After remaining dormant for several quarters, the primary market is showing signs of revival. A slew of public issues IPOs , FPOs(follow-on public offers) and rights issues from the existing companies, is slated to come out in the coming months. Unlike in the past, investing in IPOs this year has also been a better bet than buying stocks in the secondary market. Returns on seven out of eight IPOs have beaten the CNX 500 index. In contrast to recent offers, the crop of IPOs from last year has not fared as well, with 22 of the 37 offers still languishing below their offer price.Will this supply of new shares suck out the liquidity and bring down the overall market? Should one invest in these IPOs? What should one consider before investing in IPOs? Should one look for Listing Gains? These questions will be answered in this article .

The forthcoming public issues can be broadly classified into following categories

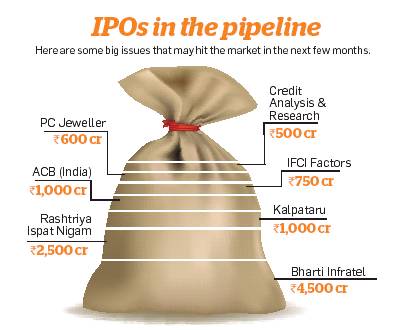

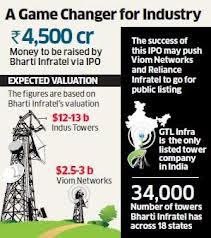

- Companies that were waiting for the sentiment to improve before tapping the market such as Bharti Infratel. If the company manages to raise around 4,500 crore as planned, it will be the biggest IPO since the Coal India issue in November 2010.

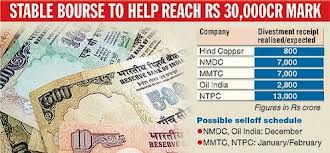

- Public Sector Unitss that have been put on the block by the government. The disinvestment proceeds will be used to reduce the fiscal deficit.The cabinet has approved disinvestment in Nalco, SAIL, Rashtriya Ispat Nigam, BHEL, Oil India, MMTC and NMDC.

- Private-sector companies with a very high promoter holding. These companies have been asked by Sebi to reduce their promoter holding to 75% before June 2013. They may launch FPOs or take the new offer for sale (OFS) route offered by Sebi. Major companies where the promoter holding was more than 75 per cent at the end of last quarter (September 30) include DLF, Jet Airways, Wipro, Tata Communications, Tata Tele, Sun TV, L&T Finance, Omaxe, Fortis Healthcare and Reliance Power etc.

Details about IPO’s Economictimes IPO section , Money Control IPO section

As mentioned unlike in the past, investing in IPOs this year has also been a better bet than buying stocks in the secondary market. Returns on seven out of eight IPOs have beaten the CNX 500 index, reckoned from their offer date. The only stock languishing below its offer price is Tara Jewels, which made its debut on Thursday. In contrast to recent offers, the crop of IPOs from last year has not fared as well, with 22 of the 37 offers still languishing below their offer price.The good returns from recent offers combined with an upbeat market seem to be prompting quite a few issuers to revive their stalled IPO plans. Bharti Infratel, CARE Ratings and PC Jewellers are set to raise a combined Rs 5,500 crore this week. Onemint Bharti Infratel IPO Review

Theoretically, the best time to invest in a stock is when it is about to start with its growth trajectory. So, IPOs give you an opportunity to participate in the growth prospects of that company. However, the reality is that investors can lose heavily if they put their money in overhyped IPOs. But Why do investors get excited about IPOs?

- First, unlike other stocks that are already listed in the market, IPOs are pushed by the company’s management, merchant bankers and brokerages. So, there is a concerted effort to market the shares. A lot of positive news and analyses are floating around during the launch of an IPO.

- Second, some recent IPOs have given excellent returns, even though several others have failed to live up to the expectations (see table). A good IPO can turn around your portfolio and, therefore, the hope that the next one turns out to be good attracts gullible investors to the primary market.If you consider the IPOs that have given good returns, most of them are driven by the consumption theme. The consumer product companies have been leading the market rally for the past 2-3 years and, therefore, it is natural that those like Tribhovandas Bhimji Zaveri and Lovable Lingerie feature in the list of winners. The pharma sector is another hot sector now and this explains why Aanjaneya Lifecare is in the list.

The follow-on public offerings are easier to evaluate because the stock is already listed in the market and the data is readily available for the past several years. Besides, you know about the aptitude of the management, as well as the growth prospects of the company. The only thing to watch out here is the manner in which the company intends to use the proceeds. Is the money being raised to expand the business or just offload shares held by promoters?

Most of the FPOs and OFSs are not business decisions but have been forced by circumstances. The PSUs are coming out with public issues because the government needs the money to bridge the fiscal deficit. Some of the private-sector companies that need to bring their promoter stake to 75% are also coming out with FPOs. Though bad for the company, forced issues are good for the retail investors because they are a great investment opportunity. Those who had bought the shares of MNCs, which were forced to go public in 1977, will vouch for this because many of them have made fortunes from them.

Table of Contents

Public Issues

The government has already announced a divestment target of 30,000 crore for this fiscal year and PSU issues will flood the market before March 2013. The government will sell

- 10% stake each Rashtriya Ispat Nigam Ltd (RINL), Hindustan Aeronautics Ltd (HAL), Oil India and NMDC.

- it plans to offload 12.15% in NALCO,

- 10.82 % in SAIL,

- 9.50 % in NTPC and

- 9.33 % in MMTC.

- 5 % stake sale in BHEL and another 4.01 % in Hindustan Copper is in the pipeline.

During the current financial year, government disinvested 10 % in NBCC and 5.58 % of Hindustan Copper Ltd (HCL) out of its shareholding and realised an amount of Rs 124.97 crore and Rs 807.02 crore respectively totalling Rs 932 crore.

Will the increased supply bring down the prices of individual stocks? For example the impact of the OFS announcement by Hindustan Copper. The floating stock of the company (shares available for trading) was only 0.41% of the total equity. Its shares were quoting at 260 when the government decided to keep the minimum bidding price at 155. The additional supply could not be absorbed by the market even at this lower price and, finally, the issue was bailed out by LIC and some PSU banks. The Hindustan Copper shares hit the lower circuit for the next three days, and are currently trading below the floor price of 155. More details at Stock Fundoo Hindustan Copper OFS The Art of Losing 9600 crores of market value to achieve 800 crores of stock sale, Economic Times LIC, PSBs bail out Hindustan Copper’s offer for sale issue

Will the the story be repeated with other PSU scrips that are expected to hit the market soon? Or as some experts say “The proper price discovery did not happen at Hindustan Copper before the OFS issue because of lack of enough liquidity. However, this price discovery is already happening in the case of NTPC, SAIL, etc, and, hence, the issues may be successful if the government is ready to give a reasonable discount to the current market price”

Promoters Holding less than 75%

The Securities and Exchange Board of India (Sebi) has asked for all listed private companies to reduce their promoters’ stakes to no more than 75% by June 2013.Public sector companies need to reduce the government’s stake in them by 10% by August 2013. Promoters of at least 144 companies are evaluating options to reduce their shareholding to meet the norm. The average promoter shareholding in private companies is 83%. Bombay Rayon Fashions Ltd, Puravankara Projects Ltd and Omaxe Ltd are some of the private sector companies that feature in the list.HMT Ltd, MMTC Ltd and Hindustan Copper Ltd are some of the public sector companies that need to meet the Sebi requirement.The value of equity dilution by private companies is pegged at Rs.20,300 crore. Sebi had issued the directive in 2010, but since then not many companies have gone ahead to reduce promoters’ stakes because the market conditions have not been conducive..The Sebi has provided various options over the recent months to help the companies meet minimum public shareholding criteria, by permitting options of rights/bonus issuances of shares, as also new routes like Offer for Sale (OFS) and Institutional Placement Programme (IPP

Some of the firms that have met the requirement in recent months include Godrej Industries, Muthoot Capital and Adani Power, while subsidiaries of a few multi-national companies have also announced plans to meet the deadline). Godrej Industries Ltd and Godrej Properties Ltd. brought the promoters’ shareholding down to 75% through the so-called institutional placement programme, or IPP

Details at : ET Sebi to get tough with companies with high promoter holding, Livemint’s As deadline nears, firms evaluate stake dilution plans

To Invest or not?

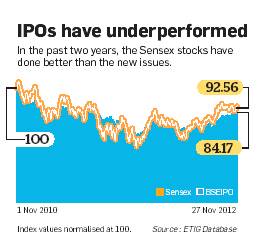

For investors, the big question is whether to invest in the new issues. Though there is a lot of hype surrounding public issues, the IPOs that have come out in the past two years have not impressed with their performance, with the BSE IPO Index under performing the broader market

A good IPO is one that is priced reasonably, leaving enough on the table for the investor. Coal India was one such issue, which created wealth for investors despite the sectoral and regulatory headwinds faced by the company. TBZ is an example of attractive pricing. A share in jewellery retailer Tribhovandas Bhimji Zaveri (TBZ), offered at Rs 120 in its IPO, is worth Rs 287 today, a neat 139 per cent gain in barely six months.The offer price had a good margin of safety and the stock is now catching up with the valuation multiple of retail companies like Titan. TBZ’s offer in April was made at a price-earnings ratio of 12, while Titan traded at over 35 times. So the rules for evaluating an IPO are no different from choosing a stock in the secondary market. Investors should only go with companies that have quality management, high growth rate, good profitability and are offered at reasonable valuations. After all, these IPO stocks are part of the same stock market! To check out performance of IPO’s SMC IPO Performance Tracker

Since most IPOs will hit the market with a lot of hype, it is possible that retail investors get carried away. Choose a wrong stock and it could kill your portfolio. Here are some danger signs to watch out for:

- Exit strategy for promoters: Be careful if the IPO is an exit strategy for the promoters, private equity investors and venture capitalists, since most of them will be waiting for an opportunity to dump the stock on gullible investors. Study the offer document to know how much stake is being offloaded through the public issue. If the percentage is very high, it is a red flag for investors.

- Flavour of the month: Avoid low-quality companies trying to ride the theme of the month. Market veterans will recall how several finance companies added ‘infotech’ to their names before coming out with IPOs during the dotcom boom.

- Valuation is key: The pricing of the IPO is of utmost importance. Even a good quality company at a high price is a bad investment. The Reliance Power IPO was priced at a much higher valuation compared with several listed power generators, such as NTPC and Tata Power. Stock should not be priced higher than the other stocks in the sector. Compare the PE ratios of the company with those of its peers.

Listing Gains

Given the losses from IPOs, a lot of investors in the primary market book profits on the listing day itself. Even good IPOs can have a shaky start. Tribhovandas Bhimji Zaveri lost money on the listing day, but recovered later. If you had exited at a loss on the listing day, you would have missed out on the opportunity to earn 139% returns. Even so, many investors swear by this method. Of the 59 IPOs in the past two years, 34 (or 58%) would have generated positive returns if you had sold them on the first day of trading (computed on a closing basis, because the first quote is mostly manipulated and it is almost impossible for anyone to get out at that price). Some of the big losers like Birla Medispa and Inventure Growth & Securities had generated handsome listing gains.

Refrence: ET Is it the right time to invest in IPOs and public issues?

Related Articles:

- ET Slide Show : What is an IPO

- Ups and Downs of Sensex

- Stock Market Index: The Basics

- Stock exchange : What is it, Who owns, controls it

The problem is that when stocks are doing well, a lot of IPOs flood the market, and it is important to separate the chaff. Though you may be tempted by the IPOs, it is important to consider the reason for the issuance as well as the company’s valuation and fundamentals before investing in one. Will you invest in forthcoming IPOs, which one, why? Will government meet it’s disinvestment target.

I found your blog while searching for the updates, I am happy to be here. Very useful content and also easily understandable providing.. Believe me I did wrote an post about tutorials for beginners with reference of your blog.

https://www.gangboard.com/business-intelligence-training/msbi-training?utm_source=backlinks&utm_medium=cmt&utm_campaign=coursepage&utm_term=msbi&utm_content=gowsi

Hello,

Many thanks for giving such valuable info. I already subscribed to this blog and regularly follow for financial matters. I notice that many of your articles are referred somewhere by other bloggers. Just refer UPCOMING IPO Details(http://www.sharpcareerfinancialupdates.in/investment-updates/what-is-an-ipo-what-process-of-issuing-ipo/).

This blog which is posted on Jan 28, 2017.

I am writing this for your information only…….