Tax payers with an annual income of more than Rs 10 lakh will not get subsidised LPG anymore, the government announced on 28 Dec 2016. This article covers in detail about the decision of the Government for forcing people with income above 10 lakhs to give up subsidy, why was the decision taken, how will government find out taxable income of a person, how to declare your income online and offline?

Please Note:

- It is not clear whether only those who have income less than 10 lakh have to submit the HIG declaration or not. In online mode you have only one Option, selecting income more than 10 lakhs. But the form has declaration of income more than 10 lakh or less than 10 lakh.

- If husband or wife have income more than 10 lakh individually, the household is not eligible to receive LPG subsidy.

- As on 25 Feb 2016, online declaration of income above 10 lakh was available for Bharat Gas only at http://my.ebharatgas.com/

bharatgas/main.jsp?opt=hig and Indane at https://indane.co.in/hig_optout_inf.php - For non-online or offline or manual mode you can download HIG declaration form from here. We found it on HP Gas website here.

Table of Contents

Overview of LPG subsidy

Who gets the LPG subsidy?

Till Jan 2016 all households were entitled to 12 cylinders of 14.2-kg each at subsidised rate. There are 16.35 crore LPG consumers in the country, according to the government, of whom 14.78 crore receive the subsidy directly in their bank accounts.

Who will not get LPG subsidy?

The government has decided that the benefit of the LPG subsidy will not be available for LPG consumers if the consumer or his/her spouse had taxable income of more than Rs 10 lakh during the previous financial year computed as per the Income Tax Act, 1961. This was declared on 28 Jan 2015. In the assessment year 2014-15, a total of 20.26 lakh assesses were reported as having a taxable income above Rs 10 lakh, according to the Central Board of Direct Taxes data. The message is clear, if you are not going to give up your LPG subsidy on a voluntary basis, then it will soon be compulsorily taken away from you. ,

How will government find out the taxable income of a person?

The government is opting to trust the people, with the declaration of income above Rs.10 lakh being a voluntary move at the moment. Initially it is on self-declaration basis while booking cylinders from January 2016 onwards. The assumption is that once the Ministry of Petroleum and Natural Gas gets its hands on the full list of people declaring an income of above Rs 10 lakh a year from the Income Tax Department at the end of this financial year, this leeway will also be removed.

Why is government taking such a harsh step?

On March 27 2015, the government had asked “well-off people” to voluntarily give up using subsidised LPG and instead buy cooking fuel at market price. By Dec 2015 of the estimated 14.78 crore LPG consumers getting LPG subsidy around 57.5 lakh are reported to have given up access to subsidised fuel voluntarily. But that clearly is not enough, considering there are 16.35 crore LPG consumers in the country.

Such a decision will likely affect at least 60 lakh people, if one were to go only by the number of people who filed their returns in the government’s e-filing portal. The actual number would be much more. It would save the government Rs. 113 crore. , it is not going to receive brickbats from that section of society either.

Has government proposed cancelling the LPG subsidy before?

Yes The oil ministry under S Jaipal Reddy during the UPA-2 regime had drawn up a similar proposal as part of the overall plan to prune cooking gas subsidy on July 9, 2011. It had suggested asking anyone who owned a car, two-wheeler or a house; or figured in the income tax list to pay market price for cooking gas. The proposal was dumped almost as soon as it was put on paper due to stiff opposition from within the Congress and alliance partners.

How much will the government save on LPG subsidy?

During financial year 2014-15, the subsidy payout on LPG was estimated at Rs 40,551 crore. During April-September of financial year 2015-16, the subsidy outgo was Rs 8,814 crore. The total payout this year is expected to be far lower than last year as oil prices have receded sharply.

As on December 7 2015, according to Ministry statistics, a total of 52,58,841 consumers have given up or surrendered their subsidy. Taking into account the quota of 12 cylinders per consumer and the average LPG subsidy of Rs 184.93 per cylinder (in the Delhi market) for the period from April to September, 2015, the annual saving would be approximately Rs 1,167 crore.

How is/will the LPG subsidy saved is used?

The government thinks that people should give up their subsidies so that the less privileged would benefit. According to Petroleum Ministry , every LPG consumer who surrenders cooking gas subsidy is linked to a Below Poverty Line or BPL household that gets the LPG connection in turn. This, according to the ministry, enables the allocation of LPG to poor households and ensures that they replace the use of fuels such as kerosene, coal, fuel wood

Without the subsidy How much will be the increase in LPG bill of the household of a family?

The effect of removing this subsidy will, at current prices, mean an increase in the LPG bill of a household consuming 12 cylinders a year by just a little more than Rs 2,200, or about Rs.188 a month.

What are the subsidy that Government offers?

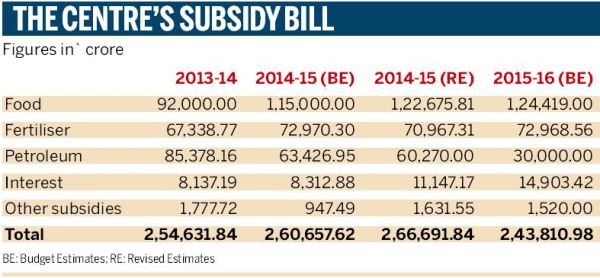

India mainly offers subsidy on food, fertilizer and petroleum. Image below shows Centre’s subsidy bill over the years,

- Food subsidy: Over the past decade, the government spending over food subsidy has drastically increased. This is especially so after the Food Security Bill, which promises essential food grains at cheaper rates for people in the low-income category. This is to ensure access to food for those who cannot afford a basic meal.

- Fertilizer subsidy: Fertilizer subsidy is given to the farming section of the population. Government provides subsidies to farmers in terms of reduced urea and other fertilizer costs. It also provides separate subsidies for irrigation-related activities.

- Petroleum subsidy: The government also sells fuel at subsidized rates. This included petrol, diesel, kerosene as well as LPG. However, the government has de-controlled petrol and diesel prices. Only kerosene and LPG – gas cylinders are sold at cheaper rates. The subsidies on the petroleum and diesel prices have varied over the past years. This is mainly because of the fluctuations in the crude oil prices worldwide. In the financial year 2015-16, this subsidy is expected to decrease because of the diesel price decontrol. The government could now utilize this money constructively for infrastructure development projects.

Why shouldn’t the well-to-do be subsidised?

Politically, the decision will win the government a lot of points with the poor, who will hopefully be the beneficiaries of the savings. Currently government’s estimates show that it spent as much as Rs 2.66 lakh crore on subsidies in 2014-15. With such a large subsidy bill, it is imperative to fix the two major problems plaguing most subsidy schemes in India: leakages and mis-targeting. Leakages refer to the phenomenon where the subsidy does not reach the intended recipient due to corruption, pilferage or a variety of other causes. This has been quite successfully addressed via the government’s decision to transfer the subsidy payments directly to the recipient’s bank accounts, something made easier with the Pradhan Mantri Jan-Dhan Yojana.

The decision to limit the LPG subsidy by income groups is an attempt to address the mis-targeting problem. By doing this, the government is trying to ensure that the subsidy is only going to go to those who need it. The hope is that rather than using the resultant saving simply to shore up the budget deficit, the Centre will use it to ensure that LPG connections are provided for those who still depend on firewood and kerosene stoves.

Why are people reluctant to give up their LPG subsidy?

It’s not the amount that one is worried about. Its a feeling of anger and frustration. Why should I give up subsidy? I am already paying so much income tax? Why are the ministers not giving up their subsidies. As one of my friend said on lines of famous dialogue by Amitabh movie Deewar,,who BTW has given up his LPG subsidy, “Jaao pehle use aadmi ka sign lekkar jo minister hai; pehle Tata, Birla Ambani Mallya ka signle lekar aao, Uske BAAD, uske baad, mere bhai, tum jahan kahoge main wahan sign kar doonga”

Original dialogue. “pehle us aadmi ka sign le ke aao jisne mera baap ko chor kaha tha; pehle us aadmi ka sign le ke aao jisne meri maa ko gali deke naukri se nikal diya tha; pehle us aadmi ka sign le ke aao jisne mere haath pe ye likh diya tha..ye.. Uske BAAD, uske baad, mere bhai, tum jahan kahoge main wahan sign kar doonga”

By asking citizens to give up their LPG subsidies, the Government intends to cut down its expenditure on subsidies and utilise it better to provide for the poor. However, a few questions that one has.

- Can the Government utilise this move for the best of benefits?

- Can we expect the Government to be transparent of its dealing with the PAHAL scheme?

- Will the Government be able to keep corruption out of this scheme?

- Can we expect committed expenditure to public infrastructure development like better roads, now that the burden of LPG subsidies is lessened by half?

Quoting from Firstpost’s article Dear PM Narendra Modi, here’s why I will not be giving up my LPG subsidy

Most of the people who Modi expects to buy expensive cylinders are already paying huge chunks of their income to the government, for cross-subsidising many of its social schemes.

Most of us pay 10 to 33 per cent of our salary as income tax, whose slabs finance minister Arun Jaitley did not bother changing even after berating the UPA for being unkind to the middle class. In addition, there are several other taxes—VAT, service tax, toll tax, house tax, municipality tax, garbage collection tax, cess for education, cess for Swacch Bharat, clean Ganga, fuel surcharge…the list is long. (A back-of-the-hand calculation would reveal that a person in the highest-tax bracket ends up paying nearly half of his income to the government.)

The government has almost withdrawn from school education, leaving the field open for the private players who overcharge us (another form of tax due to government incompetence). The government’s healthcare system has collapsed, where, again, private players are thriving. There is no form of social security for the old, handicapped, ill and the unemployed. The government doesn’t spend enough on keeping roads and streets safe for its citizens; it ignores the environment and does nothing to check pollution of air, water and other resources.

No, Prime Minister, we are already doing our best for nation-building. It is time the government repaid some of our generosity instead of asking for more charity through emotional atyachar.

You manage your finances, and let us deal with our kitchen and conscience.

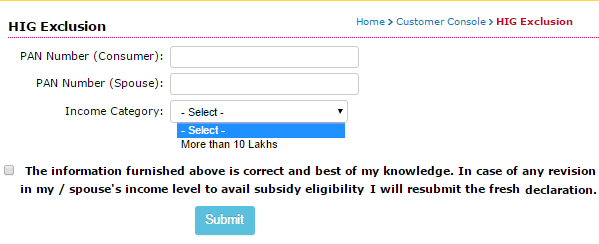

How to declare income for LPG subsidy?

You can declare income for LPG subsidy in two ways:

- You can do it online. Currently this facility is only available for Bharat Gas

- You can download the LPG High Income Group, HIG, declaration form and submit it to distributor.

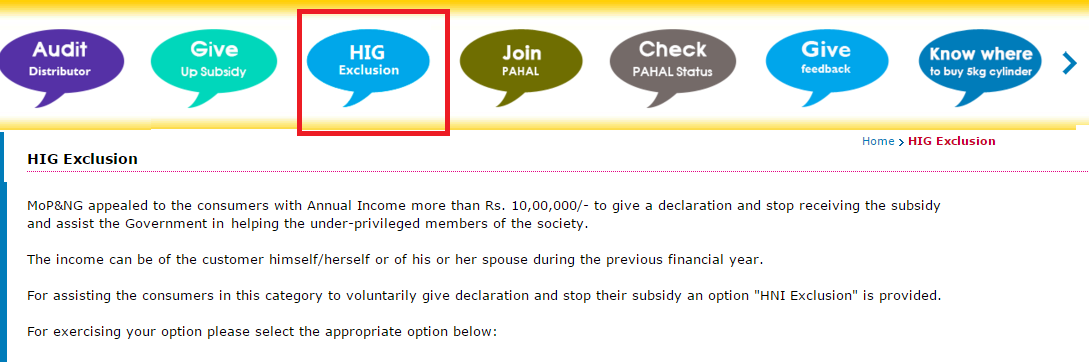

How to declare income for LPG subsidy online?

As on 17 Feb Online you can declare income for Bharat Gas online at http://my.ebharatgas.com/

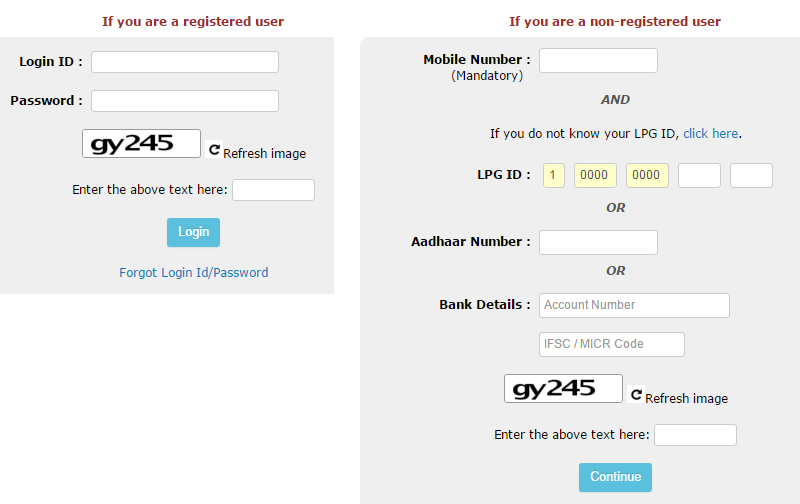

If you are registered user of Bharat Gas i.e you have opened an account at eBharatGas.com, then you declare

- Your PAN number and PAN number of your spouse.

- Select if your income is more than 10 lakh.

- Check the declaration for revision.

- Submit

http://my.ebharatgas.com/

If you are registered user i.e use online facilities of your LPG company or not, you login. If you are not you provide additional details as shown in image

If you are registered user you login,you will see details as shown in image below. You enter yours and your spouse PAN number, select Option more than 10 Lakhs, Check the declaration, the information furnished…, and Submit.

LPG Subsidy Income Declaration more than 10 lakh

How to declare income for LPG subsidy offline or manually?

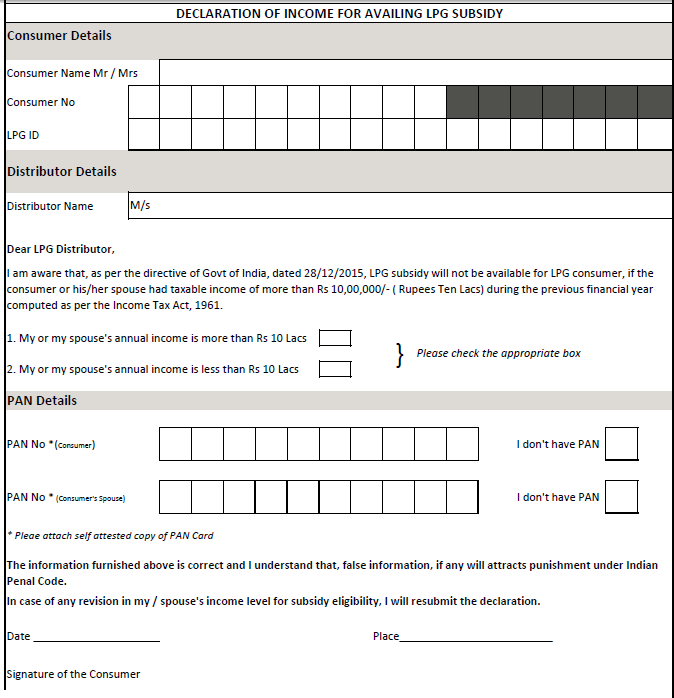

For non-online or offline or manual mode you can download HIG declaration form from here. We found it on HP Gas website here. Image below shows the form. While in online mode you have only one Option, selecting income more than 10 lakhs, the form has declaration of income for both more than 10 lakh or less than 10 lakh.

- LPG Subsidy and Direct Benefit Transfer Scheme

- What is LPG Subsidy

- How much to pay for LPG cylinder , How much LPG subsidy I will get

- LPG Subsidy and Number of cylinders : Verifying details on Distributor’s Transparency Portal

- Booking Tatkal Ticket

Useful information about Legal awareness and how to get LPG subsidy

Sir, my income for the financial year ended 2016 has reached more than 10 lacs due to arrears of my salary revision. while in the financila year ended it is below 10 lacs. I have not so far given up my indane subsidy. what should I do as per rules. Should I apply for giving up my subsidy.If I applied, and in later years my income comes to less than 10 lacs, would I be able to withdraw my option of giving up subsidy as My income would be below 10 lacs. Further it is taxable income after deductions such as 80 C etc. or gross total income. Please advise Sir.

I WISH TO GIVE UP LPG SUBSIDY. MY LPG DISTRIBUTOR DOES NOT HAVE THE SUBSIDY GIVE UP FORM . FROM WHERE DO I GET THE LPG SUBSIDY GIVE UP FORM ?

🙁

while booking the cylinder carefully i followed the IVRS Instruction at the time of booking the cylinder and the distributor said i might have pressed 1 to waive of the subsidy which is not correct as according to my Knowledge which i request the Indane distributor to allow me to avail the subsidy

I have not received the subsidy from last Cash Bill dated 20-07-2016 and 22-09-2016

Requesting you to do the needful at the earliest and please ensure that the subsidy for these dates are credited to my bank account as mentioned at the time of registration.

I have a query regarding the definition of income in this rule. Is it 10 lakhs ‘taxable income’ (after deductions) or gross total income?? The instructions on the website say ‘taxable income calculated as per Income Tax Act’. So, is it ‘taxable income after deductions such as 80C, 80D,etc,’ or is gross total income?? Please clarify. Thanks.

When it’s income tax it’s individually but in case of benifit cut it’s husband and wife combine income . Is this justify .

It’s NOT combined income of huband & wife. If any one of them has income more than 10lakhs, you will not get subsidy. For example, if your wife’s income is 6 lakhs & your income is 8 lakhs, you will continue to get subsidy. When anyone of you starts getting more than 10 lakhs annually, then you will not get subsidy.

Is it not unfair on family who has only 1 sole earner with income 10 Lakhs. Combine income of family is more than 15 lakhs will still received subsidy but not the other way

Yes ..life is not fair.

I have entered correct option of my income but the SMS I received has wrongfully excluded me from subsidy. What to do for correction?

Resubmit the application to your distributor with correct details.

My LPG new user ragistation this 1 month please give me my user please

Please contact your distributor

Unfortunately i choose wrong option in online income declaration & i excluded from subsidy.Is there any option for correction.

Fill the form again.

Unfortunately i choose wrong option in online income declaration & i excluded from subsidy.Is there any option for correction.

Fill the form again.

Dear Sir,

In online declaration there is an option for Income Category which displays selection and more than 10 lakhs. How the others, means less than 10 lakhs to submit declaration through online.

Dear Sir,

In online declaration there is an option for Income Category which displays selection and more than 10 lakhs. How the others, means less than 10 lakhs to submit declaration through online.

is it necessary to furnish both husband and wife pan no even though the connection was in one name

From what we have found yes you need to furnish both husband and wife PAN. Many have taken in name of wife who is home maker but husband would be earning more than 10 lakh.

is it necessary to furnish both husband and wife pan no even though the connection was in one name

From what we have found yes you need to furnish both husband and wife PAN. Many have taken in name of wife who is home maker but husband would be earning more than 10 lakh.

Unfortunately if i choose wrong option in online income declaration then is there any option for correction .

I have entered correct option of my income but the SMS I received has wrongfully excluded me from subsidy. What to do for correction?

Unfortunately if i choose wrong option in online income declaration then is there any option for correction .

I have entered correct option of my income but the SMS I received has wrongfully excluded me from subsidy. What to do for correction?