National Pension System (NPS) is a defined contribution retirement savings scheme. The NPS has been designed to enable systematic savings during the subscriber’s working life. It is an attempt towards finding a sustainable solution to provide adequate retirement income to every citizen of India. NPS is similar to the 401k plan offered for employees in the US. This article covers all information about NPS, gives overview of NPS, returns of NPS, How to open eNPS account, Tax Benefits on NPS.

Table of Contents

Details of NPS

Link to Following articles covers the topic in detail.

Overview of NPS

The NPS was launched on the 1st of January 2004 and was aimed at individuals newly employed with the central government, but not including ones in the armed forces. From the year 2009 however, the NPS was made open to every Indian citizen between the age of 18 and 60 . Even NRIs can invest in NPS.

- You contribute a certain sum every month during your working years, which is then invested according to your preference.

- You can then withdraw the money when you retire, which is currently set at 60 years old.

- Investment is according to investor preference, It mean one can select from different options

- Under the NPS, an individual’s savings is pooled in a pension fund.

- These funds are invested by Pension Fund Regulatory and Development Authority (PFRDA) regulated professional fund managers as per the approved investment guidelines in the diversified portfolios comprising of government bonds, bills, corporate debentures, and shares.

- Unique Permanent Retirement Account Numbers (PRAN) is allocated to each subscriber under the NPS at the time of their joining.

- Subscribers are also allocated two accounts, which they can access at any time

- Tier I Account – Under this account, withdrawals are not allowed. It is solely meant for savings after the subscriber’s retirement.

- Tier II Account – Under this account, a subscriber is free to make as many withdrawals as he or she likes at any time, similar to a regular savings account.

- These contributions would grow and accumulate over the years, depending on the returns earned on the investment made.

- At the time of a normal exit from NPS, the subscribers can withdraw only 60%. 40% has to be used to purchase a life annuity from a PFRDA empanelled life insurance company.

- NPS provides seamless portability across jobs and across locations, unlike all current pension plans.

- NInvestment in NPS is independent of your contribution to any Provident Fund or any other pension fund.

- NPS is distributed through authorized entities called Points of Presence (POP’s) . One can also transact in NPS online only.

- The contribution for NPS and interest earned are eligible for deduction while withdrawals are taxable.

The National Pension System (NPS) has managed to generate decent returns in 2016. Although its equity plans remained lacklustre, it was compensated by a good performance by the government bond plan and the corporate debt plan. If one assumes an asset allocation of 50% equity, 25% government bond and 25% corporate debt, the average NPS returns for 2016 work out to be 9.47%, better than any other competing products.

The NPS was able to outperform its benchmarks and also similar mutual fund schemes. For example, the average one-year returns for the equity plan is 3.75%, higher than 2.16% generated by the benchmark index, Nifty , and 1.88% by the large-cap equity funds. The similar pattern is visible with the government bond plan and the corporate debt plan.

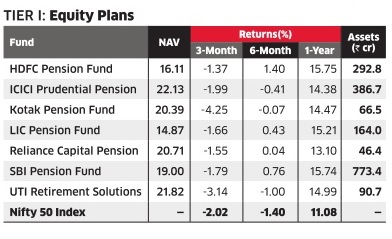

There are only seven NPS fund managers at present and the table below compares their performance for Equity Plans. For more on NPS returns please check our article Returns of NPS

Negatives of investment in NPS

- Liquidity is one of the important facets of any investment. In the NPS you will not be able to withdraw until the age of 60 except if you contract a critical illness or are buying or constructing a house.

- The entire income stream from the NPS, the lump sum, and the pension is fully taxable, except the portion actually used to purchase the annuity. Furthermore, annuity payouts i.e pension are also fully taxable. Comparing this with investments in equity and equity mutual funds which at least at present are exempt from the long-term capital gains tax. The PPF also does not suffer any tax on withdrawals.

- The worst clause is when you withdraw after the age of 60, 40% of that corpus has to be compulsorily used to purchase an annuity from a life insurance company. But, if withdrawal is done before that, then a staggering 80% of the accumulated capital must compulsorily be used to buy a life annuity and the balance of 20% can be utilised by the account holder for any purpose. Annuities are high-cost, low-return products of life insurance companies, excellent for the agents and companies that sell them.

- Even for a very long time horizon, a maximum of only 50% allocation to equity is permitted, even if the investor wants a higher equity allocation.

- While much is made of the very low fund management charge, there are multi-level charges at various offices and levels of the NPS system, the cumulative effect of which make the NPS is a far more expensive system than appears at first glance.

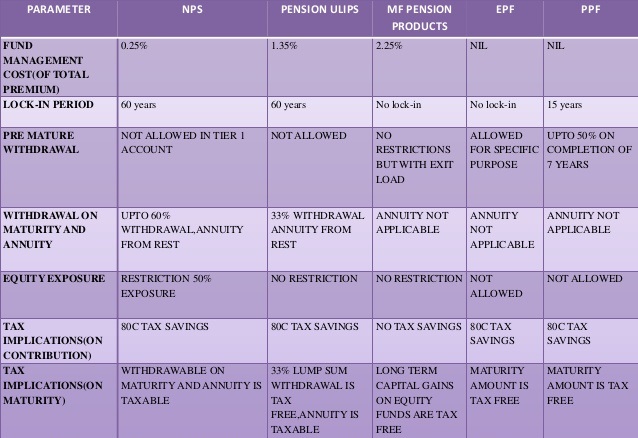

Comparing NPS with EPF, PPF, Pension Plans

New Pension scheme being a retirement plan one end up comparing with various other government pension schemes(like EPF,PPF) and linked pension schemes(private pension linked products) available in the market. Defined benefit scheme means a certain amount of benefit is defined at the beginning while in defined contribution schemes, a certain contribution is defined by both employer and employees The given table shows the various parameters on which the different pension schemes available in the market are differentiated.

NPS Tier 2 Account

NPS comes with two accounts: Tier I and Tier II. Tier I is the retirement account which gets a host of tax breaks, whereas NPS Tier II is a voluntary account is like a mutual fund, meaning there is no lock-in till retirement and money can be withdrawn any time thus offering greater flexibility.

The fund management charges of NPS Tier II plans are barely 1% of the cost of the average direct plan. For managing an investment of Rs 1 lakh

- A regular mutual fund charges Rs 1,500-2,500 per year

- A direct mutual fund charge 0.75-1.5%—or Rs 750-1,500 per year

- But NPS Tier II charge only 0.01%—or Rs 10 per year for managing an investment of Rs 1 lakh.

The ultra-low costs mean higher returns for investors. NPS Tier II plans have outperformed mutual funds of the same vintage by .7-2% across different time frames.

Despite the obvious advantage of higher returns, very few investors have put money in NPS Tier II plans

Our article NPS Tier 2 or Tier II Account: Performance,How to open,Withdraw discusses Tier II account of NPS scheme, its distinctive features, pros and cons of investing in NPS Tier II,taxation and withdrawal on Tier II account, along with returns from investment in NPS Tier 2 account.

Related Articles :

Your blogs are very helpful specially the one on RSU.

One quick observation, there is an option to increase the equity exposure up to 75% under AUTO AGGRESSIVE CHOICE of NPS.

You may wish to verify and edit the details.

Thanks.

Thanks.

Will update

National pension scheme defined contribution retirement savings scheme designed to enable the subscribers to make optimum decisions regarding their future through systematic savings during their working life.

Where should i submit iss form?