India has progressed a lot in terms of banking in last few years.After internet banking, mobile banking, e-wallets what next’s? Social Banking is the new banking option. This article talks about Can Social media and Banking be combined? And then explores in detail the Pocket App by ICICI Bank which uses Facebook for banking. It focuses on Pocket App’s two feature Pay a friend without knowing the account number and Split n Share feature of Pocket App, which really set this app apart and makes one look at Pocket App seriously.

What do I want from Bank in terms of banking services?

Bank is a place where I deposit money in my account or rather my salary get’s deposited and then I spend money from the account. I hardly go to the bank, I use ATM to withdraw my money for daily use,use ECS to set up my bill payments (electricity,mobile,broadband), netbanking to check status of my account, set alerts. Everytime there is a transaction I get an SMS and email alert(I have set it up using netbanking) which informs me of the balance also. I am ignoring the various other services that banks offer such as mutual fund ,insurance and Relationship managers. I have options of Netbanking, Mobile Banking. My preference is for NetBanking.

Do I use Social Media like Facebook and Twitter?

As individual Yes Facebook gives me an opportunity to keeping in touch with my friends and family. Twitter I use more for bemoneyaware, sending quotes related to money(every day at 10:00 am) or sharing articles that I think would be helpful or discussing about financial awareness etc . Our twitter handle is @bemoneyaware or twitter.com/bemoneyaware

Can Social Media and Banking be combined?

But can banking and Social Media be mixed? Would I like to use Facebook for my banking transactions. My first answer is No. But then I am a middle aged woman and I am not sure about Facebook being the right platform for doing banking. I mean if I on internet on my laptop I may just as well do the internet banking. Now I am able to understand the reluctance of my parents and inlaws in using the ATM. My parents and inlaws have reluctantly moved to ATM, they still prefer going to bank branch and withdrawing money. ATM machine is outside the bank only says my mother and I like when Mr. Sharma asks about me and my children and we talk few minutes about Kya ache din aayenge? And internet banking is a Big No What if I give wrong account number ? asks my father-in-law and then starts on how Mr Chauhan’s relative’s friend son’s account was wrongly debited for some money and how he had to run around to get it back.

But what about the young generation, especially those in 20s and 30s. There are 82 millions Facebook users in India in which over 40% users are below 30-years of age. Would they want to use Social Media or rather Facebook for banking. Maybe (when I did a random survey among my friends and colleagues). Some of people I surveyed asked me back what is the value add in going through Facebook. (some were worried whether their bank balance or transactions would be known to their friends/family members). Sometime back I had written about Kotak Bank’s Jifi account and did not see the value add in opening a new account just for using social media. But then my reader Gautam asked question about ICICI Pockets especially the Split and Share feature. I looked at it and the result is this article as I feel Pockets App by ICICI Bank has potential.

What is Pockets App by ICICI Bank’?

On 24 2013 September, ICICI Bank launched Pockets, an application on Facebook. Pockets by ICICI Bank can be accessed through desktop and mobile version of Facebook. This app can be used to do financial as well as non-financial transactions while you are on Facebook. Pockets App is available for ICICI Bank customers who have a resident saving account(not NRI account) with a valid debit Card. Pockets App by ICICI Bank on Facebook can do following :

- Split ‘n’ share: It allows its users to split and track group expenses and share them with friends on Facebook. It also allows the customer the option of sending messages to remind friends on pending payments.

- Pay a friend: It allows customers to transfer funds to their friends without knowing their bank account details like account number, bank branch, branch IFSC code etc. Through this facility, customers can create electronic coupons that can be redeemed by their friends on www.icicibank.com

- Recharge prepaid mobile: Pockets by ICICI Bank lets customers recharge their prepaid mobile instantly, from Facebook itself.

- Book movie tickets: Users can now plan for their favourite movie with their Facebook friends and instantly book the tickets using Pockets by ICICI Bank.

- Users can also do wide range of non-financial transactions includes viewing a summary as well as a mini statement of savings bank account, knowing credit card details and getting demat holding statements.

- Through this app, a customer do many financial transaction also such as open fixed or recurring deposit, order a cheque book, stop a cheque payment and upgrade debit card,Fund transfer to your linked account,Fund transfer to any other ICICI Bank account,Bill Payment both Direct Payments or Scheduled Bills(if added through NetBanking) etc.

What about safety of Pockets App of ICICI Bank?

It has features like secure browsing, two layer secure access, a unique dynamically generated one time password for each transaction, daily transaction limit, one Facebook account registered for one account. ICICI Bank states that all banking activities will take place on the bank server only. While you see the Facebook frame, the activities will happen on ICICI Bank’s server. The bank claims that the Facebook app is as secure as their Net banking platform. Some securities features are given below, we really like the One Time Password feature.

- To register your account in Pockets by ICICI Bank, you first need to authenticate yourself with Debit card Number and ATM Pin

- Every time when you login to your Pockets by ICICI Bank account, you need authenticate yourself with 4 Digit password set by you during registration

- Every financial transaction on Pockets by ICICI Bank is subject to One Time Password (OTP). OTP is a dynamic in nature i.e for every transaction, you will get a different OTP on your registered mobile number with ICICI Bank.

Are there some Social features of the App? What can my Facebook friends see when I use Facebook App?

- You can share your App with your friends.

- You can Like App and see how many have liked this App.

- Your completed transactions will be displayed in your Activity Feed section. You can post your transaction on your Facebook or send message to your friend about the transaction.

- You will know which of your friends have registered this App.

- You will also come to know who of your registered friends concurrently using the App.

- You can also choose to follow your friends on App if they are also registered user of the App. If you are following your friends, you will come to know about their activities on the App.

- You also have option to Like activities of your Friends whom you are following and will also come to know the total likes of your friends.

But App allows you to customize your activities settings. You can stop sharing your activities with your friends. You can either hide all of your activities or specific activities and hidden activities will not be shared.

What is Pay your Friend feature?

Using Pockets app, an ICICI customer can send money to any of her Facebook friends even if she does not have the friend’s bank details. You can see video on ICICI Bank webpage Pay your friend feature

- To transfer money, you either need a mobile number, an email ID or a Facebook account.

- Once you select an option, type the amount and name of the friend and submit.

- The receiver will get a coupon number and a password.

- You will also have to send a password, which the bank sends you.

- Using both the passwords along with her bank account number, your friend can get the money credited in her account.

- The duration for the transaction is four to six hours.

The money transfer system works on NEFT (National Electronic Funds Transfer) platform. If you want to pay a Facebook friend, the limit is Rs. 10,000 per day, for other bank accounts it is Rs. 10,000. The cost will be similar to NEFT transfer, Rs 2.50 plus service tax for amounts up to Rs. 10,000.

What is Split n Share Feature of Pockets App of ICICI Bank?

Through Split ‘n’ Share, you can manage, track, share and settle your group expenses for activities like group picnics, movies, outings, etc.

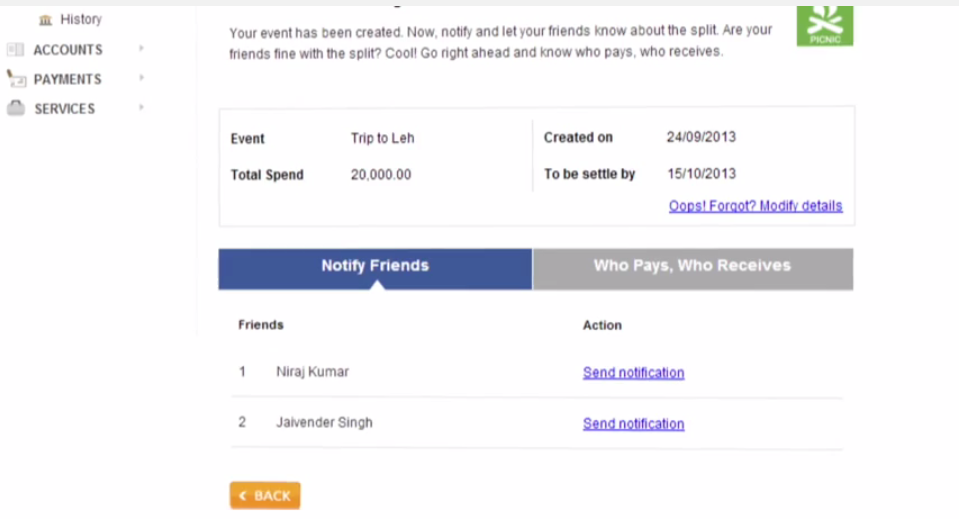

- You first create an event with details such as Total spends incurred, Event Name, last day to be settled by, etc.

- Add yourself and your friends as participants and split the expenses as you want.

- Enter the expenses incurred by each one of them and how much needs to be pooled.

- This event will be visible to all the Facebook friends who are part of this event.

- Another Facebook feature used here is notifying your friends by sending messages for the creation of the group, and checking details of the event. Settle the tab will show who pays and who receives. Once all the pending dues are closed, you can close the event.

Image below shows the details about event, who has to pay , how much each has to pay etc of Split n Share feature of Pockets App by ICICI Bank.

Video (1:42 long) on Youtube (which surprisingly is missing from Video Demos of Pockets App on ICICI Bank) is given below

How to find more about the Pockets App of ICICI Bank?

Go to the ICICI Bank webpages on Pockets App. Some links which would be helpful are

- Pockets App on Facebook

- ICICI Bank webpage on Pockets App

- Video Demos of Pockets App features of ICICI Bank

Related articles:

- Understanding Public Provident Fund, PPF

- Understanding Gold:Purity,Color,Hallmark

- Understanding Ex Showroom Price and On Road Price of Vehicle

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

- Understanding CIBIL CIR report

[poll id=”69″]

In case you bank with ICICI and you have used or want to use Pockets do share your experience with us. Do you think people will take to Social Banking? Who will use the Social Banking, the new generation? What do you want from your Bank?

juega con farmaideal

juega con farmaideal