. my total interest of June and Dec month is 55000. so what is my income tax amount on saving bank interest pls help me. and i show it in e return form, should i fill form 280 and what is the procedure and after filling it how can i mentioned my interest on saving account in e-return form

My FD, RD & SB total interest for a financial year is less than 10000. How to show it in ITR-1. Please guide.

Hello, i am working in saudi arabia and per month i transferring money 60000 rupee india in my brother’s saving account.It is any intrest amount is taxable. Plz help me to know how i save tax, I am beginner for this all tax and all that.

It is mere transfer of money so no, it is not taxable

My wife (house wife) received around 16,000 as bank interest. So, TDS was deducted by bank . She has PAN, but never filed IT as she is not eligible (income less than 2 lak) . Can I file her return separately and claim the refund. Or do I need to show this amount in my returns. If so, how to show this in my ITR2 form..

Please suggest

I am a retired professor from Osmania university and I am drawing pension. I estimated interest on my savings account and interest on deposits and filled up ITR1 online. However it is NOT accepting my submission and asking details under TDS2. TAN number etc. Wile my banker did not deduct tax on Interest in my savings account, I added ESTIMATED interest for this year on my couple of TAX FREE DEPOSITS – I submitted Form 15 H for not deducting interest. But I am showing interest in my returns. How do I get details to fill in TDS2 under Para 20 and how do I fill this up. I didnt have this problem last year. Please respond

Hai

My gross income is 2 lakh 40 thousand rupees per year.

I HAVE 3 SB Accounts (2 sole accounts, 1 either or survivor with mother)

MY MOTHER IS A HOUSEWIFE.

Recently through property sharing my mother received 3 LAKHS CHEQUE.

My mother deposited in HER EITHER OR SURVIVOR ACCOUNT.

WILL I BE TAXABLE???. BECAUSE THE SB ACCOUNT INTEREST ALSO WOULD CROSS 10000 and my GROSS INCOME ALSO WOULD ACROSS 250000 (TAX SLAB)

KINDLY CLARIFY…Expecting a reply at the earliest

Thank You

It may be consider in your mother’s account. Money related to her.

Hai Everyone

I am a housewife (Home Maker).therefore i have no income

Recently my father passed away and i received my share of property (ie) around 5 lakh rupees.

I want to open an SB ACCOUNT and deposit this money there, so that i can give it to my son when he needs some money.

But i am afraid whether i will be posted income tax , since income from SB Interest will cross 10000 rs.

Kindly clarify….whether i would be taxed.

I WANT TO SAFEGUARD THIS MONEY WITHOUT MY HUSBAND’S KNOWLEDGE.

Kindly help.

Hai everyone.

My gross income is rs 250000 (2 lakh 50 thousand). i earn rs 17000 as interest from SB accounts from multiple banks.

THIS IS MY TOTAL INCOME FOR AN YEAR.

SHOULD I PAY TAX. Kindly tell….

How can i exempt myself from paying Income tax for the above mentioned income

Calculation of tax = Rs. 1700/- (10% on Rs.17000)for this fiscal. But you are entitled to Exemption of Rs.2000/-under section 87-A Since your earnings are less than Rs.500000. So, you are not liable to pay any tax. Be free.

1. I got interest on ppf credited on 31 March 2013, So i will declare it in ITR of Assessment year 2013-2014, given the fact that Previous year in which this interest was credited is 2012-2013(1 April 2012-31March 2013) ??

2. I got interest on saving account credited in my Account on 30 June 2012 and 31 Dec 2012. So i will declare it in AY 2013-2014 ?

I am filing a revise return. Kindly help

Sir for PPF As the interest is credited on 31 Mar 2013 it has to be accounted in the FY 2012-12 or AY 2013-14.

Show it under exempt Income in Interest income as explained in our article Exempt Income and Income Tax Return.

Interest on Saving Account is tricky.

Interest on saving bank account credited on 30 June 2012 is actually for 1 Jan 2012-30 Jun 2012.

Interest on saving bank account credited on 31 Dec 2012 is actually for 1 Jul 2012-31 Dec 2012

But if amount is less than 10K it’s ok.

how to calculate RATE OF INTEREST of recurring deposit.

Suppose I’m investing 2500 per month in recurring deposit account for 2 years with rate of interest 8% compounded quarterly. Now I have to find out MATURITY AMOUNT. For this i will use formula :

ACTUAL AMOUNT (MATURITY AMOUNT) = PRINCIPLE AMOUNT *( (1+RATE/100/4)^(4*2)-1)/(1-(1+RATE/100/4)^(-1/3))

ACTUAL AMOUNT (MATURITY AMOUNT) = PRINCIPLE AMOUNT *( (1+8/100/4)^(4*2)-1)/(1-(1+8/100/4)^(-1/3))

ACTUAL AMOUNT (MATURITY AMOUNT) = 65229/-

========================

Now I want to know the FORMULA OF HOW TO CALCULATE RATE OF INTEREST.

Suppose I’m investing 2500 per month in recurring deposit account interest compounded quarterly. My MATURITY AMOUNT IS 65229/-.

But i don’t know what INTEREST RATE I HAVE GOT. I want to find out INTEREST RATE . WHAT FORMULA SHOULD I USE TO FIND OUT RATE OF INTEREST

PLEASE REPLY.

My Mother (housewife)has earned Saving bank interest as (Rs. 646) + FD interest as (Rs. 25459)= 26105 for FY 2012-13.No other source of income.

1-Does she need to file ITR?

2-Do i need to ask bank to deduct 10% tax on above?

Only those who earn more than 2,00,000 are required to file income tax return. So she does not need to file the return.

For interest earned on FD above 10,000 Rs bank deducts TDS at rate of 10% (if PAN is submitted) 20%(if no PAN). If you want to avoid TDS you need to fill Form 15H/15G depending on whether she is senior citizen or not? Our article Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund discusses it in detail

(You don’t need to ask they will do so automatically)

Regarding Interest on FD I have following questions?

Is FD interest that you mentioned is for many years or just one year?

Does she have a PAN?

Is she a senior citizen?

Has interest been deducted you should get Form 16A from bank? If yes is she eligible to get refund? Do you want to file ITR to get refund?

Is FD interest that you mentioned is for many years or just one year?

–some of them were more than 1 year old..

Does she have a PAN?

–Yes..Already registered with bank.

Is she a senior citizen?

–No.

Has interest been deducted you should get Form 16A from bank?

–i checked form 26AS , Rs. 2550 tax has been deducted for this and Rs. 25458 has been credited…B

If yes is she eligible to get refund?

–No idea.

Do you want to file ITR to get refund?

Not much time left i guess for this..

If you have clear idea on what you need it is not difficult.

Our articles might be of help to you

E-filing : Excel File of Income Tax Return

Fill Excel ITR form : Personal Information,Filing Status

Fill Excel ITR1 Form : Income, TDS, Advance Tax

Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax

Incase you decide to file the return and get the refund..boss bata dena!

Whether the date to file ITR is extended? Yes, i wish to fill the refund.

Yes it has been extended till 5 Aug. Best of Luck. Process of asking for refund is same as filing returns Our article Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund discusses it in detail.

My Mother (housewife)has earned Saving bank interest as (Rs. 646) + FD interest as (Rs. 25459)= 26105 for FY 2012-13.No other source of income.

1-Does she need to file ITR?

2-Do i need to ask bank to deduct 10% tax on above?

Only those who earn more than 2,00,000 are required to file income tax return. So she does not need to file the return.

For interest earned on FD above 10,000 Rs bank deducts TDS at rate of 10% (if PAN is submitted) 20%(if no PAN). If you want to avoid TDS you need to fill Form 15H/15G depending on whether she is senior citizen or not? Our article Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund discusses it in detail

(You don’t need to ask they will do so automatically)

Regarding Interest on FD I have following questions?

Is FD interest that you mentioned is for many years or just one year?

Does she have a PAN?

Is she a senior citizen?

Has interest been deducted you should get Form 16A from bank? If yes is she eligible to get refund? Do you want to file ITR to get refund?

Is FD interest that you mentioned is for many years or just one year?

–some of them were more than 1 year old..

Does she have a PAN?

–Yes..Already registered with bank.

Is she a senior citizen?

–No.

Has interest been deducted you should get Form 16A from bank?

–i checked form 26AS , Rs. 2550 tax has been deducted for this and Rs. 25458 has been credited…B

If yes is she eligible to get refund?

–No idea.

Do you want to file ITR to get refund?

Not much time left i guess for this..

If you have clear idea on what you need it is not difficult.

Our articles might be of help to you

E-filing : Excel File of Income Tax Return

Fill Excel ITR form : Personal Information,Filing Status

Fill Excel ITR1 Form : Income, TDS, Advance Tax

Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax

Incase you decide to file the return and get the refund..boss bata dena!

Whether the date to file ITR is extended? Yes, i wish to fill the refund.

Yes it has been extended till 5 Aug. Best of Luck. Process of asking for refund is same as filing returns Our article Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund discusses it in detail.

I earned interest from all Savings A/cs as 7000…My ITR filer has indicated ‘7000 as income from other sources and deducted 3000 from taxable income’…Is it correct? or he has to deduct 7000 from taxable income?

Ex : For income of Rs 6,00,000 if you have earned Rs 7000 as interest on the saving bank account which comes as income from other sources

On Income of 6,0,7000 taxability is 52942

On Income of 6,00,00 taxability is 51500

So as per me it is not correct,

You have to show 7000 as income from other sources, claim 7000 as deduction in section 80TTA so net taxable income is 600000.

Now do you want to revise your return?

That (ITR calculations) is draft and not filed yet. I shall correct the same as clarified.

Good to hear. Don’t delay file returns ASAP. 31 Jul 2013 is last day and avoid last minute rush(Everyone it seems wants to file on last date)

I earned interest from all Savings A/cs as 7000…My ITR filer has indicated ‘7000 as income from other sources and deducted 3000 from taxable income’…Is it correct? or he has to deduct 7000 from taxable income?

Ex : For income of Rs 6,00,000 if you have earned Rs 7000 as interest on the saving bank account which comes as income from other sources

On Income of 6,0,7000 taxability is 52942

On Income of 6,00,00 taxability is 51500

So as per me it is not correct,

You have to show 7000 as income from other sources, claim 7000 as deduction in section 80TTA so net taxable income is 600000.

Now do you want to revise your return?

That (ITR calculations) is draft and not filed yet. I shall correct the same as clarified.

Good to hear. Don’t delay file returns ASAP. 31 Jul 2013 is last day and avoid last minute rush(Everyone it seems wants to file on last date)

Under 80TTA examption of rs 10000, if i have minore a/c of my child & in both my a/c & my child a/c int income is more then 10000 then exampted both or only 10000rs.

Under 80TTA Only 10,000 Rs of interest on Saving Bank account of which you are primary or First holder is exempt.

(iii) Section 10(32) provides exemption to extent of Rs. 1,500/- in respect of minor’s income for the purpose of clubbing. Therefore, exclude Rs. 1,500/- from the income of the minor while clubbing the income of the minor in the respective head. However, if income of the minor is to be clubbed in various heads, total exclusion should not exceed Rs. 1,500/-.

So in Schedule SPI, Income of specified persons(spouse, minor child etc) includable in income of the assessee(income of the minor child to be

included after Rs. 1,500 per child)

show under relationship MINOR CHILD Nature of Income as INTEREST INCOME and under Amount (Interest income – 1500) ex: 12000-1500.

Show Rs 1500 in Exempt Income Section under Others, including exempt income of minor children as shown in our article Exempt Income and Income Tax Return

Under 80TTA examption of rs 10000, if i have minore a/c of my child & in both my a/c & my child a/c int income is more then 10000 then exampted both or only 10000rs.

Under 80TTA Only 10,000 Rs of interest on Saving Bank account of which you are primary or First holder is exempt.

(iii) Section 10(32) provides exemption to extent of Rs. 1,500/- in respect of minor’s income for the purpose of clubbing. Therefore, exclude Rs. 1,500/- from the income of the minor while clubbing the income of the minor in the respective head. However, if income of the minor is to be clubbed in various heads, total exclusion should not exceed Rs. 1,500/-.

So in Schedule SPI, Income of specified persons(spouse, minor child etc) includable in income of the assessee(income of the minor child to be

included after Rs. 1,500 per child)

show under relationship MINOR CHILD Nature of Income as INTEREST INCOME and under Amount (Interest income – 1500) ex: 12000-1500.

Show Rs 1500 in Exempt Income Section under Others, including exempt income of minor children as shown in our article Exempt Income and Income Tax Return

Hi

I have interest earned from Savings Account – Rs. 11,000. I had invested in Corporate FD from Shriram Transport Financial in 2010 for a 3 year cumulative FD. The interest earned in the 3 year period was Rs. 9000.

Kindly advise on how do I treat these incomes

In case of company fixed deposit, the TDS limit of the interest earned is caped at Rs 5,000. The companies would deduct tax at source if the interest earned in a financial year exceeds Rs 5,000 as per the tax slab of the individual.

Please correct me if I am wrong. NO TDS was deducted for you for Corporate FD from Shriram Transport Financial.

Assuming no TDS was deducted

Interest earned i.e Rs 9000 would be your income from other sources. As your interest income from Saving Bank account is more than 5000 Rs please use ITR2 and not ITR1 Our article Income From Other Sources :Saving Bank Account, Fixed Deposit,RD and ITR discusses it in detail.

Interest in Saving Bank account : Show 10,000 in section 80TTA (Same section where 80C etc are mentioned). Add 11,000 Rs to interest portion of Income from other sources as explained in our article Interest on Saving Bank Account : Tax, 80TTA

Hello Kirti,

I guess there is some confusion regarding what form to fill if the savings interest income is more than 5000. Here you are saying that we should go for ITR2. I raised a query to official IT website and there response was – interest income does not come under exempt and in this case one should go for ITR1 only.

Hi

I have interest earned from Savings Account – Rs. 11,000. I had invested in Corporate FD from Shriram Transport Financial in 2010 for a 3 year cumulative FD. The interest earned in the 3 year period was Rs. 9000.

Kindly advise on how do I treat these incomes

In case of company fixed deposit, the TDS limit of the interest earned is caped at Rs 5,000. The companies would deduct tax at source if the interest earned in a financial year exceeds Rs 5,000 as per the tax slab of the individual.

Please correct me if I am wrong. NO TDS was deducted for you for Corporate FD from Shriram Transport Financial.

Assuming no TDS was deducted

Interest earned i.e Rs 9000 would be your income from other sources. As your interest income from Saving Bank account is more than 5000 Rs please use ITR2 and not ITR1 Our article Income From Other Sources :Saving Bank Account, Fixed Deposit,RD and ITR discusses it in detail.

Interest in Saving Bank account : Show 10,000 in section 80TTA (Same section where 80C etc are mentioned). Add 11,000 Rs to interest portion of Income from other sources as explained in our article Interest on Saving Bank Account : Tax, 80TTA

Hello Kirti,

I guess there is some confusion regarding what form to fill if the savings interest income is more than 5000. Here you are saying that we should go for ITR2. I raised a query to official IT website and there response was – interest income does not come under exempt and in this case one should go for ITR1 only.

Hi Kirti,

I was filling ITR 2 and landed up in couple of doubts here.

1)I have declared some amount under allowances exempt under section 10 in the sheet Part B.(HRA,Conveyance amount)

So where should i fill the details about it .Any schedule where in we should fill that.

2)Also what needs to be filled under Schedule EI sheet, it has some options like interest, agriculture and others.

Shd we fill the exempt income mentioned in 1 like HRA under it this as others?

Thanks

Nagraj we usually don’t show HRA in ITR1 mostly it’s accounted in Form 16.

This year there is confusion regarding exempt income and whether HRA,Travel allowance need to be declared but there is no notification from Income Tax dept regarding how to show HRA etc. So like in earlier years most CAs are not showing HRA in ITR1

For HRA in ITR2 you need to show HRA allowance in Schedule S Details of Income from Salary (Fields marked in RED should not be left Blank) under

Allowances exempt under section 10

Mostly for exempt income we have interest like : Interest on EPF,PPF,Dividends etc which need to be shown.

We have discussed it in detail in our Exempt Income and Income Tax Return

Hope it helps!

I have filled HRA and conveyance(amt adding both) under schedule S as stated by you already.

My doubt was like in the schedule EI (Exempt income), do we need to fill HRA details again here under OTHERS.

I saw your other post Exempt income where in you had provided screenshot of Schedule EI.I was not seeing anything related to HRA or conveyance?

We have written article on claiming HRA in Income Tax Return HRA Exemption,Calculation,Tax and Income Tax Return. Hope it clarifies.

Hi Kirti,

I was filling ITR 2 and landed up in couple of doubts here.

1)I have declared some amount under allowances exempt under section 10 in the sheet Part B.(HRA,Conveyance amount)

So where should i fill the details about it .Any schedule where in we should fill that.

2)Also what needs to be filled under Schedule EI sheet, it has some options like interest, agriculture and others.

Shd we fill the exempt income mentioned in 1 like HRA under it this as others?

Thanks

Nagraj we usually don’t show HRA in ITR1 mostly it’s accounted in Form 16.

This year there is confusion regarding exempt income and whether HRA,Travel allowance need to be declared but there is no notification from Income Tax dept regarding how to show HRA etc. So like in earlier years most CAs are not showing HRA in ITR1

For HRA in ITR2 you need to show HRA allowance in Schedule S Details of Income from Salary (Fields marked in RED should not be left Blank) under

Allowances exempt under section 10

Mostly for exempt income we have interest like : Interest on EPF,PPF,Dividends etc which need to be shown.

We have discussed it in detail in our Exempt Income and Income Tax Return

Hope it helps!

I have filled HRA and conveyance(amt adding both) under schedule S as stated by you already.

My doubt was like in the schedule EI (Exempt income), do we need to fill HRA details again here under OTHERS.

I saw your other post Exempt income where in you had provided screenshot of Schedule EI.I was not seeing anything related to HRA or conveyance?

We have written article on claiming HRA in Income Tax Return HRA Exemption,Calculation,Tax and Income Tax Return. Hope it clarifies.

I’ve a Auto Sweep account in SBI(Savings Plus).Total Interest for FY12-13 is Rs9832/- and TDS deducted is Rs 1088/-. Whether I can claim this interest in section 80TTA.I fall in 20% Tax slab. Interest from MOD or Auto sweep FD’s are taxexempted under 80TTa or we have to pay tax on them as per our Tax slab.

Kirti, after the sweep from saving bank account into Fixed Deposit that is treated as FD and hence interest from FD is taxed as per your income slab.

Section 80TTA applies only to interest from Saving Bank account.

Just a doubt, typically TDS is 10% of interest earned so if you have earned interest of 1088 then your interest should be 10,880.

I’ve a Auto Sweep account in SBI(Savings Plus).Total Interest for FY12-13 is Rs9832/- and TDS deducted is Rs 1088/-. Whether I can claim this interest in section 80TTA.I fall in 20% Tax slab. Interest from MOD or Auto sweep FD’s are taxexempted under 80TTa or we have to pay tax on them as per our Tax slab.

Kirti, after the sweep from saving bank account into Fixed Deposit that is treated as FD and hence interest from FD is taxed as per your income slab.

Section 80TTA applies only to interest from Saving Bank account.

Just a doubt, typically TDS is 10% of interest earned so if you have earned interest of 1088 then your interest should be 10,880.

Dear Kirti,

Do me correct one thing that its is interest on saving bank account