After the death of a loved one, family is usually in deep turmoil and legalities can compound the turmoil. The right paper work goes a long way in getting YOUR money to THOSE you love. This post is about what paperwork is required for Bank accounts, Term Deposits and Locker or Deposit Boxes such as the Safety Deposit Box Manchester after the death of the account holder(s) so that family is not left running from pillar to post, trying to gain access to the money which, in many cases, could be the only saviour from doom. This post is part of the series: Right Paper Work For those you love.

Note:This posts assumes that you know about Joint Accounts, Nomination and Will. Our earlier posts Right Paper Work For Those You Love: Part 1 and Will: Right PaperWork For Those You Love-Part II deal in depth about these concepts.

Claims after the death of the holder are settled according to The Model Operational Procedure(MOP) for Settlement of Claims of Deceased Depositors published by Indian Bank Association(IBA). Let’s see Question and Answer about Joint holding of savings account that appeared in Economic Times 7 Jul 2011

If one of the joint holders of a savings account dies, what should the survivor(s) do? Is it necessary to close the old account and open a new one in the name(s) of the surviving holder(s)? Or can the survivor(s) continue to operate the old account by getting the name of the deceased removed? In case the bank is not informed of the death through oversight, omission, commission, etc, are the surviving members liable to any legal action? How are the members protected?Venkatesh P

The Model Operational Procedure for Settlement of Claims of Deceased Depositors published by IBA for adoption by banks states that in case of a joint account opened on an ‘Either or Survivor‘ or ‘Anyone or Survivors‘ or ‘Former or Survivor‘ or ‘Latter or Survivor‘ basis, the bank will permit the surviving account holder(s) to have unimpeded access to the credit balance in the account for withdrawal if one of the co-account holders dies.

Also, the balance outstanding will be paid jointly to the survivor(s) on verification of proof of death of the depositor . It, however, does not specify whether the account has to be closed or if the account can be continued by deleting the name of the person who has expired . The banks have their own internal guidelines in this regard.

Let’s examine the answer in detail.

Table of Contents

Indian Banks’ Association and MOP

Indian Banks’ Association (IBA), was formed on 26 September, 1946 as a representative body of management of banking in India. With an initial membership of 22 banks in India in 1946, IBA currently represents 150 banks (Public sector, private sector etc)operating in India. IBA was formed for development, coordination and strengthening of Indian banking, and assist the member banks in various ways including implement-ation of new systems and adoption of standards among the members. For more on IBA one can read wiki and indiamart.

Claim for Single Savings/Current Account with Nomination

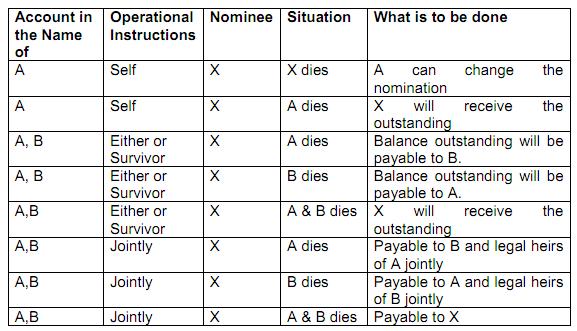

Settlement of Claims in Various types of Operational instructions for Saving or Current Account

Last row of the table: If account is in the Name of A and B and it is Joint account(Operational Instruction Jointly i.e signatures of both are required) , Nomoniee (X) has been specified and the situation happens that both A and B die then in such a case the balance outstanding will be paid to the nominee on verification of his/her identity (such as Election ID Card, PAN Card, Passport etc.) and proof of death of depositor.

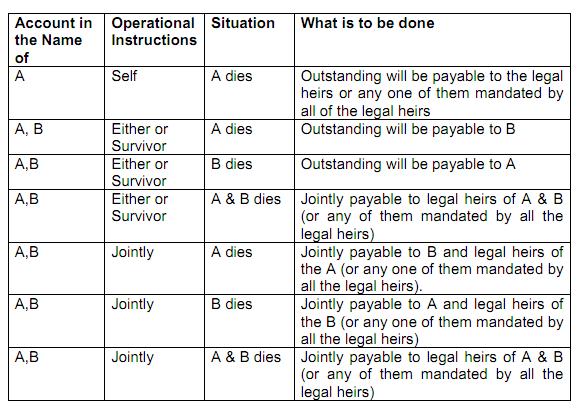

Claim for Single Savings/Current Account Without Nomination

Settlement of Claims for Saving or Current Account Without Nomination

Term deposits

Banks normally let the term deposit of the deceased accountholder mature. But as a nominee of the term deposit, you can ask for a premature withdrawal by furnishing the death certificate and your identify proof. In the absence of any nomination on the term deposit, you have to also make a joint request with all the legal heirs and submit documents to prove your legal authority (Succession certificate, Probate order or Letter of Administration). For more details on Term Deposits please read Page 6,Page 17 of IBA MOP

Lockers

Nomination facility is available to individual(s) holding the lockers singly or jointly. In respect of lockers held in joint names, up to two nominees can be appointed. Joint locker holders can give mandate for access to the lockers in the event of death of one of the holders on the lines similar to those for deposit accounts. In the absence of nomination or mandate for disposal of contents of lockers, with a view to avoid hardship to common persons, the Bank will release the contents of locker to the legal heirs against indemnity on the lines as applicable to deposit accounts. For Details one can refer to IBA MOP (pg 22 of the pdf). One can check the tables to see the various cases as earlier. Click to enlarge.

Time Norms for settlement of claims

Member bank will settle the claims in respect of deceased depositors and release payments to survivor (s)/ nominee in case of accounts with survivor/ nominee within a period not exceeding 15 days from the date of receipt of the claim subject to the production of proof of death of the depositor and suitable identification of the claimant(s) to the member bank’s satisfaction.

In the case of accounts without survivor/ nominee clause the claim should be settled within 1 month from the date on which the requisite documents have been submitted.

Documentation Required With Nomination

The nominee can approach the Bank with the complete set of documents required. However the basic documentation requirements include following:

- Claim Form (Covering letter from the nominee advising the Bank that he is the nominee and his preferred method of receiving the funds claimed. Eg. Cashier order, Demand draft, EFT, etc. Please note that the proceeds of the nominated accounts will not be paid in cash. A format is available with the Bank.)

- Death certificate issued by municipal authorities / government department. The Photocopy should be sighted as original by the Bank officer.

- Proof of Address & Photo ID of the Legal heirs / Survivor / Nominee (as required by the Bank)

- Customer Copy of Nomination, if any.

Safe Deposit Lockers: The nominee can approach the Bank with the complete set of documents required. However the basic documentation requirements include –

- Claim Form (Covering letter from the nominee advising the Bank that he is the nominee – format available by the Bank)

- Death certificate issued by municipal authorities / government department. The Photocopy should be sighted as original by the Bank officer.

- Proof of Address & Photo ID of the Legal heirs/ Survivor / Nominee (as required by the Bank)

- Customer Copy of Nomination, if any

- Inventory Form (Format available with the Bank)

Documentation Required Without Nomination

Quoting from IBA MOP(page 16 of MOP,pdf)

In case where the deceased depositor had not made any nomination or for

the accounts, member banks may adopt a simplified procedure for repayment to legal heir(s) of the depositor keeping in view the imperative need to avoid inconvenience and undue hardship to the common person. In this context, member bank will, keeping in view its risk management systems, fix a minimum threshold limit, for the balance in the account of the deceased depositors, up to which claims in respect of the deceased depositors would be settled without insisting on production of any documentation other than a letter of indemnity.

Quoting from HDFC Bank:Citizen Charter for Settlement of Dues in Deceased Deposit Account

In the absence of nomination and when there are no disputes among the claimants, the bank will pay the amount outstanding in the account of the deceased person against joint application and indemnity by all legal heirs or the person mandated by the legal heirs to receive the payment on their behalf without insisting on legal documents up to the limit approved by the Bank’s board. This is to ensure that the common depositors are not put to hardship on account of delays in completing legal formalities.

Quoting from State Bank of India(a pdf)

We do not insist on production of succession certificate from the legal heirs of the deceased constituents irrespective of amounts involved. However, banks have been advised by RBI to take such safeguards in settling claims, as they consider appropriate, including obtention of indemnity bond etc. RBI has further clarified, that banks may call for succession certificates from the legal heirs of deceased depositors,

- In cases where there are disputes and all legal heirs do not join in indemnifying the Bank,

- In certain other exceptional cases where the Bank has a reasonable doubt about the genuineness of the claimant(s) being the only legal heir(s) of the depositor

In the absence of nomination or clear mandate in respect of a joint account or a will left behind by the deceased depositor, banks are expected to pay the stock (balance outstanding) at the time of death of the person to all the legal heirs of the deceased. Considering the risk involved, bank may call for legal representation in the form of a Succession Certificate, Letter of Administration or Probateetc for settlement of claims. (Covered in separate post)

Sample letter of Indeminity from State Bank of India(Click to enlarge)

Future credit dues

There may be other investments and credit dues of the deceased person which may materialise in the future. The account is closed after the settlement is completed. But how can you get access to this future flow of funds coming in the accountholder’s name? The RBI has suggested two mechanisms:

- As a survivor(s)/nominee(s) of a deceased accountholder you can authorise the bank to open an account styled as ‘Estate of the deceased accountholder’ where all the fund flows in the name of the deceased accountholder can be credited and finally handed over to you.

- The other process is that the bank returns the cheque to the remitter with the remarks ‘accountholder deceased’ and then the nominee or the legal heirs contact the remitter for a fresh cheque in the name of the legal beneficiary.

So inquire with the bank the method it follows and proceed accordingly.

Disclaimer: Please note while efforts have been made to provide correct information.We are not an expert in legal laws and it is advisable to visit a qualified lawyer/banks for any information on such laws before making any legal moves. We do not take any responsibility, if you read this post and act based on it. We also have no tie-up with any of the external websites mentioned in the post.

Getting an account opened seems so simple but getting your money out of your own account after your loved one death seems a daunting task. RBI, IBA are simplifying the procedure through Survivorship-Mandate, Nomination etc but how many of us are using it. While doing the post I realized that I have a joint account with no nomination. Got the nomination details updated. What about you? Are your bank papers in order?

Sir, i lost my jewellary in babk robbery. Plz tell me what are the chances by which bank will compensate . And what percent of compensation does bank avail in criticle situation.

My mom was a pensioner, had a savings account with 62000 in balance, and 91000 in her fixed deposits.

She passed away on 15.07.2015, since we had financial crisis, I withdrew the 61000 from her savings account using ATM card for the funeral and other expenses.

Now while I am going for the death claim, my self and my sister are the legal heirs.

We both submitted the claim.

Now the Indian bank staff are asking us to deposit back the 61000 back to the account, since we withdrew on and after the date of her death, and get it claimed through death settlement claim.

Pls suggest your idea,do I need to deposit 61000 again and get it back from the bank as death settlement claim.

Pls comment.

What documents are required during filing of the returns to claim an exemption for the inheritance money (FD pre-mature closure and withdrawal) ?

How do we go about doing it while filing a return ?

My mother had a locker and there was no nominee or joint holder for the locker,but i had a my name joined with my mothers account.i also have the key of the account.

pls enlighten me how do i open my mothers locker,according to the manager he is not aware of the procedure of opening a locker of a person deceased.

Me, my brother are holding a joint nri/nro account (either or survivor, with my mother who has expired. Kindly let me know what are the documents the bank requires and also we have a locker which is in her name; are we liable to operate the locker, as the locker rent is deducting for the same account. Even we do not know whether she has nominated for the locker.

I have a locker in SBI with a Anyone or Survivor type account with my wife. I have keys with me. Having some internal dispute with the wife, What if she asks bank not to allow me for operating locker independantly.

Will bank not allow me to operate that locker, if I want to do that alone?

Sad to hear about your dispute. Hope it works out between you two.

Coming to your question If she requests bank should still allow you to operate as it is in Anyone or Survivor mode.

Worse come to worse bank can ask both of you to come together to operate it.

Dear Sir,

Is it a legal requirement for bank to have nomination for opening a locker in a schedule bank?, also if the customer refuses to fill in nomination is the bank suppose to take a undertaking from the customer.

Lokesh this article is for informational purpose only. It is best if you ask the bank. As per what we have found that it is not mandatory but we request you to nominate if you haven’t done so. It will save lot of headache for your family.

Dear Sir

Very informative and useful article indeed. Some questions :

Is it mandatory for banks to allow premature withdrawl of term deposits if one of the holders has expired before maturity ? If yes, is it mandatory for the banks to allow this premature withdrawl without any penalty ?

If only first holder of term deposit is senior citizen, after his death, can second holder continue to get senior citizen benefit (0.5% higher interest rate) till maturity of the deposit ?

On the above two points, different banks are telling different things. Is there any rule made by government or RBI on the above points, which all banks have to follow ? If yes, please provide reference.

Thank you very much

Thanks Chandra.

Banks normally let the term deposit of the deceased accountholder mature. But they have a clause (in the opening form) if one wants to close the term deposit prematurely. So you might have to check specific bank.

A very good question Chandra regarding Senior Citizen term deposit account. Sorry I don’t have the information and could not find anything till now. However I found a reference with respect to Senior Citizens Savings Scheme, 2004 on RBI which can be a joint account but only with a spouse. Quoting from it

In case of a joint account, if the first holder / depositor expires before the maturity of the account, the spouse may continue the account on the same terms and conditions as specified under the SCSS Rules. However, if the second holder i.e. spouse has his / her own individual account, the aggregate of his/her individual account and the deposit amount in the joint account of the deceased spouse should not be more than the prescribed maximum limit. In case the maximum limit is breached, then the remaining amount shall be refunded, so that the aggregate of the individual account and deceased spouse’s joint account is maintained at the maximum limit. [Rules 6 (4) and 8 (3)]

If you could share which bank said what then we can try finding more information though I feel that you have to go with what bank says . But my sincere request is you ask a financial expert

Usually banks refrain in making premature withdrawal of FDR TO NOMINEE OR LEGAL HEIRS IN DECEASED ACCOUNT.Please advise the guidelines whether claimant is entittled to encash premature payment in term deposits.

Thanks Surinder for asking. Quoting from the IBA MOP(Pg 17)

In the case of term deposits, member banks are advised to incorporate a clause in the account opening form itself to the effect that in the event of the death of the depositor(s), premature termination of term deposits by the survivor(s)/ nominee/ legal heirs would be allowed. The conditions subject to which such premature withdrawal would be permitted may also be specified in the account opening form. Such premature withdrawal would not attract any penal charge

In case of a term deposit standing in the name/s of –

(1) a deceased individual depositor, or

(2) two or more joint depositors, where one of the depositors has died, interest shall be paid in the manner indicated below

(i) on the maturity of the deposit:

at the contracted rate

(ii) In case of premature withdrawal by legal heir(s)/nominee/legal heir , i.e., in the event of the payment of deposit being claimed before the maturity date :

The bank will pay interest at applicable rate with reference to the period for which the deposit has remained with the bank without charging penalty.

(iii) In case of deposit being claimed after the date of maturity:

Payment of interest on matured deposits is left to the discretion of individual banks subject to their Board laying down a transparent policy in this regard.

We checked HDFC bank website and found HDFC Bank Settlement of Dues in Deceased Deposit Account

Interest Payable on Term Deposit in Deceased Account

In the event of death of the depositor before the date of maturity of deposit and amount of the deposit is claimed after the date of maturity, the bank shall pay interest at the contracted rate till the date of maturity. From the date of maturity to the date of payment, the bank shall pay simple interest at the applicable rate obtaining on the date of maturity, for the period for which the deposit remained with the bank beyond the date of maturity; as per the Bank’s policy in this regard.

However, in the case of death of the depositor after the date of maturity of the deposit, the bank shall pay interest at Savings Deposit rate (as on the date of maturity) from the date of maturity till the date of payment.

Yes he is. Answer to it on the similar question asked

Usually banks refrain in making premature withdrawal(payment) in term deposit account ie FDR in deceased cases.Please advise the guidelines whether nominee or legal heirs of deceased holder is entitled to get premature withdrawal OF FDR RECEIPT.