Many employers today, offer a group medical insurance cover to their employees, which include the employees’ family members as well. Most of the salaried people think that the corporate group health insurance policy from the employer is sufficient and there is no need to buy another policy by putting in own money. But is the corporate health insurance plan a complete solution? It looks at the employer provided Medical benefits like Health Insurance Policy,Medical Bill Reimbursement,Cost of Hospitalization,Types of Medical Insurance, Tax Benefits on Medical Insurance.

What is Employer Health Insurance Policy?

An employer-sponsored health insurance is usually a group insurance, which covers all the employees in the organization. Group health insurance is a medical insurance that covers a group of people, who are usually the members of societies, employees of a common company, or professionals in a common group. Group policies are usually cheaper than individual policies. The logic of group insurance is that all those who are insured are not going to fall sick and are not going to make a claim. But the benefit can go to that one person who falls ill and needs to make a claim.

Employees must know the benefits offered, the sub-limits and the sum assured at the time of joining.

- Usually the benefits of Employer-provided insurance policy can be availed at the time of hospitalization of those covered in the plan typically the employee and dependants. So it is a floater policy i.e in time of need coverage amount can either be used by one member or by all upto max of yearly coverage amount.

- Usually Employer Group Insurance covers Pre-existing Diseases and Maternity benefits upto two children from the day employee joins. Whereas, standalone health policies will have a waiting period of at least two to four years, depending on the insurer.

Employer Health Insurance Mediclaim Policy means hospitalization. This policy covers any illness or disease or injury and typically covers which are incurred in India and are within the policy period.

- Room, Boarding expenses

- Doctors fees

- Nursing expenses

- Surgical fees, operating theatre, anesthesia and oxygen etc

- Medicines

- Tests such as laboratory, x-ray, diagnostic tests

- Dressing, ordinary splints and plaster casts

- Costs of prosthetic devices if implanted during a surgical procedure

- Radiotherapy and chemotherapy

- Physical therapy

Expenses on Hospitalization for minimum period of 24 hours are admissible. However this time limit will not apply for specific treatments i.e. Dialysis, Chemotherapy, Radiotherapy, Eye surgery, Dental Surgery, kidney stone removal, Tonsillectomy, taken in the Hospital or Nursing home and the insured is discharged on the same day of the treatment are also considered to be under Hospitalization Benefit

What is Medical Bill Reimbursement?

The other medical facility than an employer provides is Medical Bill Reimbursement.

Changes in Employer’s Medical Insurance over the years

Employers started cutting on insurance premiums after 2008, when the slowdown started. Also Due to rising healthcare costs premium is becoming higher. So now employers are choosing some cost cutting mechanism like

- Scope of parental coverage, has been decreasing in the group health insurance policies offered by the employers. This is because the parental claims constitute to a bulk of the claims and therefore premium burden for the employer. So companies are either allowing parents who are dependent on the employee or asking the employee to pay for parental coverage.

- Defining limits on room rental It’s not the higher room rental but also the higher attendant treatment costs, such as doctor fees, operation theatre fees, etc., as hospitals do typically charge a higher treatment cost if the room rental is higher. If employee decides to use a hospital room with higher rentals, he will have to share the additional cost charged by the hospital.

- Co-payment on claims, which means that part of the treatment cost has to borne by the insured person.

What is Co-pay?

In India, Co-pay in health insurance refers to the percentage of the claimable hospital bill you need to pay from your own pocket. Say if your policy or employer has 10% Copay and your total claim amount after all exclusions comes to Rs. 10,000, employer or insurer you Rs 9000 and the balance Rs.1000 will be paid by you. In simple words, it is the portion of the claim that a policyholder agrees to bear in the event of a claim.

Is Employer provided Health Insurance enough?

Employer provided Insurance may seem attractive to the employees. But do they provide enough coverage? A very common thought amongst most of us is that company mediclaim is sufficient and further health cover is not really required. Chances are high that the workplace insurance will prove insufficient in the long run. Below are some reasons why:

- Low Sum Insured : Rising medical inflation is resulting in increasingly higher hospitalization and treatment costs. The sum insured by your employer might prove insufficient, therefore, if multiple members of the family require hospitalization in the same year. Thus, one should ascertain the available coverage and check its sufficiency against potential medical costs. Moreover, there may be caps on things like the surgeon’s fee, which would limit the employee’s access to good medical care.

- All Family Members ,Usually Parents,Not Covered : Corporate insurance plans may not always cover all the members in one’s family. In most cases, the coverage extends to employee, his spouse and their kids, or employee and his parents. This would leave a huge gap in his financial planning because the elderly usually incur greater expense on medical treatment.

- Out-of-pocket Expenses : Many workplace insurance policies have additional clauses like co-pay and deductibles that the employee would have to pay in case of a claim. Therefore, employees should ascertain the extent of these costs to ensure that they are not left foundering in times of medical emergency.

- Switching Jobs : One problem with workplace insurance occurs while switching jobs. There is a chance that the new employer will not provide medical insurance. In this case, the employee will be left without coverage.

- Going Independent : Depending wholly on one’s workplace insurance becomes an obstacle if one has plans to branch out and start something on one’s own. As soon as one leaves the workplace, one leaves the protective umbrella of the group insurance scheme.

- Policy Changes at the Workplace : In these times of financial strife, be prepared for possible policy changes in the corporate insurance scheme. Employers looking at ways to reduce costs might slash the sum insured or place caps on the existing coverage.

- Post-retirement : Most corporate insurance schemes discontinue their coverage once the employee crosses 60 years of age, if one does not retire by then. Beyond this point, the person’s medical costs increase significantly. But unless he had the foresight to purchase an independent health insurance policy earlier, he will be left with no insurance at this stage. This is particularly concerning because the costs of new health policies are exorbitant for senior citizens, and there may be a waiting period or even outright exclusion for certain health conditions.

Why should one buy health insurance instead of just accumulating a large corpus to meet their medical needs?

Nobody can predict what kind of illness would strike someone and what quantum of money will be required for the treatment. For a cover of Rs 15 lakh, say you would pay an insurance company a premium of Rs 5,000-6,000. But if you were to accumulate Rs 5,000-6,000 annually by yourself for 20 years, even then you would not be able to accumulate Rs 15 lakh. Therefore, it is advisable to buy health insurance.

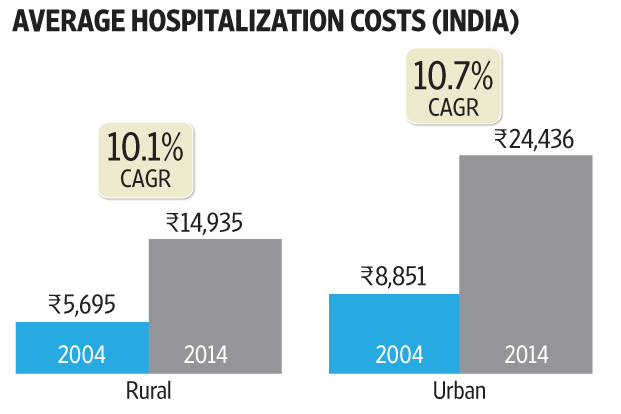

Cost of Hospitalization

The cost of health care has been rising. The cost of treatment rose at a double-digit pace of growth, outpacing average inflation in both rural and urban India over the past decade. As more and more people go to private clinics and hospitals for treatment, they have been faced with rising medical bills. The cost of treatment varies significantly across Indian states. According to WHO, 70% of Indians continue to pay for medical expenses out of the pocket, in comparison to just 30-40% in other Asian countries like Sri Lanka, and they still fail to get access to quality medicines and facilities. Let’s look at the cost of Few Procedures

| CONDITION | PROCEDURE | APPROXIMATE COST |

| Arthiritis | Arthroplasty, knee surgery | 5 lakhs |

| Bone disease (Osteoporosis) | Spine surgery | 5 lakhs |

| Heart diseases | Angioplasty, Bypass | 5 lakhs |

| Cancer | Tumor removal, chemotherapy | Ranges between 4 and 7 lakhs a month |

| Kidney diseases | Hemodialysis | Ranges between 2 and 3 lakhs a month |

| Eyes | Cataract | 80,000 (per eye) |

| Appendix/hernia removal | Appendicitis/herniotomy | 2 lakhs |

| Vein disorder (Varicose veins) | Sclerotherapy, ablation | 2 lakhs |

| Gall bladder removal | Cholecystectomy | 2 lakhs |

| Brain hemorrhage | Craniotomy | 4 lakhs |

From Livemint’s The growing burden of healthcare costs

Why should one look beyond the Employer or Company’s Health Insurance?

- Employee cannot accurately foresee his actual medical expenses to evaluate whether the cover is adequate.He should however make an estimate, in high risk cases such as his elderly parents. If he is able to estimate the costs of say 10 days of hospitalization in a year, he will be able to evaluate whether his insurance covers such an eventuality.

- Please remember that medical expenses are usually negligible in young age, but the years usually take their toll on one’s family’s health. As employee and his spouse enter their 40s and 50s, and as their parents grow older, more and more medical complications typically crop up and require treatment.

- Pre-existing diseases are excluded or covered after a pre-determined time. This can be avoided if health cover is taken at earlier age when health conditions are good. If you decide to take health cover at 55 ages, these factors will come into play.

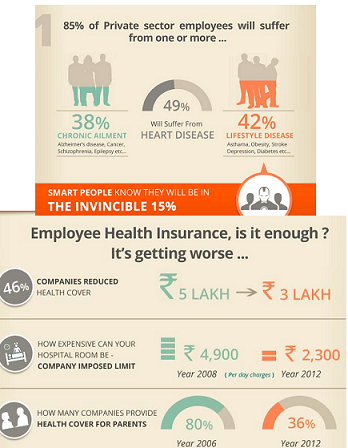

Found an interesting info graphic on Why Smart People don’t buy Health Insurance. An excerpt is given below, full graphic you can see it on our Pinterest

Types of Medical Insurance

There are various Types of Health Insurance Policies.

- Mediclaim Policy : It provides hospitalization cover and pays back medical costs of diseases or surgery when the insured was admitted in a healthcare facility.

- Critical Illness Plans: It provides cover against the threat of major ailments. One receives pre determined amount in case the insured is diagnosed with a critical illness that is part of the initial agreement.

- Top up Plan: If offer insured an additional coverage, which is beyond the threshold limit or the maximum limit of your existing health insurance policies. For example you have an Employer’s Mediclaim policy for Rs 3 Lakh and also a Top up Health cover for Rs 10 Lakh with the threshold limit (deductible) of Rs 3 Lakh. If there is a claim for Rs 5 Lakh, your employer’s mediclaim policy will pay Rs 3 Lakh and the remaining claim amount of Rs 2 Lakh will be covered by your Top up policy.

- Super Top Up: A top-up cover will pay you only if your bill for a single hospitalization is above the threshold. Like, in our example above, the top up cover will help you only when your bill is above Rs 3 lacs each time, only then it will come into picture. So if you have Rs 5 lakh bill, then the top up cover will pay you an additional Rs 3 lacs. But if you have two bills of Rs 2 lakh each, then the normal Top up cover will not help because no single bill amount is above the threshold limit of Rs 3 lakhs. But Super top up plans takes into consideration the TOTAL of the bills in a year and not just the single instance. So in case of two bills of Rs 2 lakh each, your total bill is Rs 4 lakh (above threshold limit of Rs 3 lakh), then Super top up cover will pay you, where a Top up cover will not.

Paying Medical Insurance offers Tax Benefit

Medical Insurance Premium paid for self, spouse, Children and dependant parents is allowed as exemption. This exemption is available under section 80D of Income Tax Act. This deduction is in addition to savings under IT deductions section like 80C, 80G . From AY 2013-14 a deduction of up to Rs. 5,000 for preventive health check-up is available.

For Financial year 2014-15: The maximum deduction available under 80D section is to the extent of Rs. 40,000

| You and Your family | Max Deduction | Parents | Max Deduction |

Table of Contents Health Check Up |

Total Deduction |

| You,spouse,children , your age < 60 years | 15,00 | Parents age < 60 years | 15000 | 5,000 | 35,000 |

| You,spouse,children , your age < 60 years | 15,000 | Parents age > 60 year | 20,000 | 5,000 | 40,000 |

| You,spouse,children , your age > 60 years | 20,000 | Parents age > 60 year | 20,000 | 5,000 | 45,000 |

For Financial year 2015-16: Deduction is raised from Rs 15,000 to Rs 25,000. The deduction for senior citizens is raised from Rs 20,000 to Rs 30,000. For uninsured super senior citizens (more than 80 years old) medical expenditure incurred up to Rs 30,000 shall be allowed as a deduction under section 80D. However, total deduction for health insurance premium and medical expenses for parents shall be limited to Rs 30,000.

| Max Deduction | Parents | Max Deduction |

Health Check Up |

Total Deduction |

|

| You,spouse,children , your age < 60 years | 25,00 | Parents age < 60 years | 25000 | 5,000 | 55,000 |

| You,spouse,children , your age < 60 years | 25,000 | Parents age > 60 year | 30,000 | 5,000 | 60,000 |

| You,spouse,children , your age > 60 years | 30,000 | Parents age > 60 year | 30,000 | 5,000 | 65,000 |

Related Articles:

- Insurance for Mobiles and Gadgets

- Pradhan Mantri Suraksha Bima Yojana,Pradhan Mantri Jeevan Jyoti Bima Yojana and Atal Pension Yojna

- Insurance : Surrender or Make policy paid up or Continue

- Mis-Selling or Mis-Buying: It’s My Money, My Responsibility

- What is Car Insurance

- Checklist for buying Life Insurance Policy

Even though a company health plan may seem adequate, covering your entire family, it is always advisable to opt for a personal plan too. It is thus always better to go for that extra health cover when time and health is on your side. You never know when an emergency could strike. So, if you still think that you are adequately covered under your company’s group health insurance policy, it is time to think twice especially since the medical inflation is soaring very high!

My developer is trying to persuade me to move to .net from PHP.

I have always disliked the idea because of the costs.

But he’s tryiong none the less. I’ve been using WordPress on several websites for about a year and am concerned about switching to another

platform. I have heard fantastic things about blogengine.net.

Is there a way I can import all my wordpress content into it?

Any kind of help would be really appreciated!

Cada veez más prestamistas ofrecen préstamos personales rápidos y la mayoría de

ellos siguen la misma estructura básica, ya qque se solicitan a través de Internet siin necfesidad de realizar

papeleos y no es necesario cumplir apenas requistos para obtener su aprobación.

Extremly informative article. Generally people in jobs don’t really pay attention to the nitty gritties, for them as long as they are covered it is all that matters, but the fact is that it is not enough if any unprecedented situation arises. I personally believe that its not neccesary to have only health insurance, we need to protect ourselves and our family against accidents or unfateful events. So i have bought Tata AIA life’s Smart growth plus plan which is a very good plan and, it offers flexibility in choosing policy term, has good policy returns and tax benefits u/s 80C & 10(10D).https://www.youtube.com/watch?v=p6taJlYgVgY

Extremly informative article. Generally people in jobs don’t really pay attention to the nitty gritties, for them as long as they are covered it is all that matters, but the fact is that it is not enough if any unprecedented situation arises. I personally believe that its not neccesary to have only health insurance, we need to protect ourselves and our family against accidents or unfateful events. So i have bought Tata AIA life’s Smart growth plus plan which is a very good plan and, it offers flexibility in choosing policy term, has good policy returns and tax benefits u/s 80C & 10(10D).https://www.youtube.com/watch?v=p6taJlYgVgY