Umeed pe duniya kayam hai aur India ki umeed jugaad pe. Jugaad means quick fix, life hack or a shortcut. In the video, from Exide Insurance, given below, follow the protagonist in his endeavor to employ short cuts on a daily basis, only to see them fail. In a humorous manner, we see the different phases of his life, and his final realization that short-cuts aren’t the best solution and cannot win over long term planning. After all, Zindagi mein thoda Jugaad toh chalta hai, Lekin Jugaad se zindagi thodi chalti hai!

Table of Contents

Are there Shortcuts to Financial Security?

There are no shortcuts in life. While short cuts work sometimes, they aren’t always the best solution. For a long and happy life, you need to have the foresight for long-term planning. And there are no short cuts to achieve financial security. There are no get-rich-quick schemes that work. This is truly specific for financial planning because there are no shortcuts to making money. There are many types of get-rich-quick schemes such as trading, stock market secrets, and outright lies which people fall to.

In all such schemes we hear the promise of high and consistent above-market returns. While many of those may make money in short term,ex those starting in beginning of scam just as pyramid scam, short cuts is not a viable long-term strategy. For example Trading rules are recommendations, by individuals or generated by computers, for buying and selling stocks, mutual funds, and other assets. Those recommending them insist that you will be able to beat the market by using these rules. But most traders make very little money and waste a lot of time at the expense of their families and often their regular jobs. Think about the marketers’ motives. Ask yourself, if this secret is so good, why are they telling you? Why are the sellers not using these secrets to make millions themselves, why are they telling you. The biggest flaw is that they do not work consistently and taking supposed shortcuts is usually hazardous to your wealth. Remember If it seems too good to be true, it usually is! Remember how slow and steady tortoise won the race against the fast rabbit!

Why Should You have a Financial Plan

Planning is the key to successfully achieve what you set out to do, whether it is game, leisure, life or investing. Even activities as simple as going out to watch a movie become simpler with planning. Of course, there are things that you simply cannot plan for. But our financial future should definitely not be one of them. As Benjamin Franklin said “If you fail to plan, you are planning to fail!” Our article Money Book & Goals For a long and Happy Journey called Life talks about it in detail.

Do you have a plan. Most people would say yes. Let’s Consider the following two investment plans.

- Plan A. Buy investments that are expected to do well in the coming years. If some investments do not make money, sell them and buy others.

- Plan B. Buy and hold a well-diversified portfolio of low-cost investments that match my long-term financial needs and are within my tolerance for risk.

Which one best resembles your long-term investment plan? Does Plan A looks familiar? But look carefully is Plan A a plan or it is more of a wishes. It provides no definitive guidelines for what to buy or when to buy it, and there is no mention of risk or risk control. It does not specify how much money is needed to call an investment a success, or how long an investment needs to be held before you can conclude that it is a success or a failure. So making money is not quantifiable.

It is an important step to recognize that one needs to design a good financial plan that meets one’s long-term financial objectives. Creating a plan takes time, effort and patience. Good planning comes from learning and understanding the investments, basics of the asset allocation decision, and using that information to invest according to one’s needs and to meet one’s gaols. Most of us have a handicap that proper investing principles are not taught. Most people are self-taught, usually through trial and error which often turns expensive. So most people end up having randomly selected investments. Many try going to a professional for advice, but that is a hit-or-miss proposition. A large majority of investment advisors, not all, sell investment products that pay them commissions and fees.

But isn’t Financial plans only for people with lots of money, which they don’t know what to do with it, right? Actually, studies show that a comprehensive financial plan can benefit people at all income levels. So how does a good financial plan helps?

- It will help you define your financial goals.

- It will help you see whether your goals are realistic, especially for your timeline.

- It will help you see how you can bring your spending in line with your goals.

- It will help you identify your risk capacity

- It will help you find ways to maximize your money.

The way to make money in the market is the old fashioned way,to invest in a diversified manner for many years. Successful investing rests on three principles given below

- Development of a good investment plan,

- Implementation of that plan, and a

- commitment to follow the plan in good times and bad.

Can ULIP be an investment option?

Unit-linked insurance plans or ULIPs is an investment vehicle that offers dual benefit that is life cover and investment. The premium paid under ULIP is divided into two parts, where the first part goes toward cost of life cover, and the other is invested in funds where one can choose from equity, debt or hybrid funds .However, despite the dual benefits available under ULIPs, it was rejected by the investors lately due to higher charges. Insurance Regulatory and Development Authority (IRDA) took measures to clearly structure the ULIPs so as to make them more customer friendly. High agent commissions and charges were capped. Our article What is ULIP or Unit Linked Insurance Plan explains ULIPs in detail. Lets look at Pros and Cons of ULIP

Pros:

- ULIPs are transparent wherein you can control where your money is invested

- ULIPs give flexibility of multiple fund options

- ULIPs give protection benefit along with investment returns

- ULIPs gives option for staying invested for a long time thereby making your investment strategy more disciplined

However, ULIPs have the following limitations that one should consider:

- Lock-in period of 5 years

- ULIPs have fixed policy term and premium payment term therefore one should buy it keeping in mind a long term horizon

- ULIP, even though an insurance product, exposes investors to market risk to a large extent because of its market linked portfolio.

- it is recommended to separate the insurance i.e life cover objective with investment. One is recommended to buy a term insurance plan and invest into equity funds to meet the goal

Buffet or a-la-carte? That’s the choice you often make when you visit a restaurant. The fundamental decision that people need to take while buying a ULIP is whether this in line with your risk appetite and complements your other investments. Evaluate factors such as your current income, your dependents and your lifestyle in mind. if one is convinced to keep the two goals together or allocate a part of their investment then they could go ahead with the ULIP investment. If you have already bought sufficient insurance then you can explore ULIP. Also you need to have a good understanding of the various charges that are levied and need to keep a track of the performance over a couple of years.

Exide Life Wealth Maxima

Exide Life Insurance is offering ULIP Exide Life Wealth Maxima which adapts to offer higher life cover at every new phase of life. It provides the Power of 5,

Benefits of Exide Life Insurance are:

- 3 Plan options to suit your life stage needs. You can increase your life cover in same plan by moving from one plan option to another.

- In Maxima Invest, Life Cover = Higher of ( 10 times the Annalized Premium or Fund Value )

- In Maxima Family option, Life Cover = 10 times* the Annualized Premium + Fund Value

- In Maxima Child: In this option, in addition to life cover being paid immediately, you get additional benefit of premium funding i,e All future premiums are funded by the company on your behalf so that the plan still continues till maturity. On maturity, the fund value is paid to the beneficiary. Life Cover Amount Paid Immediately = 10 times the Annualized Premium

- Investment strategies to suit your investment style :

- You can choose from 6 funds.

- It also provides Automatic Asset Rebalancing Strategy: which automates the percentage of equity exposure your investments should have over the policy term- high in start of the policy and then gradually decreasing to conserve the fund value as you approach your goal on policy maturity.

No. of years to maturity Exide Life Prime Equity Exide Life Preserver 20 90% 10% 15 – 19 80% 20% 10 – 14 60% 40% 5 – 9 40% 60% 0 – 4 20% 80%

- Benefit from Top – Ups : This plan allows you to invest surplus money as top- up, whenever you want to.(Not allowed in last 5 Policy years)

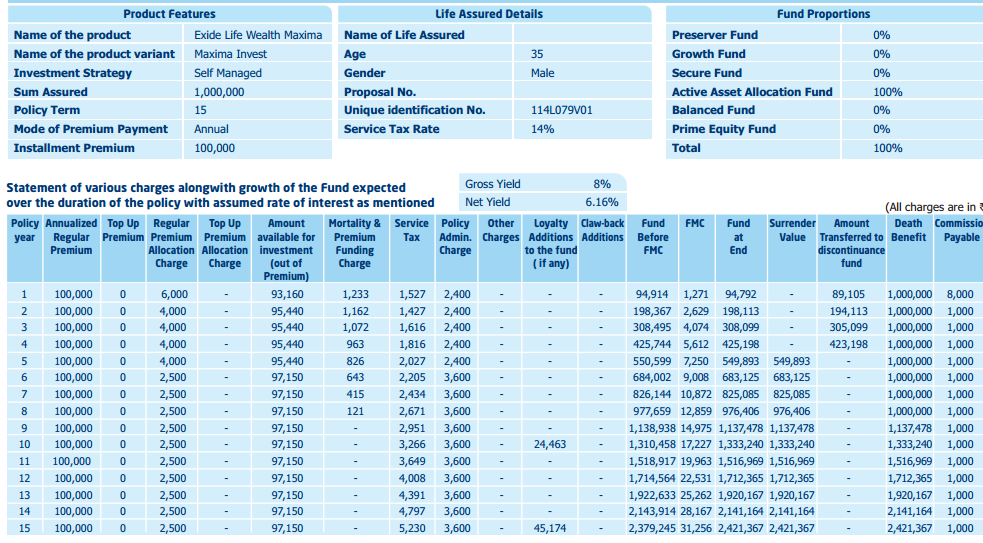

The various charges of Exide,growth,commission of Exide for Gross Yield of 8% are given below. Click on image to enlarge.

Note: This post is sponsored.

Do not trust your money to others without a thorough evaluation of any proposed investment and seeing if it meets your financial plan. And decide for #NoMoreShortCuts. Do you have a financial plan? How did you come up with your financial plan? Have you invested in ULIPs?

Very soon this website will be famous amid all blog people, due to it’s good posts

Very soon this website will be famous amid all blog people, due to it’s good posts

You are in control of how the food is made, what goes into it, and most importantly, how much

is served. Plus size lingerie has moved the undergarments from the fold of being bulky and ill fitting and has given it a new avatar of sleek, sensuous garments.

It is already obvious that Dressilyme is the best place to purchase 2

in 1 wedding dresses and discount formal dresses of different kinds.

You are in control of how the food is made, what goes into it, and most importantly, how much

is served. Plus size lingerie has moved the undergarments from the fold of being bulky and ill fitting and has given it a new avatar of sleek, sensuous garments.

It is already obvious that Dressilyme is the best place to purchase 2

in 1 wedding dresses and discount formal dresses of different kinds.

L’Afrique pour moi ce sont.

Test mail

L’Afrique pour moi ce sont.

Test mail

It is in reality a nice and helpful piece of information. I’m glad that you simply shared this helpful information with us.

Please stay us up to date like this. Thanks for sharing.

It is in reality a nice and helpful piece of information. I’m glad that you simply shared this helpful information with us.

Please stay us up to date like this. Thanks for sharing.

I have read some good stuff here. Definitely worth bookmarking

for revisiting. I wonder how a lot effort you put to make any such fantastic informative website.

I have read some good stuff here. Definitely worth bookmarking

for revisiting. I wonder how a lot effort you put to make any such fantastic informative website.