You can file your income tax returns through a professional or use efiling Service Provider or file yourself at income Tax Efiling website. To use incometaxefiling.gov.in one needs to register at the site. It is a simple process where one needs to provide his details like PAN, password details, contact details and after registration you can use This article explains how to do register as individual at incometaxindiaefiling.gov.in with pictures.

Table of Contents

How to register on Income Tax Efiling Website

Before registering on the income tax portal, you must have the following details:

- Valid PAN

- Valid Mobile Number

- Valid Current Address

- Valid Email Address, preferably your own

An Individual should have a valid PAN for registering with the E-Filing application. The process is explained below

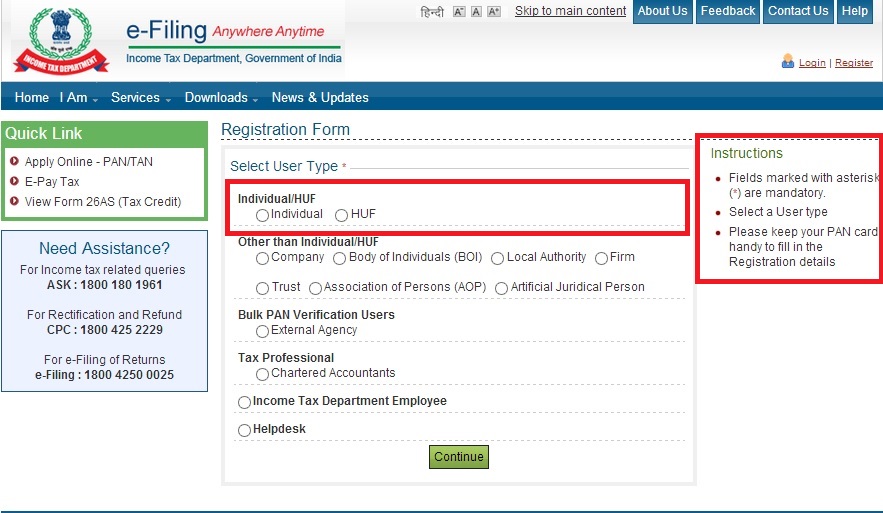

- Type in the URL of e-Filing application https://incometaxindiaefiling.gov.in (Note thesite address has https , it’s not http. https is the secure site)

- Click on the Register Yourself button.

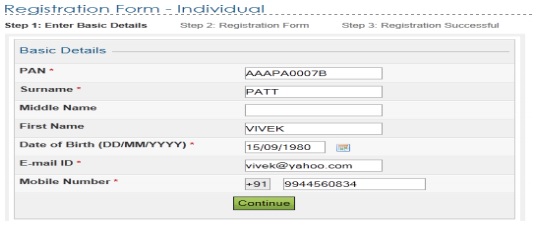

Select Individual found under Individual/HUF. Instructions are provided on the right-hand side of the screen. However, user can also refer to the HELP menu.

Fill in the details to register onIncome Tax Website

One needs to provide details about Name, password, contact details etc. All fields marked with red star (asterrisk) are compulsory(mandatory)

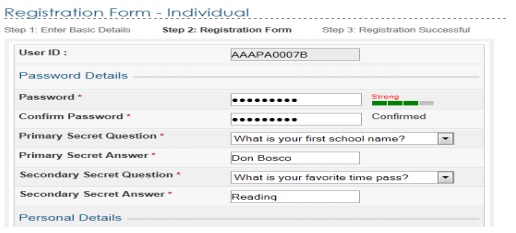

Basic Details : The user will be directed to the registration page and the user will fill various fields like Surname, Date of Birth, Email Id for further validation.

- PAN Number – Mandatory, should be valid PAN.

- Surname – Mandatory, should be as per the PAN details.

- First Name – Not mandatory, should be as per the PAN details.

- Middle Name – Not mandatory, should be as per the PAN details.

- Date of Birth – Mandatory, should be as per the PAN details.

- Email ID – Mandatory, should be valid E-mail ID.

- Mobile Number – Mandatory

Income tax registration basic details

Fill in Registration Details

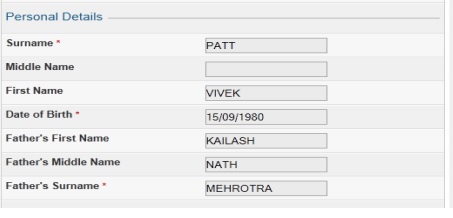

- User ID – This will be automatically populated by the system, which is entered earlier and is Person’s PAN.

- Password – Mandatory, should be between 8 – 14 characters, alphanumeric and should contain at least one special character.

- Confirm Password – Mandatory, The user has to enter the same password as entered above.

- Primary Secret Question – Mandatory, The user needs to select any one question from available in the drop down.

- Primary Secret Answer – Mandatory.

- Secondary Secret Question – Mandatory, The user needs to select any one question from available in the drop down.

- Secondary Secret Answer – Mandatory.

Income tax efile registration enter password details

Personal Details : One needs to enter Personal Details such as Surname, first name,details of father as shown in picture below. Some of these details could be automatically populated by previously entered basic details such as Surname, Date of Birth.

Income tax efile registration Personal Details

Contact Details : One needs to fill in information like Landline Number, Mobile Number,Email ID etc as shown in picture below.

- Landline Number – Not mandatory.

- Mobile Number – Mandatory.

- Alternate Mobile Number – Non mandatory.

- Email ID – Mandatory. This field is auto-filled from the previous page.

- Alternate Email ID – Non mandatory, should be valid E-mail ID.

- Fax Number – Non-mandatory.

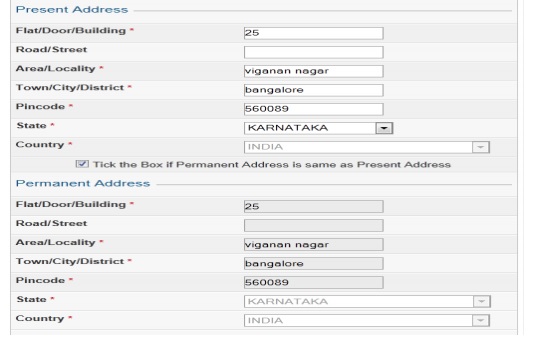

Address : One needs to give details of Present Address and Permanent Address.

- Flat/Door/Building – Mandatory.

- Road/Street – Non-mandatory.

- Area/Locality – Mandatory.

- Town/City/District – Mandatory.

- State – Mandatory, user selects from the drop down provided.

- Pincode – Mandatory.

Check the check box Tick the box if Permanent Address is same as Present Address. if Permanent Address is same as Present Address else add details about Permanent address also.

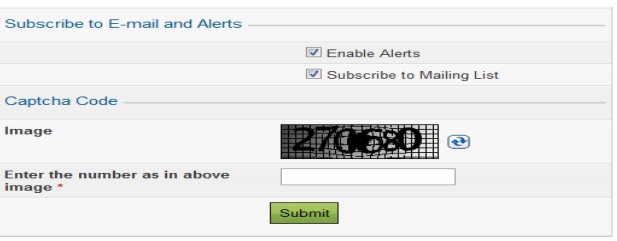

Alerts : Choose subscription, alerts reminder options and enter the numeric code,called Captcha as shown in picture below

- Subscribe to Mailing List : This will be auto-selected. User can un-check the box provided to un-subscribe for mailing list.

- Enable Alerts, reminder and notifications : This will be auto-selected. User can un-check the box provided to disable alerts, reminders and notification.

- Captcha : User has to type in the numeric code which appears on the screen. It is mandatory. It shows you are human and no computer program is entering the details as shown in picture below.

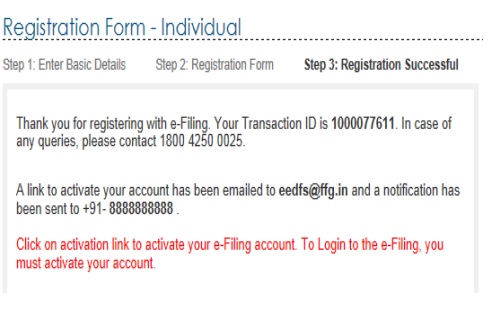

Click on SUBMIT. You will be required to verify your registration to complete the process. A one-time password (OTP) will be sent to your mobile number and a verification link will be sent to your email address. Enter the OTP received and click on the link received to successfully register yourself on the e-filing website.

The user also receives a confirmation e-mail with an activation link. In order to activate the account, the user should click on the Activation link. The user account is activated and the database is updated. An SMS is also sent to notify on the confirmation mail.

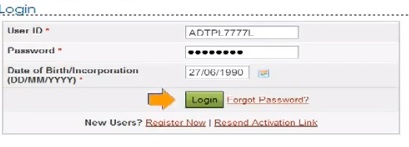

How to Login to Income Tax Website

Once you have successfully registered yourself, you can now login to your account on the income tax website. Your PAN will be your user ID to login to your account. You will need to enter your password and captcha to log-in to your account.

When you want to use the income tax efiling website you need to login to the website. To login go to incometaxindiaefiling.gov.in

- In the browser, enter the URL of the efiling application (hhttps://Incometaxindiaefiling.gov.in).

- Look for Registered User on the right-hand side of the screen as shown in the picture below highlighted with red rectangle.

- Click Login Here button.

- Enter User Id (you PAN number), Password and Date Of Birth

- Click Login. If successful you can now use the income tax efiling website.

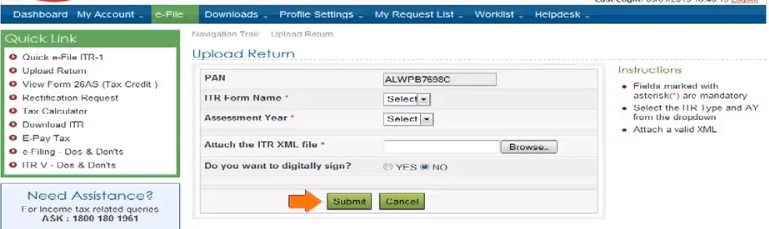

On successful login you can see the webpage as shown below. You can do various actions like Uploading the return, Viewing Form 26AS.

Login to Income tax Website through Net banking

Apart from the income tax department’s website, you can also access your account on the e-filing website via Net-banking. You must be a registered Net-banking user. Currently, the Net banking facilities of more than banks can be used to access the e-filing website. The list of banks is given below in alphabetical order.

Allahabad Bank

Andhra Bank

Axis Bank Ltd

Bank of Baroda

Bank of India

Bank of Maharashtra

CDSL

Canara Bank

Central Bank of India

City Union Bank Ltd

Corporation Bank-Corporate Banking

Corporation Bank-Retail Banking

Dena Bank

Equitas Small Finance Bank Ltd

HDFC Bank

ICICI Bank

IDBI Bank

Indian Bank

Indian Overseas Bank

IndusInd Bank Ltd

Jammu and Kashmir Bank

Karnataka Bank

Kotak Mahindra Bank

NSDL

Oriental Bank of Commerce

Punjab National Bank

Punjab and Sind Bank

Saraswat Co-op Bank

South Indian Bank

State Bank of India

Syndicate Bank

The Federal Bank Limited

The Karur Vysya Bank Ltd

UCO Bank

Union Bank of India

United Bank of India

Vijaya Bank

Yes Bank Ltd

Video on How to register and login on income tax efiling website to file ITR

Reference :Income Tax Department document Income Tax Registration services (pdf)

Related Articles :

- Income Tax for Beginner, Income Tax For Beginner – Part II

- E-Filing of Income Tax Return

- Filling ITR-1 : Bank Details, Exempt Income, TDS Details

- After filing Income Tax Return

- Understanding Form 16: Tax on income, Understanding Perquisites, Understanding Form 12BA

This article explains how to do register as individual at incometaxindiaefiling.gov.in with pictures. Hope it helped. How do you file your returns?

I have tried registering in e-filing but when I come to present and permanent address, in respect of locality, District, State etc, inspite of my clicking the box except showing ‘select’ no other option of District, State is shown. This problem is persisting for two months. What to do?

How are you registering? Mobile/Desktop?

Which browser?

i registered in incometax efilling website but i forgot to activate the activation link sent to my email id at the time of registration.when i get in to reactivation link tab its asking the password at the time of registration.but i forgot the password which i kept.

please can you given me solution for this issue?

thank u

i tried every step of income tax efiling to get password ,now you show other step to get password

I have tried multiple times to file taxes and every year, ended up having discrepancies and twice I ended up paying more money. Also, tax assessment is more confusing. Why don’t people use cleartax, myitreturns, hamaratax.com, hrblock like efiling websites which are using tax software to process automatically? Many of them are free or asks minimum charges only. http://hamaratax.com is one site I can vouch for, since they called me and assisted through out the e-filing process.

I agree with you.. There are many efiling websites like Cleartax, Taxsmile, hamaratax, Taxspanner, Taxzippy, etc, available in India. They help you to file your income tax return with easy process. Some of them like Taxsmile provide free efiling for individual tax payer. To know more other efiling sites, have found a list of top Income Tax efiling sites in India.

Everything look great in the blog except a few points. For activation, IT department sends a link to the email id. They also send an OTP to the cell phone. In case the activation link is not received we can request again. But if the OTP is not received what is the solution. OTP may be missed if the given phone number is wrong. In that case how can the phone number be corrected?

I got my otp but does not get email for activation, then when i try to fill resend option then show my passwod is wrong. So please tell me how i acctive my e-filling account

I forgot my passeord in between registered and also feed my mail what can i do when i go resend activation link he say wrong password

Good Blog. Thanks for sharing a lot of information about Income Tax efiling.

Thanks Vikranth

Good Blog. Thanks for sharing a lot of information about Income Tax efiling.

Thanks Vikranth

Thanks for sharing these valuable information…..

Thanks for giving valuable comment! It keeps us going

Thanks for sharing these valuable information…..

Thanks for giving valuable comment! It keeps us going

Thanks for providing such valid info.

Thanks for appreciating it

Thanks for providing such valid info.

Thanks for appreciating it