Many NCD’s like Muthoot Finance,IIFL are available for investment in current times. The companies issuing NCDs are promising double-digit rates, much more than bank Fixed Deposits or company Fixed Deposits. But what are NCDs? How do they compare against the Fixed Deposit.

Table of Contents

What are Debentures?

Debentures is a document that either creates a debt or acknowledges it, and it is a debt usually without physical assets or collateral. In corporate finance, the term is used for a medium-to long-term debt instrument used by large companies to borrow money and which acknowledge a debt obligation towards the issuer. Debentures are backed only by the general creditworthiness and reputation of the issuer. Both corporations and governments frequently issue this type of bond in order to secure capital.

What are Non Convertible Debentures?

Some debentures have a feature of convertibility into shares after a certain point of time at the discretion of the owner called as Convertible debentures. The debentures which can’t be converted into shares or equities are called Non-Convertible Debentures (or NCDs).

An NCD can be both secured as well as unsecured.

- Secured NCD : are backed by assets, in case the issuer is not able to fulfil its obligation, the assets are liquidated to repay the investors holding the debentures. Secured NCDs offer lower interest rates compared with unsecured ones.

- Unsecured Non convertible Debentures (NCD) : are not backed by any assets and if company is in financial crunch, there may not be able to pay back the bond holders.

So NCDs are debt instruments issued by a company wherein a company agrees to pay a fixed rate of interest on your investment for a specified period in order to raise money from market for business purposes, just like bank Fixed Deposits or company fixed deposit.

- Duration of NCD and rate of return are fixed at the time of issuing

- Interest on NCDs is paid at different time period like quarterly, semi-annually or annually. They also have an option of cumulative interest in which case interest is accumulated & paid on maturity.

- They are listed on stock exchanges so they provide liquidity to holder. However, there is normally not much volume for NCD. You might not be able to find a buyer for your NCDs if their trade volumes on bourses are insignificant.

- NCDs have to obtain credit rating from one of the rating agencies like CRISIL, ICRA, CARE or the FITCH Ratings India Pvt. Ltd . The minimum credit rating is P-2 of CRISIL or such equivalent rating by other agencies

Who can Issue NCD?

A corporate shall be eligible to issue NCDs if it fulfills the following criteria, For more details read RBI’s Issuance of Non-Convertible Debentures (NCDs)

- the corporate has a tangible net worth of not less than Rs.4 crore, as per the latest audited balance sheet;

- the corporate has been sanctioned working capital limit or term loan by bank(s) or all-India financial institution(s)

- has been sanctioned loans by banks or financial institutions which is classified as ‘standard asset’ and not as bad debt.

- The corporate shall disclose to the prospective investors, its financial position as per the standard market practice.

- The minimum credit rating should be P-2 of CRISIL or such equivalent rating by other agencies

Terms associated with Debentures or NCDs

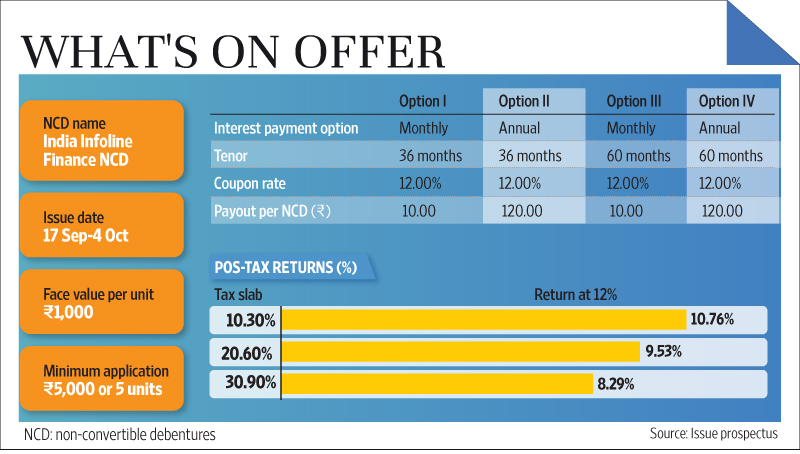

For example India Infoline Finance Ltd’s(IIFL) NCD from Livemint Get ready to take high risk if IIFL NCD

The face value (also known as the par value or principal) is the amount of money a holder will get back once a bond matures. A newly issued bond usually sells at the par value of Rs 1,000.

Coupon (The Interest Rate) : is the amount the holder will receive as interest payments. It’s called a coupon because in past there were physical coupons on the bond that you tear off and redeem for interest. The coupon is expressed as a percentage of the par value. If it pays a coupon of 10% and its face value is Rs 1,000, then it’ll pay Rs 100 of interest a year.

Maturity : The maturity date is the date in the future on which the investor’s principal will be repaid.

Issuer The issuer of a bond is a crucial factor to consider, as the issuer’s stability is main assurance of getting paid back.The rating system helps investors determine a company’s credit risk, it’s like report card for a company’s credit rating. Blue-chip firms, which are safer investments, have a high rating, while risky companies have a low rating. Ratings by agencies like CARE, FITCH, CRISIL, ICRA enables you to assess the quality of debt papers before investment

| Rating scale for Long-Term Instruments |

| CRISIL AAA (Highest Safety) |

| CRISIL AA (High Safety) |

| CRISIL A (Adequate Safety) |

| CRISIL BBB (Moderate Safety) |

| CRISIL BB (Moderate Risk) |

| CRISIL B (High Risk) |

| CRISIL C (Very High Risk) |

| CRISIL D Default |

Yield is a figure that shows the return you.If you buy with a 10% coupon at Rs 1,000 par value, the yield is 10% (100/1,000). At times Yield is referred to as yield to maturity (YTM). that shows the total return you will receive if you hold the bond to maturity. It equals all the interest payments you will receive (and assumes that you will reinvest the interest payment at the same rate as the current yield on the bond) plus any gain (if you purchased at a discount) or loss (if you purchased at a premium).

Post Tax Returns : Interest on NCDs is taxable. So, the post-tax return will be lower depending upon the tax slab the investor is in. For instance, in the above example, an investor in the 30 per cent tax slab who puts money in IIFL NCD would earn post-tax return of 10.76%. An investor in the 20 per cent slab would have a post-tax return of 9.53%. The higher the tax slab, the lower is the post-tax return.

Tax on Interest earned in NCD

- No Tax Deducted at Source (TDS) on listed debentures

- Interest earned through NCDs is taken as Income from Other Sources. It is clubbed with your income and taxed at your income tax rate.

- If one has opted for monthly, quarterly, annual payment it should be shown as Income from Other Sources of that year.

- If one has opted for cumulative option then one needs to show interest in the FY in which NCD matures.

- If you sell your NCDs on the stock exchange before a year then you will have to pay short-term capital gains .

- If the debenture is encashed after one year but before its maturity, you will have to pay long term capital gains tax on the effective return. Capital gains taxed at the rate of 10% without indexation of the cost of acquisition and at 20% with indexation, which factors in inflation

Difference between NCD and Fixed Deposit

Predominantly, there are two types of risks associated with the fixed income instruments. The interest rate risk and the default risk.

Say that interest rates are bound to decrease. In this case, the investor would benefit as bond prices would increase. But he would lose out on higher future interest income as interest rates now, have been lowered. This affects all fixed instruments

The default risk is a risk of non-payment of principal and interest by the bond issuing company. Rating agencies typically analyze the financial health of bond issuers and assign a rating to them. This helps investors in gauging the default risk associated with the company’s debt. Lower the rating, higher the default risk and higher the interest rate. A higher interest rate is offered to compensate for the risk associated with the company’s debt. Thus, it should be noted that companies offering higher interest rate on their debt are not necessarily best investment avenues.

Non-Convertible debentures (NCD) may deliver returns higher than bank FDs but they are more risky. They are not very liquid as the trading volume is low. Invest here only if you are willing to take a risk for extra return. The following table shows Difference between NCD and Fixed Deposit

| Description | Bank Fixed Deposits | Non Convertible Debentures |

| Issuer | Bank | Companies or Corporate |

| Safety | Highly safe, up to 1 lakh insured against insolvency | Can be secured against the assets or unsecured.

Generally issued by leading companies |

| Liquidity | Easy liquidity through loan against banks or break the FD by paying penalty | Not very liquid, based on demand. Can be liquidated only by selling on the exchange |

| Tenure | Flexible from Few months to Few years | 3-5 years |

| Availability | Easily Available any time | On public offer or through stock exchange |

| Taxation | Interest income will be added to the income | Interest income will be added to the income. Also capital gains tax if sold before maturity |

| Tax Deducted at Source | TDS for interest above Rs 10,000 | No TDS |

Difference between NCD and Tax Free Bonds

The following table shows Difference between NCD and Tax Free Bonds

| Description | Tax Free Bonds | Non Convertible Debentures |

| Issuer | Public sector companies | Companies or Corporate |

| Safety | Issued by Public sector companies which have government backing | Can be secured against the assets or unsecured.

Generally issued by leading private companies |

| Liquidity | Not very liquid, based on demand. Can be liquidated only by selling on the exchange | Not very liquid, based on demand. Can be liquidated only by selling on the exchange |

| Tenure | Tax free bonds are generally of 10, 15 or 20 years | 3-5 years |

| Availability | On public offer or through stock exchange | On public offer or through stock exchange |

| Taxation | Interest income is tax free | Interest income will be added to the income. Also capital gains tax if sold before maturity |

| Tax Deducted at Source | No TDS | No TDS |

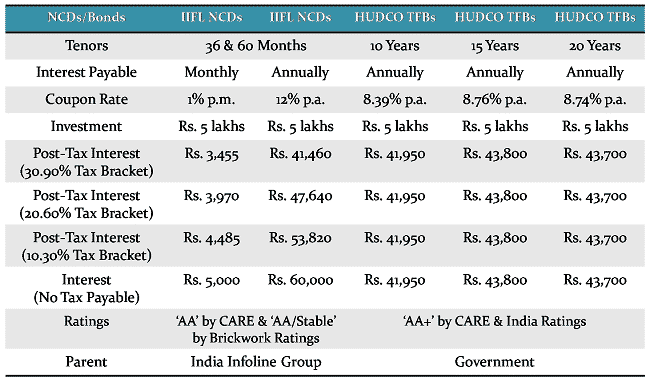

The following image from Onemint shows the comparison between Tax Free Bonds and NCDs

The decision to invest in any of the above instruments should be taken keeping in mind your tax bracket and existing portfolio. For a person falling in 30% tax bracket, tax free bonds might be a better option but if he/she is looking to diversify the portfolio from tax free bonds, NCDs can be good option. From a return perspective for people falling in lower tax bracket NCDs are the best options but as the risk in these instruments is high they should limit their investment to not more than 20-30% of their fixed income portfolio.

How to Invest in NCDs?

You can buy NCDs when they are open for public issue and afterwards from the exchange

- Public Issue: During the public issue of the bonds, you can invest in them by submitting a physical form furnishing the details as requested. If you have a you can make an investment online & enjoy the ease of investing

- Exchange: Post the public issue; these bonds are listed on NSE or BSE or at times on both. You can invest in these bonds through your Kotak Securities trading account the way you invest in shares.

Before you invest in NCD

- NCDs meant for those with higher risk appetite. Bank FDs safer than NCDs, debt funds more tax-efficient. If the person’s risk appetite is small, one should settle for a FMP which may give slightly lesser returns than an NCD, but with almost negligible risk attached to it.

- Before investing in an NCD issue you need to look at the company’s credit quality and its payback records in previous issues. Avoid investing in an NCD which doesn’t have a minimum grading of AA

- Liquidating investments in NCDs could be difficult.

- Option of holding bonds in Demat Form makes them easy to handle & monitor

To find how NCDs which were issued earlier doing you can check NSE Watch

Debentures and fixed deposits are two different ways of investing money. NCDs provide you the opportunity to earn 2-3 percentage points higher return than other fixed-income instruments such as bank fixed deposits. If you want a regular income from NCDs, you can pick those that pay interest on a monthly, quarterly or annual basis. If you just want to grow your wealth, you can opt for cumulative option where the interest earned is reinvested and paid at maturity.Use them wisely to diversify your debt portfolio

Related Articles :

- List of Articles for Investing

- Beginner To Investing

- Ways to invest in Gold

- Understanding Public Provident Fund, PPF

- Stock Market Index: The Basics

- Investing in Mutual Funds for Beginner

Have you invested in NCDs? Do you plan to invest in NCDs?

I encashed the secured non convertible debenture after 15 months of its due date of maturity. The Company did not pay interest for the said 15 months while making payment for the maturity value.

Is it correct on the part of the Company?

Am I eligible for the interest for the said 15 months. If so what provisions/Rules/Guidelines of authority.

Please help me

Interest on NCDs is paid at different time period like quarterly, semi-annually or annually. They also have an option of cumulative interest in which case interest is accumulated & paid on maturity. Which option did you go for?

Good Info..

Thanks Paresh!

Good Info..

Thanks Paresh!