We all want a place of our own, a place where we can relax in peace with our family. A perfect home is the modern key to happiness. We all have a dream house which we wish to buy someday. Some dream to buy a bigger better house, while some just wish to have a small roof with 4 walls. But owning a house that we call our home is what matters. Buying a house in today’s era is so difficult with roaring prices. If we plan to buy a house it is an investment for life. The following advertisement shows about how home loan can fulfils one’s dream of buying a house. This article talks of Process of Buying a House, Process of Getting Home Loan, What are Tax advantages of Home loan and The Right House Loan That Shows Your True Worth

Table of Contents

Process of buying a house

Buying a house is a big investment and an even bigger cumbersome process. Finding a house in the perfect location with the apt amenities in your budget seems next to impossible but all it takes is the right kind of research . What should one consider before buying home?

- Budget: Considering our savings and the potential house loan we can take, we should decide a feasible budget to purchase the house.

- Identify Location/Property: We need to identify the location or area that fits best in our budget and requirement. Say if I travel too much for work by train I would prefer a locality that is near to a railway station etc.

- Search: Once we know the locality we can search houses on Internet or can meet the local Broker who can show us various new/re-sale houses available in our decided locality.

- Final Decision: Once we have seen all the options we will have to compare the features and cost of each flat. We will also have to consider any miscellaneous cost that might add up like broker’s commission, transfer and registration fees, house improvement in case of re-sale property etc.

After considering all the above factors, we will finally decide which house to buy. But we are usually short of money and that’s where banks, Housing corporations with their home loans come to our rescue!

What are Tax advantages of the Home Loan?

One of the biggest hurdles in life is the cost of the property that you set your heart on. It’s a possibility that you do not have the required capital to make an outright purchase for your dream house. Our savings and a loan from the bank can help us buy the HOME we have endlessly dreamt of! Other than fulfilling our capital requirement house loans have additional tax benefits like

- Interest Under section 24B: You can claim deduction of up to Rs 2 lakhs (Rs 1,50,000 if you are filing returns for FY 2013-14) on your home loan interest

- Principal under section 80C: Under section 80C the principal repayment up to Rs. 1.5 lakh((Increased from 1 Lakh to Rs. 1.5 Lakh in Budget 2014) on your home loan will be allowed as a deduction from the gross total income subject to fulfilment of prescribed conditions.

- Deduction on stamp duty and registration charges under section 80C:Payment of stamp duty and registration charges are also allowed to be claimed under Section 80C, in the year in which these were paid.

- Deduction on pre-construction interest

- Section 80EE: Maximum deduction of 1 lakh for First-Time Homeowners was available for FY 2013-14 and FY 2014-15. Loan should have been sanctioned between April 1, 2013 to March 31, 2014. No other house is owned by the taxpayer on the date the loan is sanctioned.

- In FY 2016-17 First time home buyers will additional deduction of Rs 50,000 on interest for loan upto Rs 35 lakh provided the house value doesn’t exceed Rs 50 lakh.

So buying a house is a BIG investment but Government manages to give us some relief!

Comparing Home Loan from Different Banks

Interest rates on home loans are the major differentiator between institutions that provide loans, no doubt. But there are other costs and fees involved during the process of taking a home loan. A clear understanding and comparison of these costs can help you choose between two loan providers offering similar interest rates. Some institutions may waive this processing fee. But such a waiver might only be secured after tough negotiations.

For example, Processing fees: Loan applications are subject to processing, such as verification of documents, before being sanctioned. A fee is charged for this process by all institutions.

- Bank A charges 0.25 per of the loan amount as a processing fee for loans up to ₹25 lakh and a fixed amount of ₹6,500 for loans above ₹25 lakh and up to ₹75 lakh.

- Bank B the processing fee charged is up to 0.5 percent of the loan amount.

- So, with an equal 9.15 percent interest rate Bank A scores over Bank B.

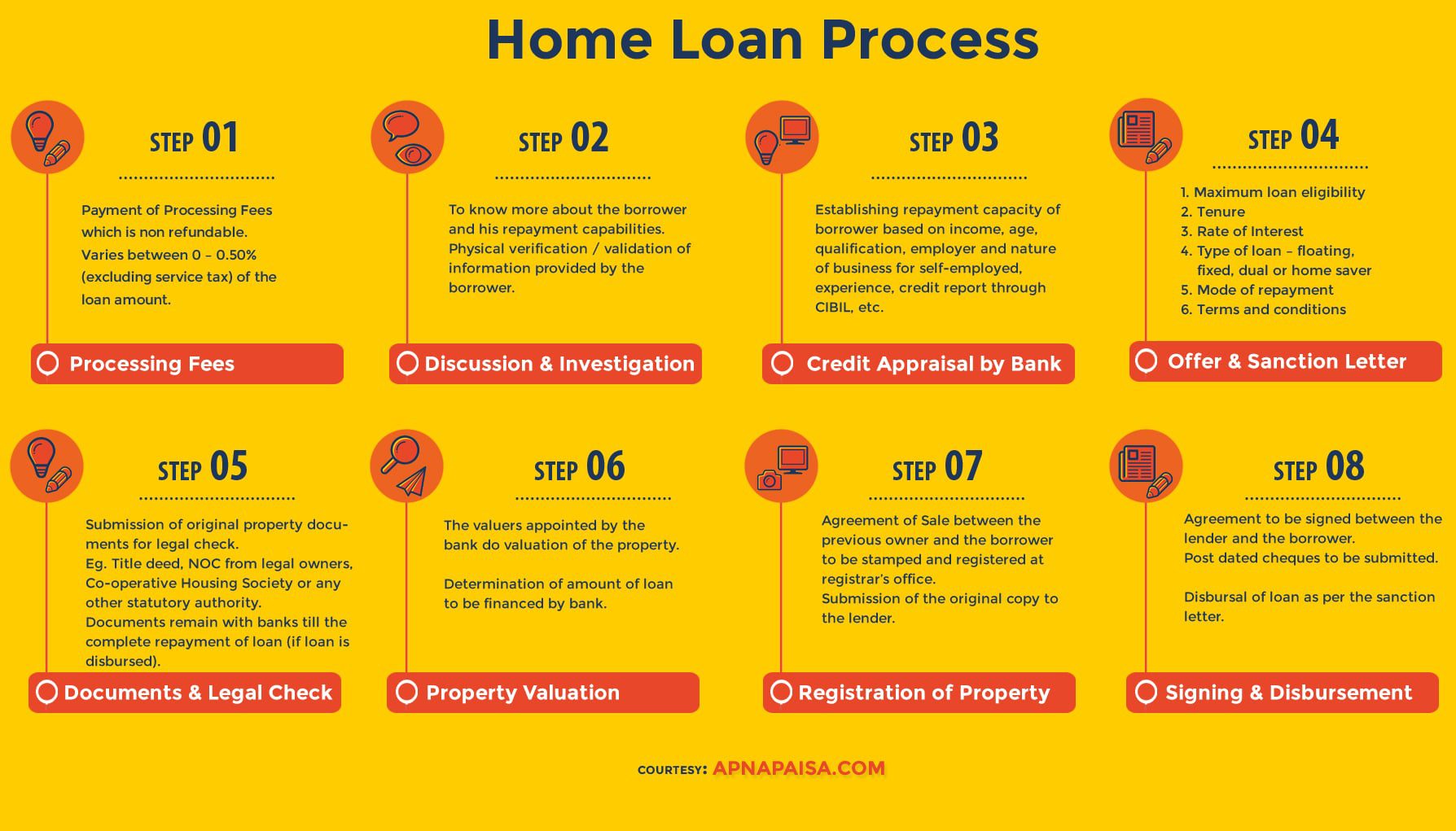

Process of getting Home Loan

With the countless benefits home loan provides, it comes with huge pre-requisites to avail the loan. Your bank might also charge you non-refundable processing fees between 0.25-0.50%. But banks have started waiving off this fee to attract borrowers. You can negotiate with the bank you are planning to apply. The process includes:

- Getting Home loan Application: You can avail the application form from any bank office branch or download it online from their website.

- Documents Along with completed loan application, some documents also need to be submitted. These include:

- 3 Passport size photographs

- Proof of identify (photo copies of Voters ID card/ Passport/ Driving licence/ IT PAN card)

- Proof of residence (photo copies of recent Telephone Bills/ Electricity Bill/Property tax receipt/ Passport/ Voters ID card)

- Proof of business address for non-salaried individuals

- Statement of Bank Account/ Pass Book for last six months

- for salaried persons Original Salary Certificate from employer orTDS certificate on Form 16 or copy of IT Returns for last two financial years.

- for Professionals/self- employed/ other IT assesses: Acknowledged copies of three years I.T. returns/ Assessment Orders, Photocopies of challans evidencing payment of Advance Income Tax.

- Signature identification from present bankers

- Personal Assets and Liabilities statement

- Guarantor Form

- Applicant’s Verification: Once you submit all the documents, bank will evaluate your age, income, no. of dependants and most important you repayment capacity. Once you pass this process you will be called for a Face-to-face meeting. A field investigation will also be conducted to check all the information stated in the application form.

- Offer Letter for the loan sanction: Once the loan is sanctioned, the bank will send an offer letter to the applicant with details regarding the home loan such as loan amount sanctioned, interest rate for the loan, type of interest selected: fixed or floating interest rates, loan tenure, mode of loan repayment, special scheme or offer if applicable and the general terms and conditions of the home loan approved. If you are satisfied with all the norms, then you can provide an acceptance letter with your signature to the bank to acknowledge the sanction.

- Valuation of property & Registration of Home Loan agreement: All the legal documents of the property involved have to be submitted. The bank will perform legal check on the property. The bank will also perform a technical valuation of the property. After all the financial and technical valuations, the home loan will be registered on stamp papers. The loan agreement must be signed and submitted back to the bank along with post-dated cheques. The documents remain with the bank until the repayment of the Home loan.

- Loan Disbursal After the Home Loan Agreement is signed, Borrower should finalize the date of Property Registration in coordination with seller and simultaneously Bank will issue DD/Banker’s Cheque for property registration.

Image below shows the home loan process

Please note:

- The buyer has to deduct TDS on property by filling Form 26QB at 1% of the total sale consideration if the amount exceeds Rs 50 lakhs. If payments are in installments, TDS must be deducted on each installment.

- Home Loan approval is solely at the discretion of bank

- Stamp Duty & Registration cost may not be included in property value. For example, if property value is 50 Lacs and Stamp Duty + Registration Cost is 5 Lakhs. Bank will sanction Home Loan of 80% of 50 lacs whereas Housing Finance Corporation will sanction Home Loan of 80% of 55 Lacs.

- Home Loan Process takes anywhere between 10-14 days to complete

- Any loan that you have taken or will take will affect your Credit Score/

This sounds like a very tedious process. How about something that gives you the power to decide what you want?

A True Worth Loan

Aditya Birla Finance has come up with a great initiative called “Know Your Worth”. They believe that the true worth of a person doesn’t limit to the bank balance or the amount of cheque he draws every month. But it is a sum of your life’s work, dreams, ambition and vision. They feel that “YOUR TRUE WORTH” should be the one to determine the value of the home loan that you truly deserve.

Why do we require A True Worth Loan?

Most loan providers may determine the loan eligibility based on traditional routine which often do not reflect your true repayment capability. At Aditya Birla Housing Finance Loans(ABHFL), they assure you of a loan eligibility which is holistic in nature – They will understand your ambitions to grow and will take cognizance of income from all sources which can be used to repay your loan well in time. They do not want us to settle for less. They want us to ask “ Is the house worth you?” They focus more on the real life scenario where there are many youngsters with good background and salaries or young entrepreneurs who are unable to avail loans from the banks due to their irrational eligibility procedure.

Why Aditya Birla Housing Finance Loans(ABHFL)?

ABHFL provides special features such as: Easy online application process, quick approvals and instant eligibility checks

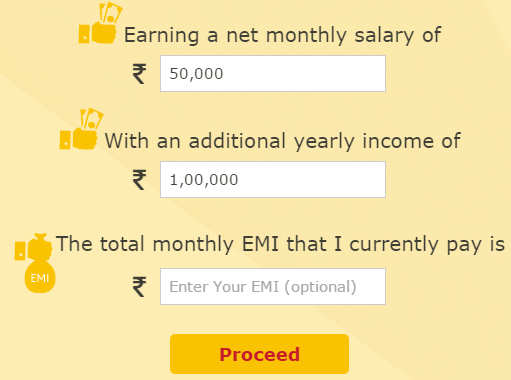

You can check your instant eligibility by few clicks on the website. The best feature about this loan is you can get an approximate amount of the loan you will be eligible for and also gives an option for you loan to be sanctioned irrespective of the property(if it is identified or not) unlike other banks which need to know the property you have decided to buy. This is as easy as:

- Select if you know the property you want to buy or you still are not sure.

- Select the location where you intend to buy a house.

- Select if you are a salaried person/professional or businessman. Doctors, CAs, CSs and Architects qualify as Self-Employed Professionals. Traders/ Manufacturers/ Entrepreneurs in various industry segments qualify as Self-Employed Businessman

- If you are salaried individual, Enter your NET monthly salary and your annual income other than your salary. Monthly EMI is an optional question.

- Select the duration for which you want the loan.

- Once you click calculate an approximate amount of the home loan you will be eligible for will be generated. This is an approximate figure and can differ from the one actually sanctioned but this will give you a rough idea of your WORTH! #TheHomeLoanIDeserve

Note: This is a sponsored post.

Related Posts:

- Switch from Base rate to MCLR for Home Loans

- Joint Home Loan and Tax

- Terms associated with Home Loan

- Tax and Income From One Self Occupied property

- On Selling a house

- Capital Loss on Sale of House

OMG ! It gives accurate data, I was planing to take 40,00,000rs Home loan, this tool is saying I am eligible to take 39,24,618rs home loan. Cool stuff from “Aditya Birla Housing Finance Limited”

OMG ! It gives accurate data, I was planing to take 40,00,000rs Home loan, this tool is saying I am eligible to take 39,24,618rs home loan. Cool stuff from “Aditya Birla Housing Finance Limited”

Really A True Worth Loan website .Birla is doing a really good job.

Really A True Worth Loan website .Birla is doing a really good job.

Helpful Article .I like the part of process of getting home loan .it makes simple for those people who dont know how get a home loan .

Helpful Article .I like the part of process of getting home loan .it makes simple for those people who dont know how get a home loan .