Investing in Mutual Fund online has become paperless. Association of Mutual Funds of India (AMFI) has rolled out a facility or rather transaction platform ,MF Utilities (MFU), through which you can invest across multiple fund houses using a common account number, in a paperless way. What is the MF Utility? How does it benefit the Mutual Fund Investor?

What is MF Utility?

MF Utility (MFU) is a shared services initiative by the Association of Mutual Funds in India (Amfi). With MF Utility, you can invest in direct plans of multiple mutual fund schemes across many fund houses using a single transaction. When you register for MF Utility you get a Common Account Number or CAN. The subscription to MF Utility is free. Official website of MFUtility is www.mfuindia.com.

Mutual Fund Utilities to allow direct plans also for online customers from January 1 2016.

How can one invest in Mutual Funds ?

There are many ways through which one can invest in Mutual Funds. You can invest in any mutual fund scheme either

- Online through online investment facility provided by AMCs or Distributor Platforms such as Fundsindia.com or 1-in-3 accounts websites such as ICICIDirect.com

- Offline through any financial intermediary or directly walking in any branch of the Mutual Fund Company. Financial intermediaries can be a bank, brokerage house or third party distributor or IFAs. IFAs (Individual Financial Advisors) are AMFI certified ARN holders, who can suggest balanced portfolio suitable for risk appetite of every investor.

- With the advanced technology, new platforms like smart phones and tablets are being used to doing online transactions while on the move.

There are few steps to follow while investing in mutual funds. Whether you decide to invest online or offline, you will require the following documents: Photograph, PAN card, Name and Address proof, Bank Account Details and KYC Compliance.

But platforms like FundsIndia, ScripBox and ICICIDirect allows one to buy Mutual Fund units online also and that too paperless?

Platform or sites such as ICICIDirect, FundsIndia, ScripBox allows one to buy Mutual Fund Units online. However, when you invest through these platform, you invest in regular plans of MF schemes. Direct plans have lower expense ratio since no distributor commission is paid and this enhances returns.

How does using MF Utility benefit Investor?

Today when an investor invests in a mutual fund, especially direct schemes, he has to apply separately for investment in each scheme. Suppose an investor wishes to invest Rs 2 lakh. Typically, he will be advised to divide the money among a few funds. Now assume that the investor decides to invest R 2 lakh divided in four funds. At present, he has to fill up four forms and provide cheques in the names of each of these schemes. However, ideally, the investor should not have to fill up four forms and the industry should not have to handle 8 documents, one form and one cheque for each scheme.Separate form and separate cheque have to be written for both the investments and form submitted to correct R&T agent(Karvy,CAMS for example, form of Reliance should be submitted to Karvy and Birla should be submitted to CAMS.) The customer should be able to fill up just one form and one cheque and the industry should have to handle only two documents. MF Utility (MFU) avoids all these hassles.

With MF Utility, you can transact multiple transactions of different Mutual Funds using a single form. Once a customer has opened an account with MF Utilities and obtained a Common Account Number (CAN), he can fill up just one form and state how his money is to be allocated among different schemes. For example if you want to buy multiple funds, you have to fill up a single form giving details of the schemes you want to purchase. You can pay the amount through a single cheque for Rs. two lakhs. Cheque to be drawn in the name of MF ESCROW ACCOUNT. This form you can submit in a single office of either of the R & T agents (Karvy/CAMS).

For Direct mutual funds one has to invest directly to the mutual fund and if you are investing in 3-4 different fund houses, you have to keep a record of different login IDs and passwords of 3-4 different websites. The mutual fund utility platform does away with this problem by providing a common investing platform for many fund houses.

How will having Common Account Number or CAN help retail investor?

When you register for MF Utility you get a Common Account Number or CAN. CAN is basically an universal folio. Today when you open an account with a mutual fund, it is called a folio. With one folio you can invest in all the schemes of a particular fund house. If you want to invest in a scheme of another fund house, you have to start another folio. CAN is similar to a folio but it is common for all mutual funds. With CAN you can invest in all the schemes of all mutual funds. The advantage for you is that you will have to remember only one number for all your fund investments. And you will not have to start a new folio each time you want to invest with a new fund house. So obtaining a CAN will allow the investor to have one common number for his investments across all mutual funds. Today, if he has invested with 10 fund houses, he has to keep track of 10 folio numbers.

Once a customer gets a CAN, all his investments in existing folios will be mapped to CAN. Tomorrow if he wants to invest more or redeem from his existing funds, he can do so via CAN. He won’t have to mention his old folio numbers.

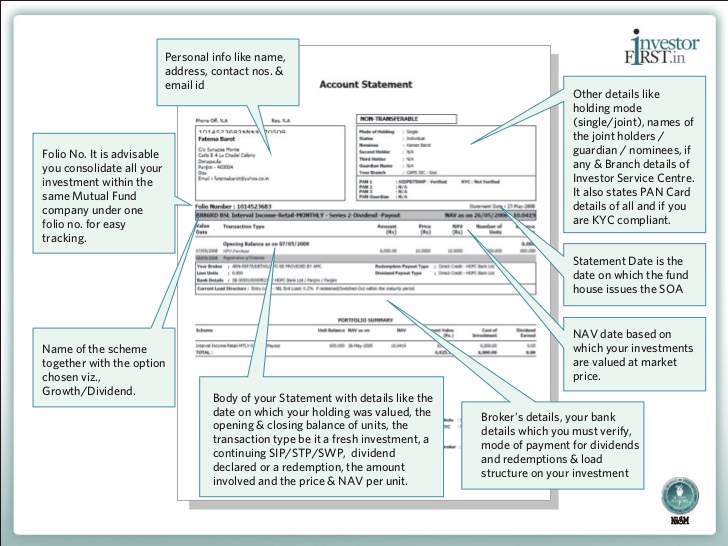

Every folio number contains a customer’s bank details. When you redeem your investment from a fund, the money is paid into that account. Today, if a customer has to change his bank account, he has to write to all the fund houses requesting for a change. With CAN he will have to write only one letter to MF Utilities. They will inform all the AMCs about the change. Image below shows a sample Mutual Fund statement with folio number.

Can one invest in SIPs using MF Utility?

MF Utility also allows to invest in five SIPs of different AMCs in one form.

What are the facilities or advantages of MF utility?

MF Utility (MFU) facilitates the following through the Portal:

- Common Account Number (CAN) registration for Investors

- Submission of documents to KRAs for KYC Registration for those investors who are seeking CAN creation

- Commercial transactions like Purchases, Redemptions and Switches

- Registration of Systematic Transactions like Systematic Investments (SIP) using a PayEezz Mandate, Systematic Withdrawals (SWP) and Systematic Transfers (STP)

- Non-commercial transactions (NCT) like Bank Account changes, facilitating change of address through KRAs etc. based on duly signed written requests from the Investors

Who is the promoter of MF Utilities?

MF Utilities was initiated by AMFI. All the Mutual Funds or Asset Management Companies (AMCs) who have signed up are equal shareholders in MF Utilities.

How many fund houses have signed up with MF Utilities?

Currently 25 out of 44 fund houses have signed up with MF Utility. These 25 AMCs account for 92% of the industry’s AUM and 95% of transactions.

How to Register with Mutual Fund Utility?

To access MF Utility, you need to get CAN (Common Account Number) activated. You can download the CAN registration form and submit the completed form at MF Utility Points of Service (POS). This is a one-time procedure and free of cost. Along with the application form one needs to submit

- PAN

- Proof of KYC, date of birth

- Proof of bank account for bank mandates registered under the CAN

- Proof of depository account

- Proof of guardian relationship (in case of minor applicants)

If you are not KYC compliant then MF Utilties India will facilitate the KYC registration for investors along with the creation of CAN. Download KYC registration forms

The existing investments of investors are not migrated by MFU. However, upon creation of a CAN, MFU will map the existing folios of the investors across mutual funds to the CAN, based on the PAN, holding pattern and other parameters.

What about investment made in different Modes of holding such as Joint Holding?

If you want to invest as an individual as well as a joint holder, you would need to apply for separate CANs. In case of joint holdings, a separate CAN is created for different combinations of investor holdings. CAN is provided for a combination comprising different number of investors 1, 2 or 3, order of holding, mode of holding (single, joint, anyone or survivor)and tax status.

What is PayEezz?

PayEezz is facility provided for investors to register a one-time bank mandate introduced by MF Utility in Nov 2015 which has made investing through MF Utility paperless. PayEezz, allows you to register your bank account with your Common Account Number or CAN. Thereafter, every time you invest, you don’t need to issue cheques. You just need to quote your PayEezz Registration Number (PRN) in your form and money will get debited from that bank account. Your distributor can quote your PRN in the form . You get the approval email and SMS, which you need to authorise for the transaction to get implemented. Once authorised, money is debited out of your bank account. This has made online investing paperless.

PayEezz works with a one-time mandate (OTM), which a few fund houses have also launched. However, unlike an MF’s OTM, which works only for that particular fund house, PayEezz works across all fund houses that are present on the MFU platform.

What is TransactEezz?

With TransactEezz, a facility provided by MF Utilities for distributors, distributors can create transactions online for their clients by logging into MF Utility (MFU). MFU takes an approval from the investor electronically over a mobile or an email registered under the CAN. Payment for subscriptions will be completed by the investor based on the payment mode chosen by the distributor at the time of creating the transaction; i.e. Net Banking, RTGS, NEFT or PayEezz.

What is the timeline of MF Utilities?

MF Utilities was launched on 21 January 2015. CAN forms were accepted from customers from then onwards. Transactions across India began from 4 March2015. MFU launched facility TransactEezz for distributors and PayEezz from November 05 2015. So far, 10% of the transactions have happened in liquid funds, and about 60% in equity funds.

For more information about the process, you can go through the official link MF Utilities India – Investor FAQs

Hi!

Is it possible to do a systematic transfer from a liquid fund to an equity fund using MF utilities?

Yes you can.

Login to MF Utility and on the menu select CAN Transaction STP as shown in the image below

Thanks ! Good useful article !

BTW, what is “Proof of depository account” ? I have sharekhan trading account. Can I use that demat account ? or Should I open new for MF Utility ?

You would have to get a new CAN number and then link Demat account if you want MF in demat form

MF Utility(MFU)is a shared services initiative of Association of Mutual Funds in India(Amfi). Using MF Utility, one can invest in direct plans of numerous mutual fund schemes across differing fund houses by utilizing a single transaction. On registering for an MF Utility scheme, you will receive a Common Account Number or CAN.

Is it wise to invest directly into mutual funds OR SIP is fine ?

Anirudh, investing through SIP is recommendable because when you start SIP, some amount goes monthly to buy your fund and you will be regular investor and you don’t have to remember buying fund every month. on other hand if you buy MF unit every month, there may be time you forgot to buy fund and your investment will not regular.

NOTE :- In SIP you direct your MF House to debit your bank account to buy MF unit every regular interval.

Thanks for the detailed answer. I really appreciate it.

I didnt saw any self service feature for retails investor on MFUtilities website, may be later they will itnegrate, but for now I found CAMS portal as single point for transactions in Mutual funds

Its fully functional now on mfuonline.com. You can invest through direct plan once you open CAN account and get log in id and password after online request to clientservices@mfuindia.com. Its very simple procedure to invest in mutual funds through direct plan.

Thanks Prakash, I requested for on line access.

Hi..is this platform open for retail investors now?

yes.. its free and open to all retail investors..Open CAN account get online access and enjoy free service to invest in mutual funds direct plans.

Thanks for sharing wonderful information

great article will help person to buy and invest in proper way in mutual funds thanks and share more with us

This is incorrect. We cannot *yet* invest in direct plans for retail investors. This looks like a platform for distributors and agents who will take commission. Has anybody gone direct through this platform? i doubt it.

VROL has a nice article on this recently: https://www.valueresearchonline.com/story/h2_storyview.asp?str=200119

Arun, you are correct. MF Utility is providing online facility to distributors, but not for retail investors. Dont know why? MF Utility/AMFI is concerned more about distributor than retail investor?

You are right Although MFU offers a way to invest in direct plans of fund houses, it has not yet opened the online and paperless investment facility for direct investors. If an investor wishes to invest in direct plans of fund houses, she will need to go to the R&T agent and submit the MFU-specified application form.