Financial planners advise that one should carefully assess one’s need for insurance and the features of a policy before signing on the dotted line. A insurance plan bought in a hurry to save tax or sold by some insurance agent or a bank executive persuaded are common situations. What should you do if you have already bought an insurance policy? What are the exit options? Those who are wondering whether they should discontinue their traditional life insurance policies have the following options.

- Let the Policy Lapse

- Surrender the Policy

- Make the Policy Paid up

- Take loan against the policy

In this article we shall discuss these options in detail.

1.Policy Lapse:

If you stop paying your insurance premium it discontinues the policy, which in insurance terminology is called the policy lapse.

- One loses protection cover.

- In case of endowment, money-back policies, if you have paid the premium for the policy for less than three years and decide to discontinue it, you will receive no benefit for the money you have paid as premiums. In case of term plan you will not get any premium back at any time. The insurance company will retain all the premiums paid. You don’t get anything back and all your premiums paid go waste.

If due to ignorance or money crunch if policy gets lapsed one can revive it, called as Policy Revivals: The lapsed policy may be revived from the date of the first unpaid premium by making payment of the premiums in arrears along with interest on such terms and conditions as fixed by the Company. Revival is a fresh contract wherein the insurer can impose fresh terms and conditions. It varies from policy to policy, insurer to insurer Details for revival of LIC policy from LIC’s webpage guidelines for policy holders.

Letting the policy lapse might be the preferred option if you had bought the traditional insurance policy(endowment, money-back) just 1-2 years ago. You will have to forego the premium paid in the first couple of years, but it is better than continuing with it and compounding the error.

2. Surrendering the policy

Surrendering the policy means exiting from the policy before the maturity. It is the voluntary termination of the insurance contract by the policyholder before the maturity or premature encashment of the life insurance policy. On surrendering a policy:

- The life cover or protection ends.

- The tax benefit, if availed of on the premium paid till then,may be reversed if surrendered before premium has been paid for two years and 5 years for ULIP products after the date of commencement of policy.

- On surrendering before the maturity date the cash value that you receive is called the surrender value of a policy.

- Policies usually acquire a surrender value after premiums have been paid for three years.

- If any extra premium is paid towards Accident benefit etc, it is usually excluded.

- The surrender value is calculated by the insurance company depending upon the time for which the policy was in effect (the age of the policy), the total duration of the policy, the premiums paid and any bonus accrued.

- If the policy is in its initial stages (3-4 years old) the surrender value is only about 30% of the premiums paid plus any bonuses that may have accrued till then. The closer you are to the maturity date of your policy, the higher is the amount you get when you exit. Towards the end of its term, this can be as high as 80% of the premium. Even after three years, during the early stages of policy the surrender value is just a fraction of the total premiums paid.

The top three reasons for traditional policy surrender are: low bonus or benefits, wanting to get proper insurance through term life and better investment options. Our article Surrendering Life Insurance Policy covers Surrendering a Policy, Tax implications , calculating surrender value, how to surrender.

3. Turn it into a paid-up plan

When you make a policy paid up,

- You don’t have to pay any more premiums,but the policy is not cancelled.

- Instead the policy continues till maturity with a reduced Sum Assured. This means that you would be halting future contributions to the policy, but still let it run to maturity. The reduced sum assured is called the Paid up value of the policy.

- Paid up value is calculated as a proportion of premiums paid versus the premiums actually needed to be paid.

- If you have bought insurance policy with additional benefits such as future bonuses and dividends, these would be lost in such a policy. However, you would retain any bonuses paid out before you made the policy “paid-up” and would be paid on maturity( end of the policy term) or on death, whichever is earlier

- Riders such as Accident benefit and critical illness riders do not acquire any paid-up value.

- Many traditional products offer final additional bonus (FAB) as an incentive to stay with the policy. The FAB,if associated with your policy, given at the end of the policy term will not be given for paid-up policies.

LIC’s webpage for Bonus Information, LIC’s Bonus rates for 2010-11 (pdf)

Paid Up Value

Paid-up value is calculated by multiplying the original sum assured and the ratio of the number of premiums paid to the number of premiums payable.

Paid Up Value = Original sum assured * (Number of premiums paid / Total number of premiums that were required to be paid)

Total Paid Value = Paid Up Value + bonus.

For example Mr Mehta pays Rs 25,000 annual premium on a quarterly basis, and the sum assured is Rs 5 lakh for a policy term of 20 years. If he stops paying after four years,then

- As he pays quarterly premium Premium paid = 4* 4 = 16

- Value of premium paid = 25,000 * 4 = 1,00,000

- Total number of premiums he had to pay = 20* 4 = 80

- The paid-up value will be = Rs 5,00,000 X (16/80) =1,00,000

For example, a policyholder of age 25 years holding LIC endowment policy with a policy term of 10 years pays a premium of Rs 1,03,032 for Sum Assured(SA) of Rs 10 lakh. If the policyholder converts the policy to paid-up after paying five premiums, (Ref: MoneyLife)

- He would have paid Rs 5,15,160. (1,03,032 * 5)

- The paid-up value will be half the Sum Assured (SA), which is Rs 5 lakh.

- The paid-up value along with bonus declared till converting the policy to paid-up will be paid on death or end of policy term. The total bonus based on current bonus rate (of Rs34 per thousand of SA) is Rs 1,70,000. Please Note The bonus amount will depend on the actual declared rate , this is just an example

- The total paid on death or after completing the policy term of 10 years is Rs 6,70,000.

- The return on premium at the end of 10 years is 3.33%. If you had continued premium payment till the end of policy term, the return on premium would have been 4.73%.

Loan against the policy

Most of the traditional life insurance policies , especially endowment plans, have a loan feature which can also be used. An individual can avail of loans on all traditional policies, except moneyback plans, if he has paid premiums for at least three years.Private insurers may charge a higher rate of interest on the loan than LIC. Kotak Life is charging between 12%-12.5%pa.

- Interest rates: The interest rates vary from company to company.Insurers have their own criteria to arrive at the rate. Banks link it to their base rates. Banks, unlike insurers, do not charge a fixed rate-it depends on criteria such as the premium paid by the insured, the number of premiums paid. Interest rates of some of the insurers are From Business Today Loans on Life ( Jan 2012)

-

Name of Insurer Interest rate LIC 9% Bharti Axa 11% Kotak Life 12.5% Birla SunLife 13.5% ICICI Prudential 14.5% - Loan Amount : The amount of loan and way the loan amount is calculated is different for Ulips and traditional policies. It also varies from company to company.

- In traditional plans, you get the higher of the guaranteed surrender value or surrender value, also called the special surrender value. The guaranteed surrender value, which is the minimum amount available as loan, is 30% of the total premium paid minus the first premium amount.

- Thus, if you have paid Rs 25,000 as premium for four years and take the loan in the fifth year, the total you have paid is Rs 1 lakh. So, the minimum loan you can get is 30% of 1,00,000 that is, Rs 30,000.

- Unit-linked plans (Ulips): Not many insurance companies offer loans against Ulips. The loan amount depends on the current value of the corpus. If a Ulip has invested more than 60% assets into equity, you can get up to 40% of the corpus. If debt accounts for more than 60% assets, the maximum loan amount is 50% of the corpus.

- It also varies from company to company. For example:

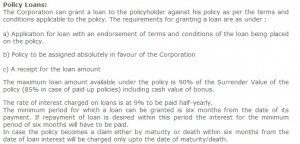

- LIC : The maximum loan amount available under the policy is 90% of the Surrender Value of the policy (85% in case of paid up policies) including cash value of bonus. Details here.

- For Bharti Axa The maximum amount of loan will not exceed 70% of the acquired Surrender Value. The loans given under the Policy are as per the Policy provisions. Details here.

- Life Insurance Corporation’s loans have tenures of at least six months. If you wish to repay before six months, you have to pay interest for the full six months. In case of death of the policyholder or maturity of the policy, the interest will be charged only up to the date of death or maturity.

- The first step is to ask the insurance company or the bank the amount you are eligible for.

- The next is applying for the loan and assigning the policy to the insurer/bank. This means all rights on the policy will be transferred to the lender.

- The loan is usually sanctioned in two-three days. But this may vary from company to company.

Difference between Surrendering and Making Policy Paid up

| Surrender a Policy | Make a Policy Paid Up | |

| Stop paying premiums immediately? | Yes | Yes |

| Get money immediately? | Yes -Fraction of premiums paid | No |

| Insurance cover continues? | No | Yes – for reduced amount |

| Get money at the end of the tenure? | No | Yes – the paid value |

How to check the ‘Surrender Value’ and ‘Loan Eligibility’ , Paid Up Value of your policy?

Contact your insurer/agent to find the Surrender Value, Loan Eligibility of your value.

From policy-wala How to check the ‘Surrender Value’ and ‘Loan Eligibility’ of your LIC policy online?

- Visit LIC and register as a new user or Click on Lic New User Registration (it’s free. Help on LIC’s Registration can be found on LIC webpage Registration)

- Login to your account and click “Enrol Policies” in the left menu.

- Click “Click to Enrol New policies” and click “Proceed”.

- Enter your policy number, premium and name of the insured and “Enrol your policy”.

- Once enrolled, click “View Enrolled policies”.

- From your policies list click “Click for details” under “Loan and Bonus” column.

- The surrender value and loan eligibility can be found there.

Note:

- I followed the steps, created the account and enrolled my policies but I was not able to get the Surrender Value/Loan Detail.

- From eHow How to Calculate the Surrender Value of LIC some references I found are: Sriraj Digital Magazine: LIC Policy Surrender Value Details, Blogsolute: Check LIC Policy Details Status and Pay Premium Online.

- InsureMagic gave me the details but I had to create a Free account on it.

- IIT(M) Prof,Pattabiraman M who runs Free Personal Finance Calculators, has written an excel Insurance Policy Surrender Value & Paid-up Value Calculator. Try it to get an idea of surrender value

- If you know the resource we would be obliged if you can share with our readers.

Related Articles:

- Mixing Insurance with Investment

- Surrendering Life Insurance Policy

- Life Insurance

- Basics of Insurance

In this article we covered the exit options that one has after buying a life-insurance policy. More on Surrendering the policy, and choosing the exit option soon. If you have information on surrendering /paid up/loan eligibility please share with us. Have you considered or used any exit options? If yes why?

Sir

I am Mr. nagaraj k,

i am taken LIC loan on may 2008 amount of Rs. 8999/-, due to some problems i not able to contineo the LIC premium, now surrendering the LIC bond,

Up to till date i paid is = 78570/- (July 2004 to Jan 2018 i paid the amount (485*162 months)

Loan amount is 8999/- (May 2008) i have not paid intrest + Principal from 2008 May

now they telling in LIC office after surrounding the amount is Rs. 30000/- correct or not

Kotak life is all fraud company, never opt any plan from them, LIC is Best to be with.

Why do you say so?

I have taken a policy Of Max life insurance and I paid only one. First premium in 2013 will I get my money back please suggest

I PAY MY FINAL PREMIUM FOR ICICI PRUDENTIAL LIFE INSURANCE LIFE TIME PENSION PLAN ON VESTING DATE 31/03/2014. I WANT GET FINAL MATURITY PAYMENT LUMPSUM,WHAT PRCEDURE

Hello sir.. .

If I stop my LIC policy …Can I get my full money back with Interset?

I paid 6 installments.

What type of LIC policy do you have? Term or Endowment or Money back?

Did you claim 80C anytime for premium paid?

Sir,

I am holding icici prudential life insurance cash advantage. Paid 3 full year premium money 30000 each year total 90000 till date.

I need to surrender my insurance. So i want to know that how much surrendered money i will get back?

I took a policy of 40,000 4 years ago.

1 year ago I took loan of 25,000 approx.

Now I want to end the policy.

how much money will I get back??deducting the interest amount and loan amount.

i hv pay only one instalment of maxlife insurance policy through axis bank.the instalment is Rs 25000/year.now i m not able to pay….is there not any solution…

Hi,

I am facing a strange problem. I have bought an insurance 4 years ago in the name of my husband. Now we are going through separation and procedure is underway. I have paid the premium for the last four years, but stopped since 5th year (2016). My daughter is the nominee (minor), and I am Appointee, as per the policy documents. Now I want to surrender the policy, but the insurance company is saying the owner will get the policy amount paid so far. Is there any way I could get my hard earned money back. Else whether I could transfer the same policy to my name, so that I can continue with the policy. The policy is an endowment education policy. I did talked to the policy agents, but not satisfied with theie response. Kindly help

I have total 03 policies from LIC. one policies from 2007 to till date,anther one policies june 2013 to june 2016 completed,anther one policies completed at two and half years completed i have paid all my monthly instalments but now due to financial problems ,so i want to discontinue for only one policies this policies total 50172 rs paid three years completed. can I get my 100% money back? how? reply me on my email id mangalasundari7@gmail.com and my mobile no 08106231953

sir..

i have joined in LIC from2013 and i have paid only that year. cUrrent years are pending with dUe and intrest till 2015 so its my request how to get back the amount that i ve paid during previous years and itsit possible to get back?

Due to financial problem i cannot continue plz help meout

Hi, I have Jeevan Saral policies, I have paid 4 years, every year it’s about 2.4 lakhs, 61000 Quarterly premium. I have paid about 10.5 lakhs so far and to surrender them I am getting only about 7 lakhs as 3 years rule applies. I have 3 instalments (1.83 lakhs) remained to complete 5 years. Can you please help me whether it will be a big difference surrendering policies after 5 years then doing it now? I was thinking if paying 1.83 lakhs doesn’t give me more money at the end of 5 years then there is no point of waiting. Thanks.

Yes there will be difference of 500,000, by paying 1.8 you will get maturity amount of 12 to 14 lakhs after two years. If you have urgency than pull the money out, otherwise you areoasing 3 lakhs approx that too the principl amount..

Hi,

I have a LIC Jeevan Anand 149 plan with 20 bonds policy term from 28 years – 48years. That is, only one bond gets matured in one year and so on. My first bond is expected to mature in 2039, 2nd in 2040 & so on…I started the policy on 20/12/2011. The agent is none other than my relative and they totally cheated me hiding all the details. I was told that the paying term will be 15 years and none of it was true. As I completed paying the policy for 4 years, I’m now thinking to opt for PAID-UP PLAN. I don’t know too much about it and I just gained some knowledge on it after going through your blog.

Request you to please suggest if paid-up plan is better to opt. If not, please suggest me other options.

Dear Santhu,

Iam also facing the same problem, the same 149 policy plan i also have,

So now iam also planing to surrender the policy. but Iam also waiting for some expert opinion. I consulted the LIC agent and office one year before but from their side, they are discouraging the surrender option.

So if you are getting any solution please share it to me.

My name- Vishnu

email:- vishuskec@gmail.com

I have 03 policies from LIC. from 2008 till december 2014 i have paid all my monthly instalments but now due to financial problems i want to discontinue. can I get my 100% money back? how? reply me on my email id – franzrathod007@yahoo.in & my mob – 09574310888.

Hi, I have a Aviva Life Shield advantage term policy, where the annual premium date is 27th Feb. I have already paid the advance premium now for year 2016. Now I need to surrender the policy. Is the advance premium amount refundable?

Hi,

I have taken Birla vision plan life insurance policy on 2012. I Only paid first and second premium. After that, i didnt paid any premium.Now I need the amount back that I paid. But company told that they never refund my amount. How can i get my amount back? Please give suggestion.

I have made one policy with Bajaj Allianz life insurance co. policy name :-

Bajaj Allianz New Family Gain II Regular premium on 18/02/2010 and paid

one premium only Rs.6,000/-, now I wants to draw the money. How I can get

the refund as the company appointed as agent one Chit Fund Company who collected several crores as premium for the Bajaj Allianz, after one year or Two both Bajaj Allianz and the agent Sri Dilip Kr. Verma shifted their Office some unknown place.

Hey,

I bought a Kotak premium money back plan last November 2015 paid premium 20000/ yearly I want to discontinue please suggest me the way

Did you buy the policy last year to save tax under section 80C?

Kotak Premier Moneyback Plan is a participating savings cum protection plan which provides lump sum cash payouts at regular intervals depending on the Policy Term and Basic Sum Assured chosen

As mentioned in our article Before Buying Insurance Policy to Save Income Tax

There is a Minimum lock-in period for policy to retain tax benefit under section 80C. So you need to pay the premium atleast for some number of years. The minimum time period for which the policy must be held by the policy holder in order to retain tax benefits on premium paid are:

For single premium life insurance policy – 2 years from date of commencement of policy.

For ULIPs – at least 5 years, for which premium has been paid, from start of policy.

For any other life insurance policy – at least 2 years, for which premium has been paid, from start of policy.

So if you have taken benefit of 80C you need to pay premium for atleast 2 years.

If you go through the Kotak Premier Moneyback plan brochure(pdf) then

• For 16 years term, the policy will acquire Surrender Value after payment of full premiums for

two consecutive years;

• For 20 yrs & 24 yrs term, the policy will acquire Surrender Value after payment of full premiums for three consecutive years. Surrender Value will be higher for Guaranteed Surrender Value or Special Surrender Value.

You can check the brochure for the Surrender value. In first year you will not get anything

Hi , I have 1 LIC policy Jeevan anand Policy for 15 years terms with a sum assured of 1,00,00,000 and premium of 7,50,000 per annum. I had been paid 3 years.

I have taken loan also Rs.7,50,000 from lic against my policy.

Now I wanted to discontinue with my LIC Policy Could you please suggest policy can be surrendered or may be converted to paid up.

give me policy no

Dear sir I WANT TO SURRENDER MY POLICY (LIC),BECAUSE I HAVE SOME DOMESTIC PROBLEM.I HAVE PAID A PREMIUM OF RUPEES 844 PER MONTH FOR THREE YEARS OR TILL NOW.

SO CAN U SUGGEST ME .HOW GET MY MONEY AND HOW MUCH. PL ANSER ME

WITH REGARDS,D.SASIKUMAR

Please contact your LIC agent/LIC office and get the details.

Sir, I purchased Max Guaranteed Income Plan Policy for six year term through Axis Bank and have paid Rs 1 Lakh as annual premium last year to sAve some tax bur this year I am not within the tax range and therefore want to discontinue. Please advise what should I do to save this money.Thanks.

Max Guaranteed Income Plan policy can be surrendered once it has acquired Surrender Value. The policy acquires Surrender Value as shown below:

For 6 years Policy Term – After payment of 2 full years’ Premiums

For 12 years Policy Term – After Payment of 3 full years’ Premiums

And Surrender value after 2 years is 30% of the annualised premium paid.

you will have to let go of the tax benefits earned this year. As per tax laws, if the policy is terminated before premiums for two years have been paid, the tax relief granted earlier will be revoked.

So you have to take a call whether atleast you want to continue the policy for atleast 1 more year.

Thanks for the reply. Will tax relief be revoked in case of polic ‘paid-up’ also or it’s just in case of surrendering the policy ?

Hi,

Need expert advise: I’ve 16 Jeevan Anand policy each with 1L sum assured. Each polic has different premium paying term (starting from 10 yrs to 26 yrs). Total premium for 16 policy is approx 1,10,000 and 3 premiums are paid so far. I also have another Jeevan anand with 5L sum assured for which 3 premiums are paid.I feel my LIC contribution is more that it should be and now i’m thinking to get rid of some policy, take term insurance and invest future premium in SIP instead. My monthly contribution to LIC and SIP is 57% and 43% respectivly. (By surrendering or making paid-up of LIC policy, I want to increase my SIP contribution) Pls advise.

Hi

I had bought a HDFC sap policy for 10 years with an annual premium payable Rs 1 lakh. The sum assured on the policy is Rs 840,000. I have paid 6 premiums already and my banker is advising me to put the policy on paid up mode and don’t pay rest of the 4 annual premiums because the returns not good.

Kindly advise what should I do?

Hi,

I had bought a half yearly money back policy in 2005 and paid the premiums for three years. Later I did not pay any premiums. On enquiring in the insurance office, I was told if I stop paying its equivalent to paid-up. Is that true? If not, what options do I have?

Thanks,

Shri

Hi,

I have taken a traditional money back policy for premium term payable for 5 yrs. I have paid premium for 4 years. if I want to surrender value what is the amount I will be getting.

Please note that when I contacted my insurance company they say only 30% of amount is payable and less 1st year premium paid.

Option if I pay my final premium then will I get complete 4yrs premium I paid or only 30% of that as well. Because I am loss of more than 1 lac Rs.

Please suggest best option. Your help in this regard is highly appreciable.

Regards,

Sunil

Hai I applied LIC insurance money back plan… I paid the one year premium 60000 for joining fee .. I paid may month .. I didn’t get any bond also… That agency still telling its under process only.. I don’t have trust on him… So j want to discontinue this plan.. So pls help me… How I cancel this plan? Could u pls share anyone strong point to inform to them.. Because they r telling right can’t able to cancel as well as money also will not be refundable… Pls help me… I need my amount….

I have term plan with bharti AXa ,e protect policy,i would like to know what unfortunate death means ,if death due to accident is covered or not .

What are things cvered in unfortuneta event of death in term policy,if it covers death due to accidentand others illness ,please clarify

Term insurance pays in case of an accidental death. The sum assured or cover taken under the term plan will pay the claim if the death has occurred due to any reason, be it natural or accidental death, or death due to some illness.

Which Lic policy is good to recover against home loan

THIS IS MY E-MAIL ID PLEASE REPLY ME AS SOON AS POSSIBLE.

cmanisha212@gmail.com

I WANT TO SURRENDER MY NEW BIMA GOLD POLICY (LIC),BECAUSE I HAVE SOME DOMESTIC PROBLEM.I HAVE PAID A PREMIUM OF RUPEES 2100 PER YEAR FOR THREE YEARS OR TILL NOW.

SO CAN U SUGGEST ME TO HOW TO GET MY PREMIUM BACK.

WITH REGARDS,

ANTHONY GURUNG

GANGTOK,SIKKIM

Hello,

My uncle invested in Market Plus policy (LIC) but owing to equity market slump he incurred massive loss on his investment. He was then told by his policy agent that he could recover the lost money if he followed what was advised by the agent. What followed was a regular discussion which was aimed at enticing uncle into the monetary trap by that agent. Finally , uncle did what agent wanted him by getting into a replacement policy (Jeevan Akshay-V1). However, later on he realized that the this policy does not have any survival benefit at all and he as well as nominee are entitled to get policy benefit post death. Clearly, he was misguided by the agent. Now, he is in need of a huge sum of money (planning to purchase a flat) and if somebody can guide him on the ways to recover the invested money that would be extremely helpful for him and would appreciate his help.

Thanks & Regrads

Shyamal

I am 24yrs old.I bought lic new jeevan anand policy in may 2015 sum assured 1000000 premium 4576/mnth in .I paid 4 Premiums But now i dont want to continue bcz this benefits and return is not satisfied.What should do plz guide me.thank u in advance

Have you received original policy? Whats your policy number? Need to know answer of these questions to answer you.

Hi

I am having a LIC jeevan saral and paying qly Rs.15312/- since 2009 Feb. Till date I have paid Rs.398112/-

I am availing a loan for Rs.2,06,000/-. On checking with the the LIC office, I received the following details

Loan amount Rs.2,06,000/- Interest 10,186/- balance surrender value Rs.63989/-. As per my present condition it is difficult to repay the amount atleast for another one year. If I keep for 10 years then I have to pay further 214368/- i.e. 14 installment @ 15312/- till Feb 2018. Kindly advice whether it is advisable to surrender or keep till 2018 feb

dear sir/madam

I have money back policy in LIC. Policy name “New Bima Gold-T.No-179″, Term policy 16 ,from the date 21/03/2012 ,i want discontinue this policy and withdraw my full paid money end of this term …so please giveme information how to withdraw with procedure

Hello sir

I have the Kotak life insurance money back plan.I want to discontinue this policy because of bad interest rates or less benefits . I just paid only a one premium of RS 25000 in September 2014. Please tell me what can i do either pay the premium of three years for Reduced paid up or shall I discontinue now . Please reply with which is benefit for my money. (Sorry for my bad grammar)

I have two money back policy in LICI. Policy name “New Bima Gold-T.No-179”, Term policy 16, Year of Date Oct’2006, I have already received two times money returned properly. But presently I have discontinue my policy last 2014. Please told me, if I apply for loan that policy. Is it possible. If possible then how many percentage(%) for loan is possible? or if I surrender that policy, how many percentage(%) returned me LICI?

I have taken a policy from BSLI “Vision Regular Returns Plan” and Premium is around 7000. I already paid 3 premium. If i plan to surrender my policy then how much i get back from company. As i already pay around 21500 rs.

Thanks in advance.

I have taken jeevansaral lic policy but due to job loss I am not able to pay the premium, Qtrly i was paying 34,000 Rs, I had paid 4 premiums 1.36 Lacs, my policy is lapsed since 2007,

Now to pay with late fee lic is telling i have to pay 10 lacs, i am worried what to do now ? I cant pay such amount .

pls guide me .

Hi , I have 2 LIC policies one is money back policy for 25 years with a sum assured of 8,00,000 and premium of 41065 per annum. I had been paying from last 6 years and other is jeevan anand policy for 23 years with a sum assured of 10,00,000 and premium of 44000 per annum . I had been paying for last 5 years.

I wanted to discontinue with one of the policy as i am planning to take other medical insurance policies. Could you please suggest which policy can be surrendered or may be converted to paid up.

Dear/ Sir,

I have one policy, i have diposite only 12 Premium( Monthly). After that i was not able to deposite premium. So i want to know, i can withdraw my deposite amount from LIC.

You have policy for one year only. Minimum 3 years premium is required to surrender the policy. Can you send me the policy copy? Let me check type of policy for the correct reply.

NIVVA

982012895

Hi, It is a great learning. But I was unaware regarding the things till the date I need to know a specific issue. let me tell you that.

I have a LIC Money back policy 20 years. I have paid 5 consecutive yearly premium approx 39500/yr. After 5 years got the money back of around 1.2 L. Now I want to withdraw my policy. I am unable to calculate how much I will get?

If anyone kindly help me regarding the issue, it will be great.

Thanking you in anticipation.

Why do you want to discontinue? There is other option is also available. You need to speak to me personally. After counselling I can guide you.

NIVVA

9820128395

I lost my original lic bond and the bond was assign(loan) by uco bank. Now what can I do for issue duplicate policy bond.

LIC POLICY bond is the main evidence for policy taken by the policy holder from LIC OF INDIA, so it is the most important document from LIC point of view.

If due to some reason (like: Shifting of house, white washing) it is misplaced and you are not able to locate it, no need to worry, you can get a new one (Duplicate Policy Bond) from LIC OF INDIA if you follow the below mentioned procedure and deposit the same in your home LIC BRANCH.

To get the Duplicate Policy Bond from LIC of India, follow below procedure –

Step 1- Advertisement in a Local Daily Newspaper

If the LIC Policy is due for maturity or survival benefit within 3 years and if the sum assured is more than Rs.25,000, an advertisement in a Local Daily Newspaper having wide circulation is required. But the requirement of advertisement and Indemnity Bond may be dispensed with or modified in certain circumstances as given below :

1- Loss of policy by theft

2- Destruction of policy by fire

3- Loss of policy while in custody of an office of government

4- Mutilated or damaged policy

5- Policy in torn and a part of it is missing

6- Policy partially destroyed by white ants

Step 2- Form 3756 on Stamp Paper

The Form No. 3756 matter should be printed on a non judiciary stamp paper of Rs. 100 (check appropriate value from the LIC branch) and get it notarized from notary and sign on each page.

Step 3- Surety

If the sum assured of your lost LIC policy exceeds Rs. 50,000, then you also need to submit Surety (Form No. 3807). The Surety declaration is only acceptable from the person of a sound financial status from the same area where you live.

Step 4 – Visit LIC Branch

You need to visit your LIC Branch (from where you had bought the policy) with photo id and address proof.

Step 5- Pay Duplicate Policy & Insurance Stamp Charges

Pay Duplicate Charges of Rs. 5 and Insurance Stamp Charges at prevailing rates.

New policy bond will be issued to you within few days time.

Note – If the policy bond is partially destroyed due to natural causes like, fire, flood, etc, the remaining portion may be returned as evidence of loss of policy to LIC, while applying for a duplicate policy.

Hi kirti.Can you advise me regarding one of my LIC ploicy please.I’ve got Jeevan Surabhi-15 years plan with minimum payment term of 12 years. I’ve been paying roughly Rs 1,05,000 every year from last 7 years.Total sum assured in this policy is Rs 10,00,000.Only this year i haven’t paid my premium as yet and current policy status is reduced paid up.I took this policy from one of my close relative without thinking about it and i do feel bit duped now about this policy.Can you please advise me what is the best option for me now going forward in terms of benefits.Shall i leave this policy on its current status as PAID UP or continue paying the premiums.Will really appreciate your and advise..Many thanks

Hi Mukesh,

Yu are paying this policy regularly.In this policy your cover is increases every 5 years. It is not advisable to close this policy. We need to check your liability and then I can guide you.

Madam/Sir,

I want to discontinue my policies No.735676588 and 731662383. I am in need of money and i am going to abroad. So requesting to give your feedback in my mail id.urgent please.

Sorry can’t help you . You need to get in touch with your agent or the insurance company

Hi,

You can avail loan against your policy instead of surrendering your policy. we do provide service to abroad also.

Dear Madam,

i have to withdrawal my LIC before maturity period

My policy is money back policy for 20 years period

almost 10 years+ i have complited .now i have to withdrawal my policy .

i can withdrawal? & discontinue .

Request you to please advice me.

Hello Sir,

It is difficult to advise without having the full picture.

Why suddenly you decided to withdraw? Do you need money? Is your life covered if yes by how much? etc

We can provide you link to FreeFincal Insurance Policy Surrender Value & Paid-up Value Calculator to help you arrive at paid up or surrender value. Hope it helps

Kriti we want purchage policy Pradhan Mantri Jeevan Jyoti Bima Yojana,

Pradhan Mantri Suraksha Bima Yojana & Atal Pension Yojna (APY) from HDFC Bank . my wife joint a/c with me name Kiran Devi(Voter-ID) Same HDFC BANK. but my wife Education document, Adhar Card, Pan Card name show name Kiran Kumari. please advise me purchage policy without a/c correction name wife OR first correction name than purchage policy above policy.

Sir it is better to have one name for IT purposes.

A doubt, do you want to purchase the Policy for her or for yourself?

I Have a icici pru GSIP plan.every month i give Rs 2437.This policy complete 3 yeras now i will not continue this policy can i suurender this policy and if i surrender this policy how much amount i get.

thanks

Regrds

Mohit Srivastava

Loads of Info! Thanks a lot…

Hi,

I had purchased LIC jeevan saral in 2010. I have already paid 3 yearly premiums for the same . However, I have decided now to stop paying the premimums . Can I consider the PAID-UP option now to be eligible for my policy ?

Dhiraj, LIC’s Jeevan Saral is a participating endowment assurance plan that provides you death benefit like a term plan and a maturity benefit at the end of the policy term. Also since it is a participating plan, it would participate in the profits of the company and get its share of the profits in the form of loyalty additions which are terminal bonuses payable along with death benefit or maturity benefit.

SURRENDER:

Surrender value will be greater of guaranteed surrender value or special surrender.

Guaranteed Surrender Value: This value will be available to you if you have paid the premiums for atleast 3 full years and is equal to 30% of the total premiums paid excluding the premiums paid in the first year and all the extra premiums and premiums for accident benefit/term rider.

Special Surrender Value:

· 80% of the Maturity sum assured if the policy is in force for 3 or more years but less than 4 years.

· 90% of the Maturity sum assured if the policy is in force for 4 or more years but less than 5 years.

· 100% of the Maturity sum assured if the policy is in force for 5 or more years.

You can contact LIC either through phone or email and find the surrender value, paid up value.

phone number webpage, email-id-webpage

Then think about why you want to exit the policy, do you have other protection. What will you do with the premium – where will you invest?

Don’t take a hasty decision but think carefully and then take a call.

This is very important information shared by you . Many would get benefit from this.

Thanks a lot Vishal for your kind words. We at bemoneyaware strive to provide such information in laymen terms!