What is KYC or Know your Customer for an individual? Why is it required? For what it is required? Who requires it? Is KYC for bank account different from that of mutual funds? Is doing KYC one time sufficient? Is it effective? This article tries to answer these questions.

Table of Contents

What is KYC?

KYC is an acronym for Know your Customer or Know your client. It refers to due diligence activities that financial institutions and other regulated companies(LPG,telephone) must perform to ascertain relevant information from their clients for the purpose of doing business with them.

Why is KYC required?

Know your customer policies are becoming increasingly important globally. The objective of the KYC guidelines is to prevent identity theft, financial fraud, money laundering and terrorist financing. Money laundering is the process of concealing the source of money usually obtained through illegal sources such as drugs and arms trafficking, terrorism, extortion and theft. Terrorist financing is diverting of money from terrorists into the financial market and the reverse flow, that is terrorists investing in the market to reap handsome gains that they could use for unlawful activities.

For example, a bank must verify a customer’s identity and, if necessary, monitor transactions for suspicious activity. This means, to begin with, knowing the identity of the customers, and further, understanding the kinds of transactions in which the customer is likely to engage. By knowing one’s customers, financial institutions will often be able to identify unusual or suspicious behavior, termed anomalies, which may be an indication of money laundering

What does KYC need?

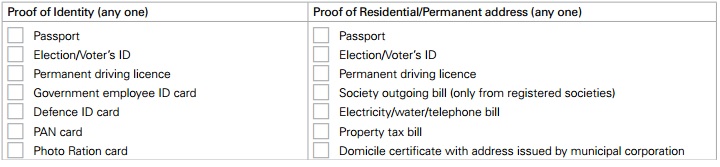

There are two aspects of Customer Identification. One is establishing identity and the other is establishing present residential address. KYC needs two kinds of documentation :

- Identity Proof to tell them you are you and not anyone else. It requires any authentic document carrying photo of the customer such as PAN card, passport, driving license, ration card (as per institution expectation)

- Address proof, so that mails and bills etc can be sent to the right home, such as PAN card, passport, driving license,bills of utilities like telephone, LPG, electricity etc., bank statement, ration card.

Though Proof of Identity documents carry the residential address of the customer, it may not be the present address. Therefore, in order to establish the present address of the customer, in addition to Proof of Identity, the institution asks for address proof.

Who requires KYC?

KYC has to be followed by every financial institute like Banks, Mutual Funds, Utility companies like mobile phone while dealing with customers. KYC procedure needs to be adhered to by a customer during following instances with sample KYC forms.

- While opening an account in a bank . Sample KYC form of HSBC Bank

- While investing in a mutual fund. Sample KYC form (pdf) for Mutual Funds from AMFI

- While issuing Credit Cards/Debit Cards/Smart Cards, add-on/ supplementary cards.

- Getting a new mobile connection Sample KYC form from AirTel

- Getting a gas cyliner (LPG) connection Sample KYC form from BharatGas.

It is important to note that based on norms, organizations may ask for a mandatory KYC process in other instances too.

Why do LPG companies require KYC?

- Because LPG cylinders are used in household kitchens,government provides almost 45-50% subsidy on gas cylinders. There is a huge black-market of LPG cylinders in India. So in order to provoke the black marketing and reduce the burden of subsidy, LPG providing companies need to update the KYC rules.

- Also there are multiple connections on one name in the oil companies list. Companies need to check it and discontinue providing the subsidy cylinders to the person who has multiple connections with the same name or at the same address.

How to do KYC?

While submitting the filled-up form, one needs to submit Proof of Identity(POI) and Proof of Address (POA) . With the form attach the self-attested(signed) photocopies of relevant documents like PAN, proof of address, proof of identity, etc with the organization.

Original documents may be required to be shown(shown,not submitted) while submitting KYC application form for verification, thereafter, documents are returned.

Sample Proof of Identity(POI) and Proof of Address (POA) documents are shown in picture below. Aadhaar (UIDAI) accepts 18 PoI (Proof of Identity) and 33 PoA (Proof of Address) documents , Aadhar valid list of documents.

Is the information given by me to the organization under KYC is treated as confidential?

Yes. The information collected from the customer for the purpose of opening of account is treated as confidential and details thereof are not divulged for cross selling or any other similar purposes.

Is there any legal backing for verifying identity of clients?

Yes. Prevention of Money Laundering Act (pdf) is Indian law passed in 2002 to prevent money-laundering and to provide for confiscation of property derived from money-laundering

For Banks Reserve Bank of India(RBI) has issued guidelines to banks under Section 35A of the Banking Regulation Act, 1949 and Rule 7 of Prevention of Money-Laundering Act. Ref RBI guidelines

If I refuse to give information on KYC asked for what action can be taken against me?

If you don’t provide the KYC during the opening of account/start of service then you might not get the service for example bank account will not be opened or you will not get mobile connection.

Where the organization is unable to apply appropriate KYC measures due to non-furnishing of information and /or non-cooperation by the customer, the organization can consider closing the account or terminating the relationship after issuing due notice to the customer explaining the reasons for taking such a decision.

Once KYC requirements are complied with while opening the account, whether the organization(bank/mutual fund etc) can again ask for KYC compliance?

Yes. To ensure that the latest details about the customer are available, banks have been advised to periodically update the customer identification data based upon the risk category of the customers. For example :

- Advertisement by mobile companies for Re-KYC for reasons of National Secuirty (Ad at Vodafone (pdf))

- By January 2012 Mutual Fund investors had to submit updated KYC forms.

- In Apr 2013 banks are asking for Re-KYC due to Cobra-post.

Is there any other case in which I need to update my KYC?

Yes if there is any change in Name,Address etc you would have to submit the details to the organization. Process is the same, get the form, fill it, attach the documents.

Is there one centralized organization to do KYC?

No. Each organization (bank, LPG company, mobile company ) does it’s own KYC. Mutual Funds/Demats have a kind of centralized KYC process.

What is KYC process of Mutual Funds/Stock Markets?

For the mutual funds and demat (which come under SEBI) there are five KYC registration agencies (KRAs). These are:

- CAMSKRA (set up by Computer Age Management Services (Cams), one of the two largest registrar and transfer agents to service MFs)

- CDSL Ventures Ltd (CVL, a division of Central Depository Services (India) Ltd)

- NSDL Database Management Ltd (NDML, a subsidiary of National Securities Depository Ltd)

- DotEx International Ltd, a unit of the National Stock Exchange

- Karvy Data Management Services Ltd.

Inter-operability (connectivity) between the five KRAs is still in process.The inter-operability will ensure that once your updated KYC data is registered with one KRA, the same change in your data takes effect with all the financial market intermediaries under Sebi in which you have investments.

InvestorFirst presentation on what is KYC and how to fill it for Mutual Fund is useful.

Is KYC effective?

There is multiplicity of enforcement agencies, array of regulations and variety of documents for the identification of a single person which make KYC difficult.

We’ve had KYC rules for quite a time now (almost a decade) and as reports and allegations show money keeps on being laundered. Cobrapost has shown how bankers allegedly marketed insurance products to convert black money into white. (Cobra post is discussed later)

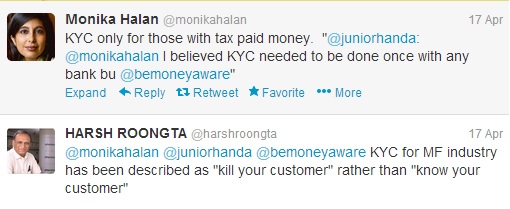

It’s become difficult for common money to keep on doing KYC and investing. As Firstpost Why KYC sends us all over the bend says

Most KYC requirements accept address proof from documents like passports, voter IDs, ration cards, utility bills, and bank statements. But the catch is this: getting one of these requires prior address proof.Almost every document is based on the validity of another document which in turn is based on the validity of yet another document. It’s like a vicious circle which keeps repeating over and over again. There isn’t a single standalone primary document that does not require another proof of address whatsoever.

Livemint’s Clunky KYC norms keep investors away, Mythili Bhusnurmath ET’s KYC norms have made investments in financial instruments all but impossible highlight the plight. Monical Halan and Harsh Roongta said on twitter

What was Cobrapost expose?

Cobrapost.com, Delhi-based website conducted the sting operation in which using hidden-camera videos of the officials of country’s three leading private banks’ ICICI, HDFC and Axis were made allegedly advising customers on money-laundering.

- The Cobrapost videos shows bankers asking for easily available KYC documents(a lease agreement and rent receipts), and, in some cases, even advising customers not to submit a PAN card so they can stay off the tax radar. A Cobrapost video shows a banker allegedly advising an undercover re-porter to fill out Form 60 to avoid detection by tax authorities.

- The Cobrapost expose shows bankers allegedly marketing insurance products to convert black money into white. Insurance products are profitable, because the bank earns a high first-year commission on the premium. The bank manager could benefit, too: many banks and insurers offer rewards for high sales, such as foreign junkets.Insurance products are easy to sell. The bank’s KYC requirements are sufficient proof for investing any amount in an insurance scheme. A PAN card is not necessary, even though some single-premium policy amounts are as high as Rs 30 lakh.

- Cobrapost has also alleged that the three banks have been laundering money. Cobrapost alleges that the banks suggested opening accounts in the name of the applicant’s spouse, cousin, or friend, which is not money-laundering in the strict sense.

A day after Cobrapost published its investigation, ICICI and HDFC banks appointed audit firm Deloitte Touche Tohmatsu to carry out an independent forensic enquiry in addition to their own internal investigations into Cobrapost’s allegations.RBI and the Insurance Regulatory Development Authority are investigating KYC violations and the background of customers who have put large sums into single premium insurance plans. ICICI Bank’s life insurance arm has launched a probe, too. Details at Businesstoday Too many loopholes

Related articles:

- How Gold Ornament is Priced?

- Personal Finance and Scott Adams,Dilbert

- Money Awareness for Beginners

- Books on Money for Children

- Understanding Returns: Absolute return, CAGR, IRR etc

What do you think of KYC? Do you think it helps? Do you think it is required? How can KYC be made more effective?

Once again Lovely information . I have done KYC in my jobs in insurance and Banking Jobs.

Travel India

Once again Lovely information . I have done KYC in my jobs in insurance and Banking Jobs.

Travel India

I am trying to open an account with FundsIndia. I have sent them all the docs including the KYC form and related documents to that. Now, FundsIndia is saying i have a record in NSE KRA with status as “Old Records Submitted” which means, the KYC is not complete. Since the record already exists they cannot initiate another KYC request, even if they do, it gets rejected

They have asked me get it updated by the previous Intermediatary (In this case ICICIDirect where i had an account before). But the problem is, i have closed this account and ICICIDirect refused to the KYC since i don’t have an account.

FundsIndia has asked me to get the NSE KRA rejected so that they can initiate the new KYC. I dont know how to get this done! I even submitted a new KYC form theu ICICBank, but they sent it to CVL and it got rejected, reason – Available with DOTEX!!!

I am stuck and cannot do any Investments!!! Goddam, why do they have to make to so difficult!!

I am trying to open an account with FundsIndia. I have sent them all the docs including the KYC form and related documents to that. Now, FundsIndia is saying i have a record in NSE KRA with status as “Old Records Submitted” which means, the KYC is not complete. Since the record already exists they cannot initiate another KYC request, even if they do, it gets rejected

They have asked me get it updated by the previous Intermediatary (In this case ICICIDirect where i had an account before). But the problem is, i have closed this account and ICICIDirect refused to the KYC since i don’t have an account.

FundsIndia has asked me to get the NSE KRA rejected so that they can initiate the new KYC. I dont know how to get this done! I even submitted a new KYC form theu ICICBank, but they sent it to CVL and it got rejected, reason – Available with DOTEX!!!

I am stuck and cannot do any Investments!!! Goddam, why do they have to make to so difficult!!

Thanks for sharing very useful info. KYC is becoming an annual ritual for the bank with whom I’m having my a/c. I don’t know whether one has to submit KYC every year.

We have to do what we have to do so far it is not annual affair.

Thanks for sharing very useful info. KYC is becoming an annual ritual for the bank with whom I’m having my a/c. I don’t know whether one has to submit KYC every year.

We have to do what we have to do so far it is not annual affair.

thanks for the info share !! I had no clue about the Cobra Post !! Now I know why KYC is so important !1 Elss i was thinking it was such a waste of account holder’s time !!

although I have visited this site before .. the look seems to have changed !! guess !!

I also thought the same, waste of time and effort.

Thanks for coming again

thanks for the info share !! I had no clue about the Cobra Post !! Now I know why KYC is so important !1 Elss i was thinking it was such a waste of account holder’s time !!

although I have visited this site before .. the look seems to have changed !! guess !!

I also thought the same, waste of time and effort.

Thanks for coming again