Apne mujhe padhaya likhaya iss kabil banaya ki apne faisle khud le sakoon, says the daughter who has come to visit her parents house first time after marriage. When father insists it is shagun, his son-in-law looking at his daughter says says “Shagun to humme mil gaya” and then comes the features of LIC Jeevan Shagun. Shagun is a Sanskrit word which means an auspicious moment. Typically it means the gifts you give in in occasion like marriage,birth etc . You can see the ad on youtube at www.youtube.com/watch?v=SvW2CtpWju8. An advertisement that touches the heart.

LIC Jeevan Shagun plan opened on 1st September 2014 to the maximum period of 90 days. LIC describes it as non-linked, with profit, single premium and money back policy. For more details you can refer to LIC webpage for LIC Jeevan Shagun ( UIN: 512N290V01)

How does the LIC Jeevan Shagun Plan works?

You choose the sum that you want at maturity i.e maturity sum assured (MSA). Based on this MSA and age of proposer premium will be paid one time only while the insurance or the policy will be for 12 years. If you survive the 12 years then after 10th and 11th year you will get some money back, also called as Survival benefit in Insurance lingo.

- The life insurance coverage is 10 times the Sum Assured ( This is mainly to avoid denial of tax benefit under Sec 80C which requires the minimum SA to be 10 times of Premium. In earlier plans it use to be 7-10 times.)

- You can claim 80C deduction for the amount paid as premium.In 2014 limit for investments and expenditures up get exemptions under Sections 80C, 80CC and 80CCC of the Income-Tax Act was increased from 1 lakh to 1.5 lakh. The financial instruments which enjoy exemption include life insurance premium, public provident fund, employees provident fund, National Savings Certificates, repayment of capital on home loan, equity linked saving schemes sold by mutual funds and bank FDs of five year maturity.

- Minimum age for person who can take insurance is 8 years and maximum age is 45 years.

- At the end of 10th policy year: 15% of the Maturity Sum Assured.

- At the end of 11th policy year: 20% of the Maturity Sum Assured.

- On maturity, called as Maturity Benefit,you will receive remaining 65% of Maturity Sum Assured along with Loyalty Addition also called as Bonus.

- Returns are tax free.

- Loan facility is available.

- SURRENDER VALUE: The policy can be surrendered for cash at any time during the policy term. The minimum Guaranteed Surrender Value allowable shall be as under:

- First year: 70% of the Single premium excluding extra premiums and taxes, if any.

- Thereafter: 90% of the Single premium excluding taxes, any extra premium paid and survival benefits, if paid earlier.

Ex: If a person aged 25 Yrs and buys LIC Jeevan Shagun policy for Rs 1,00,000 MSA.

- He will pay a premium of Rs. 52,803 only once i.e at beginning.

- After 10th year he will receive 15% of MSA i.e Rs 15,000

- After 11th year he will once again receive 20% of the Maturity sum assured i,e Rs. 20,000

- At end of 12th year the policy completes and he will get 65% of MSA i.e Rs 65,000 and some loyalty addition or profit . Assuming Loyalty Addition of Rs 300 per Rs 1,000 MSA he will get Rs 30,000 + Rs 65,000 on maturity.

Difference between Basic Sum Assured and Maturity Sum Assured

The sum assured is the amount of money an insurance policy guarantees that the policyholder will receive. This is also known as the cover or the coverage amount and is the total amount for which an individual is insured.Maturity value is the amount the insurance company has to pay an individual when the policy matures. So Maturity value includes the sum assured and the bonuses.Premium to arrive at Basic Sum Assured will not include the taxes you paid, any extra premium and is before applying rebate.

What about the insurance cover?

If one who takes the policy passes away before 12 years

- During first five policy years, his family will get Basic Sum assured i.e. 10 times the single premium paid.

- After five policy years to 12 years : family will get Basic Sum assured i.e 10 times the single premium along with Loyalty Addition, if any, shall be payable.

Understanding the terms associated with the Plan

LIC describes Jeevan Shagun polciy as as non-linked, with profit, single premium and money back policy. Our article Life Insurance explains these terms in detail.

- Single premium : you need to pay premium only once while the policy is for 12 years. Typically one pays premium during the tenure of the policy.

- Money back: You will get some part of money back during the 12 years. In LIC Jeevan Shagun policy at the end of 10th and 11th year.

- Non Linked : It means that it is NOT Unit linked Insurance Plan or ULIP which are life insurance and investment plans. In ULIP part of the premium paid by the customer goes towards providing the insurance cover and the balance is invested in venues of investment desired by the policy holder. These insurance plans double as mutual funds.In Unit Linked Insurance Plans(ULIP), the investments are subject to risks associated with the capital markets i.e linked to the stock market. But this plan is not linked to stock market.

- With Profit: Over and above the returns mentioned ,you also get an additional benefit in the form of reversionary bonuses. Typically, these bonuses are a percentage of the sum assured and are declared at the end of every year. Once declared they become guaranteed. These bonuses come from the surplus generated by the participating fund. The insurer is free to exercise its discretion, while declaring the surplus. However, once declared, the policyholder is entitled to get 90% of the surpluses, whereas the shareholders can keep up to 10% of the surplus.Such plans are called as Participating plans. Our article Bonus of Life Insurance Policies explains about Bonus in detail.

Comparison of LIC Jeevan Shagun with Fixed Deposit

Suppose a person of age 25 years invests in Jeevan Shagun policy for Sum Assured of 4 lakh. His premium is Rs 2,02.964

- After 10th year he gets 15% of 4,00,000 i.e 60,000 which he reinvests at 9% interest rate. So after 2 years he will get 71,690

- After 11th year he gets 20% of 4,00,000 i.e 80,000 which he reinvests at 9% interest rate. So after 1 year he will get 87,446.

- On completion of 12 years he will get Rs 2,60,000 from LIC Jeevan Shagun policy and 1,59.136 from his investment. Total 4,19,136.

- And he also gets Loyalty addition or bonus , lets say at the rate of Rs 250 per 1000 Rs of Sum Assured. So he will get 250 * 4,00,000/100 = 1,00,000 making total returns as 5,19,136 Rs,

If he invested premium amount of Rs 202,964 in Bank Fixed Deposit for 12 years compounding quarterly he would get (Typically maximum period for FD is 10 years but for simplicity let’s keep it for 12 years)

- At the end of 12 years he will get 590,552 Interest .

- Tax at the rate of 20% on interest received of 387,588 is 77,517.6 .

- Net he gets Rs 5,13,034.4 along with tax exemption under 80C and 10D and insurance coverage for 12 years

A simple Bank FD can beat Jeevan Shagun’s plan’s return easily. Please note also that insurance cover for him will get over at 37 years so he would need to go for more insurance and at age of 37 his premium would be higher than if he would have taken at 25 years.

Comparison of LIC Jeevan Shagun policy with Term Plan

If one has avail a pure term insurance then his premium would be less. If you take LIC Amulya Jeevan II For a Rs 3.12 lakh you have to pay annual premium of approx Rs. 700-800 while in online term plans it will be lesser. But in today’s scenario sum assured of Rs 3.12 lakh is not sufficient as it will meet only few months expenses.

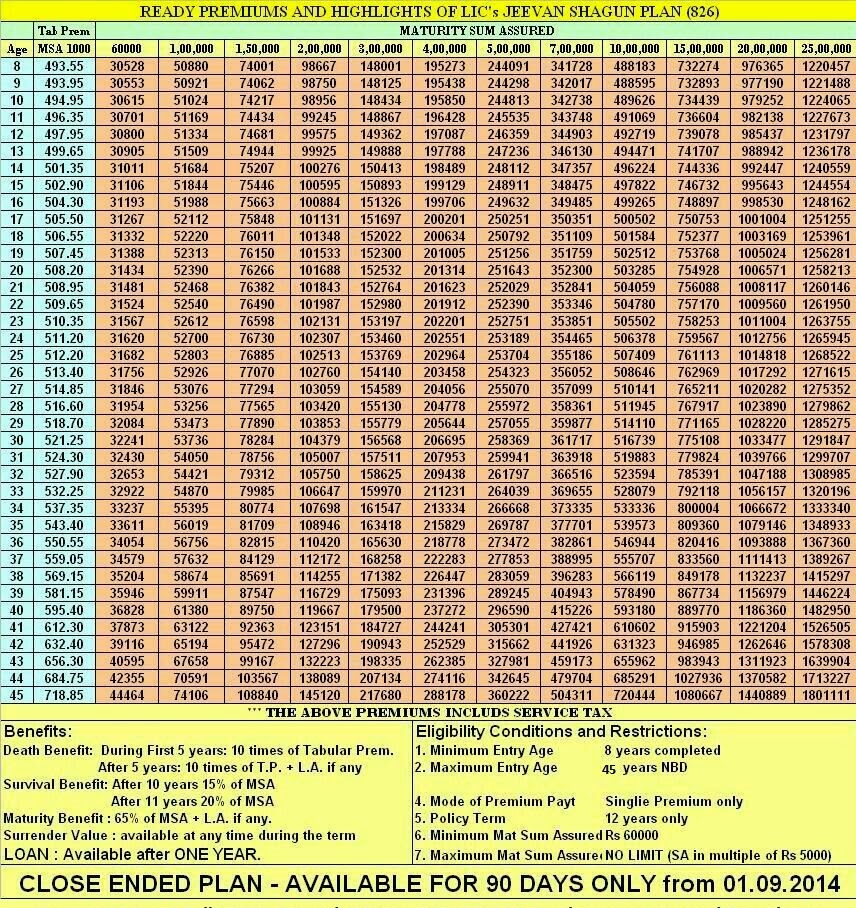

LIC Jeevab Shagun premium Table No 826

Premium that one needs to pay for LIC Jeevan Shagun policy is given below. Click on the image to enlarge.

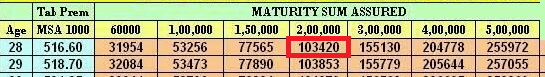

How to read the premium table

Maturity Sum of various amounts is across various columns and Age of the person to be insured is in rows. So if a person of age 28 years want to be covered for Rs 2,00,000 he would have to pay a premium of Rs 1,03,420 and for 5 lakh a premium of 2,55,972.

When should you buy Jeevan Shagun policy

- If you are happy with 7-8% return like FD than you can think of purchasing Jeeavn Shagun which gives you additional benefit of risk cover.

- Also when one looks at premium chart it seems that for younger buyers the premium is very less like 8 Yrs of age Rs. 1,00,000 MSA premium is Rs.50,880 but at the same time for 45 Yrs old the same MSA premium will be Rs. 74,106. This seems that if you want to enter into this plan then better to invest in the name of younger member of family.

LIC Jeevan Shagun policy was available from 1 Sep 2014 and is for 90 days only. So if you want to buy decide before 1st Dec 2014. You can go through Checklist for buying Life Insurance Policy.

Related Articles :

- Life Insurance

- Checklist for buying Life Insurance Policy

- Insurance : Surrender or Make policy paid up or Continue

- Mixing Insurance with Investment

- Basics of Insurance

What do you think about LIC Jeevan Shagun policy? Have you invested in it? Do you plan to invest in it? What do you think of the advertisement of the Jeevan Shagun policy?