RuPay is India’s own card payment network just like Visa and Master Card and provides a low cost alternative system for banks to provide debit card service. Dedication of RuPay to the nation is symbolic of the maturity of the payment system development in India said President Pranab Mukherjee said after formally launching the card at a function at Rashtrapati Bhavan on May 8 2014. But what is Rupay? Who developed it? Why was it developed? Who developed it? What does it mean for India? History of Rupay.

Table of Contents

What is Rupay?

RuPay is an Indian domestic card scheme conceived and launched by the National Payments Corporation of India (NPCI). RuPay, like any other debit card, works on ATMs, Point of Sales (PoS) and online e-commerce sites beside Aadhar-based micro ATM. The main objective of the RuPay payment network project is to reduce the overall transaction cost and develop products appropriate for financial inclusion. A Point of Sale (POS) typically is a little machine on which your card is swiped, but increasingly now it can mean just about any computer on any network, anywhere.

RuPay is 7th payment network in the world after Visa, MasterCard, American Express, Discover, Diners Club, and JCB. China already has its domestic payment network Union Pay, a benchmark against which RuPay may be compared. 31 scheduled commercial banks based in public and private sector, 49 regional rural banks and 175 co-operative have issued over 2 crore RuPay cards.

How does the Plastic Card Work?

A lot of things happen between the time you swipe your debit or credit card and sign the credit card slip.Those involved in each plastic card transaction are given below. Our article What happens when credit card is swiped? , What are MasterCard and Visa Card explains it in detail.

- The customer who presents the plastic card for payment.

- The merchant who swipes the card for payment on machine from a bank ,called merchant bank.

- The payment terminal communicates with the merchant bank to ask whether customer can make the card purchase.

- The merchant’s bank sends card transactions for approval to card payment network. The card payment network is a liaison between the merchant bank and the card issuer. Ex of card payment networks are Visa, MasterCard, American Express, Discover etc.

- Card payment network sends the transaction to the bank which has issued the card.

- The card issuer approves or declines the transaction.

- If it approves the transaction it sends back an authorization code. The merchant bank sends the approval message for your card purchase, the receipt prints, you sign, and you can leave with your purchase

Rupay is domestically developed equivalent of the Visas and MasterCards of the world

What is NPCI?

National Payments Corporation of India or NPCI was founded in 2008 under RBI with 10 core promoter banks, is a pioneer organisation in the field of retail payments in India . 10 promoter banks are State Bank of India, Punjab National Bank, Canara Bank, Bank of Baroda, Union bank of India, Bank of India, ICICI Bank, HDFC Bank, Citibank and HSBC. The core objective was to consolidate and integrate the multiple payments systems with varying service levels into nation-wide uniform and standard business process for all retail payment systems. i.e NPCI has been set-up as an umbrella organisation by the banking community to take over the retail payment system activities in the country.To know more about NPCI visit their webpage www.npci.org.in/aboutus.aspx

NPCI provides following services touching your life in many ways :

- National Financial Switch (NFS) which connects 166928 ATMs of 242 banks (78 member+ 164 sub-member banks)

- Immediate Payment Service (IMPS) provided to 62 member banks, with more than 6 crore MMIDs issued, and crossed 3 million transactions.

- National Automated Clearing House – has close to 400 banks as Live.

- Aadhaar Payments Bridge System (APBS) has more than 300 banks as Live.

- Cheque Truncation System (CTS) has fully migrated western & southern grid from MICR centres.

- Aadhaar-enabled payment system (AEPS)- has 26 member banks.

- RuPay – Domestic Card Scheme- has issued over 17 lakh cards and enabled over 9 lakh PoS terminals in the country.

What was the need for Rupay?

NPCI led by RBI launched Rupay with following objectives in minds

-

Lower cost and affordability Reduction in cost of card or e-commerce transactions. Banks have to pay less to the payment gateway provider. Since the transaction processing will happen domestically, it would lead to lower cost of clearing and settlement for each transaction. This will make the transaction cost affordable and will drive usage of cards in the industry. In FY10, according to RBI, domestic banks coughed out Rs 490 crore in interchange charges to Visa and MasterCard.

- Rupay charges USD 0.03 for a customer’s transaction size of USD 25.8 against Visa or Mastercard charge of USD 0.05. In Rupee Terms banks have to pay nearly Rs. 2 for a customer’s transaction size of Rs. 1,600 in RuPay network while the same is around Rs. 2.80 with Visa or MasterCard

- There is no entry fee for Rupay, where as Visa or MasterCard charge as high as USD 40,000 ie same fee would be in the range of Rs. 10 lakh –Rs. 30 lakh for other two major gateways.

- There is no quarterly fee for Rupay as against Visa or MasterCard’s fee of USD 16,000 – 50,000.

-

Data Security and Privacy: Data related to transactions and customers to reside in India for Rupay, whereas Visa/Mastercard stores this data in their data centres across the globe.

-

Customized product offering : RuPay, being a domestic scheme is committed towards development of customized product and service offerings for Indian consumers. RuPay Scheme provides flexibility to card issuing banks to issue special purpose cards like Kisan Cards, Milk Procurement Cards, Grain Procurement Cards and Financial Inclusion Cards.A variant of the card called Kisan Card is now being issued by all the Public Sector banks in addition to the mainstream debit card .

-

RuPay helps in financial inclusion as many co-operative banks and regional rural banks (RRBs) are included in its network. Kotak Mahindra Bank in partnership with RuPay rolled out an initiative for financial inclusion, where the dairy farmers across 75 cooperative societies of AMUL in regions of Burdwan and Hooghly of West Bengal will be able to get their payments directly into their account on the same day of sale of milk. The same model is planned to be adopted in the state of Gujarat where 1200 cooperative societies comprising over 300,000 dairy farmers will be the part of the programme.

BottomLine is RuPay Cards will address the needs of Indian consumers, merchants and banks. A switchover to RuPay Card, the Indian version of Visa or MasterCard, can help domestic banks save as much Rs 300 crore annually in transaction fees. For all the stakeholders it makes immense business sense as NPCI charges just 90 paise as the fee per transaction — 60 paise from the merchant and 30 paise from the issuing bank — with the same kind of security; the same on a Visa or MasterCard is as high as Rs 4.

What does Rupay mean?

RuPay is the coinage of two terms Rupee and Payment. The orange and green arrows indicate a nation on the move and a service that matches its pace. The color blue stands for the feeling of tranquillity which is the people must get while owning a card of the brand RuPay. The bold and unique typeface grants solidity to the whole unit and symbolizes a stable entity.

Roadmap of Rupay is as follows

History of Rupay

- In 2009, RBI asked the Indian Banks Association to design a rival card to Visa and MasterCard. China has already developed a similar card called the Union Pay of China. The vision of RBI can be found at rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/VIS01092009.pdf (pdf)

- National Payments Corporation of India (NPCI) had in December 2010, decided to change the proposed name of India’s first indigenous payment gateway to RuPay from IndiaPay.

- It was launched on June 20, 2011 and Bank of India was the first bank to issue automated teller machines (ATM)-cum-debit cards to Unique Identification (UID) number holders in Pagdha village of Maharastra Thane district.

- On Mar 7 2012, NPCI entered into a strategic partnership with Discover Financial Services (DFS) for RuPay Card, enabling the acceptance of RuPay Global Cards on Discover’s global payment network outside of India

- NPCI commercially launched RuPay Card on March 26 2012, with major banks such as SBI, BoB, UBI, BoI, Corporation Bank and Axis Bank launching their domestic debit cards on the RuPay platform.

- On June 21, 2013 NPCI launched its e-commerce solution named RuPay PaySecure that enables all RuPay card holders to make online payment

- On 8th May 2014, RuPay was dedicated to India by President of India, Pranab Mukherjee.

Payment Systems worldwide

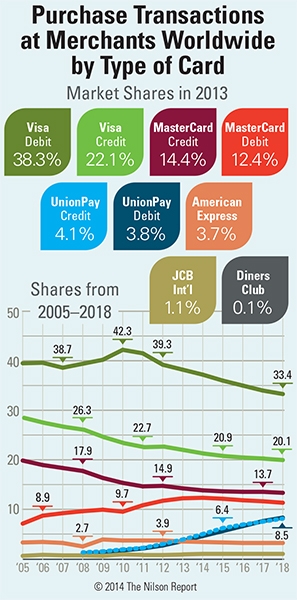

As per Nilson Report 2014 Purchase Transactions at Merchants Worldwide by Type of Card Visa, MasterCard, UnionPay, American Express, Diners Club, and JCB card transactions are identified by product for 2013 and projected through 2018.

China already has its domestic payment network Union Pay, a benchmark against which RuPay may be compared. Union Pay has 200 member banks, including 30 outside China, and is accepted in 104 countries.

To know about country specific Payment Systems worldwide one can read www.npci.org.in/paysw.aspx

- South Korea : KFTC

- UK : BACS Payment system , SEPA- UK, UK Payments Administration Ltd-UK, British Banker’s Association-UK

- China : China Union Pay

- Japan : Zengin Payment System

- Australia : Australian Payments Clearing Association

- US : NACHA , The American Banker’s Association-US, Electronic Payments Network (EPN) , Federal Reserve – Board of Governors of the Federal Reserve System , Federal Reserve – Financial Services

- Germany : RPS

- South Africa: PASA

- Ireland : IPSO

- Canada : Canadian Payments Assocation, The Canadian Banker’s Association

- Singapore : NETS

Related articles:

- What happens when credit card is swiped?

- Credit Card Fees and Charges

- When you loose your wallet,Credit Card, PAN Card, Driving License

- Credit Card Debt

India is today the world’s fastest-growing country in number of ATMs and usage of plastic and other forms of electronic and non-paper money. RBI has been working to make the international companies like, PayPal Western Union, MasterCard,Visa to fall in line with demands for consumer protection, but also for adherence to Indian laws. At the same time it is pushing to grow our domestic solutions like Rupay. India’s RuPay payment gateway and card which, except China, no other country, not even the European Union and Japan, has been able to start successfully. Hats off to the those who envisioned and then executed the idea of our Made in India card payment. Do you have a Rupay card? How has been your experience in using it?

Nice article…… i would urge all fellow Indians to use RuPay cards so that the transaction charges stay in India itself or else the charges are to be paid by the bank in USD, hence leading to foreign exchange burden. Please please support our own payment system – RuPay

Does Indian bank Rupay Debit Card is acceptable by paypal?

Please try to get my answar.

ya rupay is not there on the list of debit card in paypal. :'(

hey, i am using RuPay debit card issued by UCO bank but i found some problem while making online transactions through that, as i also registered my card on paysecure

for making online payments.But problem is that when i tried to make a payment

error message pop-up on the screen ” Transaction was timed out,there will be no response from the bank. click re-register or cancel button”.

Can you figure this out?

That’s weird. I hope you didn’t loose your money.

I don’t have Rupay card so I can only guess. I shall try to find out.

From what I

Rupay allows the customer to use his ATM PIN to make the payment online.It uses a simplified yet secure architecture. It offers additional security measures where in the mode of validation is by selecting an image and passing a phrase.

Did you image/phrase not match?

Was the Union bank server down that time?

What does the bank say?

Have you ever used Rupay card for online transactions?

hey, i am using RuPay debit card issued by UCO bank but i found some problem while making online transactions through that, as i also registered my card on paysecure

for making online payments.But problem is that when i tried to make a payment

error message pop-up on the screen ” Transaction was timed out,there will be no response from the bank. click re-register or cancel button”.

Can you figure this out?

That’s weird. I hope you didn’t loose your money.

I don’t have Rupay card so I can only guess. I shall try to find out.

From what I

Rupay allows the customer to use his ATM PIN to make the payment online.It uses a simplified yet secure architecture. It offers additional security measures where in the mode of validation is by selecting an image and passing a phrase.

Did you image/phrase not match?

Was the Union bank server down that time?

What does the bank say?

Have you ever used Rupay card for online transactions?

This article has been written in a very professional manner. It is quite descriptive but easy to glance and the author has put in appropriate links where ever detailed description was needed.

I will start using Rupay immediately.

Thanks Amsang. Let us know how your experience has been in using Rupay

This article has been written in a very professional manner. It is quite descriptive but easy to glance and the author has put in appropriate links where ever detailed description was needed.

I will start using Rupay immediately.

Thanks Amsang. Let us know how your experience has been in using Rupay

Thanks a lot for understating the product and explain it so simply,

Thanks Jyoti for your encouraging words. We appreciate you taking time to comment on the post.

Thanks a lot for understating the product and explain it so simply,

Thanks Jyoti for your encouraging words. We appreciate you taking time to comment on the post.

Thanks for posting such an informative article. Did not know so many details on RuPay. I don’t have a RuPay card. I have been using Visa card.

May be you can post more details on international transaction. How the Rupay transactions are charged compared with the Visa / Master cards for international transactions.

Thanks Nandini for kind words.

Good question about International transcation.

Quoting from Interview with MD & CEO, NPCI

You had also tied up with Discover Financial Services to take RuPay international. What is the progress there?

Technically, we are ready. But the commercial rates are yet to be decided. The idea is to make it more attractive than MasterCard or Visa. In the domestic market, the cost is a third but in the international market, we are finding it difficult to price it accordingly.

Our volume is low as we are not in the credit card market. We’re only in the debit card market and the bulk of transactions internationally happen in credit cards. So, other players can leverage it, while we can’t. It is also difficult to determine the rates of the two international players, as they have different rates for different banks.

Thanks for posting such an informative article. Did not know so many details on RuPay. I don’t have a RuPay card. I have been using Visa card.

May be you can post more details on international transaction. How the Rupay transactions are charged compared with the Visa / Master cards for international transactions.

Thanks Nandini for kind words.

Good question about International transcation.

Quoting from Interview with MD & CEO, NPCI

You had also tied up with Discover Financial Services to take RuPay international. What is the progress there?

Technically, we are ready. But the commercial rates are yet to be decided. The idea is to make it more attractive than MasterCard or Visa. In the domestic market, the cost is a third but in the international market, we are finding it difficult to price it accordingly.

Our volume is low as we are not in the credit card market. We’re only in the debit card market and the bulk of transactions internationally happen in credit cards. So, other players can leverage it, while we can’t. It is also difficult to determine the rates of the two international players, as they have different rates for different banks.