A new laptop, latest mobile, the new TV, dream vacation. Personal loans can help meet all your financial needs effectively. Banks and financial institutions say Precious moments need to be cherished, without the worry of financial constraints. With simplified documentation and speedy approvals, availing personal loans is easy. Infact outside many office buildings I have seen people distributing pamphlets or flyers about personal loans.

Debt used to be a four-letter word in India. Gone are the days when our ancestors saved every penny they earned, lived within their means and considered debt as a shameful thing, to be avoided at any cost. Now everyone seems to be exposed to some or the other kind of debt. In fact, an average urban mass middle class person typically has four-five kinds of debts in his bag. The usual culprits are home loan, car loan, educational loan, some personal loan and credit card dues. People are working because they have EMIs to pay! Understanding Loans explained about the basics of loans such as interest rates, EMI, Credit history. Today we are going to talk about Online Personal Loans.

Table of Contents

What is Personal loan ?

Personal loan is given to individuals for their own personal expenses say for purchase of consumer durables. It is generally taken by borrowers who are looking for loans quickly and with minimum documentation. One need to specify the purpose for which one is taking loan so borrower can use the loan for any purpose they like. .

How much loan can you get?

Personal Loans can range from ten thousand to 30 lakh, based on the lender and the borrower’s ability to pay back.

What is the duration of a personal loan?

A personal loan is of a shorter duration, the duration is usually between one and five years. The repayment options are usually flexible and depend on the lender and the credit history of the borrower. One need not make any down payment (as in car loan or house loan) or provide a guarantee or collateral security (as in education loan). So it is an unsecured loan.

What are the interest rates for personal loans?

Interest rates for a personal loan vary from borrower to borrower & lender to lender, depending on their individual credit history and amount borrowed. Typically the factors that determine the Personal Loan interest rates are as follows:

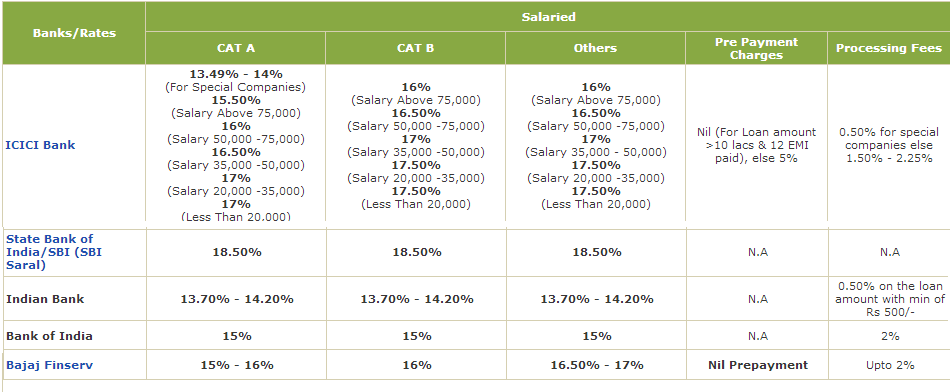

- Income: How much one earns decides the interest rate.

- Company Status: Banks divide the companies into various categories CAT A, CAT B, CAT C, Non-Listed etc. If the company is a good interest rate is slightly better. Generally, the various categories are

- CAT A means Top 1000 companies

- CAT B Multi National Companies( MNC’s )

- CAT C means Small companies

- Non Listed means Smaller companies with 100 emloyees.

- Credit and Payment history : Banks follows Cibil scores or rating before deciding giving loans. If you have poor Credit Score, your application can be rejected or the Bank will give you at a much higher rate.

- The Bank : If you have Salary account or Savings account the bank might give some benefit in terms of interest rate or Processing fees.

- Negotiating Ability : one can always negotiate and can ask for Bank to give you waivers on Rates, Fees Etc

Sample interest rates as on Aug 2014 are given below. Found deals4loans webpage on personal loans a quick overview. Click on image to enlarge.

What are the fees and charges payable on personal loan?

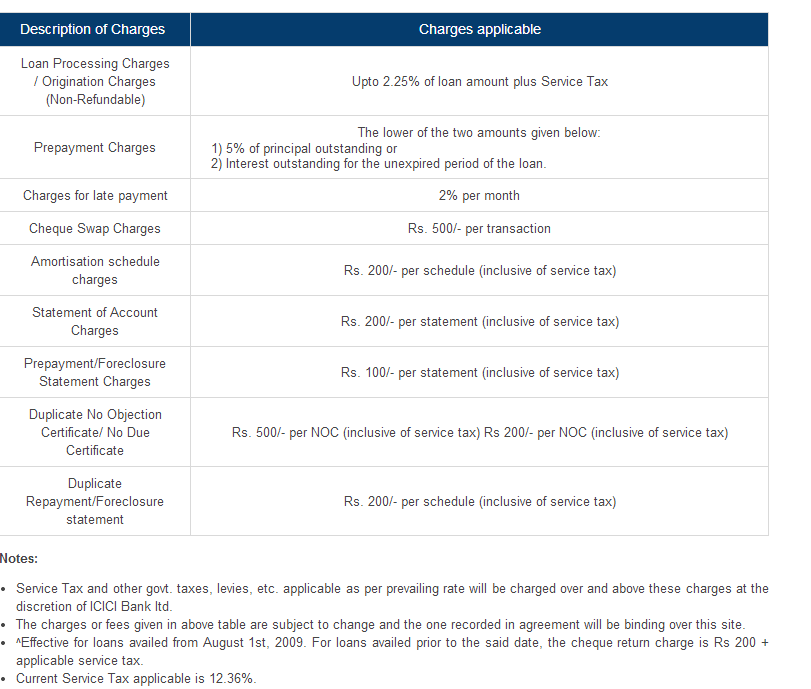

Various types of charges that are levied are given below , though it varies from lender to lender.

- Processing fees : are charged on the loan amount and is payable upfront by the borrower, while filing the loan application. This is non-refundable and covers the costs of determining the loan eligibility of the potential borrower. It varies from half to 3% of the loan amount applied for. Some banks charge a flat fee.

- Pre-payment Fee: If the EMIs are paid before the tenure, banks will normally charge the borrowers a pre-payment fee which will be in the range of 2% and 5% of the outstanding loan amount. Usually, pre-payment is permitted only after a certain period of the loan disbursal.

- Charges for Late payment : If there is a delay in paying off the monthly EMIs, banks levy a late payment fee with the EMI. It usually is in the range of 2% and 3%

- Cheque bounce charges : If you have given post dated cheques(PDC) and it is not honoured by bank on account of insufficient funds, borrower is charged a penalty for cheque bouncing anywhere between Rs. 250 and Rs. 500.

Sample list of charges from ICICI Bank for personal loan (as on Aug 2014) are given below. Click on image to enlarge.

How does one repay the Personal loan?

Repayment is done every month via EMIs. You have to pay fixed amount every month and have to submit post-dated cheques or you can mandate them to directly debit the EMI by ECS ( Electronic Clearing Services) with the Bank where you have an account. The repayment affects your credit history which affects your future capability of paying loans. Our article Understanding CIBIL CIR report explains CIBIL CIR report in detail. Interest rates can be calculated at a flat rate keeping the outstanding amount ( i.e. the amount on which interest is calculated) constant throughout the loan tenure or at a reducing balance rate, which lowers the outstanding amount as the loan is paid back. From our article Understanding Loans explains how method of calculation affects Total payment.

| Reducing cycle | EMI | Total payment | Interest outgo |

| Annual | 4,802 | 1,15,248 | 15,248 |

| Monthly | 4,614 | 1,10,736 | 10,736 |

| Daily | 4,535 | 1,08,840 | 8,840 |

What do lenders look for before sanctioning a Loan?

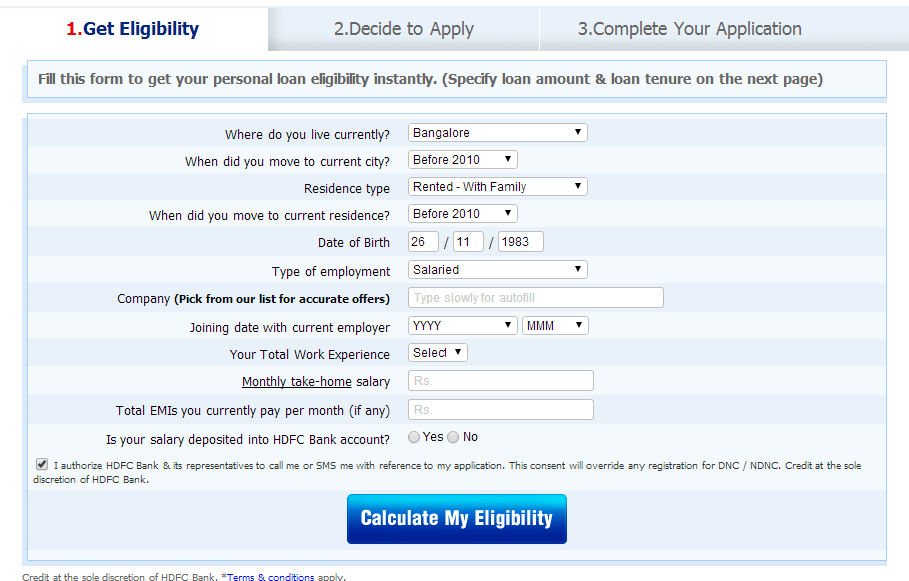

Your annual income, current EMIs, credit history of a borrower & his profile in terms of the company you work, are taken in to consideration when you apply for a loan. Since it is an unsecured loan, lenders specifically look at the repayment history and the credit score of a borrower. Eligibility Criteria for Personal loan from HDFC Bank is given below. Play around with the calculator for different options.

Documentation required for personal loans

Typically the documents required are:

| Documents | Description |

| ID Proof | Passport Copy/ Voters ID card/ Driving Licence/Copy of PAN Card |

| Address Proof | Passport /Ration card/Voter’ss ID/Driving license/Last 2 month Electricity bill /Last 2 month Landline Telephone Bill |

| Financial Docs |

|

How long does it take for a loan to be sanctioned?

The time taken to disburse personal loans varies from lender to lender. Personal loans may be approved in as little as 24 hours or may take up to 7 business days.

What should one look out for before taking Personal Loan?

While applying for a Personal Loan,

- Make sure you borrow within your means. It affects your credit history and credit score

- Compare interest rates from different banks.

- Check the way EMI is calculated. Don’t choose a flat rate of interest. Always choose an option that calculates interest on the reducing balance method. Is it calculated on a monthly reducing basis (the moment you pay your principal, the following month’s interest rate is calculated on the reduced amount).

- Check for documentation, administration or processing fees, prepayment fees.

- Try and keep the loan term short, preferably 1-2 years.

When should one take Personal Loan?

Debt is debt. The only certainty of a loan is that it has to be paid back. Loans establish our credit history : good or bad. The trick is to only borrow what you need and what you can afford to pay back. Personal loans are one of the most expensive forms of loan available in the market. So some do’s and don’t of taking personal loans are. Our article Life of Debt – Responsibly talks about how to take loans

- Choose carefully after conducting due research and understanding of the cost & the benefits involved.

- Opt for personal loans only to meet your essential needs which cannot wait. It should be your last resort. Taking a personal loan for satisfying leisure needs can prove to be costly i.e. for vacation, buying a new gadget etc.

- There is an emergency and you need funds immediately. A personal loan can be taken because the processing time is much lesser on account of minimal documentation.

- If you have a very large credit card debt (interest on credit cards is usually between 2.5-3 per cent a month), you can take a personal loan to pay that off (interest on personal loans is between 1.5-2 per cent a month). But you shouldn’t use your credit card for the duration of the personal loan.

Related articles:

- Understanding Loans

- Credit Card Debt

- EMI and Amrotization Table Calculator

- FAQ on CIBIL CIR Report and Score

What are your views on a personal loan? Have you taken personal loans? How has been your experience been? Could you have avoided personal loan?

Yes I agree with that personal loans can help meet all our financial needs effectively. Your post really give lots of information about personal loans, thanks for sharing it.

Its really a wonderful article posted here. Useful

Thank you for sharing your information

WOW what a convenient loan. जितनी जरुरत हो उतनी निकालो और सिर्फ उसका ही इंटरेस्ट पे करो. और EMI भी केवल इंटरेस्ट का पे करो, By availing Bajaj Finserv Flexi Personal Loan you borrow when you need, and pre-pay when you can, while paying 45%* lesser EMI. You can also take more time to plan your repayment and make necessary provisions for easy repayments.

We are a private lender who gives a loan to individuals and private companies. Have you been rejected by many banks? Do you need funding to establish your business? Do you need funding to expand your business? Or do you need a personal loan? Loan ranges from personal loans to business. The interest rate is very affordable and our loan process is very fast as well. Contact us now via Email: magmafincropp@gmail.com

You can Whats-app us on +447459704849

Reading this piece helped me understand loans in a much better and simpler way. Kudos to the writer! FlexSalary provides instant online cash loans with no hassle and quick verification process- https://www.flexsalary.com/

Thank you for providing the information actually I was looking for personal loan and this helped me to make my decision.

Your all post I used to read. In many ways it helped me a lot. Thanks for sharing the information regarding personal loans.

Apply for loan 3% rate urgent response.

please kindly contact my email id: mj311695@gmail.com

Thanks for sharing awesome information related to personal loan. Even I am looking to get personal loan but I had very less knowledge on it. After reading your post I am happy that I got knowledge on personal loan and deals4loan explained very well.

Now get all types of home loan India, apply home loan online service from deal4bank in pune with easy documentation and no extra charges…..

hey Thanks for sharing this wonderful Content….

Now get all types of home loan India, apply home loan online service from deal4bank in pune with easy documentation and no extra charges…..

Hey,

Thanks for this beautiful article. I really loved it.

I’ve seen the ad on google that you can get personal loan at just 11.49% ? Is it true?

Because when I visited bank they were giving me personal loans at 15%+ rates/

What is the fact? can you explain me this terminology

I think that you hit the nail on the head. There is no such thing as a get rich scheme or free lunch.If you want to build a solid online business, it would take hard work, dedication and lots of time.At the end of the day, it will be all worth, if its financial freedom you after. I look forward to checking out your site and learning more.RegardsRoopesh

Do you need a loan to start again your activities? Do you need a loan for the purchase of a house or a car? Do you need a loan to pay your debts? I am willing to grant the loan dowry to you you need with an interest rate which will facilitate the life to you. I can make you a loan between 5,000 and 2,000,000 $. Do not hesitate to contact me for more information.

heinrichkarl7@gmail.com

If you are looking for emi then visit to this link .it is available for those all who want to take loan

http://www.personalloanguru.com/

Awesome Article. It is helpful for a lay man to understand what is personal loan and also clear clinches which people face while applying loan.

Wow, its really amazing blog structure! your content inspired me getting all solution for personal loan. The whole content of your blog is magnificent, Thanks for it!

I am Mr. Joe Soto, a private lender. I give out loans with an interest rate of 3% per year, totaling 1000.00 to 10,000,000.00 as the supply of credit. 100% financing of the project with secured and unsecured loans. We are assured in serving financial services to our numerous customers all over the world. With our flexible lending packages loans can be processed and transferred to the agent for the borrower in the shortest possible time. We operate under clear and understandable terms and we offer loans of all kinds to interested clients, companies, enterprises, and all types of business organizations, private individuals and real estate investors. Simply fill out the form below and return to us as we expect your rapid and direct response. EMAIL: joe.sotomortgagelending@hotmail.com

Hello Everybody,

My name is Mrs.Irene Query. I live in Philippines and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of $150,000.00 to start my life all over as i am a single mother with 2 kids I met this honest and GOD fearing man loan lender that help me with a loan of$150,000.00 US. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs.Irene Query, that refer you to him. contact Mr Mark Harry,via email:(farrukhloan@yahoo.com.sg) Thank you.

Thanks for sharing all the information related to personal loan.

Thank you for the useful information you are sharing with us.It is really a nice blog

we are best Mortgage Broker Melbourne

We are a Mortgage brokers Melbourne and compare the council Commercial Property Loan offering free advice on mortgage financing packages, compare loan mortgage analysis system using the most advanced credit.

Very nice article. Many thins of beneficiary to who need personal loan. Please visit our site www.letzbank.com for loan services.

Yes I agree with that personal loans can help meet all our financial needs effectively. Your post really give lots of information about personal loans, thanks for sharing it.

Yes I agree with that personal loans can help meet all our financial needs effectively. Your post really give lots of information about personal loans, thanks for sharing it.

great article.

“People are working because they have EMIs to pay!”

Yeh ..I have heard it so many times..I would have quit my job..(the manager sucks !) but I have to work as I have Car EMI/house EMI to pay!

great article.

“People are working because they have EMIs to pay!”

Yeh ..I have heard it so many times..I would have quit my job..(the manager sucks !) but I have to work as I have Car EMI/house EMI to pay!