Rural Electrification Corporation (REC) has come out with the first tax free bond issue in the current financial year FY 2013-14. REC can raise 70 per cent of the total amount through public issue, total amount allowed by the government is Rs. 5,000 crore. The company aims to collect Rs 3500 crore through Tranche 1 issue by issuing bonds in three different tenures 10-year, 15-year and 20-year.. Last year, it had garnered Rs 2648 crore via same issue at a lower coupon.

Table of Contents

About REC

REC is a public financial institution under the Ministry of Power, Govt. of India. It provides financing to all segments of the power sector, including power generation projects as well as independent power projects. REC will use the capital raised through this bonds for lending purposes.

The CBDT has authorised REC to raise the Bonds aggregating to Rs. 5,000 crore in one to more tranches in FY14. REC has earmarked Rs 1500 crores of the Shelf Limit for Soveriegn Wealth Funds, Pension and Gratuity Funds, which shall be raised through private placement route. From Tranche 1, the company proposes to raise Rs. 1000 crore with an option to retain over subscription upto the Residual Shelf Limit of Rs. 2500. The lead managers to the issue are ICICI Securities, A K Capital Services, Axis Capital and Edelweiss Financial Services.

To understand about Tax Free Bonds in detail such as Comparison with other investment options like PPF, Fixed Deposits,Different from Tax Saving Bonds. please go through Understanding Tax Free Bonds

Who can invest?

Individual investors, Hindu undivided families (HUFs), Non-resident Indians (NRIs), qualified foreign investors (QFIs) can invest. Retail Individual Investors means individual investors, Hindu Undivided Families (HUF) through Karta and Non Resident Indians (NRI), applying for up to Rs. 10 lakhs . Individual investors investing more than Rs. 10 lakhs will be classified as High Net Worth Individuals (HNIs). Various categories of Investors and how much would be issued to them is given below . Allotment shall be on first cum first serve basis in the respective categories

| Investor category | Reserved issue |

|---|---|

| Qualified institutional bidders (QIBs) | 20% |

| Non-institutional investors (NIIs) | 20% |

| High net worth individuals | 20% |

| Retail individual investors | 40% |

Date of Issue

Offer is open from 30 Aug 2013 to September 23. The company may choose to pre-close it.

Interest Rate

REC will pay successful applicants at the coupon rates interest given below. The coupon or coupon rate of a bond is the amount of interest paid per year expressed as a percentage of the face value of the bond. Face value of each REC Bond is Rs 1000, so it will pay 8.26% of Rs 1,000 i.e 826 per year to person who buys the bond. If the person holds the bond till maturity he will get his 1000 Rs back.

Effective yield = coupon rate/ (1-tax rate).

Hence, for a coupon of 8.26%, an investor in the 30.9% tax bracket has an effective yield of 11.95%.

| Options | Series 1 | Series 2 | Series 3 |

|---|---|---|---|

| Tenure | 10 years | 15 years | 20 years |

| Coupon rates (retail individual investors) | 8.26% | 8.71% | 8.62% |

| Effective yield – 30.9% tax bracket | 11.95% | 12.60% | 12.47% |

| Effective yield – 20.6% tax bracket | 10.40% | 10.97% | 10.86% |

| Effective yield – 10.3% tax bracket | 9.21% | 9.71% | 9.61% |

Minimum investment

Minimum investment to be made is Rs. 5000, or 5 bonds of face value Rs. 1000 each. It can be issued In dematerialized form as well as in physical form but traded only in dematerialized form.

Interest and Record date

Interest is payable annually. For REC issue the interest payment date will be December 1. Mode of payment of interest will be Direct Credit, NECS, RTGS, NEFT and. Cheques or Demand drafts

Interest on Application Money and Refund

Interest at the rate pf 8.01%, 8.46% and 8.37 % p.a (+ 25 bps if applicable) shall be paid on amounts allotted from the date of realization of the cheque(s)/demand draft(s) or 3 (three) days from the date of receipt of the application (being the date of submission of each application as duly acknowledged by the Bankers to t he Issue) whichever is later upto one day prior to the Deemed Date of Allotment.

Interest on Refund: 5% p.a for all categories

This has to be shown as Income from Other Sources while filing Income Tax Return

Safety rating

CRISIL, CARE, India Ratings and ICRA have given the high ‘AAA’ rating to the bonds. REC, being a Navaratna PSU, offers a secure and safe investment option through these bonds. The bonds are further secured by assets of the company.

Tax

- Tax Free: The Bonds are tax free in nature (exempt u/s 10(15)(iv)(h) of the Income Tax Act, 1961 and the interest on the Bonds will not form part of the total income. It has has to be shown as exempt income while filing income tax return.

- No TDS These instruments – being ‘tax free’ – do not attract TDS provisions.

- Long Term Capital Gains: Under section 2 (29A) & 2 (42A) of the Income Tax Act, the Bonds are treated as a long term capital asset if the same is held for more than 12 Months where they are subject to the tax at the rate of 20% of capital gains with indexation or 10% of capital gains without indexation

- Short Term Capital Gains: Short-term capital gains, where bonds are held for a period of not more than 12 months would be taxed at the normal tax rates.

- STT: Securities Transaction Tax (STT) is not applicable on transactions in the Bonds.

- Wealth Tax: No wealth tax is levied.

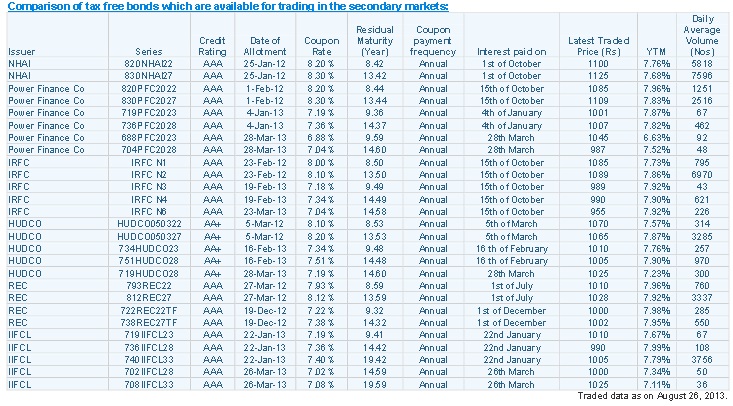

Earlier Issues of REC Bonds

In FY2011-12, REC has issued Tax-free Bonds of Rs.1, 000 each with coupon rates of 7.93% and 8.12% for 10 & 15 years bonds respectively. These bonds are currently quoted at Rs. 1010 and Rs.1,028 offering YTM of 7.96% and 7.92% respectively (trading data as of August 26, 2013) .

In FY 2012-13, in tranche I, (19 Dec) the company offered coupon rate of 7.22% and 7.38% for 10 & 15 years bonds respectively. They are currently quoted at Rs. 1,000 and Rs.1,002 offering YTM of 7.98% and 7.95% respectively (trading data as of August 26, 2013).

In tranche 2, (28 Mar) the company offered coupon rat e of 6.88% and 7.04% for 10 & 15 years bonds respectively but they are hardly traded on the exchanges. Yields on existing bonds are higher but volumes traded on the exchange are low. For more details on price and you can check our Last Year Tax free bonds

Should you invest?

- Higher interest rate that too tax free.

- Long tenure , 10 years minimum and liquidity is not so great, it can be sold on stock exchange but volumes are low.

- Every year you will get interest which needs to be re-invested. At maturity you will only get invested amount plus interest for last year.

- More issues are in pipeline . This year 13 companies in the infrastructure development or infrastructure finance space have been authorised to issue tax-free bonds worth Rs 48,000 crore. So you can wait and watch to see are people investing in tax free bonds or not, maybe with rupee devaluing yields may go up slightly so you may get slightly higher coupon rate or if 10 year GOI yield goes down you may get slightly lower coupon rate.

Related Articles :

- Exempt Income and Income Tax Return

- Understanding Tax Free Bonds

- Tax Free Bonds of FY 2011-12, FY 2012-13

- Investing:Think about Liquidity,Safety,Returns,Risk,Tax

- Our website Bemoneyaware.com has be revamped and has now articles organized for kids, beginners in 20s-30s, women etc. Please do check it out

So are you investing in REC Tax free bonds? If yes why? If no why not?

Please provide the excel on my mail. It will help If i get live YTM figures as I am invested in earlier bonds and would like to sell them and invest in current ones depending on yield.

Sold 812REC27 and pplied in current bond.

Current data will help.

Regards

Sir links to Tax Free Bonds of FY 2011-12, FY 2012-13 are provided in our article Tax Free Bonds of FY 2011-12, FY 2012-13

There are so many bonds , on NSE and BSE so it would be difficult to provide an excel to your mail

Thanks. Please keep up excellent work.

Regards

Please provide the excel on my mail. It will help If i get live YTM figures as I am invested in earlier bonds and would like to sell them and invest in current ones depending on yield.

Sold 812REC27 and pplied in current bond.

Current data will help.

Regards

Sir links to Tax Free Bonds of FY 2011-12, FY 2012-13 are provided in our article Tax Free Bonds of FY 2011-12, FY 2012-13

There are so many bonds , on NSE and BSE so it would be difficult to provide an excel to your mail

Thanks. Please keep up excellent work.

Regards

Interesting.

Interesting.